Bitcoin Fundamentals Report #314

Comprehensive industry newsletter, Bitcoin consolidates after a panic-driven rally, fueled by MicroStrategy's aggressive buying and spot ETF options approval, setting the stage for a potential breakout.

November 18, 2024 | Block 870,920

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | No dip |

| Media sentiment | Very Positive |

| Network traffic | Rising |

| Mining industry | Lagging price |

| Price Section | |

| Weekly price* | $90,576 (+$2,418, +2.7%) |

| Market cap | $1.799 trillion |

| Satoshis/$1 USD | 1101 |

| 1 finney (1/10,000 btc) | $9.08 |

| Mining Sector | |

| Previous difficulty adjustment | +0.6322% |

| Next estimated adjustment | +1% in ~14 days |

| Mempool | 106MB |

| Fees for next block (sats/byte) | $4.08 (32 s/vb) |

| Low Priority fee | $3.57 |

| Lightning Network** | |

| Capacity | 5198.93 btc (+0.5%, +27) |

| Channels | 46,960 (-0.4%, -205) |

- Panic FOMO cools

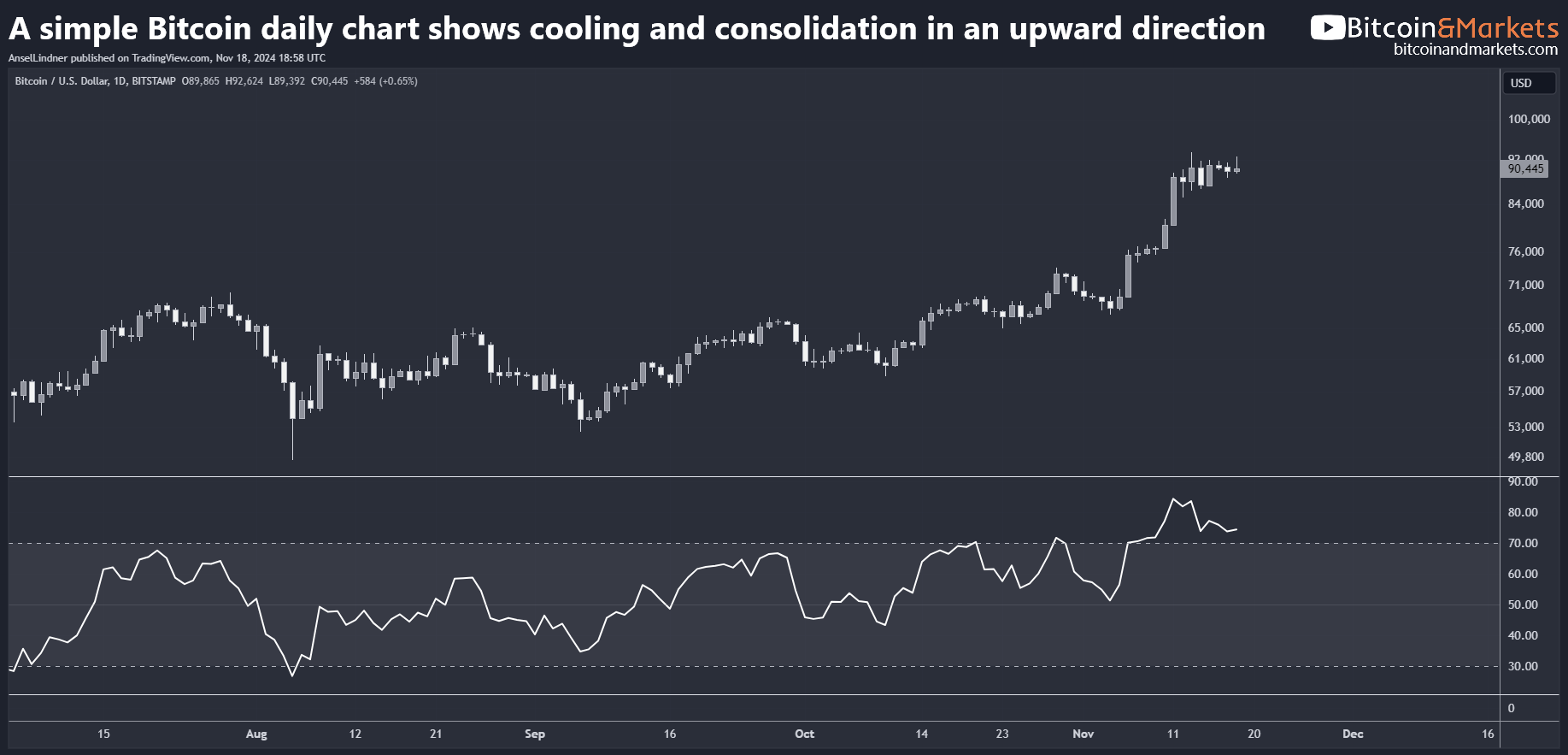

Monday and Tuesday last week were wild. The price surged higher and higher into overbought conditions, leaving the market in desperate need of cooling off. In a way that validates the practice of technical analysis, which predicted a cooling and that is what we got. (More details on price action below.)

- MicroStrategy Buys Another $4.6 Billion

Saylor's plan just a week ago was for $42B in three years. He has now bought $6.6B in 8 days.

This will repeat until the price moves dramatically higher. Effectively, this strategy absorbs all available Bitcoin during any downward price movement.

The concept dubbed the "Saylor Put"—coined by BritishHODL and inspired by the decades-old "Fed Put"—illustrates this phenomenon. Just as the Federal Reserve intervened to prop up markets, Saylor's consistent buying during dips creates a price floor.

If the U.S. government adopts a similar strategy by building a Strategic Bitcoin Reserve, they might buy all dips to avoid spiking the price. This could usher in an era of steady price appreciation, contrasting with Bitcoin's traditionally volatile four-year cycles.

- Bitcoin Options on the spot ETFs has its final approval, waiting for trading to start

I've been covering this story since the surprising first-step approval in September. Options on the Bitcoin ETFs will be the first-ever options on a truly fixed supply asset. It will differ from traditional options, because other assets have a volatility curve that decreases with increasing price, and hence options hedges against rising price becomes less expensive with rapid price rises. However, in bitcoin, it has at least as much volatility to the upside as the downside, so these options will have a reinforcing feedback loop to the upside, unique from any other asset.

Bitcoin options for spot ETFs have received final approval, and trading could begin as early as tomorrow.

Nasdaq is ready to go, said that $IBIT options will list “as soon as tmrw” - Alison Hennessy on ETF IQ just now 🔥

— Eric Balchunas (@EricBalchunas) November 18, 2024

- Gensler is out at the SEC, Hopefully this doesn't usher in the effective approval of fraud on a major scale

Gary Gensler has resigned as SEC Chair, perhaps effective as early as today. While many altcoin proponents are celebrating, this news should give Bitcoiners pause.

JUST IN:🇺🇸 Gary Gensler releases statement suggesting that he may be resigning from the SEC 👀 pic.twitter.com/l5MekBZ17H

— Simply Bitcoin (@SimplyBitcoinTV) November 14, 2024

There is the possibility, with Trump's waving of capital gains tax on centralized crypto projects proposal, and a scam-friendly new SEC Chair, fraud will be amped up 100x. On the bright side, at least this did not happen in 2019, because there would have been even more massive amounts of fraud. At least today, the altcoin Ponzis have lost a lot of their appeal.

Let me be clear, this is a very bad idea to open it up like this. These projects are admitting they were unregistered securities and fraudulent to conform with Trumps exemption. As products of a centralized company, their need for decentralization and blockchain does not exist and was a lie all along. Trump is likely taking advise from his sons, who have been tricked by the scammers.

🚨BREAKING: President Trump wants to eliminate all capital gains taxes on Cryptocurrencies issued by U.S. companies

— Shawn (@oroogle) November 14, 2024

This would ultimately make all profits Americans make on holding crypto assets such as $ADA $ALGO $XRP and $HBAR fully tax free, as their creators are U.S.… pic.twitter.com/DCtG14S6kJ

OG Bitcoiner Jimmy Song summed it up perfectly when he said, 'Gary Gensler wasn't the problem. Altcoins are the problem.'

- Polish Presidential Candidate Runs on Bitcoin Strategic Reserve

Strategic reserves are going global!

JUST IN: 🇵🇱 Polish presidential candidate

— Simply Bitcoin (@SimplyBitcoinTV) November 17, 2024

Sławomir Mentzen pledges to adopt a strategic #Bitcoin reserve if elected. pic.twitter.com/4KsJJhYaJk

Macro

- Trump's Cabinet Takes Shape and It Promises To Shake Things Up

Trump is assembling a disruptive team for his administration, with battles expected over high-profile appointments like Matt Gaetz for Attorney General.

I'm not a procedural expert, but I think there are ways Trump can push through his appointments. Stonewalling Presidential appointments is almost unprecedented in the history of the country. The President gets to pick his cabinet, end of story. I expect Trump to win this battle.

The Secretary of the Treasury will be critical for Bitcoiners. With control over the Exchange Stabilization Fund (ESF), they could make decisions to back U.S. debt with Bitcoin. Among the candidates, Howard Lutnick is the favorite among Bitcoin proponents, but Scott Bessent would also be a reasonable choice.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

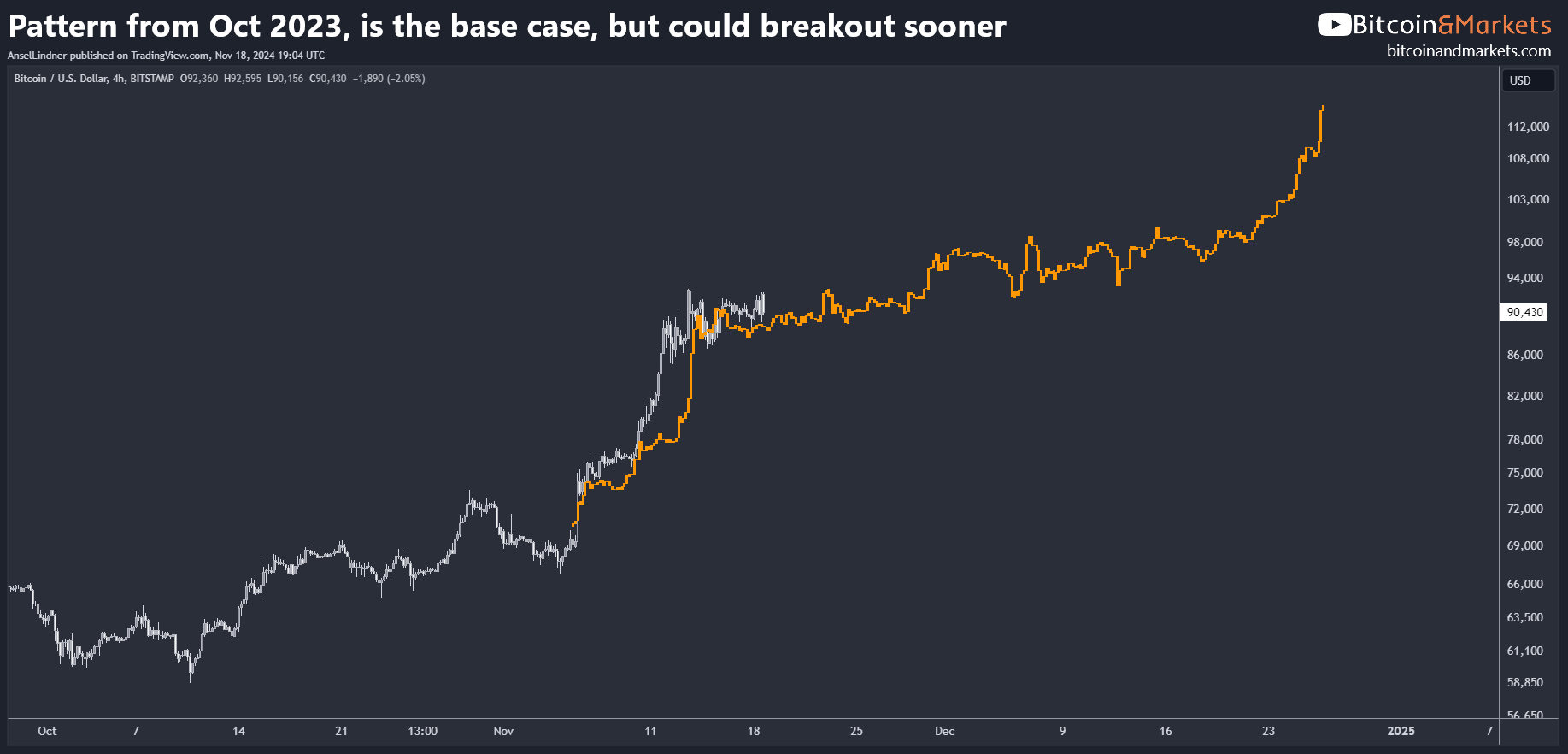

Overall, I'm not calling a top at the current price of $87,500, we could reach $95k-100k this week, but the risk of a correction is already elevated. If we go straight to $100k, the likelihood of a very significant pull back becomes very high. At that point, a brief drop back to $80k would not be surprising at all. The most likely scenario right now is for the immediate impulse to cool here around $87k, and trickle upward for a week, similar to October 2023 on the chart above.

The momentum from last week's panic spike eventually pushed the price to a high of $93,493. However, the general idea from last week was correct: the market was significantly overbought and needed to cool down. So far, the RSI has dropped enough to allow another push higher at any time, but this is not the base case.

Last week's premium post was published on Thursday, incorporating several additional days of price data since the Monday newsletter. In that post, I shared a chart illustrating the October 2023 price pattern, which remains my base case for the current market.

This type of price action likely stems from MicroStrategy’s continuous buying absorbing available supply at this level, preventing a correction. At the same time, the price needs time to consolidation and digest profit takers and find and reset before the next leg higher. There appears to be sufficient demand at this level from large buyers, so the consolidation might not last as long as it did in October 2023 before another breakout of approximately 20%. It’s possible the price could follow the October 2023 pattern for only a couple of weeks before accelerating again.

The risk of a significant sell-off has decreased this week, but caution regarding leverage trading remains warranted.

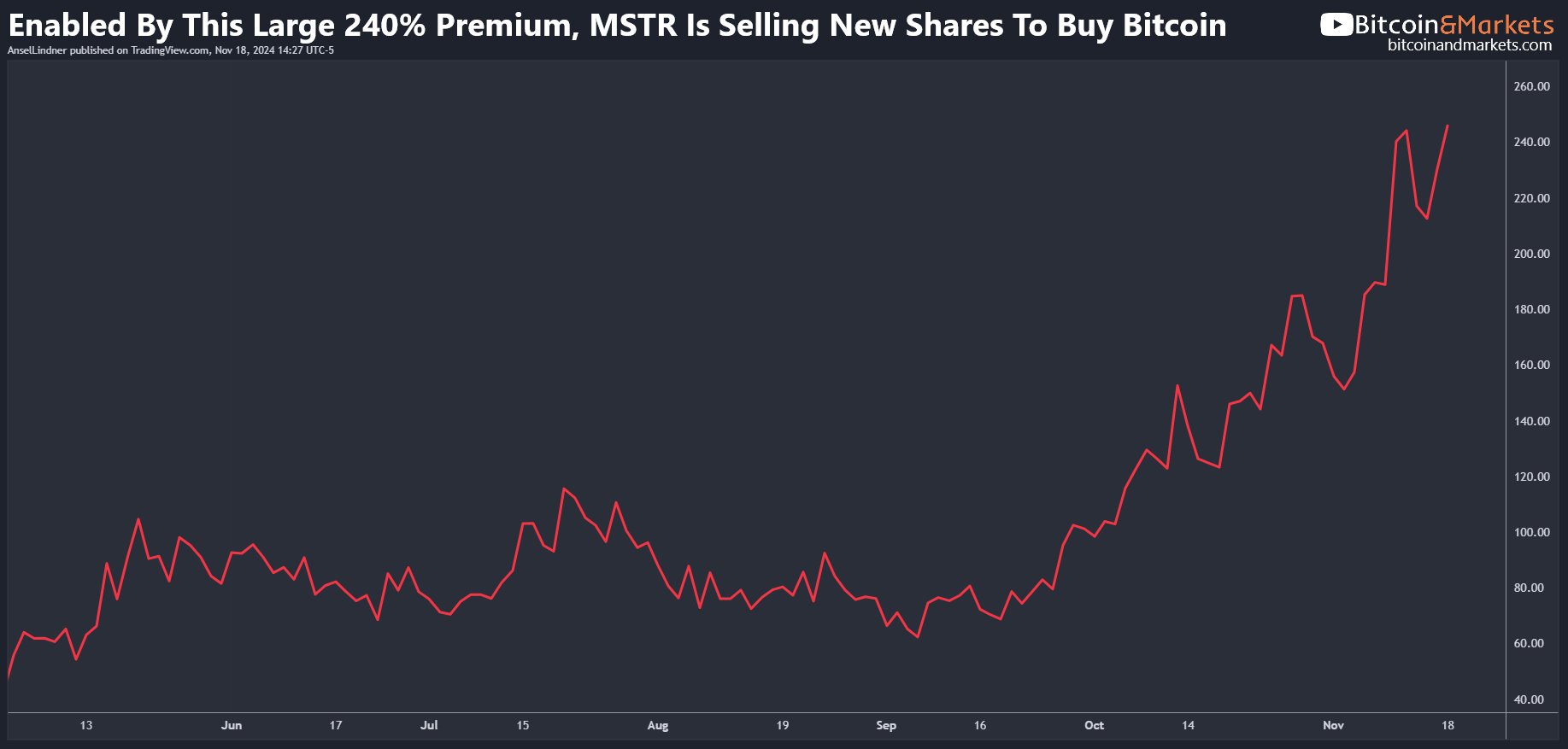

MSTR Premium

With a significant premium on MSTR stock above the value of the Bitcoin it holds, MicroStrategy can sell additional shares to raise funds and buy more Bitcoin. This strategy inherently increases the BTC/share valuation.

To explain this in simple terms:

- An ATM offering allows MicroStrategy to sell new shares directly into the open market at prevailing prices.

- With the stock trading at a 240% premium to its net asset value, MicroStrategy raises substantially more capital per share issued than the value of the bitcoin per share. The Bitcoin purchased with this capital exceeds the dilution effect, increasing the Bitcoin per share for existing shareholders.

Michael Saylor can continue this strategy as long as the premium persists. The feedback loop is striking: an increase in Bitcoin per share raises the premium, which allows for more shares to be sold and more Bitcoin to be acquired, reinforcing the cycle. If Bitcoin’s price rises to close the premium, buyers might remain incentivized to purchase MSTR above par value.

Theoretically, the end game is a massive spike in the bitcoin price and a closing of the premium. Other companies are beginning to adopt similar tactics, which, if widespread, could break traditional valuation models. Combined with negative vanna dynamics in Bitcoin options (where participants must buy more Bitcoin as the price rises) and the potential for a U.S. strategic Bitcoin reserve, a $1 million Bitcoin price during this cycle is no longer unrealistic. This flywheel effect might extend even further.

Despite all this bullish potential, the base case for this week remains consolidation along the October 2023 path. Some supply between the current price and $100K may become available, but the Saylor Put should prevent a significant dip. A breakout could happen this week, but it’s more likely to occur next week.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

- Chinese EV maker Kaixin buys Middle East Bitcoin Mining company

This story speaks to the potential of China opening up to bitcoin as well. They are slowly, but as it becomes more likely, that just adds more fuel to the fire.

BREAKING: 🇨🇳 Chinese electric vehicle company, Kaixin, is buying a #Bitcoin mining company in the Middle East. pic.twitter.com/VsVpmWIKo7

— Bitcoin Archive (@BTC_Archive) November 18, 2024

A cryptocurrency plant in central New York can continue operating after a court rejected the state’s effort to shutter the facility over concerns about its climate impact.

In 2022, the New York Department of Environmental Conservation denied a required air permit to the plant on the grounds that its greenhouse gas emissions ran afoul of the state’s ambitious climate goals.

In response to a lawsuit by the corporation, State Supreme Court Justice Vincent M. Dinolfo ruled Thursday that the agency had failed to give Greenidge an opportunity to justify its alleged violation, an “interpretative error” under the law.

Greenidge has said it is in compliance with its permits and that the plant is 100% carbon neutral, thanks to the purchase of carbon offsets such as forestry programs and projects that capture methane from landfills.

No mention of the easiest defense, that bitcoin miners do not produce CO2 at all! They are as clean as EVs. Big win none the less.

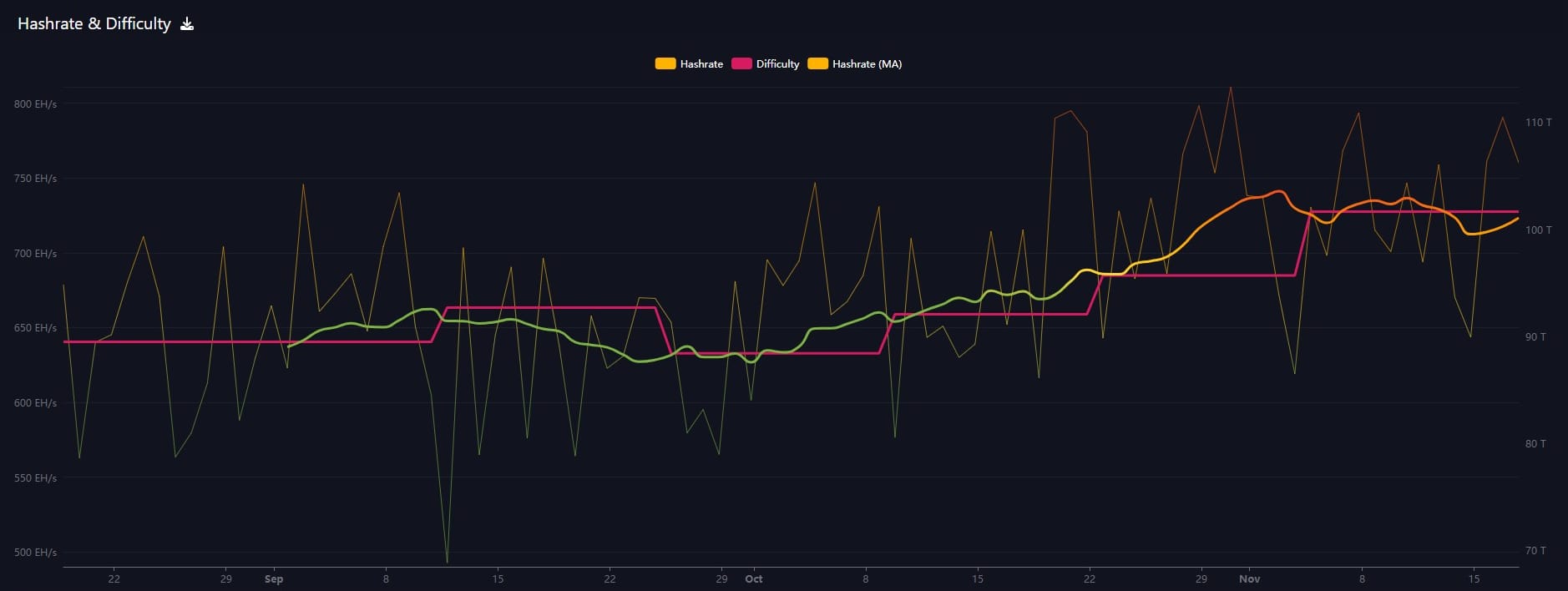

Hash rate and Difficulty

Bitcoin's hash rate has been surprisingly flat this week, with no catch up yet to the price spike last week. This is generally healthy and we should expect it to rise in the near future.

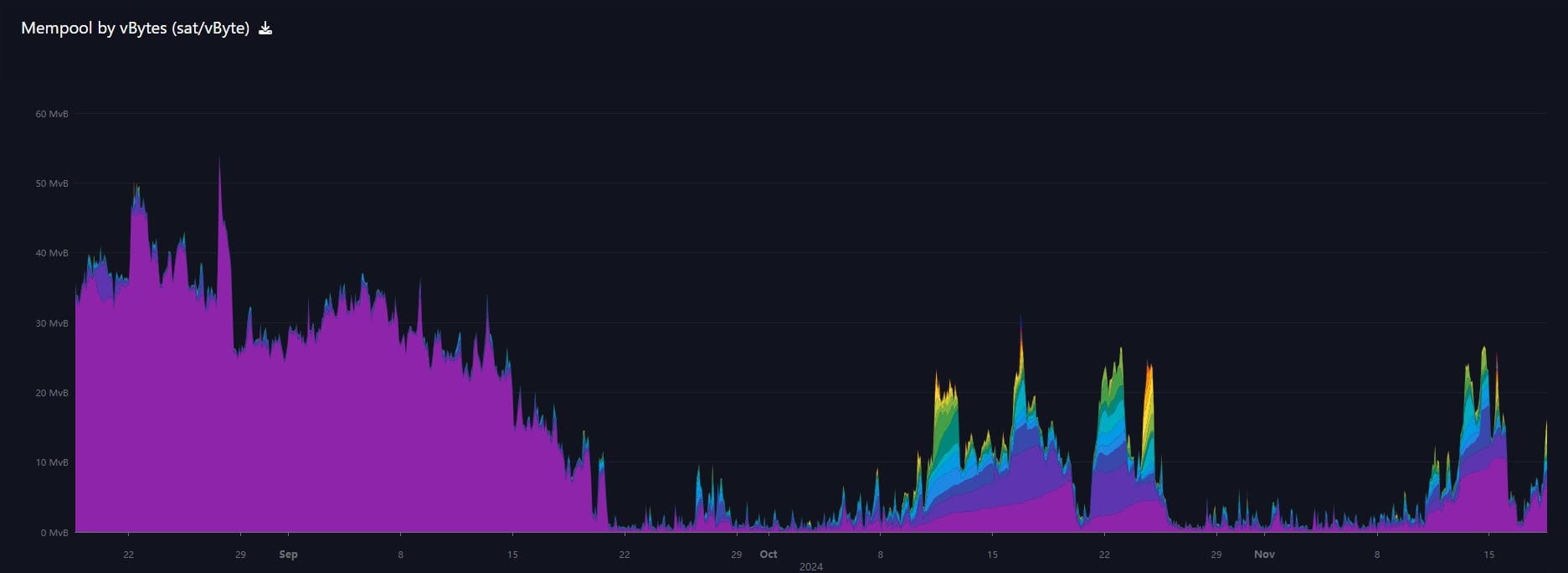

Mempool

I've removed the cheapest layer of transactions in the mempool to better see the action. As you can see, there were significant increases in fees last week, and yesterday. Still no sign of congestion as all spikes are very quickly confirmed by miners. This should help the marginal miners as this raises their income slightly.

- NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- The Evolution of Global Reserve Money - Infographic

- Key Indicators for Bitcoin's Path to $100K and Beyond - Premium

- Bitcoin In The News As It Approaches ATH, When $100k? - E413

- Bitcoin Momentum is Surging - Weekly Roundup! - E412

- What Trump’s Ross Ulbricht Pledge Could Mean For Other Campaign Promises

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com