Bitcoin Fundamentals Report #305

Federal Reserve Rate Cuts, Altcoin Declines, and the Growing Dominance of BTC in an Uncertain Economic Landscape

September 16, 2024 | Block 861,600

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

LIMITED TIME - My content relies on your contributions! Join the community while supporting independent Bitcoin and Macro analysis!

Check member perks. Click button below for half off $5 support!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | $58K gang |

| Media sentiment | Slow |

| Network traffic | Very low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $57,953 (+$1,439, +2.5%) |

| Market cap | $1.143 trillion |

| Satoshis/$1 USD | 1727 |

| 1 finney (1/10,000 btc) | $5.79 |

| Mining Sector | |

| Previous difficulty adjustment | +3.5765% |

| Next estimated adjustment | -5% in ~9 days |

| Mempool | 112MB |

| Fees for next block (sats/byte) | $0.49 (6 s/vb) |

| Low Priority fee | $0.32 |

| Lightning Network** | |

| Capacity | 5193.39 btc (+2.1%, +106) |

| Channels | 48,558 (+0.2%, +93) |

The enterprise software maker, whose corporate strategy includes buying the cryptocurrency, bought the tokens between Aug. 6 and Sept. 12, according to a US Securities and Exchange Commission filing on Friday. It’s the largest amount of tokens purchased since the firm announced in February 2021 that it snapped up 19,452.

MicroStrategy now holds around 244,800 Bitcoin, valued at around $14 billion. That’s around 1% of all the Bitcoin ever issued. BlackRock’s iShares Bitcoin Trust is the world’s largest Bitcoin fund at about $20 billion. MicroStrategy has acquired its tokens at an aggregate purchase price of about $9.45 billion and an average purchase price of approximately $38,585, according to the filing.

- UK introduces bill in Parliament to clarify Bitcoin's status

I do not have confidence that this will pass. We have a long way to go in Europe for Bitcoin to be seen somewhat positively. To my knowledge, we haven't seen a single major political figure in Europe/UK that has endorsed Bitcoin. Perhaps Farage has, but cannot think of a time off the top of my head. However, this could be seen as a sign of the most negative position against Bitcoin slowly coming to an end.

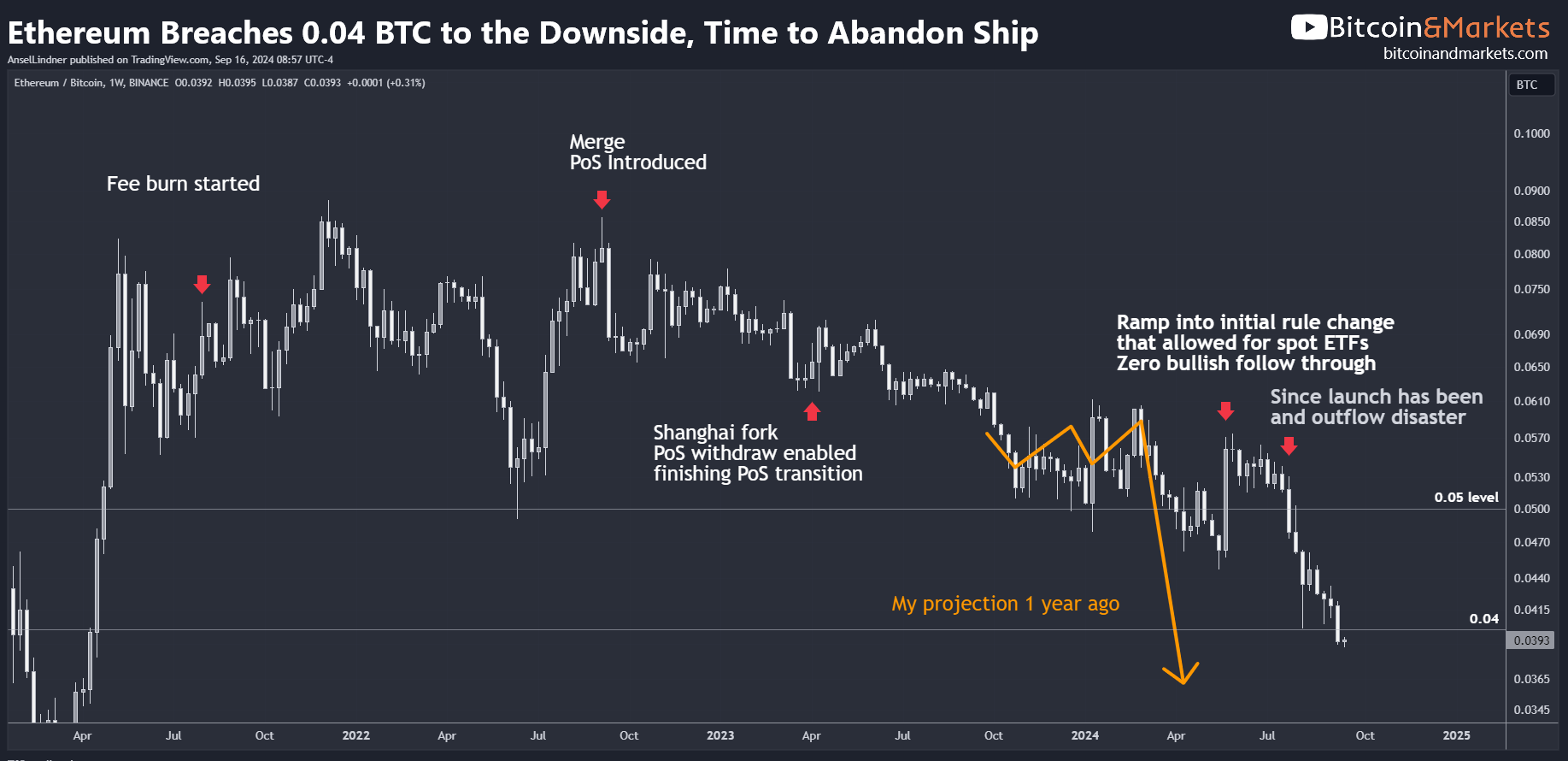

- Ethereum breaks into the 0.03 BTC handle

Nothing is going right for altcoins, and Ethereum is the kind affinity scam on Bitcoin. It's becoming more popular to dog on Ethereum, but some of us have been here since the beginning. It is not what they claim. Altcoins are one big affinity scam on Bitcoin.

One year ago, I predicted a 0.03 BTC handle for ETH. The only thing that delayed it from happening was the nearly unforeseeable 180 pulled by the SEC to approve a spot ETH ETF. Eventually, every fake "crypto" will go to zero, and Bitcoin will stand alone.

This also has implications for this cycle. In previous cycles, altcoins stole some attention from the true innovation here in Bitcoin. Yes, some of those ill-gotten gains found their way into Bitcoin (Block.one has a ton of Bitcoin still), but much of it was simply funneled into founders', VC's, and whales' pockets. This time could be different, and nearly all the inflow will be directed towards the King, Bitcoin.

Macro

- Federal Reserve Rate Cut This Week

Readers will know the Federal Reserve doesn't really do anything mechanically in the market. So, when predicting what they will do, we should not consider their actions in regard to causing specific monetary effect. Instead, we should think of their policy as acknowledging economic circumstances as they currently are, and how they are trying to influence the psychology of the market.

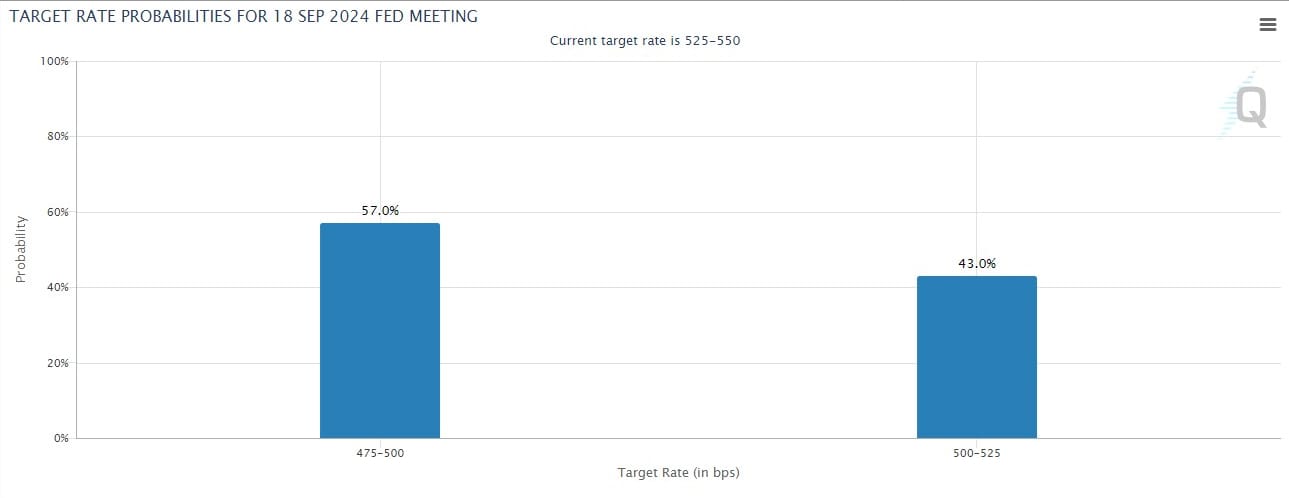

The odds of a rate cut are 100%. The only question is, by how much? This morning the market is pricing in a 57% chance of a 50 bps cut.

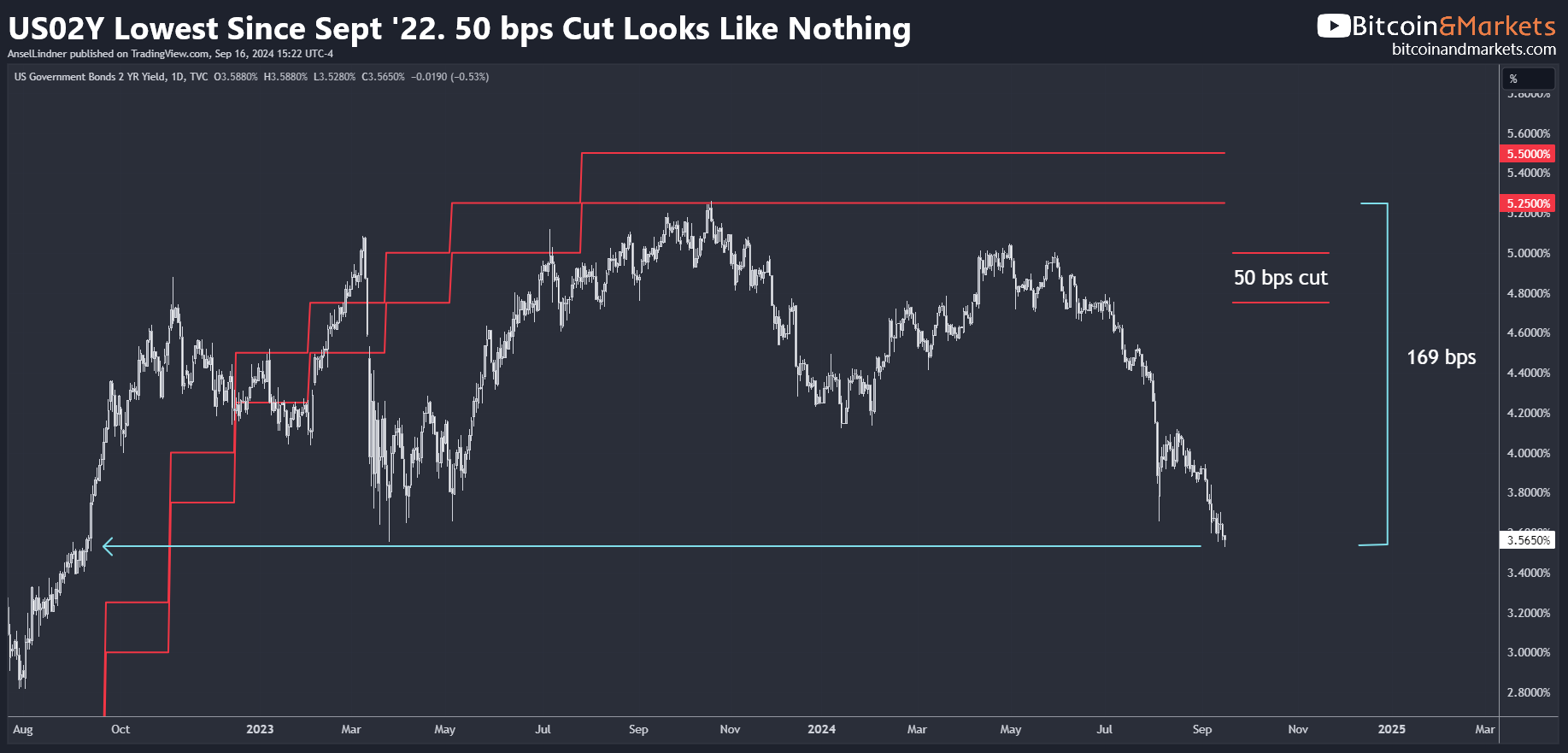

I'm still on the 50 bps train. The Fed gets behind because they follow the market and what is the 2Y telling us? The same thing as the Dotcom and the GFC, the Federal Reserve is way behind.

A few headlines about banking stocks having a bad couple of days last week, but there is still no major signs of imminent banking stress as we approach the end of Q3. It seems markets might have some runway left prior to recession, but I will be watching and reporting on this going forward.

- Things are getting bad in China

🇨🇳 China Overnight Economic Data:

— Jesse Cohen (@JesseCohenInv) September 15, 2024

*Unemployment Rate: Miss 🔴

*Retail Sales: Miss 🔴

*Industrial Production: Miss 🔴

*Fixed Asset Investment: Miss 🔴

China's economy is in awful shape. 🇨🇳 pic.twitter.com/oNpYGZFpLt

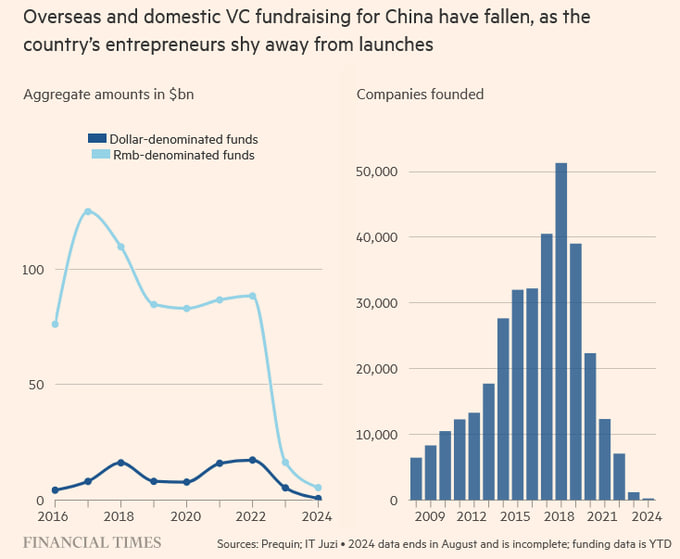

I talk about China so regularly for a a very important reason. Most people's vision of China is dead wrong, based on a faulty assumption of the direction of the global economy. China, in its current form, is not bound to be a significant rival of the US. It will be a victim of deglobalization and communist collapse.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week, we were bouncing off support. During the week we attacked the 50-day MA, broke it, but are currently sell off again. On my Friday LIVE stream I said to expect a slow weekend followed by the first half of the week being slow due to the FOMC anticipation.

We are still on track for October's typical rally to occur a week or two earlier in September due to an earlier halving.

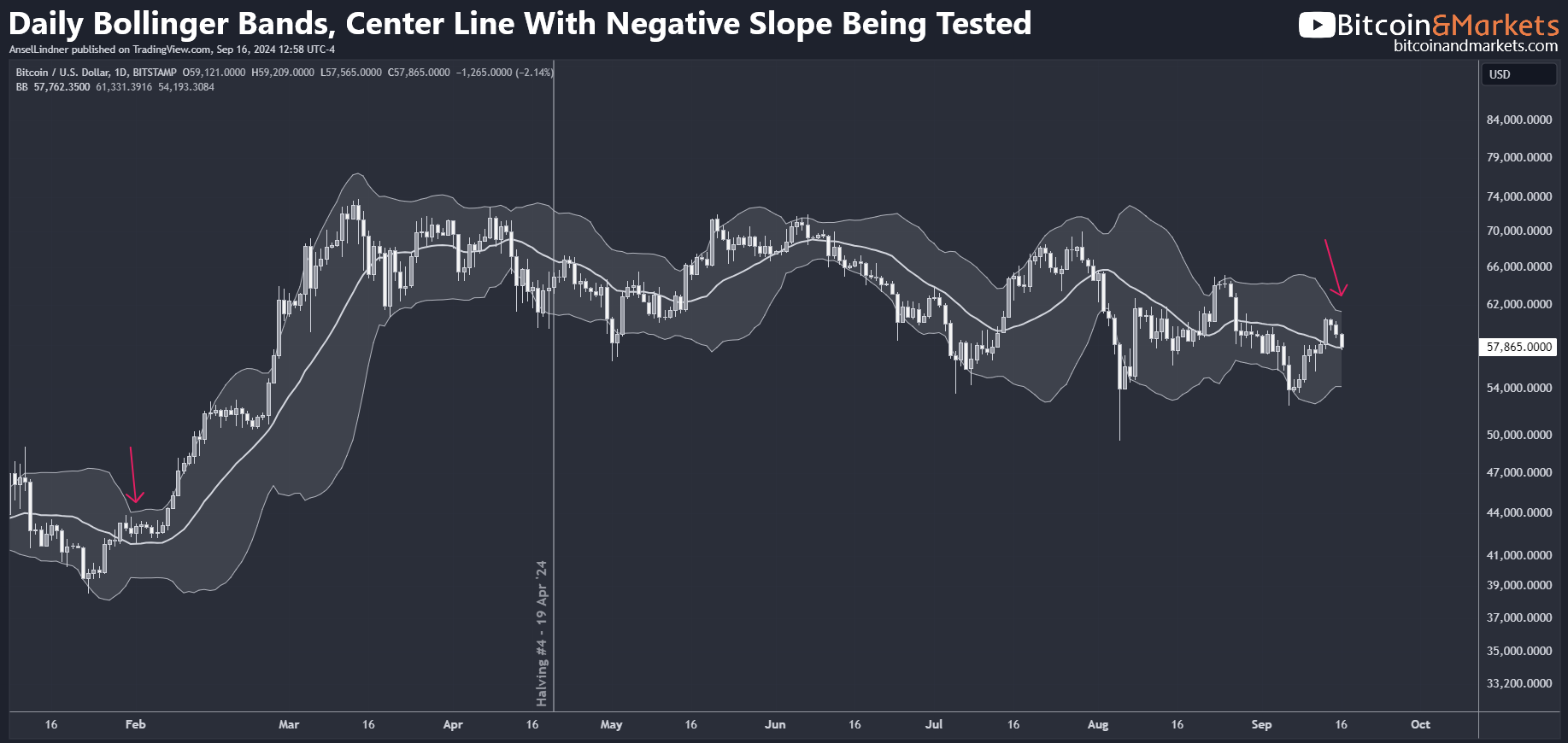

The Bollinger Bands is not an indicator I watch regularly, however, it does use the 20-period MA as its center line. As you can see, the center line is downward sloping, and the last time we had a similar setup, was right before the post-ETF rally.

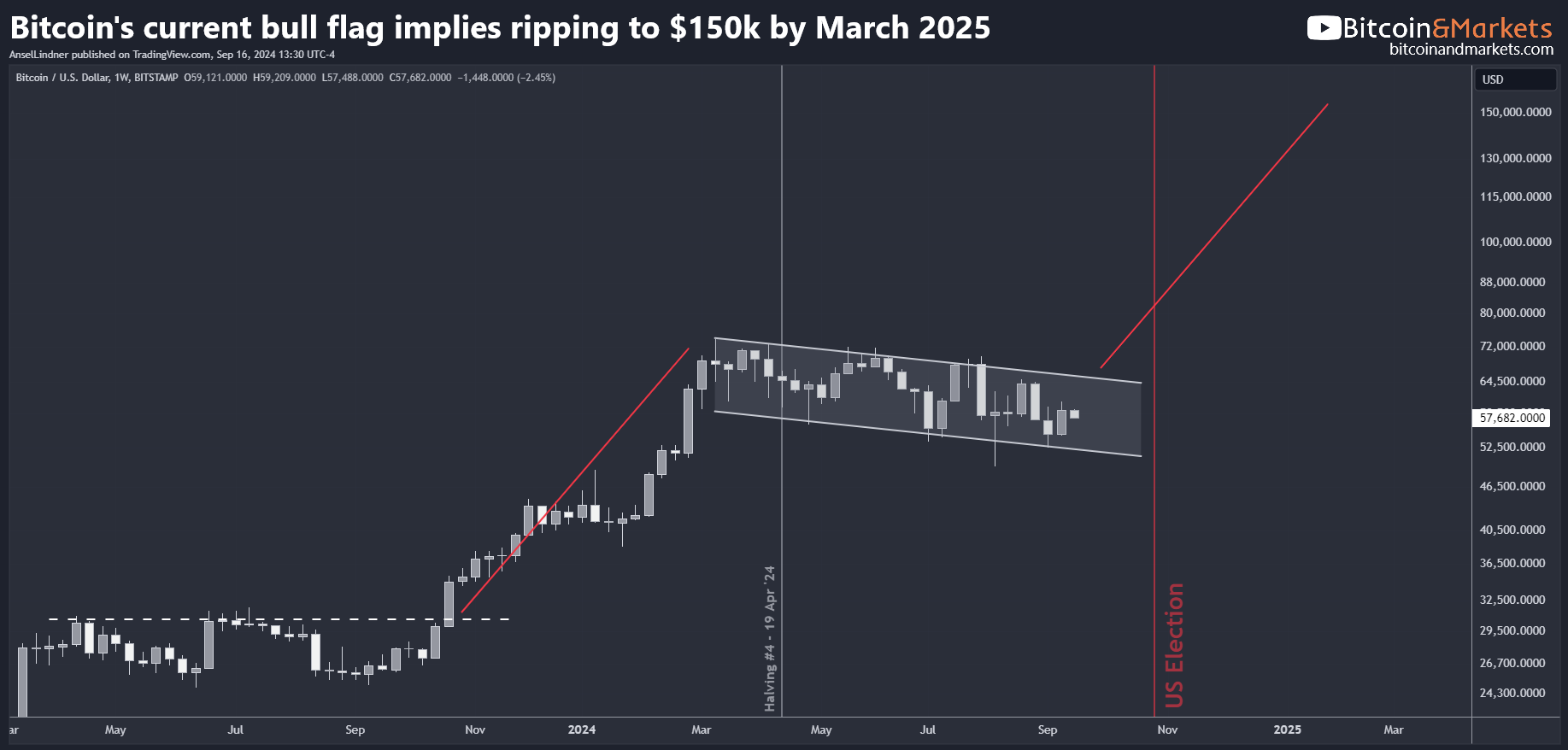

The bull flag is massive. The measured move out of it is equal to the flag pole. As you can see, that implies a move to $150k by March 2025.

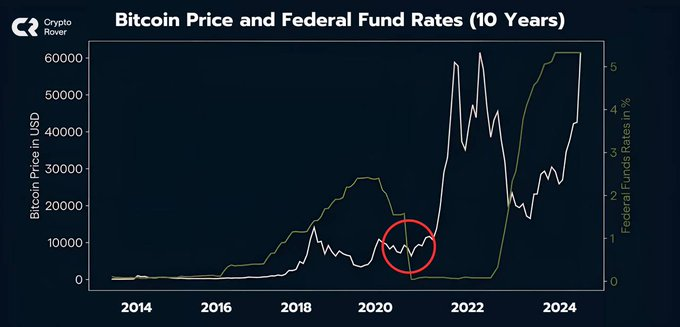

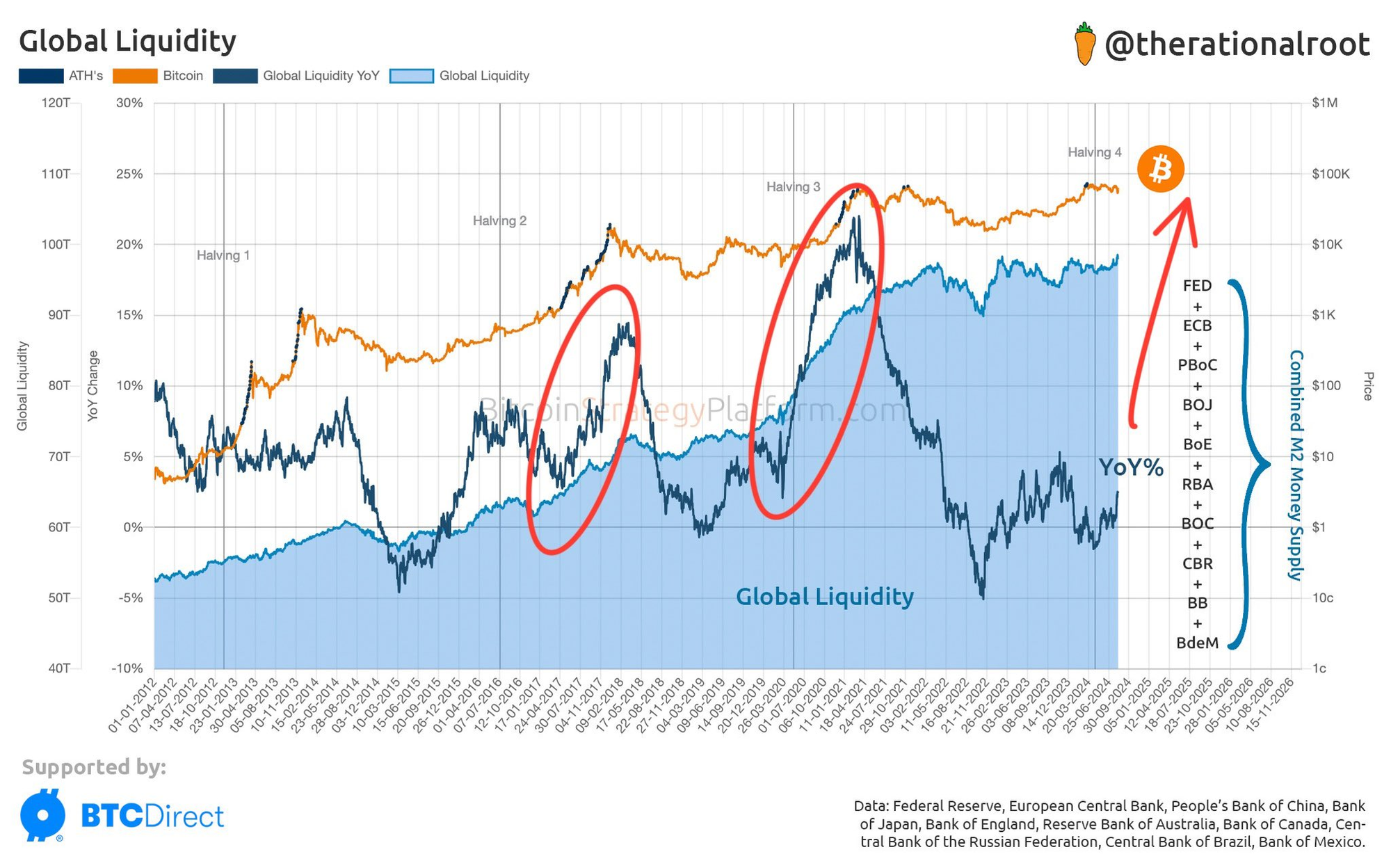

There is not much else to say on price for the first half of this week. FOMC and their rate cut is sucking up all available mind-share. There are tons of charts circulating on X about M2 money supply and Fed rate cuts being positive for the bitcoin price. Here are just a couple:

My opinion is this is correlation not causation. M2 money supply grows when shadow banking liquidity and esoteric forms of money supply shrinks. Bitcoin as an alternative asset without counterparty risk also grows during those periods. I'll be writing more about this in the next Bitcoin Minute.

Overall, fundamentals are still very solid. Macro factors continue to align with recession, creating a quite favorable environment for Bitcoin. Most gains happen in very short periods of time. For example, if you check out the chart above again with the bull flag, nearly all the gains this year came in February alone. Fundstrat’s Tom Lee has previously said Bitcoin sees its biggest gains in just 10 days each year.

This week should be slow into the FOMC, but has the potential to rally in the second half.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

After a Bitcoin mine closed in Hadsel, Norway, residents received a surprise. Initially lauded for decreasing noise pollution, the shutdown has raised community electricity expenses.

Operating under Kryptovault, the mine consumed a significant portion of the local power distributor Noranett’s income. Now, with its closing, locals are dealing with a 20% rise in their electrical bills.

Residents had complained for years about the continuous noise the cooling systems of the Bitcoin mining operation. Mayor Kjell-Børge Freiberg said that the noise had bothered a lot of the roughly 8,260 residents of the town.

For those against the mine, closing seemed like a victory, but it has had unexpected financial consequences. The neighboring power company was obliged to raise rates in order to offset the lost income from Kryptovault’s operations. The network manager, Robin Jakobsen, claimed that losing such a large customer has seriously damaged their income.

BREAKING: BHUTAN GOVERNMENT’S $750M BTC NOW ON ARKHAM

— Arkham (@ArkhamIntel) September 16, 2024

Bhutan’s Bitcoin holdings are now labeled on Arkham. These holdings come from Bitcoin mining operations carried out by the Kingdom of Bhutan’s investment arm, Druk Holdings.

Arkham is the first to publicly identify these… pic.twitter.com/a8ScUNJJ9F

South Asian country Bhutan, a Buddhist kingdom on the Himalayas’ eastern edge, has been revealed as a major Bitcoin holder, owning 13,011 BTC worth around $780.49 million, according to a report by Arkham Intelligence. The public data company identified Bhutan’s Bitcoin addresses, marking the first time this information has been publicly shared.

"Bhutan is the 4th largest government with Bitcoin holdings on our platform, with over $750M in BTC," Arkham stated on X. "Unlike most governments, Bhutan’s BTC does not come from law enforcement asset seizures, but from Bitcoin mining operations, which have ramped up dramatically since early 2023."

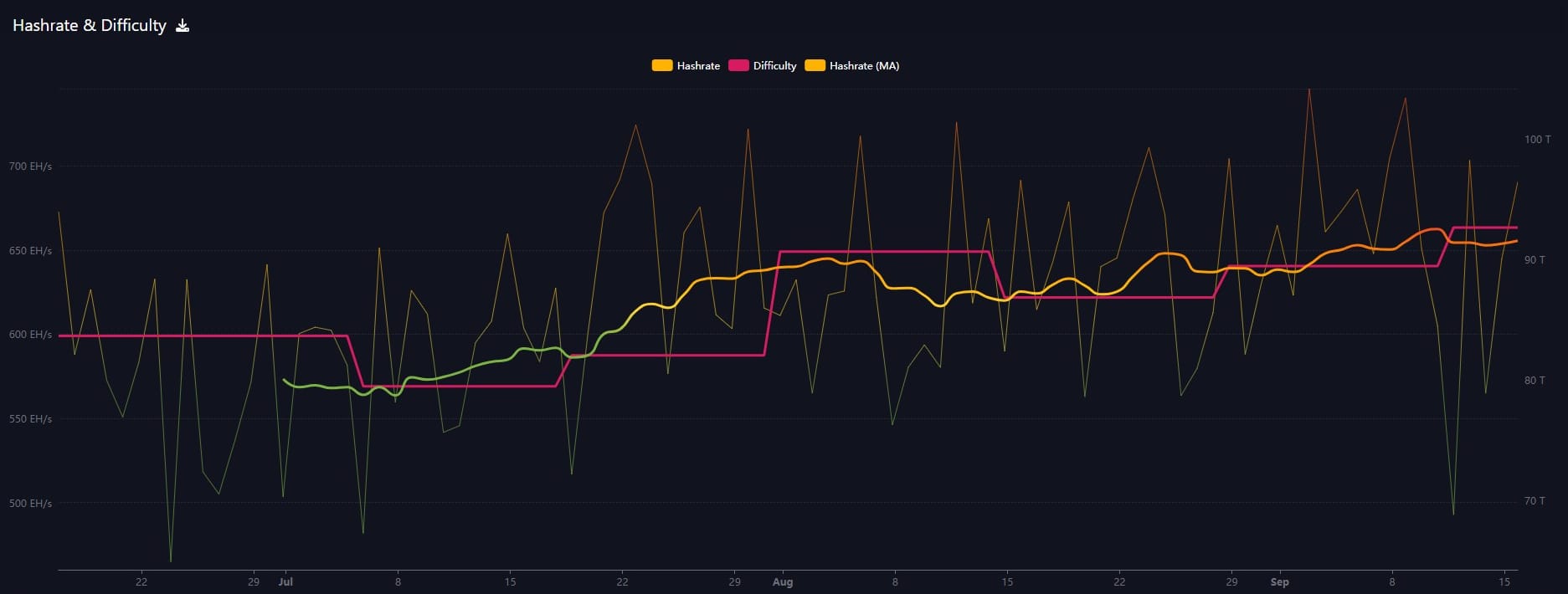

Hash rate and Difficulty

As the difficulty jumped last week to a new ATH, hash rate promptly fell off. Hash rate is down only slightly on a 7-day MA.

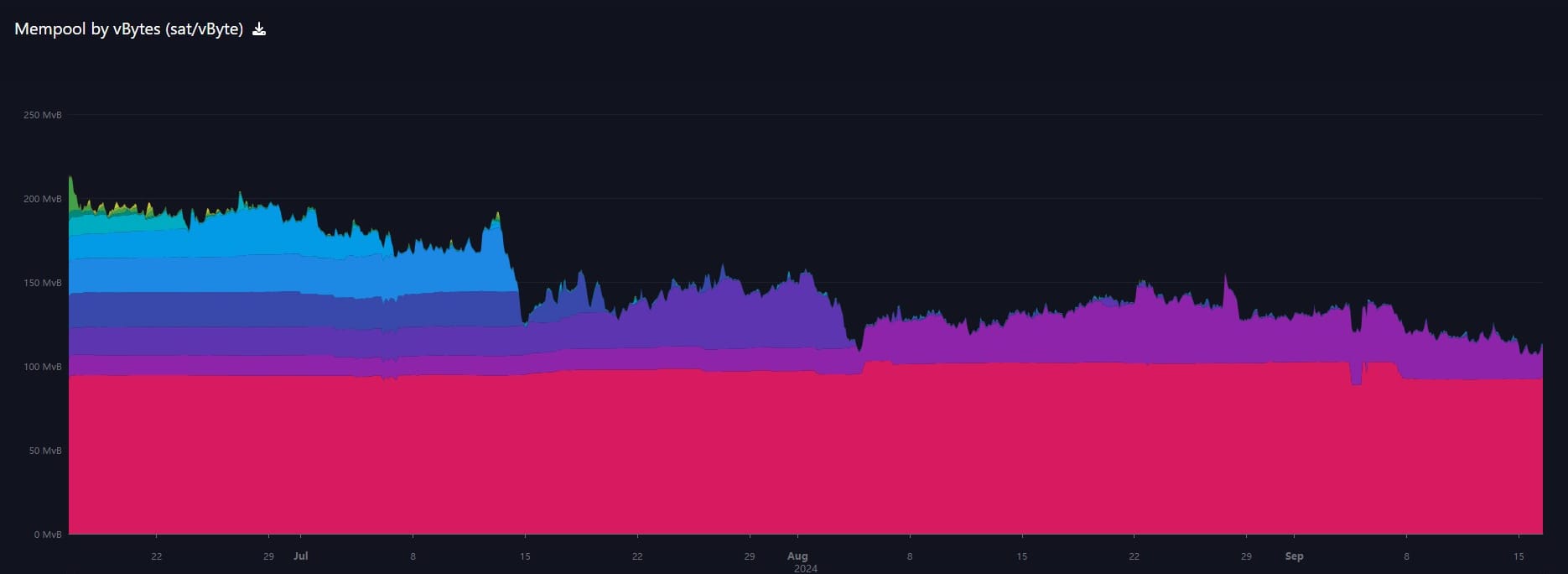

Mempool

Bitcoin's mempool (transactions waiting to be confirmed by miners) lost several more MBs this last week, down to 112 MB. Most of the remaining transactions are very cheap at 1.2 sats per virtual byte (s/vb).

DAOs are an old idea at this point in Bitcoin's history. Decentralized Autonomous Organizations are complete doublespeak.

Decentralized

They are not decentralized, normally because insiders and founders have either controlling keys or controlling share of a pre-mine (coin distributed before the public had a chance to buy). These things are not present in Bitcoin obviously.

Autonomous

They are autonomous only to the extent that they've been tested in a very simulated environment under perfect conditions. One of the Laws of Programming is there will always be bugs. If this DAO runs into a bug, it ceases to work and your investment will crash to zero. Unless there is a centralized group with override keys to go in a fix things.

Also, these DAOs always want to upgrade. Well, how exactly does that happen against the game theory. In decentralized networks with a token, the game theory will protect the value of the token as it is, creating a Nash Equilibrium against hard forks. If there is a hard fork, what is stopping existing nodes from running both? Why hold a token that can infinitely fork and dilute your investment to zero. Moreover, each fork introduces yet more risk of a bug.

Overall, DAOs are scams that are technically impossible now, and likely into the far far future. The technical hurdles are so large, and the return on fraud so high, you can be certain that every DAO attempt is a total scam. People who believe in DAOs are either ignorant or in on the scam.

Cadence Mining plays a pivotal role in Fractal Bitcoin’s design. Unlike the usual merged mining, where miners safeguard two blockchains at once, this method spaces out block rewards, enabling bitcoin (BTC) miners to mine Fractal Bitcoin blocks every third block. This approach offers a distinct take on how mining rewards are distributed, all while aiming to ensure the security of the main Bitcoin network remains intact. In the past, merged mining projects raised concerns about diluted hashpower and a weaker commitment to Bitcoin.

Fractal Bitcoin aims to be a distinct sidechain, complete with its own native token. Out of the 210 million total tokens, half are set aside for miners through PoW, in order to keep network security strong. The ecosystem treasury claims 15%, while another 10% is earmarked for community grants, intended to drive engagement. Interestingly, 5% of the tokens are allocated for pre-sale, with a lockup period in place—an attempt to maintain stability during the network’s infancy.

In Case You Missed It...

My latest posts

- September Turns Positive, Q4 Move Starting Early - Premium

- FORBES - 3 Concepts Investors Must Know About Bitcoin’s 4-Year Cycles

- Can Bitcoin turn it around right here, right now in Uptember? Bitcoin Dawn, Weekly Round up - E395

- Bitcoin Minute: Rethinking the Bitcoin vs Gold Debate

- Bitcoin Dives, What's Next, Can Bitcoin Recover? - E394

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com