Bitcoin Fundamentals Report #307

Weekly Bitcoin Recap: SEC Battles, China Stimulus Impact, FTX, Price Analysis, ETF Inflows, and Mining Sector Update

September 30, 2024 | Block 863,546

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

JOIN NOW TO ENTER OCTOBER PRICE FORECAST COMP!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Bullish |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $63,408 (-$50, -0.0%) |

| Market cap | $1.253 trillion |

| Satoshis/$1 USD | 1577 |

| 1 finney (1/10,000 btc) | $6.34 |

| Mining Sector | |

| Previous difficulty adjustment | -4.6046% |

| Next estimated adjustment | -2.5% in ~9 day |

| Mempool | 106MB |

| Fees for next block (sats/byte) | $0.36 (4 s/vb) |

| Low Priority fee | $0.27 |

| Lightning Network** | |

| Capacity | 5242.33 btc (+0.5%, +27) |

| Channels | 48,419 (-0.3%, -113) |

- Congress Promotes Scams

My position on this is unpopular, I understand that, but I hate fraud. It is popular to hate Gary Gensler, but I think he is not a bad SEC Chairman. All of these scams are securities. As Gensler appeared in Congress to testify, members of Congress took turns grilling him for political capital.

The Howey Test is very clear, but members of Congress have either bought into the gaslighting or accepted campaign contributions from these groups.

Don't forget, these are politicians. With very few exceptions, they are not particularly fighting for our rights. Altcoins are securities, consumer protection would be served best by financial disclosures. Bitcoin is different, there's no central party.

JUST IN: 🇺🇸 $2 trillion BNY Mellon bank receives SEC approval to offer crypto custody services.

— Watcher.Guru (@WatcherGuru) September 26, 2024

The SEC has approved the Bank of New York Mellon Corp (BNY)’s custody of crypto assets beyond crypto ETFs. SEC Chair Gary Gensler revealed the revelation Thursday following a speech in front of the Fed of New York. The BNY Bank controls $2 trillion in crypto assets and has now been approved by the Securities and Exchange Commission to offer crypto custody services.

The structure that BNY currently uses to offer its crypto custody services already includes Bitcoin and Ethereum ETFs. However, the bank recently presented a plan to the SEC’s Office of Chief Accountant to custody those two assets in a way that would protect customer funds in the event of bank insolvency. The SEC granted BNY with a “non-objection” to the plan.

- Operation Crypto Choke Point Getting Confirmed

This is a good interview with Marty Bent and Caitlin Long. I value Caitlin's work but she didn't mention certain important things during the interview. Specifically, those who failed from this were complicit in crypto scams. Her bank survived, and I'm glad, but she is likely bitcoin-only, or very close to it.

I do not support government overreach at all, but it is very important to consider in the same conversation that these were banks which facilitated fraud on a massive scale.

We can consider both sides at once. They got mixed up in dangerous things, and the government was wrong in this case. It misses hides one half of the story that is immensely important to tell.

There are lots of rumors of FTX distribution starting tomorrow, but I have been unable to find a legit source. Their latest press release sets October 7 as the day of voting. But the actual distribution story promises to be much more drawn out. Perhaps extending into the middle of next year.

FTX Distribution

— Sunil (FTX Creditor Champion) (@sunil_trades) September 29, 2024

False: Large accts. spreading false info, FTX distribution has started and/or start on 1st Oct etc and $16bn inflow

7th October: Plan hearing

Approx No.

Est. $5.5bn claims bought (50%) - not crypto investors - won't reinvest in crypto

Claims <$50k:…

With all the excitement in Congress last week, this case received a visceral reaction. The headline is extremely misleading. This was a cloud mining scam (a well-known kind of scam in bitcoin) with its own scam token. In Ponzi style, it is alleged the defendant Green United LLC was taking money from new clients and paying existing clients, and they weren't mining at all. The "boxes" were fictitious.

They would fit as security transactions because they were an investment of money into a common enterprise, dependent on a central party, with the expectation of profit. Close and shut IMO.

They could have operated, they just needed to file the proper disclosures. But that would have exposed the Ponzi.

Macro

- China's Stimulus Will Prove To Be Temporary

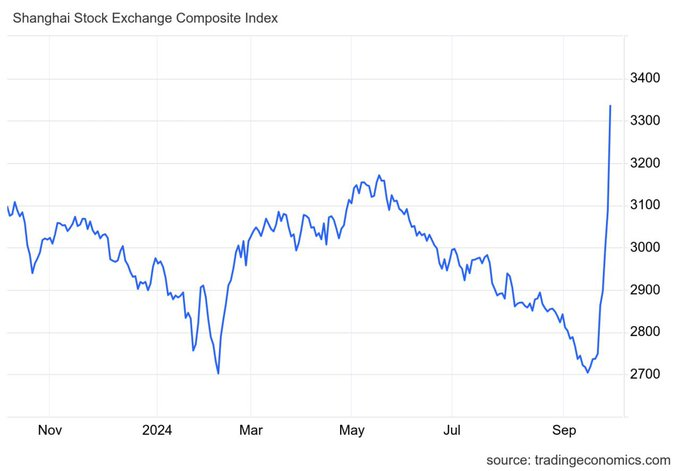

China fires stimulus bazooka.

This is out of character for China, but the gravity of their situation might have finally dawned on them. The Shanghai Composite was stopped today for volatility to the upside. It was the best day for Chinese stocks since 2008, with some indices up 30% in a week.

Many market pundits are saying this is going to bring China back. Of course, if you know my content, you'll understand that China is not coming back. This is a temporary euphoria, but once it sinks in that this stimulus was "needed" because the economy was so utter bad, markets will roll back over again.

Most people get the question backwards, they ask a future-oriented question about what this stimulus means for future performance? Instead, if they wish to make semi-accurate predictions, they need to first ask the past-oriented question, how bad is it that made them provide is unprecedented stimulus?

This is not a real rally and is unsustainable.

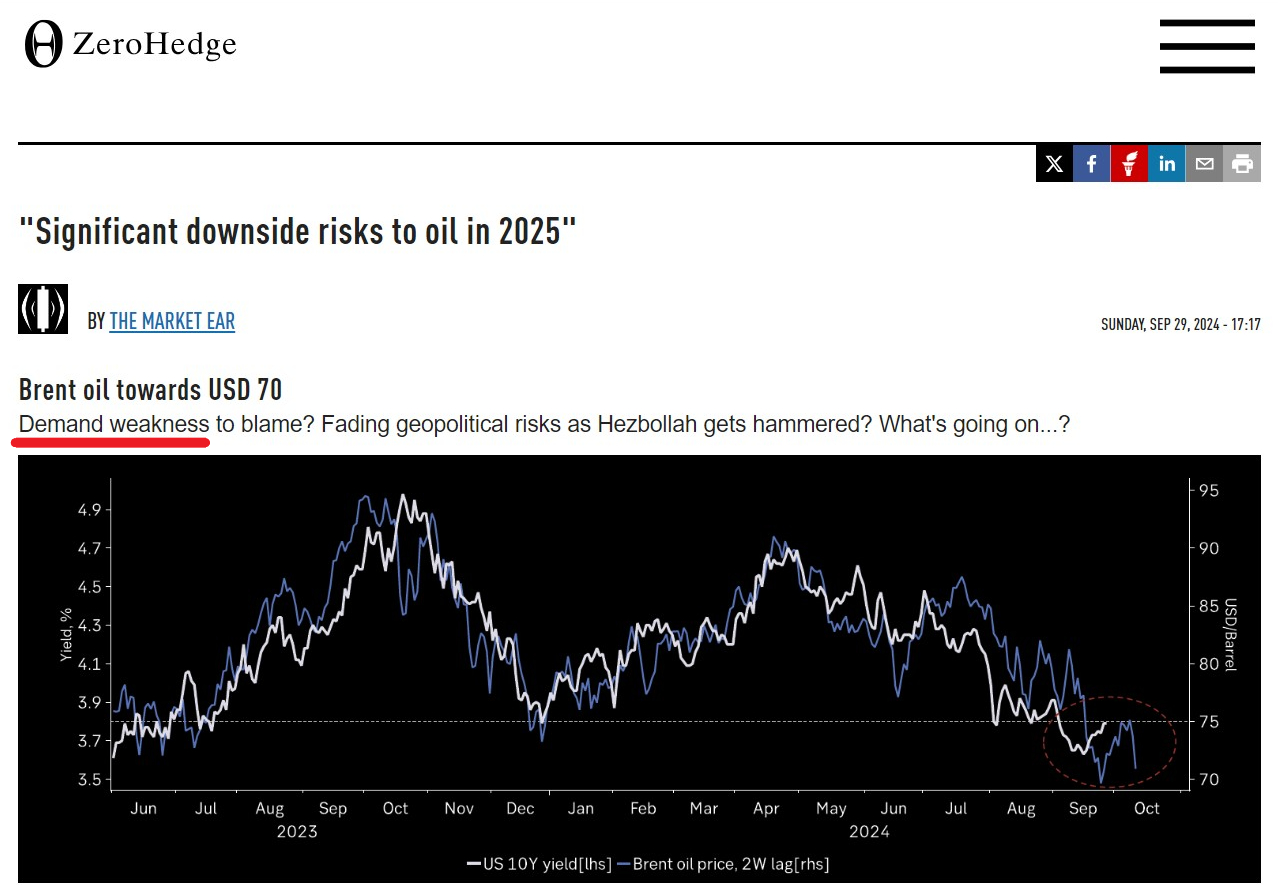

Saudi Arabia is preparing to abandon its unofficial $100 a barrel oil price target as it gets ready to raise output to win back market share, even if it means lower prices, the Financial Times reported on Thursday.

However, prices are down nearly 5% so far this year, amid increasing supply from other producers, especially the United States, as well as weak demand growth in China.

Earlier this month, OPEC+ agreed to delay a planned oil output increase for October and November after crude prices hit their lowest in nine months, saying it could further pause or reverse the hikes if needed.

The FT, citing people familiar with Saudi thinking, reported that Saudi Arabia is committed to the group raising production as planned on Dec. 1, even if that means a longer period of low oil prices.

Peak Oil Demand is starting to catch on!

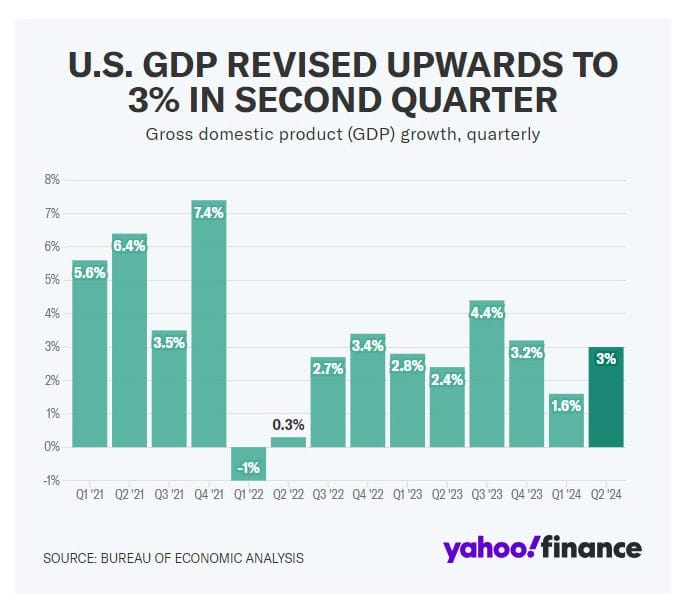

- Q2 GDP Revised A Little Higher

There are significant problems with GDP and, like CPI, it should the focus of some private groups to reformulate how it is calculated. We spoke about this last week on a live stream. Next quarter is going to be a really important one. Last year, Q3 was 4.4%, if it is under 3% this year, that will be a significant sign of deterioration.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

"Many investors have decided to wait until after the election to deploy capital."

-- Tom Lee.

Bitcoin Charts

Last week, I expected breaking the 200-day to send us much higher. However, I was not looking at the channel and megaphone tops until later in the week. These can be powerful Schelling points and did cause price to stop and now test the 200-day from above.

Several commentators in bitcoin, are claiming we will not break out until the election is over. While I agree that this particular election is quite tense and many people will wait, the jury is still out whether or not US elections have an effect on the bitcoin price. I wrote about this several weeks ago, where I looked at the timing. It seems the halving is still the overwhelming factor, or at least the timing milestone. Therefore, I expect bitcoin to have an excellent October.

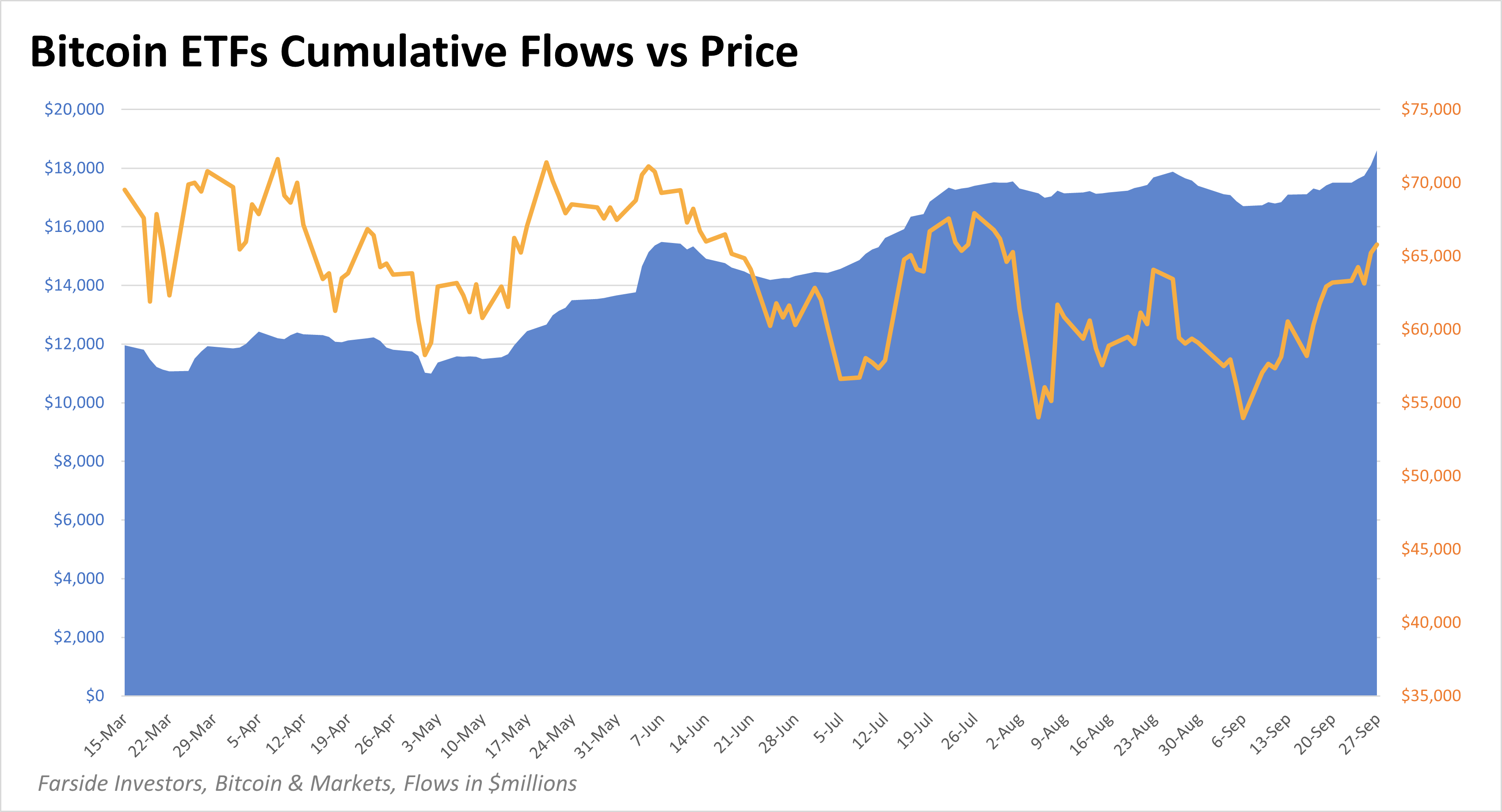

ETF Flows

ETF flows continue to rocket higher. Last week was huge, breaking the previous cumulative ATH up to $18.8 billion. They brought $1.1 billion last week alone. Price continues to lag ETF inflows, but we should expect it to catch up.

Today, will be an important day for flows. As I've observed before, it is the rare days of decoupling that is the signal for directional price movement. For example, if today's flows are positive, but price ends negative, that would be a very bullish signal for price.

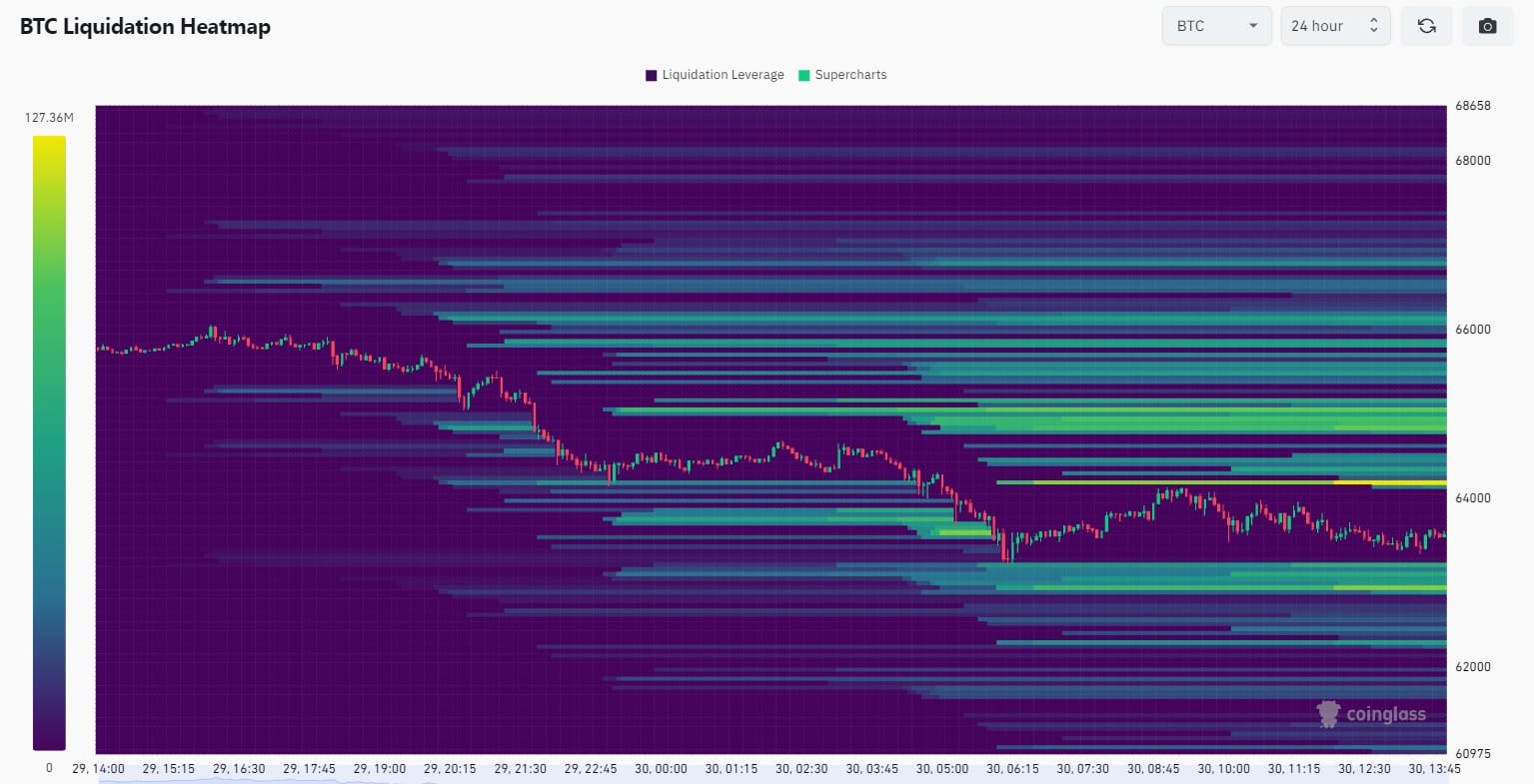

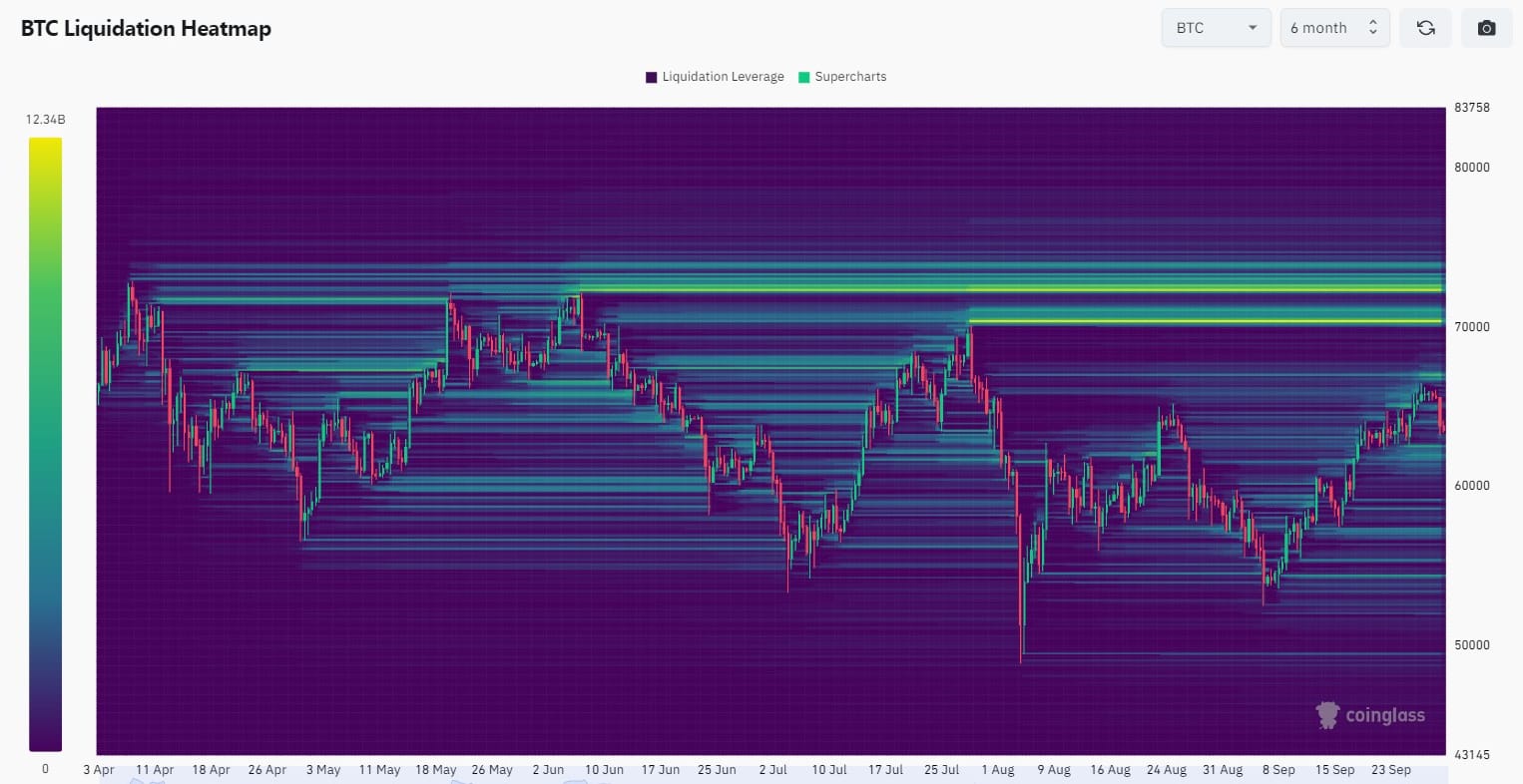

Heat Map

The heat maps are interesting. Below, we have different time frames. On the 24-hour time frame, liquidations slightly favor a rise in price. On the 1-week time frame, it leans slightly bearish. However, on the long term time frame of 6-months, there is only one direction, bullish.

Source: Coinglass

Overall, the weight of fundamentals and price pressures are upward, but near term is more balanced than it has been in the last few weeks. Bears are fighting to not be liquidated at $70,000 and decided to defend the top of the pattern.

Breaking the 200-day to the downside, raises the risk of testing lower levels again, like the 50-day at $60.3k. I think that is unlikely in this environment.

There is chatter from Fed officials that they expect another 50bp cut at the November meeting as well, China stimulus might make its way into bitcoin, and we are right on time with the deflationary spiral from the halving. Everything is still lining up for a rally in October.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Swan Bitcoin has filed suit against a group of former employees and consultants, alleging they “hatched and executed a ‘rain and hellfire’ plan” to "steal" its lucrative bitcoin mining business with the help of Tether, Swan Bitcoin’s one-time ally and fundraising partner.

The lawsuit accuses six employees of looting Swan’s trade secrets – including “highly proprietary code,” hash-rate optimization techniques, and financial models – and using them to create an “illegal facsimile” of Swan’s bitcoin mining operation called Proton Management. After two months of pilfering and planning, the lawsuit claims, the coup-de-grace came on Aug. 8, when they and several other employees resigned “near-simultaneously” to join Proton.

Many people have jumped to the conclusion that Tether is the bad guy here. We don't know the real story, yet. Tether is not perfect, but neither is Cory and Swan.

I remember when Swan announced this mining effort, and it was kind of odd to me at the time. In hindsight, it was not a great fit. I'm open to being proven wrong, but I bet Tether's role was simply a concerned largest investor. They might have honestly thought there was a more profitable line of action.

Bhutan is currently generating anywhere from 55 BTC ($3.6 million) to 75 BTC ($4.9 million) every week from its mining operations.

Population: 727,145

GDP: $2.7 billion

The low end of their bitcoin mining income is 6.9% of GDP, which should rise as price goes up.

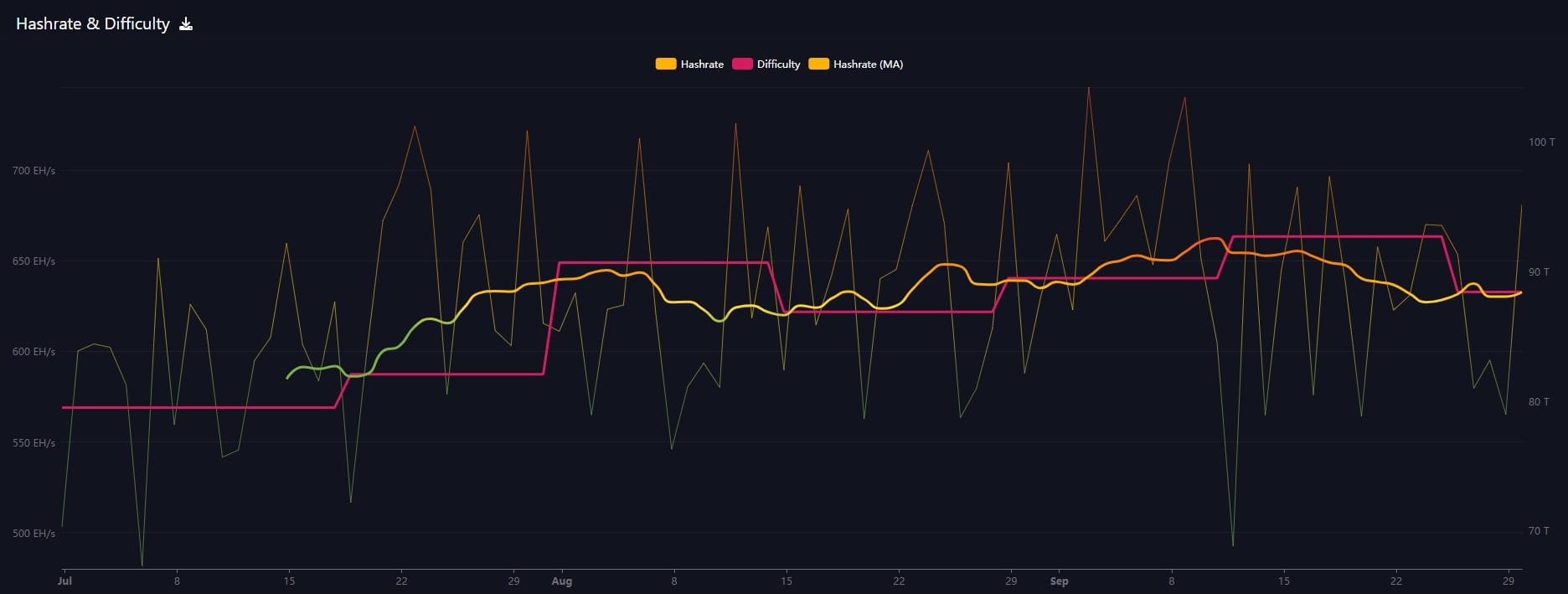

Hash rate and Difficulty

Bitcoin's difficulty adjusted downward this week by 4.6%. It is currently on track for another -2.5% adjustment in 9 days.

Mempool

Bitcoin's mempool is up slightly on the week to 106 MB. Fees remain very cheap. lost several more MBs this last week, down to 96 MB. Most of the remaining transactions are very cheap at 1-2 sats per virtual byte (s/vb).

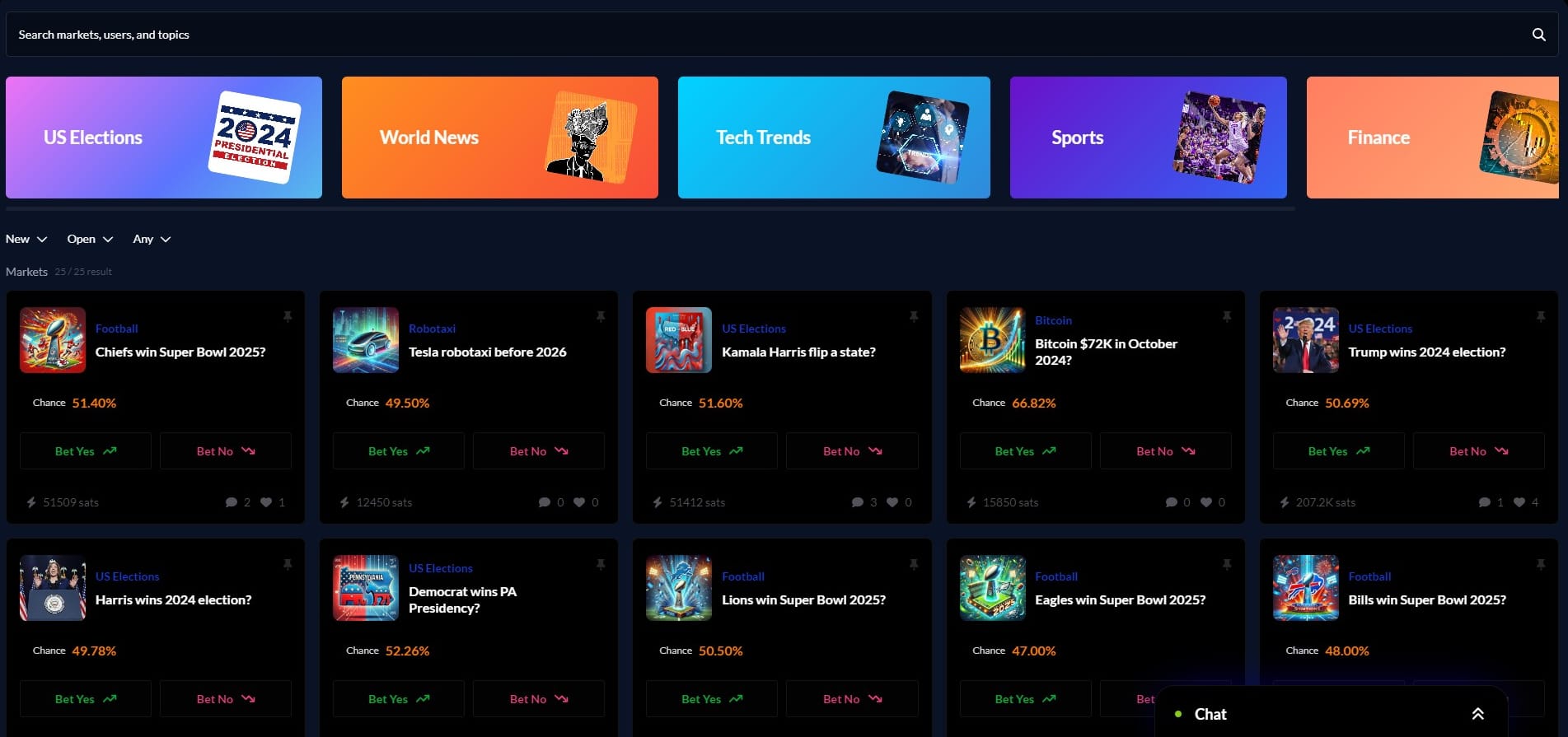

- Polymarket has grown in popularity in the last year. It is a prediction site where you can use "crypto". It is currently not officially serving US customers. Now, there is a Lightning Network alternative called Predyx.

In Case You Missed It...

My latest posts

- Best September In Bitcoin History - Premium

- FORBES - Bitcoin’s Q4 Setup: Record ETF Performance And Powerful Tailwinds

- Bitcoin Minute: Crypto Gaslighting In Congress

- Macro Minute: More Signs of Recession, 5y5y Forward and Breakevens

- The Fed Makes A Huge Mistake, Cuts Rates - Reaction - E398

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com