Bitcoin Fundamentals Report #311

The most comprehensive newsletter in Bitcoin! Growing momentum of the Bitcoin ecosystem, in-fighting, Tether FUD, price breakout, and shifting macroeconomic dynamics.

October 28, 2024 | Block 867.813

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Whitepaper Special Discounts!

In celebration of the 16-year Anniversary of the Bitcoin Whitepaper, I'm offering 50% off your first month of both tiers of membership. Get unique and proven accurate bitcoin and macro forecasts!

Or support independent bitcoin content and join our Monthly Price Forecast Competition.

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Wants to break out |

| Media sentiment | Positive |

| Network traffic | Low |

| Mining industry | ATHs, healthy |

| Price Section | |

| Weekly price* | $69,130 (+$1514, +2.2%) |

| Market cap | $1.364 trillion |

| Satoshis/$1 USD | 1449 |

| 1 finney (1/10,000 btc) | $6.90 |

| Mining Sector | |

| Previous difficulty adjustment | +3.9360% |

| Next estimated adjustment | +5% in ~7 days |

| Mempool | 107MB |

| Fees for next block (sats/byte) | $0.29 (3 s/vb) |

| Low Priority fee | $0.29 |

| Lightning Network** | |

| Capacity | 5225.33 btc (+0.9%, +48) |

| Channels | 47,554 (-1.1%, -524) |

- Emory University becomes first endowment to buy Bitcoin ETFs

The first large endowment has disclosed ownership of $16M in Bitcoin in their latest filing. We should expect more filings over the next couple of weeks as the mid-quarter deadline approaches. I'm anticipating big numbers from major players buying Bitcoin ETFs and MicroStrategy!

- Saylor Recants

I have to report on this for full news coverage, as Saylor's interview comments created a huge stir in the Bitcoin X community. Personally, though, this doesn’t concern me in the least. Last week, I said to watch what he does, not what he says. He is currently running a massive speculative attack on the dollar, which is all that should concern you—not what he says in an interview.

The pressure apparently became too much for Saylor, and he's recanted:

"I support self-custody for those willing & able, the right to self-custody for all, and freedom to choose the form of custody & custodian for individuals & institutions globally. #Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone."

I support self-custody for those willing & able, the right to self-custody for all, and freedom to choose the form of custody & custodian for individuals & institutions globally. #Bitcoin benefits from all forms of investment by all types of entities, and should welcome everyone.

— Michael Saylor⚡️ (@saylor) October 23, 2024

Then he posted this video about why self-custody matters.

- The newest Tether FUD

Reports indicate that the U.S. government has opened an investigation into Tether for possible violations of sanctions and anti-money laundering laws. The allegation has been refuted by Tether.

US government opens investigation into Tether $USDT, exploring potential sanctions over alleged violations of sanctions and anti-money laundering laws, per WSJ. pic.twitter.com/jM9PKcg9v3

— TFTC (@TFTC21) October 25, 2024

Nothing new here. Notice that the allegation doesn’t concern solvency, but the Tether solvency bots were activated anyway. Twitter exploded with claims about why Tether is supposedly insolvent and a Ponzi scheme, all of which are, of course, 100% lies. The CEO of Cantor Fitzgerald, a primary dealer and Treasury banker for Tether, has unlimited instant liquidity. He spoke at Bitcoin 2024 and said they were able to meet a 2-day, $10B redemption attack on Tether by FTX.

As for this allegation, I’m sure some Tether may slip through sanctions and be used for money laundering. In fact, two of the largest scam sectors—DeFi and NFTs—are hotbeds for money laundering. However, this activity is not a core part of Tether's business. Far more laundering occurs in traditional banks knowingly than slips through the cracks with Tether.

Bottom line: This is FUD. Powerful globalists want to destroy Tether to clear the way for a CBDC, so I’m a Tether supporter.

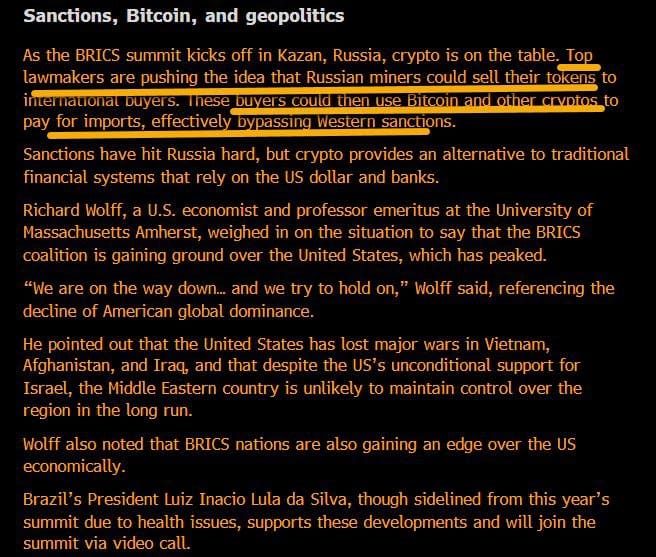

- BRICS talk about using Bitcoin

All the focus is on the unlikely idea of a BRICS alternative to the dollar, which won’t happen anytime soon, if ever. The real news from the BRICS summit is their discussion of Bitcoin. "Top lawmakers" are reportedly discussing Russia mining Bitcoin and BRICS countries using it to bypass Western sanctions. They know what the deal is.

This morning, a VanEck representative on CNBC said, "Three of the six new BRICS members (UAE, Argentina, and Ethiopia) are mining Bitcoin with government resources. Russia's Sovereign Wealth Fund is investing in Bitcoin mining throughout BRICS countries to settle global trade in Bitcoin."

Macro

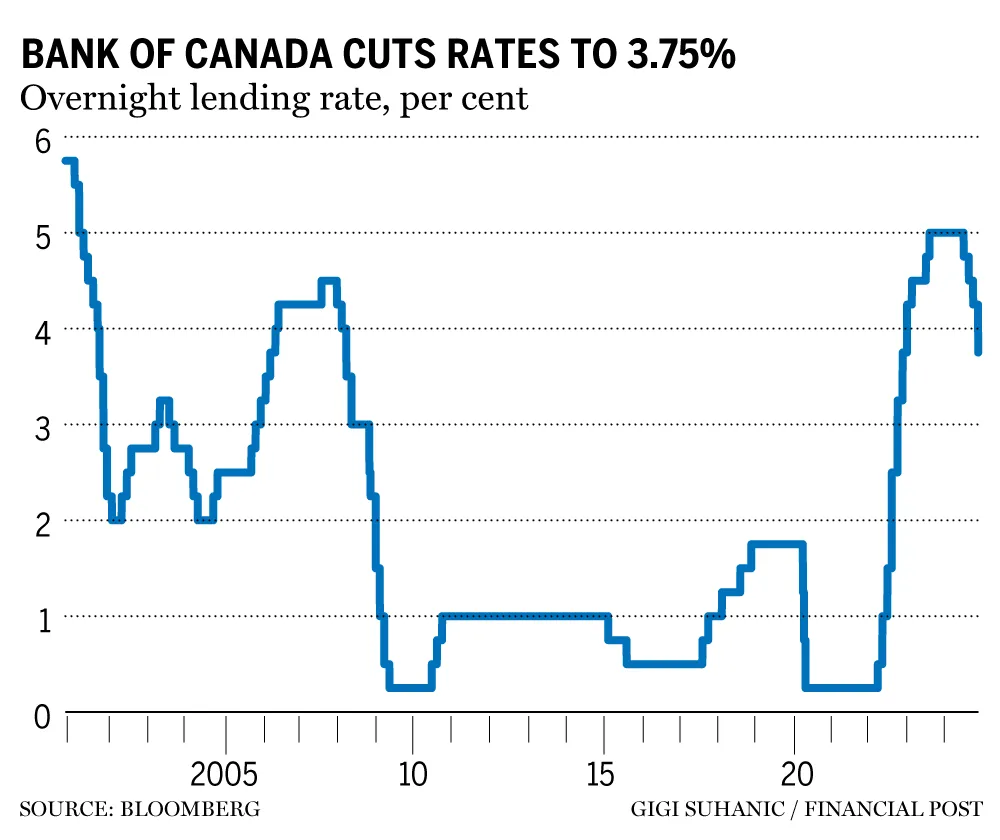

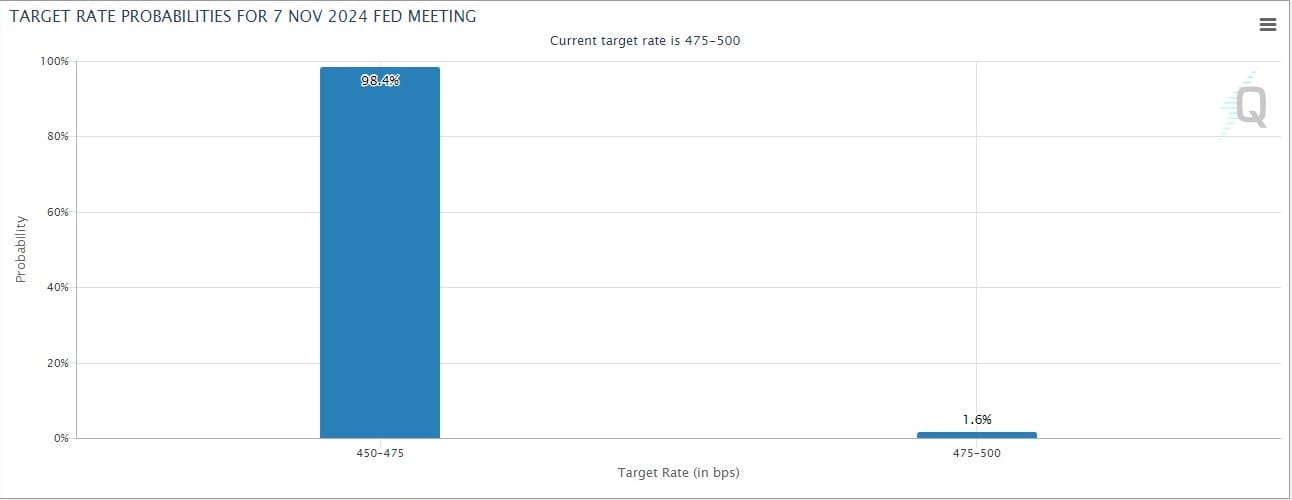

- Bank of Canada cuts 50 bps, ECB cuts 25 bps, Fed next

The Bank of Canada and ECB both cut their policy rates in the last two weeks. The Fed’s decision comes up on November 7. Right now, the odds suggest a 25 bps cut, but I put the odds of a 50 bps cut at 25% myself. The chance is much higher than currently priced in.

TSMC’s new Arizona chip production plant has already surpassed yields at similar factories in Taiwan, which Bloomberg calls “a significant breakthrough for a US expansion project initially dogged by delays and worker strife.”

The share of chips created at TSMC’s new Arizona facility produces usable chips at a rate 4% higher than Taiwanese plants, according to TSMC’s US Division President Rick Cassidy.

TSMC’s CEO said last week during an investor call “our first fab entered engineering wafer production in April with 4-nanometer process technology, and the result is highly satisfactory, with a very good yield. This is an important operational milestone for TSMC and our customers, demonstrating TSMC’s strong manufacturing capability and execution.”

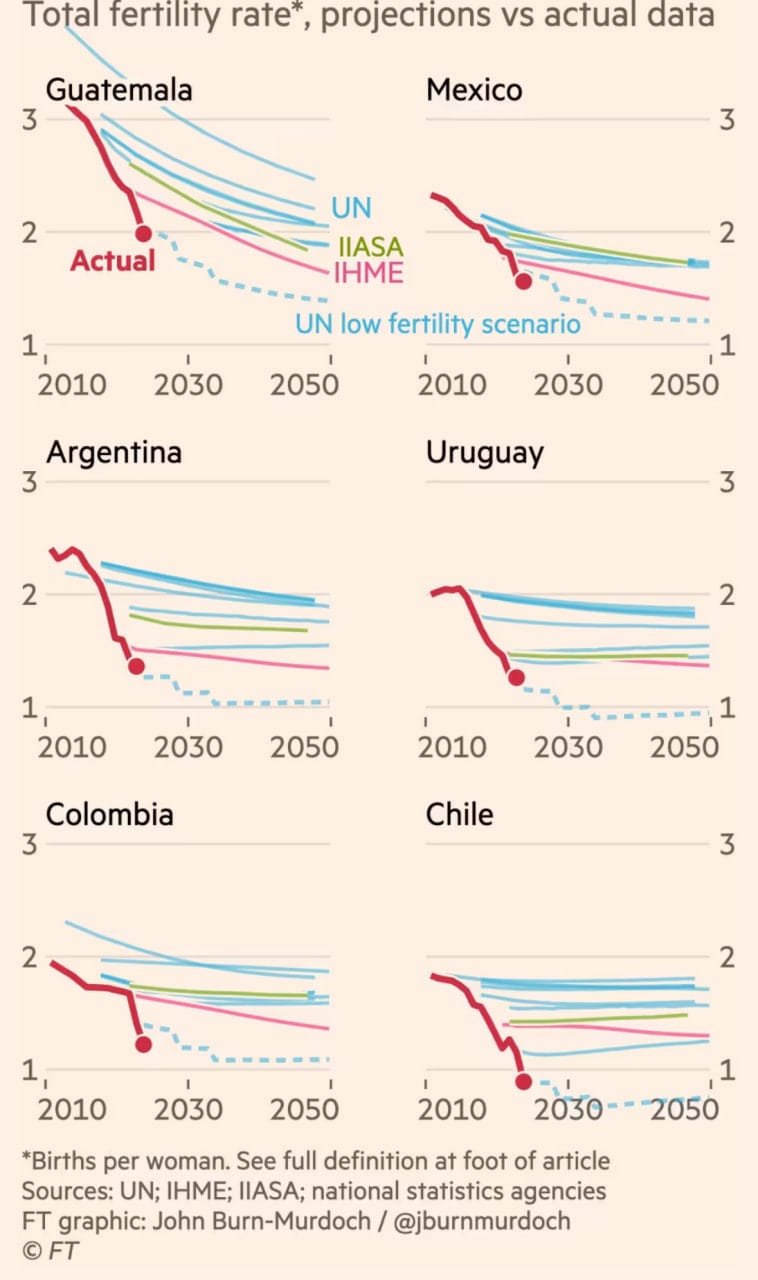

- New Fertility numbers out of South America look horrible

Every fertility update looks worse than the last. New numbers from South America are no exception, with projections consistently missed to the downside. Just look at those rosy projections—they’ve all been missed badly, with fertility declining faster than expected.

Guatemala and Mexico are crucial for U.S. immigration. Many believe immigration can supplement declining fertility, but they’re wrong. These countries are running out of people fast.

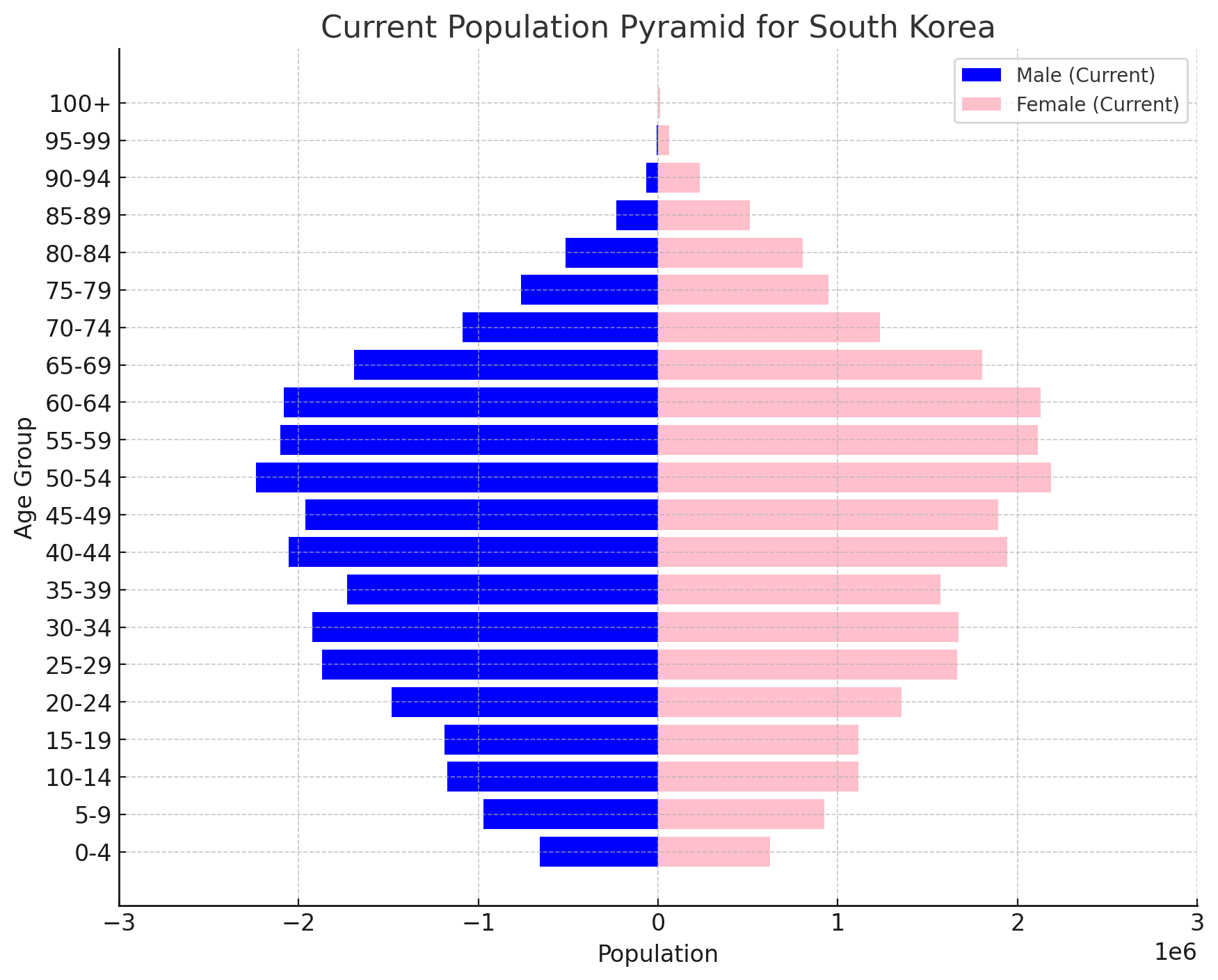

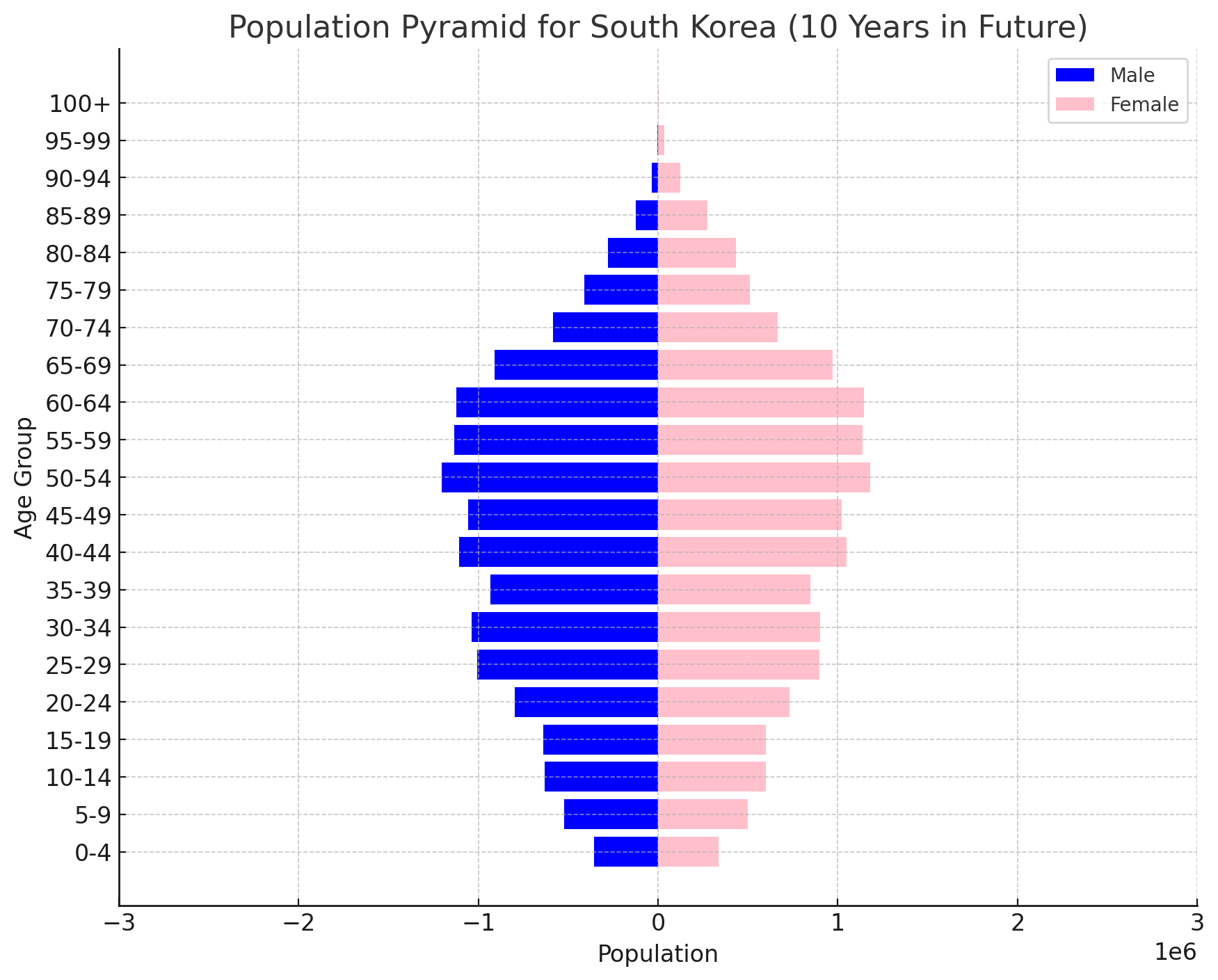

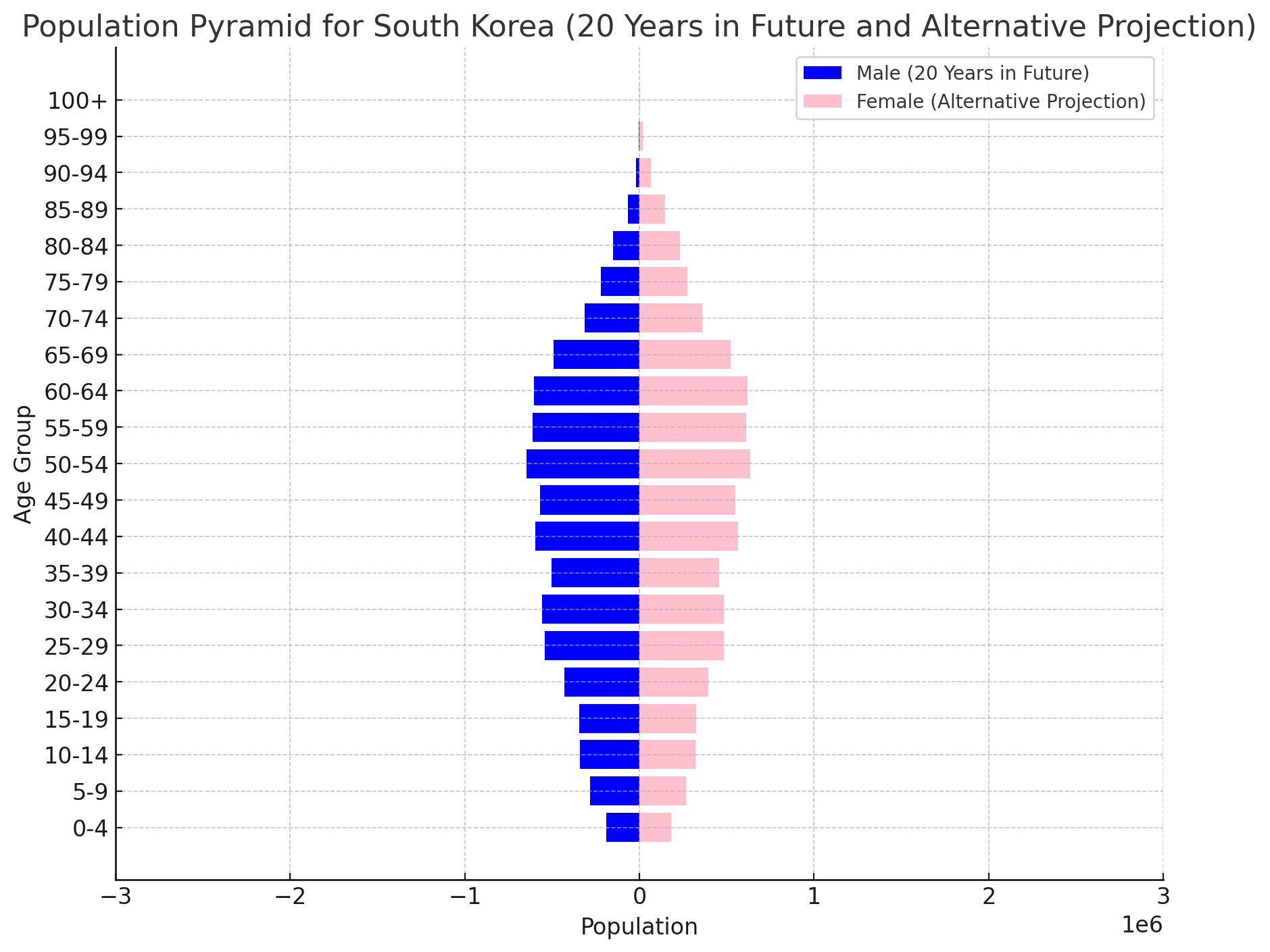

I recently heard Samo Burja suggest on a podcast that we may soon see a city with a 0.0 TFR. Seoul, for example, is at 0.55, and Shanghai is at a similar level. Seoul's fertility rate dropped from 0.63 in 2021 to 0.59 in 2022, and 0.55 in 2023—a decline of over 6% each of the last two years! At this rate, it only takes 30 years to fall below 0.1!

I had ChatGPT make me some population pyramids for Seoul (it is labeled South Korea, but this is using Seoul's TFR and 6% yearly decline) to compare and visualize this decline. The same horizontal population axis is used so we can see the shrinking.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

Not much to say about price this week. We are waiting for the break out that will happen soon. I remain very confident this week that we are close to that breakout. However, markets are about to start holding their breathe for the election, which could delay things further.

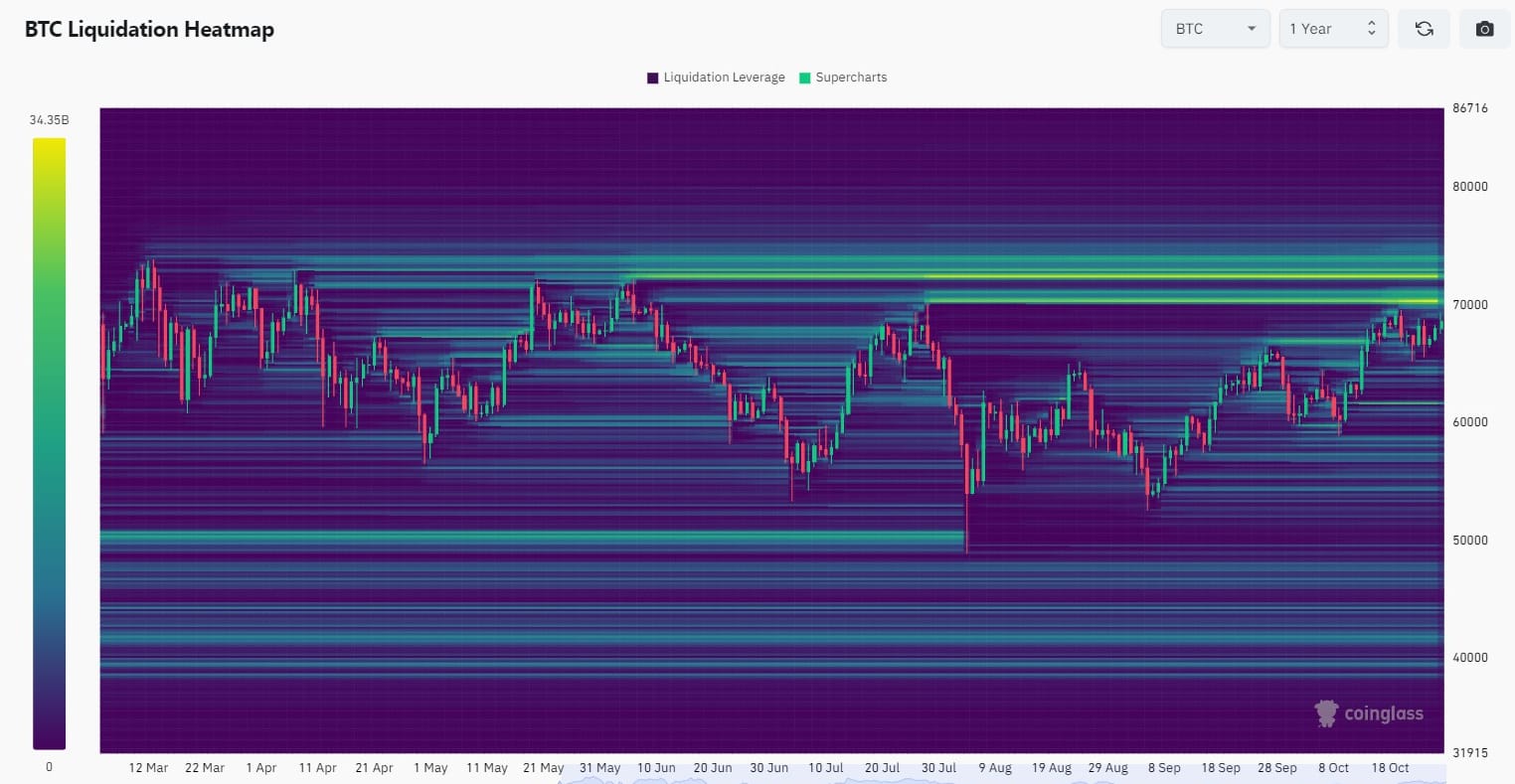

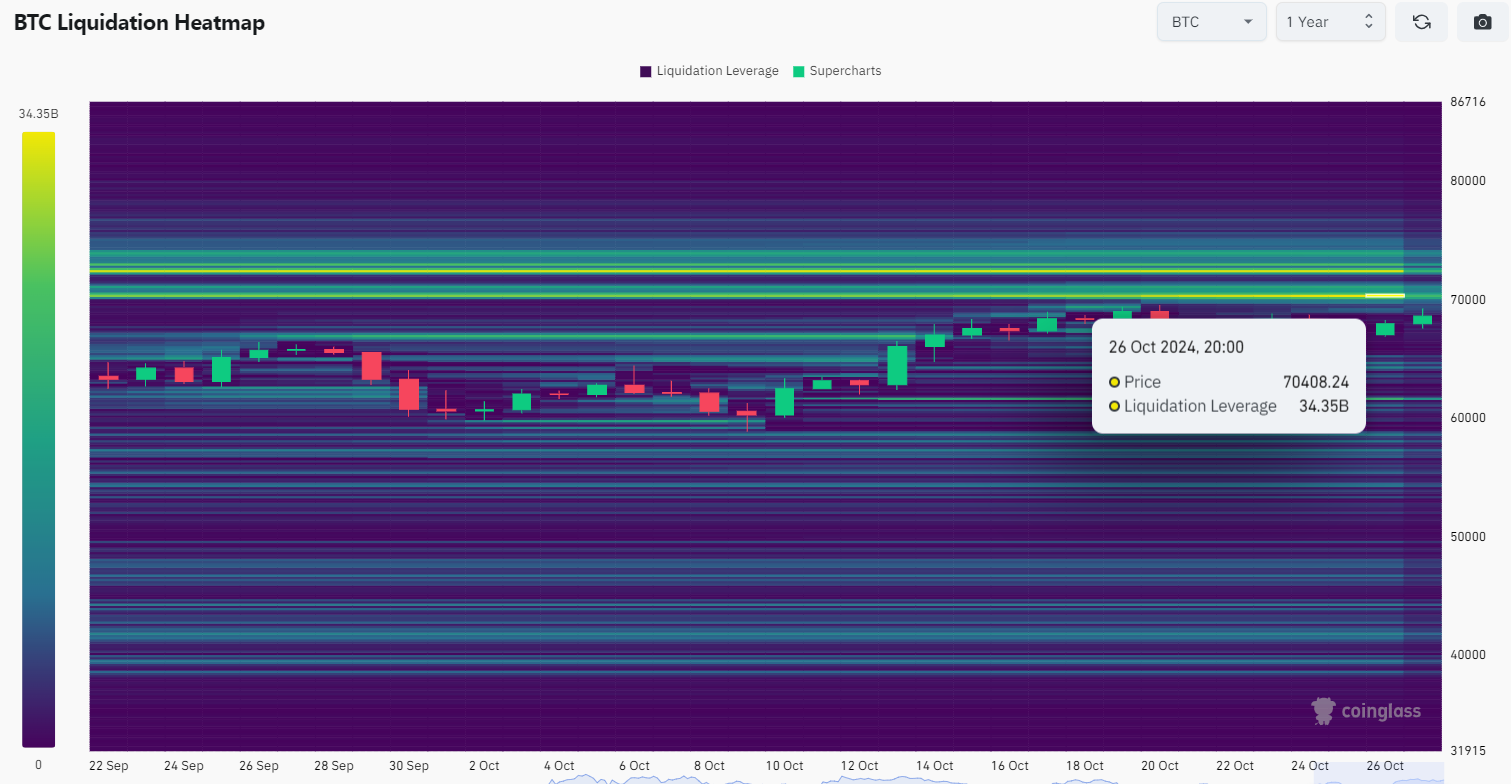

Again, this week we are waiting for the break out. Shorts have been successful in putting it off long enough. When it happens, after all this build up, I think it will be a rapid rise to the ATH. On the heat map, notice the scale on the left. The top number is $34B.

That $34B-level is $70,400.

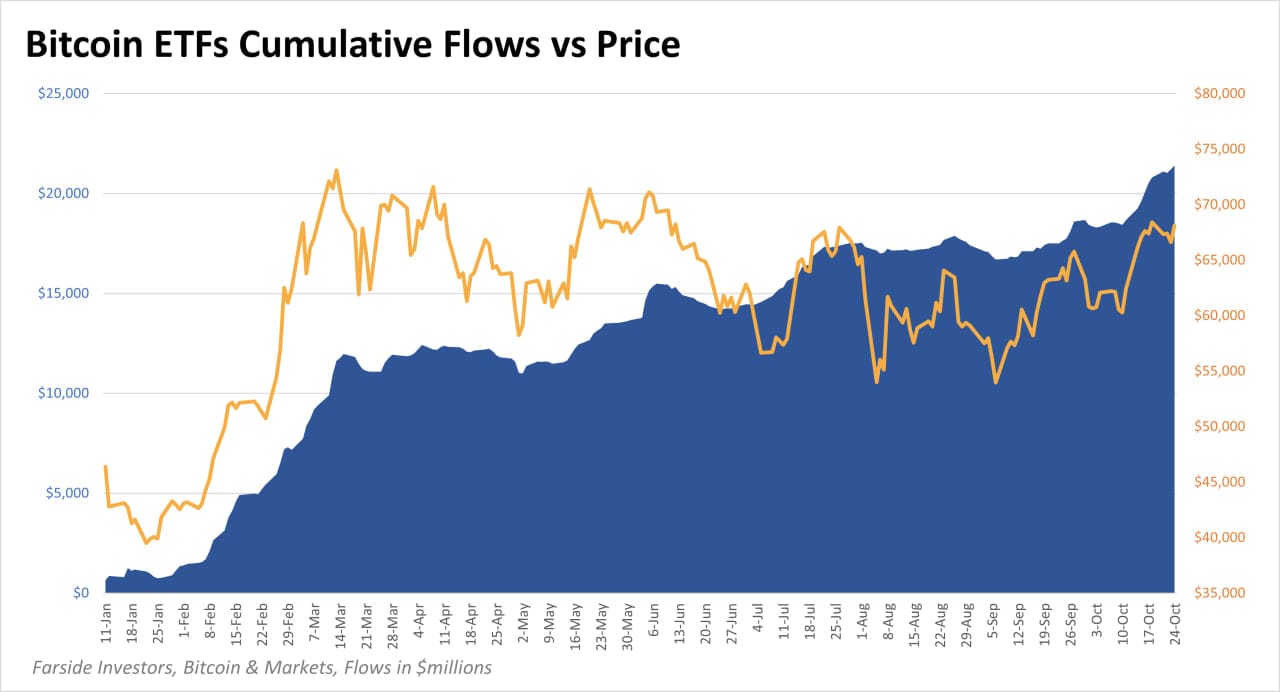

Total ETF inflows saw several strong divergences last week, with positive flows while the price went negative on the day. I'm treating this as a leading indicator for bullish price action. Total inflows are now $10B above where they were at the ATH, passing $22B.

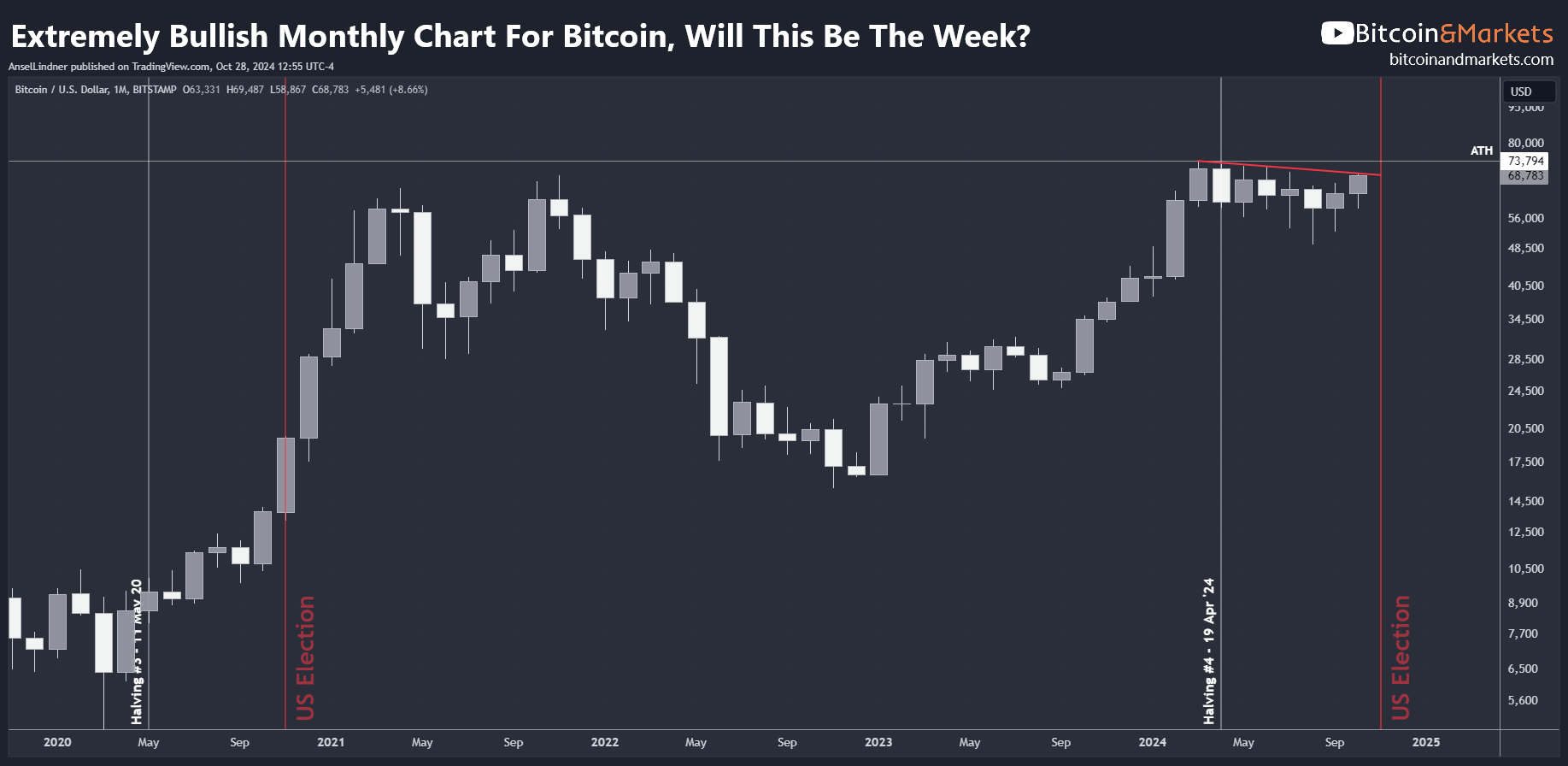

Price has risen 8% in October, a good month, but not quite as strong as I anticipated—I was expecting closer to 25%. We’re now just 7% from the ATH. The monthly chart provides context for how close we are to the ATH and how bullish things look.

The daily chart shows a Golden Cross of the 50- and 200-day Moving Averages. Price initially dipped toward the cross last week as I often talk about, then rallied back to resistance.

Investing is as much about timing as where you allocate capital. Right now, the risk of missing a significant breakout far outweighs the risk of a breakdown. If you’re waiting to buy the dip, you’ll likely miss out. If you’re unconvinced the timing is right, seriously consider DCA’ing at least part of your allocation soon.

Macro

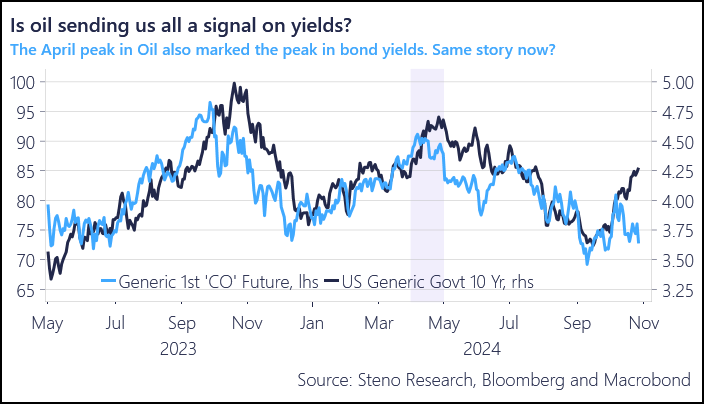

The macro atmosphere is summed up in this great chart from Andreas Steno of Steno Research. Oil prices (in blue) lead yields. When oil prices fall due to weak demand in a recession, there’s a flight to safe assets like U.S. Treasuries and yields fall. We can see the "hidden" recession in this chart.

Overall, we’re close to the liquidation level, ETF flows are skyrocketing, reducing supply on the market, resistance is weakening, and macro forces favor safe-haven assets like Bitcoin. I wouldn’t be surprised by a new ATH in days, even before the U.S. election. Gains will come quickly once they start.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

- Bitcoin miners and AI

There have been a lot of headlines in the last month or so about Bitcoin miners diversifying into hosting AI compute. I've also reported on it here. This week, we have positive stories about Terawulf and Core Scientific, again promoting this idea of hosting AI computers has some great diversification potential. The jury is still out.

TeraWulf's strategic shift towards AI/HPC is a key focus for the company and analysts. The company has ordered a 128-GPU cluster for its pilot project and plans to complete a 20 MW AI/HPC building by the end of 2024. Management has indicated strong demand for AI/HPC solutions, with plans to add an additional 200 MW in the latter half of 2025.

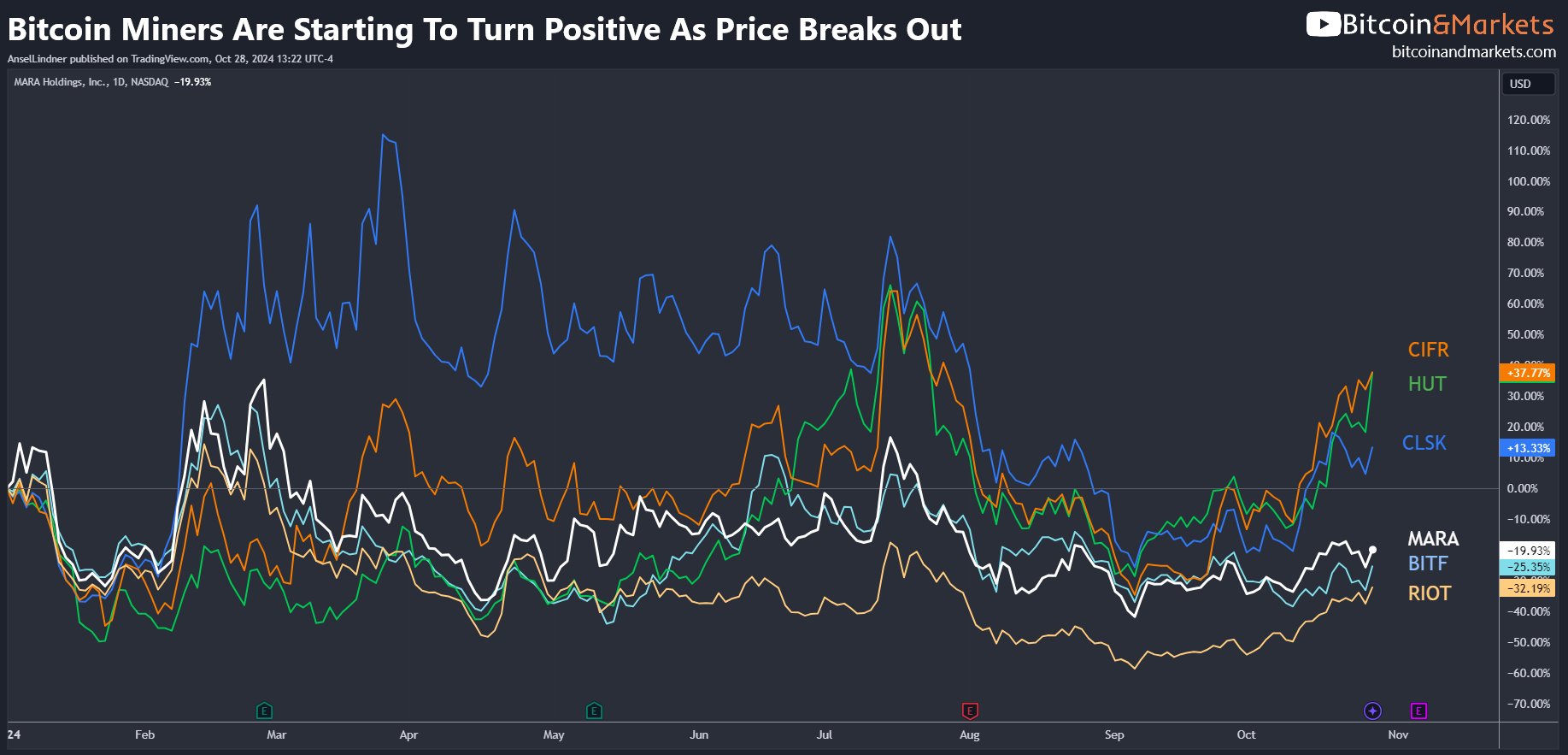

- Bitcoin Mining Stocks Starting to Perform Better

This is a year-to-date chart for major miners. Other notable miners include Terawulf and Core Scientific, as mentioned above, but not shown. I'll be writing a blog post about the two strategies this week.

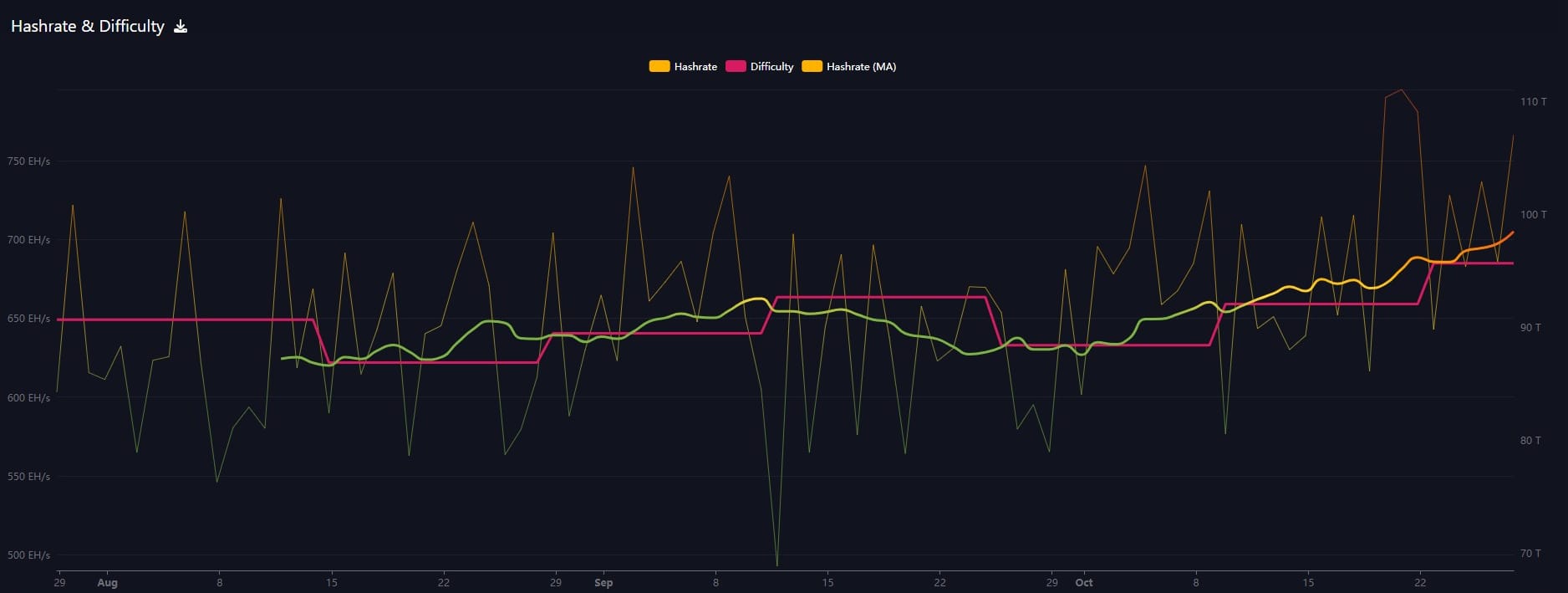

Hash rate and Difficulty

After hitting an ATH for hash rate last week, this week we are at an ATH for difficulty. Hash rate is only slightly lower than last week, as price looked primed for a breakout. I full expect hash rate to follow price higher. Overall, the mining sector is very healthy and growing fast!

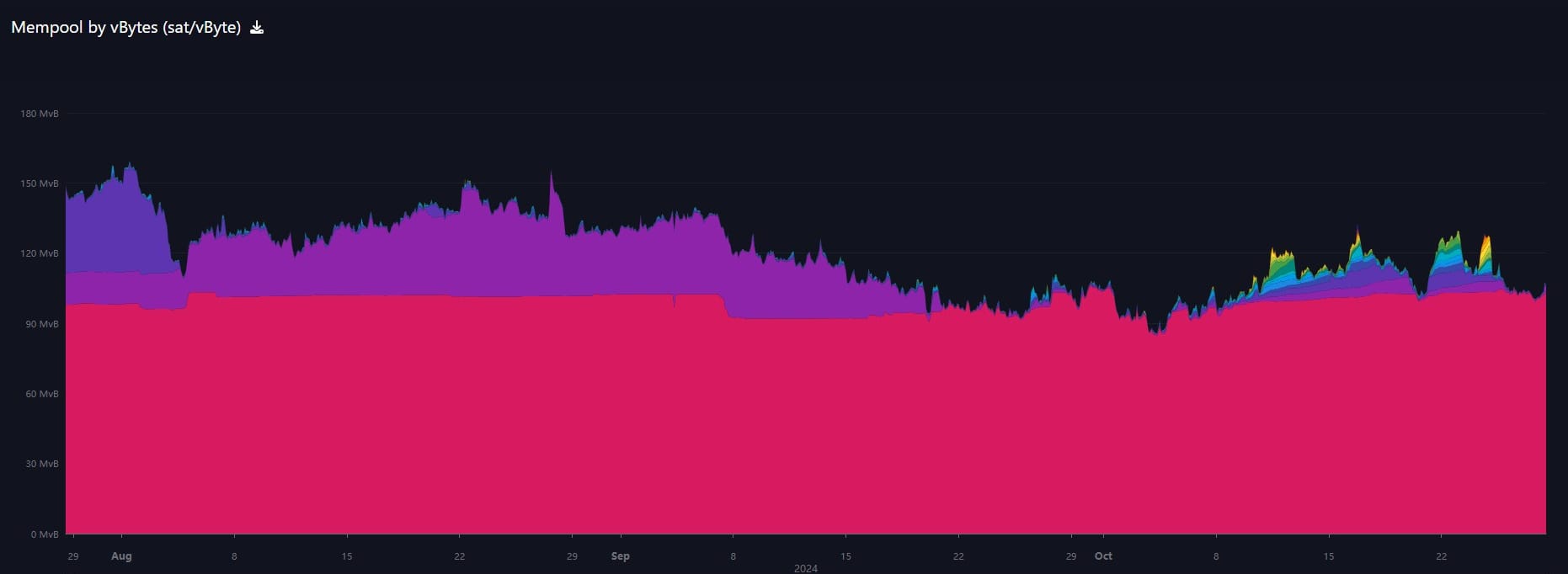

Mempool

The mempool remains largely unchanged from last week. Fees rose mid-week due to price excitement but have since come down to very low levels.

- Kraken launches new wash-trading platform

Kraken has launched a new Layer 2 platform, Ink, similar to Coinbase's Base. These are not serious projects; they primarily offer exchanges a way to scalp fees from degens. Despite the supposed popularity of Base and this new effort by Kraken, prices have not risen for altcoins as one would expect, and especially not Ethereum. Therefore, it's safe to say there is some funny business going on, most likely fake wash-trading volume IMO. In general, altcoins are approaching multi-year lows against bitcoin. I recommend not going near these projects.

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Blackrock Evangelizes Bitcoin, IMF Obsessed, Marco News and Bitcoin Price - E405

- Can Bitcoin Recover? What Headwinds or Tailwinds Are Dominating The Market? - E404

- China Stimulus, Bitcoin and Politics - E403

- Macro Minute: From Eurodollar to Bitcoin - A New Parallel Path

- Soft War by Jason P. Lowery (download)

- FORBES - Bitcoin Doesn’t Fix Everything, Yet All Roads Still Lead to Bitcoin

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com