Bitcoin Fundamentals Report #301

Bitcoin Ticks Along; 13F Updates, Bitcoin Elasticity Debate, Fed Watching, Price Path to New ATH, Miner Revenue and Reserves, and Layer 2 News

August 19, 2024 | Block 857,509

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

🎆 🥳 CELEBRATING 300 REPORTS!!

GET A FREE MONTH WHEN YOU BECOME A MEMBER TODAY!

LIMITED TIME - Join the community supporting quality Bitcoin and Macro analysis! You also will be able to enter our monthly Price Forecast competition, and get access to the clickable version of the Bitcoin Pre-History infographic.

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidation |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Struggling |

| Price Section | |

| Weekly price* | $58,997 (-$194, -0.3%) |

| Market cap | $1.165 trillion |

| Satoshis/$1 USD | 1694 |

| 1 finney (1/10,000 btc) | $5.90 |

| Mining Sector | |

| Previous difficulty adjustment | -4.1897% |

| Next estimated adjustment | +2% in ~8 days |

| Mempool | 142MB |

| Fees for next block (sats/byte) | $0.99 (12 s/vb) |

| Low Priority fee | $0.66 |

| Lightning Network** | |

| Capacity | 4978.97 btc (-0.5%, -27) |

| Channels | 49,089 (-0.5%, -331) |

- Lackluster Q2 13F filings

I wrote a Bitcoin Minute about this topic last week as the deadline approached. Overall, there were only $2 billion in inflows to ETFs in Q2 compared to $12 billion in Q1, so the 13F filings were bound to be unremarkable. However, there were a few highlights:

- The State of Michigan pension fund dipped their toe into Bitcoin with a $6M investment, follow neighbor Wisconsin.

- Goldman Sachs investment bank bought $400M+ (~20% of the quarter's total inflows).

- Morgan Stanley bought an additional $184M

- Many large pools of capital bought MicroStrategy stock; Norwegian Central Bank- $152M, Swiss National Bank - $64M, Mitsui Sumitomo (one of Japan's largest insurers) - $39M, South Korea's National Pension Fund - $33M, and Wellington Management ($1T AUM) - $26.7M.

- Elon Musk Responds to Luke Dashjr

This isn't a major story, but it's cool. Elon Musk responded to Bitcoin-famous Luke Dashjr in a thread about GitHub terminology. That's all.

- Bitcoin Elasticity Debate

Last week, the elasticity debate resurfaced in Bitcoin, centered around Jeff Snider. I'm a fan of Jeff's work on the shadow banking (Eurodollar) system, but his thinking on monetary evolution is, in my opinion, not well-grounded. I did a LIVE stream reaction to his debate with Parker Lewis, in which he rambled on and got into the weeds. I'll be writing a follow-up that is much more concise this week.

The bottom line:

- Jeff insists on the medium of exchange function as the defining principle of money and I'd respond, "What are you exchanging? Value? That means value (monetary premium) accumulation to the asset precedes widespread use in transactions?"

- Jeff argues that the credit-based dollar beat gold because it was better able to respond to the market's need for elasticity and implies it mandatorily follows that significant elasticity is always what the market will choose. Of course, this is not how evolution works; it is not a straight line. There are periods where the environment reverts and prior adaptations will be selected again.

- Jeff is unwilling to accept that elasticity is a double-edged sword. Money supply can expand in good times and contract in bad times. If you constantly expand, you get consistently high levels of inflation. However, at the end of a global credit bubble, when bad times dominate and deflationary pressure is the norm, people will naturally begin switching to a money that doesn't suffer from the backward cut of deflation, or the negative side of elasticity.

Macro

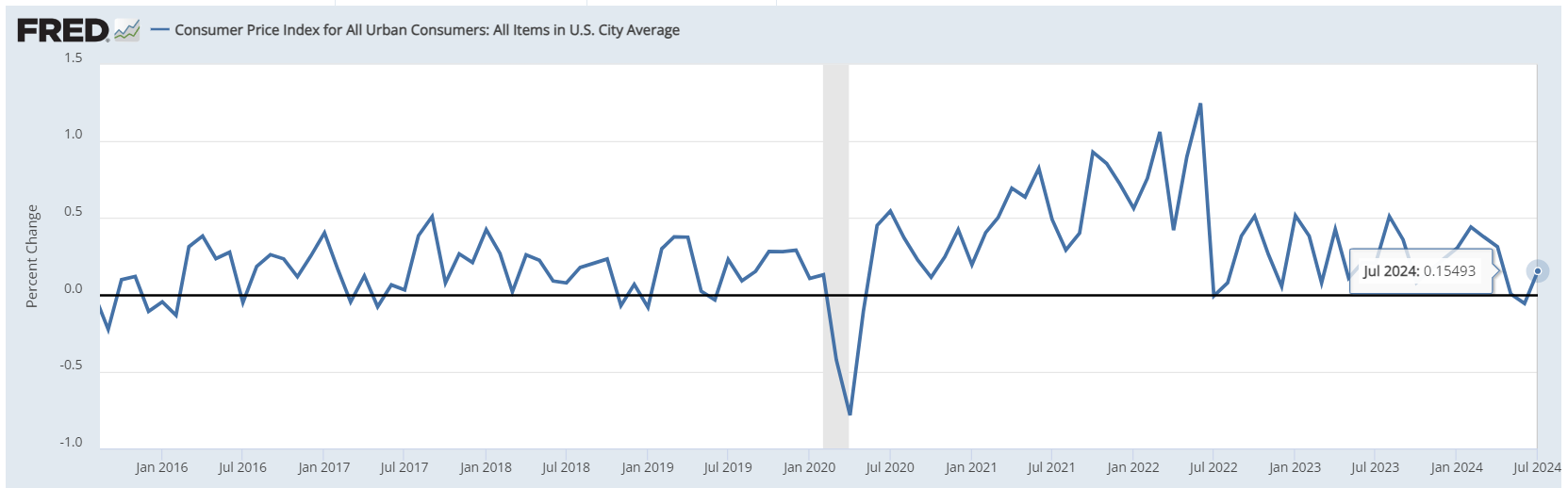

- CPI Was Uneventful, Jackson Hole Friday

July CPI came in on expectations when rounded up, hence no major market reactions. Fed monetary policy expectations have shifted from 50/50 between a 25 and 50 bps cut next month to now a 77% for a 25 bps cut and 23% for a 50 bps cut.

However, people might not be aware of the fact that the actual MoM CPI was 0.15%, rounded up to 0.2%. That's a big difference because 0.15% is under the 0.166% annualized rate for the Fed's 2% target, where 0.2% is above.

This means CPI did come in 0.09% below the Cleveland Fed's Inflation Nowcast of 0.24%. Fourth 0.1% miss in a row.

On Friday, Jerome Powell will be speaking at the annual Jackson Hole summit. People will be scanning his comments closely for any hint of what he will do in September. I think it will be a very bland speech.

- Iran Uncertainty Has Died Down

I have not read much about the Iran threats to strike Israel this week. There was news about a massive naval mobilization from the US, which might have deterred any strike. It is likely Iran will launch a strike at some point in the future, but for now, things have died down.

- Germany is Pissed About Nordstream 2 Revelations

The original theory on Nord Stream 2 stemmed form Seymour Hersh's post blaming the US and Norway. However, this week a damning story from the Wall Street Journal (archived) reports it was a Ukrainian plot, initially green-lit by the Ukrainian government. A group of men rented a small yacht and set off to blow up the pipeline.

It is kind of a fantastical story; however, the Germans are taking it very seriously. They've issued an arrest warrant for the semi-anonymous person, Volodymyr Z, in Poland who has since fled. Germany then rejected new funding to Ukraine and is now demanding repayment.

Join the Professional tier to receive my MARKET PRO, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

Overall, this week it is less easy to say where price will go in the short-term other than simply spending some time at the $60k level.

Price has hugged the 20-day moving average downward. When there is a cluster of moving averages together, they create stouter resistance. This is due to the confluence of eyes on that level. Different traders will trade the 20-day MA, the 50-day MA, and the 200-day MA. When they are all together on the chart, the combined sell-side pressure compounds. However, once the MAs start to diverge, as they are doing now, the price can break them individually.

For example, once bitcoin breaks the 20-day, now trading strategies that buy the 20-day break will be added as price approaches the 50-day. Similarly with the 50-day and 200-day MAs. Therefore, as it stands now, we should expect a battle with these moving averages and not a spike until after price is above the 200-day at $62,800.

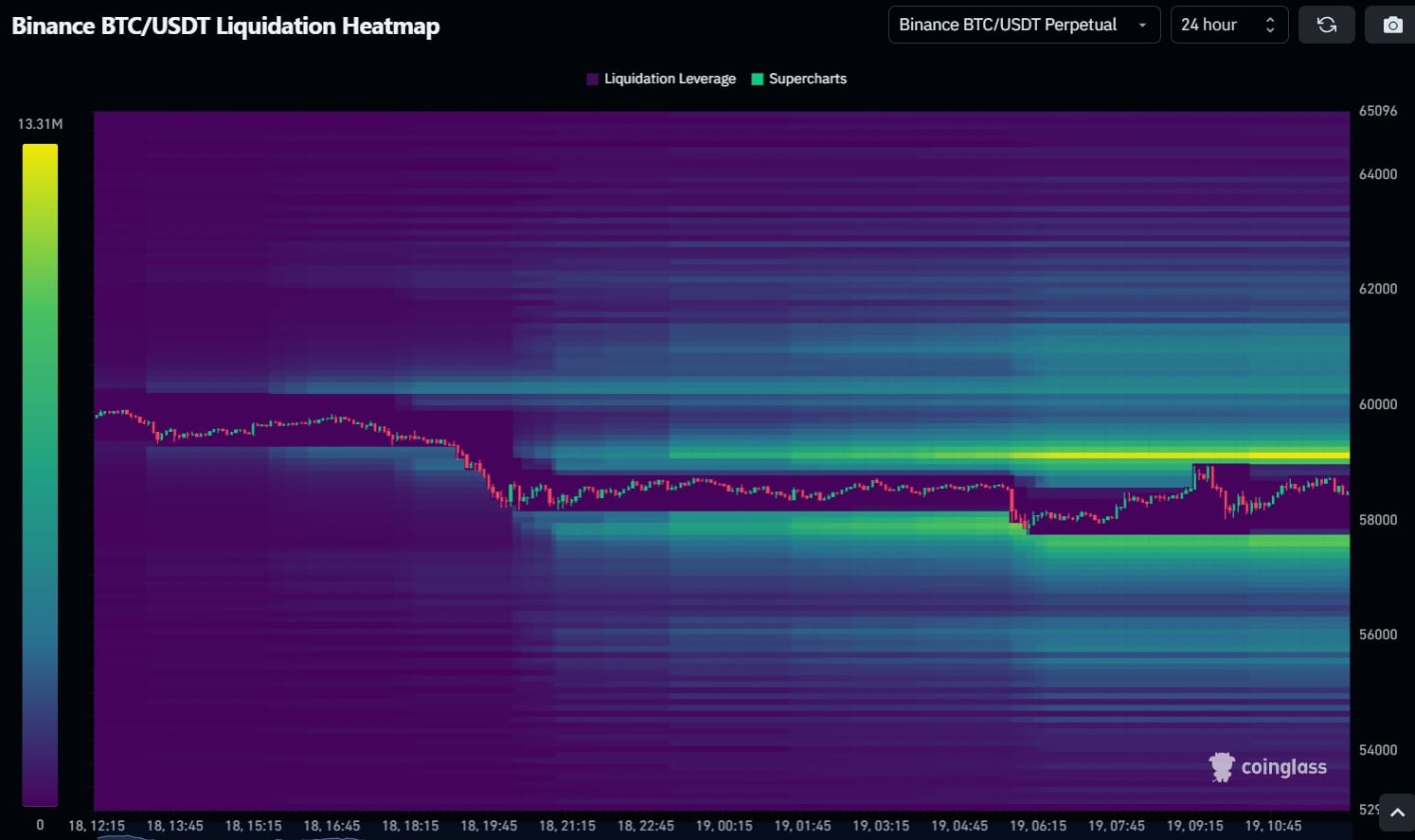

We can clearly see the next nearest source of liquidity on the 24-hour heat map at $59.1k.

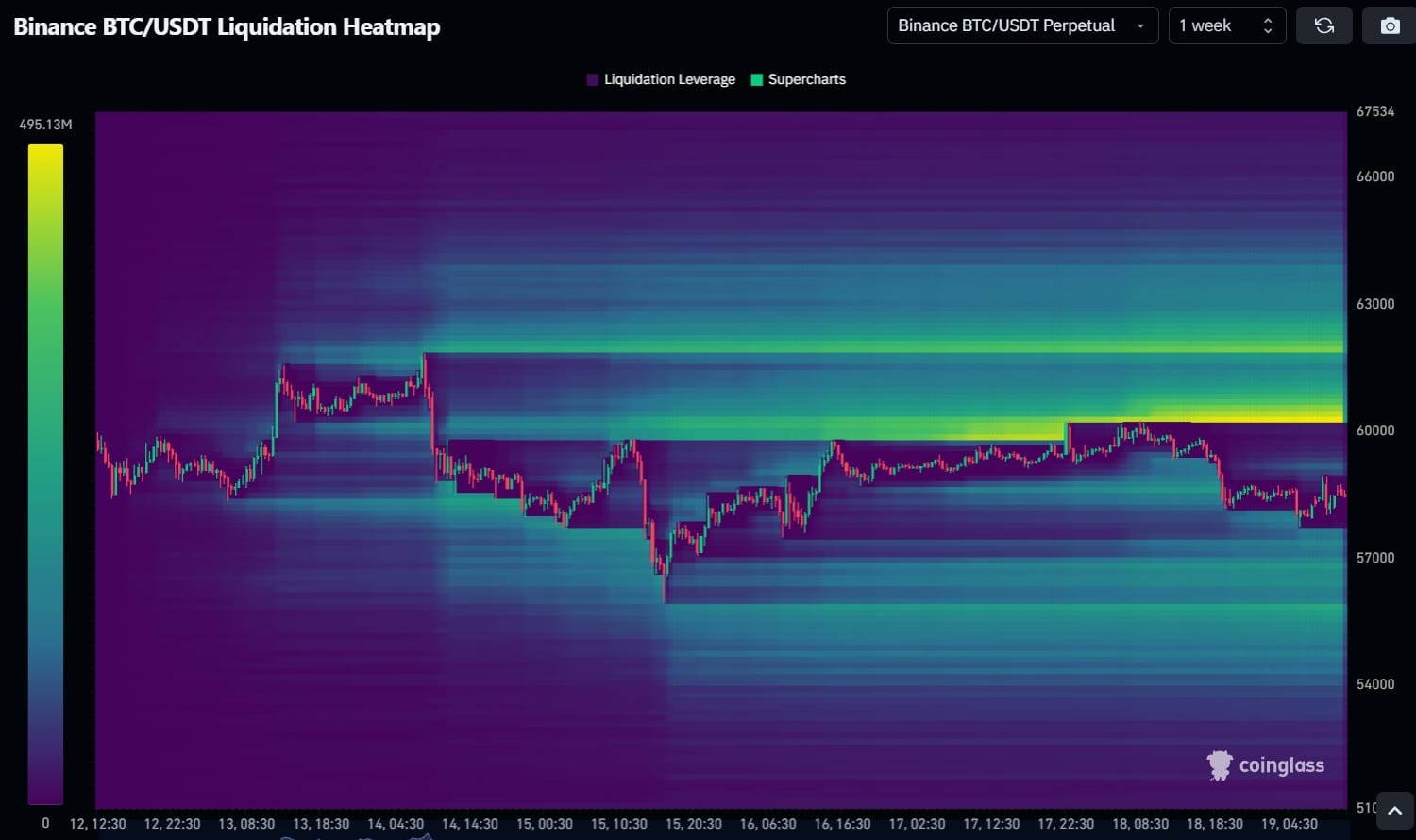

Zooming out to the 1 week heat map, there is a glowing area at $60-61k of over $2B in liquidations on this one trading pair alone, which should act as a major magnet. This would coincide with attacking the 50-day MA above, currently $61,500.

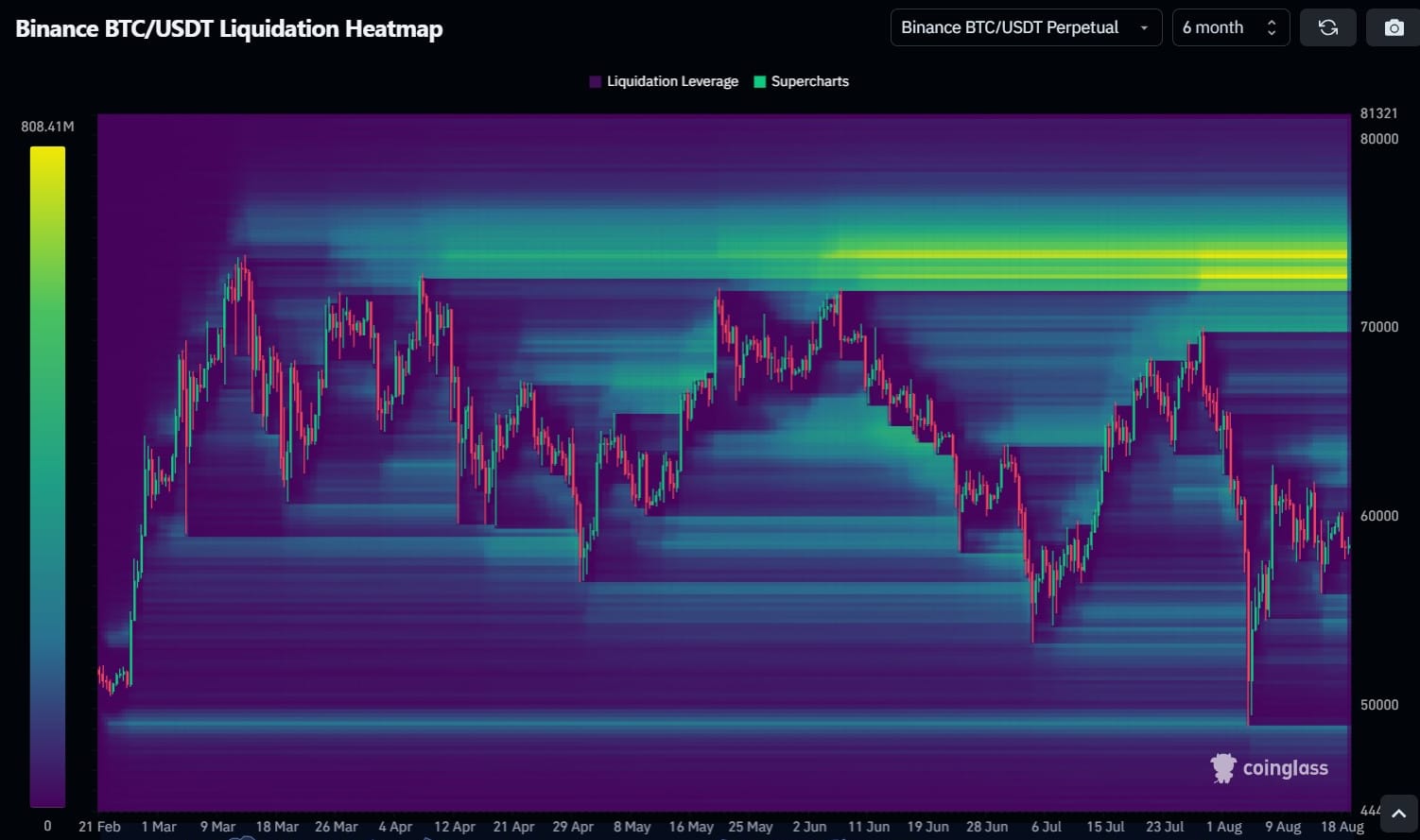

Things get really interesting when zooming out to the 6-month heat map. Here, we can see the massive glowing liquidation level up at the ATH. Looking at this chart, there is no place for price to go but up to capture that liquidity. I think we'll be there faster than people are thinking.

Overall, there is a clear path for price on the technical side from here to the ATH. As the Moving Average cluster separates, Bitcoin will be able to break them independently. Fundamentally, Bitcoin is bound to hit a supply crunch soon. People have become accustomed to $60k and bitcoin has been distributed from people taking profits to those accumulating. Therefore, the stage has been set for a new ATH and beyond.

Over the next week, expect the battle with the moving averages to continue, with no spike higher until breaking the 200-day.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

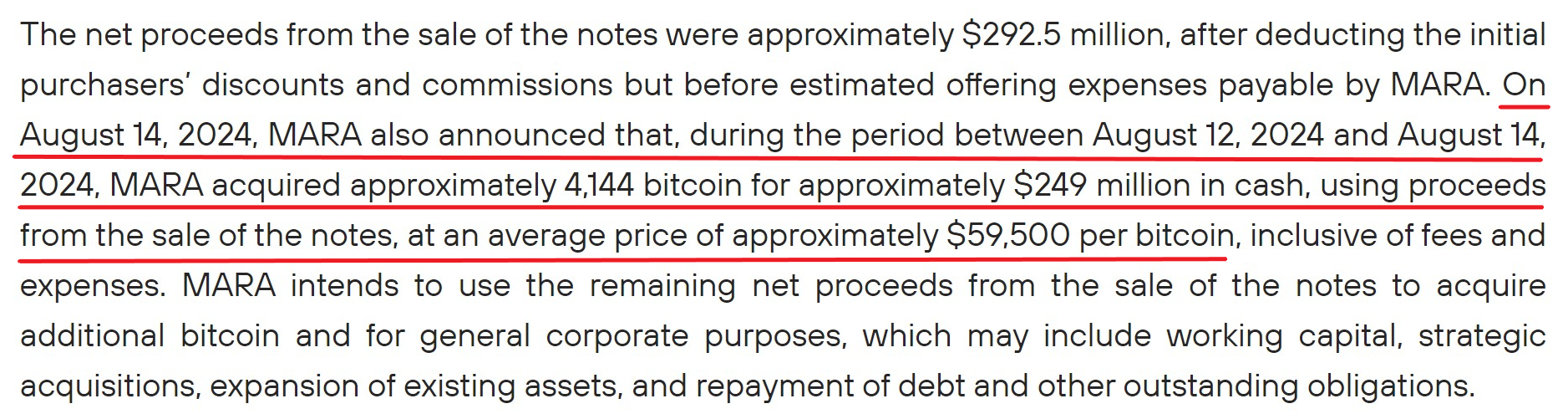

This week, JP Morgan is out with their analysis, namely ATL for miner profitability.

Bitcoin (BTC) mining stocks gave back artificial intelligence (AI) related gains in the first two weeks of August as the network hashrate rose which pushed mining profitability to record lows, JPMorgan (JPM) said in a research report on Friday.

The hashprice, a measure of mining profitability, is still around 30% lower than the levels seen in December 2022 and about 40% below pre-halving levels, and this could slow hashrate growth in the near term, the report added.

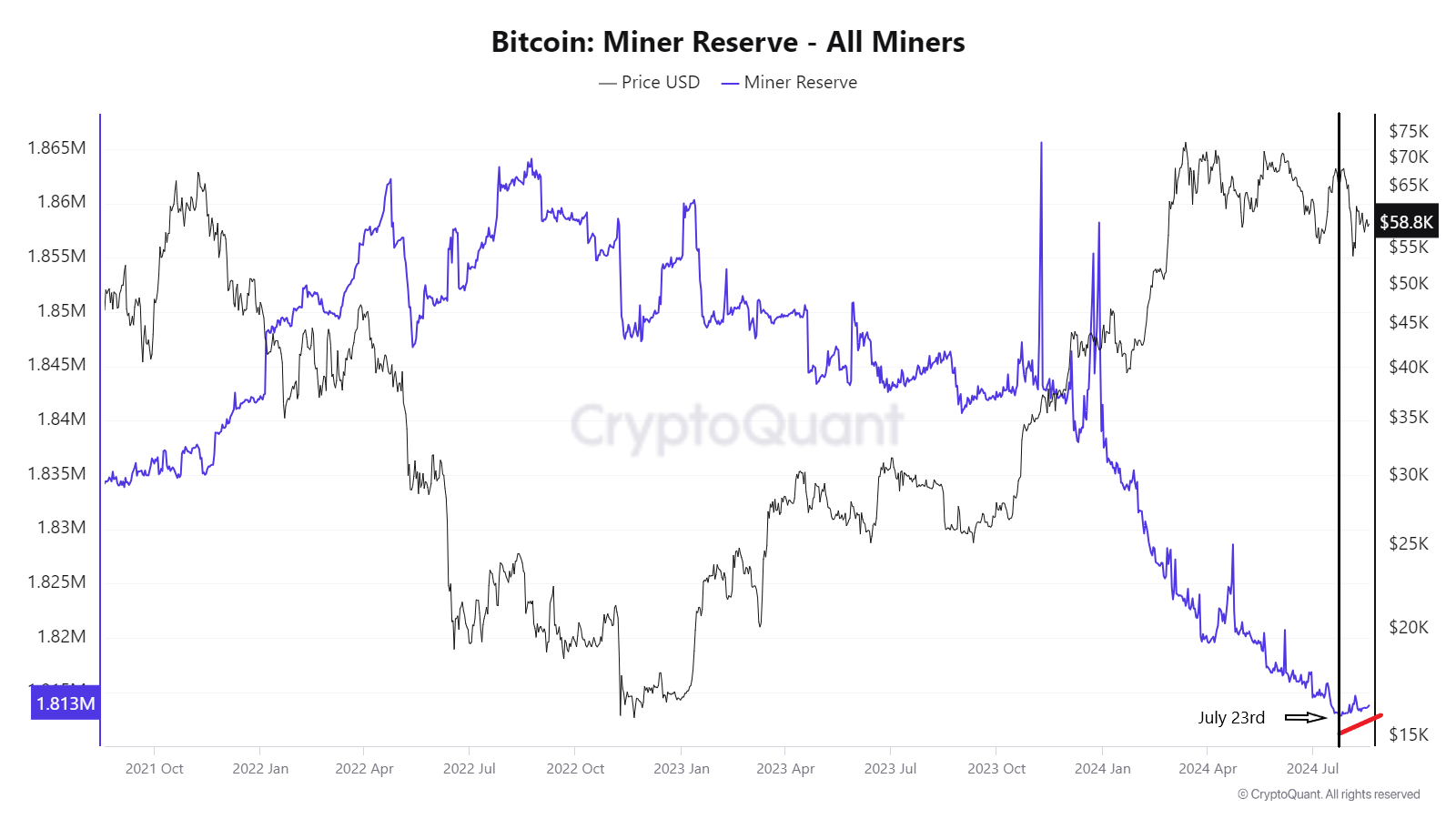

Last week I included this chart; here is an update. The bottom for Miner Reserve was on July 23rd and has been slightly up since. This is on the CryptoQuant free tier btw.

The Puell Multiple is a mining specific cycle indicator. Specifically, it is the ratio between the daily issuance value (in USD) by the 365-day MA of the daily issuance value. If you want to see the pain in the mining sector, this would be a good metric to look at.

As you can see above, the halvings (red arrows) have occurred in the mid-range, neither in the red top section nor the green bottom section. Each halving was followed by a period of depressed miner revenue in USD that then rallied to the top as the bull market proceeded. This time does not look different at all.

This brings their total bitcoin reserves to 24,962. Note, this could be affecting the above Miner Reserve stat.

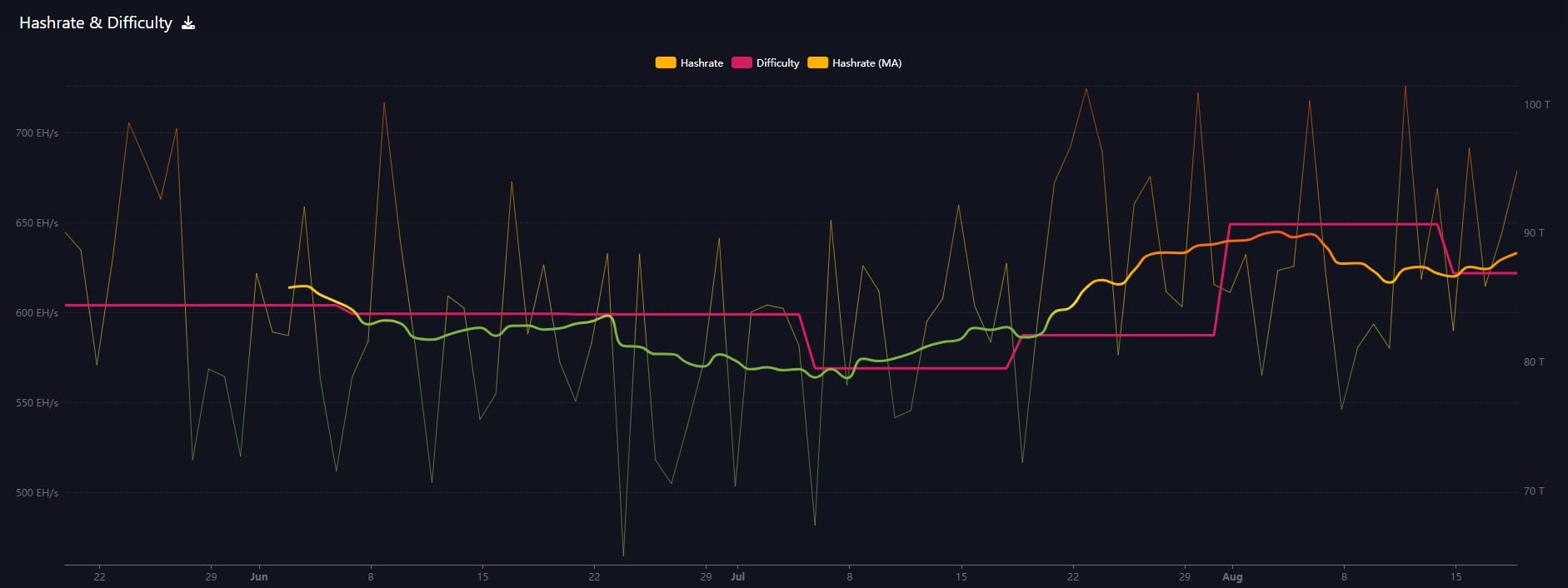

Hash rate and Difficulty

Despite the revenue troubles for miners, hashrate has returned to an uptrend (dark yellow line). This was helped by the difficulty adjustment of -4% last Wednesday. Miners' bullishness has outweighed price over the last month, which is an overall sign of market bullishness.

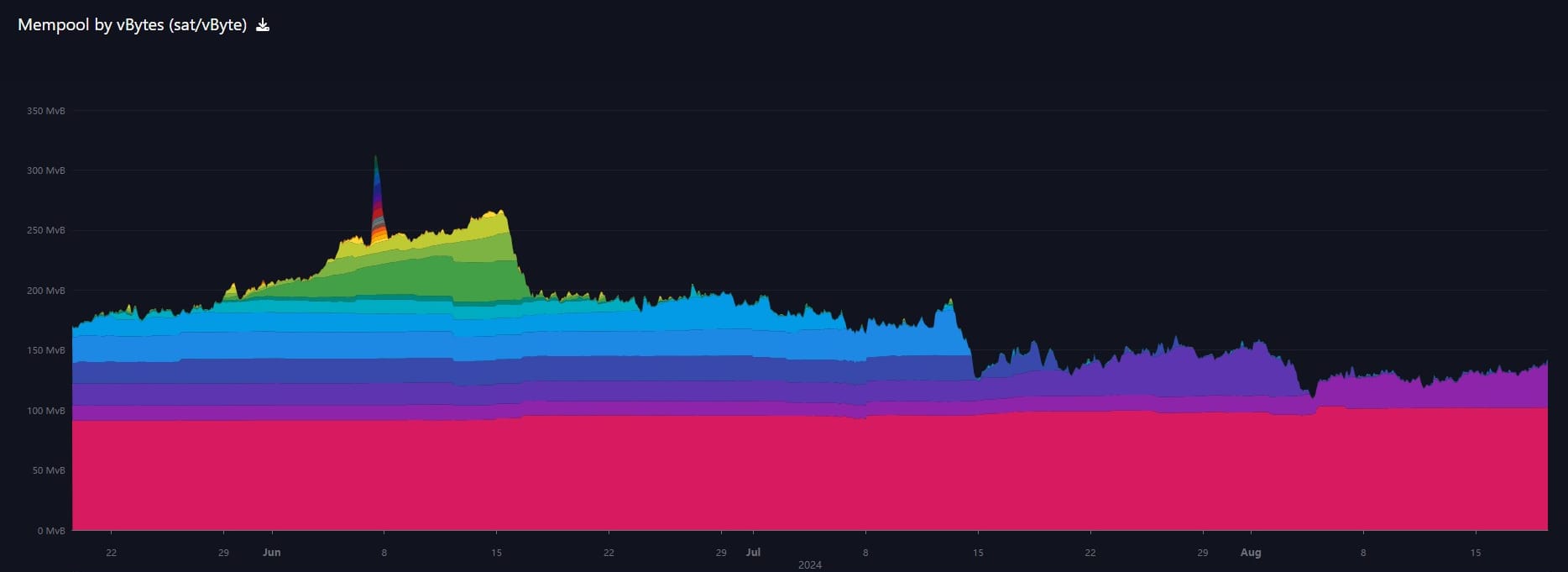

Mempool

The mempool has risen this week but remains generally low. You can see the large batch of 1-2 sats/byte fees in pink, which represent the vast majority of transactions in the mempool. This is generally bullish as well. A bearish mempool would be one that is spiking as holders rush to make transactions.

A detailed update by Alexei Zamyatin outlines all the changes to the Layer 2 call BitVM2.

BitVM2 and BitVM Bridge: TLDR

— Alexei Zamyatin | Hiring (@alexeiZamyatin) August 15, 2024

Today we released the BitVM2 tech and bridge paper!

Huge thanks to brilliant @robin_linus @lukas_aumayr Andrea Pelosi @zetavar1 @matteo_maffei

TLDR:

- BitVM2 is a major improvement over previous BitVM versions.

- BitVM Bridge is now the most… pic.twitter.com/KeNdjSCTwA

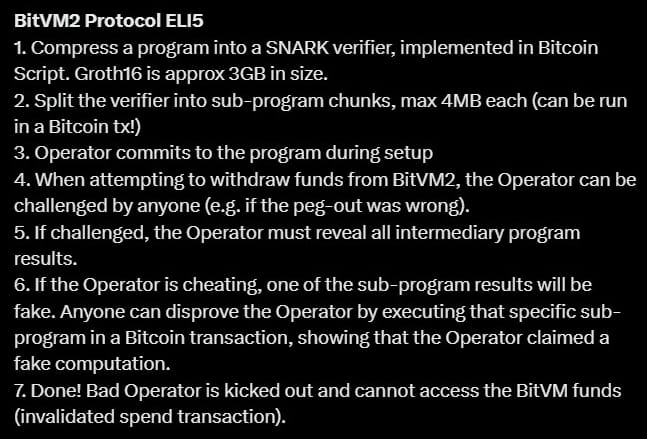

It includes a helpful BitVM2 ELI5:

In Case You Missed It...

My latest posts

- Charting Bitcoin: Critical Juncture for Entire Cycle - Premium

- Weekly Round Up of the Bitcoin Market, Uncertainty Amid Bullishness - E389

- Macro Minute: Predicted Stabilization in Markets, Decision Time

- Bitcoin Minute: 13F Deadline, Big Players Quietly Expand Bitcoin Holdings

- A closer look at commodities and recession, plus Bitcoin ETF flows update - E388

- Deflationary Drift: Insights from PPI, CPI, Stocks, Curves, and Shipping - Premium

- Macro Minute: Markets Stabilize Amid Overblown Fears

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com