Bitcoin Fundamentals Report #306

Get the latest updates on the Bitcoin industry, including the SEC’s approval of options for BlackRock’s Bitcoin ETF, MicroStrategy’s ongoing Bitcoin purchases, macroeconomic factors impacting Bitcoin, and a closer look at mining and market trends.

September 23, 2024 | Block 862,563

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Trying to breakout |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $63,458 (+$5,505, +9.5%) |

| Market cap | $1.254 trillion |

| Satoshis/$1 USD | 1575 |

| 1 finney (1/10,000 btc) | $6.35 |

| Mining Sector | |

| Previous difficulty adjustment | +3.5765% |

| Next estimated adjustment | -5% in ~1 day |

| Mempool | 96MB |

| Fees for next block (sats/byte) | $1.24 (14 s/vb) |

| Low Priority fee | $0.71 |

| Lightning Network** | |

| Capacity | 5215.38 btc (+0.4%, +22) |

| Channels | 48,552 (-0.0%, -6) |

The U.S. Securities and Exchange Commission (SEC) has just granted approval for the listing and trading of options on BlackRock's spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT).

The approved options on the iShares Bitcoin Trust will be physically settled, meaning that when the option is exercised, Bitcoin will be delivered to fulfill the contract. These American-style options can be exercised at any time before the expiration date, providing flexibility for traders. According to the SEC, the listing will follow the same rules as options on other exchange-traded funds (ETFs), including position limits and margin requirements.

The SEC highlighted that this approval would allow investors to hedge their positions on Bitcoin, using the options market to mitigate the inherent volatility of BTC.

"Important note: This is just one stage of approval, the OCC and CFTC has to approve as well before they officially list," Balchunas continued. "The other two don't have a 'clock' so not sure when they'll be approved. A big step tho nonetheless that the SEC came around."

This explanation received over 1 million views about the implications of this approval. I cut it in three so you can expand and read it more easily.

Since 2020, MicroStrategy has adopted a Bitcoin-focused corporate strategy, taking advantage of Bitcoin's potential as an inflation hedge and store of value. The company has accumulated over 252,000 bitcoins worth more than $15 billion, substantially increasing shareholder value.

MicroStrategy has borrowed money by issuing convertible senior notes to fund its Bitcoin purchases. It recently raised over $1 billion through note offerings, partly to acquire more Bitcoin. Other public companies have emulated this "buy Bitcoin" corporate strategy to take advantage of Bitcoin's growth.

MicroStrategy's Bitcoin treasury purchases are like a large-scale "speculative attack" against fiat currencies. By exchanging fiat for scarce bitcoin when it is undervalued, the company could reap enormous returns if bitcoin continues appreciating as a global digital store of value.

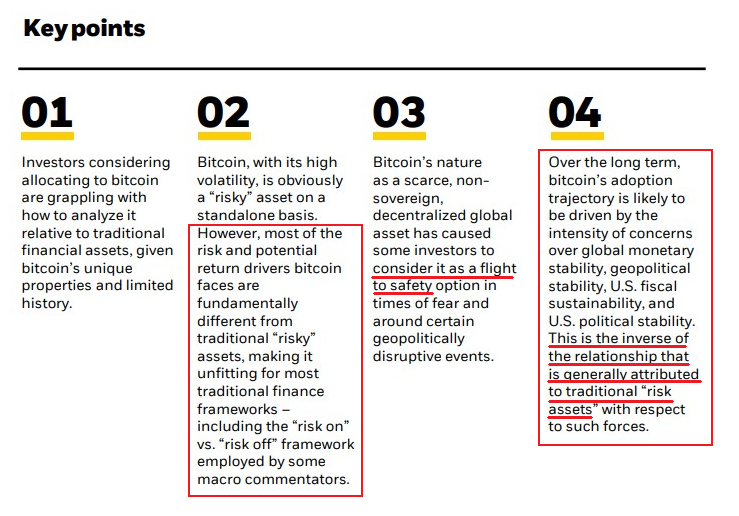

I covered this report on the Friday live stream and discussed it in the Professional tier post as well. Bottom line: bitcoin is uncorrelated and does not fit into the typical "risk on" vs "risk off" paradigm. It is also a flight to safety in an era of very heightened global and domestic risk.

It's not a long report, I recommend taking a look for yourself.

- Trump makes stop at a Bitcoin Bar in NYC

Can't see video? Here is the original.

BlackRock amends Coinbase agreement to make withdrawals within 12 hours.

A key development surrounds BlackRock amending its Coinbase custody agreement to enforce 12-hour withdrawal windows. This comes amid rumors that Coinbase isn’t properly allocating Bitcoin to IBIT, instead issuing debt to fund their Bitcoin holdings—a theory similar to long-held beliefs about paper gold manipulation. However, this scenario is highly unlikely, extremely illegal, and risky. Coinbase would not engage in such practices.

This situation also ties into exceptions to SAB 121, which previously prohibited banks from acting as Bitcoin custodians. BNY Mellon is rumored to be the first bank to receive an exception, and BlackRock likely aims to diversify its custody arrangements.

While details remain unclear, this positioning likely anticipates significant changes, including the SAB 121 exceptions and the listing of options trading.

- Operation Choke Point 2.0 was real?

Nic Carter has released a thread containing evidence that Silvergate Bank was deliberately targeted for termination by globalists. After the bank got back on its feet, the Federal Reserve allegedly told them to reduce their crypto exposure to a nominal part of their business, which forced them to liquidate.

so many of you will remember my reporting around "operation choke point 2.0" from the spring of 2023; TLDR, Biden's financial regulators, namely the Fed, FDIC, and OCC launched a crackdown on banks covering the crypto space...

— nic carter (@nic__carter) September 19, 2024

This targeted enforcement and potentially illegal requirements by the Fed certainly hint at the existence of Operation Choke Point. However, focusing solely on Bitcoin instead of scammy altcoins could have avoided this issue.

The crackdown on fraudulent crypto projects was long overdue. While some will use this as evidence of Operation Choke Point targeting crypto, the real question is whether it was aimed at fraud more generally, not just crypto.

Macro

- Federal Reserve cut rates 50 bps as predicted

I live streamed this rate cut decision and stayed live to react to Powell's press conference. It was a fun one, check it out!

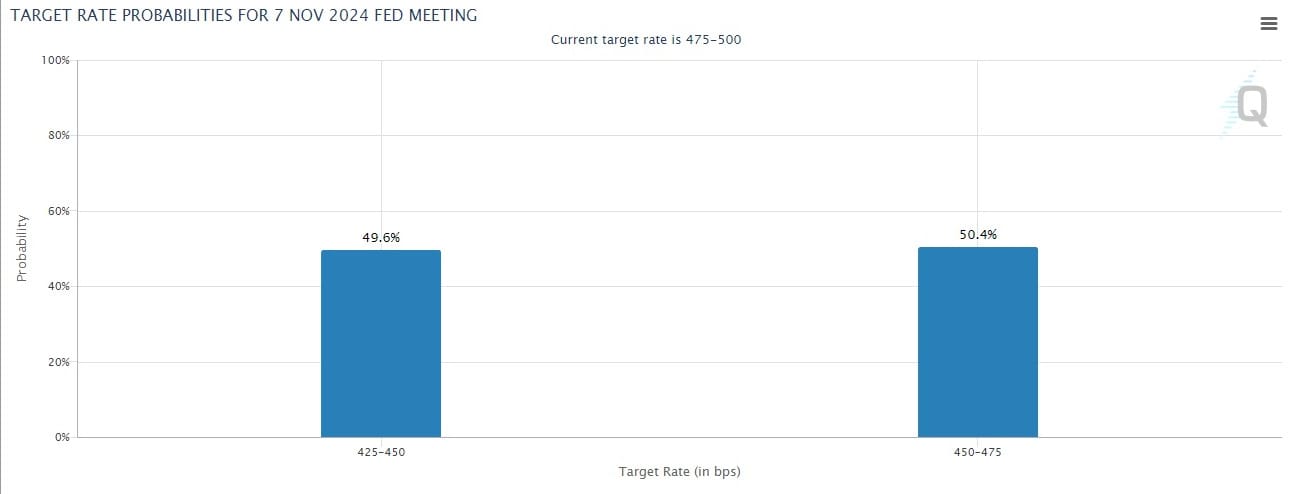

We are still 44 days away from the next FOMC meeting, which is two days after the election on Nov 7. The market is currently pricing in a 50/50 chance of a 25 or 50 bps cut. I'm leaning toward 50 bps.

- China Launches More Stimulus: PBOC Cuts Rates, Announces Rare Press Conference On Support For Economy

The situation in China is only getting worse. I predicted this years ago and it is all coming to pass. The Chinese economic model will not get back on its feet. China is now a net drag on the global economy.

Macro heavyweights like MacroAlf are now jumping on board with the China crisis narrative.

Everybody and their dogs are talking about the Fed.

— Alf (@MacroAlf) September 20, 2024

But once again, the real macro action is going on somewhere else.

The situation in China keeps getting worse.

1/

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

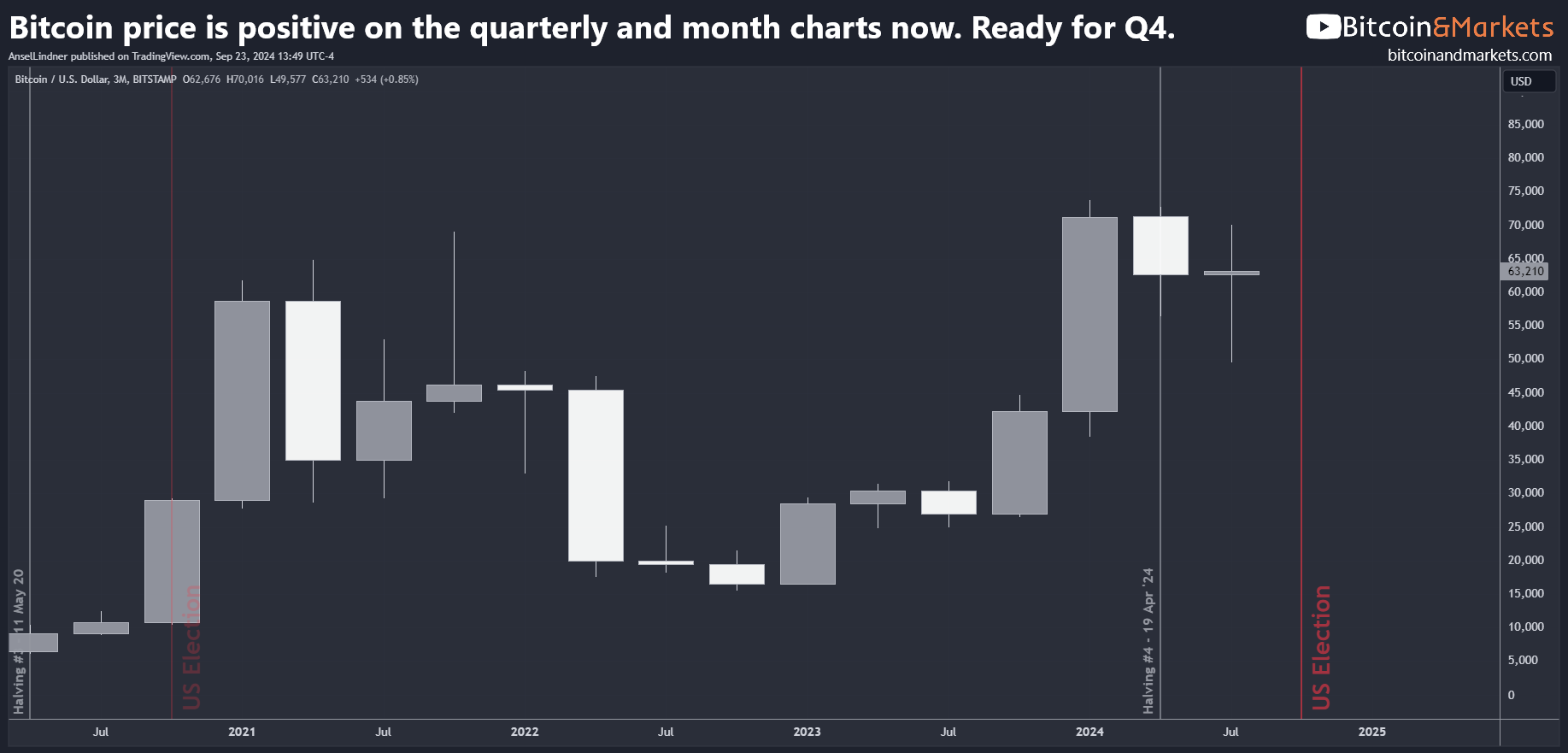

Last week:

This week should be slow into the FOMC, but has the potential to rally in the second half.

That is exactly what we saw last week, with price taking off after the FOMC on Wednesday.

We are currently challenging the 200-day, which has given us more resistance than I envisioned. However, there is no resistance above the 200-day all the way until $70k.

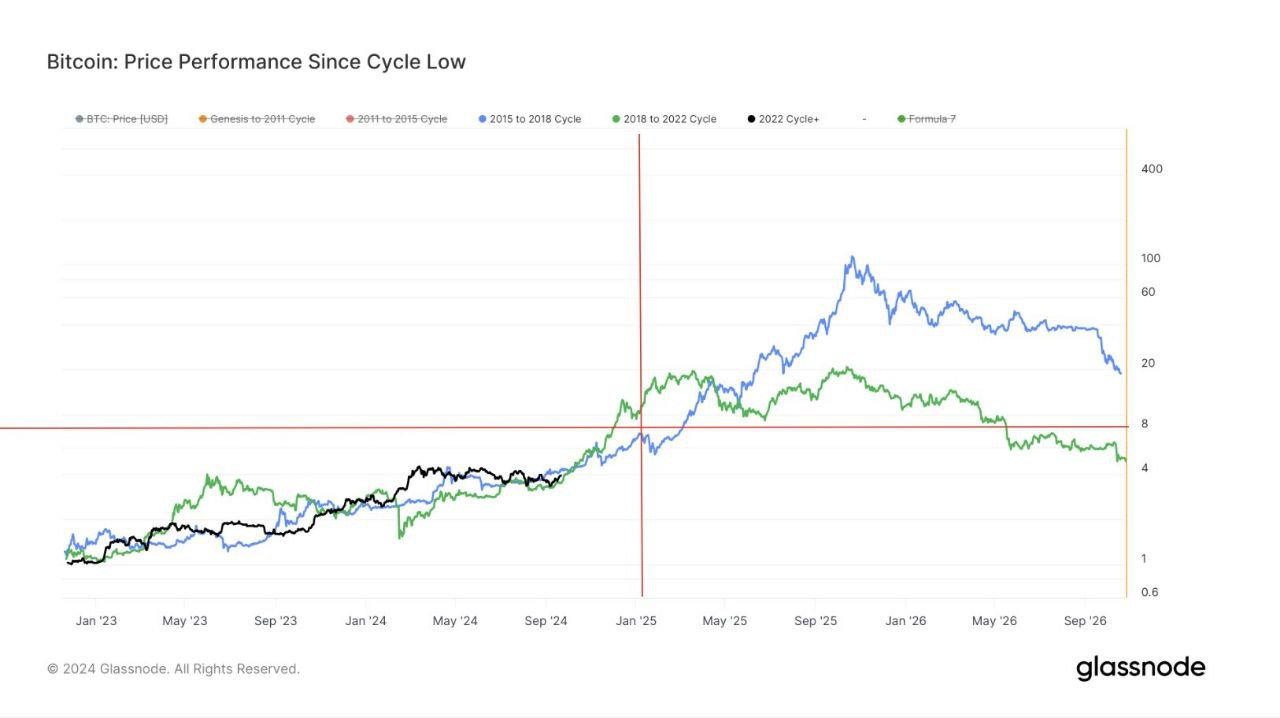

I usually measure the cycle from the halving, which shows this cycle is the worst performing yet. However, if you compare from the previous cycle's bottom this is what you get. It is amazing how the price of all there cycles has been contained in a VERY narrow section at this particular time in each cycle.

The above chart would imply a multiple off the bottom of no more than 20x. The low was $15,479, so multiplying by 20 = $309,500.

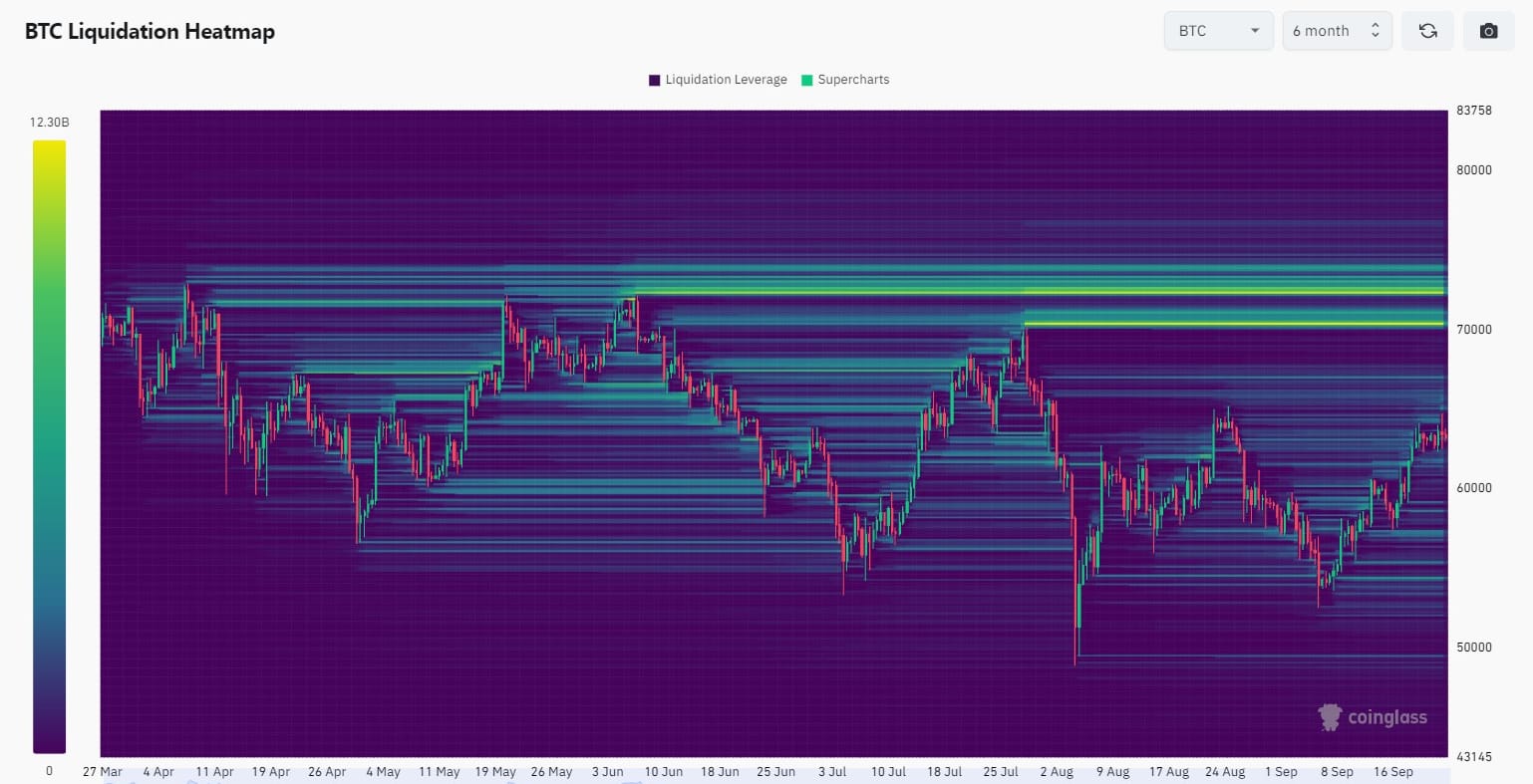

The 6 month heatmap still shows the overwhelming gravitational pull of liquidity is up to $70-74k. The real fun starts at a new ATH.

The last week has seen some major catalysts come to the fore. Spot ETF options, Microstrategy buying, and a return to rate cuts. This has the ability to become quite explosive for bitcoin once it breaks this last line of structural defense until nearing the ATH again.

With the pause at the 200-day MA, it opens up the opportunity to test some lower support like the 50-day before price can break through. Remember, gains happen fast. Once we break the 200-day it could be within a couple trading days and we're at $70k.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Despite its stance against crypto, China still controls 55% of the Bitcoin mining network even though it has a ban on the asset. Indeed, the country is a key player in BTC mining despite the restriction that was imposed on the asset class more than three years ago.

The country maintains control over more than half of the entire global network, according to CryptoQuant CEO Ki Young Ju. In a post to X (formerly Twitter), he discussed the dominance of the industry shifting from the United States. Moreover, he discusses how it has transferred to the Eastern Asian nation.

It is widely speculated that China will officially change its rules again legalizing bitcoin in the fourth quarter. This comes as Trump and the US are embracing it, and Hong Kong already has spot ETFs themselves.

Hut 8 plans to deploy the new miner in the second quarter of 2025, with an initial hosting agreement handling approximately 15 exahash per second (EH/s). This hosting deployment, facilitated by custom-built data center infrastructure developed in-house by Hut 8, is a key part of the company’s strategy to expand its computing power across Bitcoin mining and AI compute sectors.

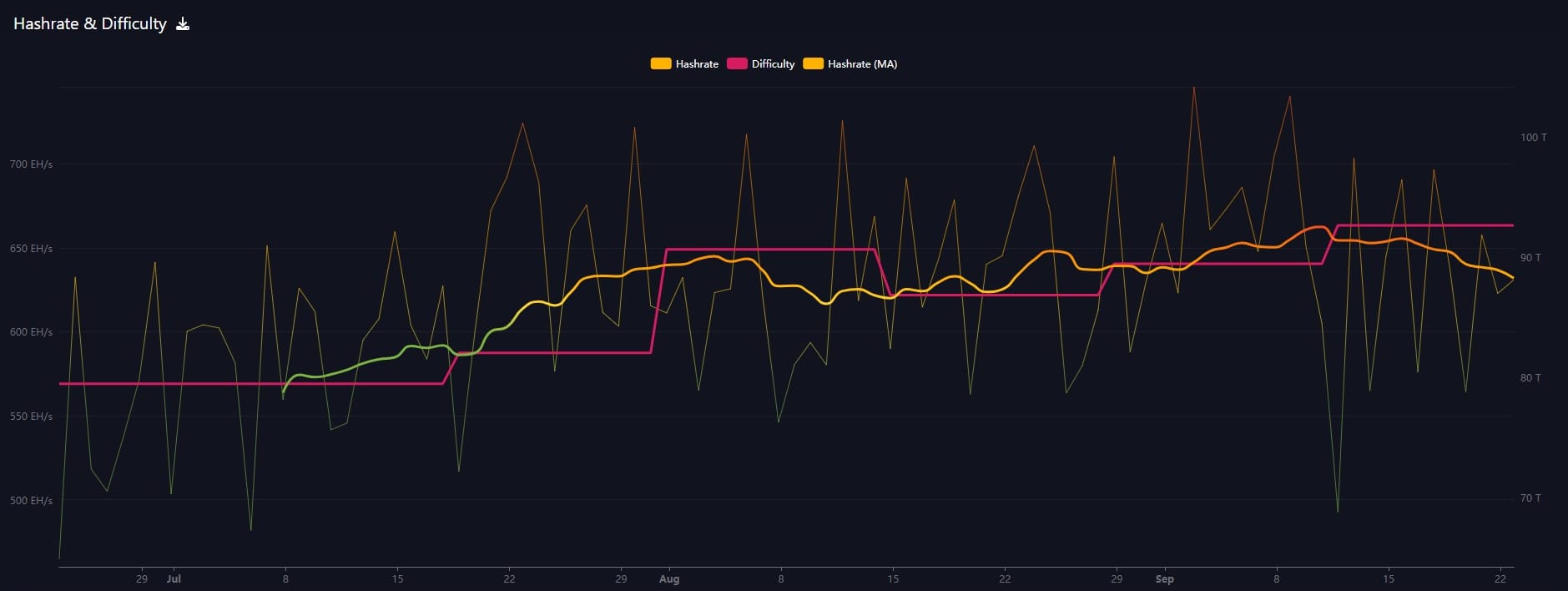

Hash rate and Difficulty

As the difficulty jumped last week to a new ATH, hash rate promptly fell off. Hash rate is down significantly on a 7 daily rolling average as well.

Mempool

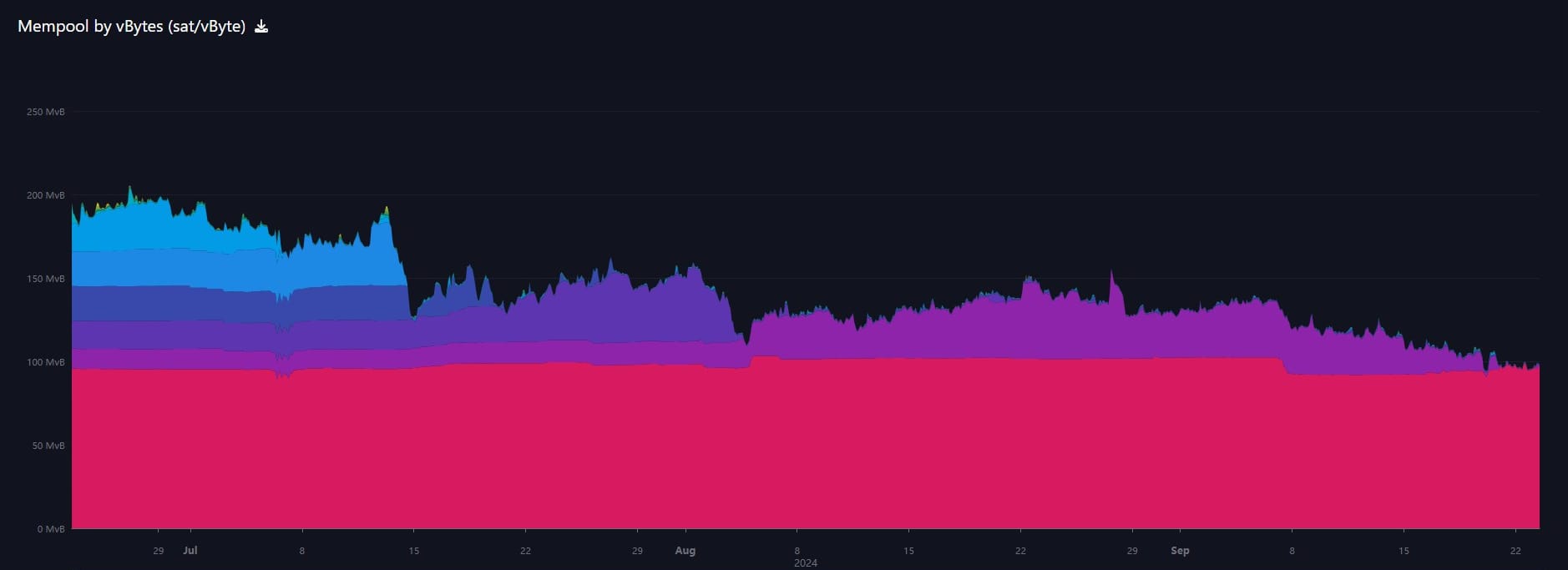

Bitcoin's mempool lost several more MBs this last week, down to 96 MB. Most of the remaining transactions are very cheap at 1-2 sats per virtual byte (s/vb).

- NSTR

In Case You Missed It...

My latest posts

- Shorts Getting Nervous, Bitcoin Threatens to Break Out - Premium

- FORBES - The Truth About Bitcoin: Busting The Biggest Myths

- Macro Minute: Overproduction Does Not Bring Demand, China's Economic Illiteracy

- Major implications from the Federal Reserve rate cut this week for Bitcoin - E397

- Bitcoin Minute: False Assumptions About Gold vs Bitcoin

- Bitcoin Surges, Holds Critical Levels, What is Next?? - E396

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com