Bitcoin Fundamentals Report #319

The bitcoin price cools as corporate buying slows, macro and geopolitical calm before the storm, bitcoin price analysis, and miners buying bitcoin instead of ASICs.

December 23, 2024 | Block 876,069

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Consolidation |

| Media sentiment | Very Positive |

| Network traffic | Steady |

| Mining industry | Buying |

| Price Section | |

| Weekly price* | $92,782 (-$13,001, -12.3%) |

| Market cap | $1.835 trillion |

| Satoshis/$1 USD | 1079 |

| 1 finney (1/10,000 btc) | $9.26 |

| Mining Sector | |

| Previous difficulty adjustment | +4.4294% |

| Next estimated adjustment | +0.8% in ~6 days |

| Mempool | 102MB |

| Fees for next block (sats/byte) | $0.78 (6 s/vb) |

| Low Priority fee | $0.65 |

| Lightning Network** | |

| Capacity | 5044.38 btc (-0.8%, -42) |

| Channels | 45,949 (-0.4%, -172) |

Nic Carter With Controversial Bloomberg Interview

Notorious crypto scam financier Nic Carter was interviewed by Bloomberg and asked about the likelihood of a Strategic Bitcoin Reserve. His comments were quite controversial on X.

Can't see video? Original tweet.

To sum up his points:

- We can reasonably expect the USG to maintain current stockpile.

- Acquiring more bitcoin AND moving away from the credit-backed system to a bitcoin-backed system is unlikely.

Notice the lumping in an outright change to the monetary system, which is above and beyond anything even remotely touched on by Trump. It's a straw man.

That is not to say I think the chances are very high that we get a bitcoin strategic reserves right away. I think Nic is right that the US will maintain their current stockpile with nearly 100% certainty. It is also likely that the Treasury will use some of the $200 billion Exchange Stabilization Fund to buy bitcoin. It will then come down to Congress to pass the Sen. Lummis bill.

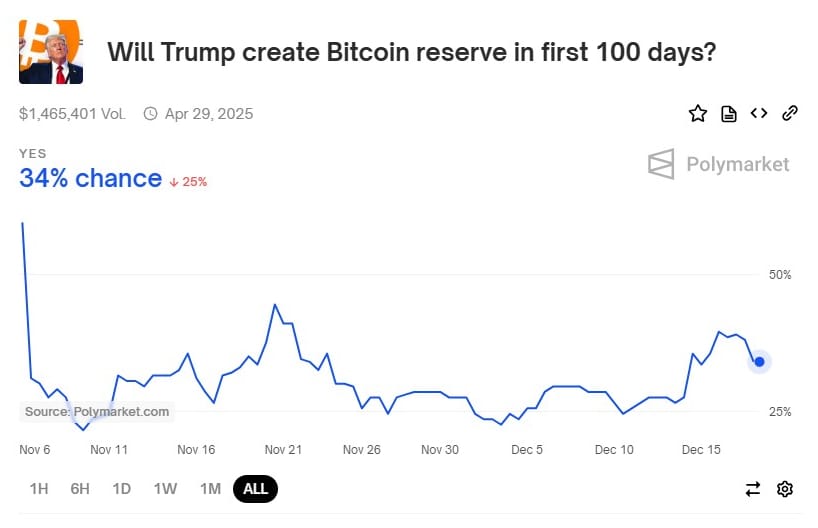

Regarding the latter bill, it is my opinion that the odds for a relatively quick passing is 50/50. The current better markets has it as a 34% chance in the first 100 days, which is ballpark fair odds.

But Nic doesn't go here, he wants to say there is very little chance of a bitcoin backing to the dollar. Of course, no one is talking about that yet. We will, but give it another 4 years.

MicroStrategy Continues to Accumulate Bitcoin

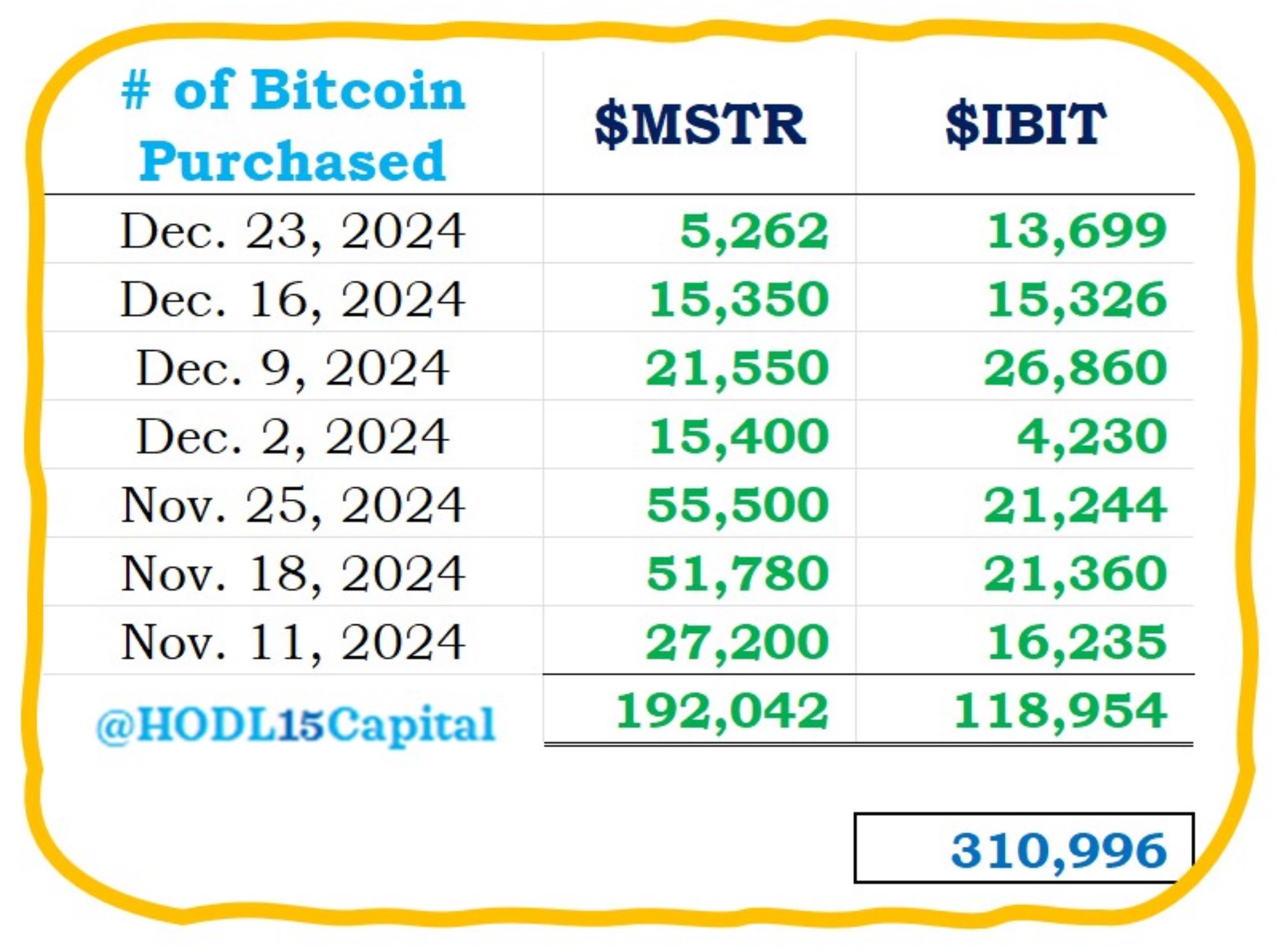

MicroStrategy has acquired 5,262 BTC for ~$561 million at ~$106,662 per bitcoin and has achieved BTC Yield of 47.4% QTD and 73.7% YTD. As of 12/22/2024, we hodl 444,262 $BTC acquired for ~$27.7 billion at ~$62,257 per bitcoin. $MSTR https://t.co/asDGerBV7q

— Michael Saylor⚡️ (@saylor) December 23, 2024

There is a noticeable slowdown here in the last week for MSTR buying. This could be for a few reasons.

- EOY rebalancing by MSTR and customers.

- Slowdown in demand near the EOY.

- A change is strategy.

Trump Comptroller Joins MicroStrategy Board

Michael Saylor has brought on 3 new members of the MicroStrategy board. These selections could be intended to quiet fears of irresponsibility levied at the company's successful strategy.

Brian Brooks, former Acting Comptroller of the Currency, joins MicroStrategy’s Board of Directors. pic.twitter.com/jjCsKwlERO

— TFTC (@TFTC21) December 20, 2024

Rumors of Nation State Adoption

Last week, several sources of rumors out of the Abu Dhabi bitcoin conference started circulating about nation state adoption of bitcoin. The main rumor is that the UAE has already created a stockpile surpassing the US' of 200,000 bitcoins.

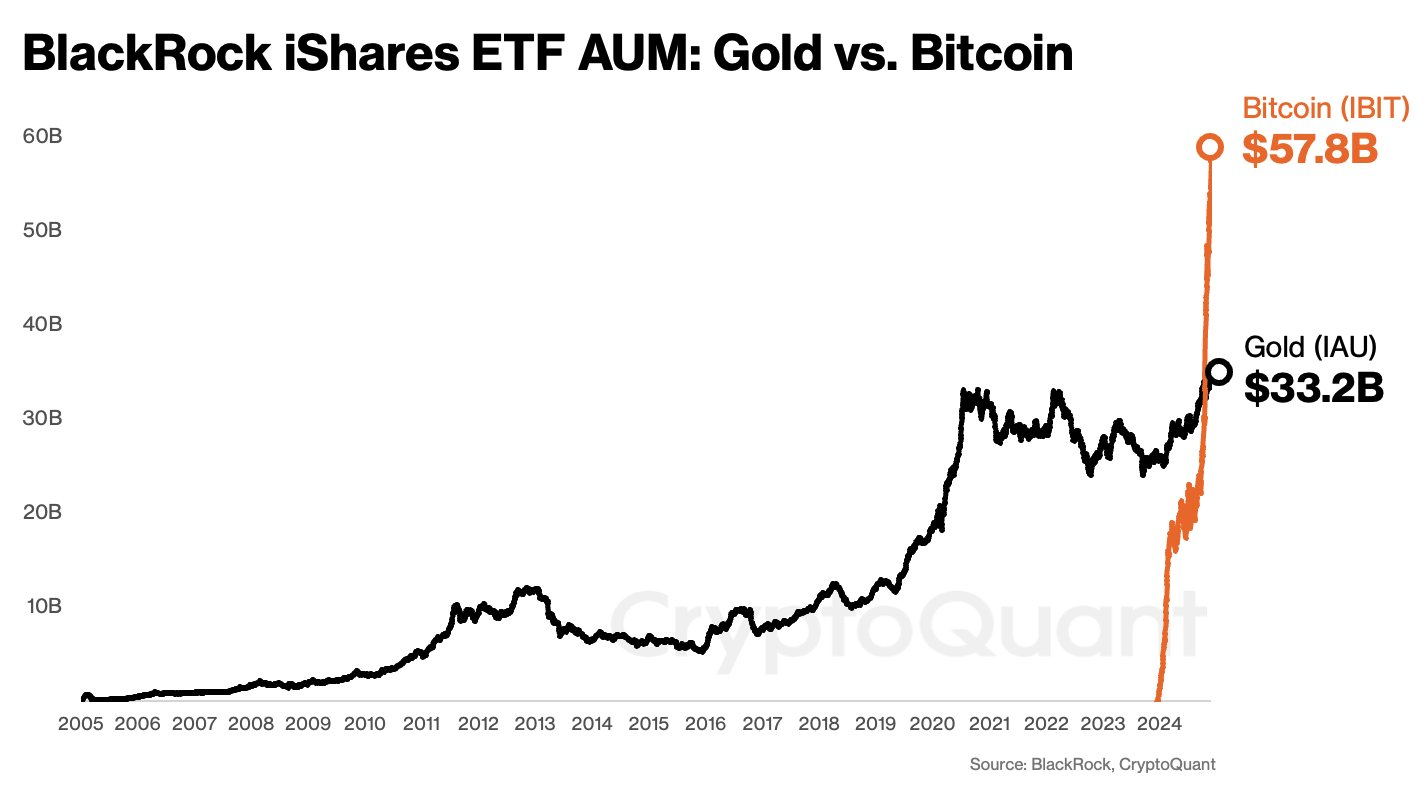

Bitcoin ETFs' size surpasses gold ETF size within 1 year

This is an absolute amazing chart. It goes to show that it is bitcoin not gold that will be chosen for the next sound money era. Yes, this has been helped by the relatively large bitcoin gains, but something remains as true today as 10 years ago when I said it for the first time - Bitcoin is actively doing what gold tries to do passively. Its incentives are aligned and the massive upside is convincing more and more people. Gold does not have the same upside promise.

Macro

FOMC cut rates last week as expected

It was no surprise to readers and listeners of Bitcoin & Markets that the Fed decided to cut by 25 bps. Nothing significant to report about the cut itself, they just followed what was priced in.

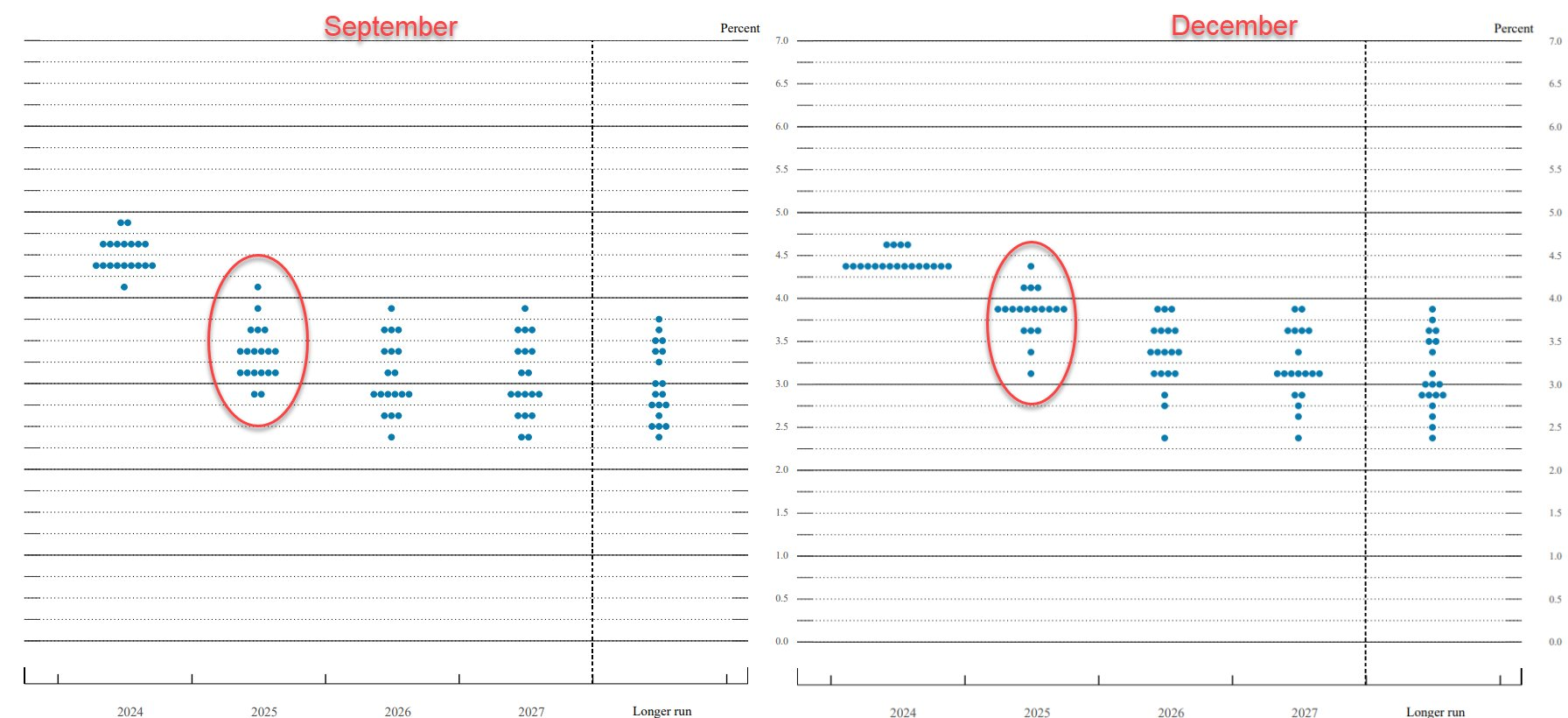

The dot plots from the Summary of Economic Projections (SEP) is where the controversy starts. FOMC members noticeably moved up their yield projections for 2025, now only expecting 2 cuts.

In my response last week, I pointed out the reason the FOMC is always behind. As Milton Friedman warned us, that if the Fed is "data driven" they will always be behind, and are unable to see a recession coming. Their "projections" are no better than the latest print of PCE or other economic indicators. As I stated on my stream, they have no ability to add insight or forecast downturns period.

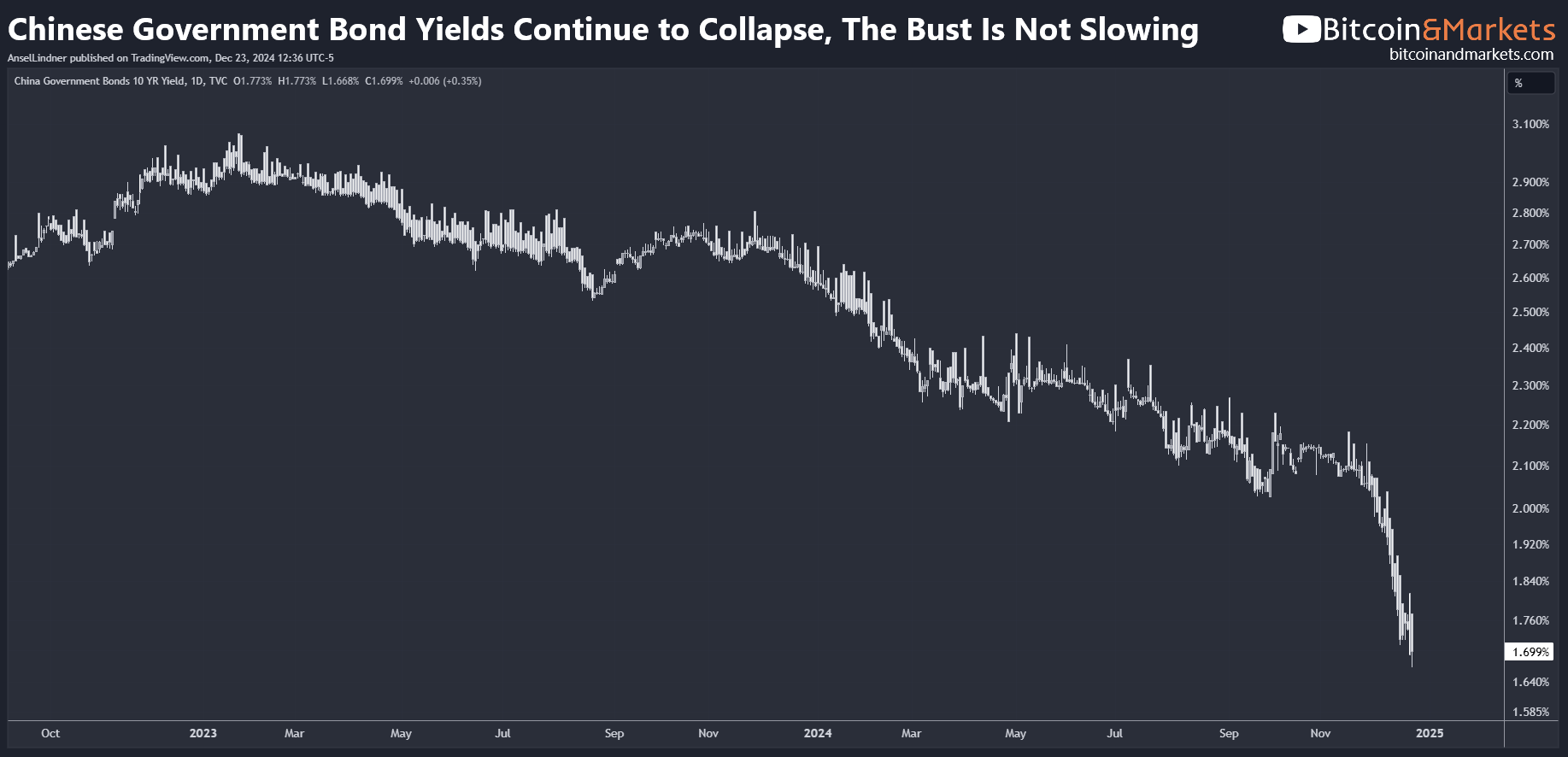

Chinese Government Bond Yields Collapse

The economic collapse in China is not slowing, it is accelerating. So far the currency has held on, staying below 7.3 CNY/USD, but that is looking increasingly likely to break. China can stimulate production, but they cannot stimulate demand. What happens when you overproduce by an insane amount?

The China story right now is basically the real estate collapse has ruined 70% of household savings, leaving no ability to boost domestic consumption. They have to boost manufacturing output (not a problem in a communist country) but they have no buyers. No domestic buyers, fewer and fewer international buyers. They're going to run into a massive wall sooner or later, and it's going to be bad.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

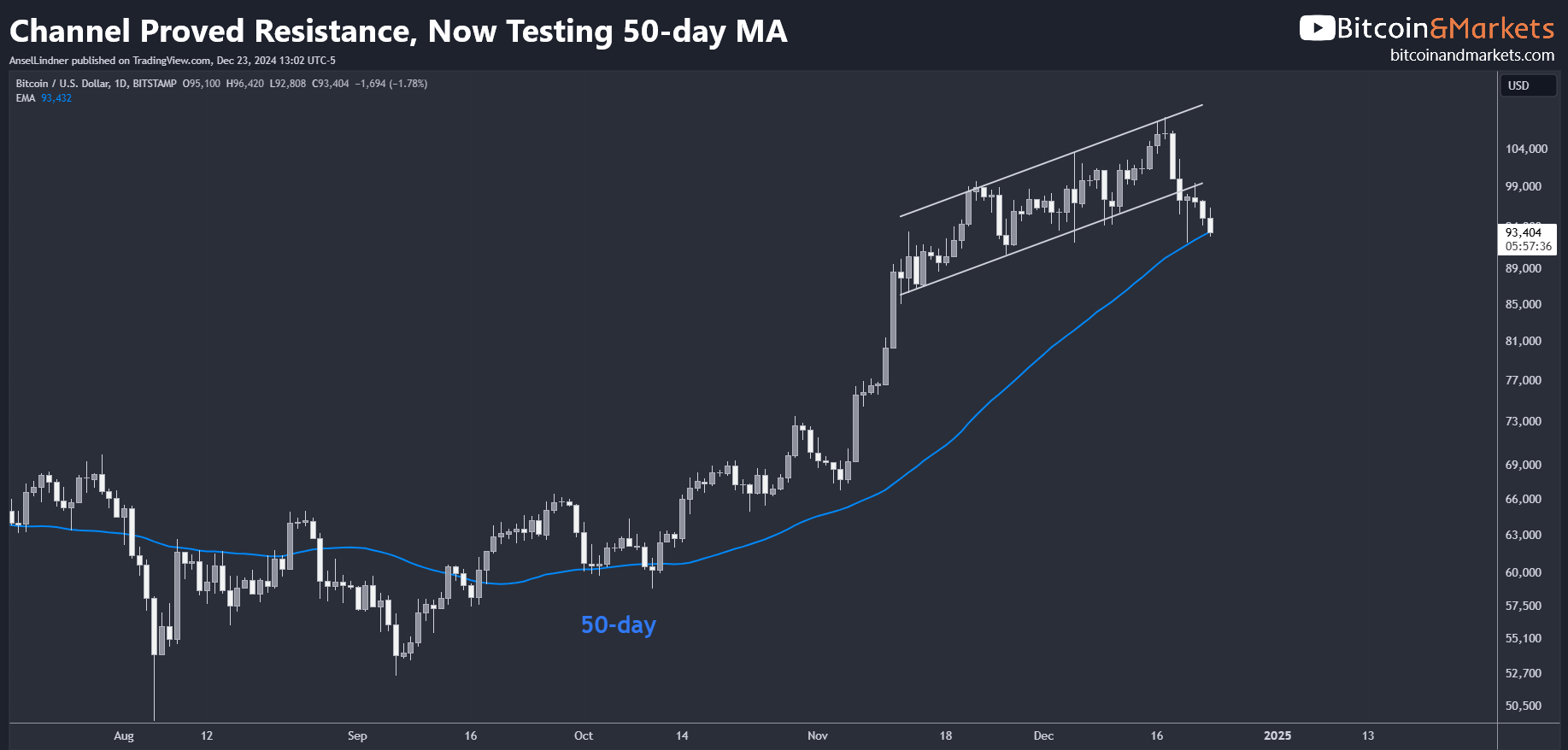

"There is potential resistance from this price channel. However, I do not think it will be significant since there are cleaner more impactful trend lines already broken."

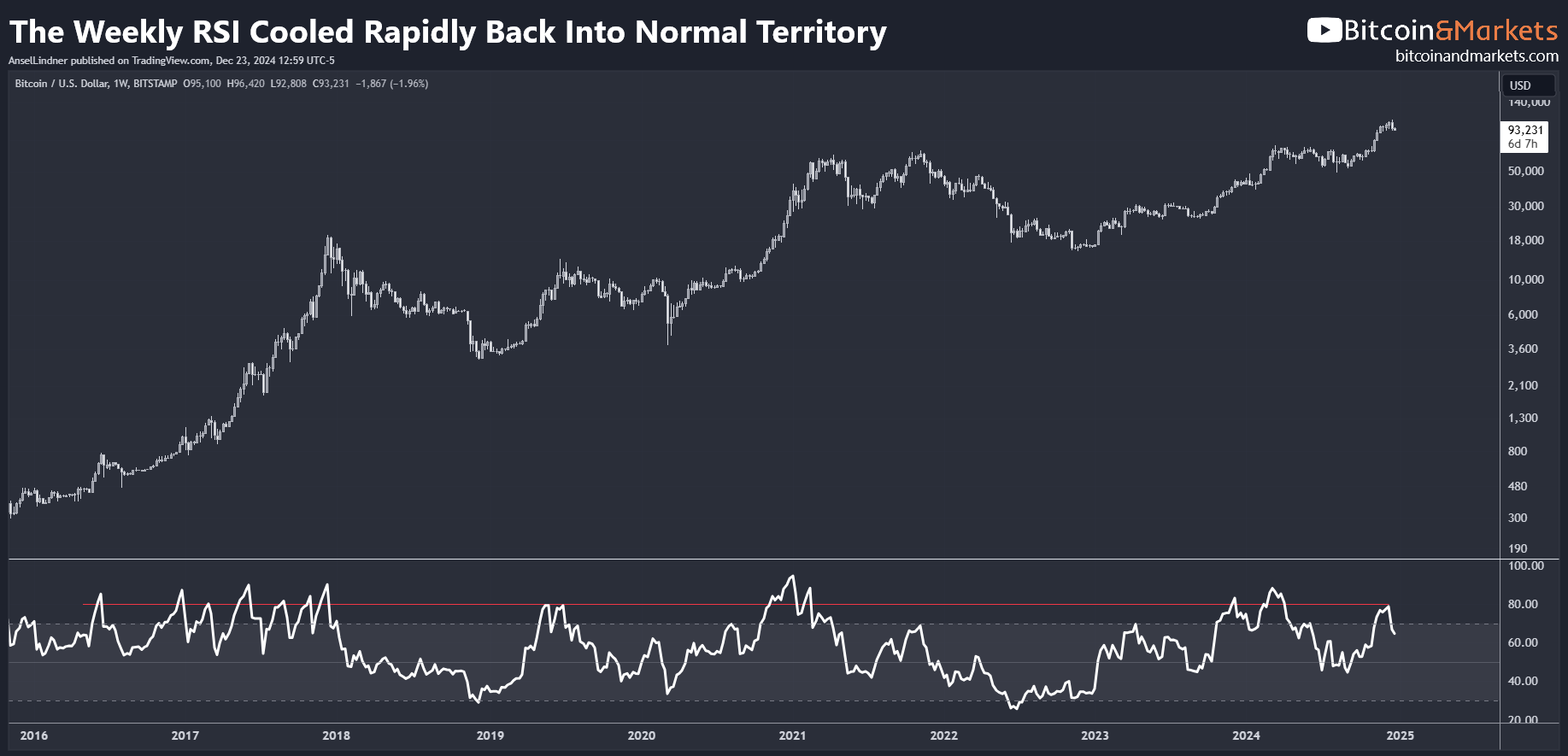

"However, when we zoom out to the weekly chart, RSI is elevated. It is currently at 80, which is not an extreme, but should be considered elevated, resulting in an increased risk of a correction."

Last week, I was wrong on my overall forecast, but right to point out the upper band of the channel as possible resistance.

The warning about the weekly RSI was also pretty good. Where I went wrong was expecting the rally would necessarily continue due to intense positive developments in the news cycle. It became so bullish, there had to be a cool down period.

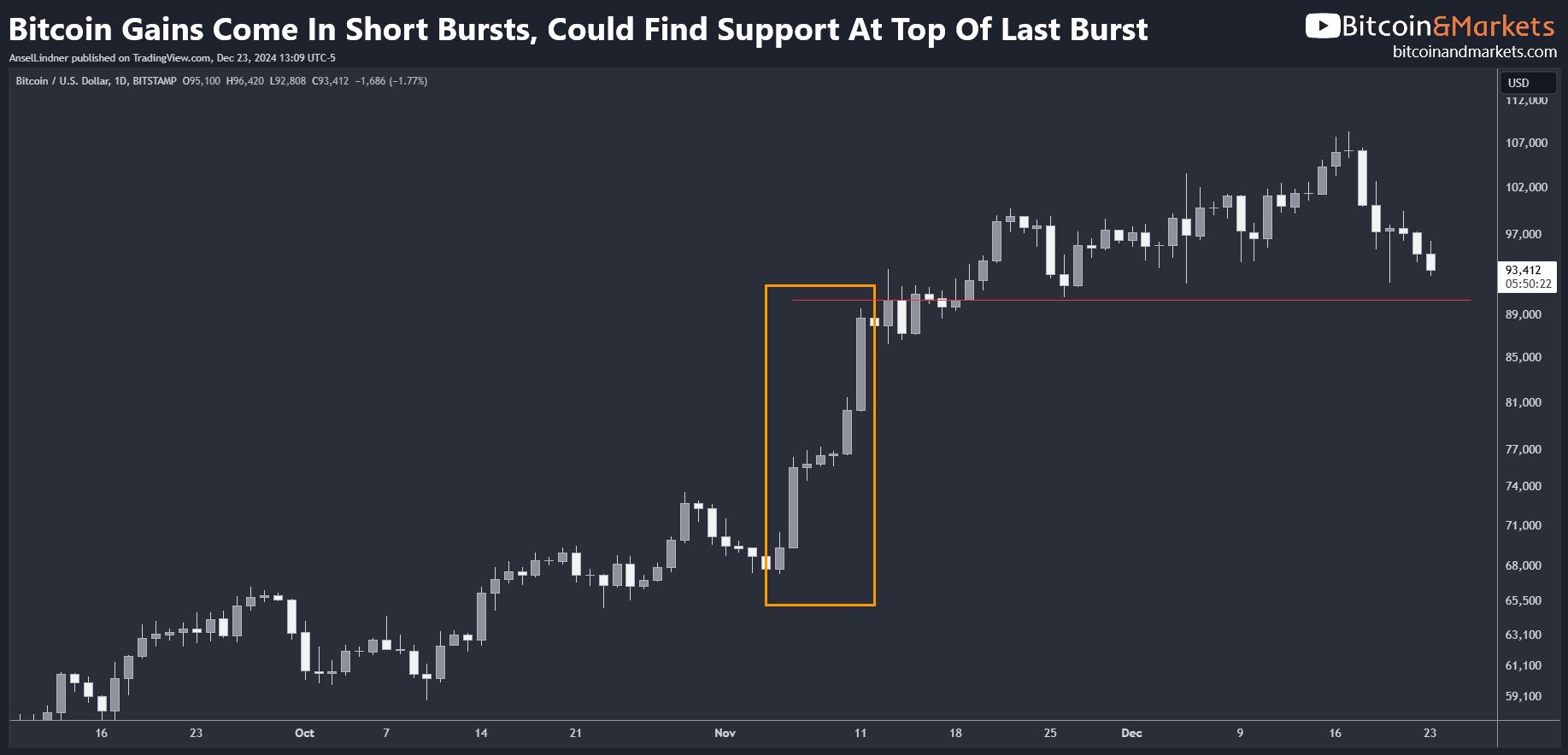

As of now, it seems the bitcoin breakout is going to be delayed by a while. One feeling I'm getting from the market is of an adrenaline dump. Bitcoin has rallied 44% from the October takeoff point of $60k. Most of the gains had occurred in a very brief window of 6-7 days. This is the typical behavior we should expect to continue.

There is a chance for support at roughly the red line. This would be support from the top of the last moon shot, about $90k. If we break below there, we are looking at a much longer consolidation.

The next move higher will also likely be over a brief period. We will have to pay attention to breakout set ups (it won't come out of no where), and be prepared for a week or two of outrageous rises.

A powerful factor affecting price at the end of the year is rebalancing pressure. If you are a large fund with a 2% allocation to bitcoin, and it has doubled relative to the market in general, you will have to sell to get back to 2%. This pressure might spill over into the new year, but will ultimately be temporary.

This is not the top of the cycle. If that was the top of the cycle, bitcoiners in general will have to go back to the drawing board. It would mean Blackrock is wrong, the 4-year cycle is wrong, the seismic shift toward larger adoption is wrong, our understanding of the incentives is wrong, the state of the traditional system is wrong. IOW many people, the most educated about the asset and the financial system, are deeply wrong about price.

It remains to be seen if this is the start of the longer consolidation I have been talking about. We could range until after the inauguration. However, if we hold above $90k, there could be a significant rally on the rumor prior. The risk of a major correction is limited, with the caveat that thinner market volume around the holidays could provide an opportunity, with rebalancing selling, for a temporary dip. If you have longer than a 1 month time horizon, it should not be too concerning. Remember, if you are new, have a long term mindset.

My base case for this week is to hold $90k. With a slight edge to the possibility of a recovery above $100k.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Chinese company comes out as 3rd largest miner

This was a bit of an out-of-the-blue surprise. According to a press release from back on November 15th, Cango purchased bitcoin miners with $256M in cash. Cango is a Shanghai auto financing company, making this move somewhat odd. But it also speaks to the ability to mine in China, which would be a major pivot for the second largest economy.

Bitcoin Mining Giant MARA Gobbles Up $1,530,000,000 Worth of BTC As Fellow Miners Add to Crypto Treasuries

Bitcoin (BTC) mining company MARA says it acquired 15,574 BTC for $1.53 billion after raising $1.925 billion from its zero-coupon convertible notes offerings in November and December.

The company says it plans to buy more Bitcoin as it achieves a BTC yield of 22.5% quarter-to-date (QTD) and 60.9% year-to-date (YTD).

Hut 8 says it just purchased approximately 990 BTC for $100 million, increasing its Bitcoin reserve to a total of 10,096 BTC worth around $983.1 million based on the asset’s current value.

Riot Platforms also recently purchased 5,117 BTC using company-issued bonds, increasing its Bitcoin holdings to 16,728 BTC, which is now worth $1.63 billion.

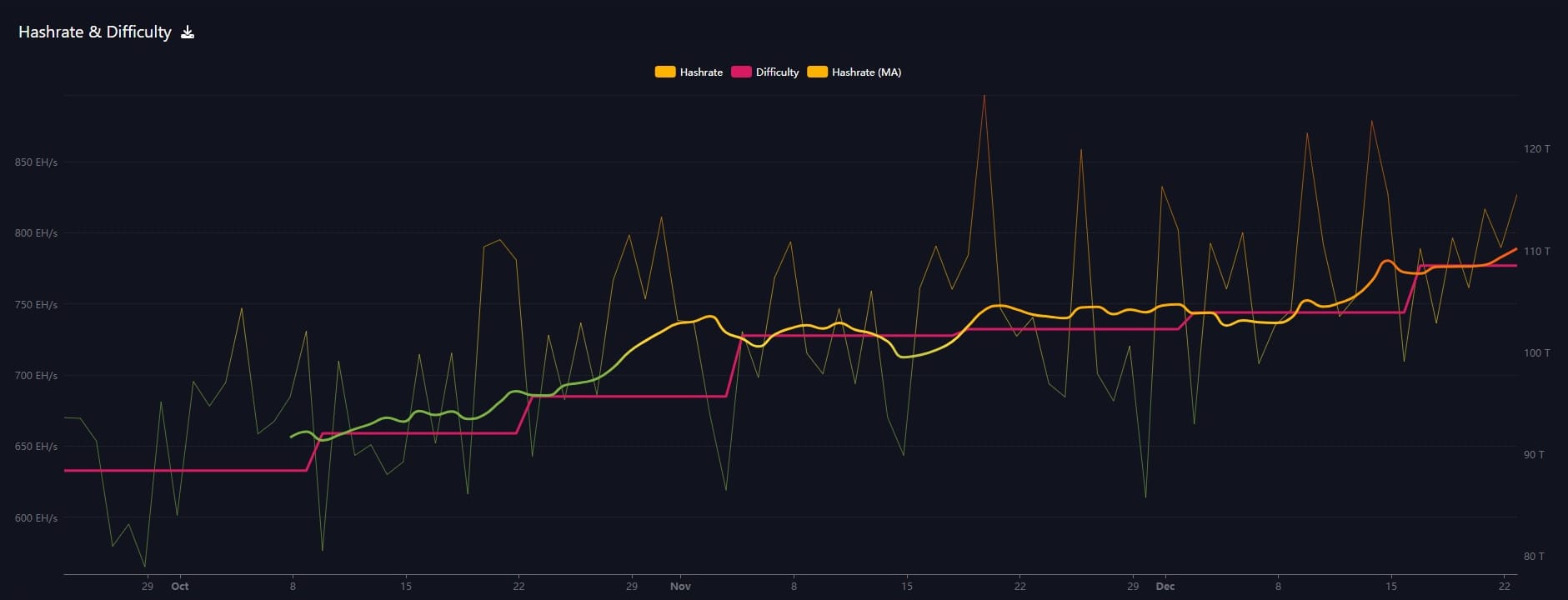

Hash rate and Difficulty

Hash rate has consistently moved higher throughout the last week in a less volatile pattern than usual. Hash rate still has not fully adapted to the higher price of the last couple of months, but is starting to show signs of stable advancement.

Recent attention by miners of raising money to simply buy bitcoin, has delayed other potential uses of funding, like expanding hash rate. The opportunity to raise money is just too easy right now. It is possible that we don't see rapid rises in hash rate until a long term consolidation in price, and frenzy for bitcoin related convertible debt has subsided.

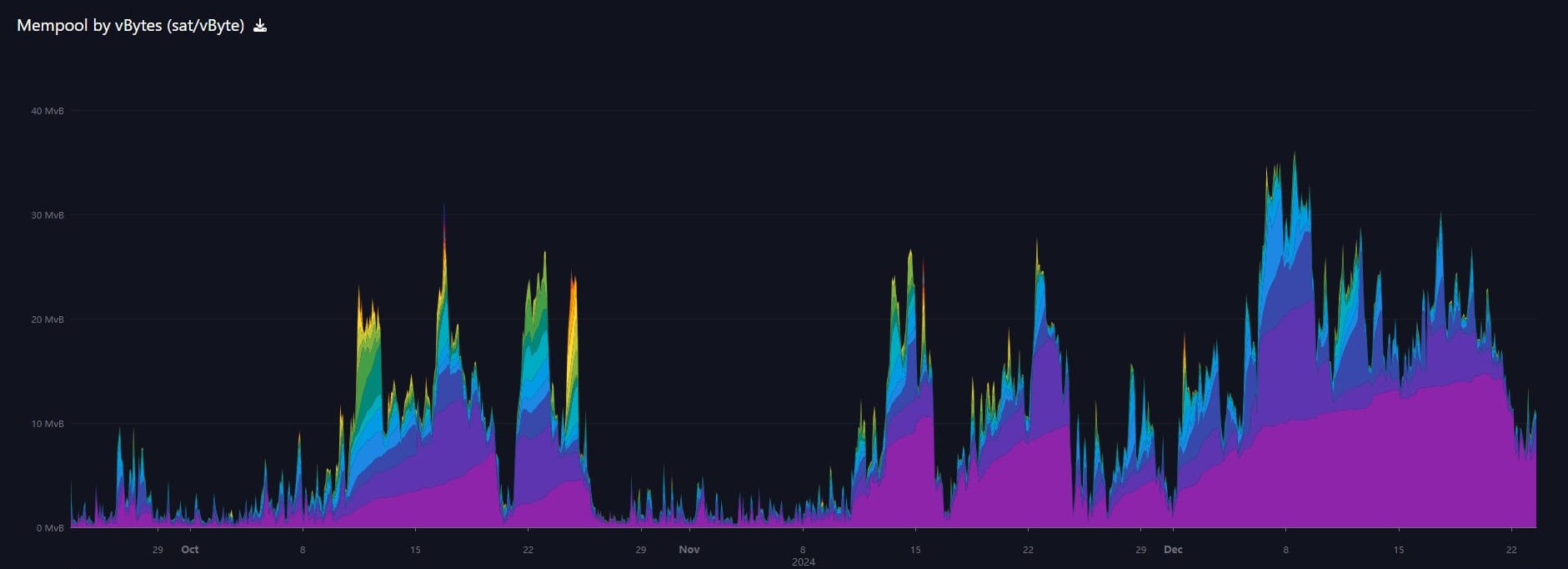

Mempool

The mempool has slightly decreased this week. My usual interpretation of this is a decreasing risk of a major sell off in price as it seems there is less urgency to move coins.

NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Why Will Bitcoin Be Monetized, If Gold Was Demonetized?

- Endogenous Money and Bitcoin: A Shift in the Monetary Order

- Answering The Critics Of The Bitcoin Reserve Bill

- 10Y Yield and CPI Connection - Premium

- Google’s Quantum Computing Leap: What It Means For Bitcoin’s Security - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com