Bitcoin Fundamentals Report #300

Marathon borrows to buy Bitcoin, Trump Jr Bitcoin platform, China struggles, Iran uncertainty, price analysis - it wants to go up, mining and layer 2 news.

August 12, 2024 | Block 856,498

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

🎆 🥳 CELEBRATING 300 REPORTS!!

GET A FREE MONTH WHEN YOU BECOME A MEMBER TODAY!

Limited time - Join the community supporting quality Bitcoin and Macro analysis! You also will be able to enter our monthly Price Forecast competition, and get access to the clickable version of the Bitcoin Pre-History infographic.

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Dip recovery |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $59,191 (+$6,173, +11.6%) |

| Market cap | $1.169 trillion |

| Satoshis/$1 USD | 1689 |

| 1 finney (1/10,000 btc) | $5.92 |

| Mining Sector | |

| Previous difficulty adjustment | +10.5046% |

| Next estimated adjustment | -3.8% in ~2 days |

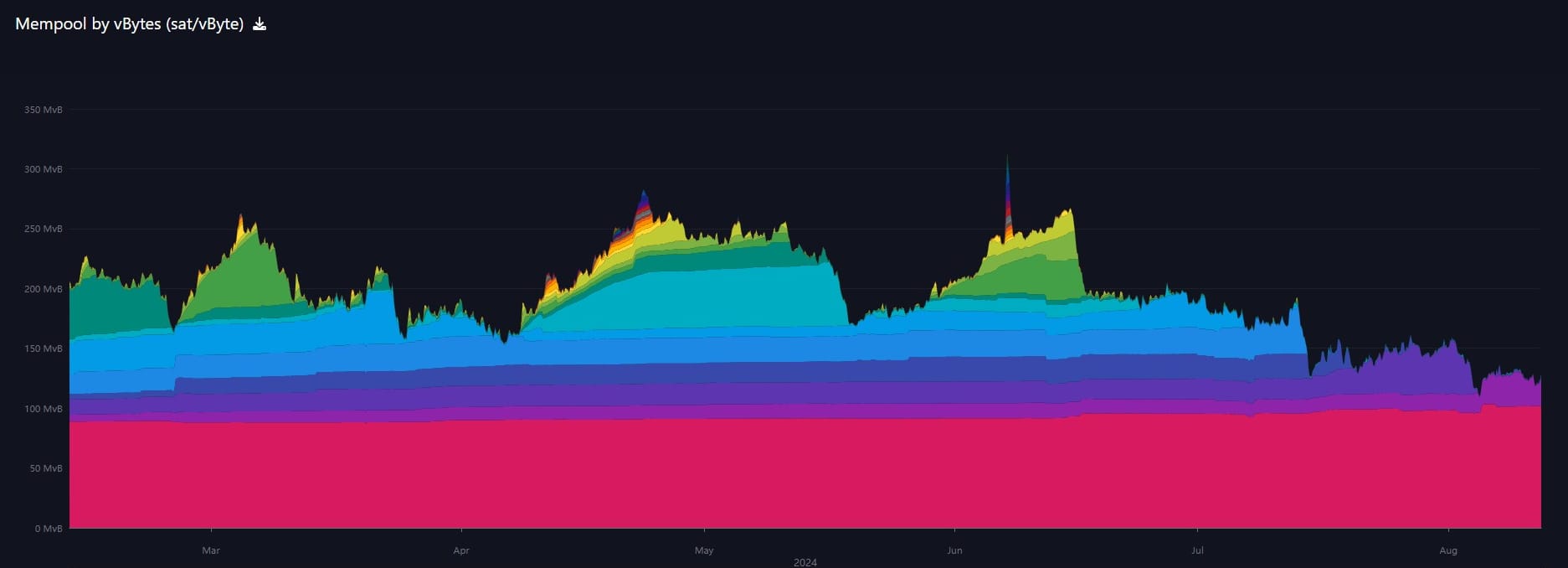

| Mempool | 125MB |

| Fees for next block (sats/byte) | $0.25 (3 s/vb) |

| Low Priority fee | $0.25 |

| Lightning Network** | |

| Capacity | 5005.68 btc (+0.5%, +25) |

| Channels | 49,420 (-0.2%, -97) |

In what is certainly a testament to the crypto’s health, Bitcoin miner Marathon Digital has announced a plan to raise $250 million to purchase more BTC. Indeed, the firm took to X (formerly Twitter) to unveil the plan. Specifically, it revealed a “proposed private offering” of convertible senior notes.

In a press release, the firm stated that “net proceeds from the sale of the notes” will be used to acquire Bitcoin. Marathon Digital had increased its BTC stash notably last month. Over the course of July, the company added more than $124 million worth of the leading cryptocurrency.

Speculation swirled after Eric Trump tweeted about a venture coming in "crypto/defi".

I have truly fallen in love with Crypto / DeFi. Stay tuned for a big announcement…@Trump @realDonaldTrump @DonaldJTrumpJr

— Eric Trump (@EricTrump) August 6, 2024

Many initially suspected it would involve a shitcoin project, while others, including myself, leaned toward a stablecoin. However, recent clarification from Trump Jr. indicates they are building a “crypto platform,” though its exact nature remains unclear.

During a Q&A session on subscription-based platform Locals on Aug. 8, Donald Trump Jr, the eldest son of presidential candidate and former President Donald Trump, said he wasn’t launching a memecoin but working on a crypto platform to take on the banks.

I talked about this at length on the LIVE stream on Friday. Putin has legalized Bitcoin mining (not crypto). The Russians aren't dumb, they have an advantage in energy and the world is moving toward Bitcoin. Why not?

Macro

- China in huge trouble

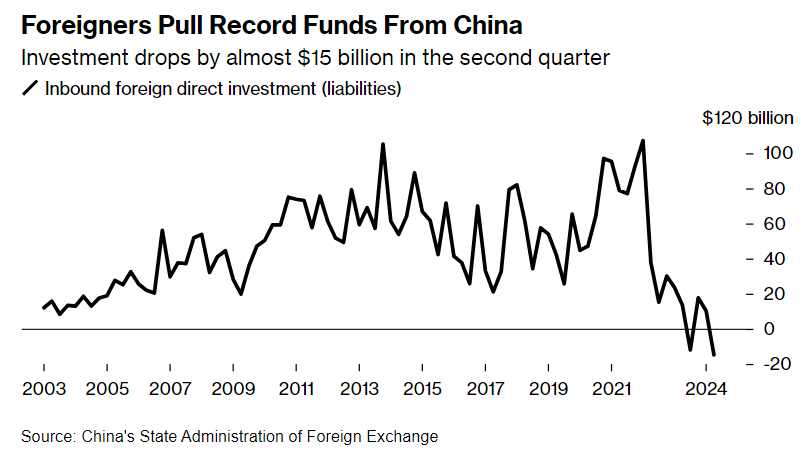

I was the first analyst in Bitcoin to call the collapse of China’s economy, and the situation is only worsening. Any dream of China outcompeting the US over the next decade has been thoroughly quashed by this point. Foreign companies and investors are withdrawing their funds from China at an accelerating pace, signaling the end of the country’s manufacturing pyramid scheme.

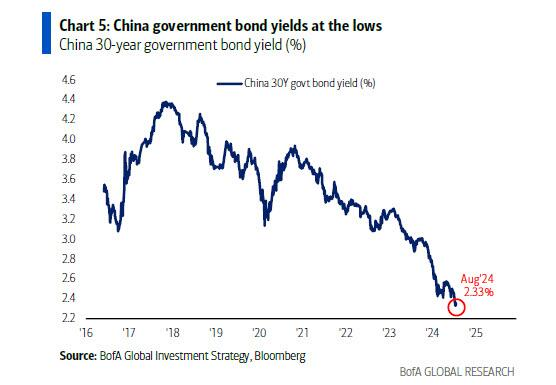

Market participants are starting to panic and shift into government debt. Upon seeing this chart this morning, my immediate reaction was, “Why aren’t people talking about this in relation to the Japanese carry trade?” Japanese banks are heavily invested in China, and the narrative of relatively high government bond yields in China was almost as universally accepted as low rates in Japan.

Israeli intelligence's see-sawing assessment reflects an ongoing debate inside the Iranian government, a source with access to the intelligence told Axios:

"The Iranian Revolutionary Guards Corps [IRGC] is pushing for a more severe and broader response than Iran's April 13 attack on Israel, but the new Iranian president and his advisers believe a regional escalation now wouldn't serve Iran's interests, the source said."

The strengthening of the US force posture included the deployment of the USS Georgia guided missile submarine to the Central Command theater. Armed with up to 154 Tomahawk land-attack cruise missiles, the Kings Bay, Georgia-based vessel recently completed joint training exercises in the Mediterranean with force recon Marines and special operations forces, including units from the UK, Norway and Italy. Austin also ordered the USS Abraham Lincoln carrier strike group, already steaming to the conflict zone laden with F-35C and F/A-18 fighters, to "accelerate its transit", the Pentagon said.

- US CPI this Wednesday, Preview

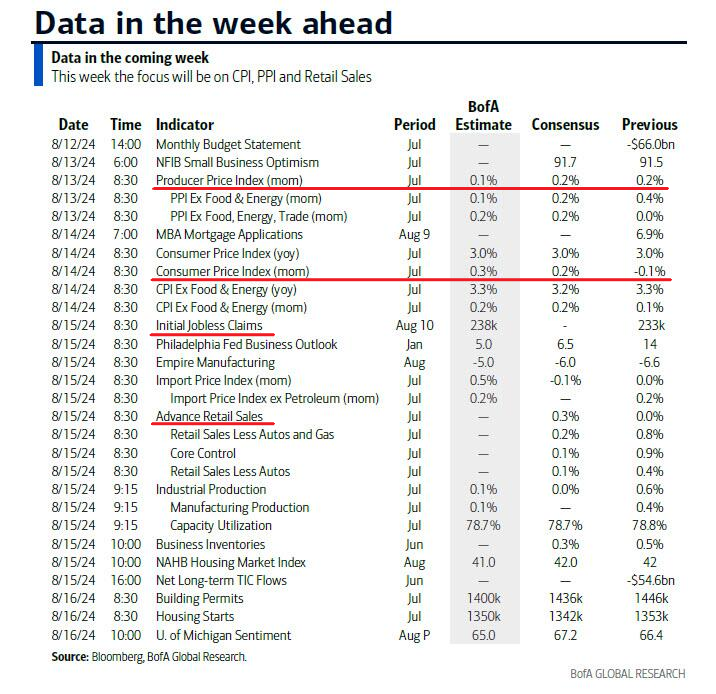

Big week this week for data. We start today with the Bitcoin Fundamentals Report 😉 with more data throughout the week.

I will be LIVE streaming the Wednesday CPI drop. Stay tuned for that!

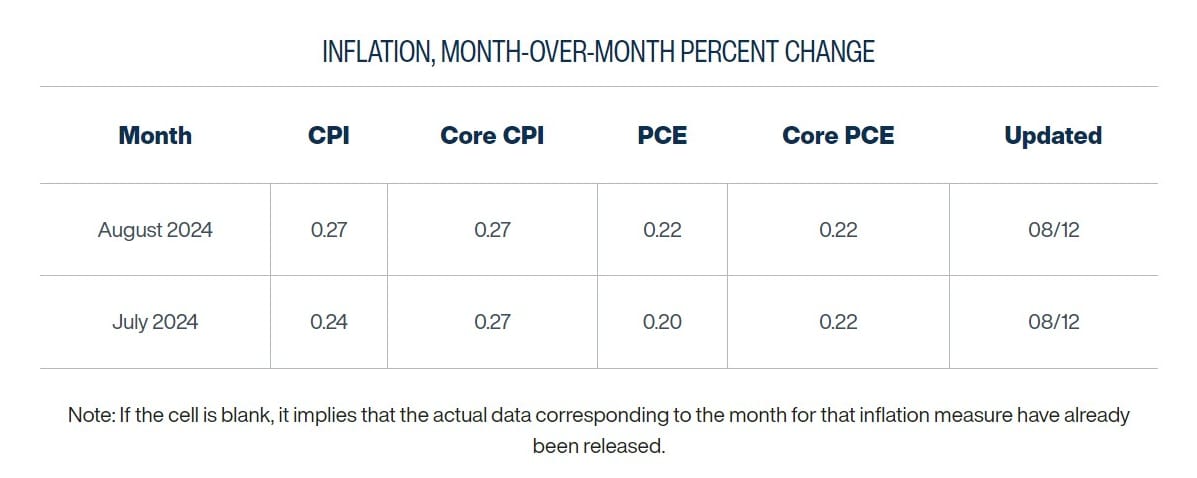

As you can see above, the Bank of America is forecasting 0.3% MoM for CPI. Below, the Cleveland Fed Inflation Nowcast has it at 0.24%. I'm taking the under as usual.

If CPI comes in 0.1-0.2% there will likely be a rally in Bitcoin and the stock market because market participants will anticipate the Fed cutting in September. I think both want to rally right now, but are holding back due to elevated uncertainty at the moment. However, anything under 0.1% might be interpreted by the market as bearish, meaning recession is very close.

Join the Professional tier to receive my MARKET PRO, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week's conclusion was pretty spot on:

Overall, this is a Tradfi driven panic, not Bitcoin fundamentals. Supply is still being squeezed and the bull market is still on. Things to consider, 1) oversold again on the daily, 2) support on the 365-day and 50-week, 3) a death cross coming a two days, and 4) the deleveraging in the futures market. Taken together it is likely the bottom is in. I'm expecting a significant bounce tomorrow and perhaps a week's worth of consolidation around $60k before a full recovery, but I am watching what is going on with Iran and Israel, which could cause further delay.

We did indeed bounce off the support at the 50-week/365-day moving averages (above) right at the bottom of the megaphone and rallied into the Death Cross perfectly. We also closed the gap that had formed on the CME futures (below). Gaps are created with price movements outside trading hours. They typically get filled due to Schelling point effects.

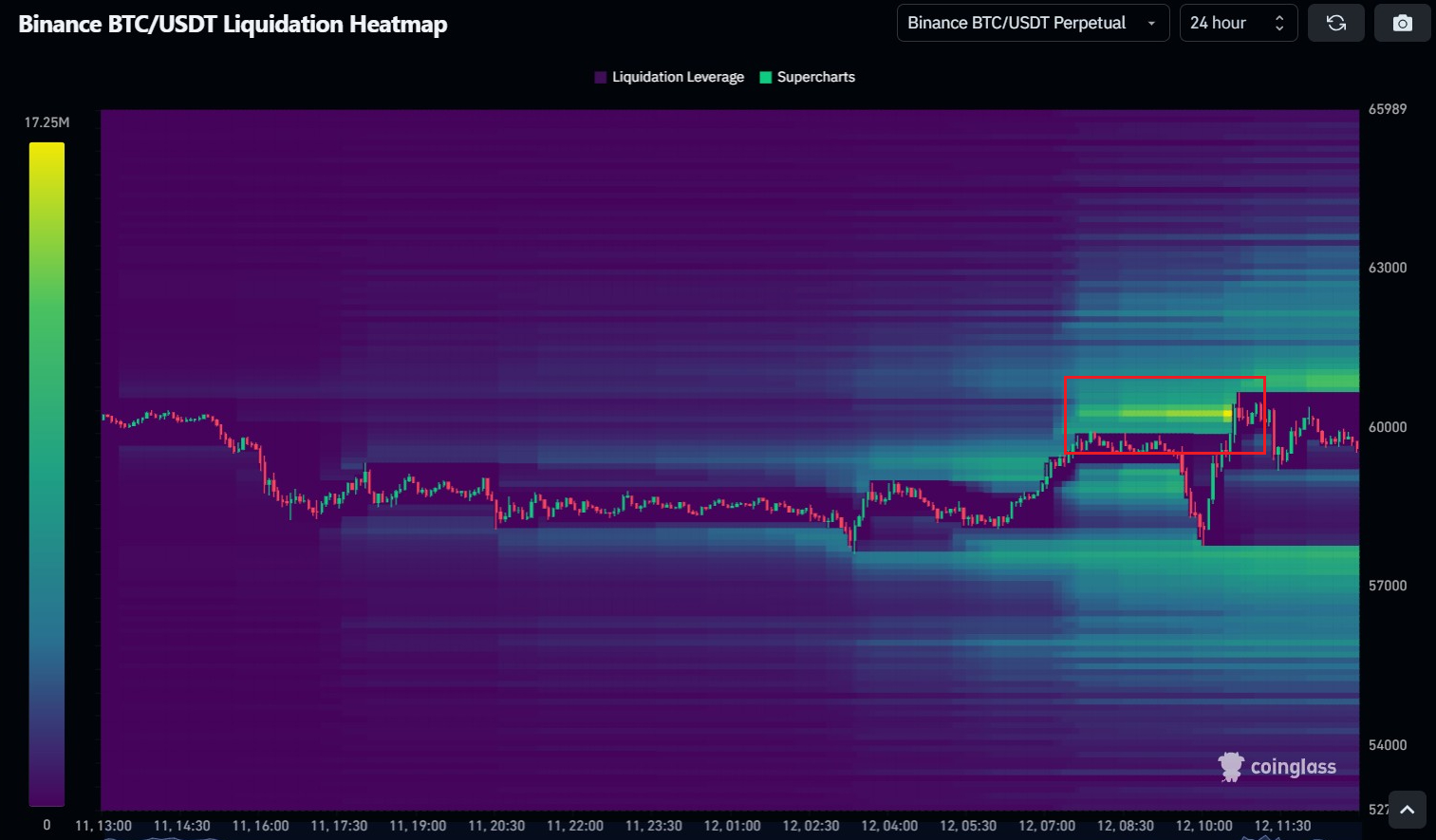

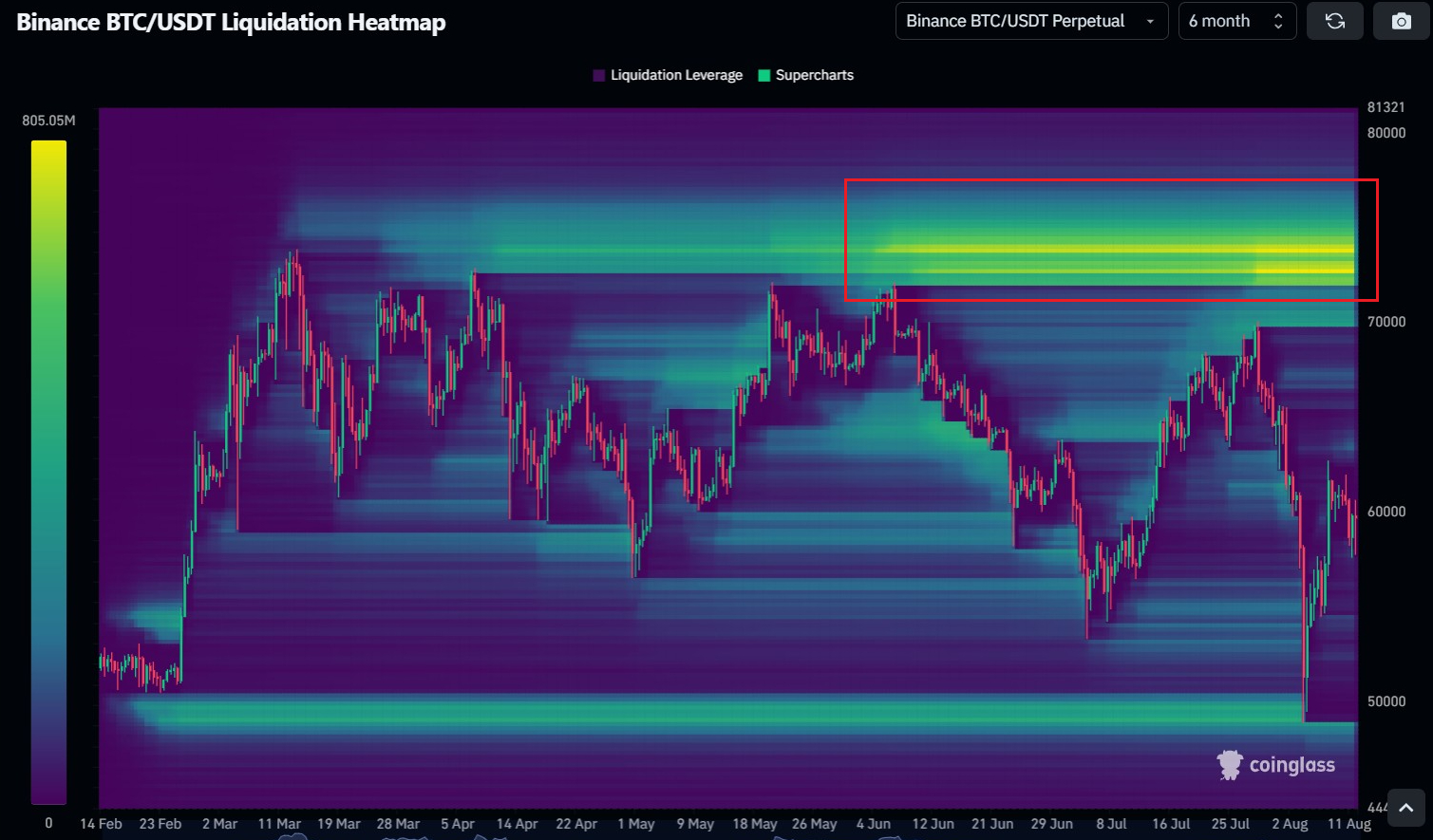

We can clearly see the short-term liquidity grab on the 24-hour heat map at $60k. No clear advantage for up or down in the near-term at the moment.

However, there is still the liquidity at $72k that is daring the price come and get it. That is a crazy chart that should make anyone bullish. Notice in the immediate vicinity of the price, there is little juice to be squeezed out this market, except for the overwhelming zone of interest at the ATH.

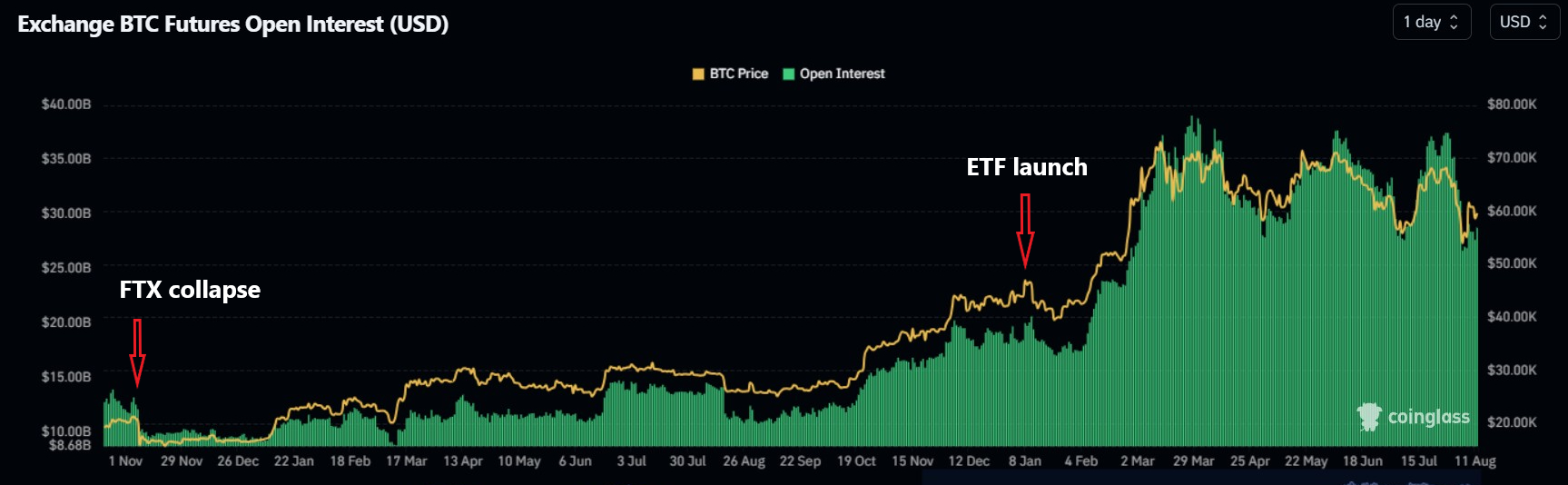

Open interest is also showing plenty of room to the upside. If open interest starts to increase, price could rally rapidly. Again, I think the price of Bitcoin wants to go up, it is simply being held down by elevated uncertainty at the moment.

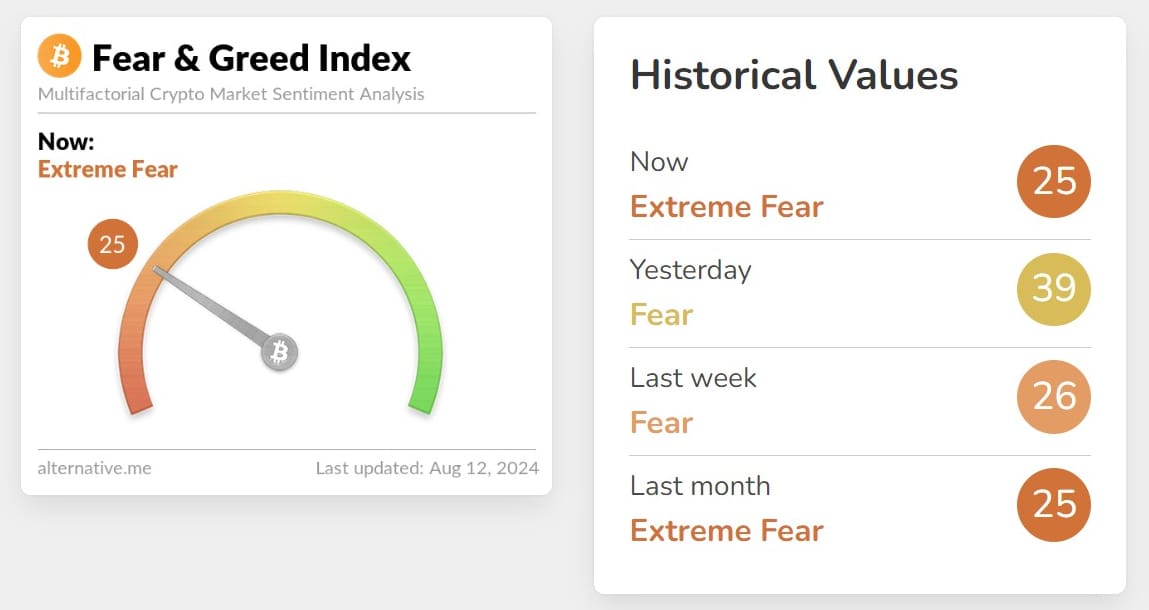

You can see this elevated uncertainty in the Feed and Greed Index. We are in "Extreme Fear" territory at $60k!? There is lots of room to turn bullish from this point, but little room to be more bearish. IOW, if people haven't sold yet, they likely won't be selling. And those who did sell will probably buy back as price begins to rise.

I’ve discussed market comfort levels with certain prices before. When the price initially breaks into a new, higher range, people subconsciously think, "this is a high price," making continued gains harder to achieve. However, after a few months of consolidation, people become accustomed to the price in the $50-70k range, creating psychological space for higher prices. The $100k level is going to be a major psychological barrier, so we will likely spend a lot of time at or just below that level later this year and into next year.

Overall, this week it is less easy to say where price will go in the short-term other than simply spending some time at the $60k level. All things equal, without a Iranian attack, Bitcoin leans heavily bullish at this time. The next stop higher is the ATH.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

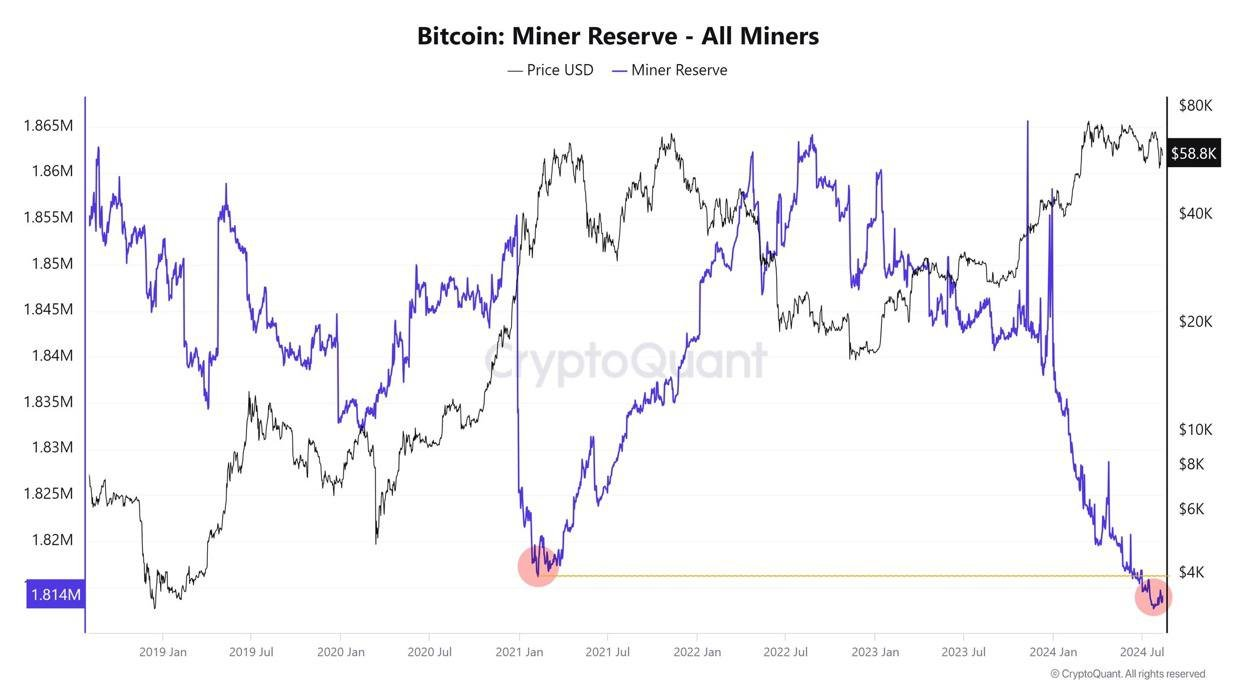

Bitcoin miners have had to sell much of their reserves to stay afloat during this long consolidation in price since March. Especially, after the April halving. Those reserves are reaching historically low levels right now, and imply selling from miners is likely slowing and coming to an end soon as they run out of coins.

According to the official press release, the company generated 614 BTC in the second quarter of 2024 with an average direct production cost of $30,600 per BTC, up from $18,400 in the first quarter. Meanwhile, the total cash cost per BTC increased to $47,300 in the second quarter, compared to $27,900 in the first quarter, as a result of producing a lower quantity of BTC.

[However ] July saw a 34% increase in Bitcoin earnings for the firm, reaching 243 BTC valued at $14 million, an improvement from 189 BTC worth $11 million in June.

Hash rate and Difficulty

Hash rate has pulled back from the monster rise over the last month, accompanied by a significant rise in difficulty to match.

Mempool

The miners have eaten their way through nearly all of the mempool above the very lowest fee bands (1-2 sats/vb).

Franklin Templeton Digital Assets and ABCDE, a crypto venture capital firm co-founded by Huobi co-founder Du Jun, co-led the round, Bitlayer Labs said Tuesday. Other investors included Framework Ventures, WAGMI Ventures, GSR Ventures, Flow Traders and FalconX. Angel investors, including DOMO, creator of BRC-20, and Brian Kang, co-founder of FactBlock KBW, also joined the round.

Founded last October, Bitlayer Labs is building a Bitcoin Layer 2 network based on the Bitcoin Virtual Machine (BitVM) system, which offers Bitcoin-equivalent security. Bitlayer launched its mainnet V1 in April and claims to have an ecosystem of over 200 projects already. It is currently ranked the number one Bitcoin scaling project in terms of total value locked at over $550 million, according to DeFiLlama data.

In Case You Missed It...

My latest posts

- Macro Minute: Commodities Under Pressure, Support Recessionary Signals

- Rally or Retest? Navigating the Bitcoin Rollercoaster - Premium

- The Bottom Falls Out, What Is Next For Markets? - E387

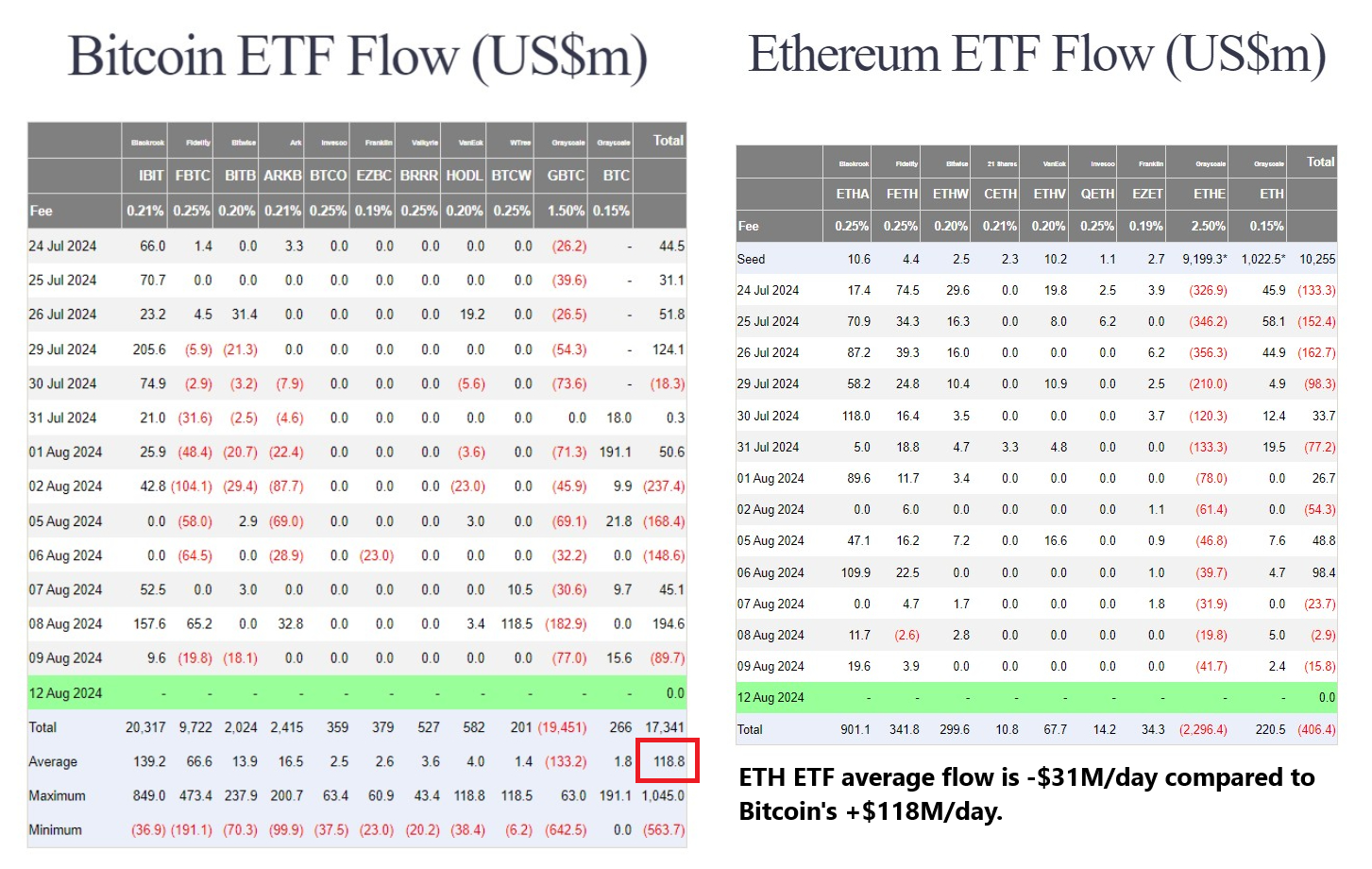

- Bitcoin Minute: Bitcoin ETFs Hold Strong Amid Market Panic

- Podcast Replay: Markets Panic, Bitcoin Holds, Q3 Seasonality Strikes - E386

- Macro Minute: Markets Stabilize Amid Overblown Fears

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com