Bitcoin Fundamentals Report #298

Trump's Bitcoin Endorsement, USG Moves Bitcoin, Strategic Reserves, Global Adoption, Deglobalization in Macro, Mining Sector Turnaround, and Price Analysis

July 29, 2024 | Block 854,538

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Break out |

| Media sentiment | Very positive |

| Network traffic | Very low |

| Mining industry | Recovered |

| Price Section | |

| Weekly price* | $67,318 (+$3808, +6.0%) |

| Market cap | $1.329 trillion |

| Satoshis/$1 USD | 1487 |

| 1 finney (1/10,000 btc) | $6.72 |

| Mining Sector | |

| Previous difficulty adjustment | +3.2109% |

| Next estimated adjustment | +11% in ~1 day |

| Mempool | 145MB |

| Fees for next block (sats/byte) | $0.57 (6 s/vb) |

| Low Priority fee | $0.47 |

| Lightning Network** | |

| Capacity | 5223.84 btc (-0.3%, -14) |

| Channels | 50,139 (-1.6%, -820) |

- Trump speaks at Bitcoin 2024

This was a monumental moment in Bitcoin history. Not only is the leading candidate for US President speaking favorably about Bitcoin, but he is making significant promises, to not sell bitcoin and free Ross.

Alex Thorn has a shortened version of the 50 minute speech with many of the important parts included. It was too large to attach here.

fmr president trump spoke for 49 minutes on saturday at bitcoin 2024 in nashville, a truly historic speech

— Alex Thorn (@intangiblecoins) July 29, 2024

here’s a condensed 12min version w/ his most important statements on bitcoin & crypto — click the times below to jump around

0:00 hello bitcoiners

0:23 bitcoin legends… pic.twitter.com/90hBX1icUy

This speech has received a ton of coverage, I'll just add a few thoughts.

1) This provides a stark difference between populists and the global Marxism of the current administration. The democrats cannot support Bitcoin because their goals are predicated on control and tyranny. Bitcoin is everything thing they are fighting against. The dems might be able to pay lip service to Bitcoin during the election, but we all know they could do something about it right now, being in the White House. They could fire Gary Gensler today. They could order Treasury to begin work on a Bitcoin Reserve right now.

2) This is a natural outgrowth of Bitcoin incentive structure and game theory. First mover will get most of the benefit. The US government and Trump need bitcoin, Bitcoin doesn't need the government. But if they jump on and accelerate Bitcoin's global domination, they will only be helping people everywhere.

3) I've said for years, the dollar isn't going away because they can just back it with Bitcoin. That doesn't seems so far fetched today does it?

- US Bitcoin Reserve Bill Announced

This was perhaps an even bigger announcement that Trump's. When taken in combination with Trump's pledge, it is a bill that could define a century.

Sen. Cynthia Lummis call it our Louisiana Purchase moment. I agree.

The bill would create a Strategic Bitcoin Reserve made up of the current 210,000 btc held by the government and would add another 800,000 to get the total up to 1 million btc. They'll accomplish this by using excess reserves and foreign currency reserves to buy, at current market price, $85 billion in bitcoin. Of course, it will end up costing much more than that. Perhaps $500 billion when all is said and done, or even $1 trillion.

- Other States and Governments Announce Bitcoin Reserve Goals

Louisiana and Hong Kong are the first governments to immediately take up the Bitcoin Reserve idea. Many more will follow. However, it would not be their best interest to telegraph their intentions prior to stacking. The interesting thing with government reserves is they will likely have to go through a public process to proceed.

- Michigan adds Bitcoin to its pension fund, following in the footsteps of neighbor Wisconsin

JUST IN: 🇺🇸 State of Michigan adds #Bitcoin ETFs to its pension fund, discloses $6.6 million purchase.

— Watcher.Guru (@WatcherGuru) July 26, 2024

Four men kidnapped a foreigner in Kyiv, stole almost UAH 7 million from him and killed him.

The offenders were preparing for the crime in advance. They found out that the man had bitcoins worth about seven million hryvnias and decided to take possession of them. The defendants tracked down his address and around midnight, when he was returning home, they beat him, forced him into a car and took him to an abandoned building in Kyiv region. There, they forced the victim to transfer bitcoins to their crypto wallet, and then strangled him. To hide the traces of the crime, they changed the car's licence plates and appearance, took the body to the forest, where they buried it, and cashed in the cryptocurrency," the police added.

Macro

This was kind of a shock because we are expecting the US to slide into recession. However, this could be revised down in the future, or it could be a temporary 1-quarter improvement.

A first-ever gathering of defense chiefs from Japan, South Korea, and the United States here produced a trilateral security agreement, “grave concern” over increasing Russian-North Korean cooperation, and vague opposition to “unilateral attempts to change the status quo”—a reference to China and Taiwan.

A key topic of discussion between the United States and Japan was the co-development of counterstrike missiles such as Lockheed Martin’s PAC-3 Missile Segment Enhancement, or MSE, and the Raytheon’s AIM-120 Advanced Medium-Range Air-to-Air Missile, or AMRAAM.

In another bilateral statement, the U.S. and South Korea defense chiefs said they discussed the “illegal arms trade and transfer of high technology between Russia and the DPRK” that violate U.S. Security Council resolutions, and vowed to “continue to enforce the UNSC sanctions, in close cooperation with the international community.”

“In 2021, President López Obrador … asked me to develop what he called Plan Mexico. This is a plan to create awareness that Mexico, like North America [as a whole], needs to produce more than it consumes, that we’re depending too much on basic products from China for our homes,” he said.

“… Mexico has to carry out its own review because … we buy US $119 billion [worth of products] per year from China and we sell $11 billion [worth of goods] to China. China sells to us but doesn’t buy from us and that’s not reciprocal trade,” said Ramírez, who will stay on as finance minister after Sheinbaum is sworn in as president on Oct. 1.

This is important news because the US is not alone in its crackdown on China dumping practices. Europe and now countries like Mexico are raising the alarm. China's economic model was built for the waning global order, it cannot handle the new order of trade blocs, North America being the most powerful.

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

It's been two weeks since my last newsletter, so let's review where we were back on July 15th:

Last week:

We [...] are approaching the major resistance zone at $65,000.

Important level to the downside is now the gap at $58,800. To the upside, breaking the 50-day MA ($64,000) will be huge. The 20-week ($65,400) is another important level. If this strong bounce can close above there, we should see a couple days of consolidation.

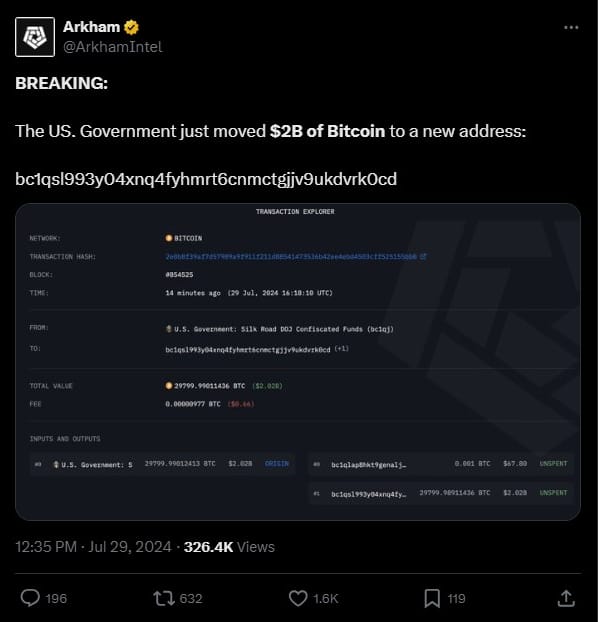

At the time of writing, a tweet has just hit showing the US government moving Bitcoin. The expectation is for this to be sold. This story is still developing, the address sent to is unknown. It would be monumentally stupid to sell bitcoin after the actions of Trump over the weekend. Monumentally stupid.

Several weeks ago, I tweeted this anticipating this move.

The affect on price has been immediate.

Bitcoin is comfortably above recent resistance. Hopefully, this has turned support. Trading any support hold gives the opportunity to place a stop loss right below the support.

With the information we have, and the information we don't have (for example no announcement by the government that they will be dumping these coins), at this time I'm calling it FUD. We'll have to wait and see over the next couple of days.

Prior to this move, I was hoping to set a new ATH this week. Those plans are now on hold. It is a good time to continue accumulating and buying the dip. Any significant sell off is going to be a massive buying opportunity.

Anything the US government sells at this point is going to be bought directly by large investors, pension funds, and even secret Strategic Bitcoin Reserves springing up around the world.

BREAKING at the time of writing... It looks like these coins have been split and Arkham believes it is a custody service. Another point in favor of this not being a selling issue.

On to more price...

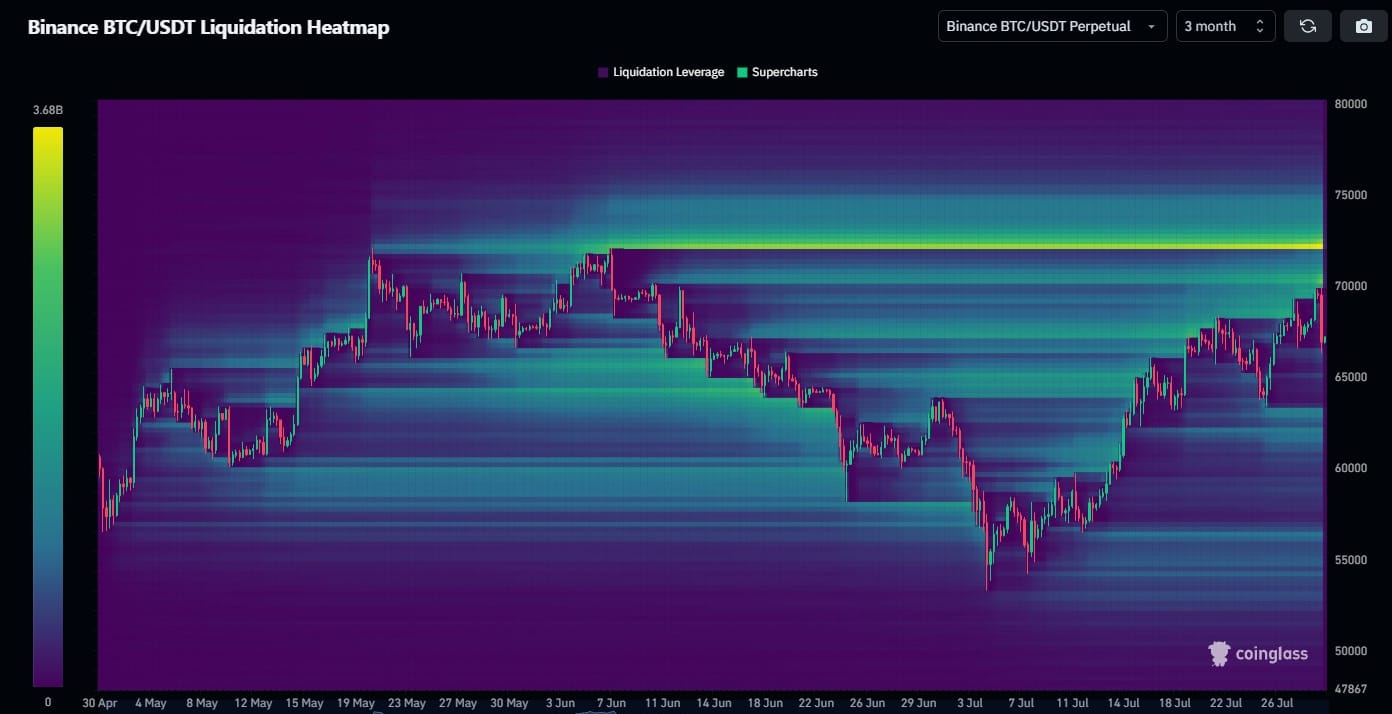

The bitcoin heat map is extremely important here. The level at $72-73k is still a magnet for price.

Overall, this move lower is likely very temporary. There is still a possibility of hitting an ATH by the end of the week as volatility returns. Levels to watch are, to the downside $65,200 or the 128-day moving average, to the up side is any new high above today's intra-day high of $70k.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

“However, I think that Republicans have kind of seized the day on this, and I think under a Trump administration, you’re going to see Bitcoin mining flourish. Under a Harris administration, we have no idea what the energy policy is going to be.”

This statement was made on stage at the conference this weekend. Overall, Bitcoin 2024 was extremely bullish for Bitcoin mining in the US.

Some people are worried that Bitcoin mining is becoming too concentrated in a single jurisdiction, and that favorable rules in the US are actually a bad thing. This might be the case, however, it also is in no danger in the foreseeable future, and will serve as an example for the rest of the world. Bitcoin mining will be seen in everyone's national security interest and expand everywhere as we can see in our next story.

“Regulation of mining at the legislative level can stimulate the development of the industry, attract investment and create new jobs,” Chaplin added, highlighting that last year, Russian miners produced approximately 54,000 bitcoins valued at over $3.5 billion.

The proposed law sets strict guidelines for individuals and entities involved in cryptocurrency mining, with oversight from the Ministry of Digital Development. Registered Russian legal entities and individual entrepreneurs are permitted to mine legally. Non-registered Russian citizens can also mine if they comply with specified energy consumption limits. Additionally, the legislation requires miners to disclose information about the obtained digital currency and related transaction identifiers to the government.

In a statement, the Florida-headquartered firm says it just bought $100 million worth of [bitcoin] and currently holds over 20,000 BTC on its balance sheet, which is currently worth over $1.3 billion.

The cryptocurrency miner says that aside from buying more Bitcoin on the open market, it also plans to keep all of the BTC that it mines as it adopts a full [HODL] approach towards its Bitcoin treasury policy.

“We believe Bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold Bitcoin as a reserve asset.”

“Given Bitcoin’s current tailwinds, including increased institutional support and an improving macro environment, we are once again implementing this strategy and focusing on growing the amount we hold on our balance sheet.”

Hash rate and Difficulty

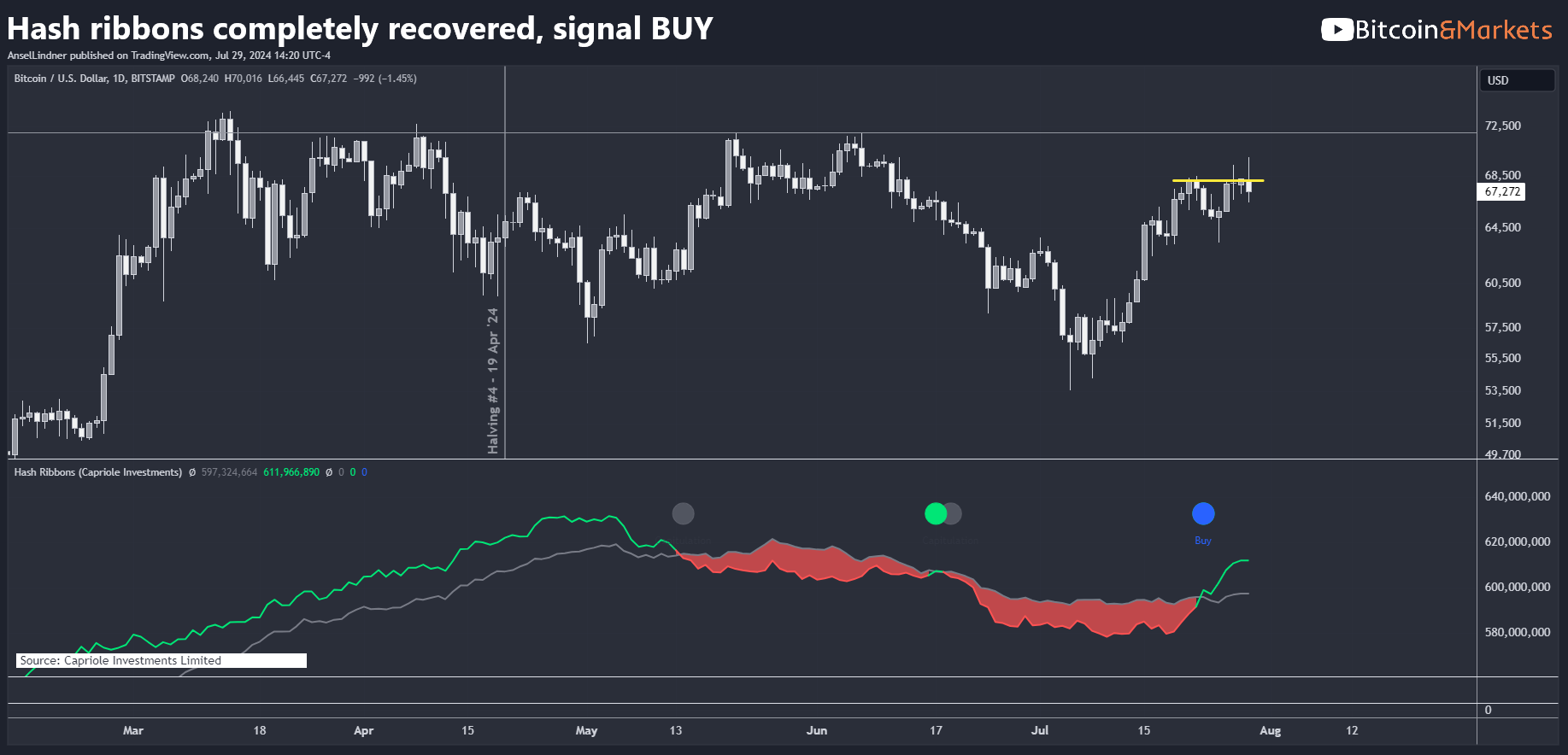

Hash rate has exploded with the price increase as predicted. Difficulty has increased and should recover rapidly over the next couple of adjustments.

Hash ribbons have raced into a BUY. This is the short term and long term moving average for hash rate. When they cross bullish and price is over the 20-day MA, you get an historically strong BUY signal.

Mempool

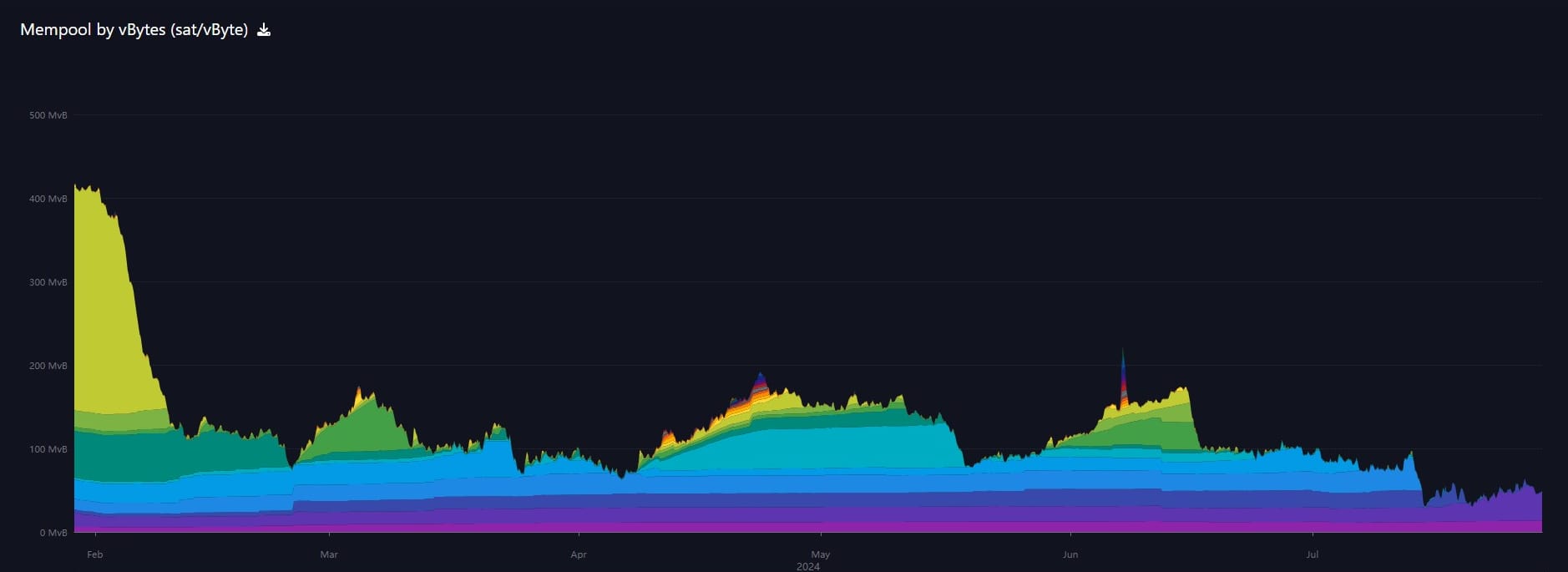

Mempool consolidating at around 145 MB for the last two weeks. Fees are stable under $1 as well. There is no sign that the market is sniffing out any sort of contraction or correction here. If so, we'd expect fees to be rising as uncertainty led people to move coins to exchanges. Therefore, very quite mempool ready to break to new ATHs means the price could rally far past $73,000.

Surprisingly, there was very little talk about Layer 2's on the main stage at Bitcoin 2024. I did catch one panel discussion, which I'll likely react to on a future LIVE stream. Certainly there was more action on the smaller stages at the conference, but they didn't make any headlines.

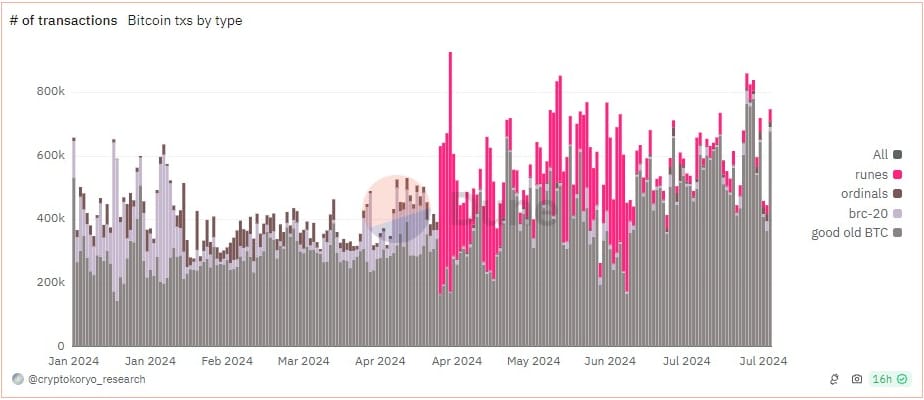

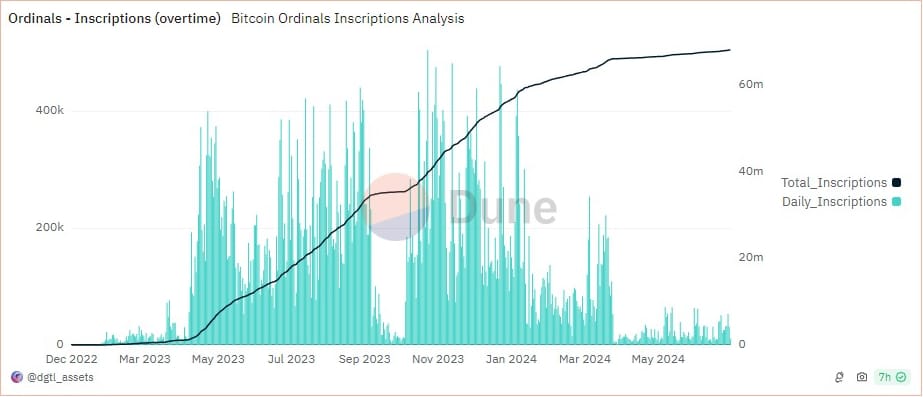

- Update on Inscriptions and Runes

It's hard to imagine that just a couple months ago, the Bitcoin community was up in arms about Runes and Inscriptions. Today, there's barely a peep. Runes were the latest hotness, and we were told they'd be very popular because tokens and NFTs are the future. I have been unconvinced by the economic arguments for NFTs on any decentralized network. They don't make sense above a very niche and obscure market.

Runes usage is laughable.

Inscriptions have help a nonzero transaction volume which is impressive, but they have not caught on at all.

In Case You Missed It...

My latest posts

- Macro Minute: Fed Rate Cut Odds Soar, Bitcoin is Ready

- Bitcoin Minute: Historical Price Performance During Bitcoin Conferences

- Short-Term Bitcoin Forecast and ETH ETF Impacts - Premium

- Bitcoin Minute: Trump vs Bukele

- Bitcoin Minute: Here is what to expect from the Ethereum ETFs Launch This Week

- Bullish Breakout: Short, Medium and Long-Term Bitcoin Forecasts - Premium

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com