Bitcoin Fundamentals Report #304

Bullish signals are emerging, with Trump leading in polls and FTX set to distribute $16B to creditors. We explore market dynamics, Federal Reserve rate expectations, CPI trends, and Bitcoin mining developments, while diving into key chart patterns and macroeconomic implications.

September 9, 2024 | Block 860,656

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

LIMITED TIME - My content relies on your contributions! Join the community while supporting independent Bitcoin and Macro analysis!

Check member perks. Click button below for half off $5 support!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Bottom |

| Media sentiment | Slow |

| Network traffic | Very low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $56,514 (-$1,031, -1.8%) |

| Market cap | $1.118 trillion |

| Satoshis/$1 USD | 1770 |

| 1 finney (1/10,000 btc) | $5.65 |

| Mining Sector | |

| Previous difficulty adjustment | +2.9931% |

| Next estimated adjustment | +4.6% in ~1 day |

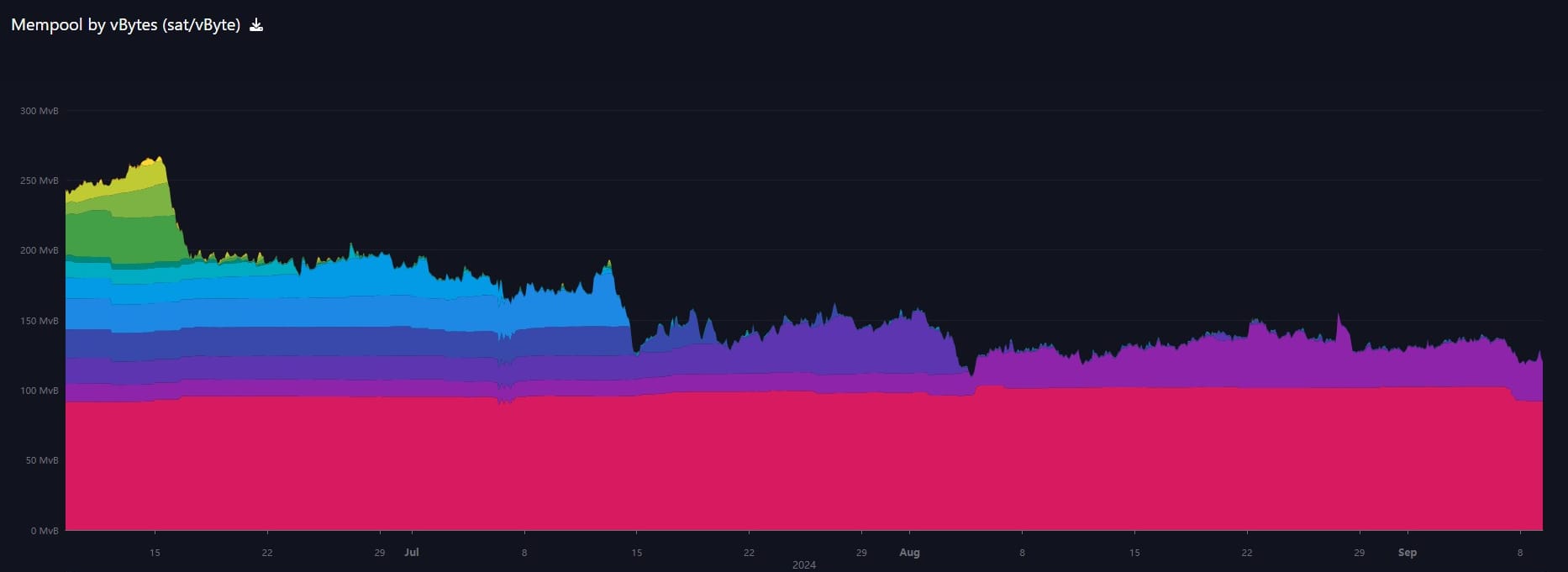

| Mempool | 122MB |

| Fees for next block (sats/byte) | $0.24 (3 s/vb) |

| Low Priority fee | $0.24 |

| Lightning Network** | |

| Capacity | 5087.41 btc (-0.0%, -1) |

| Channels | 48,465 (-1.4%, -664) |

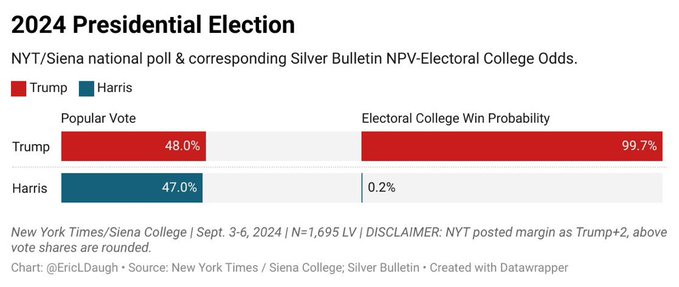

- Trump pulls ahead in polls, very bullish for bitcoin!

BIG BREAKING 🚨

— BITCOINLFG® (@bitcoinlfgo) September 9, 2024

BULL RUN INCOMING 🚨🚨

$850 BILLION BERNSTEIN SAYS IF TRUMP IS RE-ELECTED #BITCOIN MAY REACH $90,000 BY THIS YEAR. pic.twitter.com/AOyYWv0Fm1

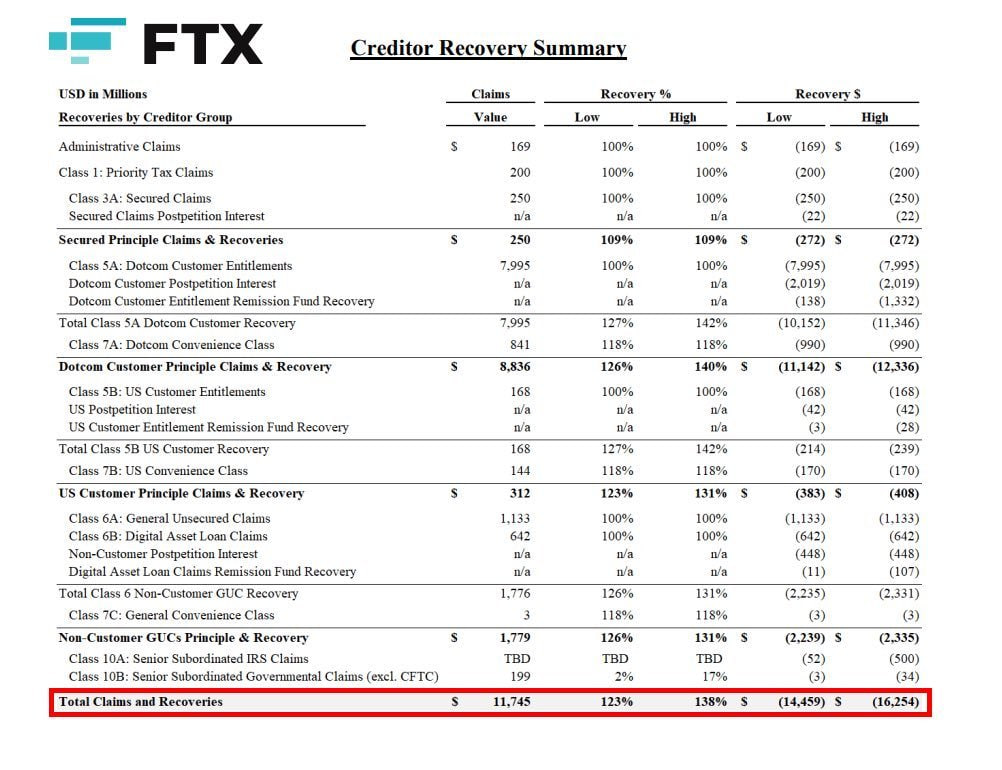

- FTX to distribute $16B in cash to creditors in Q4

In the last couple of months, we've lived through a German State dumping 50,000 BTC onto the market and the MtGox bitcoin distributions where a small portion likely found their way to exchanges to dump. Now, we have some bullish news. FTX cash distributions of $16B are coming in Q4.

Where it's not clear how much will be coming into bitcoin from this cash, 10% is my conservative estimation. That's $1.6B in unilateral buying pressure, or 28,000 BTC at a price of $57k.

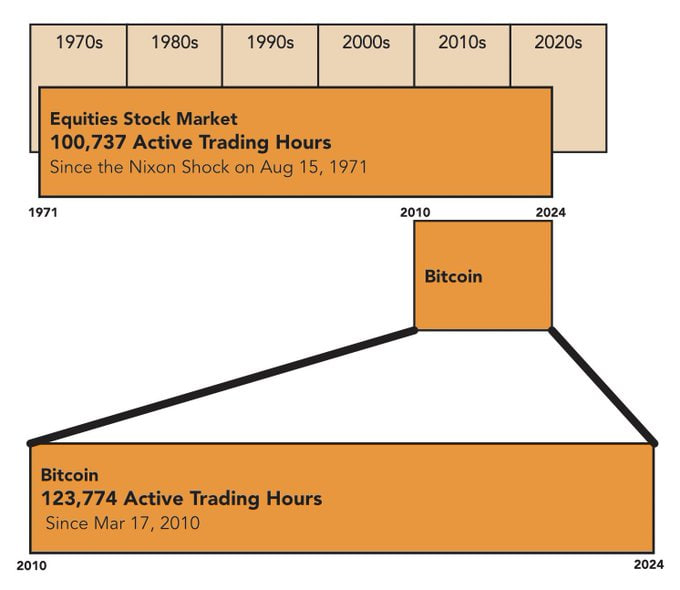

- Bitcoin has more trading hours than the stock market since 1971

- CFTC now coming after altcoins

While I do not specifically like that government agencies are going after altcoins, it should be expected. They at least have a written mandate at consumer protection and to stop scams, which altcoins obviously are. This time it's not Gensler and SEC, but the much more friendly CFTC going after Uniswap.

BREAKING: 🇺🇸

— Radar🚨 (@RadarHits) September 4, 2024

Uniswap hit with order by CFTC for Illegal Trading in Digital Asset Derivatives. pic.twitter.com/t2aLmM49L3

Macro

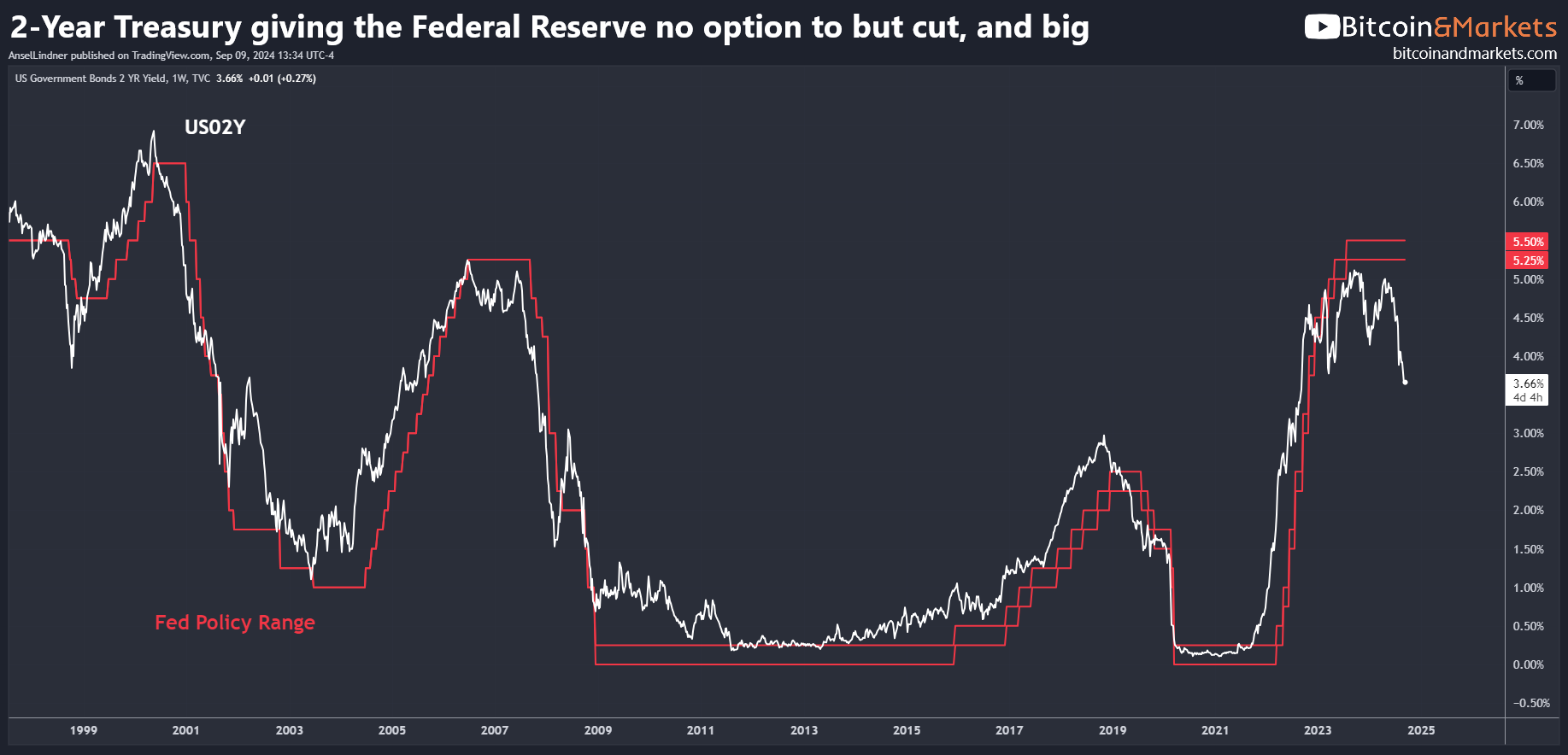

- Federal Reserve Rate Cut Next Week

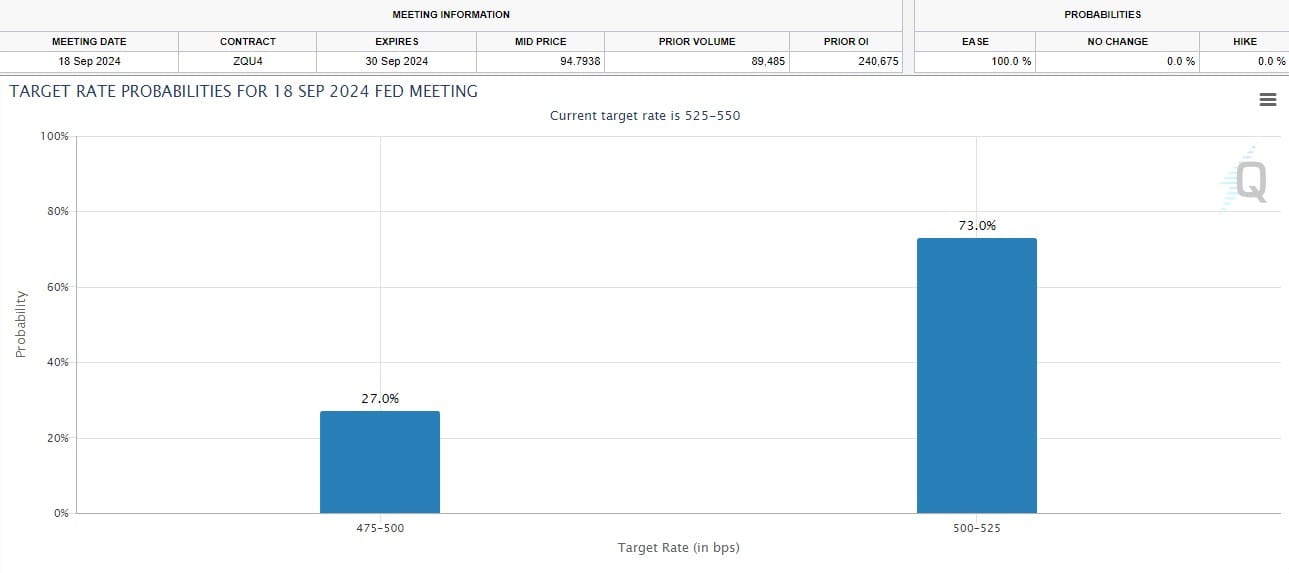

The Fed will cut rates. The only question is, by how much? The market is pricing in a 73% chance of only a 25 bps cut. However, the Fed usually starts with a 50 bps cut. That’s what they did in the Dotcom recession and the GFC. Moreover, there is currently a larger gap between yields and the Fed Funds rate than in those other two times.

I expect a 50 bps cut, but it really doesn't matter. The Fed is merely reacting, unable to stop the runaway train that is the coming recession. Their focus will be on managing the panic, and I think they will be mostly successful. This is shaping up to start, not as a panic banking crisis, but as a textbook recession, though it could still turn nasty for banks.

- US CPI this week

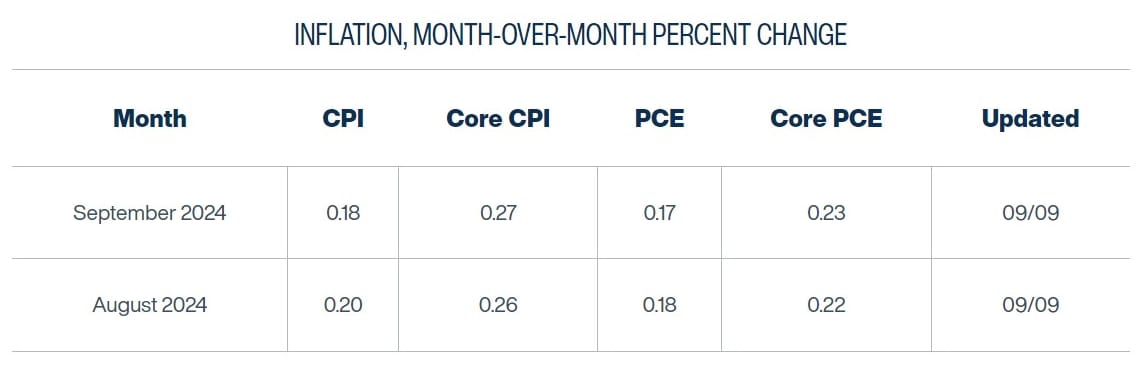

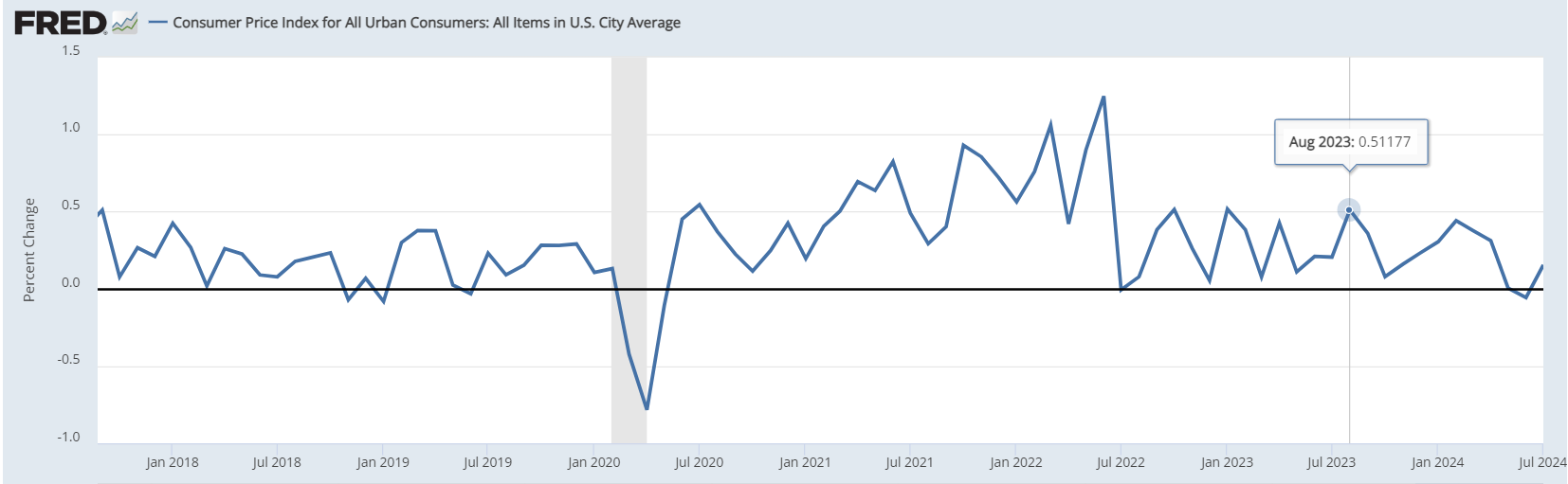

The Cleveland Fed's Inflation Nowcast has overestimated CPI by roughly 0.1% MoM for the last several months. Currently, they are forecasting a 0.18% MoM for August CPI.

Even at that forecasted level, the base effect is setting up for a significant move down in CPI due to replacing August 2023's 0.51%. In other words, the YoY CPI should drop by at least 0.33%, from 2.92% to 2.59%. However, if CPI comes in weak again, we could easily see 0.10% MoM and 2.5% YoY, bringing us well on our way to the 2% target.

I’ve expected CPI to be transitory the whole time and stuck to my guns while others mocked it. We are heading into a recession, and CPI will drop even more in the coming months.

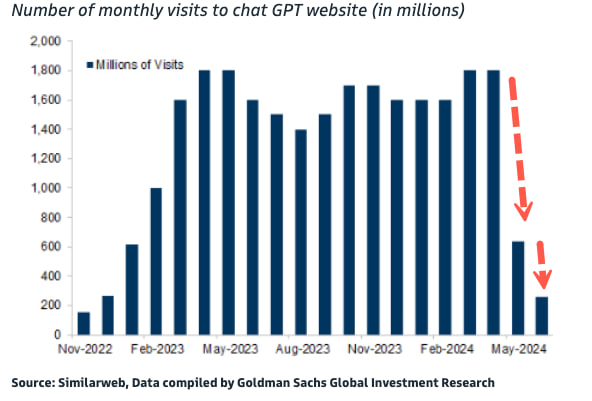

- AI race over? Monthly Active Users of ChapGPT Crash

The argument against AI is simple: its "exponential utility" comes at an exponential cost, just when we are facing a demographic cliff that will make profit scarce.

There might be another season for AI investments in the next few years, but the hype is significantly overblown.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

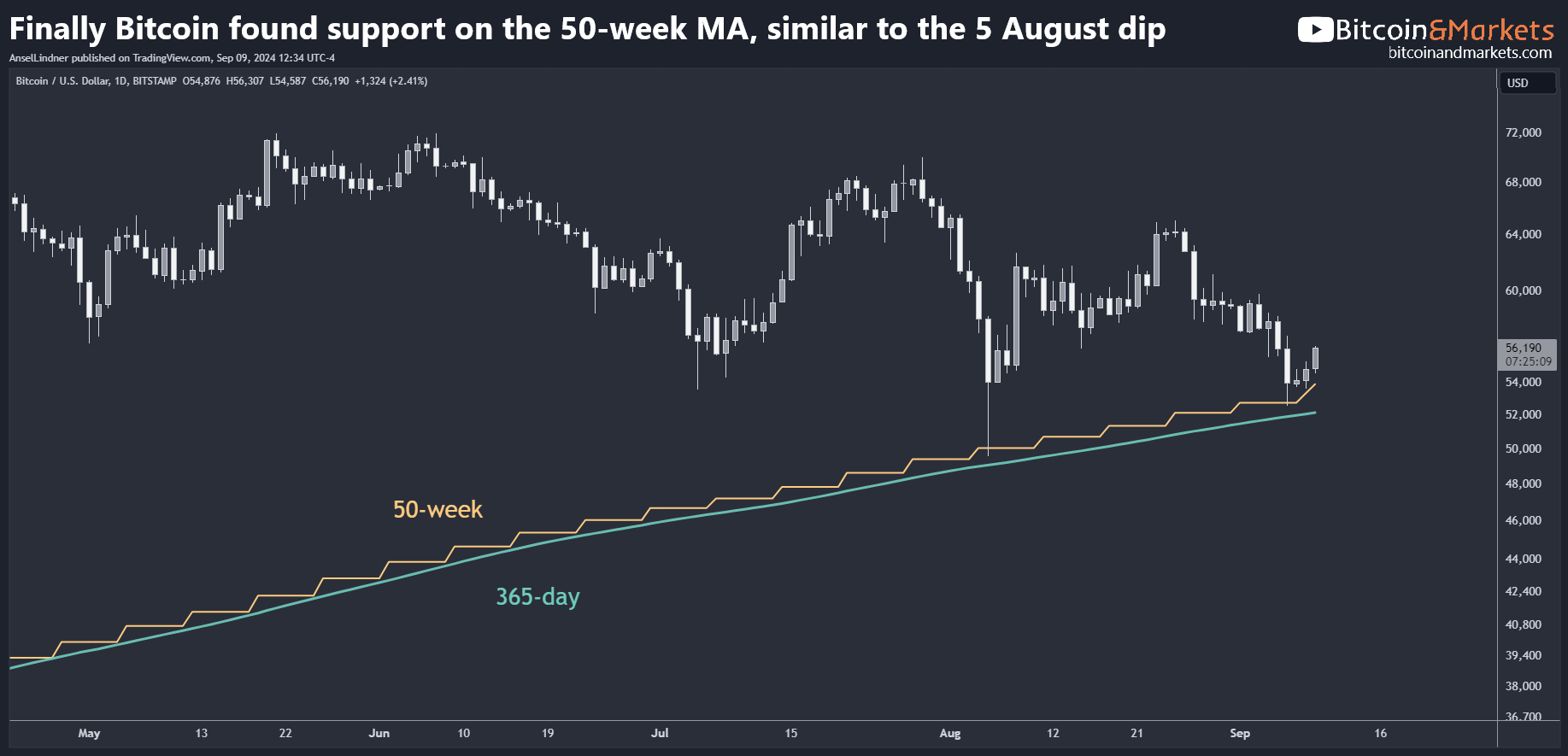

We've finally found some support on the aforementioned 365-day and 50-week MAs, just like the dip on August 5th.

The absolute intraday low was much higher this time; however, the daily close was lower, leading to a significant bullish divergence!

Price remains squarely within the large megaphone pattern. If this turn prior to the bottom holds, it is a sign of strength.

I’ve seen some of these Inverse Head & Shoulders charts floating around today. This is a stretch. There is no clearly defined neckline and no Head on the daily closes. The RSI is somewhat promising, but you want the first shoulder to have the most extreme RSI, tapering off. Notice the left shoulder’s RSI came earlier than the bottom in question. All in all, this is not a well-formed H&S pattern.

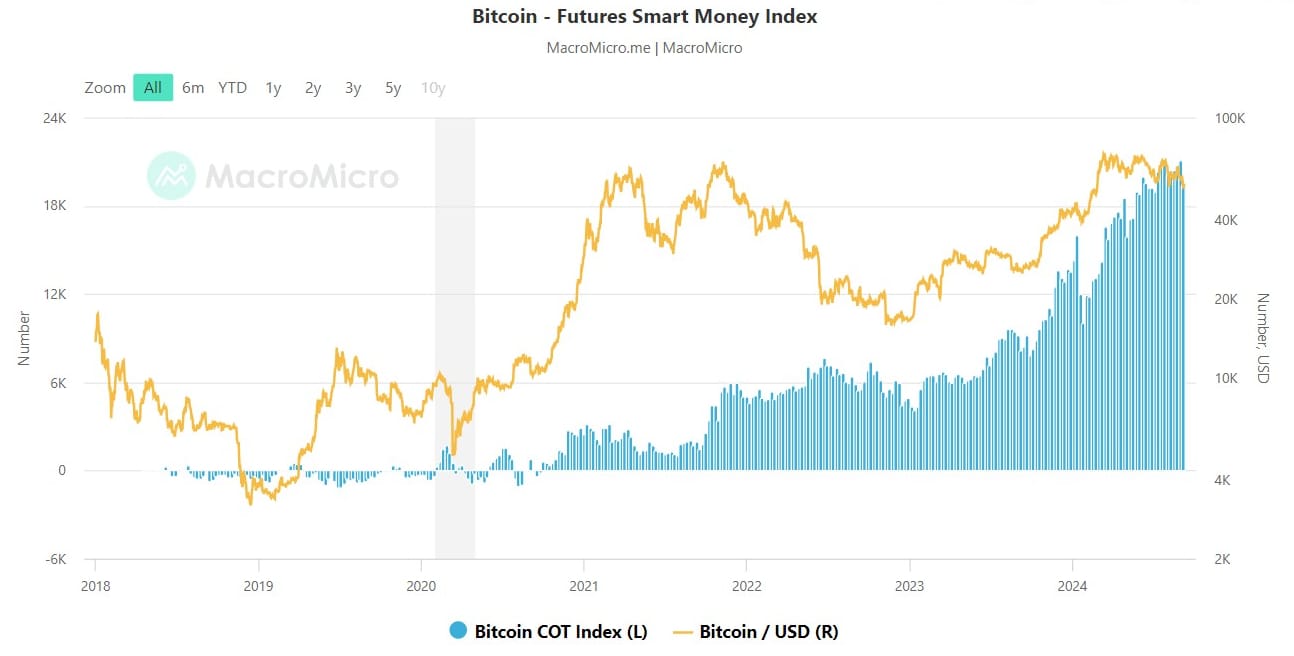

The Bitcoin Smart Money Index continues to grow, as the Fear and Greed Index is captured by Fear. The smart money is defined as "Bitcoin futures' large investors include asset managers and other reportables. Bitcoin futures large investors' long positions - their short positions = Bitcoin futures smart money index."

Uptember?

September is still shaping up to be a critical month, and we are getting some breathing room currently. There is still a lot of work left before we can say we’re out of the woods. September's opening price was $58,967, and Q3's opening price was $62,676. Those levels are nearly a given. We’ve already jumped 9% off the bottom, and those levels are just another 4% and 10%, respectively.

I’m still expecting some Uptober energy to creep into September. If that happens, we could easily squeeze shorts all the way to an ATH this month. Internal mid-range support and resistance have been sliced through many times, meaning price should be able to make an uninterrupted move higher when it does go higher. The possibility of an ATH by the end of the month is still very much alive, but looking less likely. Let’s see what develops because everyone’s models might need rewriting after this month.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

JUST IN: 🇯🇵 Japan's largest power company TEPCO is mining #Bitcoin using surplus energy. pic.twitter.com/ZrsmbV7mv6

— Bitcoin Magazine (@BitcoinMagazine) September 9, 2024

With over 27 million residential and business customers, TEPCO established Agile Energy in 2022, and now they are exploring Bitcoin mining powered by surplus renewable energy. The subsidiary has installed mining rigs next to solar farms in Japan's Gunma and Tochigi prefectures.

The BMN2 token is designed to “provide direct exposure to Bitcoin hashrate operated by Blockstream’s… enterprise-grade mining facilities across North America,” Blockstream said.

Priced at $31,000 per token, each BMN2 represents a 48-month claim on one petahash per second (PH/s) of Blockstream’s mining hashrate, the company said. Hashrate measures the computing power used to mine blocks on the Bitcoin network.

In effect, Blockstream is selling four-year claims on the proceeds from its BTC mining operations in exchange for upfront funding. Investors benefit from a significantly discounted hashprice of $21.23, Blockstream said.

Hash rate and Difficulty

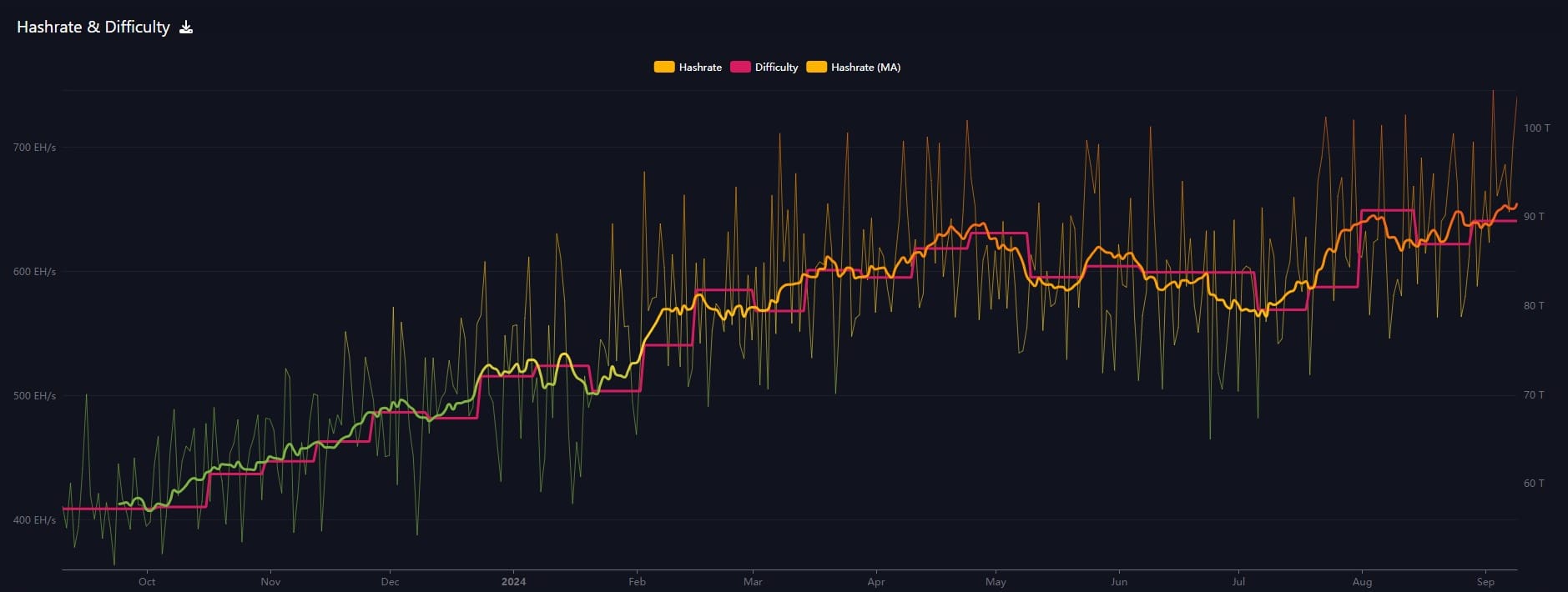

I've included the daily hash rate line in today’s chart to show the recent ATH for hash rate on September 2nd. Additionally, the 7-day MA of the hash rate is hitting fresh ATHs. This is a massively bullish fundamental for the Bitcoin price. Difficulty is estimated to adjust upward by 4.6% tomorrow to a new ATH as well.

Mempool

The mempool has been extremely quiet and flat over the last three months. Nothing significant to report here—no sign of building uncertainty or worry in the market whatsoever. That said, it’s not building major confidence either.

- NSTR

In Case You Missed It...

My latest posts

- Bitcoin’s Breaking Point: September's Bearish Cycle and What Comes Next - Premium

- Macro Minute: Bai Lan (Let It Rot) in China

- Macro Minute: Recession Risks Rise as Yield Curves Un-Invert

- Bitcoin Chop is Ending, Here's What to Watch - E393

- Macro Minute: Oil Prices Plunge as Supply Outpaces Demand

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com