Bitcoin Fundamentals Report #312

MicroStrategy’s plan to buy $42B in bitcoin, ETF historic performance, and Florida’s adoption highlight a shifting landscape. Pre-election market analysis, mining innovations, and macro updates.

November 4, 2024 | Block 868,879

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Whitepaper Special Discounts!

In celebration of the 16-year Anniversary of the Bitcoin Whitepaper, I'm offering 50% off your first month of both tiers of membership. Get unique and proven accurate bitcoin and macro forecasts!

Or support independent bitcoin content and join our Monthly Price Forecast Competition.

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Pre-election dip |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Consolidation |

| Price Section | |

| Weekly price* | $67,804 (-$1326, -1.9%) |

| Market cap | $1.340 trillion |

| Satoshis/$1 USD | 1473 |

| 1 finney (1/10,000 btc) | $6.78 |

| Mining Sector | |

| Previous difficulty adjustment | +3.9360% |

| Next estimated adjustment | +3% in ~4 hours |

| Mempool | 75MB |

| Fees for next block (sats/byte) | $0.19 (2 s/vb) |

| Low Priority fee | $0.19 |

| Lightning Network** | |

| Capacity | 5232.33 btc (+0.1%, +7) |

| Channels | 47,419 (-0.3%, -135) |

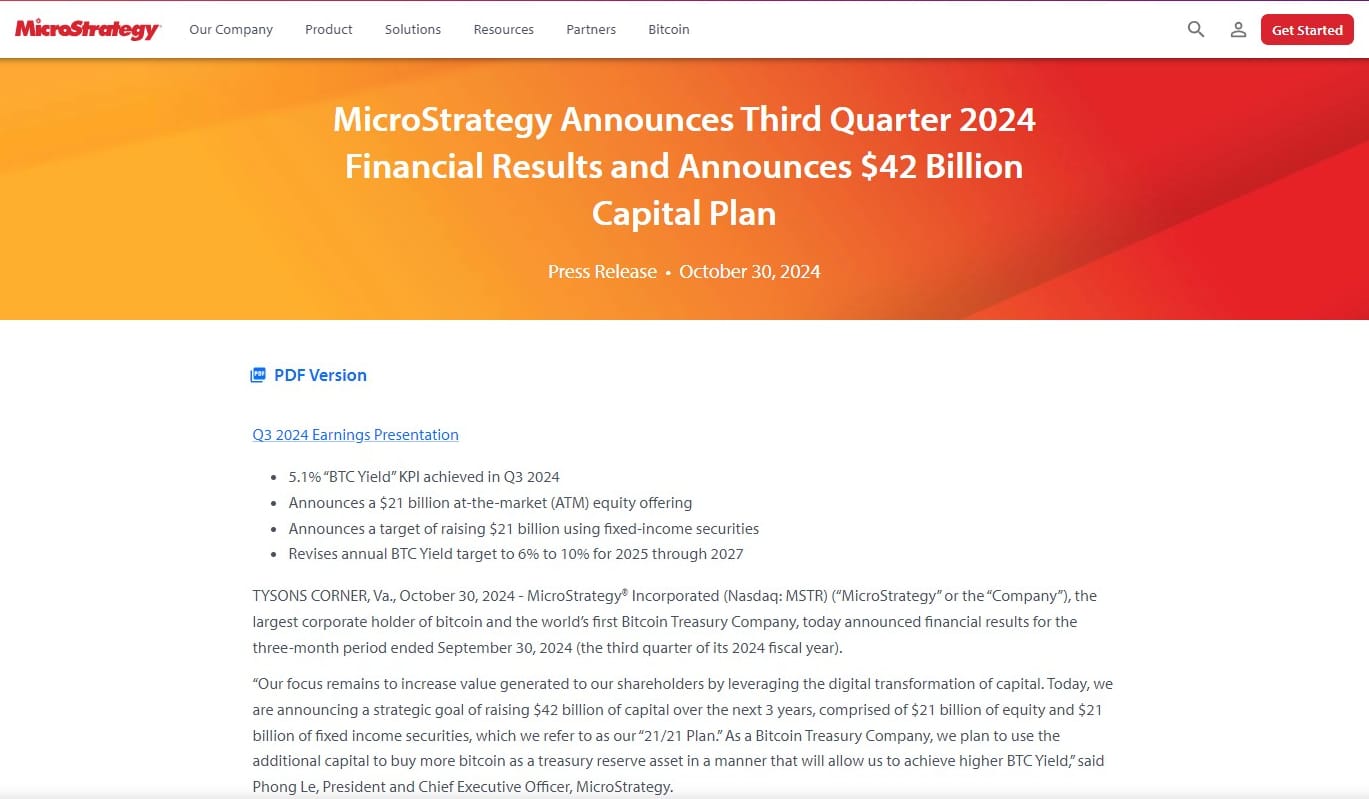

- Microstrategy announces plan to buy $42 billion in bitcoin over the next 3 years

Michael Saylor raises the stakes on his bold speculative attack against the dollar. In their most recent financial results, he also drops the bombshell that Microstrategy will aim to acquire an additional $42 billion in bitcoin over the next three years, using a combination of equity and debt.

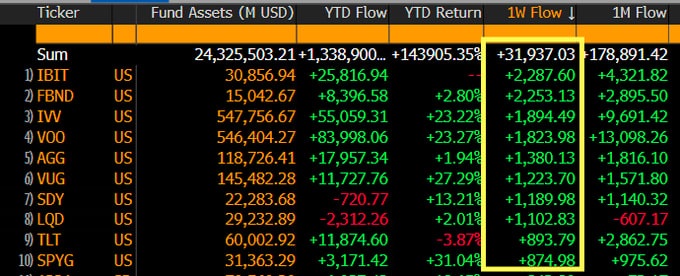

- Blackrock's IBIT took in more money than all other ETF in the world last week

Last week was monumental for ETF inflows, with two days surpassing $800 million. This made IBIT the ETF with the highest inflows globally for the week. There are now over $24 billion in ETF inflows, accelerating once again. With a Trump victory, we could see another $10 billion added by year-end.

The success of Bitcoin ETFs hasn't gone unnoticed by major investors. While a few critics still linger on social media (who are fun to call out), the largest players are preparing to enter Bitcoin in a major way. So far, ETFs hold close to 1 million bitcoins; the next million will be highly competitive. HODL.

- The State of Florida has $800M exposure to bitcoin

Florida was orange pilled by having the bitcoin conference there for 3 years. Miami is fully on board and now the entire State has exposure. This is going to become the norm. Tennessee and others will follow. Increasingly, more states, endowments, sovereign wealth funds, and central banks are gaining Bitcoin exposure either through ETFs or through MSTR. The dam is breaking.

Macro

- Market Holds Its Breathe Ahead of US Elections

This election is a pivotal moment in the fight against global Marxism, though it likely won’t have a direct or lasting impact on Bitcoin. Bitcoin is already embedded in the system, with nearly $25 billion in ETF flows, marking one of the most successful financial product launches in history. There’s no turning back.

Even if Trump loses, people may rush to exit the traditional financial system. Bitcoin will stand as a neutral, fixed asset ready to absorb capital inflows.

The election will not change the economic trajectory; we’re headed for a significant recession. However, the winning candidate could influence how that recession unfolds and the future of the dollar.

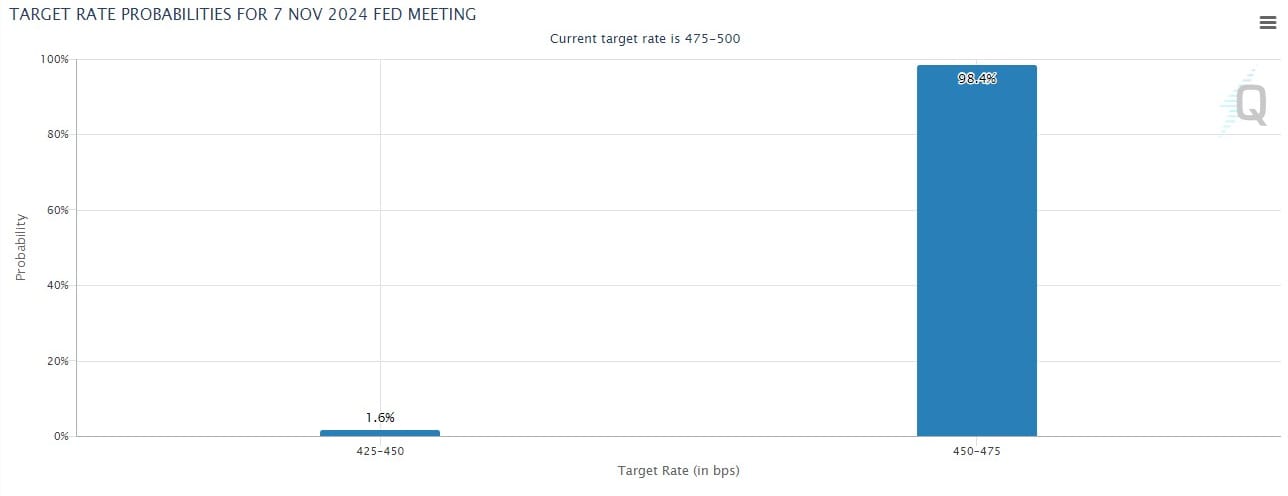

- FOMC this week

I tend to favor a larger rate cut. Last week, despite low market expectations for a 50 bps cut, I estimated the probability to be higher than priced in. Currently, odds are shifting in that direction, with about a 25% chance of a 50 basis point cut. See more about my recession call in my recent blog post here.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

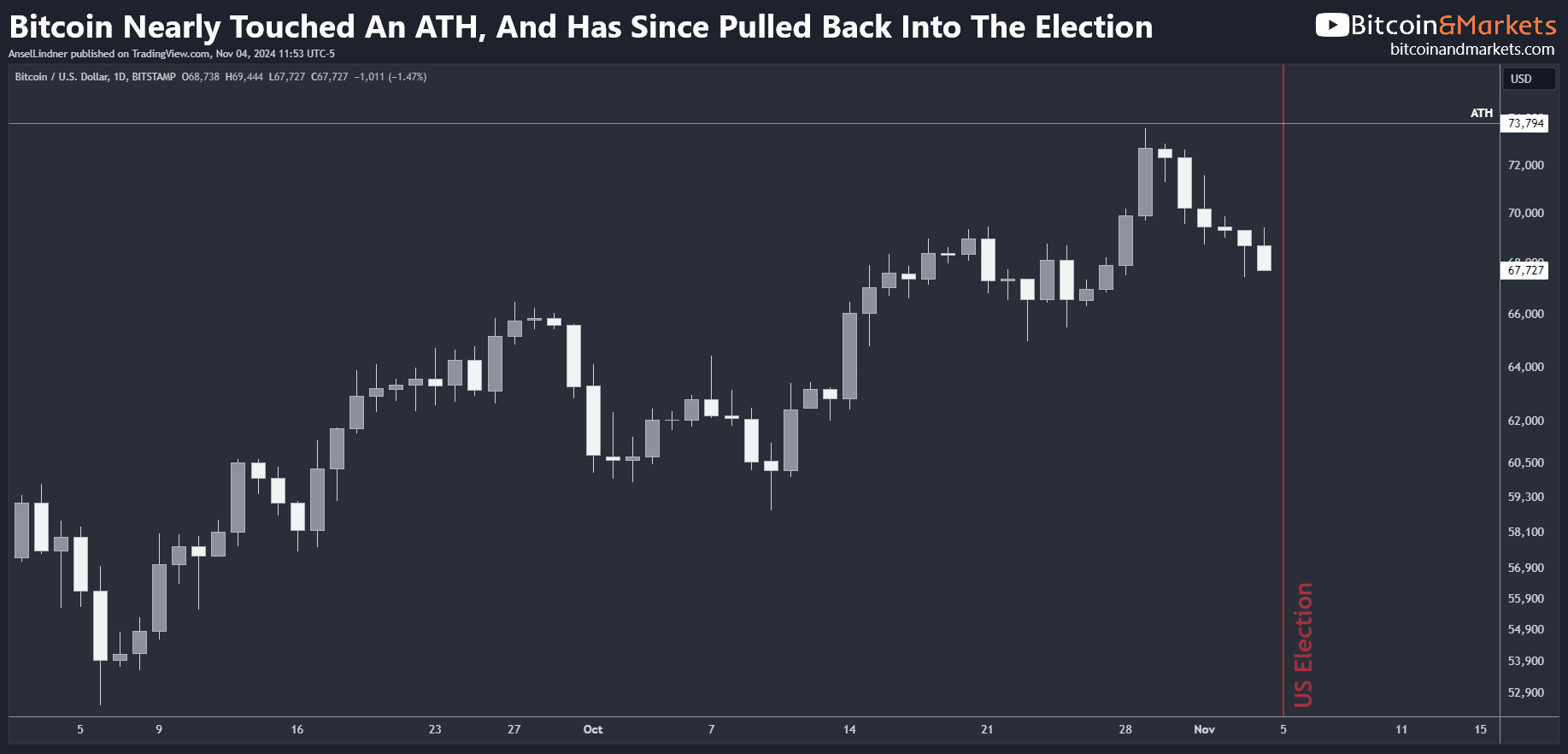

I wouldn’t be surprised by a new ATH in days, even before the U.S. election. Gains will come quickly once they start.

Price nearly reached the ATH last week, then pulled back slightly. Currently, we’re 7.5% off the highs, a bit more than expected but within the ballpark of the 5% range I anticipated.

Last week, I revised my forecast, initially expecting a pullback ahead of the election, to expecting the election having little impact. Analysis of previous election weeks did not indicate a strong election reaction. However, it seems my initial thought of a soft November leading into the election was correct.

Price is currently finding support at a high volume-by-price level.

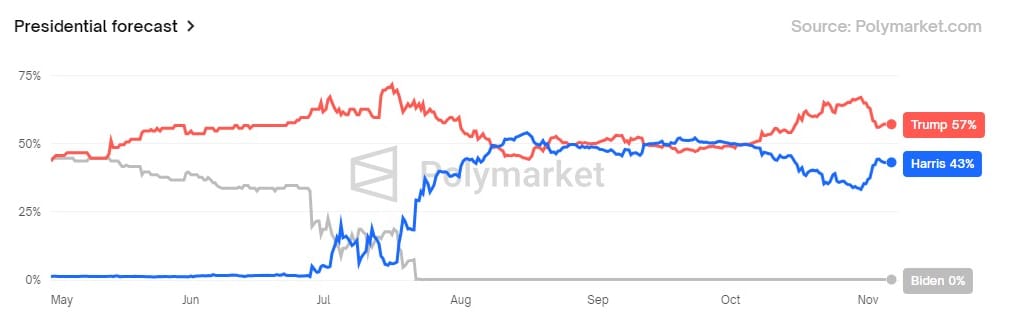

One thing that might have made bitcoin dip more than it otherwise would have is the fact that Kamala spiked on Polymarket. This is most likely a manufactured surge to drive a narrative. I realize that is what the Marxists were saying over the prior weeks when Trump kept surging, but in this case, they project. Everything they blame on the other side, they are guilty of themselves. Anyway, this could have weighed more heavily on the bitcoin price.

13F filings are starting to trickle in, with more expected in the coming week. Today, a UK pension scheme advised by Cartwright allocated 3% to Bitcoin. Expect to hear about major new holders of the ETFs and MSTR.

This uptick in 13F disclosures will coincide with the conclusion of the U.S. election, likely with a Trump victory. If prices challenge the ATH again amid these compounding positive signals, we could see significant bullish momentum.

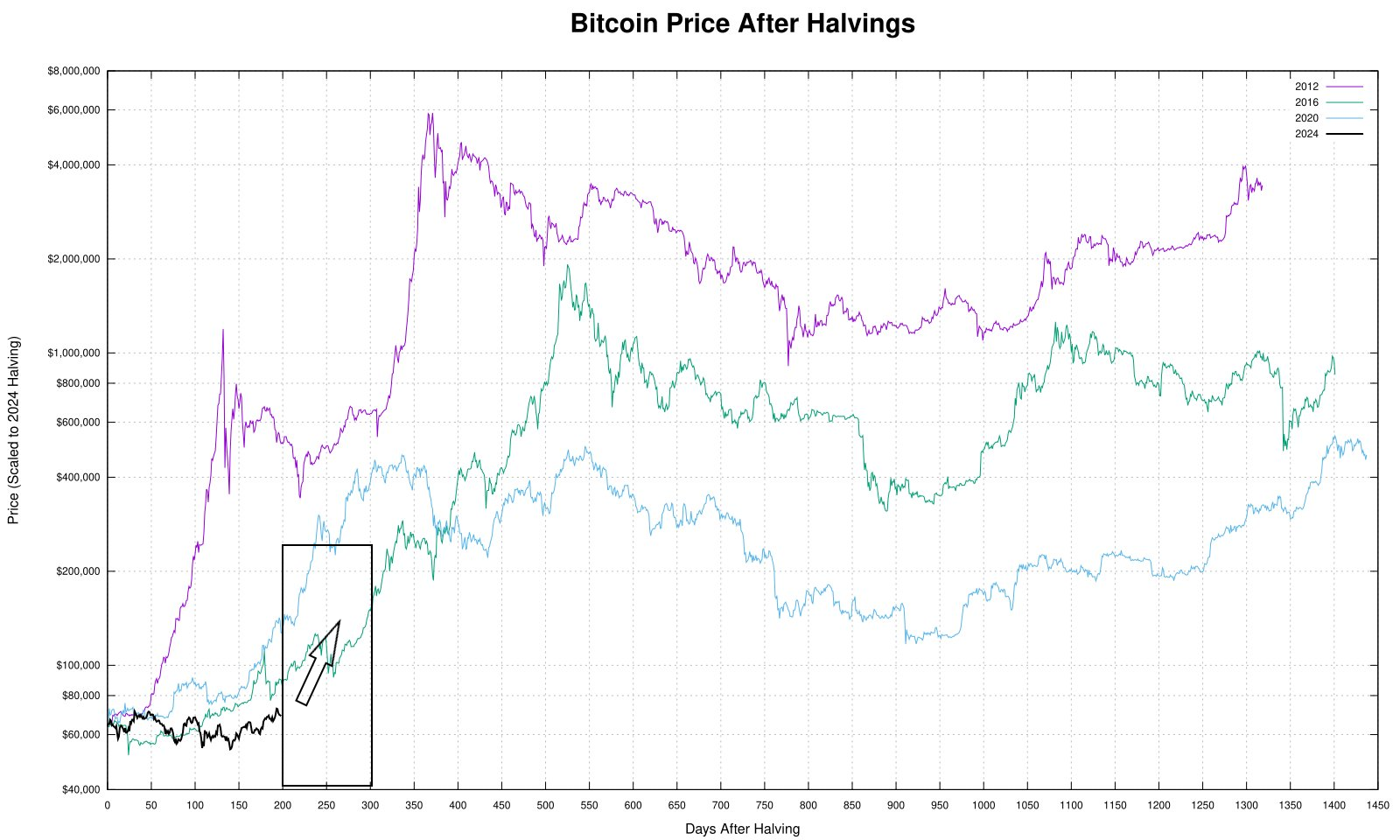

Measured from the halving, this cycle is still below previous cycles. However, the unusual pre-halving ATH has skewed this. A post-election rally could push Bitcoin back to mid-cycle averages, as shown below. I highlighted the next 100 days, which will be very important for this cycle. There is a possibility that the price hits $150k in that window.

Overall, this pre-election pullback has been larger than expected but does not threaten to go much lower. The election appears favorable for a pro-Bitcoin Trump victory. Price remains above key levels, with the bullish trend intact. Cycle timing suggests a significant move over the next 100 days. Additionally, we have a Fed rate cut that should prove bullish for the bitcoin price, as well.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

- Deutche Telekom subsidiary, Digital Monetary Photosynthesis, is testing bitcoin mining to balance their grid and energy production

Bitcoin aligns incentives. Despite the EU’s anti-Bitcoin stance, Bitcoin mining's benefits are undeniable. Mining can make renewable energy more profitable and enables the most efficient energy production levels 24/7 instead of ramping up and down production around peak hours.

Deutsche Telekom subsidiary MMS, in collaboration with Bankhaus Metzler, is launching a pilot project to operate a Bitcoin mining infrastructure using surplus energy. The mining is intended to be powered by electricity from renewable energy sources, which would otherwise remain unused due to insufficient grid input possibilities and/or lack of storage options. The pilot project aims to provide valid field data and insights to plan subsequent projects.

- Bitcoin Mining Bans Could Lead to Increase in Carbon Emissions: Researchers

This story is striking. Only a few years ago, Bitcoin mining was vilified as wasteful. Now, it’s seen as potentially beneficial to renewable energy and carbon reduction.

While I'm not particularly worried about the environment, this is another great example of bitcoin aligning incentives. Bitcoiners don't care much about why you fall down the rabbit hole, only that you do. This new research is completely destroying the waning anti-bitcoin talking points. And just like climate activists' attacks on nuclear, attacks on bitcoin mining expose them as hypocrites after power.

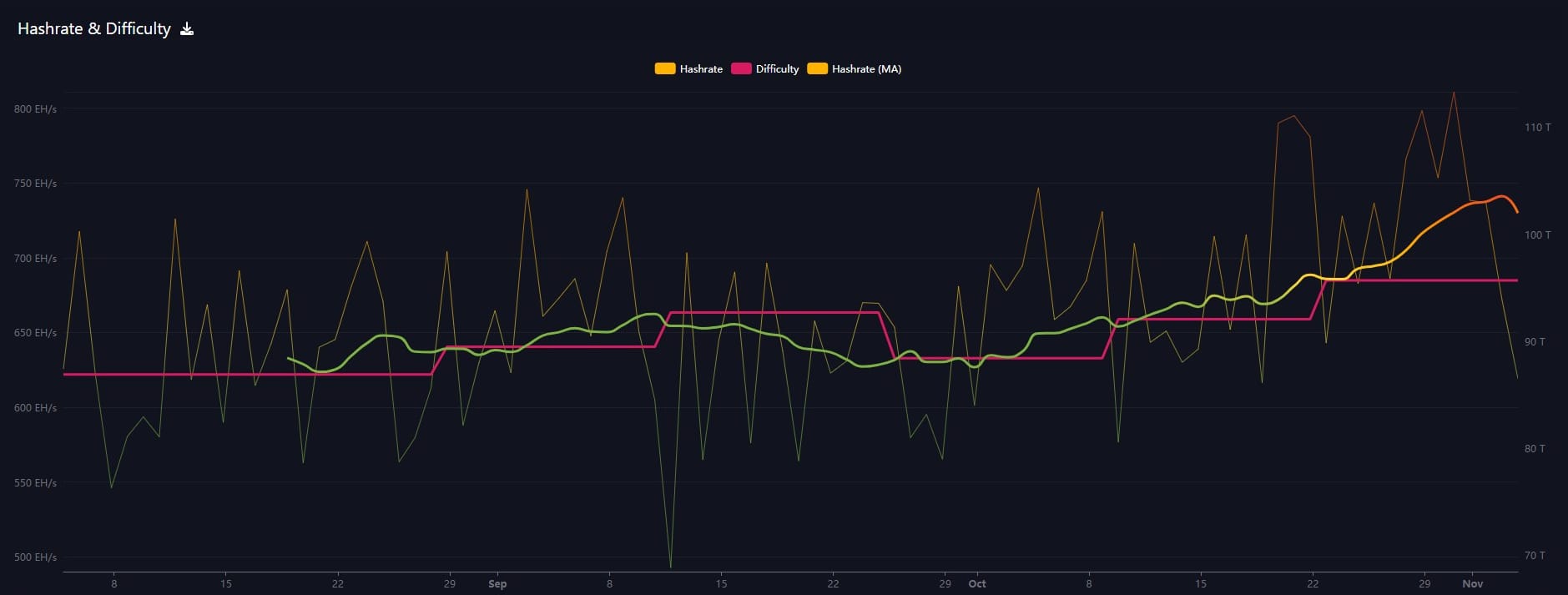

Hash rate and Difficulty

Bitcoin's hash rate has dropped drastically over the last few days, after the hash rate and difficulty hit new ATHs around the time the price was also very near an ATH. The fact that hash rate reacted so cleanly to the price dip is telling evidence that the hash rate is sensitive to price as a lagging indicator, not the other way around.

Difficulty will change in roughly 5 hours from the time of writing, and is estimated to be a +3% adjustment.

Mempool

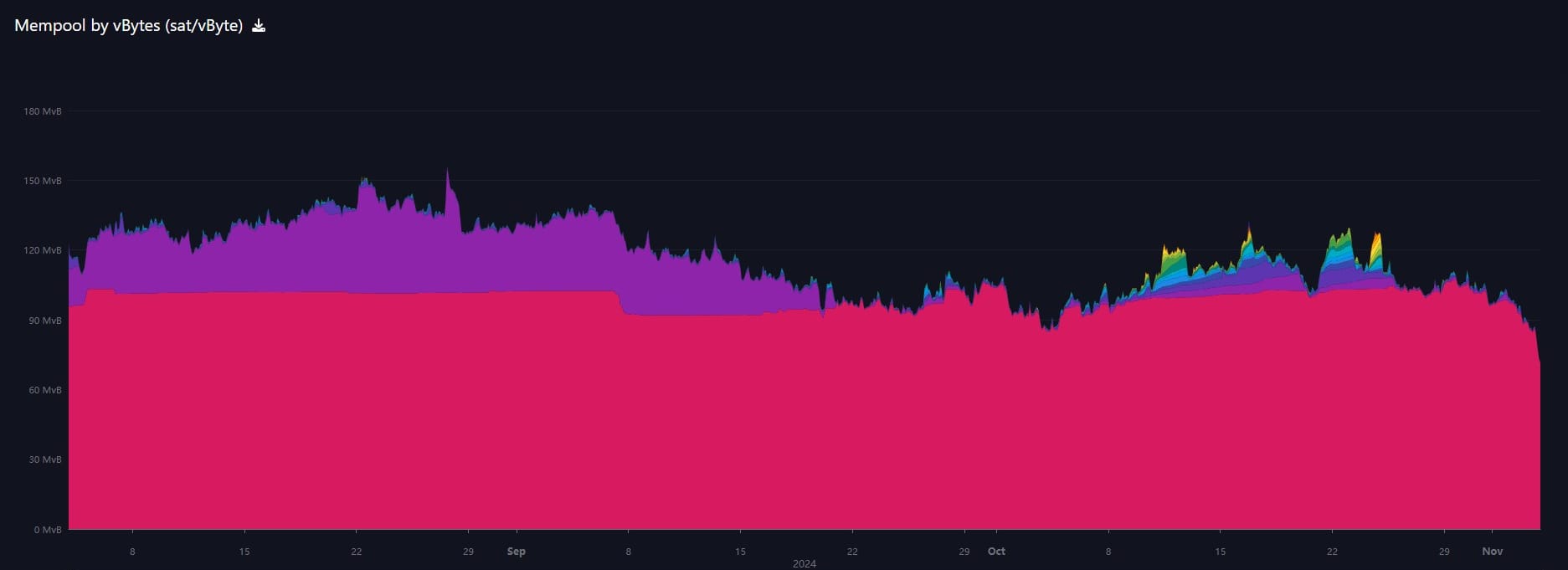

A major dip in the mempool over the last week, brings fees to rock bottom levels. There is little transactional demand right now, another symptom of the tense uncertainty around the US presidential elections.

- NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Bitcoin Price Spikes! Shorts Panic - E409

- Macro Minute: Reliable Recession Signals to Anchor Your Forecasts

- Bitcoin Nearing Major Breakout! Dollar Up, Oil Down, What is Happening!? - E408

- Massive Bitcoin Endorsements! - Monday Weekly Roundup - E407

- November Price Forecast Competition

- Bitcoin Breakout and 10-Year Treasury Misinterpretation - Premium

- Bitcoin and Microstrategy Spike Higher, Macro Setups, and XRP Co-founder Donations - E406

- FORBES - Bitcoin Doesn’t Fix Everything, Yet All Roads Still Lead to Bitcoin

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com