Bitcoin Fundamentals Report #299

Global Markets in Freefall: A Bitcoin Buy Opportunity Amid Broad Panic

August 5, 2024 | Block 855,553

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Panic |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Surging |

| Price Section | |

| Weekly price* | $53,018 (-$14,300, -21.2%) |

| Market cap | $1.053 trillion |

| Satoshis/$1 USD | 1882 |

| 1 finney (1/10,000 btc) | $5.31 |

| Mining Sector | |

| Previous difficulty adjustment | +10.5046% |

| Next estimated adjustment | -1.5% in ~8 days |

| Mempool | 124MB |

| Fees for next block (sats/byte) | $0.37 (5 s/vb) |

| Low Priority fee | $0.30 |

| Lightning Network** | |

| Capacity | 4981.17 btc (-4.6%, -243) |

| Channels | 49,517 (-1.2%, -622) |

🔥🚨 Members, do not forget to get your end-of-month price prediction in if you have not, today is the last day. Readers not signed up, if you become a paid member you can join as well! Become a member today and enter for a chance to win $20 in sats!

- EVERYTHING IS CRASHING

We will cover most of this below in the Macro section, since it is not primarily a Bitcoin phenomenon. Suffice it to say here, bitcoin is down big on the day, volumes are through the roof, people are lamenting the bull market is over, panic is in the streets; it's a great time to buy the dip, there's panic in the streets.

- It was Circle behind the years worth of Tether FUD, and they employed FTX to help crash it

It was my firmly held belief that Circle was behind much of the Tether FUD over the years, because their CEO Jeremy Allaire is a sworn enemy of Bitcoin, and started a competitor to Tether. FTX also had a stablecoin competitor.

Howard Lutnick, CEO of Cantor Fitzgerald:

"In May of 2022, Sam [Bankman-Fried] of FTX had obviously done a deal with Circle, and he sought to try and destroy Tether. So, he amassed huge amounts, $10B of USDT. Then in May of '22 redeemed it all in 2 or 3 days, because he assumed they wouldn't have the liquidity. But we had not announced to the world that we were holding Tether's Treasuries yet, and we met $10B in redemptions instantly."

This bill was introduced on 31 July and is now off to committee. Many letters have been flowing to Congress members. Below is the running total so far.

They might be stacking this current dip hard.

JUST IN: Michael Saylor's MicroStrategy to raise $2 billion to purchase more #Bitcoin.

— Watcher.Guru (@WatcherGuru) August 1, 2024

Macro

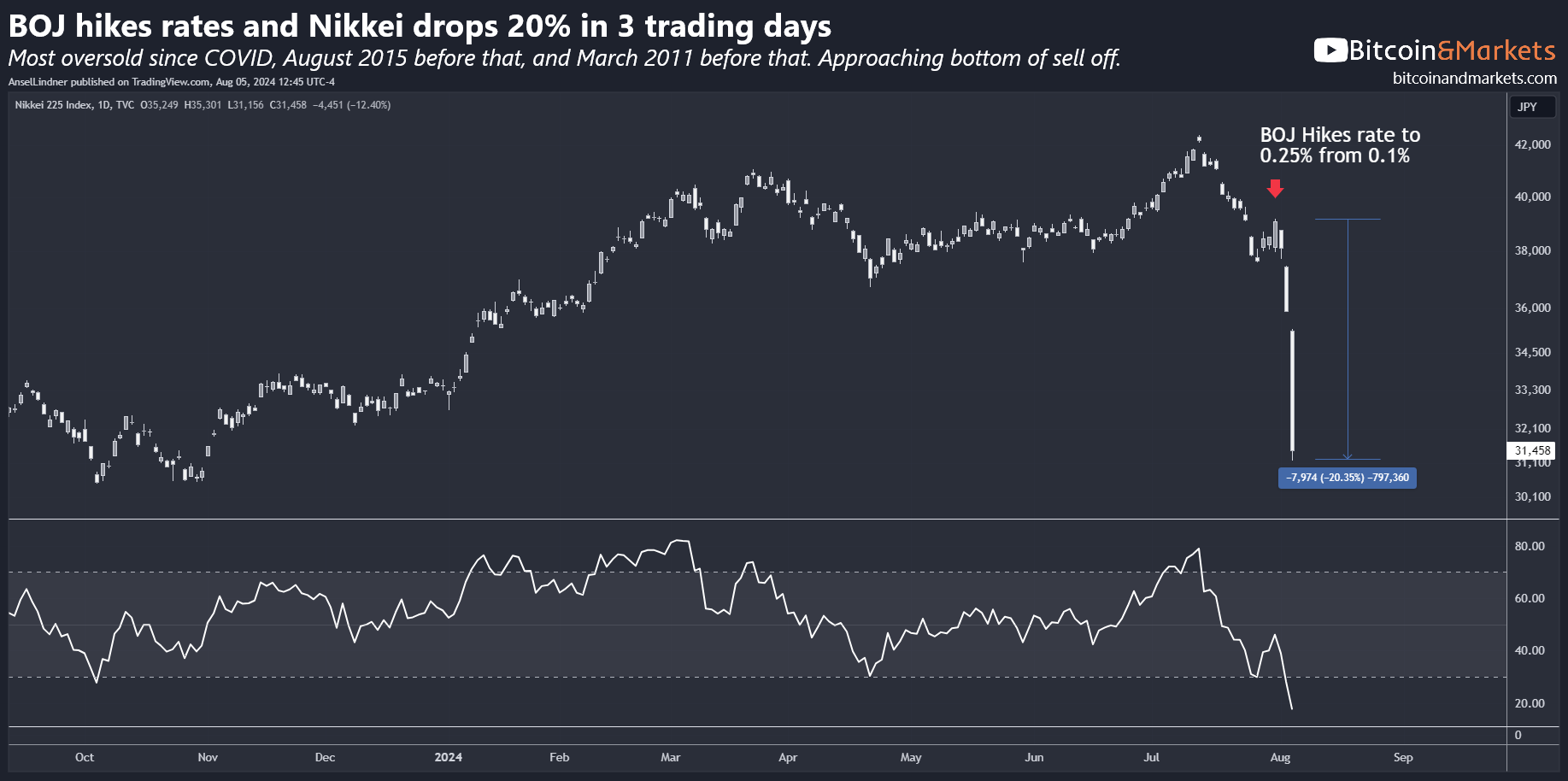

- Japan raises rates and triggers meltdown in their stock market

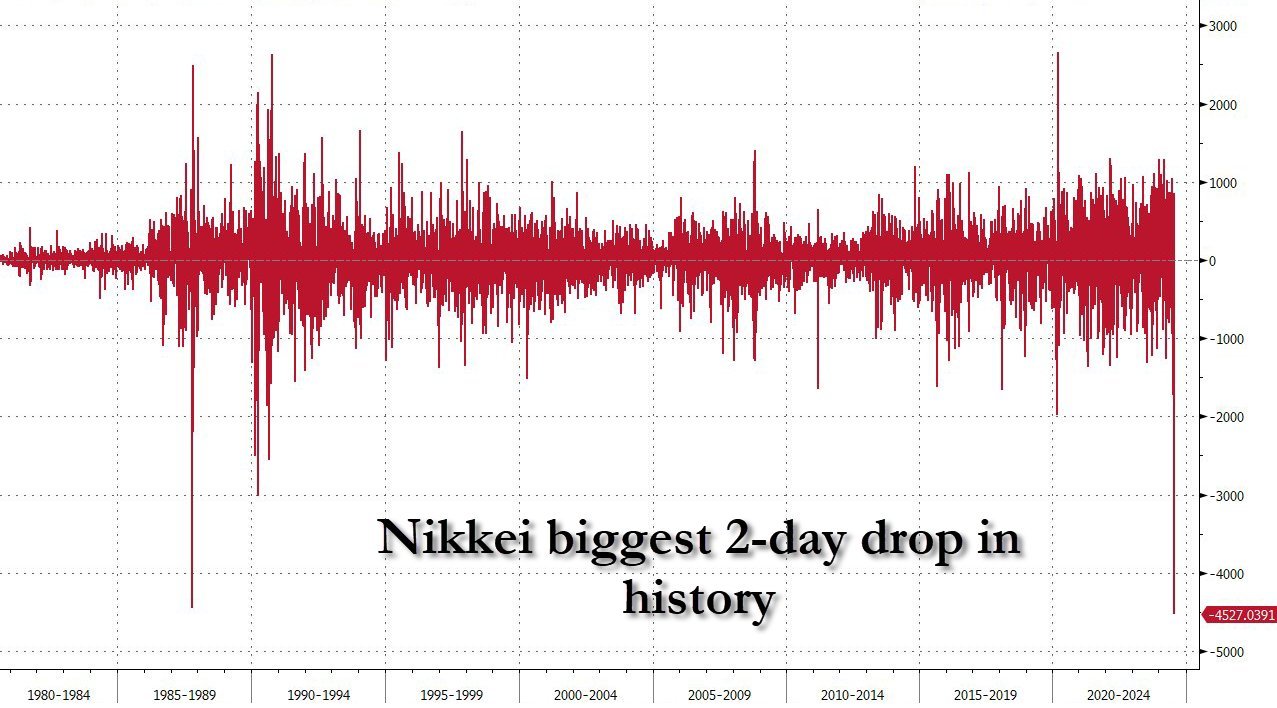

This whole panic started when Japan raised rates as yields around the world are coming down. It has reached an extreme on the RSI, signaling it could be near a temporary bottom.

Most stock exchanges are crashing along with them. Taiwan, South Korea, British FTSE, German DAX, Toronto, and US markets, all down big today in panic.

It is the Nikkei's biggest 2-day loss in history.

There is reportedly $20 trillion in the Japanese carry trade, where you borrow in JPY and buy higher yielding foreign assets. When Japan hiking, only by 0.15% and global rates coming down, people are worried that this massive market is going to unwind.

- US Markets crash, brokerage firms down

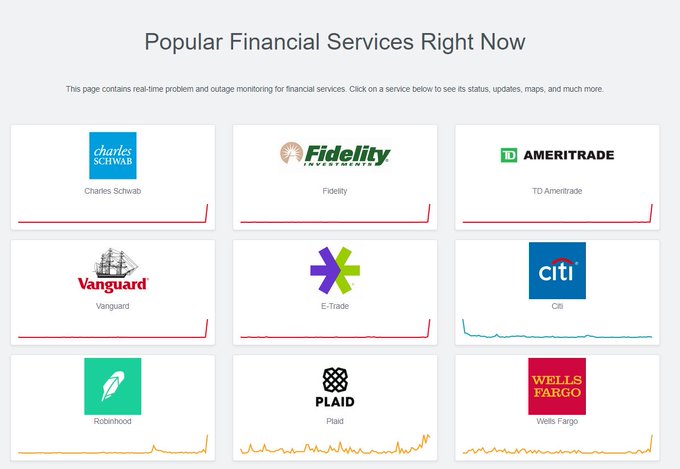

Everyone woke up this morning the US and raced to sell into the crash. Lucky for them, many trading platforms were down. People were reporting not being able to log in. Very convenient.

Just so happens that there was also a solar storm at the exact same time which might be responsible for this outage.

The market might retrace the whole gap by the end of the day now.

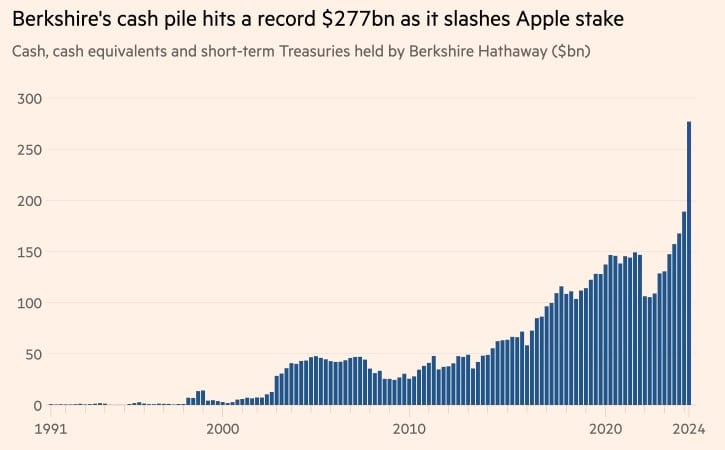

New hit the air waves over the weekend that Berkshire sold half their stake in Apple and stacked it in cash. This added to the market panic at the open today.

- US Economic Data Signals Recession Last Week

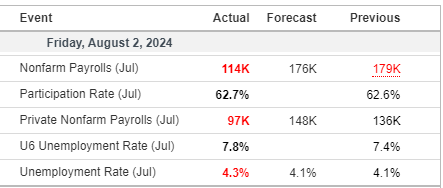

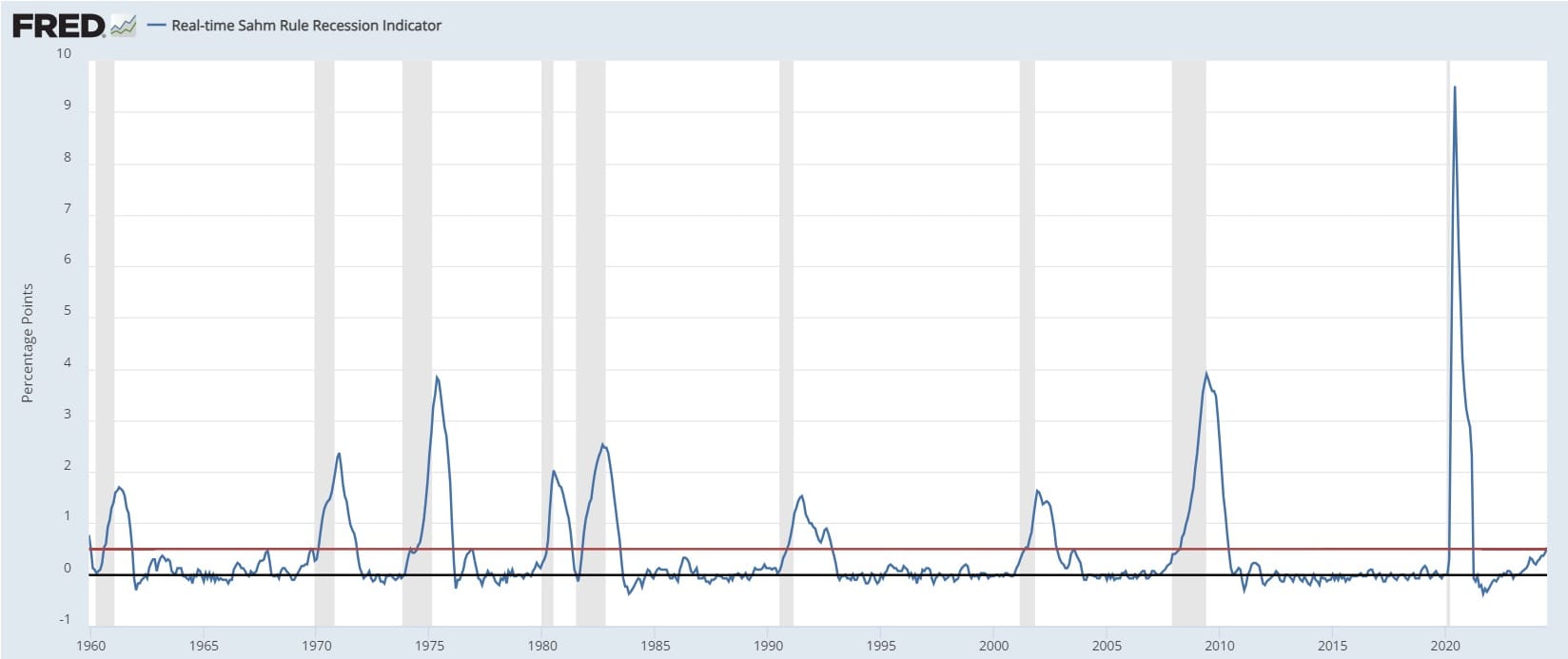

Adding to the panic was all the bad economic data that came out last week. The Non-farm payrolls was horrible triggering Sahm Rule.

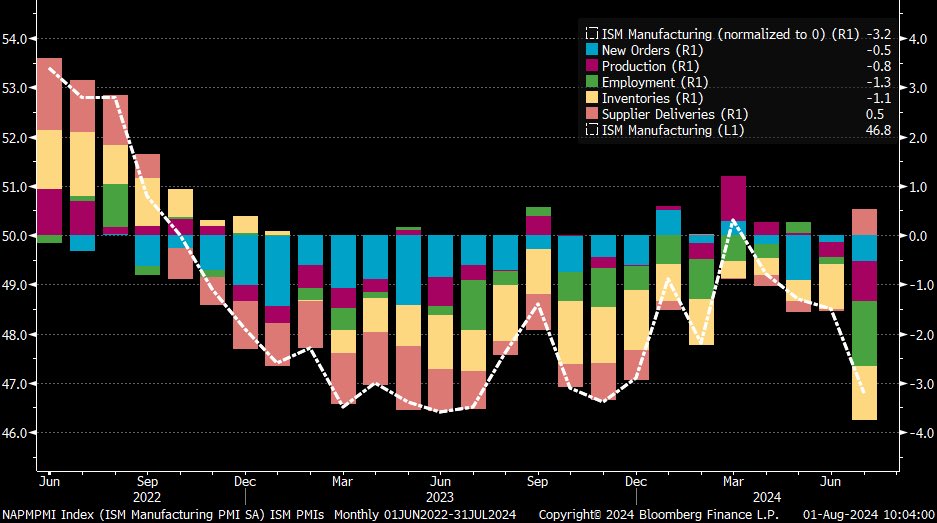

The ISM Manufacturing PMI was also terrible. PMI in the US has now been in contraction for 20 of the last 21 months.

- UK riots break out over the weekend, Elon tweets civil war

I'll be the first one to say that I'm not up-to-speed completely on what is going on over there. I know the silent majority is mad over immigration and the recent election results. It seems they have taken to the streets to riot, and the Muslim immigrants are counter rioting. However, the police and the government are only going after the white protesters.

'When BLM riots happened in 2020, the media coverage was all asking the question "why do black people feel the way they feel?" but no one seems to be prepared to ask these questions this group of people.'

— GB News (@GBNEWS) August 4, 2024

Sunil Sharma, on how to stop the ongoing riots in the UK. pic.twitter.com/EBRq0tPncl

Civil war is inevitable

— Elon Musk (@elonmusk) August 4, 2024

Less than a week after the killing of a top Hamas leader in Tehran and a top Hezbollah commander in Beirut, the entire Middle East is on edge. Fears of a broader regional war have been mounting amid vows of revenge from Iranian leaders that have left Israel in a state of deep uncertainty.

Today, it is being reported that Iran has warned neighbors of a strike, and has been clearing airspace.

Israel hopes to pull the US into this conflict, but I do not think that is possible. This administration will not fight against Hamas or Iran. The American people do have the stomach for war right now. We are in the midst of a vicious political battle with pro-peace former President in the lead, and a pro-war/pro-Palestinian administration in power now. Iran knows this, Israel cannot give an inch.

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

A ton of damage has been done to the chart. People are making lots of comparisons to other major dips in Bitcoin's history. I can't help but compare this feeling to the COVID crash.

There is a death cross coming up, where the 50-day crosses below the 200-day. These crosses are historically bullish, believe it or not. Price tends to rally toward the Schelling point of the cross, whether it be a death cross or a golden cross.

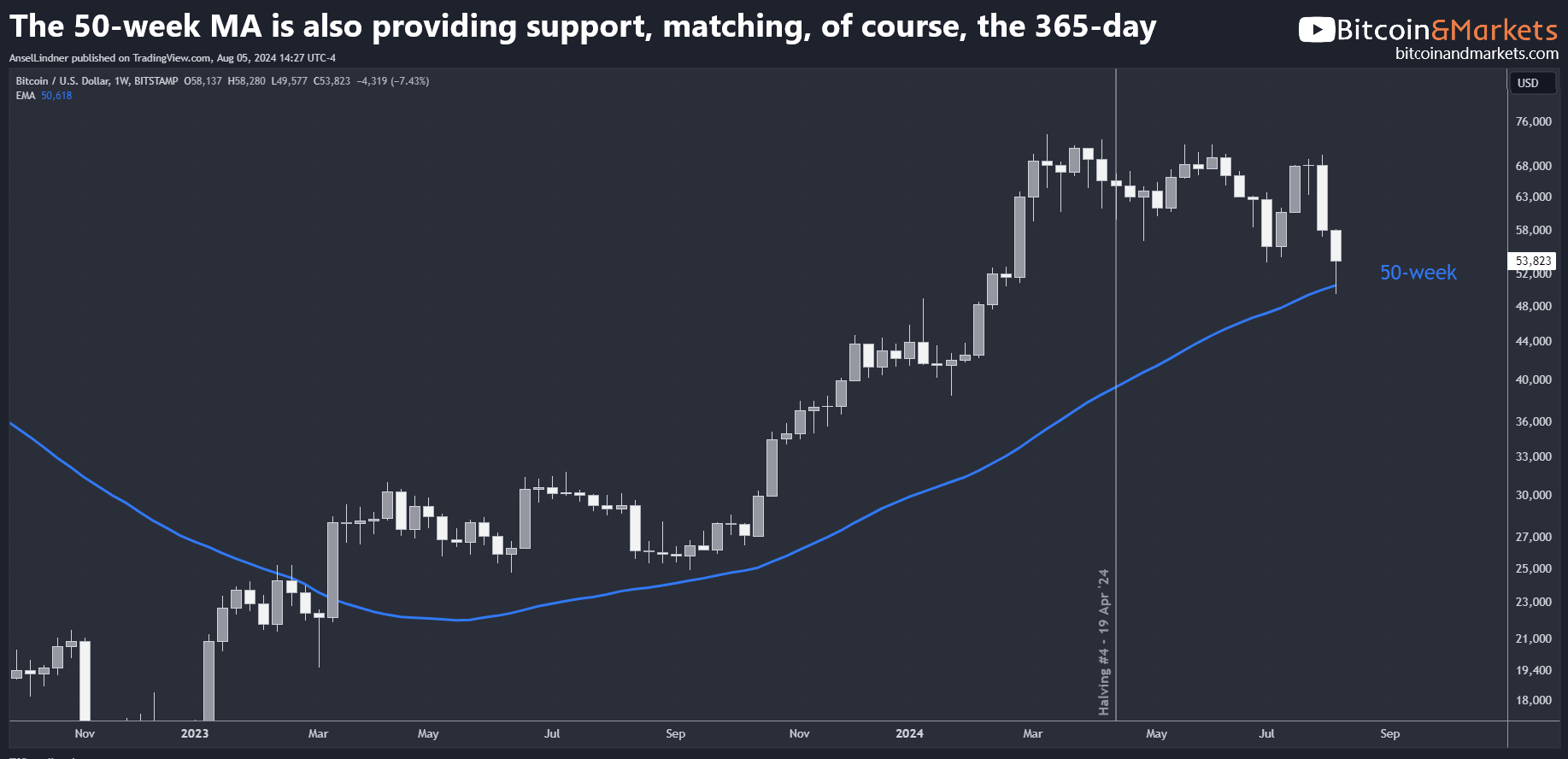

The 365-day matches closely the 50-week, of course.

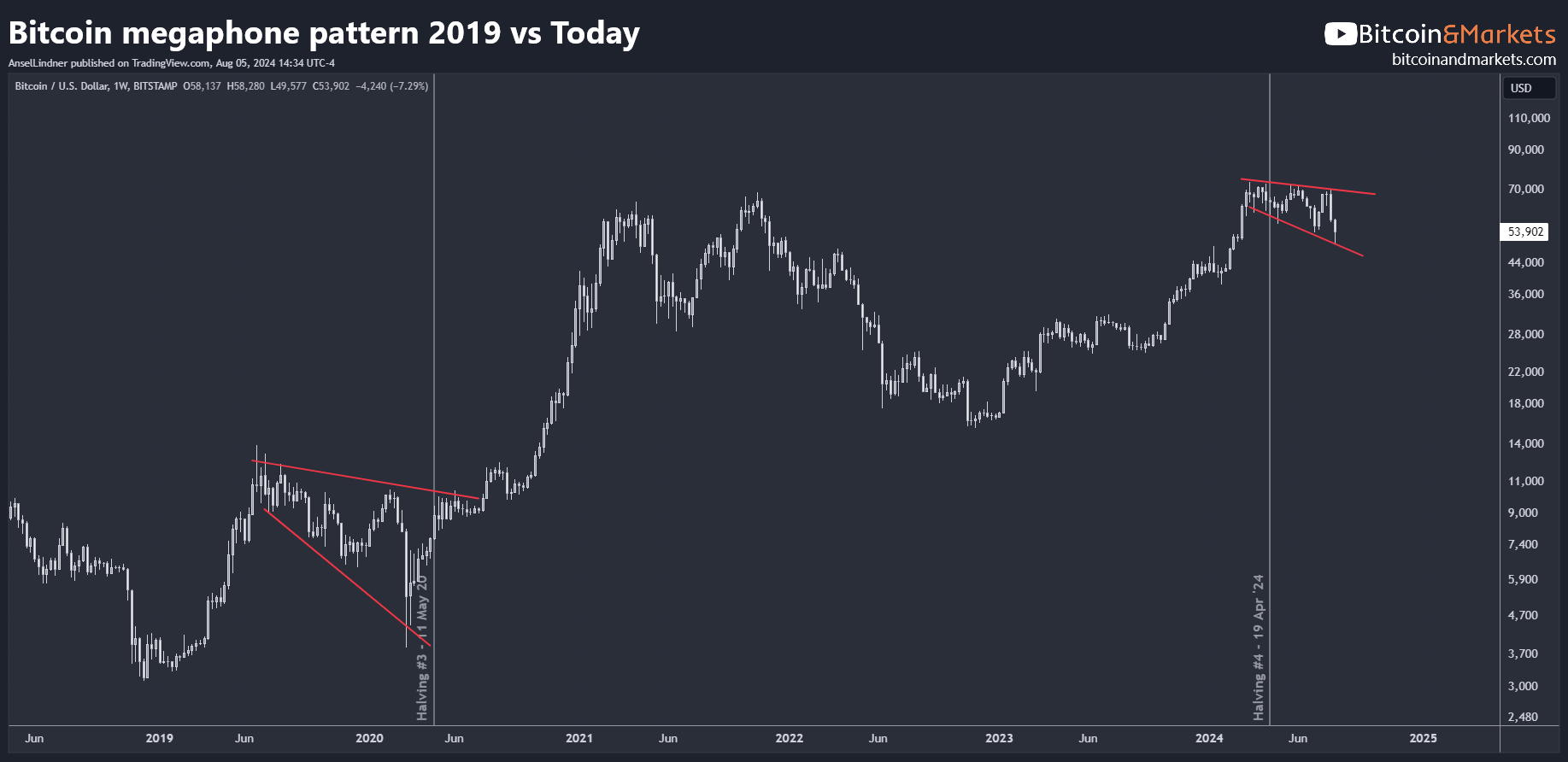

Some people have pointed to this megaphone pattern. This is a well-known pattern and is often a continuation pattern. In this case, bullish continuation.

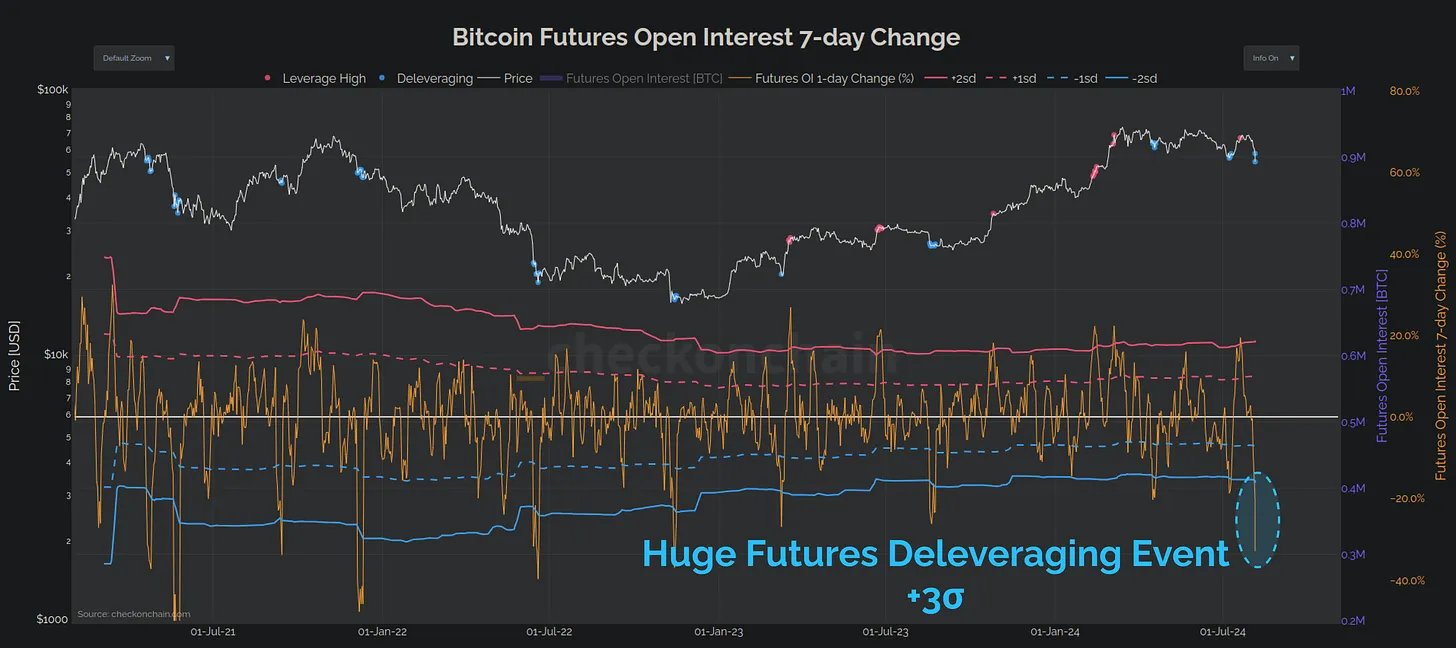

Interestingly, Bitcoin futures open interest has made a quick round-trip from signaling a top, to now signaling a bottom. The market has deleveraged significantly and is ready to lever back up as we bounce.

Overall, this is a Tradfi driven panic, not Bitcoin fundamentals. Supply is still being squeezed and the bull market is still on. Things to consider, 1) oversold again on the daily, 2) support on the 365-day and 50-week, 3) a death cross coming a two days, and 4) the deleveraging in the futures market. Taken together it is likely the bottom is in. I'm expecting a significant bounce tomorrow and perhaps a week's worth of consolidation around $60k before a full recovery, but I am watching what is going on with Iran and Israel, which could cause further delay.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Hash rate and Difficulty

Hash rate has been exploding higher the last week. Right after a monster 10.5% difficulty adjustment to an ATH, the price crashes. This should be telling us that the dip will only be temporary. The deep fundamentals in the space which the miners are exposed to are very bullish.

Mempool

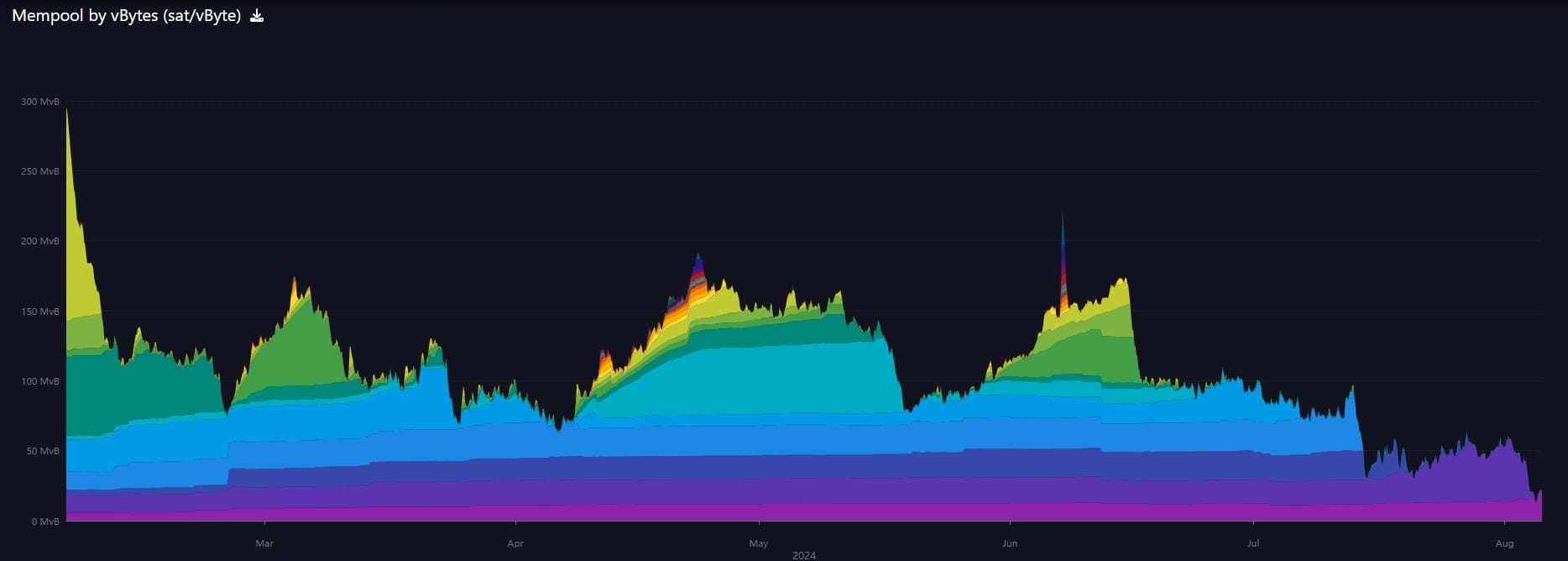

The mempool continues to shrink. Now down to 124 MB. Surprisingly, there was no sell signal from the mempool prior to this current dip, likely due to the fundamentals coming from Tradfi and not bitcoin directly.

I've joined Nostr finally. You can follow me here.

Other than that Layer 2 is NSTR (nothing significant to report). Pun intended.

In Case You Missed It...

My latest posts

- Bitcoin’s Precarious Position, When Bull Reversal? - Premium

- August Price Forecast Competition

- Bitcoin Minute: RFK vs Trump vs Kamala on Bitcoin

- Podcast Replay - Federal Reserve Prepares for September Rate Cut - E385

- Macro Minute: 1970s CPI versus Today

- Bitcoin Minute: Weird Cycle Patterns and FOMC Watch

- Podcast Replay - Bitcoin and Trump, US Gov sells bitcoin? Macro deglobalization and price analysis - E384

- Macro Minute: Xi Jinping Thought

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com