Bitcoin Fundamentals Report #302

Bitcoin weekly developments from spiking fees to CBDCs, ETF flows and Telegram bros, Macro headlines, price update, and mining sector news.

August 26, 2024 | Block 858,547

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

LIMITED TIME - Join the community supporting quality Bitcoin and Macro analysis! You also will be able to enter our monthly Price Forecast competition, and get access to the clickable version of the Bitcoin Pre-History infographic.

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Confirm higher |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Bottoming |

| Price Section | |

| Weekly price* | $63,645 (+$4648, +7.9%) |

| Market cap | $1.225 trillion |

| Satoshis/$1 USD | 1573 |

| 1 finney (1/10,000 btc) | $6.36 |

| Mining Sector | |

| Previous difficulty adjustment | -4.1897% |

| Next estimated adjustment | +3% in ~1 days |

| Mempool | 137MB |

| Fees for next block (sats/byte) | $0.89 (10 s/vb) |

| Low Priority fee | $0.62 |

| Lightning Network** | |

| Capacity | 5032.02 btc (+1.1%, +53) |

| Channels | 49,436 (+0.7%, +349) |

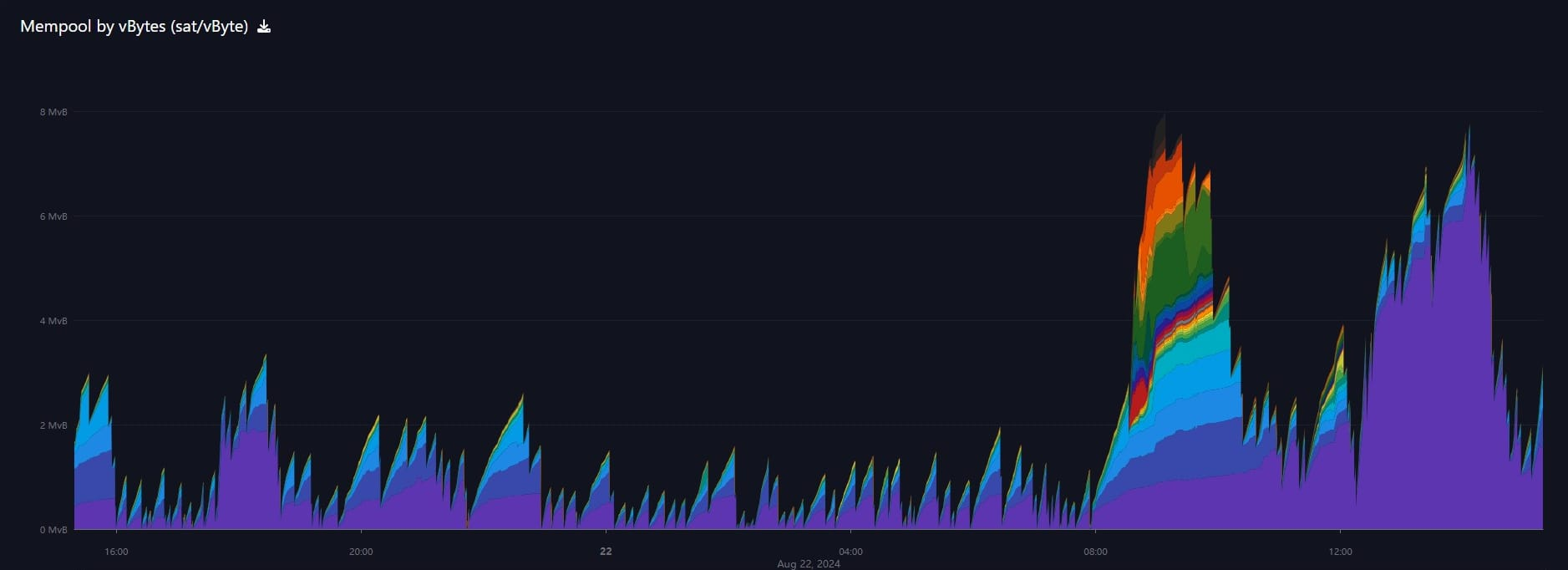

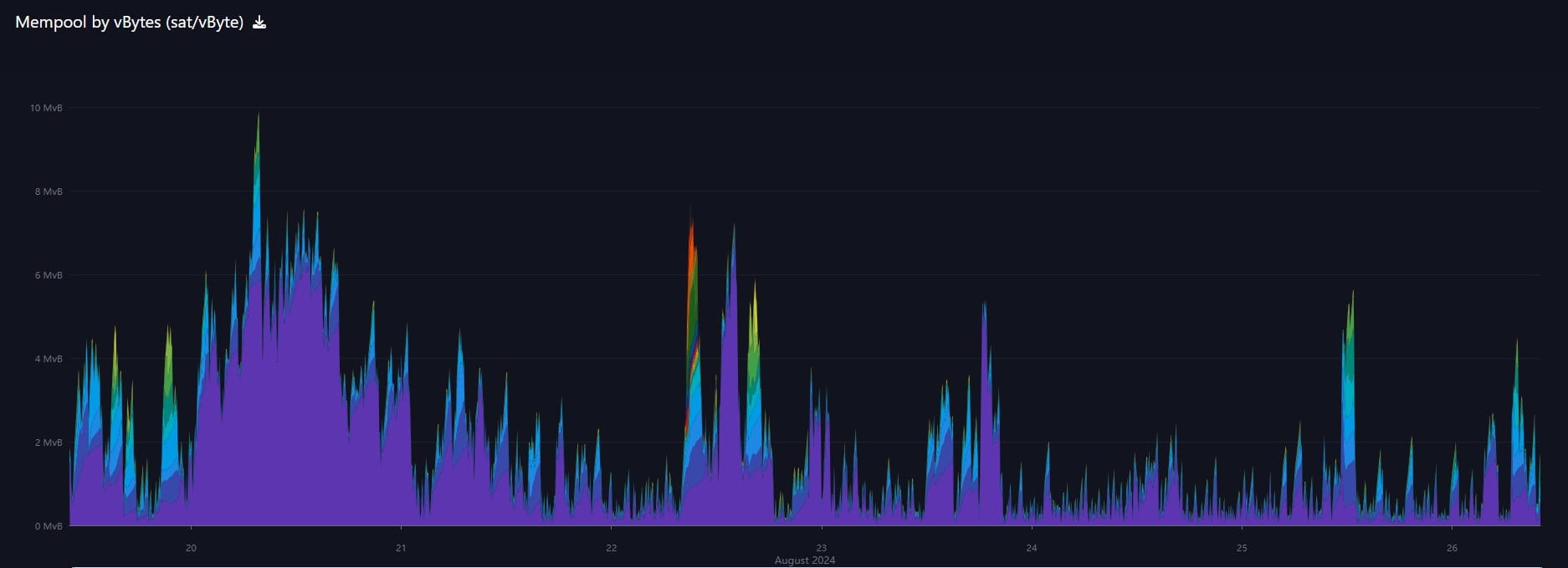

- Bitcoin Fee Spike, Now Back to Normal

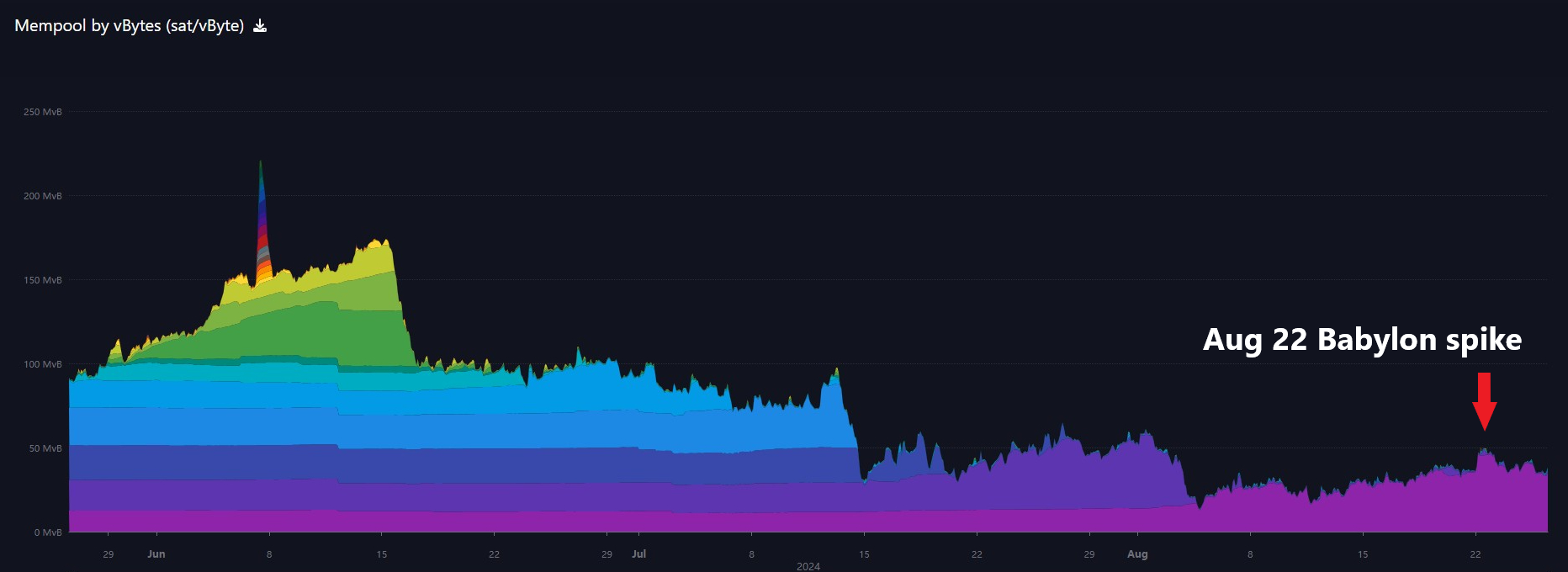

I wrote about this in the free Bitcoin Minute last week. There was a massive spike in the bitcoin mempool all of a sudden with fees reaching as high as $500 for a couple blocks. I use mempool and fee spikes as a leading indicator for volatility; however, as a leading indicator, it tends to build up into a volatile event. This move was out of the blue with no build-up.

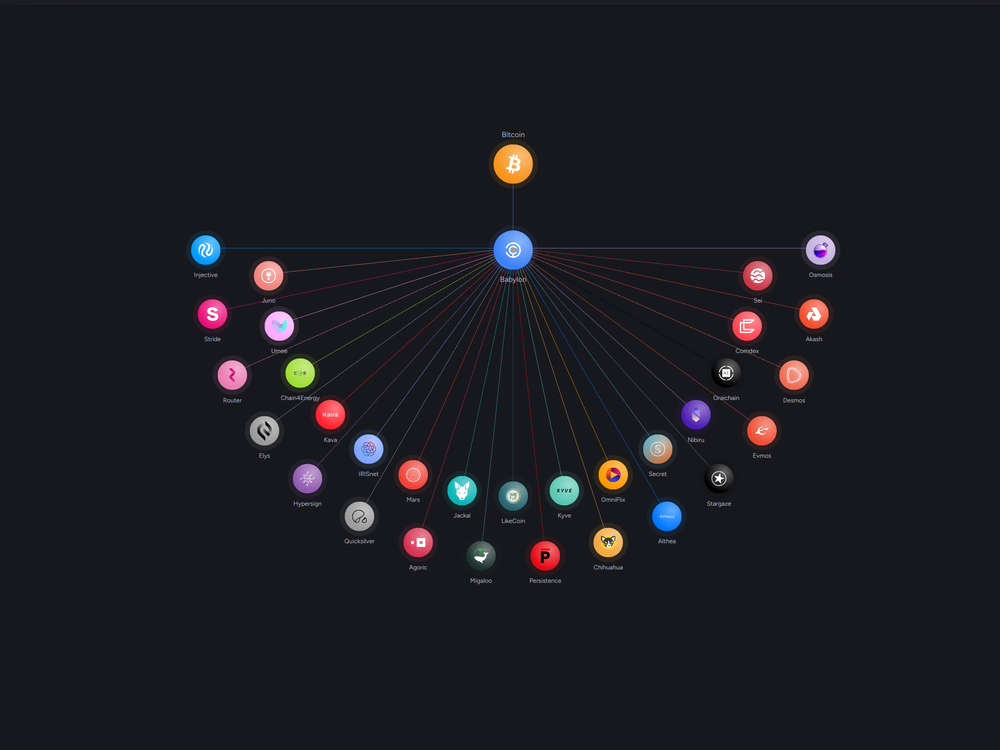

It was due to a new Layer 2 Proof-of-stake scheme called Babylon, that allows the pegging of bitcoin into a contract that can then be used and reused into multiple staking schemes in a group of altcoins. After the initial rush, the mempool and fees quickly returned to normal.

The Thai government is issuing a digital currency with a six-month expiration date.

— Camus (@newstart_2024) August 22, 2024

The essence of the experiment:

— Thais will be given 10,000 baht ($280).

— Recipients of digital money must be over 16 years old and have a digital wallet app on their phone.

— The money can be… pic.twitter.com/U3TcFsSOTA

"The essence of the experiment:

— Thais will be given 10,000 baht ($280).

— Recipients of digital money must be over 16 years old and have a digital wallet app on their phone.

— The money can be spent within 6 months within a radius of four kilometers from your place of residence.

What does this mean?

— Digital money will be tied to biometrics (for access to a digital wallet)

— Electronic currency will have an expiration date

— You will be able to spend your money only when the state approves it."

My initial reaction was that this is going to be a disaster and cause massive inflation. But it depends how the baht are printed. If they are borrowed or taken 1:1 from somewhere else, it won't be all that inflationary. In fact, if they are destroyed in 6 months, it could be deflationary. However, and I think this is more likely the case, if they simply print these CBDC tokens out of thin air, there is going to be a big inflationary impact, followed 6 months later by a deflationary impulse if the tokens are destroyed again.

This is likely a Globalist influenced experiment.

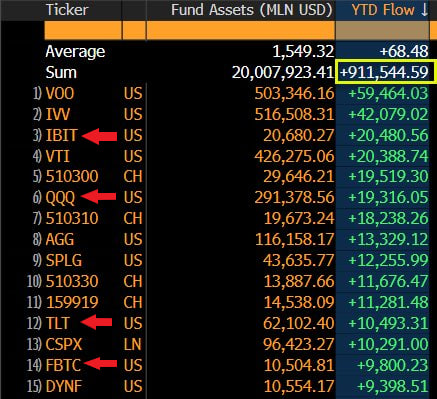

- Blackrock's IBIT Bitcoin ETF has 3rd highest ETF YTD inflow

This is more YTD inflows than $QQQ or $TLT. Imagine when it hits new ATHs, the flows are going to be crazy!

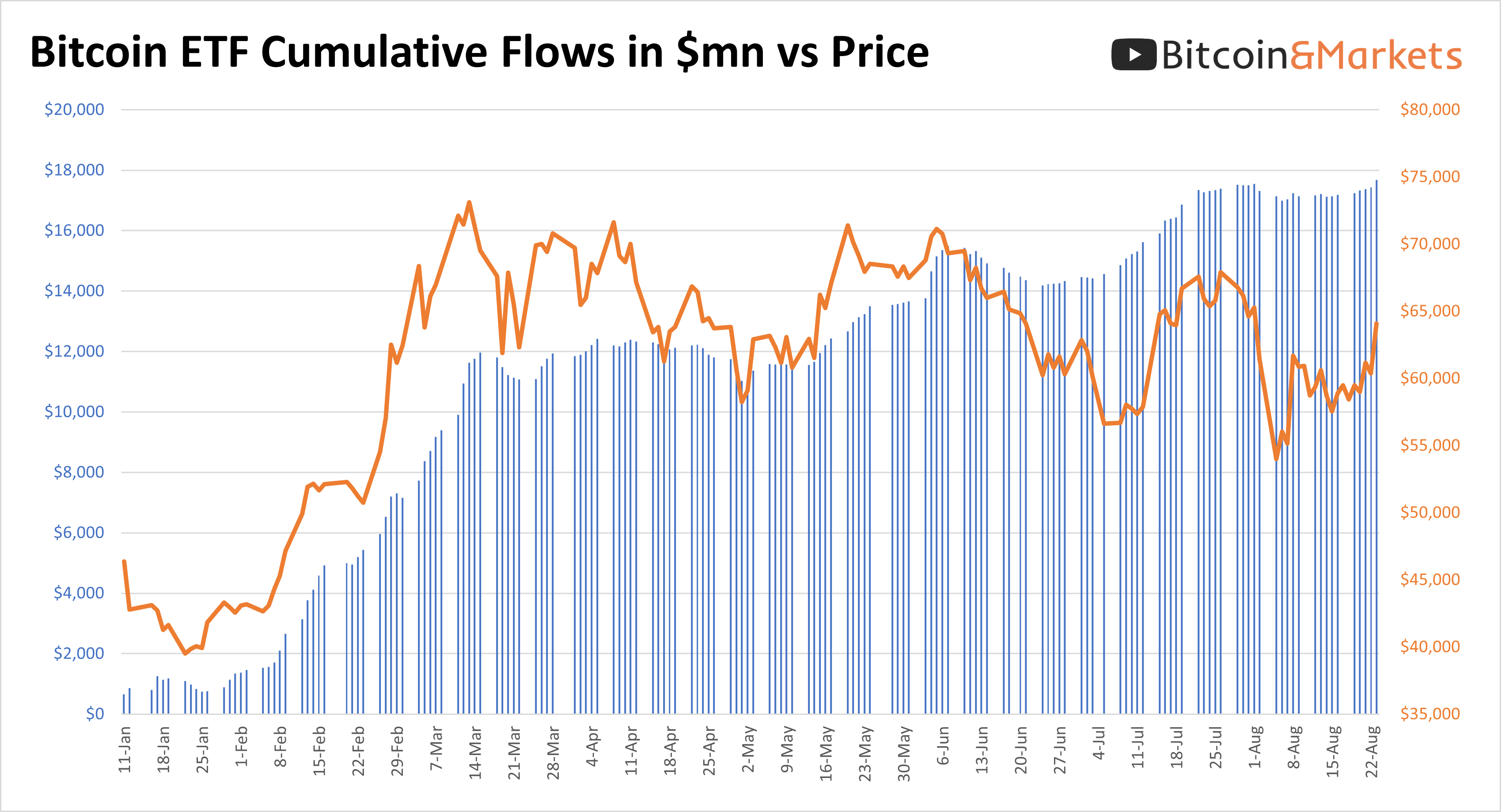

- Bitcoin ETF Inflows Begin Streak, Big Friday Number

Bitcoin's Friday ETF flow was the largest since July 22, $252M and hitting a new ATH of total inflows at $17.8B.

French police are investigating Telegram founder Pavel Durov for Telegram's unmoderated content and its links to "a wide range of crimes."

Moscow quickly responded, saying Durov should be afforded all this rights, and Elon tweeted about freedom of speech being under attack in Europe. Macron has responded as well, stating the arrest was not politically motivated.

Some people are pointing out that the woman he was traveling with was posting on Instagram, which could have been an OPSEC leak that helped French police know his movements and pending arrival in France.

His app is great but he has launched a shitcoin TON. It is down 16% on the news of his arrest. Not as much as one might think for such big news.

Overall, I hope for a quick resolution to this event and upholding a dedication to freedom of speech everywhere.

Macro

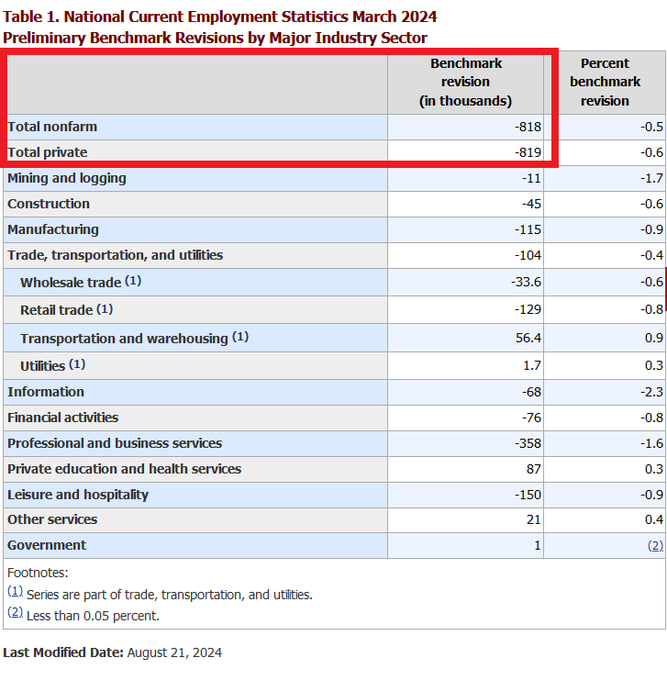

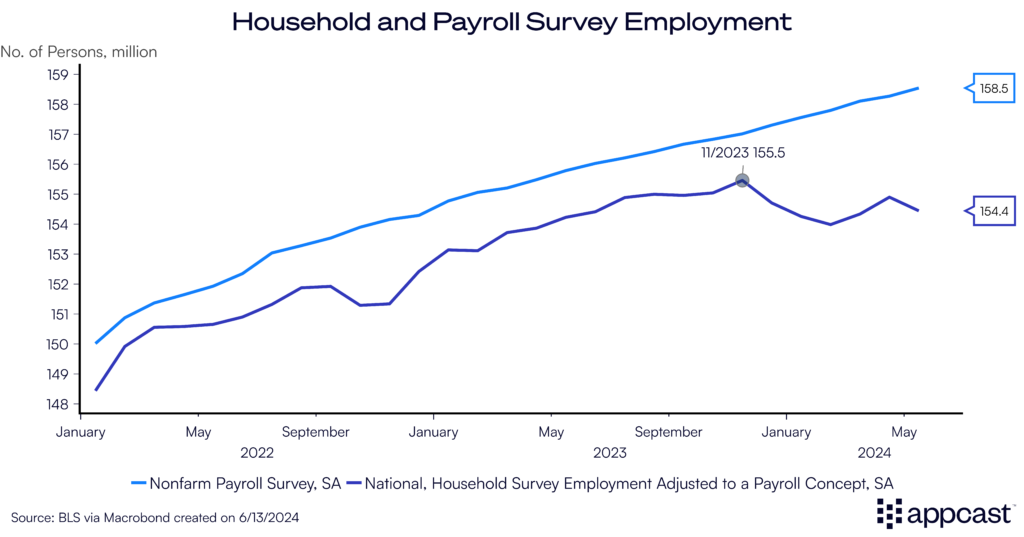

- Non-farm Payrolls Revised Down 818,000 Jobs

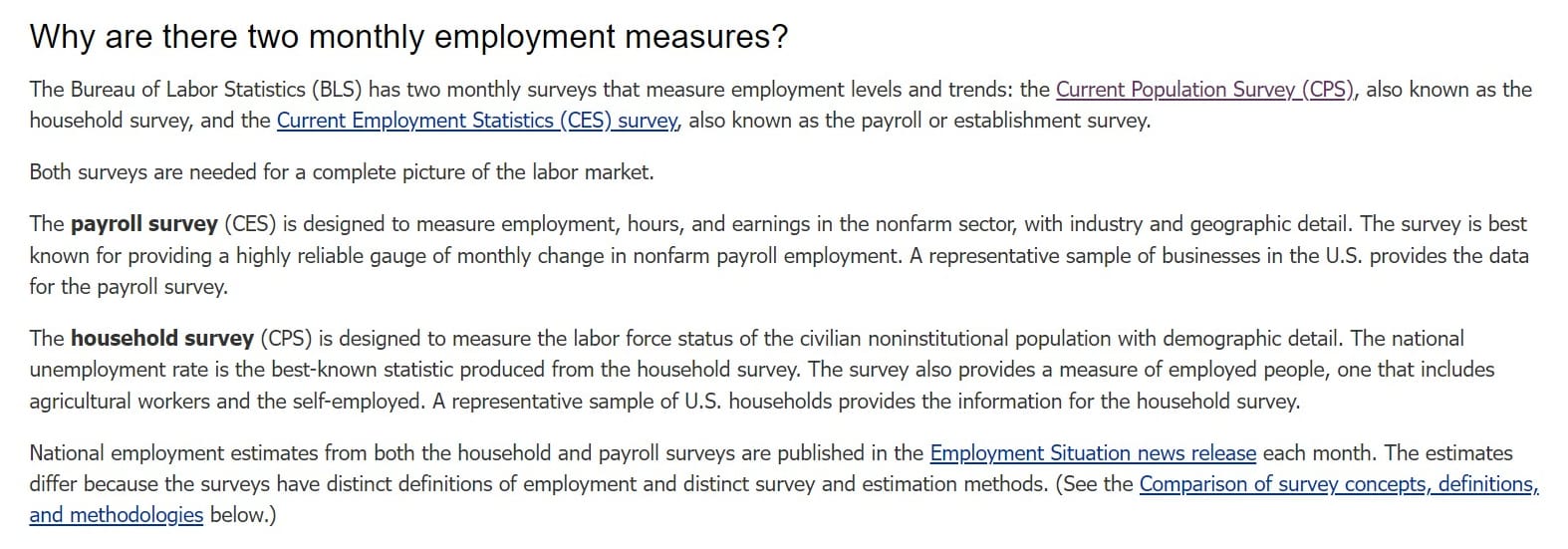

In a huge data revision, non-farm payrolls were cut by 818,000 jobs in one swoop. We've been waiting for a revision like this due to the massive gap between the two government-provided employment surveys. This is the "Establishment" survey, also called the Payrolls survey, which has diverged massively from the "Household" survey, both released by the Bureau of Labor and Statistics (BLS).

The BLS has a FAQ about why there are two surveys. Here is what they say:

Importantly, the gap between surveys had grown to a whopping 4.1 million. This 818,000 downward revision doesn't even cover a quarter of that spread. There are likely more revisions coming. Also, the unemployment rate of 4.3% will be unaffected by this revision because it is figured from the household survey, not the establishment.

- FOMC Minutes and Jackson Hole

The minutes released for last month's FOMC meeting showed that several members were entertaining a July cut but ultimately voted against it. This would match my suspicion that the chance of a July last meeting was higher than the market was pricing in at the time. Overall, the minutes were quite dovish and paved the way for the Fed Chair Powell's speech at Jackson Hole.

We covered them in a live stream on Friday.

My main takeaways from the Powell speech.

1) He was much more low key than normal at the FOMC press conferences. His demeanor was quiet and reserved.

2) He had several blunt statements leading up to the big one. "The balance of risks to our two mandates has changed." Meaning they are done fighting inflation and pivoting to fighting unemployment, but said very bluntly and matter of fact.

"The cooling in labor market conditions is unmistakable." "It seems unlikely that the labor market will be a source of elevated inflationary pressure anytime soon," meaning there's room to fight unemployment.

3) And the big one, "The time has come for policy to adjust," meaning they're going to cut at the September meeting.

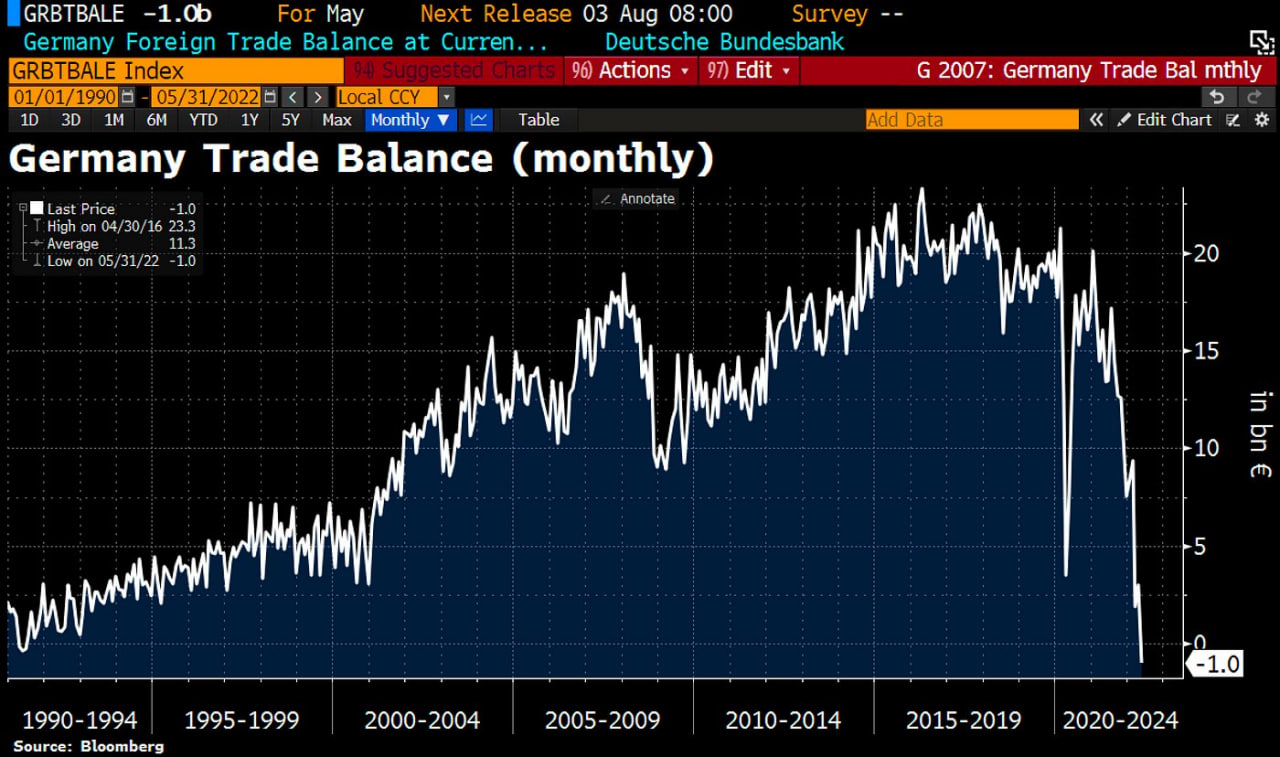

- Germany's Economy is a Warning

I've been very bearish on Germany for a while, but not without reason. They are captured by radical Marxist Globalists, have destroyed their energy infrastructure, are large exporters in an era of deglobalization, and have horrible demographics.

This week, this chart crossed my feed of Germany's monthly trade balance. It has crossed zero. The once great exporter is becoming a net importer.

This is a warning of what is to come to exporters everywhere. As the international system grinds to a halt, global credit will come under pressure, and the only logical direction is toward recession or even depression for many export-led economies.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Short price section this week. The next Professional Premium post this week will look at several fundamental indicators from on-chain and miner indicators, so we can time this next big move higher. Make sure you are subscribed!

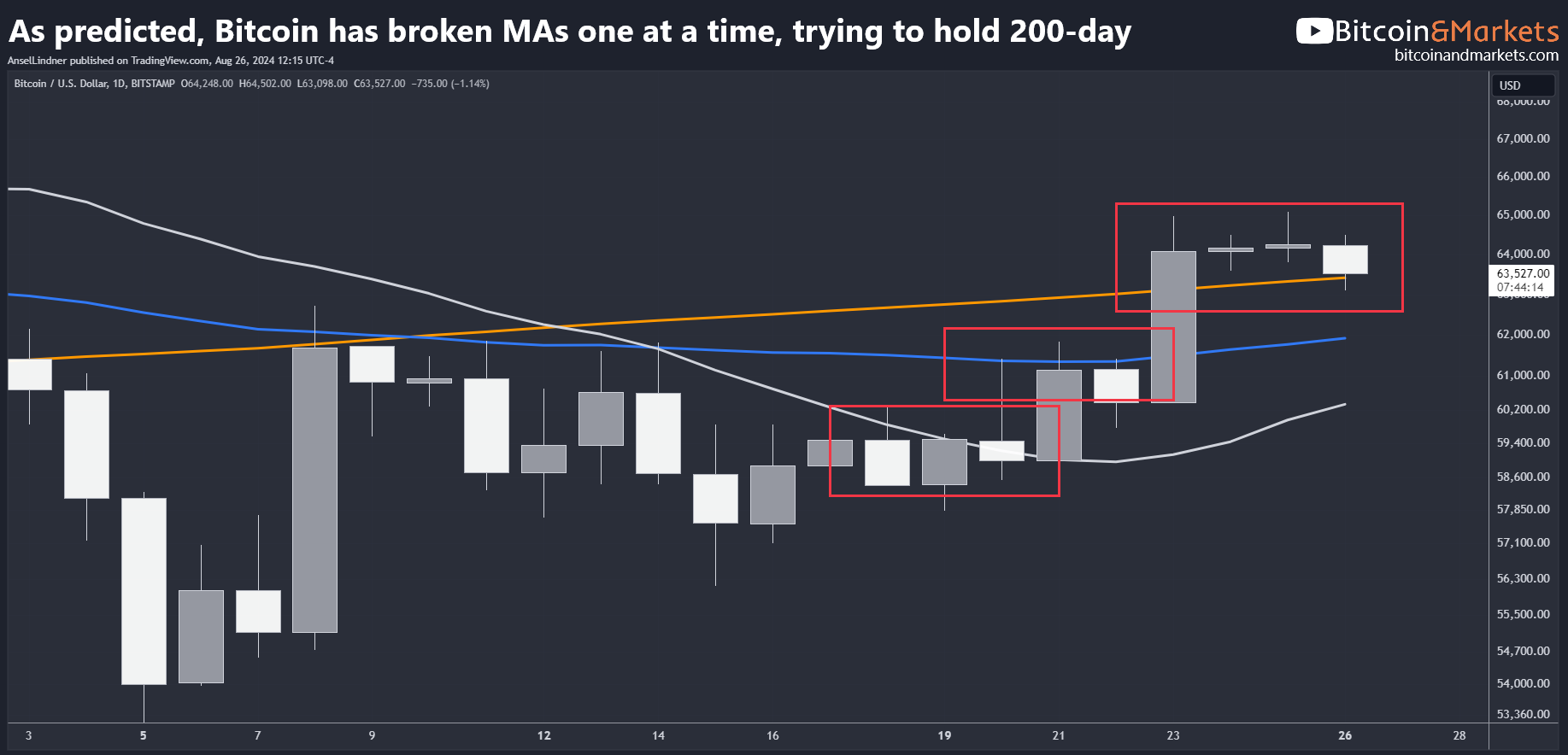

Last week:

Over the next week, expect the battle with the moving averages to continue, with no spike higher until breaking the 200-day.

Price is progressing almost perfectly with my predictions last week.

The price jump on Friday was likely due to the small surge in ETF demand. If today's candle closes above the 200-day MA that should be a significant sign of strength for the rest of the week.

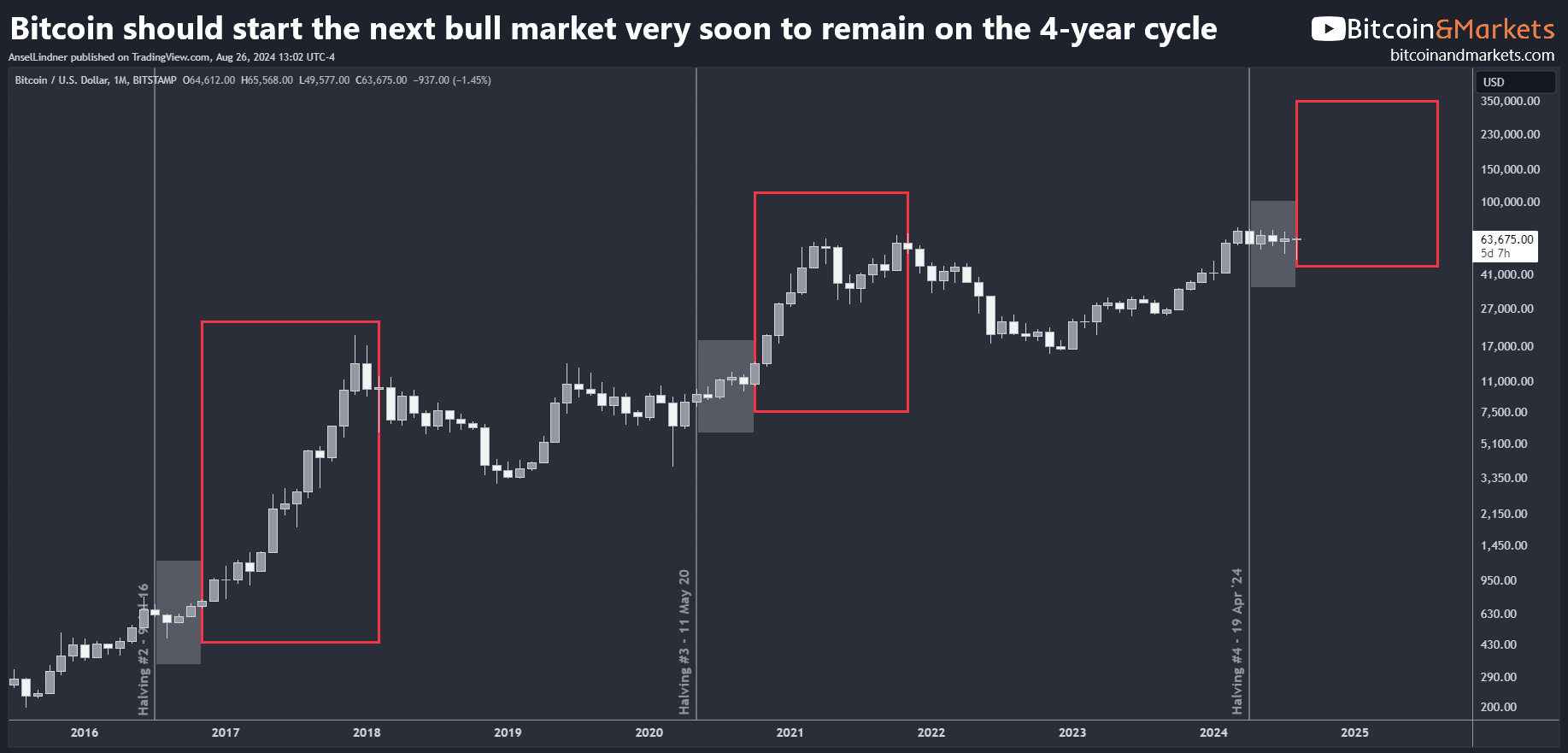

Something has to happen soon for price to maintain the 4-year cycle pattern. We are now 4 months removed from the halving, and price historically is on its way higher by this point.

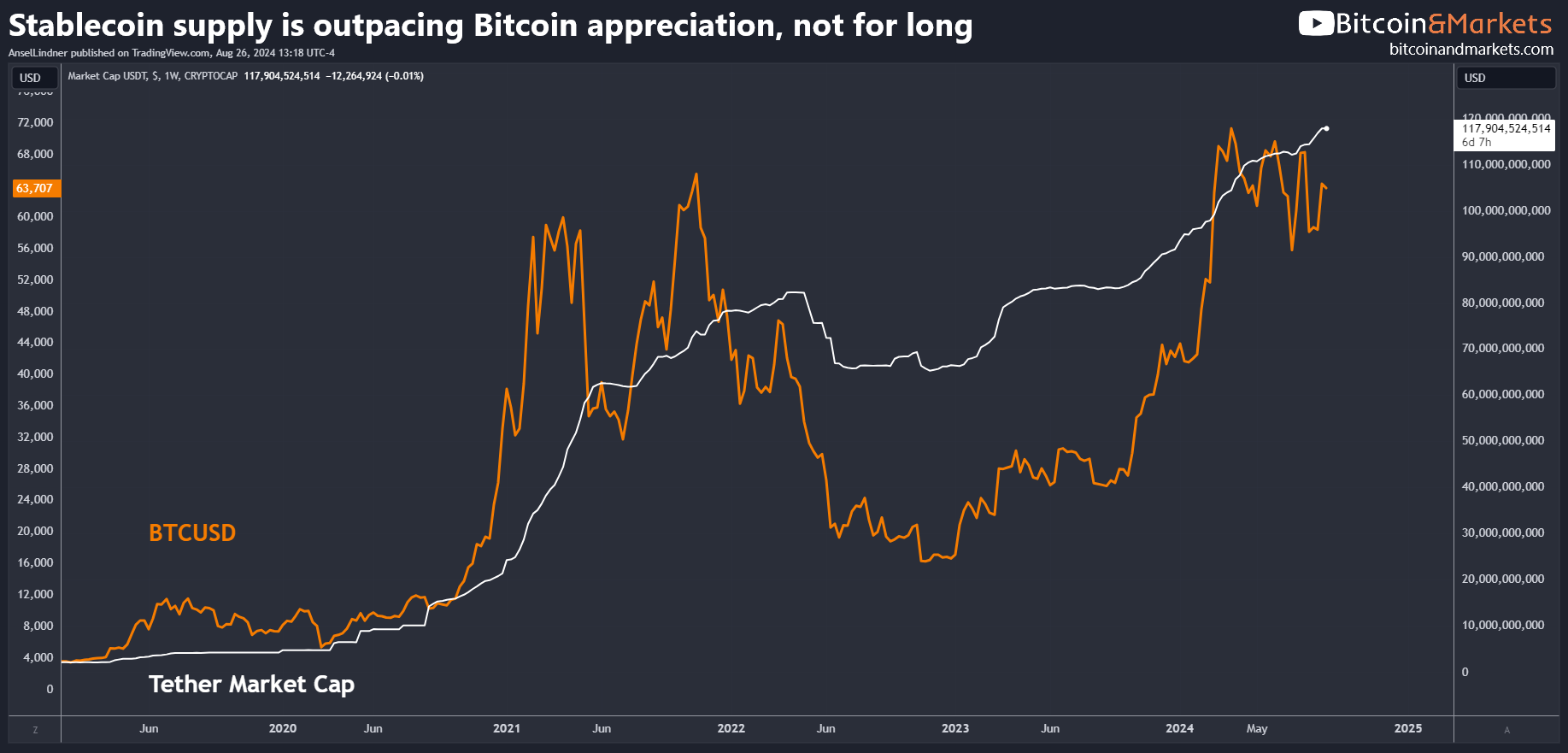

The supply of stablecoins has been outpacing the Bitcoin price for months. It is only a matter of time until the Bitcoin price responds, it's not going into altcoins for sure.

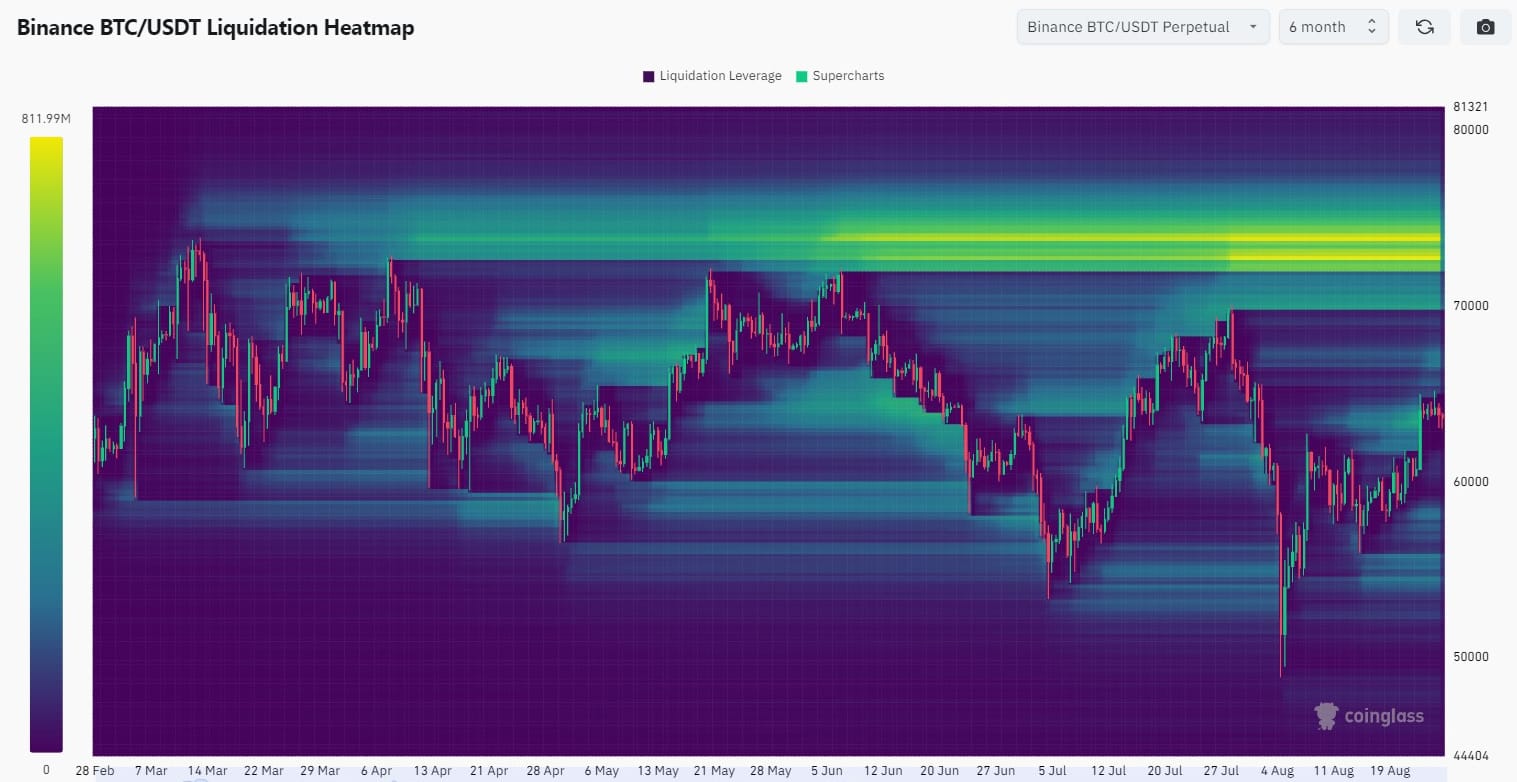

The heat map still shows the insane liquidity magnet up at the ATH. Just a hop, skip and a jump to $72k.

Overall, we are not done battling the moving averages at the time of writing but that could easily come this week. Time is running out for a Q3 rally and for the bull market pattern to repeat again. A sell off in other macro markets is becoming more likely, and it is important for bitcoin to establish itself with a strong move prior to that IMO.

Over the next week, expect to establish itself over the 200-day with multiple closes and the likelihood for a spike higher has risen. We will be approaching the ATH before you know it.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Police and officials from the Provincial Electricity Authorities (PEA) raided the house in Ratchaburi town on Friday.

“We found bitcoin mining rigs, pointing to people using this house to operate a mine and using power they didn’t fully pay for,” said Jamnong Chanwong, a chief district security officer.

No one was arrested during the raid, he added.

It was fourth time this year that authorities have raided an illegal bitcoin mine in Ratchaburi province.

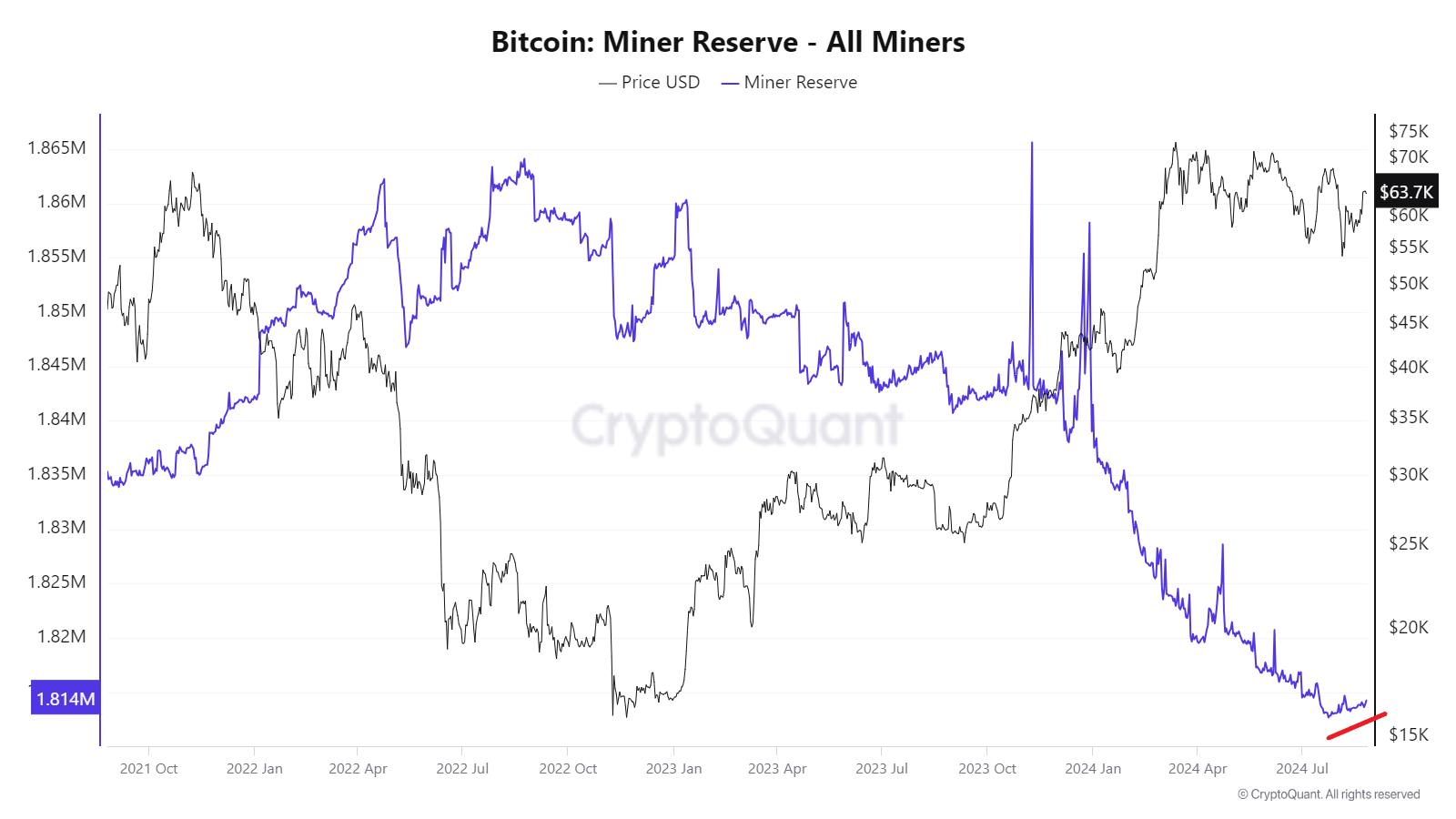

- Bitcoin miner reserves halted sell off

I've updated this chart the last two weeks to track the bottoming in sell off from bitcoin miners. It's not much yet, but the tide might have turned in the selling.

Hash rate and Difficulty

Hash rate has maintained its upward movement over the last week, extending the estimated gain in difficulty to +3.1% in 1 day.

Mempool

We experienced that brief interruption on the 22nd, which has since dissipated. The mempool is a nice 137 MB and fees are back to normal. In comparison to previous mempool states you can see on the chart, this disruption was minimal.

I'm not going to write much about this here. You can go to this week's post about it if you'd like to read more. Suffice it to say here, I just wanted to point out that creativity around Bitcoin layer 2's continues to improve. While I don't think this particular use case is promising, it pushes the boundaries of what people think can be done with Bitcoin.

In Case You Missed It...

My latest posts

- Macro Minute: The Fed's Illusion of Control

- Bitcoin Minute: A Tale of Babylon, PoS and Fees

- Bitcoin Path to New ATH, Weekly Round Up - E390

- Macro Minute: Myths and Realities of Global Dollar Dominance

- Bitcoin Minute: Levels of Bitcoin Awareness

- Charting Bitcoin: Critical Juncture for Entire Cycle - Premium

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com