Bitcoin Fundamentals Report #303

Bitcoin Market Holds Steady: Price Trends, Altcoin Decline, Miner Activity, and Macro Factors Ahead of September

September 2, 2024 | Block 859,579

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

LIMITED TIME - Join the community supporting independent Bitcoin and Macro analysis! You also will be able to enter our monthly Price Forecast competition, and get access to the clickable version of the Bitcoin Pre-History infographic. Click button below.

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Chop |

| Media sentiment | Indifferent |

| Network traffic | Very low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $58,545 (-$5,100, -8.0%) |

| Market cap | $1.153 trillion |

| Satoshis/$1 USD | 1708 |

| 1 finney (1/10,000 btc) | $5.85 |

| Mining Sector | |

| Previous difficulty adjustment | +2.9931% |

| Next estimated adjustment | +1% in ~8 days |

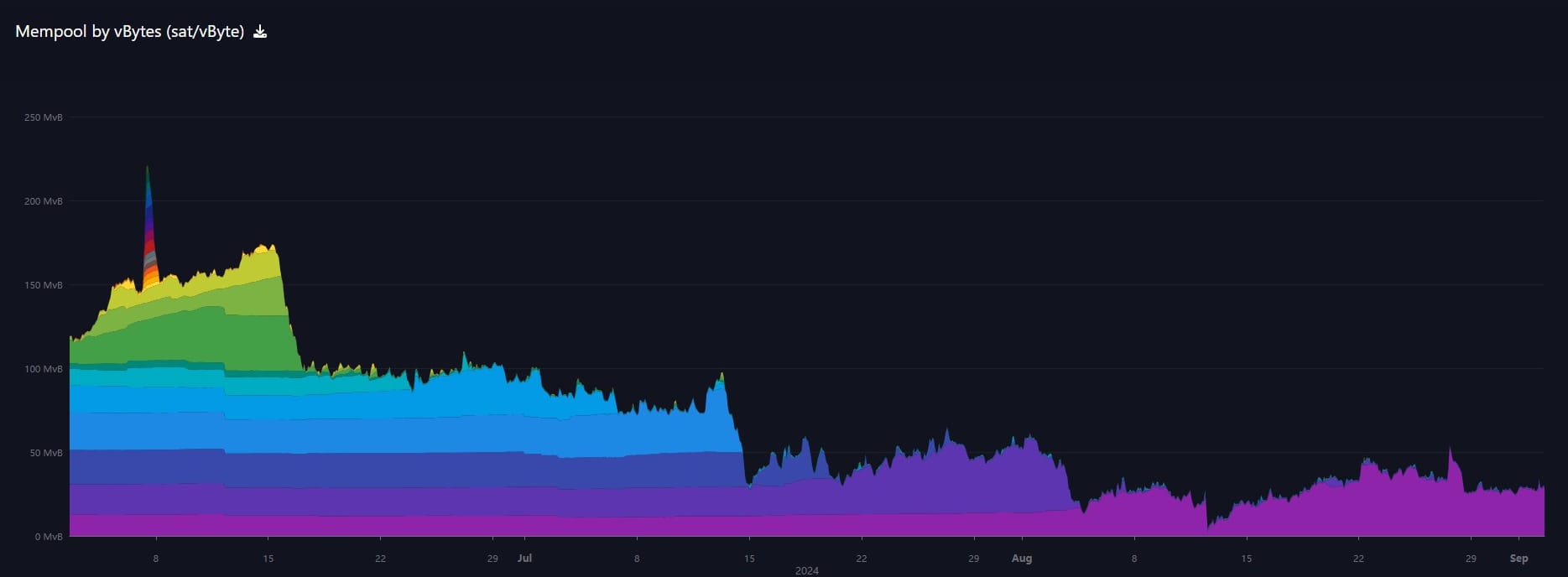

| Mempool | 132MB |

| Fees for next block (sats/byte) | $0.33 (4 s/vb) |

| Low Priority fee | $0.33 |

| Lightning Network** | |

| Capacity | 5088.38 btc (+1.1%, +56) |

| Channels | 49,129 (-0.6%, -307) |

- Bitcoin rn

A quiet last few weeks is building up to something in September.

- Post-halving performance has been painful

This week, in a tongue-in-cheek remark, I reposted this chart and said, "Worst cycle ever." From the halvings, this cycle has the weakest price performance yet; however, it's not the "worst." Bitcoin also had the best pre-halving performance. It all balances out. Onward.

- Altcoiners capitulating

Eric Wall is a famous troll and altcoin scammer. How he still has any clout in this space is beyond me, but he is a great example of the total despondency in altcoins. All their narratives are dead, and all their fake promises exposed. They better become bitcoiners before they lose their seat on the rocket ship.

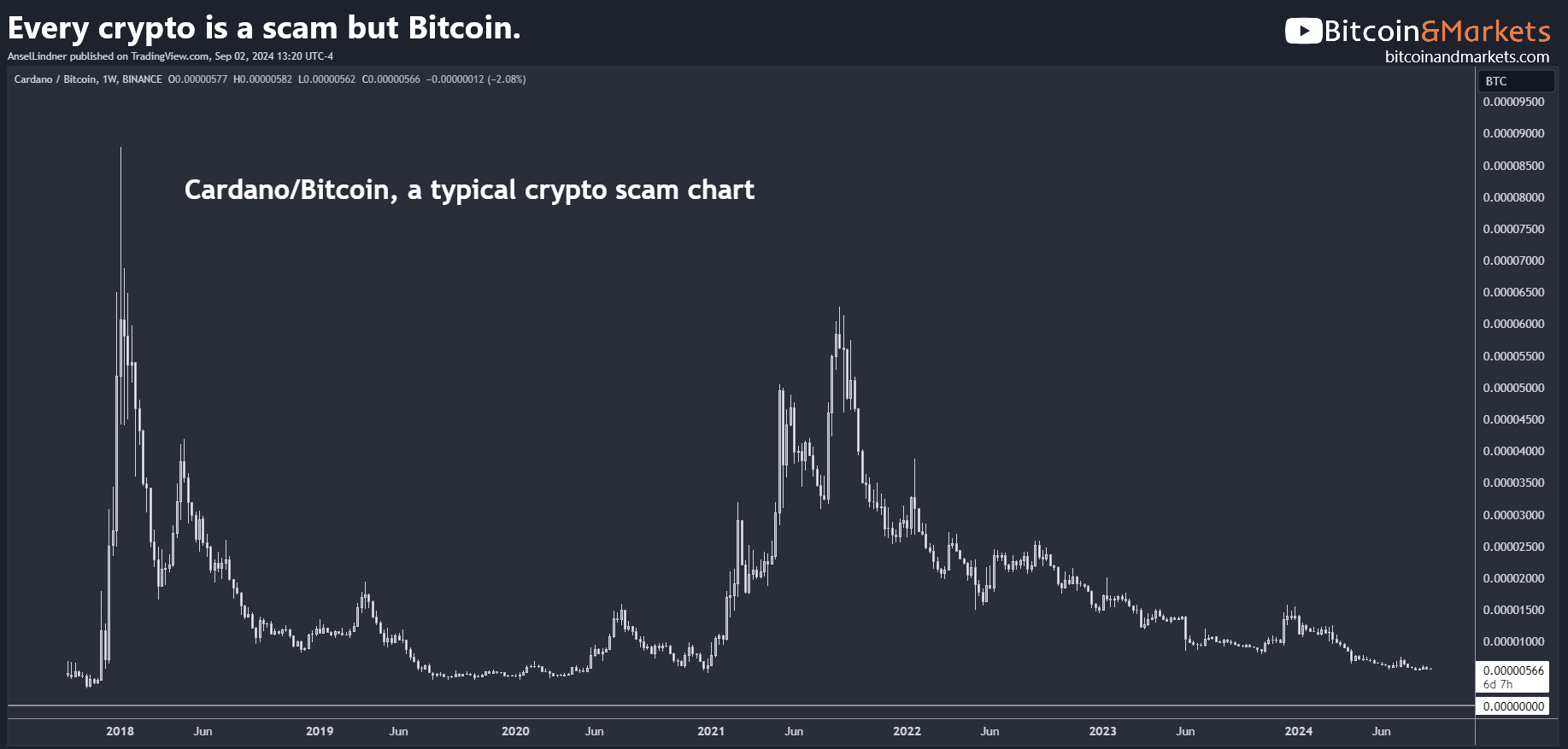

Cardano (ADA) is a great example of what's happening to the whole altcoin scam complex. Built on lies and preying on the undiscerning, this chart encapsulates the sentiment around altcoins right now.

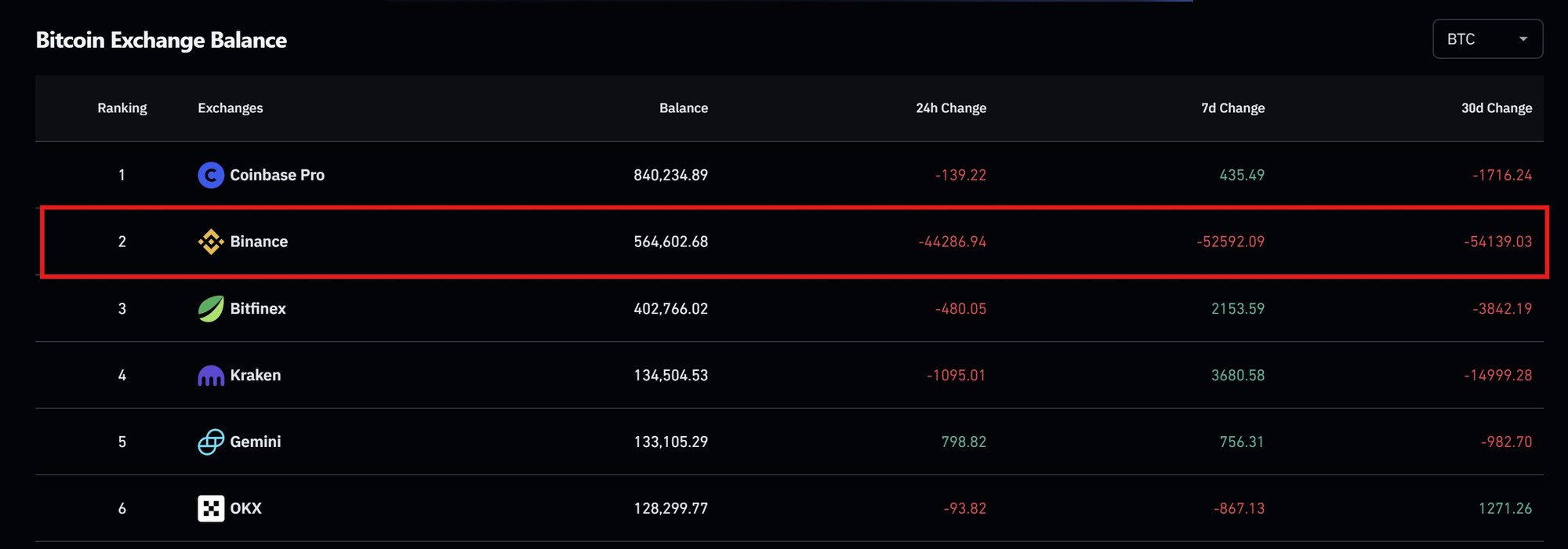

[O]nline reports alleged that Binance, the largest exchange by trading volume, had mass-frozen the assets of its Palestinian users. The report, made by Noones CEO and Paxful co-founder Ray Youssef, stated that the exchange has “seized all funds from all Palestinians” as per the request of the Israel Defense Forces (IDF).

Amid the backlash, Binance’s CEO addressed the situation. Teng denied the report, calling it FUD (Fear, Uncertainty, and Doubt) as “only a limited number of user accounts, linked to illicit funds, were blocked from transacting.”

The CEO affirmed that the statements claiming they froze funds from all Palestinian users are incorrect and emphasized that the exchange complies with internationally accepted anti-money laundering legislation “just like any other financial institution.” Teng also stated that Binance hopes “for a lasting peace throughout the region.”

Macro

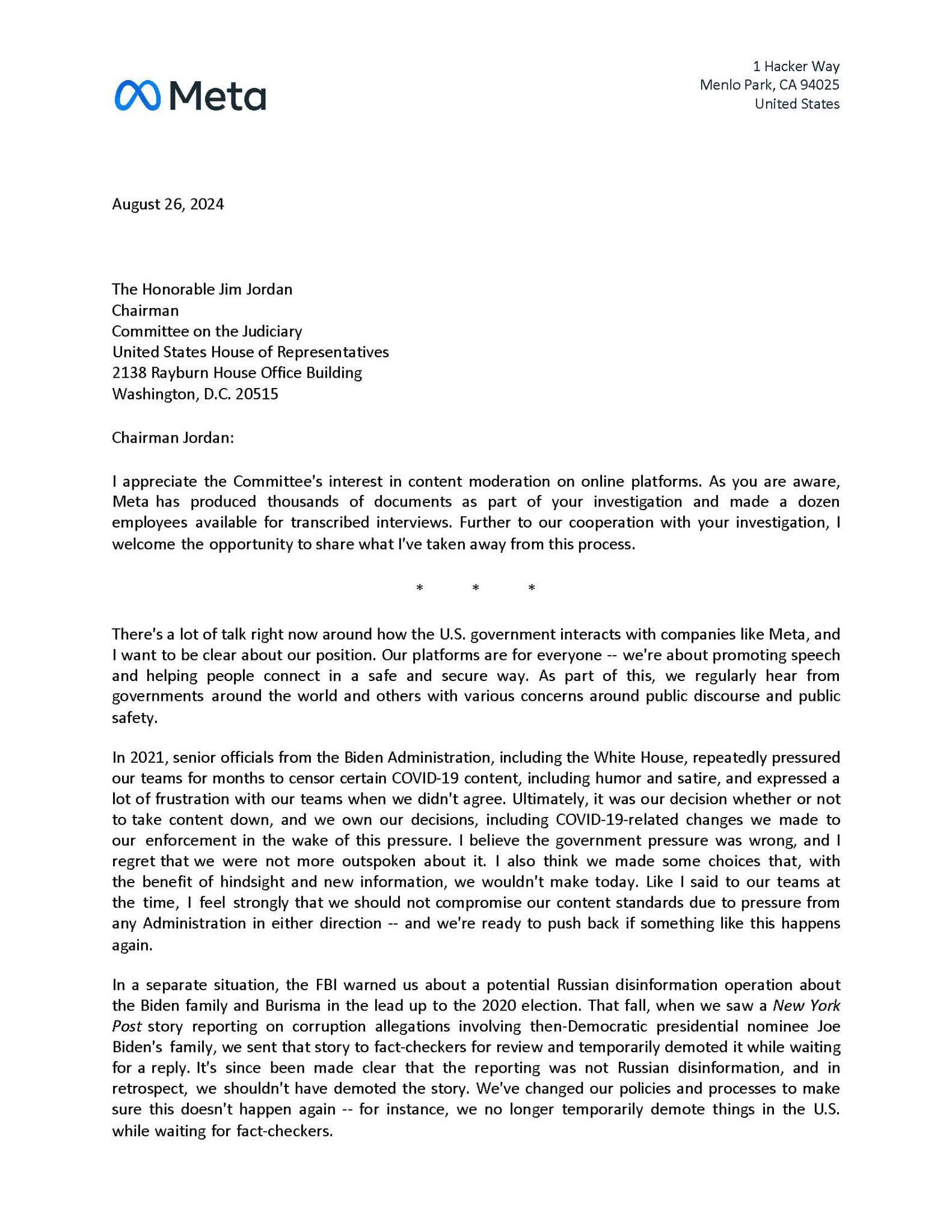

- Zuckerberg admits to working with Biden/Harris admin to censor Americans

Yet another tech elite breaking allegiances with the globalist elite. Who knows the reasons behind this admission? It all results in the same: the erosion of the current ruling class's power.

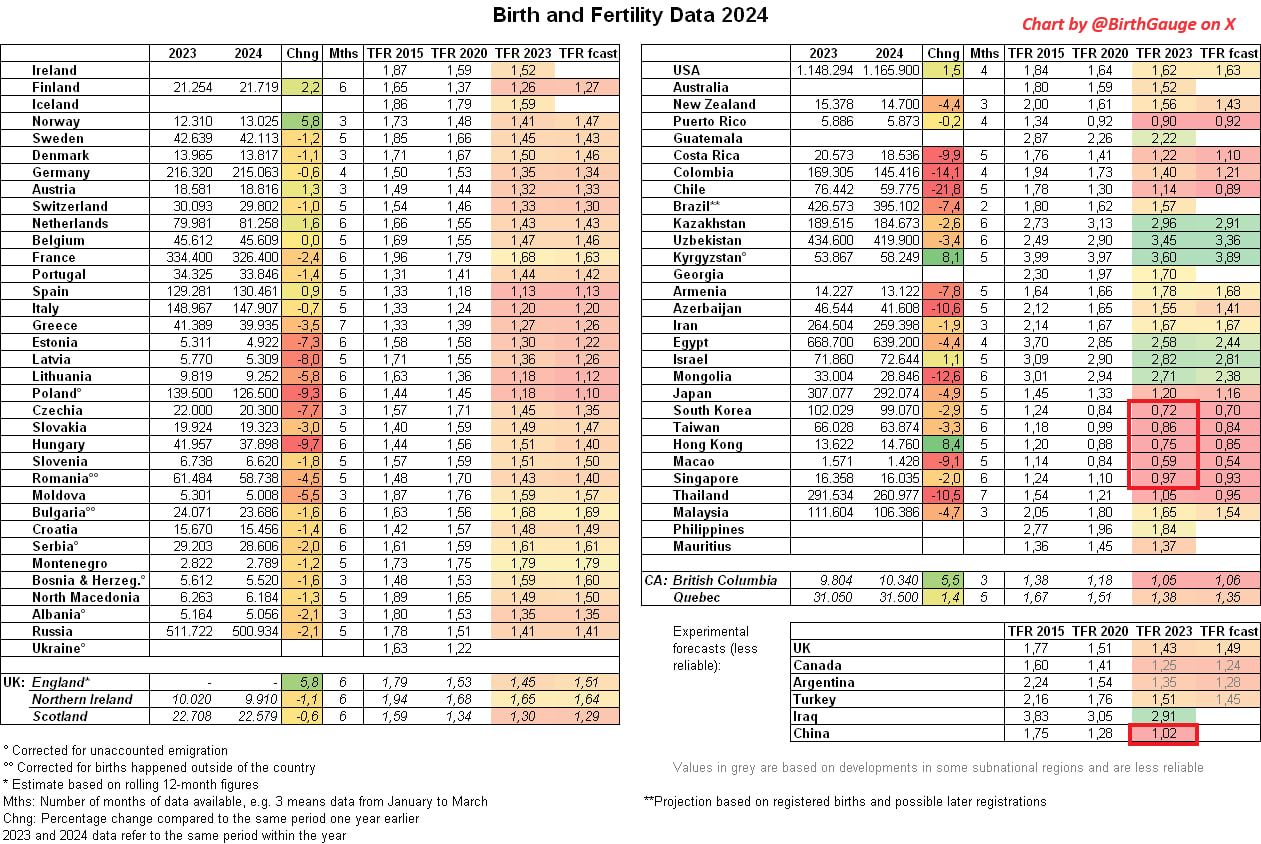

- Fertility rate data for YTD 2024 has dropped and it is horrendous

As you can see in the graphic below, several countries are far below even 1. That means the size of each successive generation will be less than half of the prior generation (not highlighted: Puerto Rico, which is also below 1).

Demographics is a force that allows us to predict the future with more accuracy. Its effect on the economy, innovation, and credit markets cannot be overstated.

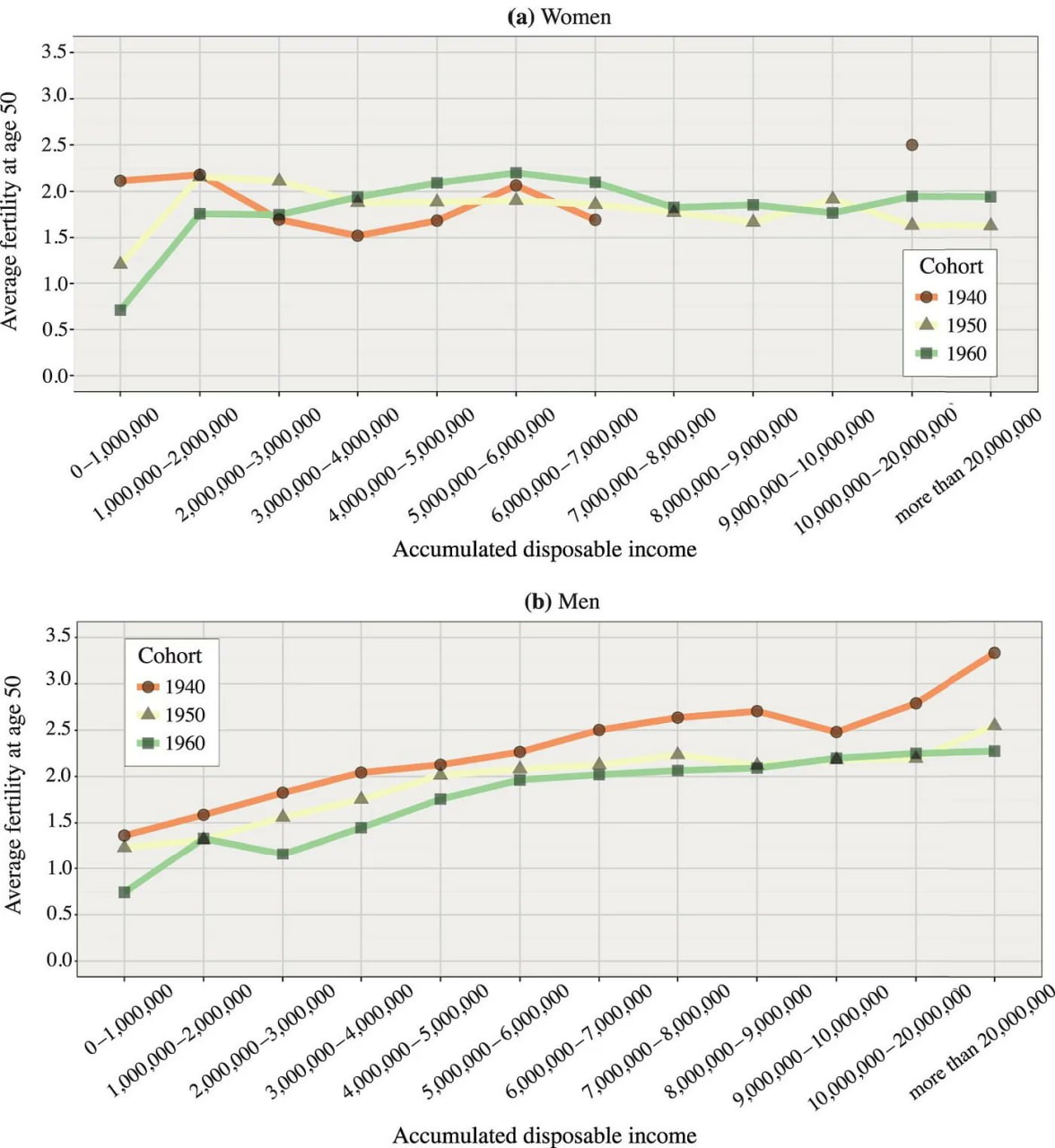

A new study about income's effect on fertility shows that fertility rises with male income but slightly falls with female income. The X-axis represents lifetime income.

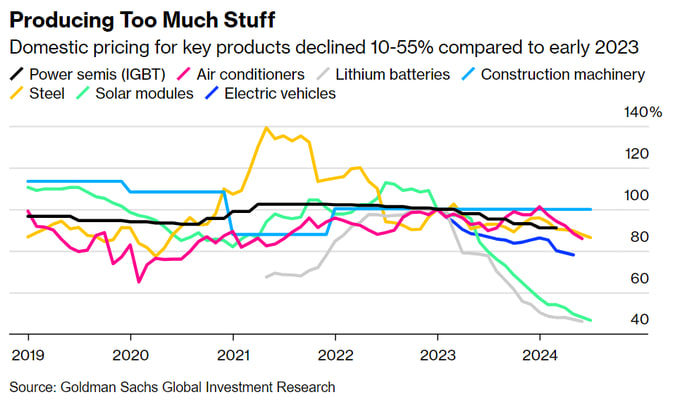

- Chinese domestic pricing is paying the price for a slowing global economy as it absorbs massive surpluses

Most people think falling prices are a good thing, but they only see it from the consumer's perspective. Producers cannot stay in business with these types of YoY declines; workers will lose their jobs, and demand will only fall further without incredibly wasteful government subsidies. The only way out is for China to allow an economic crash, which also means the CCP would likely be overthrown.

Relatedly, we have the PBOC buying bonds to intervene in the rally of government bonds. This intervention is puzzling because there is no shortage of demand for government bonds in China, which are in the middle of a massive rally. The speculation is that the PBOC is buying the bonds to dump them at a later critical juncture. This is the first such move by the PBOC since December 2022.

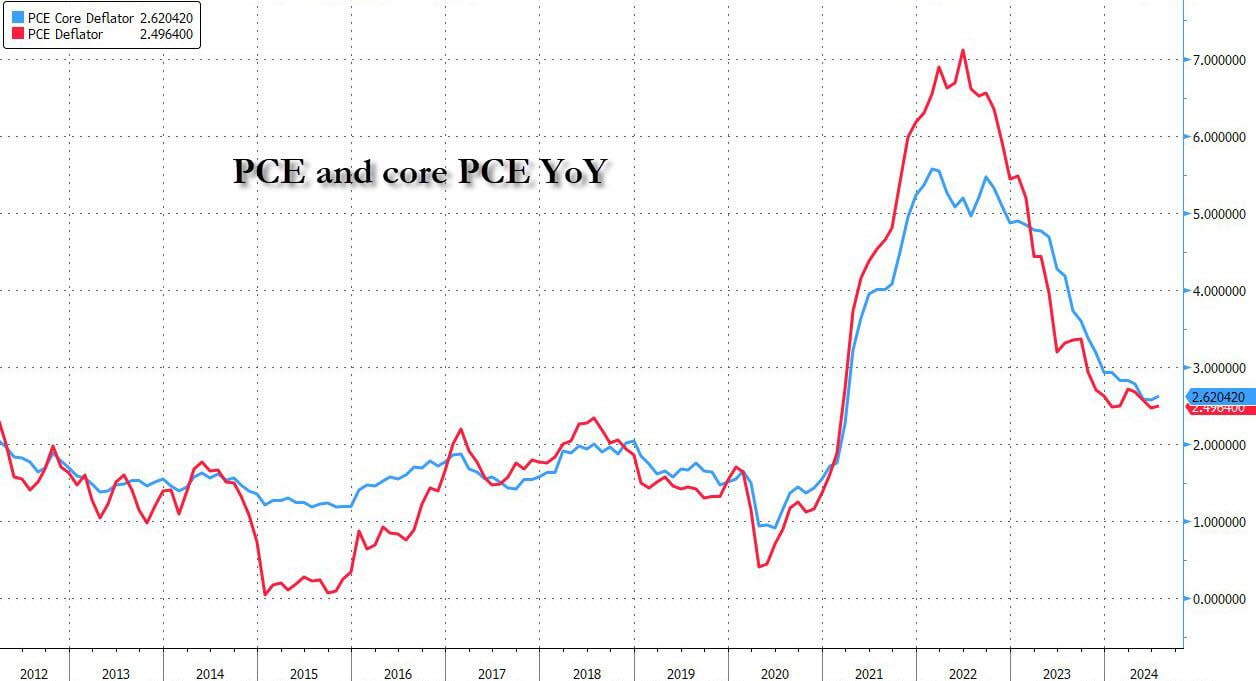

- US Personal Consumption and Expenditures at consensus for July

PCE has a much larger lag than CPI. Where CPI is released in the first week to 10 days of the following month, PCE comes in the last few days of the following month. Therefore, the data is already reflecting changes that could be the result of market behavior 8 weeks prior.

Despite this, let's look at the July PCE data, which is the "inflation" metric used by the Federal Reserve.

Headline - 0.155% MoM, 2.5% YoY

Core - 0.18% MoM, 2.6% YoY a slight beat of 2.7% YoY forecast

The important part, IMO, is that the numbers came in right around the sweet spot of 0.166% to hit the 2% YoY target. This fits right into Powell's near-promise of a rate cut in September.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Bitcoin chop is chewing up the mid-range support and resistance around the moving averages.

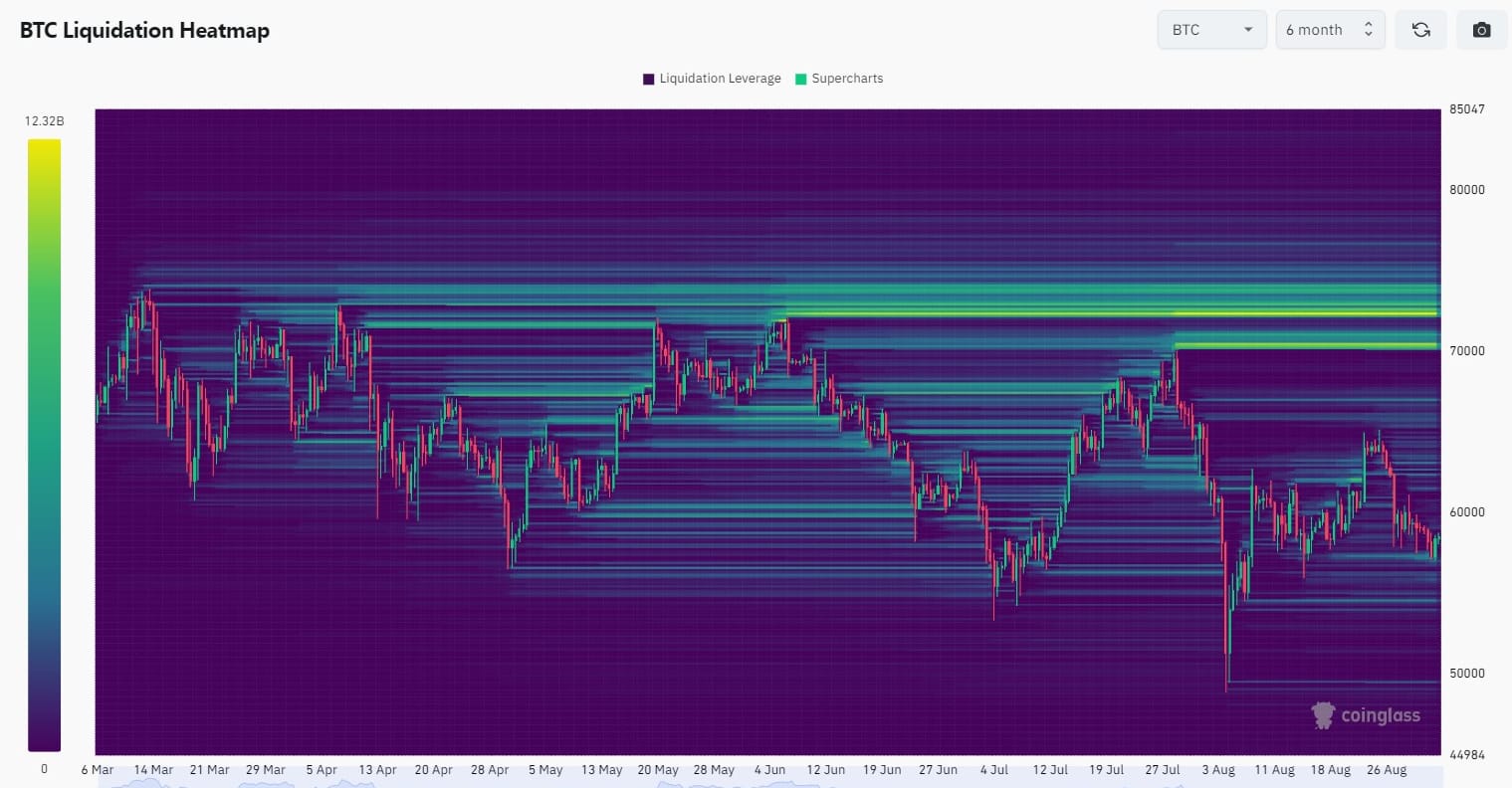

If you recall, the theory behind the moving average support and resistance is that they are Schelling points around which bids and asks congregate. However, as these levels get tested and broken time and again in a chop, their importance wanes. Price can move more easily through those areas of previous support or resistance. What we are setting up right now is a rapid move to the top of the range, catching many shorts offside.

The 6-month heat map alone shows $10B in liquidations at $70,500 and $12B at $72,500, not to mention all the other levels around those likely adding up to another $10B.

An interesting chart forwarded by Point on Telegram from Yodaskk on X shows many powerful similarities to this time last year—11 months ago, to be precise.

Adding in the 50-day reveals even more similarities. The 100-200 spread narrows, the 50-day crosses under the 100-day while the price is supported by the 200-day. Price then rallies to avoid the death cross of the 50 and 200-day MAs. If this plays out, which is a possibility, we should see fireworks this week.

Overall, September is shaping up to be critical, which I have written elsewhere on this blog in the last week. The jury is still out on a recessionary impact on the macro environment. As of now, the pre-recession trade continues: long Bitcoin, stocks, and bonds.

Bitcoin has been range-bound, but a breakout becomes more likely with each passing week. Extremely similar fractals from 2023, the lack of mid-range support and resistance, and the liquidity screaming to be tested at the ATH create an atmosphere that could result in an explosive move higher for the price.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

- Solo miner finds a block

A solo miner with 40 PH/s reportedly just mined a block. With a total hashrate of 640 EH/s, that gives this miner about 1/16,000th of the total hashrate and at that ratio, you'd expect them to mine around 3 blocks per year. #Bitcoin

— Wicked (@w_s_bitcoin) August 29, 2024

40 / 640000 x 144 x 365 ≈ 3 blocks/year

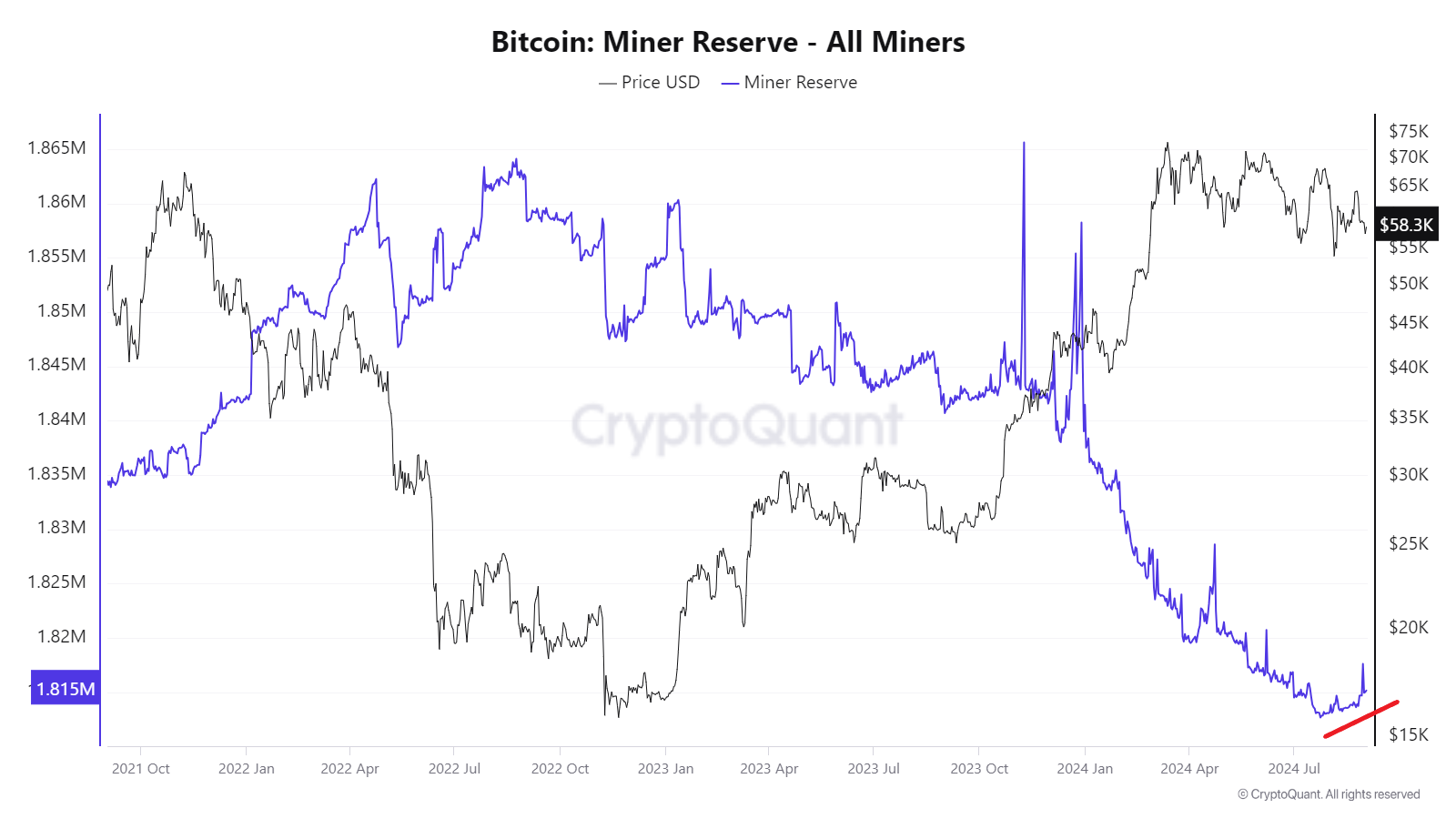

- Bitcoin miner reserves halted sell off

Once again, we check in on Bitcoin Miner Reserves, and we see that the bottom is so far holding. There is an obvious change in direction here. While this is not directly represented in price, it signals a change in the solvency and confidence of the miners.

Hash rate and Difficulty

Shown is the 7-day moving average of hash rate estimated using block times and difficulty. Hash rate has remained strong despite price weakness, and difficulty recently adjusted up by 3%.

Mempool

The mempool has been extremely quiet and flat over the last week. Nothing of significance to report here—no sign of building uncertainty or worry in the market whatsoever. That being said, it is not building major confidence either.

- NSTR

In Case You Missed It...

My latest posts

- September Price Forecast Competition

- Bitcoin Minute - Bitcoin's Historical Performance in Q3 and What to Expect This Year

- Bitcoin Minute: Bitcoin Cycles and US Presidential Elections

- The FED Just Changed Everything - E392

- All Eyes On September, A Critical Month For Bitcoin and Macro - Premium

- Macro Minute: As Economic Data Weakens, Bitcoin Takes Cues from Gold

- Dollar CRASH, Bitcoin Ready to SPIKE? - E391

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com