Bitcoin Fundamentals Report #308

The Most Comprehensive Newsletter in Bitcoin Explores Blackrock’s Sound Money Push, IMF’s Bitcoin Obsession, Support for Bitcoin Reserve, Price Analysis, and Mining Sector News

October 7, 2024 | Block 864,650

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

JOIN NOW TO ENTER OCTOBER PRICE FORECAST COMP!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Bullish |

| Media sentiment | Very positive |

| Network traffic | Low |

| Mining industry | Low Revenue |

| Price Section | |

| Weekly price* | $63,252 (-$156, -0.2%) |

| Market cap | $1.251 trillion |

| Satoshis/$1 USD | 1580 |

| 1 finney (1/10,000 btc) | $6.33 |

| Mining Sector | |

| Previous difficulty adjustment | -4.6046% |

| Next estimated adjustment | +3.8% in ~1 day |

| Mempool | 99MB |

| Fees for next block (sats/byte) | $0.62 (7 s/vb) |

| Low Priority fee | $0.53 |

| Lightning Network** | |

| Capacity | 5200.7 btc (-0.8%, -42) |

| Channels | 48,279 (-0.3%, -140) |

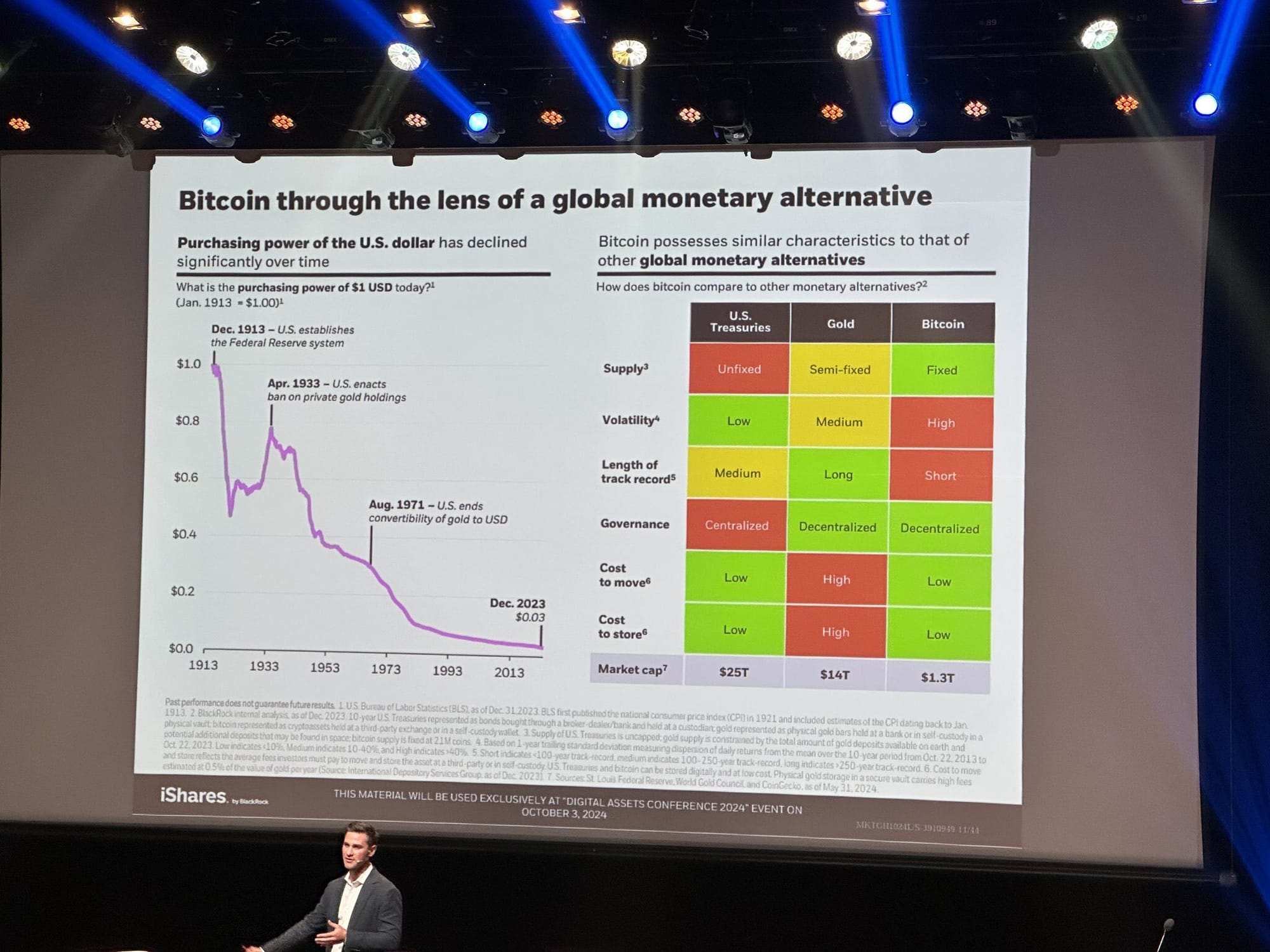

- Blackrock Preaching Sound Money In Brazil

This is reportedly a slide from a Blackrock presentation to Brazilian investors. It is indistinguishable with a slide that any bitcoiner would have given 5-8 years ago. Blackrock is the establishment. The impact of this cannot be overstated IMO. People are turning to bitcoin as a true safe haven asset.

The chart on the right of their slide is of the purchasing power of the dollar, something bitcoiners and gold bugs before them have been showing for years. It was not something that you could say in serious company, until now. The table to the right shows bitcoin with more green boxes than other monetary alternatives. Woah. The only two that are red are volatility and length of track record. These are both things that will improve as time goes on.

- IMF Is Obsessed With Bitcoin

This week in an IMF press conference, they brought up El Salvador and critiqued them for their bitcoin policies. They want to see reforms including limiting public exposure to bitcoin. Nayib Bukele laughed it off. A simple case of the existing global Marxist elites trying to stop bitcoin, but they're about 10 years too late.

Source: @NayidBukele

Lummis’ bill would use existing funds at the Federal Reserve and the Treasury Department to purchase 1 million bitcoin. The move would cement the United States’ position as the largest nation-state holder of bitcoin, granting it 5% ownership of the entire network—on par with the country’s stake in the global gold supply.

Support for a strategic bitcoin reserve has now crossed party lines. In a recent episode of the Unchained Podcast, Democratic Representative Ro Khanna, threw his support behind the idea: “We want to make sure that we have the openness to having bitcoin as part of the Federal Reserve and as a reserve asset because of its potential for appreciation and because of its potential to allow America to set the financial standards.”

- Less Noise More Signal Podcast

I was on the Less Noise More Signal podcast last week with Pascal. It was a good conversation talking about my specific macro thesis. Check it out!

- Trump Promises To Pardon Ross Ulbricht

FREE ROSS! This alone makes Trump the obvious choice for bitcoiners.

Macro

- US Payrolls Came In Hot

The 254,000 jobs added in September was also paired with a revision of +72,000 jobs in July and August. At first glance this is a banger of a jobs report, and has caused some movement in the broader market, with Treasury yields popping higher. The US 10Y has hit 4.00%.

Many are saying this is the sign of reacceleration they've been expecting. They say Powell and the Federal Reserve made a massive misstep with their 50 bps cut. Sorry, but I have to pour cold water on that idea.

What is it with some people who scream the Fed is manipulating interest rates too high and will crash the economy, then turn around and say they cut too much and will reaccelerate inflation? This spike in yields, as well as the spike in other commodities, is likely due to the psychological effects of the Fed cut, plus the China stimulus. Markets are giving the CCP the benefit of the doubt right now, that they will be able to stimulate the economy.

More on the next Premium member post...

This is what de-dollarization looks like.

Russian companies have established a barter trade system with Pakistan to facilitate economic exchanges without the need for monetary transactions, as they seek to overcome challenges with payments related to Western sanctions on Moscow.

The alternative trade arrangement was signed at the first Pakistan-Russia Trade and Investment Forum in Moscow. According to the Russian state media outlet TASS, the first Russian company to use the mechanism will be Astarta-Agrotrading, which will supply Pakistan with chickpeas and lentils. Pakistan’s Meskay + Femtee Trading Company will reciprocate by providing mandarins and rice.

Under the terms of the agreement, Russia will export 20,000 tons of chickpeas, while Pakistan will supply an equivalent amount of rice. Another contract stipulates that Russia will send 15,000 tons of chickpeas and 10,000 tons of lentils in exchange for 15,000 tons of mandarins and 10,000 tons of potatoes.

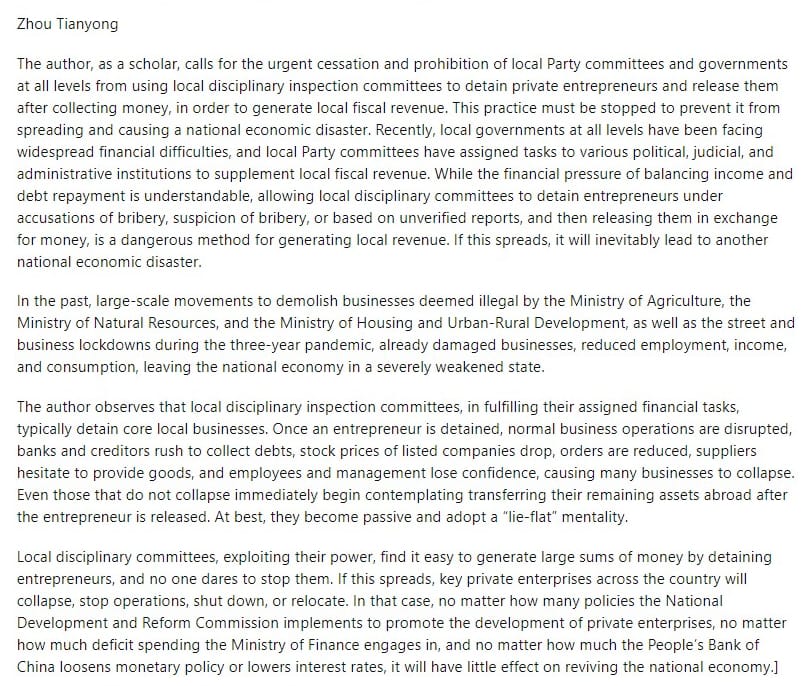

In a truly shocking op-ed (not surprisingly scrubbed now) by Deputy Director of the Institute of International Strategy, Party School of the Central Committee of the CPC Zhou Tianyong called for an immediate cessation of local governments kidnapping entrepreneurs and extorting money from them in a desperate attempt for revenue.

He warned, "This practice must be stopped to prevent it from spreading and causing a national economic disaster."

Full translation I found:

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

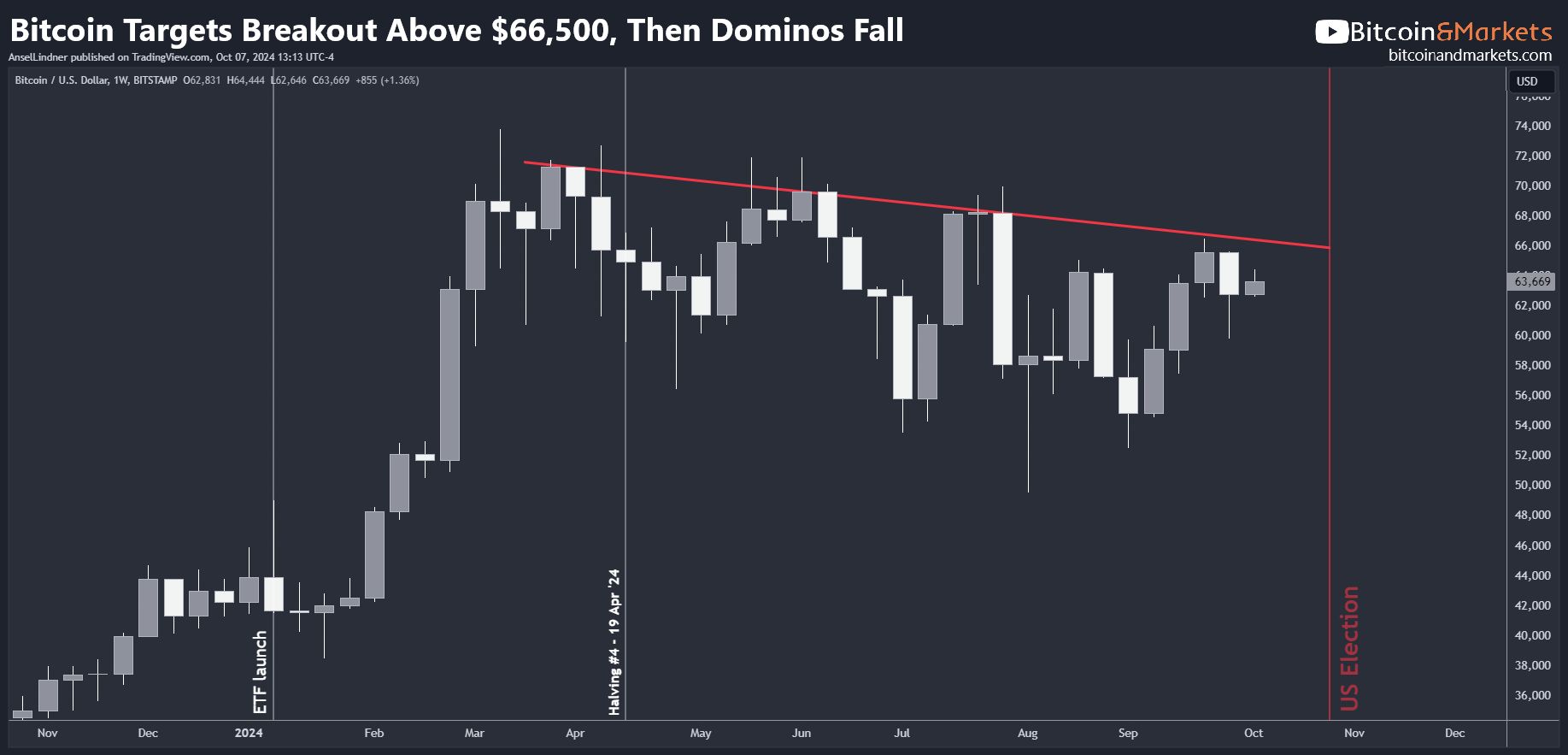

Last week, I said testing the 50-day was unlikely but possible. Well, it did test the 50-day which held nicely, maintaining overall bullish momentum. Today, price broke back above the 200-day MA.

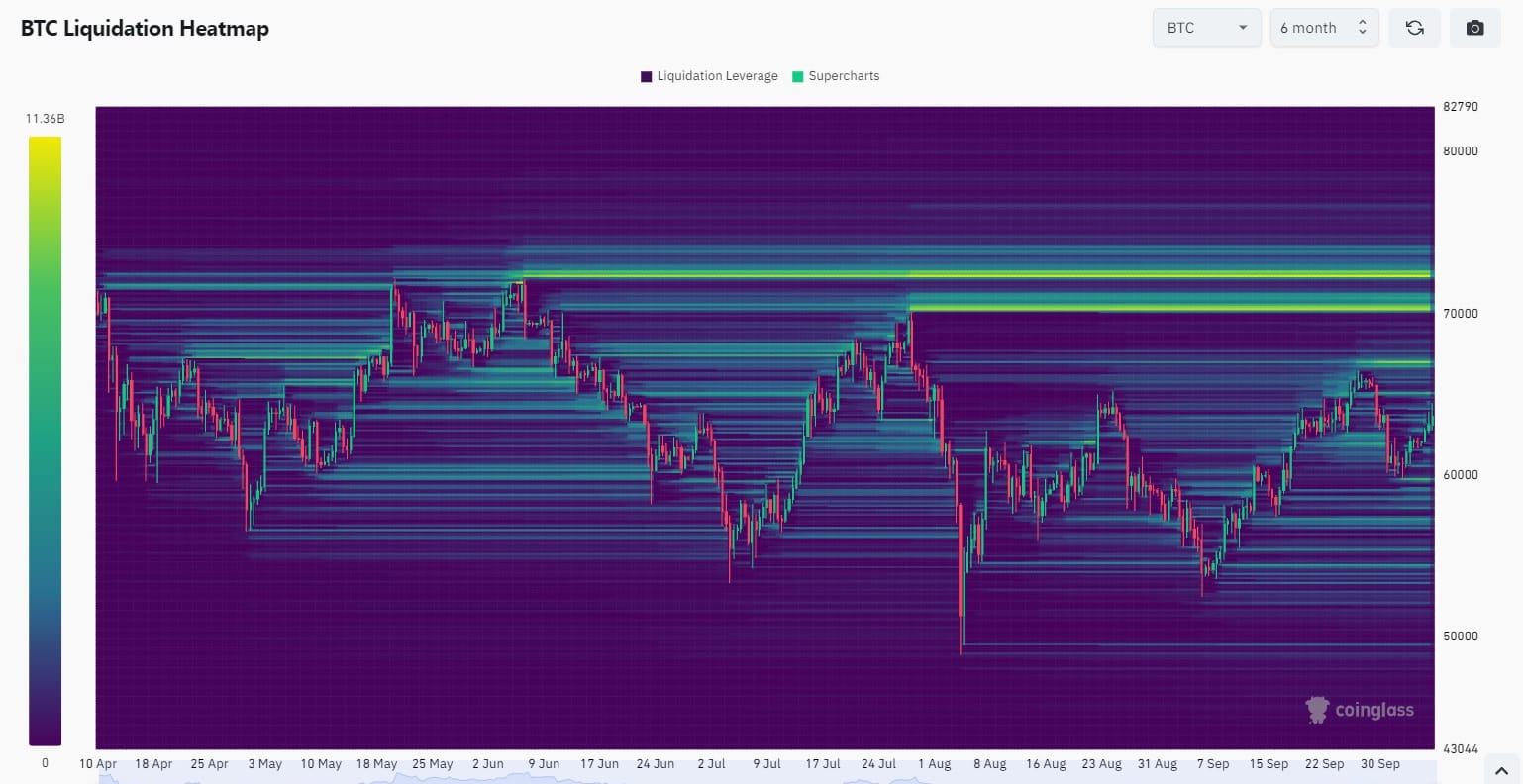

THE level to break is the top of the pattern and making a new higher high above $66,500. Once that happens, there is nothing stopping price from slipping all the way up to $70,000.

Short which are sweating at $70k will try to defend the $66,500 level again, but they will eventually get squeezed. On the monthly chart the consolidation at or above the previous cycle high is still an extremely bullish stance heading into the historically explosive Q4.

The US election is less than a month away. The uncertainty surrounding this event is likely weighing on markets, but this is a great opportunity for bitcoin to climb a wall of worry without building a lot of long exposure for the price to seek out. A bitcoin rally into the election will be a good sign that Trump is going to bring home the win.

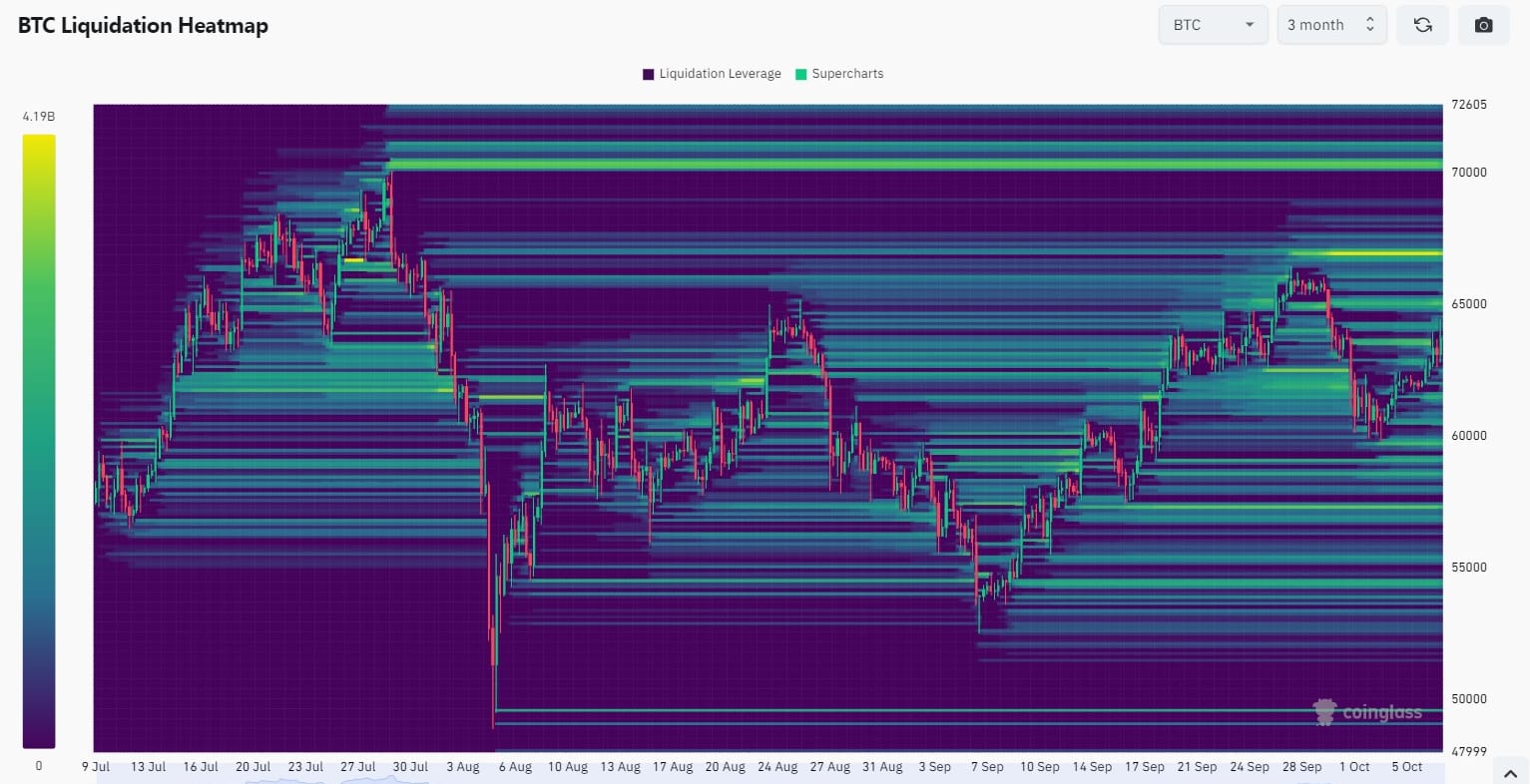

Heat Map

The 3-month heat map is showing an area of $4B+ in liquidity up at $67k.

Above $67k is a gap in liquidity up to $70k and then the ATH above that.

Overall, the weight of fundamentals and price pressures are upward. Near term pressures were quite balanced last week in my estimation, but this week have turned decidedly bullish with the test of the 50-day and breaking back above the 200-day. The liquidity at $67k is likely taken out this week.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

According to the lawsuit, investors claim Nvidia and its CEO, Jensen Huang, misled them about the company’s reliance on revenue from crypto mining-related sales. They argue that Nvidia’s leadership downplayed the company’s dependency on crypto mining despite being fully aware of it. The firm’s vulnerability became apparent when its revenue declined after the 2018 crypto market crash.

In response, Nvidia countered that investors relied on fabricated data about its revenue sources. However, investors maintain that their data, drawn from multiple reliable sources, indicates securities fraud.

Among these sources are two former Nvidia employees, who disclosed that the CEO was aware of the firm’s sales tracking to crypto miners. They also noted that Huang attended meetings where the impact of crypto mining on the company’s revenue was discussed.

Russia’s Ministry of Energy is looking to curb the “uncontrolled growth” of crypto-mining and prevent power shortages with new energy rules. This follows recent efforts by the Russian government to legalize mining.

As per local media sources, Russia’s Ministry of Energy is seeking to bring in new rules that would enable them to cut off crypto miners from the nation’s power supply whenever they want.

“The uncontrolled growth in electricity consumption for cryptocurrency mining could lead to a power deficit in certain regions. And this has already been noted in the Irkutsk region, Buryatia, the Trans-Baikal Territory,” - Putin

Furthermore, Russia’s new crypto mining rules will reportedly allow individuals to mine without needing to register with the authorities. Those that exceed a certain capacity will have to sign up.

Hash rate and Difficulty

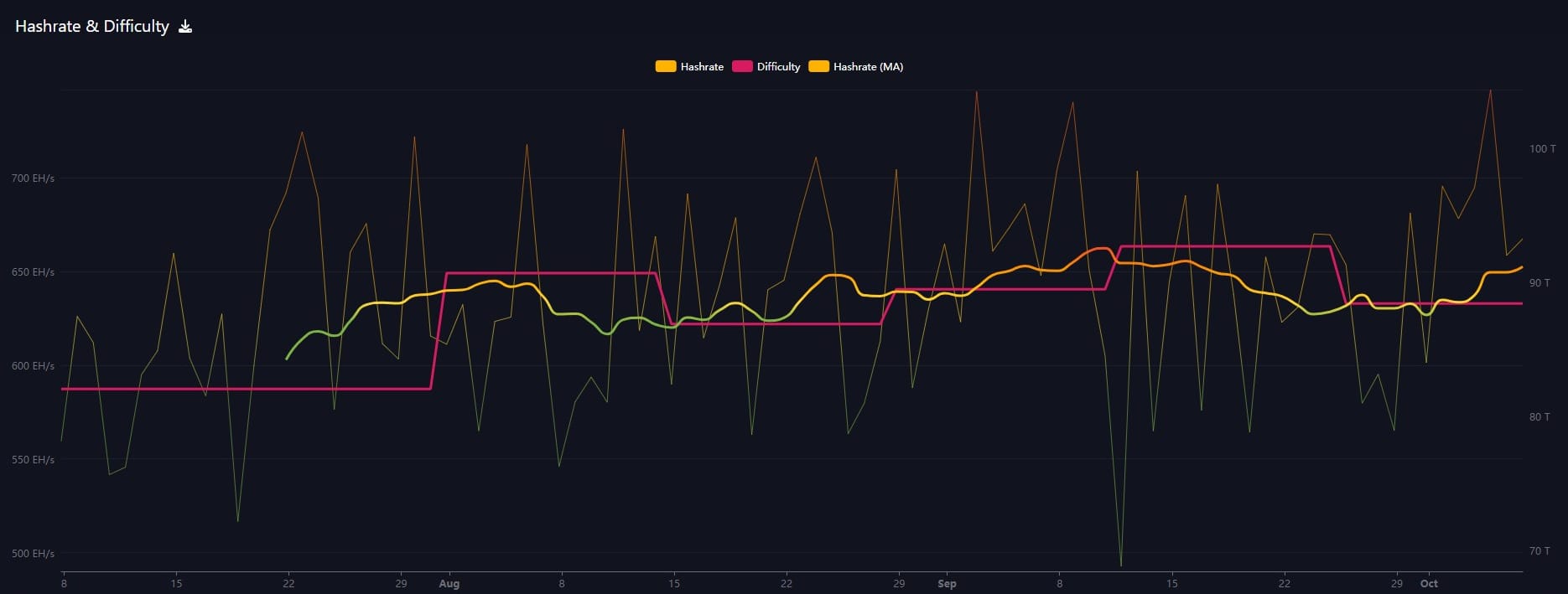

Hash rate has recovered this week. There will a difficulty adjustment tomorrow estimated at +3.8%. That will not be a new ATH but very close. This is despite the languishing price. When price pumps, expect hash rate to confirm the price break out with a break out of its own.

Mempool

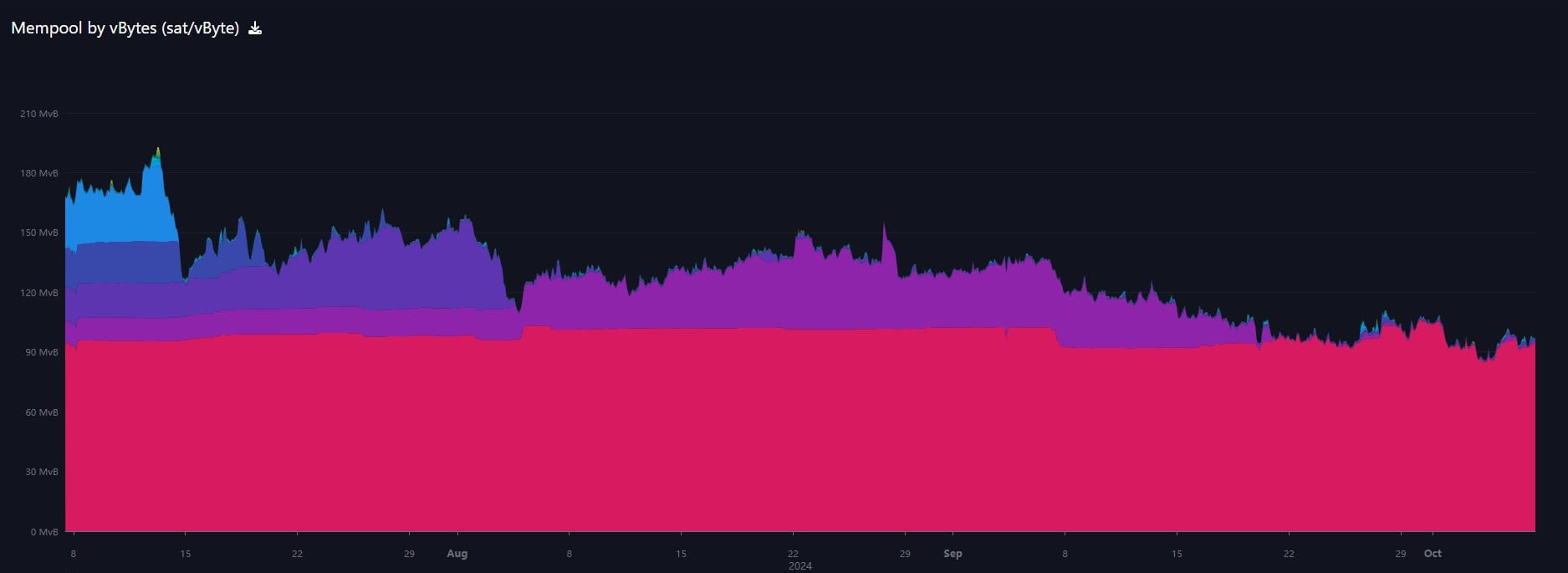

The mempool has been very uneventful for the last several months. Over the last couple of weeks, it has been fairly flat, with several small periods of heightened activity and fees. Nothing significant to report.

Multichain layer-2 network Anduro, incubated by mining firm Marathon Digital Holdings (MARA), has developed a platform for issuing and investing in real-world assets (RWAs) on Bitcoin.

The platform Avant, developed alongside tokenization specialist Vertalo, is planning a pilot project to tokenize whiskey barrels, according to an announcement shared exclusively with CoinDesk.

Like various other uses of blockchain technology, tokenization has been largely absent from Bitcoin. This has begun to change in recent years, however, through developments that have introduced smart contracts or facilitated the minting of tokens.

The reason it has been, "largest absent" on bitcoin is because they are pump and dump scams and bitcoin-only is an intelligence test.

Anduro wants to avoid taking a RWA play that exists on the Ethereum and Solana blockchains and simply cut and paste it to Bitcoin, but instead is looking to offer something that "a bitcoiner would understand," he said.

"A bitcoiner who wants tokenized Treasury bills can easily access that via Ondo Finance. Why would we create an Ondo Finance competitor?" he said in an interview with CoinDesk. "We see the opportunity being in these traditional, hard industries that are immediately recognizable, such as American whiskey."

You cannot tokenize real world objects because of the Dual Consensus Problem. The token obeys network consensus, while the physical object obey physical world consensus. Therefore, you need a central party to keep the two synced, and hence don't need a blockchain or the pretense to decentralization. This is a pure marketing scam.

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Macro Minute: The Fertility Crisis: Why Economic Decline, Not Technology, Will Boost Birth Rates

- Bitcoin Minute: Clarity on Why Bitcoin Is A Geopolitical Hedge

- Member - October Price Forecast Competition (Last day for entries)

- Game-changing Week, Huge Fundamental Flood Gates - E400

- Bitcoin Spikes As TradFi Rushes In, Major Implications - E399

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com