Bitcoin Fundamentals Report #316

MicroStrategy's massive BTC accumulation, Hong Kong's tax incentives, demographic challenges, and shifting global power dynamics. Plus, bitcoin price analysis and mining headlines.

December 2, 2024 | Block 872,960

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Join NOW to enter the December Price Forecast Competition!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Consolidation |

| Media sentiment | Very Positive |

| Network traffic | Stable |

| Mining industry | Lagging price |

| Price Section | |

| Weekly price* | $95,538 (+$596, +0.6%) |

| Market cap | $1.891 trillion |

| Satoshis/$1 USD | 1046 |

| 1 finney (1/10,000 btc) | $9.56 |

| Mining Sector | |

| Previous difficulty adjustment | +1.5937% |

| Next estimated adjustment | +0% in ~13 days |

| Mempool | 108MB |

| Fees for next block (sats/byte) | $2.27 (17 s/vb) |

| Low Priority fee | $1.74 |

| Lightning Network** | |

| Capacity | 5210.84 btc (-0.0%, -2) |

| Channels | 46,537 (-0.8%, -355) |

MicroStrategy Continues to Accumulate Bitcoin

Another week, another massive bitcoin purchase by MicroStrategy (MSTR).

MicroStrategy has acquired 15,400 BTC for ~$1.5 billion at ~$95,976 per #bitcoin and has achieved BTC Yield of 38.7% QTD and 63.3% YTD. As of 12/2/2024, we hodl 402,100 $BTC acquired for ~$23.4 billion at ~$58,263 per bitcoin. $MSTR https://t.co/K3TK4msGp0

— Michael Saylor⚡️ (@saylor) December 2, 2024

This time, the company has added more than 10,000 BTC, bringing it closer to controlling 2% of bitcoin’s total supply. Considering Satoshi’s 1 million BTC and an estimated 3–4 million more likely lost forever, MicroStrategy’s holdings already surpass 2% of the potential circulating supply.

At their current pace—and with Bitcoin’s historical growth trajectory—investing in MicroStrategy effectively doubles your bitcoin exposure over a seven-year horizon. For a deeper dive into this math, check out BernieBlueShell's simple explanation.

Debanking hit the mainstream this week during Marc Andreessen's appearance on The Joe Rogan Experience.

Can't see video? Here is the link to it on X.

My take on Andreessen’s position is nuanced. While his concerns about debanking are valid, it’s worth noting that he has been a major backer of altcoin schemes, many of which are scams. Perhaps 99% of it is completely fraudulent.

We had a discussion on Telegram about this situation, and opinions differ wildly. I sympathize with the view that debanking is the particular evil here. That people will scam, but debanking is a special category of rug pull that is worse.

I will repeat my criticism of defending crypto scams against government crackdown, that force and fraud are antithetical to the consensus view of free markets. So, it is unclear which side to take when they are fighting each other. The tiebreaker for me is the impact on bitcoin. Altcoins actively divert resources and trust away from Bitcoin, and governments aren't targeting Bitcoin because it's not fraudulent.

I'll continue this in a separate blog post. Stay tuned for that.

Hong Kong to Eliminate Capital Gains Tax on Bitcoin

"Hong Kong plans to waive tax on investment gains from cryptocurrencies and other alternative assets for hedge funds, private equity funds and certain family offices as the city strives to enhance its appeal as a wealth management hub.

In a consultation paper circulated this week, seen by Reuters, the Financial Services and the Treasury Bureau proposes expanding the capital gains tax exemptions to cover overseas properties, carbon credits, private credit, virtual assets, among other assets, applicable to privately-offered funds and eligible single family offices' investment vehicles."

As you can see, this is not a bitcoin-only policy, but throwing things at the wall to see what sticks. We can take a couple things away from this: 1) China and Hong Kong are in a desperate situation, 2) in a deteriorating economic environment, the game theory favors Bitcoin. They are incentivized to embrace, not fight, its adoption.

Michael Saylor Speaks At Microsoft Shareholder Call

This was a very good short presentation. Unfortunately, I don't think it will make a difference to their vote this time. I really appreciated one of the phrases he used, "an asset without counterparty risk." I think that is the ultimate reason bitcoin will takeover.

Can't see the video. Here is a link to it on X.

Macro

Premium Post on Macro and Bitcoin Forecast

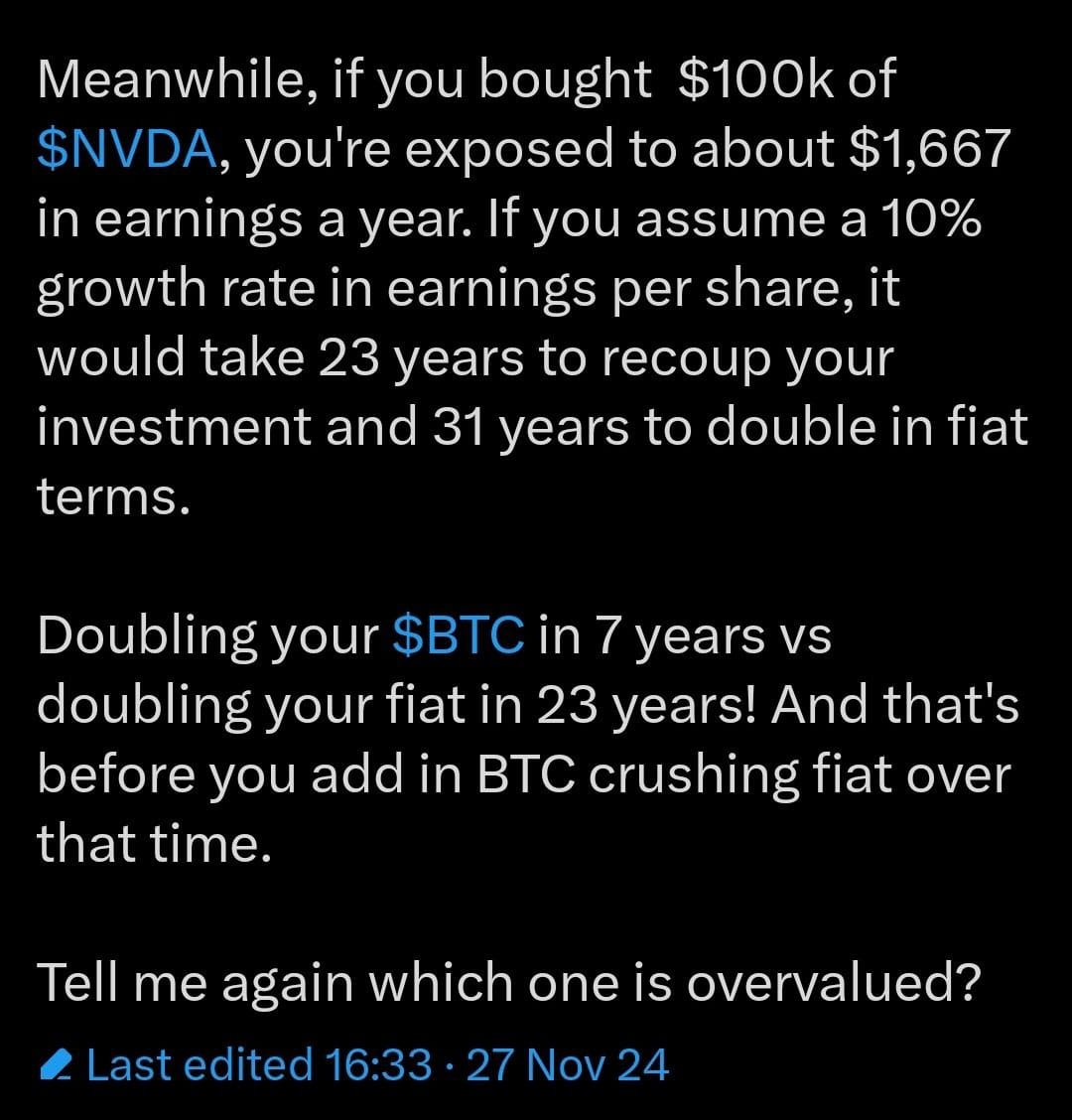

Yesterday, I published a Premium post examining the shifting macro landscape and its implications for Bitcoin. I covered Treasury yields, oil prices, Chinese government bond yields, and stocks.

One striking insight is the collapse of Chinese government bond yields to levels below the COVID-era lows. This mirrors Japan’s experience after the end of its economic miracle in 1990, when bond yields crashed and stagnated for decades. Yields are a window into future growth expectations, and China’s outlook looks bleak.

The SEC Has Approved 23/5 Trading for TradFi

Bitcoin has once again led the way, but the best TradFi could manage is 23 hours a day, five days a week. LOL.

A startup stock exchange aiming to handle trades around the clock won a US watchdog’s approval to operate a venue 23 hours daily, five days a week.

24X National Exchange, which counts Steve Cohen’s Point72 Ventures fund as a backer, secured permission to start offering sessions that span the US daytime and later add overnight trading, the Securities and Exchange Commission wrote in a notice posted Wednesday. The plan would preserve one-hour breaks starting at 7 p.m.

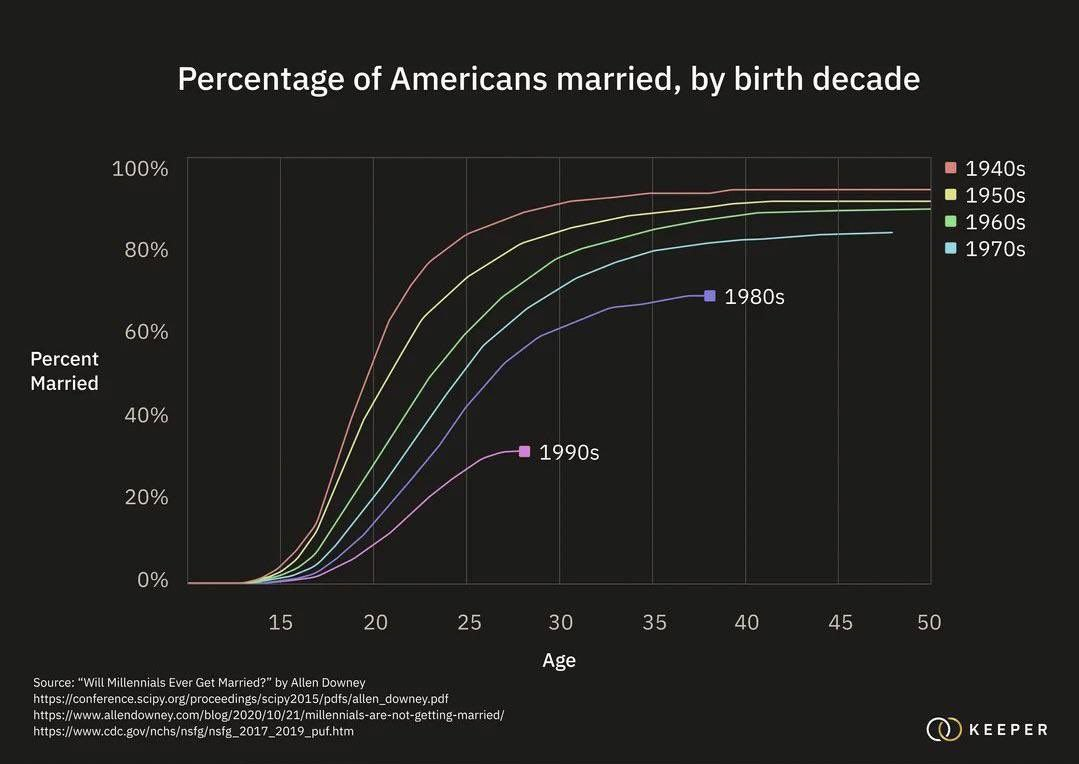

Demographic Decline: Marriage Rates are Plunging

With Bitcoin now firmly in the mainstream, demographics is the next big topic that normies will soon discover. Demographics are destiny and dictate our path into a world of declining credit and living standards throughout the rest of the century.

Above, you see the marriage rates by decade born and age. It's bad folks. Think about it this way, most children come from marriages, if the current fertility rate disaster is coming from the 1980's cohort, what is going to happen to fertility rates from the 1990's cohort, who are getting married at HALF the rate?

You can disbelieve the diagnosis or willfully bury your head in the sand, but this is happening for sure. We have an opportunity to act accordingly now, and put ourselves and our future families in the best possible situation to thrive 50 years from now.

Attacks on Populism by the Left Ramp Up

National populism is rising and hardcore leftist Marxists are losing. If they have to resort to these kinds of tactics, it's getting desperate for them.

Globalists Initiate Proxy Attacks As Escalation in Ukraine Doesn't Work

I don't claim to be an expert, but it is very interesting that as escalation in Ukraine has failed, proxies involving Russia heat up. I personally would not wish to live in Russia, but if the globalists say Putin is evil, he most likely is not. If they tell us these protestors in Georgia are "freedom fighters," they most likely are anything but.

That being said, we cannot know who the good guys are and who the bad guys are. What we can do is try to predict the outcome from the most unbiased position we can. If these are escalations by the covert Western ops, they will likely not last much passed the Trump inauguration and only hasten a US withdraw from NATO. If they are not foreign influenced plots, they are destined to fail anyway.

Whatever the case is, they are good evidence that the old order is disintegrating as I predict.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

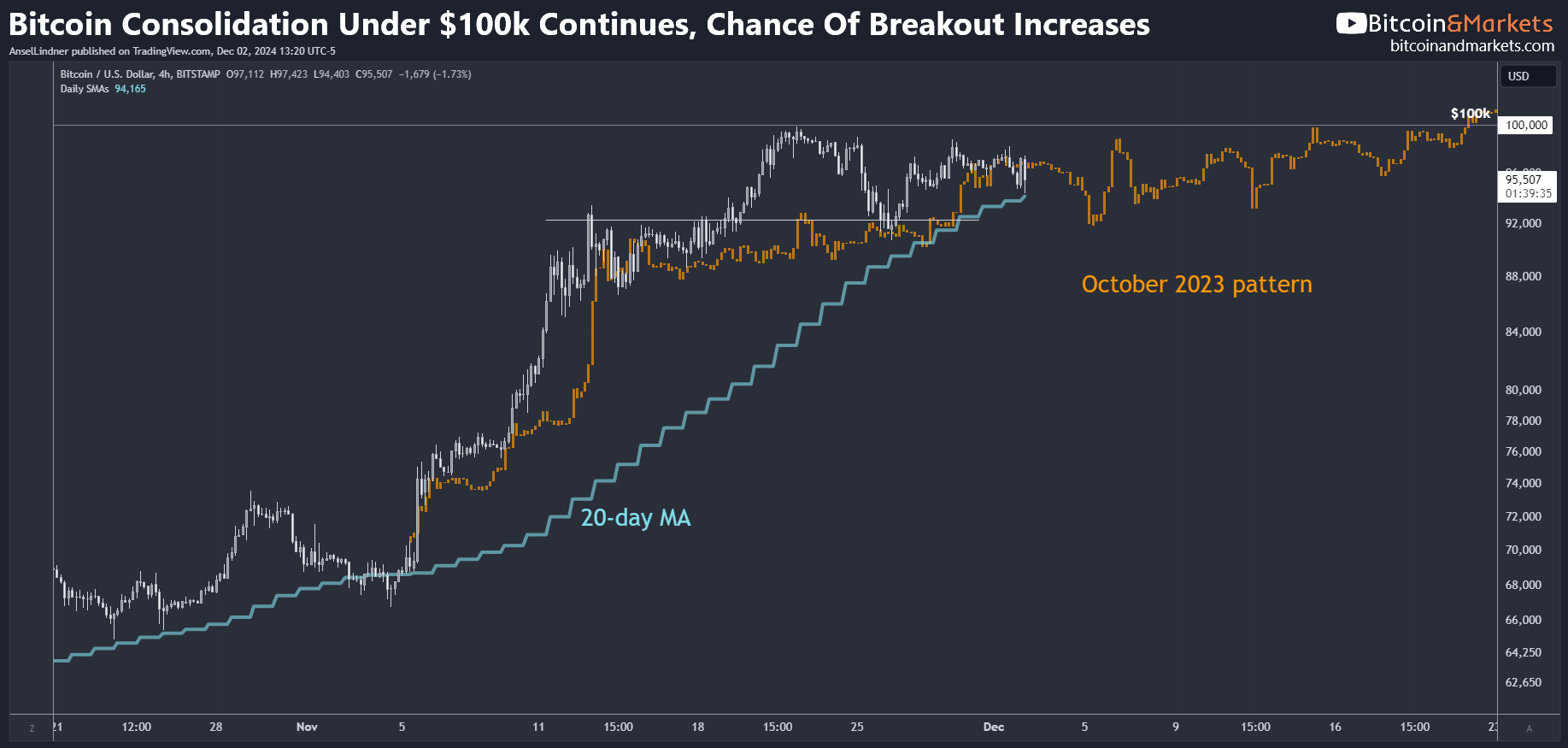

Bitcoin Charts

Last week:

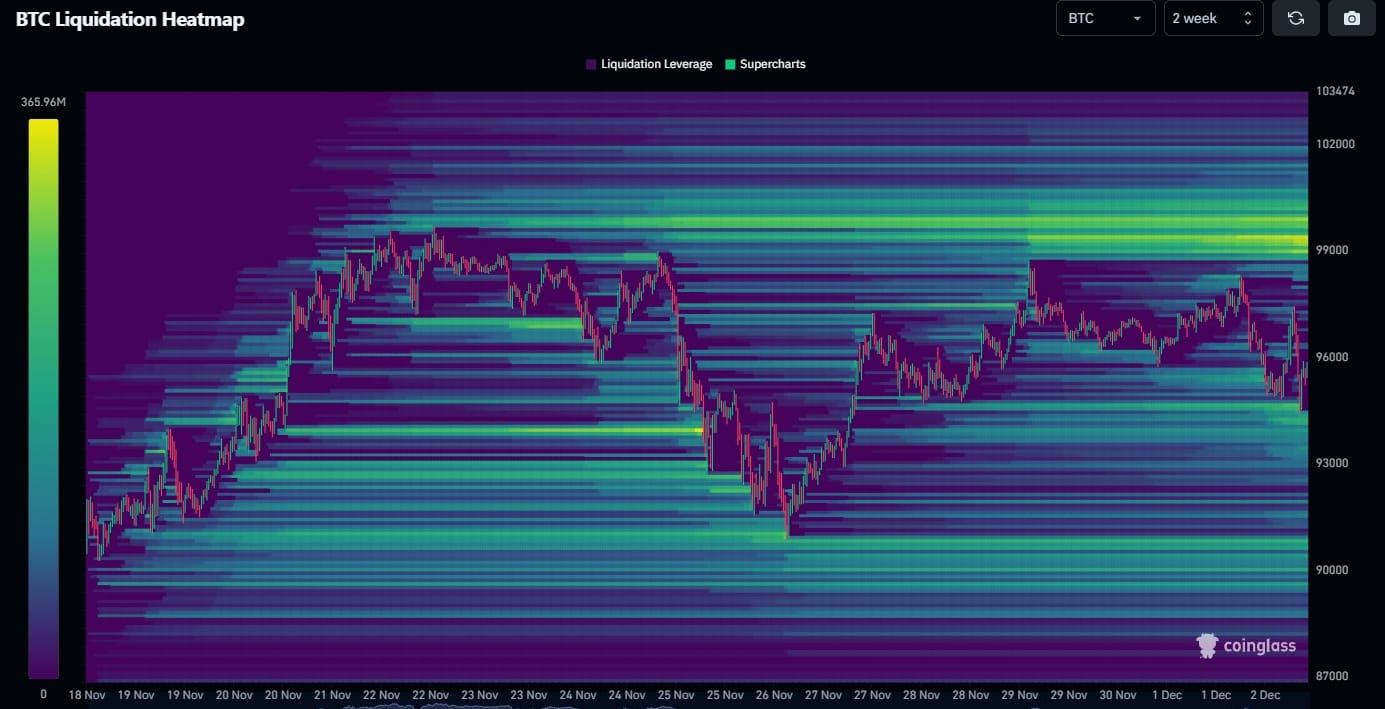

My base case for this week remains consolidation sharing characteristics with the October 2023 pattern. Supply that has come onto the market due at the $100K level has been demolished by massive buyers already. The next test will have much less resistance. [...] A breakout could happen this week, but it’s more likely to occur next week.

IDK how my Oct 2023 pattern could be any more perfect than it has been. We just continue to consolidate under that $100k level, gobbling all the available supply at that price and taking it off the market.

Thomas Lee of Fundstrat is quickly becoming my favorite pundit on CNBC. LOL He says the chase will be on above $100k.

Can't see video? Here is the link to X.

There is speculation right now on X that the US government has moved bitcoin to a Coinbase address in preparation to sell it. While that is possible, we have seen this kind of movement before and it has never preceded a sale.

Notice how Tom Lee said that OTC desks are in low supply. People have been connecting the dots between low OTC supply and MSTR buying, then adding in the US government moving bitcoin to Coinbase's OTC desk. The theory has now expanded to the US gov trying to provide liquidity to suppress the price. That simply goes too far for me. I refuse to believe in manipulation conspiracies without solid evidence. Pure speculation is not enough.

My base case for this week remains consolidation sharing characteristics with the October 2023 pattern, but with the most likely scenario of a breakout by the end of the week. There is plenty of liquidity up to and passed $100k to pull us over. Chances of a breakout increase with each passing week. We won't stay under $100k for much longer.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Bitcoin Miner Marathon Buys $618 Million Worth of BTC

Bitcoin miner Marathon Digital paid $618 million cash to acquire approximately 6,484 Bitcoin, the company said in a new SEC filing.

"MARA expects to use up to $50 million of the net proceeds from the sale of the notes to repurchase a portion of its existing convertible notes due 2026 (the 'existing 2026 convertible notes') in privately negotiated transactions with the remainder of the net proceeds to be used to acquire additional Bitcoin and for general corporate purposes," it wrote in the SEC filing, "which may include working capital, strategic acquisitions, expansion of existing assets, and repayment of additional debt and other outstanding obligations."

At the same time as the above announcement of completing the purchase of $618M in bitcoin, they announced they will be raising another $700M for their next purchase.

Putin Signs Law on Cryptocurrency Tax

This new bitcoin law does the following:

- Defines bitcoin as property

- Exempts mining and sales from VAT

- Requires miners register

- Creates a tiered capital gains tax (13% up to $22k, 15% above that)

- Establishes corporate tax of 25%

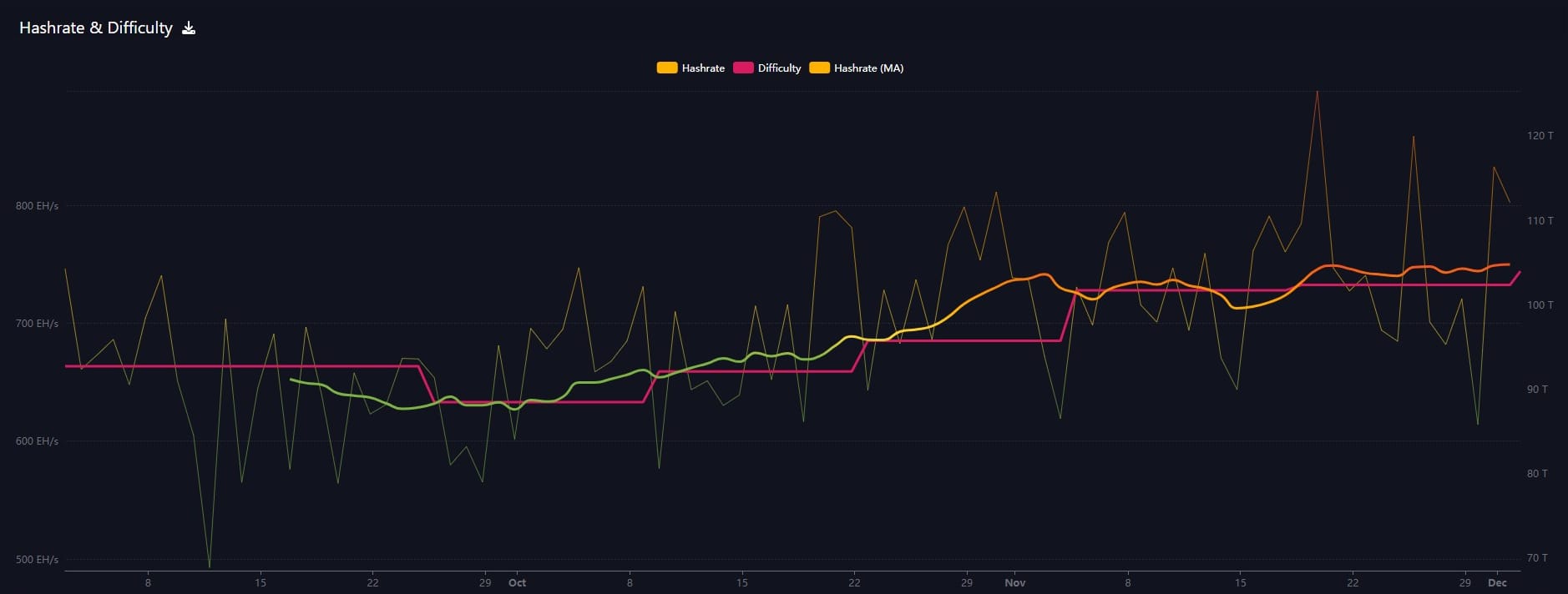

Hash rate and Difficulty

Hash rate has fluctuated this week but the moving average has remained stable. Difficulty adjusted upward by 1.5% this morning to a new ATH.

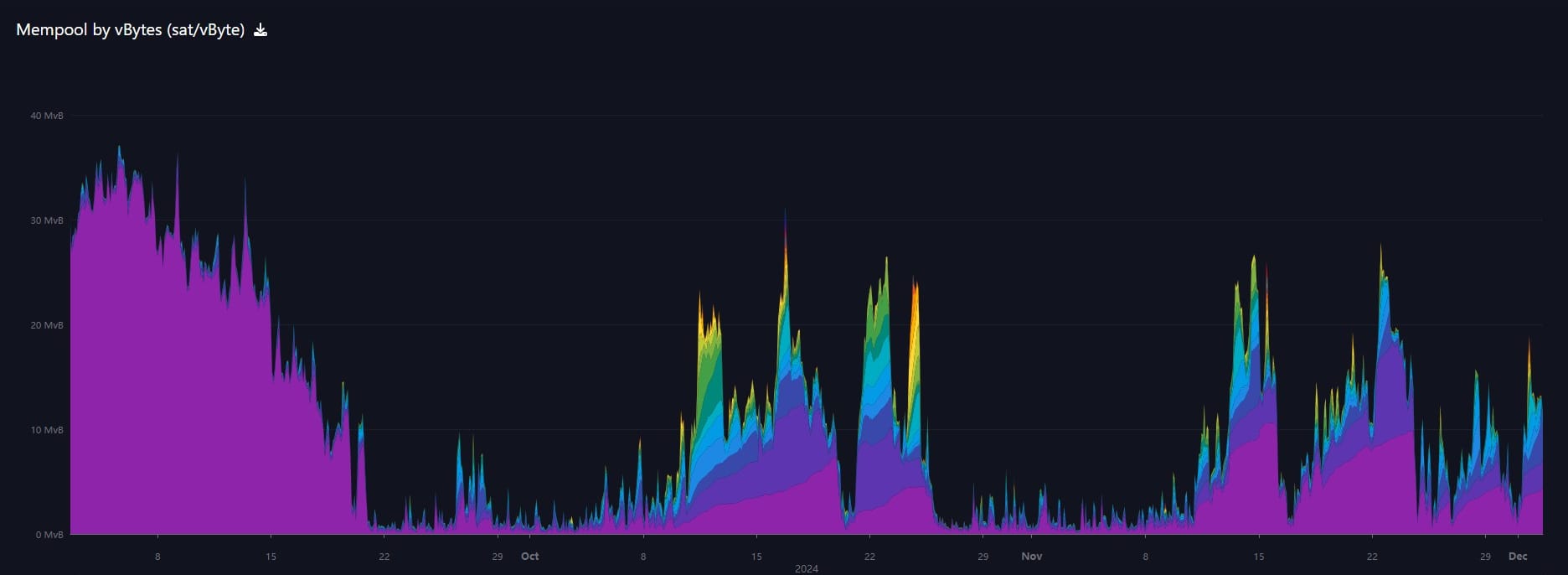

Mempool

The mempool has been surprisingly quiet over the past couple of weeks. I expect fees to spike as price surpasses $100k. If you need to consolidate UTXOs, now could be your last chance before fees spike for several weeks.

I stripped out the cheapest fee transactions to show the action this week more clearly.

Disclaimer: I do not support any of these projects and by default assume they are scams. However, for sake of completeness on this newsletter, I'll try to keep you informed on what's going on in Layer 2's.

Bitfinity Network launches Bitcoin L2 with $12M backing

Bitfinity Network, a new Bitcoin layer-2 (L2) solution, has launched with $12 million in funding to create Ethereum Virtual Machine (EVM)-compatible decentralized finance (DeFi) functionality for Bitcoin.

EVM is a marketing scam that hasn't borne sustainable fruit on Ethereum, so they are trying to use it with bitcoin now. Bitcoin is not in need of DeFi functionality like this. Bitcoin is the only truly decentralized financial tool, all the rest have been proven to be centralized and/or scams.

Bitcoin Layer-2 GOAT Network Will Let Users Stake Dogecoin to Earn Crypto

This is has red flags all over it.

Users will be able to accrue rewards in the form of Bitcoin, which is used to pay transaction fees on GOAT Network, as well as GOAT Network’s planned token, the project's Core Contributor and Metis co-founder Kevin Liu told Decrypt in an interview.

"To secure the network, we need some tokens to be staked,” Liu said. “Bitcoin is a natural selection, but our model supports multiple assets.”

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Retail Traders Are Coming: New Google Trends Data For Bitcoin

- Macro Rundown Amid Bearish Shift, As Bitcoin Approaches $100k - Premium

- MicroStrategy’s Bitcoin Blueprint Isn’t A Hunt Brothers Silver Scheme - FORBES

- What Trump’s Ross Ulbricht Pledge Could Mean For Other Campaign Promises - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com