Bitcoin Fundamentals Report #310

Bitcoin sees ETF options approval while facing criticism from central banks. Market volatility, miner strategies, and bullish momentum shape the industry's outlook.

October 21, 2024 | Block 866,756

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Shorts desperate |

| Media sentiment | Positive |

| Network traffic | Low |

| Mining industry | Recovery |

| Price Section | |

| Weekly price* | $67,616 (+$1644, +2.5%) |

| Market cap | $1.337 trillion |

| Satoshis/$1 USD | 1478 |

| 1 finney (1/10,000 btc) | $6.77 |

| Mining Sector | |

| Previous difficulty adjustment | +4.1233% |

| Next estimated adjustment | +4.3% in ~1 day |

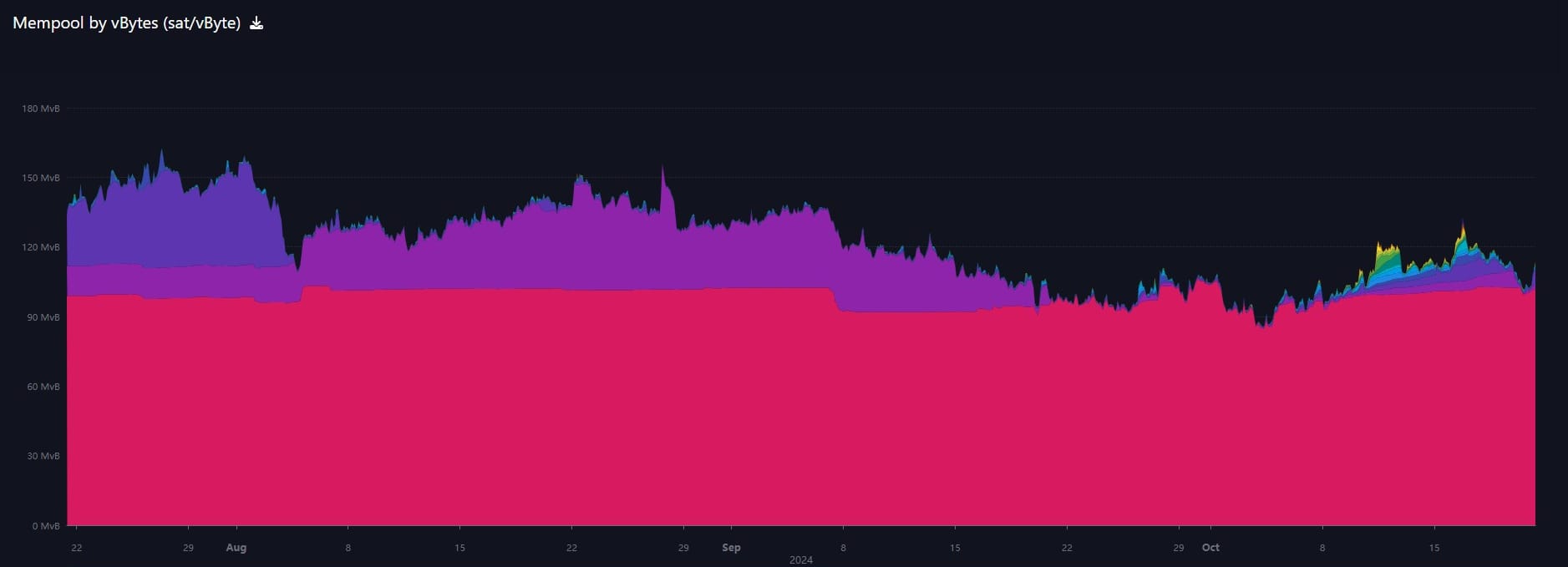

| Mempool | 119MB |

| Fees for next block (sats/byte) | $1.33 (14 s/vb) |

| Low Priority fee | $1.14 |

| Lightning Network** | |

| Capacity | 5177.32 btc (-0.4%, -19) |

| Channels | 48,078 (-0.2%, -119) |

- SEC Approves Options Trading on Spot Bitcoin ETFs

JUST IN: 🇺🇸 SEC approves NYSE options trading on spot #Bitcoin ETFs.

— Watcher.Guru (@WatcherGuru) October 18, 2024

This is a massive milestone for Bitcoin. It allows for the first-ever regulated options on a fixed-supply asset. Bitcoin's fixed supply creates a rare "volatility smile," where price surges (melt-ups) are as likely, or more so, than crashes (melt-downs). As Bitcoin rises, implied volatility also rises, creating negative vanna. This forces market makers to buy the underlying asset to hedge their positions.

If there were one thing to read today re the game-changing nature of Bitcoin ETF options, read (and bookmark) this one for 2025 - it's going to be wild. pic.twitter.com/On2DmUsbHX

— Jeff Park (@dgt10011) September 20, 2024

Bitcoin will experience negative vanna gamma squeezes, a condition where sharp price movements have major reinforcing characteristics. This can cause the price of Bitcoin to explode higher, but also lead to larger drops. However, the attention and adoption this brings to Bitcoin will somewhat mitigate the sell-offs, as more demand arises to buy the dips.

Check out Friday's LIVE stream where we covered this topic.

A new paper by Ulrich Bindseil and Jürgen Schaaf at the European Central Bank took shots at bitcoin. I'll include a few thoughts here, but want to address it more in a post all its own soon. Important to understand that this and the next paper by central bankers are opinion papers, not official positions of the institution.

1) The authors argue Bitcoin hasn't achieved what Satoshi or early bitcoiners aimed for. This is a silly argument that doesn't address what it has accomplished, instead focusing on irrelevant perceived failures.

2) The authors claim central intermediation in the current banking system is not "mediation" and then say bitcoiners are misunderstanding what "mediate" means. This is a semantic argument purposefully missing the point. Banks can mediate when they want to or are forced to by the government.

3) The authors respond to a Satoshi comment on double-spending on a peer-to-peer network by claiming there are cheaper and more efficient ways to prevent double spending. They completely disregard the peer-to-peer network aspect.

4) The authors claim that there are "countless assets on earth with a limited or finite supply," and offer these examples: German stamps from the 19th century, and any other set of collectibles, pieces or art, and land. None of those rank very high on monetary properties, and the authors aren't even correct. Collectibles are non-fungible. Art is a supply of one, not a very good money. Land can be created, just look at Dubai, the Netherlands, or the Kansai airport in Osaka, Japan.

5) They end the paper with an examination of bitcoin adoption's effect on wealth distribution, claiming early adopters will benefit at the expense of late adopters. It is full of strange assumptions and doesn't pass the logic test. Wouldn't you want your consumers to have more money? How could they voluntarily sell to late comers if the late comers weren't benefiting? How could the price even rise to significant levels if demand was pushing up the price?

6) It was just last week that Kamala introduced the idea of equity being applied to bitcoin, by primarily targeting their efforts to help black men in bitcoin. That was specifically a cultural Marxist attack. Now, we have authors at the ECB explicitly attacking property rights. This is Marxist logic.

Not to be left out, Amol Amol and Erzo G.J. Luttmer have produced a paper claiming "the government can uniquely implement a permanent primary deficit using nominal debt and continuous Markov strategies for primary deficits and payments to debtholders. But this result fails [with the existence of bitcoin]."

Their suggested solution to allow governments to run permanent deficits forever? Ban bitcoin or tax it at high rates.

- Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, Blasts Bitcoin

"I'm an avowed skeptic [of bitcoin]. I have yet to get a compelling answer to a question I ask everybody that's either an expert or a believer, and that's, "What problem is this solving for?" I get lots of different answers, but none that terribly compelling. It's not a currency. Um, it's not, it's not a store of value. It's not a medium of exchange. Uhh, it's a, it's a speculative investment. That's made a lot of people a lot of money."

Liz Sonders just states these things as fact, contrary to evidence, and with no explanation.

1) A currency is a system of money in general use. Bitcoin is owned by up to 22% of U.S. adults. Holding Bitcoin is using it, as its primary utility is appreciation during monetization.

2) Bitcoin is most definitely a store of value. If it weren't, we wouldn't be talking about it. Studies and research show Bitcoin’s value as a geopolitical hedge as well. Sonders would have to argue the insane position that Bitcoin hasn’t preserved purchasing power in its 15-year history.

3) itcoin is a medium of exchange. While it may not be universal, 250,000 transactions a day or $40+ billion in settlement is significant.

- Saylor Promotes Holding Bitcoin With Custodians/Counterparties

Clip on X here, Full interview here

Bitcoiners on X are all upset about what Saylor says here about "paranoid crypto anarchist" but it is not all that exciting to me. I never jumped on the Saylor bandwagon, never binging his interviews or anything like that. Other than clips on X, I've probably only listened to a handful of other interviews. He's a smart guy, who respectably changed his mind on bitcoin over the years and came to be a believer and major influencer. He’s running a significant speculative attack on the dollar. But he’s not perfect. He’s in a risky public position. Let’s move on.

Macro

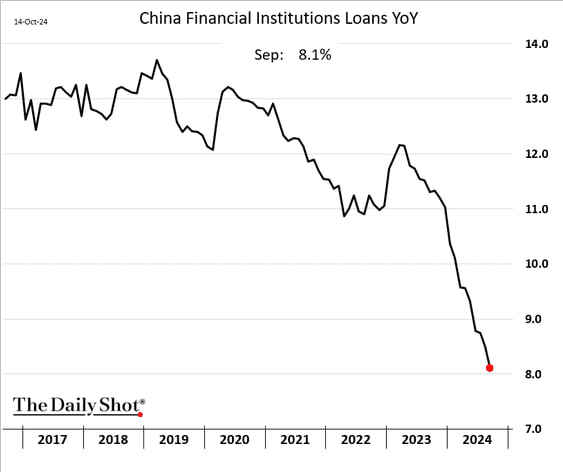

- More China Stimulus

...economists have been expecting an additional stimulus package worth up to 10 trillion yuan ($1.4 trillion) to restore bullishness in the world’s second-largest economy. Thursday’s press conference by the Housing Ministry didn’t deliver on those hopes.

During the press conference, the Ministry of Housing and Urban-Rural Development vowed to nearly double bank lending to designated property projects to four trillion yuan ($561 billion) by the end of 2024.

In January, China unveiled a “whitelist” of construction projects, which allowed banks to provide them with loans to help get them to the finish line and into the hands of buyers.

Note: "Designated property projects" and "whitelist" underscore China's centrally controlled economy, making it unlikely to pull itself out of this tailspin.

The growth rate of China’s institutional loans is critical; credit is a cruel master. When it slows, the burden of repayment quickly forces a financial crisis. Debt forgiveness or bailouts may delay the pain, but won't revitalize the economy.

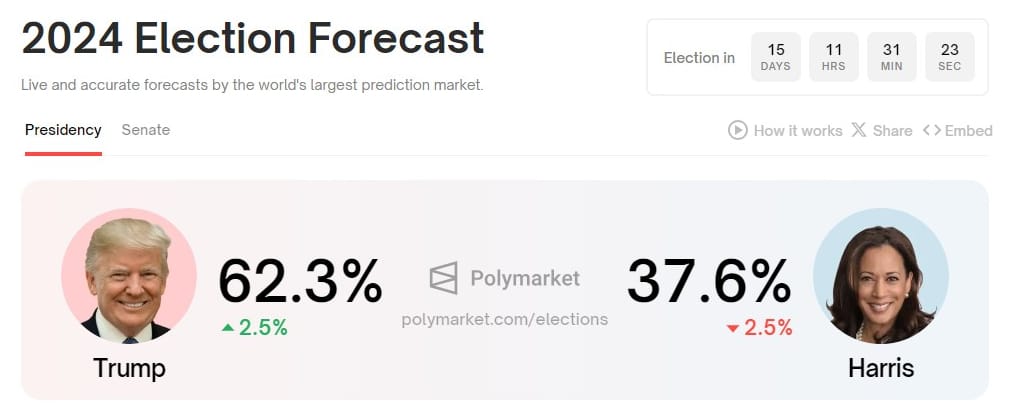

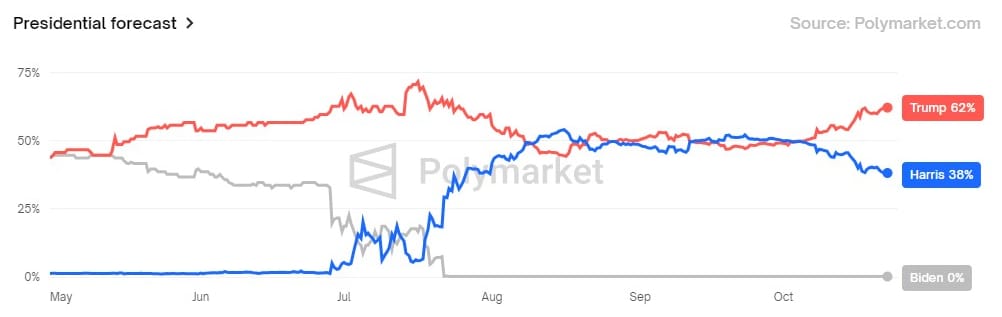

- Trump Has Taken Commanding Lead In Honest Polls

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Overnight, price hit $69,487 before quickly turning around. We are currently at $67,200 at the time of writing.

Last week:

October is historically a positive month for bitcoin, and there is a significant amount of liquidity pulling the price toward $74k. I wouldn't be surprised to see a strong breakout this week to the $70-74k range.

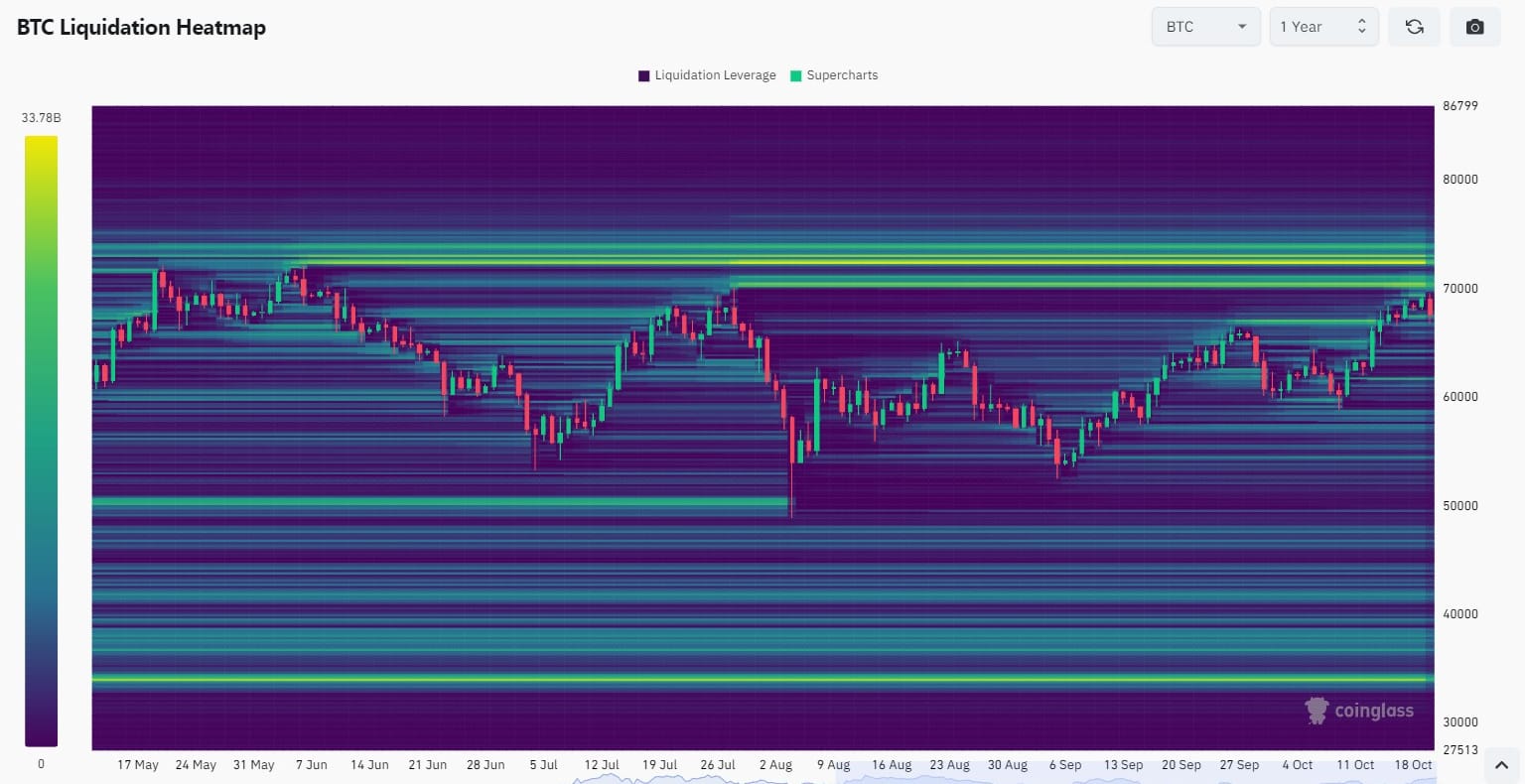

I was a little early on the breakout. I underestimated the fight that the shorts have in them. They are desperate to keep bitcoin below the $70k liquidation cascade. Ultimately, that will be a losing battle–the market will snag that liquidity.

This is the very last pattern resistance if we use the intra-day extremes.

Not much to say about price this week. We are waiting for the break out that will happen soon. I remain very confident this week that we are close to that breakout. However, markets are about to start holding their breathe for the election, which could delay things further.

I don't think it is a coincidence that all the fundamentals, including the new options approval, were lining up for bitcoin right as some central bankers decided to publish their anti-bitcoin articles. That effect combined with shorts trying to protect their positions, has only temporarily delayed the inevitable.

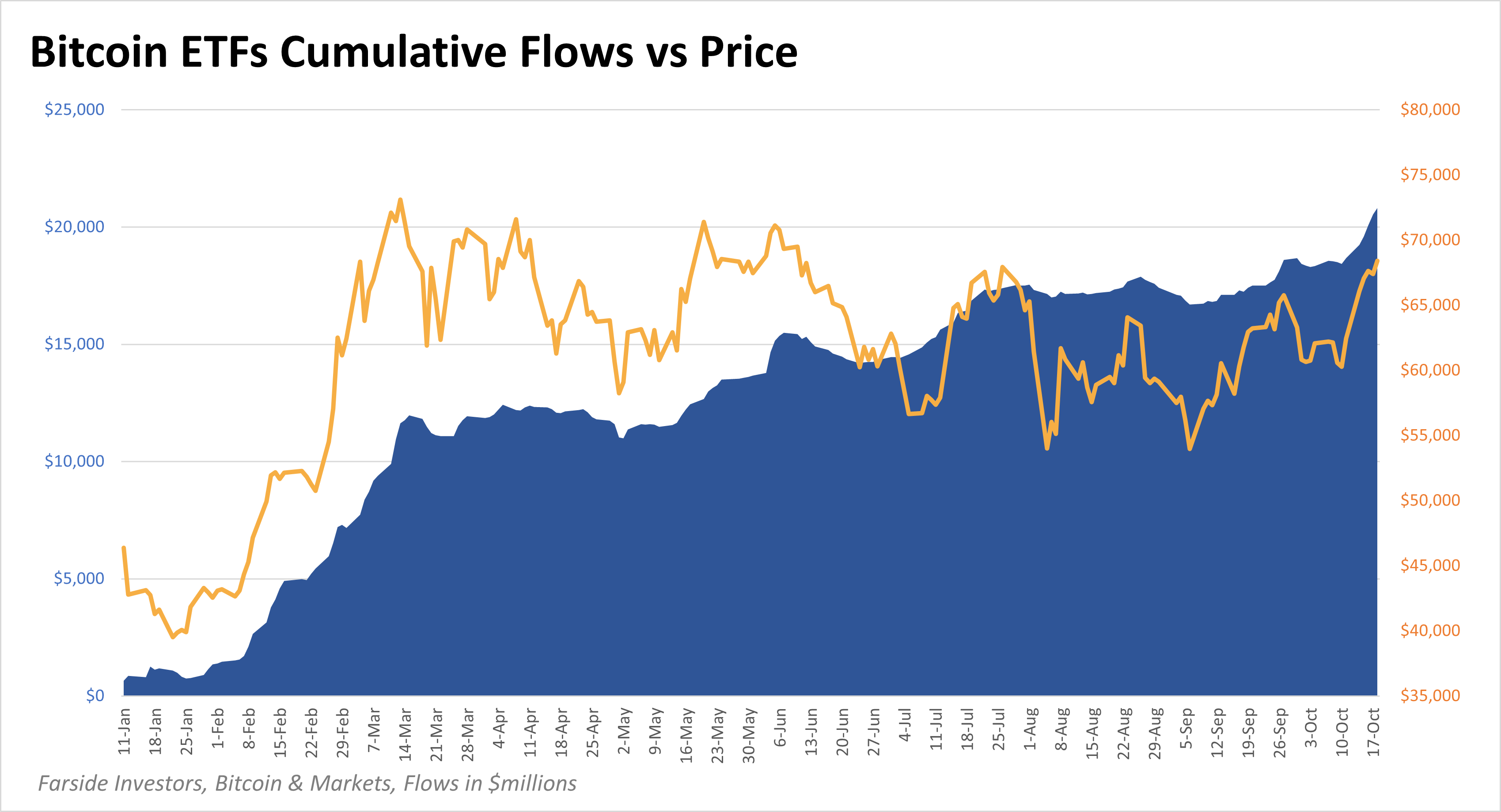

ETF inflows rocket passed $21B.

Bitcoin is up 6% in October so far, and getting back to the ATH is only 9% from here. Things can happen fast. There is the uncertainty around the election, which could delay a true breakout in bitcoin, but I think that is overblown. On last week's Premium post, I looked at the effect of the last two Presidential elections on the price and neither had a significant impact at the time, and no one would say those were less intense than today.

Overall, we are so close to the liquidation level, I do not expect a significant sell off before an ATH. Macro markets are generally bullish and predicting a Trump win. An ATH for bitcoin prior to the election seems likely.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

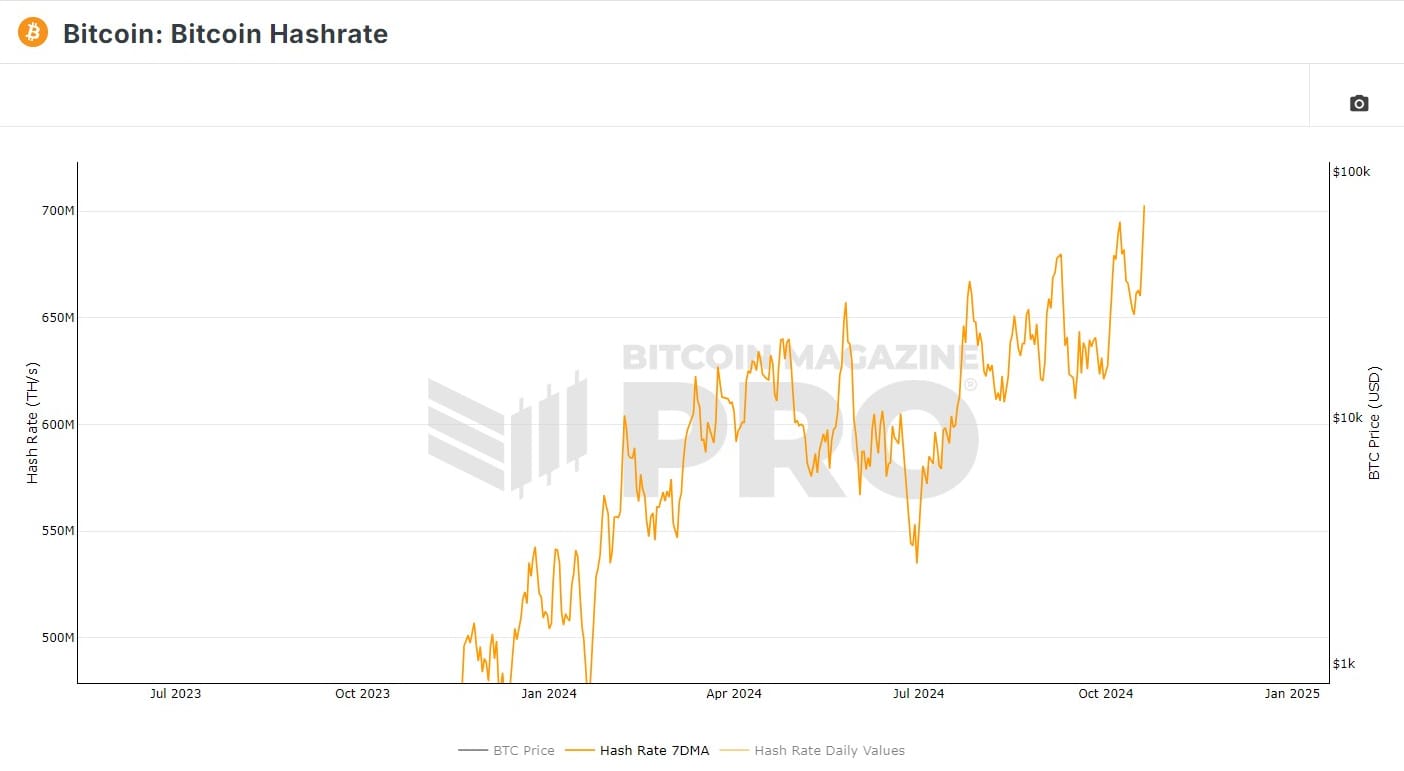

- Hash Rate Hit ATH

Despite the price still not being at an ATH, hash rate has responded to the recent bitcoin price rise by hitting its own ATH. Hash rate can be a leading indicator, for example, bullishness by miners and investors could lead to higher demand for hash rate and the mining equipment suppliers selling more miners. But short term movements like we've seen in the last week are likely a response to the recent price rise. Miners had slowly accumulated hash rate, but many miners were turned off at lower prices. Once the price rose, that dormant hash rate came back online.

Publicly traded mining companies like MARA Holdings, Riot Platforms, and CleanSpark are adopting different strategies to adapt. Some are opting to hold onto their mined Bitcoin, anticipating that the asset’s value will appreciate over time. This “HODL” approach reflects a belief that long-term gains will offset short-term revenue losses. Meanwhile, other miners are diverting resources toward building data centers that support artificial intelligence (AI) applications, a move aimed at diversifying their revenue streams.

In contrast, companies like Core Scientific and TeraWulf, which have embraced AI, are seeing major gains. Core Scientific’s share price has increased by 272% this year after securing multi-billion-dollar contracts with AI company CoreWeave, while TeraWulf’s stock has more than doubled (up 128% so far this year) as it pivots to AI data centers.

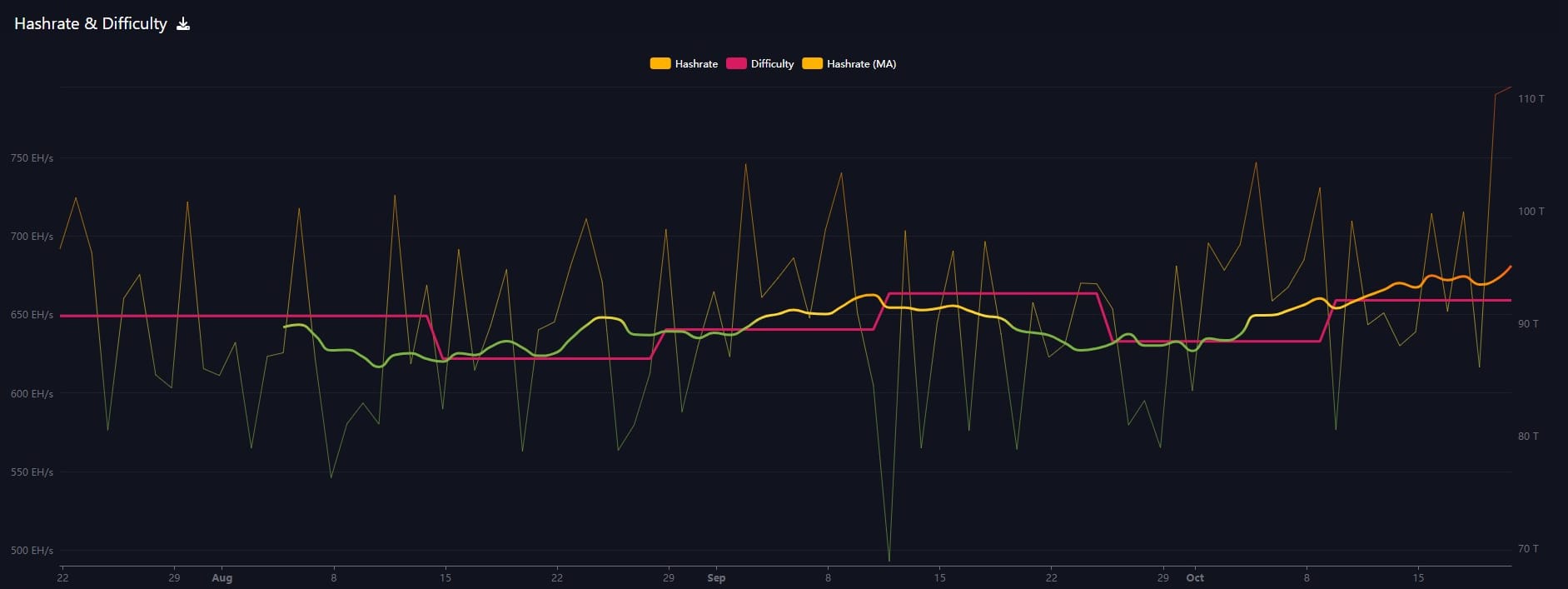

Hash rate and Difficulty

Hash rate has spiked to an ATH. The next difficulty adjustment is on pace for 20 hours from now, and will be another 4.3% jump to an ATH for difficulty as well. In refutation of the anti-bitcoin skeptics above in the headlines section, miners are casting a solid vote of confidence here.

Mempool

There was a little excitement in the mempool over the last two weeks, but has been very quite the last few days. The miners have chewed through all of the above 2 sats per byte fees. There is little congestion on the network right now.

I'm partial to sidechain scaling solutions, so Blockstream and Liquid funding are of particular interest.

Blockchain technology firm Blockstream has expanded its capital-raising efforts, securing $210 million in financing through a convertible notes round led by Fulgur Ventures.

According to an Oct. 15 announcement, the debt will support Blockstream’s ongoing Bitcoin infrastructure projects, including its layer-2 strategy, mining operations and financial products development.

Among Blockstream’s flagship products is the Liquid Network, a Bitcoin sidechain launched in 2018 to provide faster transactions and asset issuances, such as stablecoins and security tokens.

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Short Squeeze, Time To Pay Attention - Premium

- Record September for Bitcoin, Massive China Stimulus, Bring on Q4! - E402

- Bitcoin Ready to Spike, plus Crypto Games In Congress - E401

- Macro Minute: Has The Buffett Indicator Outlived Its Usefulness?

- Bitcoin Minute: Institutional Giants Clash Over Bitcoin

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com