Bitcoin Fundamentals Report #320

A weekly roundup including Tether FUD, Russia using bitcoin for trade, Chinese yields collapse, price holding $90k and mining industry news.

December 30, 2024 | Block 877,094

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Consolidation |

| Media sentiment | Very Positive |

| Network traffic | Low |

| Mining industry | Steady |

| Price Section | |

| Weekly price* | $94,351 (+$1569, +1.7%) |

| Market cap | $1.870 trillion |

| Satoshis/$1 USD | 1058 |

| 1 finney (1/10,000 btc) | $9.44 |

| Mining Sector | |

| Previous difficulty adjustment | +1.1605% |

| Next estimated adjustment | +2% in ~12 days |

| Mempool | 72MB |

| Fees for next block (sats/byte) | $0.40 (3 s/vb) |

| Low Priority fee | $0.40 |

| Lightning Network** | |

| Capacity | 5052.04 btc (+0.2%, +8) |

| Channels | 45,420 (-1.2%, -529) |

Coinbase Delists Tether for EU Customers

There is a lot of FUD about Tether over the last several days. The story is that Tether is going to be out of compliance for the new EU MiCA regulations, and will be delisted from all exchanges.

First, those claims are unsupported, Tether is not out of compliance and hasn't been told it is out of compliance. Second, only Coinbase has delisted Tether pairs in Europe. This is very suspicious, being that Coinbase has major vested interest in Circle, Tether's largest competitor.

It has been Circle, and bitcoin enemy Jeremy Allaire likely behind most of the FUD over the years against Tether.

Russia is Using Bitcoin in Foreign Trade

This year, Russia permitted the use of cryptocurrencies in foreign trade and has taken steps to make it legal to mine cryptocurrencies, including bitcoin. Russia is one of the global leaders in bitcoin mining.

"As part of the experimental regime, it is possible to use bitcoins, which we had mined here in Russia (in foreign trade transactions)," Siluanov told Russia 24 television channel.

"Such transactions are already occurring. We believe they should be expanded and developed further. I am confident this will happen next year," he said, adding that international payments in digital currencies represent the future.

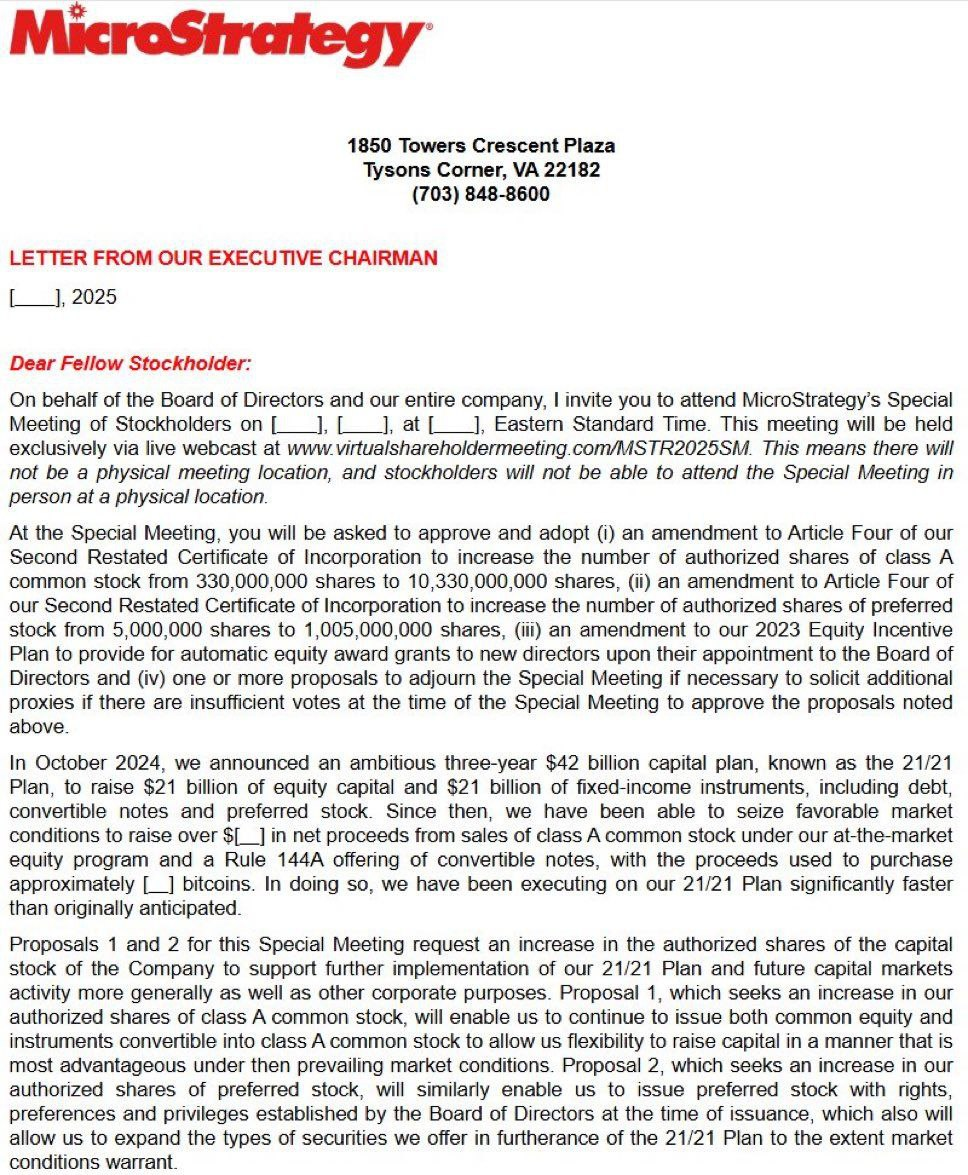

MSTR to Vote on Issuing 10 Billion More Shares to But Bitcoin

This new plan expands on MicroStrategy's earlier $42 billion plan. At current share price this would amount to ~$3 trillion, of course, phased in over a couple years to avoid harming shareholders. MSTR would then turn around and buy bitcoin with it.

This plan has not been voted on, and I'm not sure when it will be voted on.

Macro

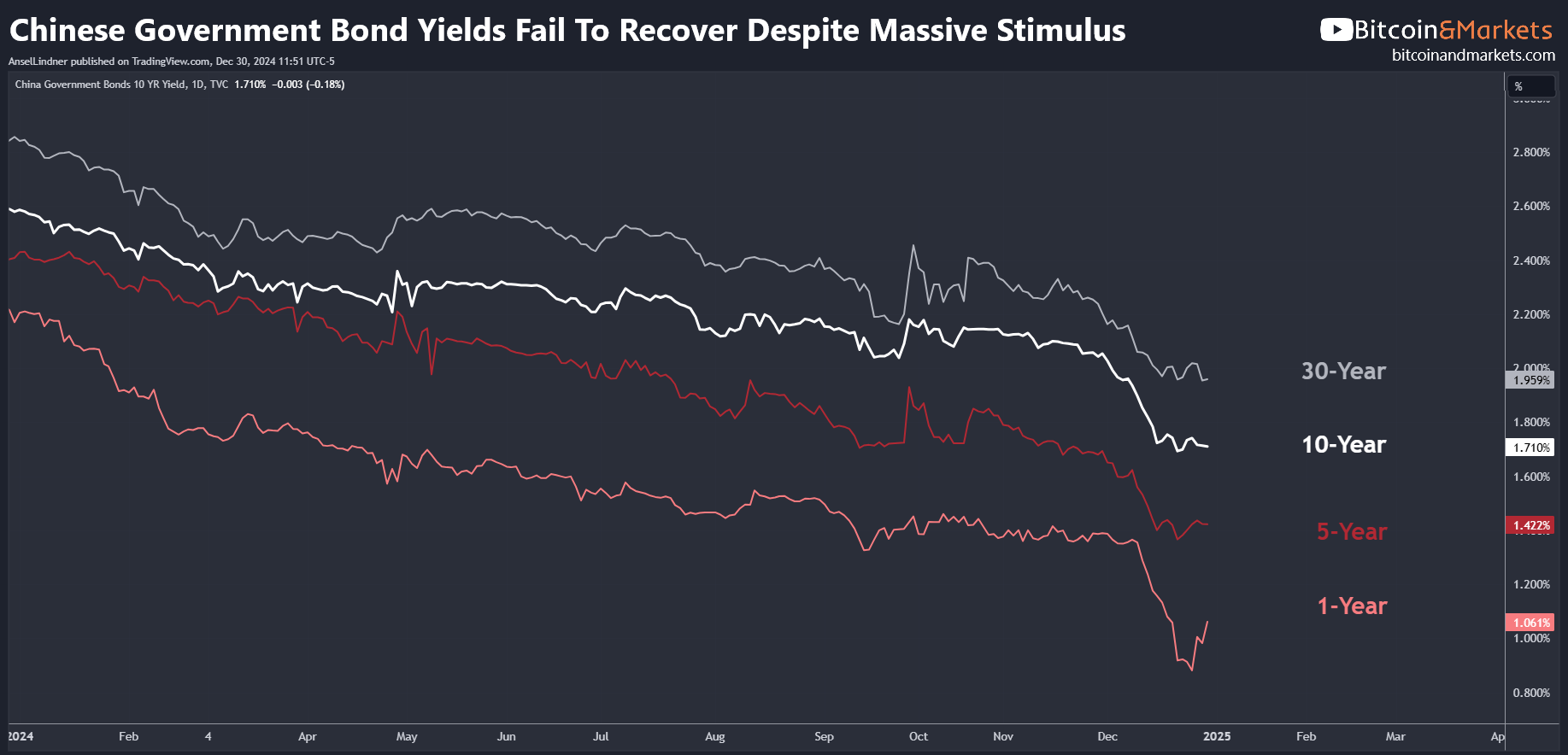

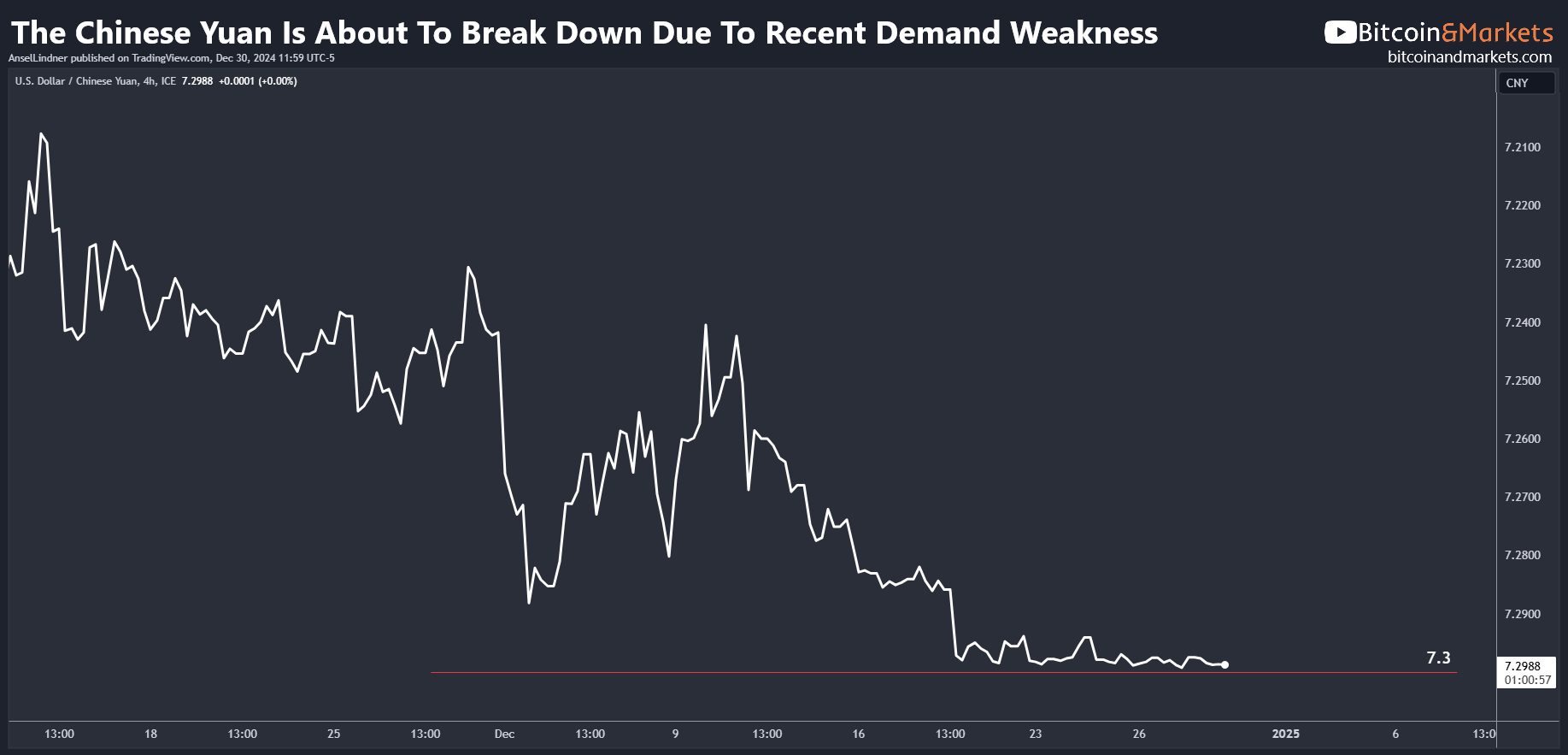

Chinese Government Bond Yields Collapse

The Chinese financial system is providing us a glimpse into what is ahead for the rest of the world. As their economy spins its wheels more and more, and its growth picture becomes worse and worse, their yields are falling. This signals major recession inbound for the whole world.

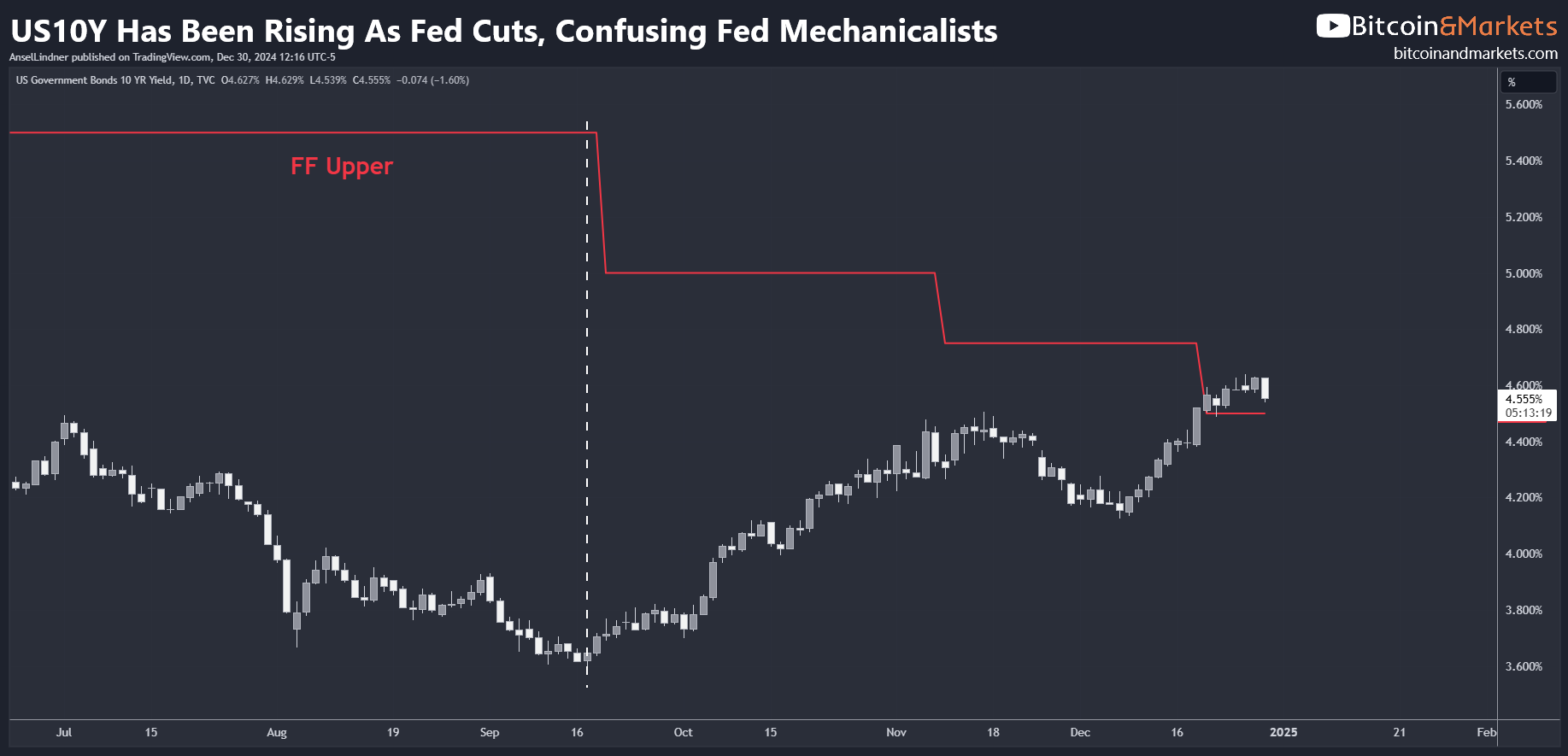

Increasing Dislocation In US10Y Versus Fed Policy

In all of my predictions for 2024, this has been the most unexpected to be honest. The US10Y yield continues to climb as the Federal Reserve is cutting rates. While a small jump in the 10Y was expected due to increased optimism around rate cuts, the sustainability of this move has been surprising.

This is a great chart but slightly misleading. If we place it on a chart with a shared axis, it looks like this.

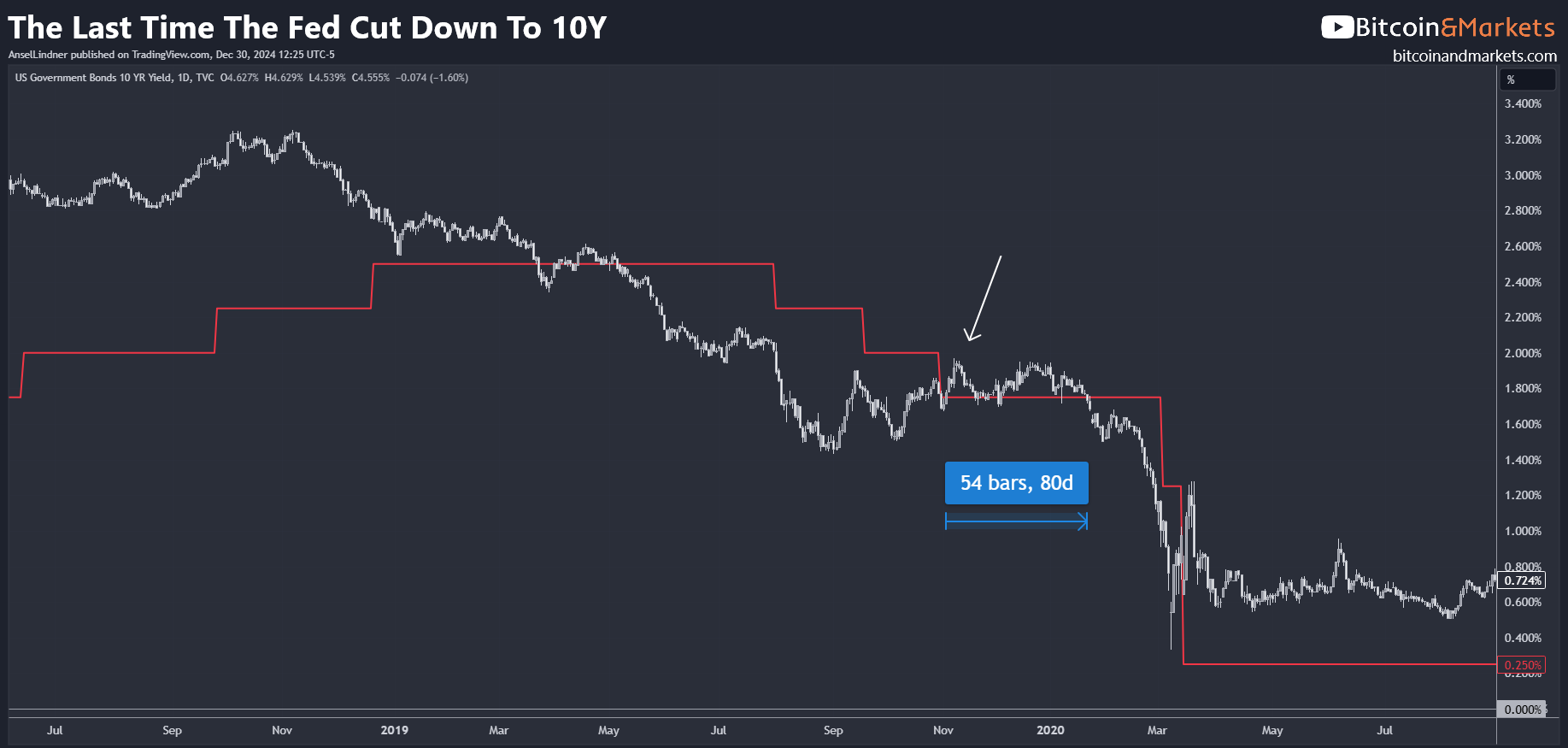

This is a different story, the Fed was cutting down to the US10Y that was stubbornly inverted from their policy for the longest time in history. The question now is, can the 10Y yield continue higher from this point? The last time this happened under Powell is very similar, after 3 cuts, followed by 80 days until it broken down.

Chicago PMI Back Down To 36 vs 42 Estimated

In PMIs (purchasing managers index), any below 50 is contraction month to month. This latest disaster makes 26 out of the last 27 months in contraction. This is why it feels like a recession, even if it hasn't been officially a recession. The underlying economy is deteriorating.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

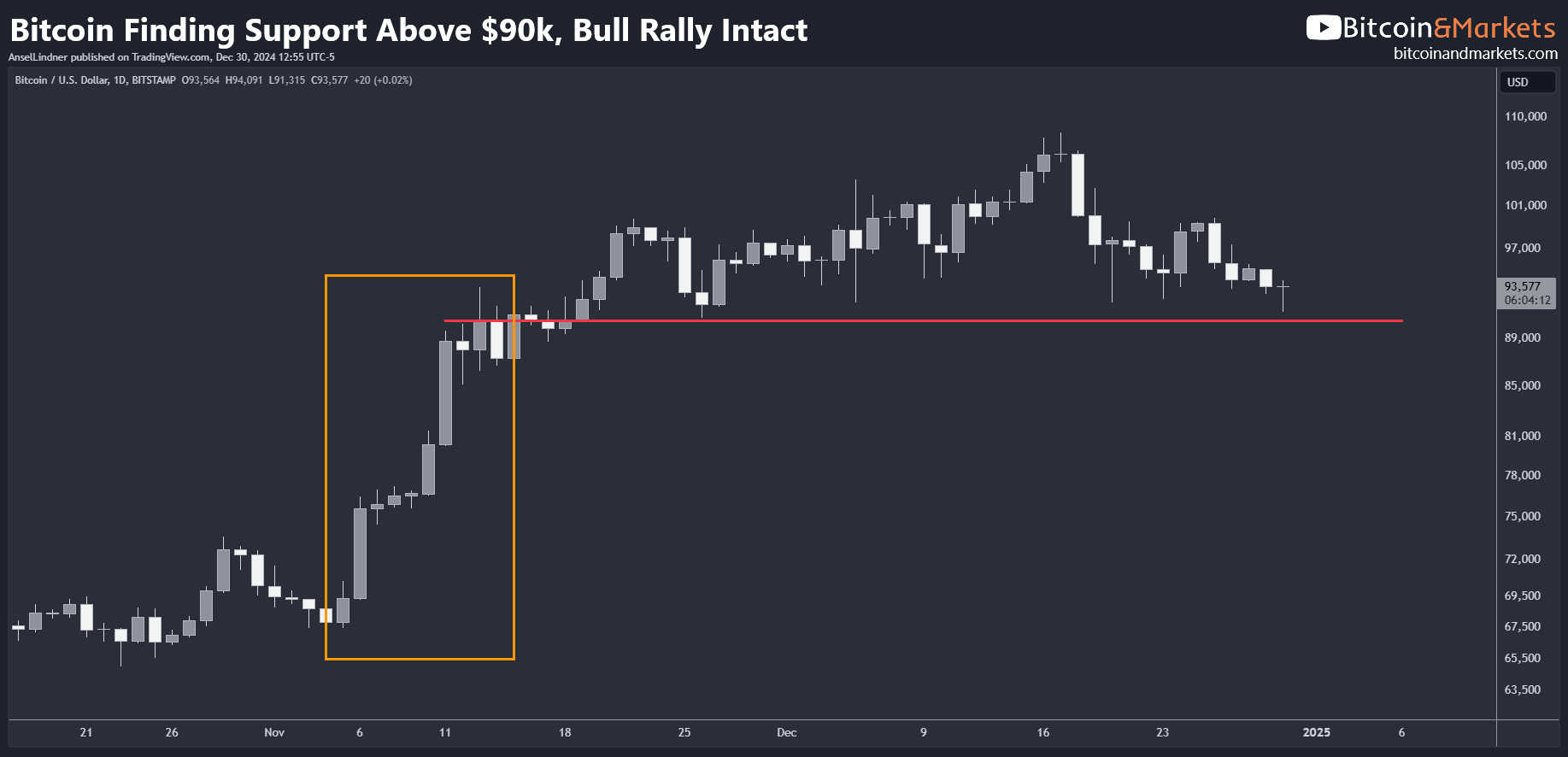

Last week:

"My base case for this week is to hold $90k. With a slight edge to the possibility of a recovery above $100k."

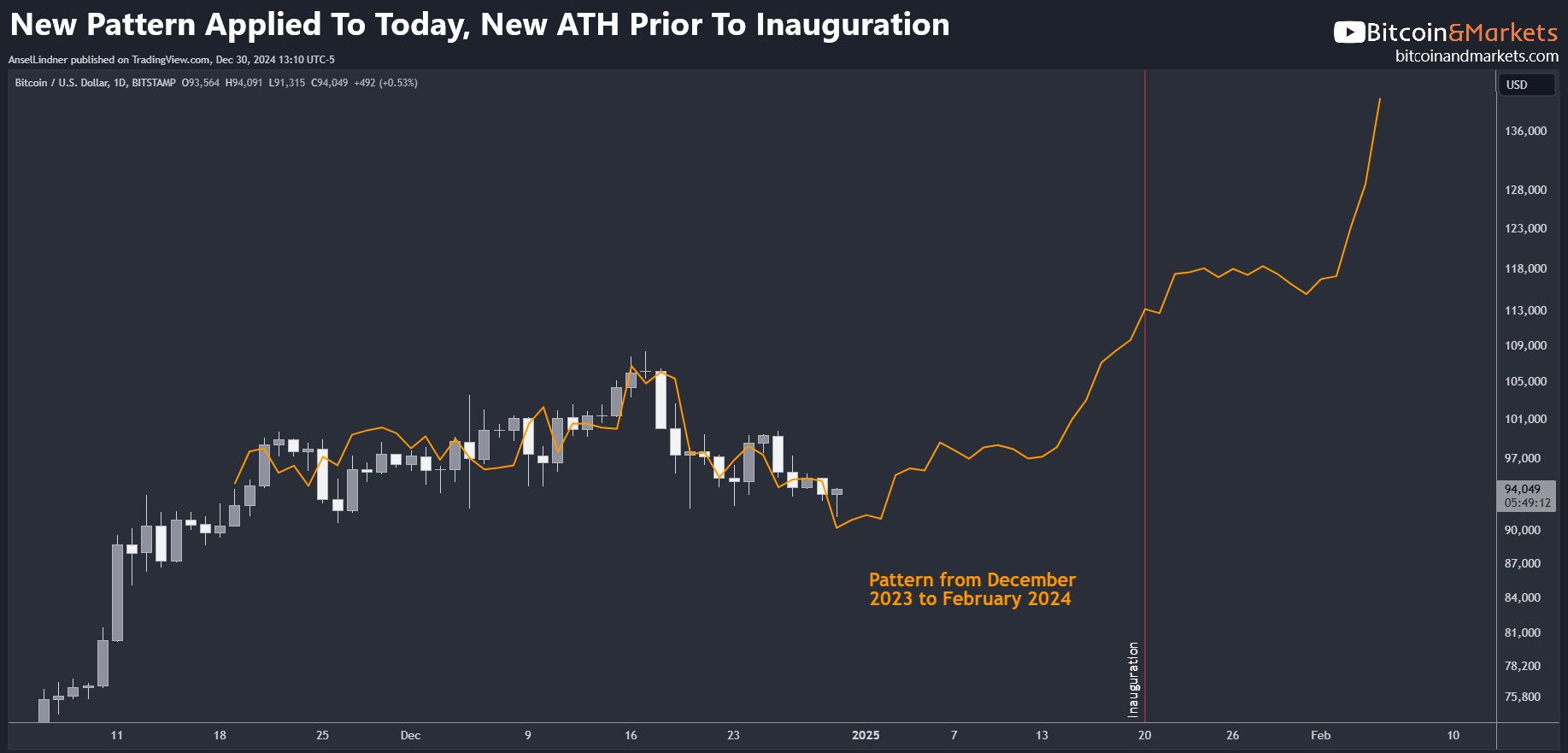

One pattern I've cited a lot recently is the October - November 2023 pattern. However, if we continue with this comparison, that brings us to another interesting alignment.

Below is what it looks like lining up December 2023 to February 2024 with today.

I liked the previous comparison pattern better, because it was relating the general reason behind an upward consolidation, namely a relative shortage of sellers and a plethora of dip buyers. The new pattern includes the dip in the orange line after the ETF launch. We have nothing as powerful happening right now (that we know of). It is interesting though that the current dip could also be influenced by the ETF, this time EOY tax selling and rebalancing.

But just looking at it plainly, the above pattern suggests a bottom soon, and a steady climb for the next month through the inauguration. If we follow it closely, we'll hit a new ATH just days before. This is a fairly rational forecast, as I even pointed it out last week:

"We could range until after the inauguration. However, if we hold above $90k, there could be a significant rally on the rumor prior."

My base case for this week is to hold $90k. There could be a resurgence of buying in the new year. If any rally comes it will likely start then. There is some controvery about the FTX distributions. Some are claiming they will start Jan 3, but that seems to be the day of the plan taking effect, and billions of dollars will be distributed up to March. Either way, that is a significant event. I think altcoiners will be surprised with how much goes into bitcoin and not shitcoins.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Russia bans crypto mining in several regions until 2031

What is going on in Russia. First, they flip-flop and legalize bitcoin, then announce they are using it in international trade, but then ban bitcoin mining in several areas in the country.

Russia has banned crypto mining in ten key regions of the country until 2031, citing its high energy consumption, according to Russian news sources.

Dagestan, North Ossetia, and Chechnya are among the regions impacted by the new ban, which will start January 1, 2025 and stay in effect for the next six years.

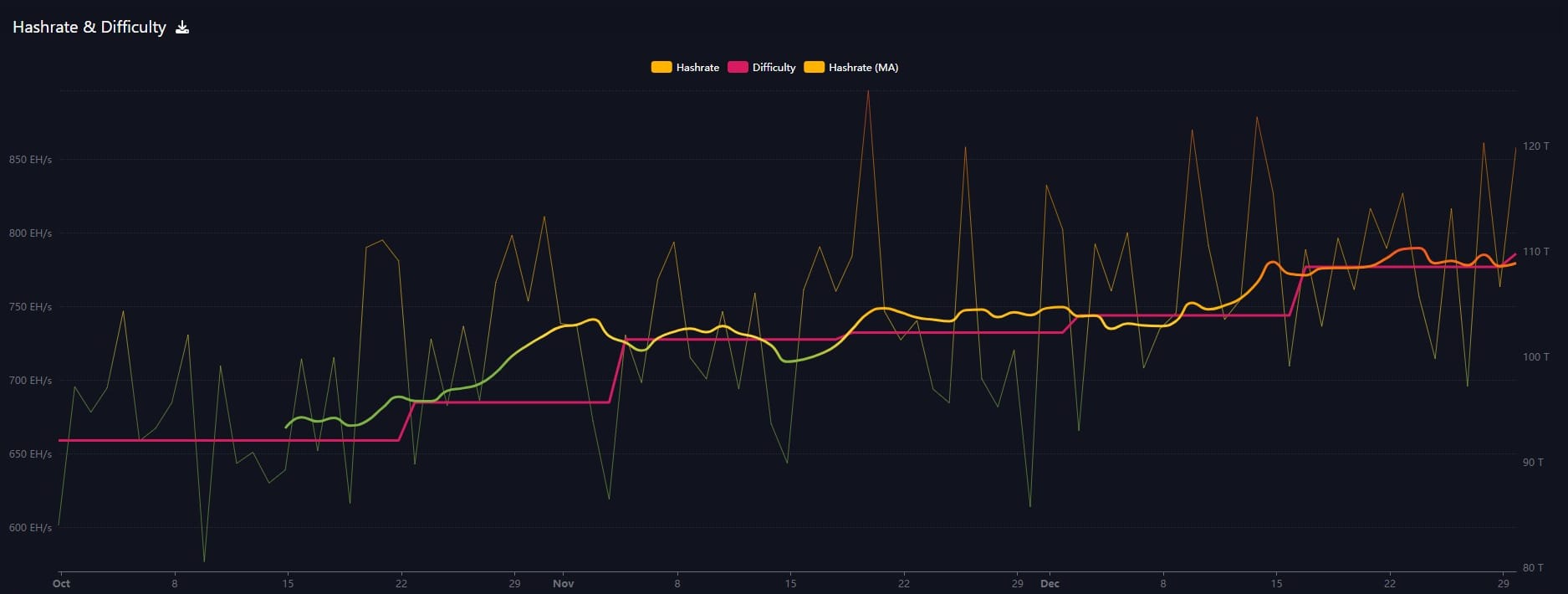

Hash rate and Difficulty

Difficulty has adjusted upward by 1% this weekend to a new ATH, but has yet to truly spike following the rally up to $100k. This is solid performance, and I believe hash rate will really start accelerating soon.

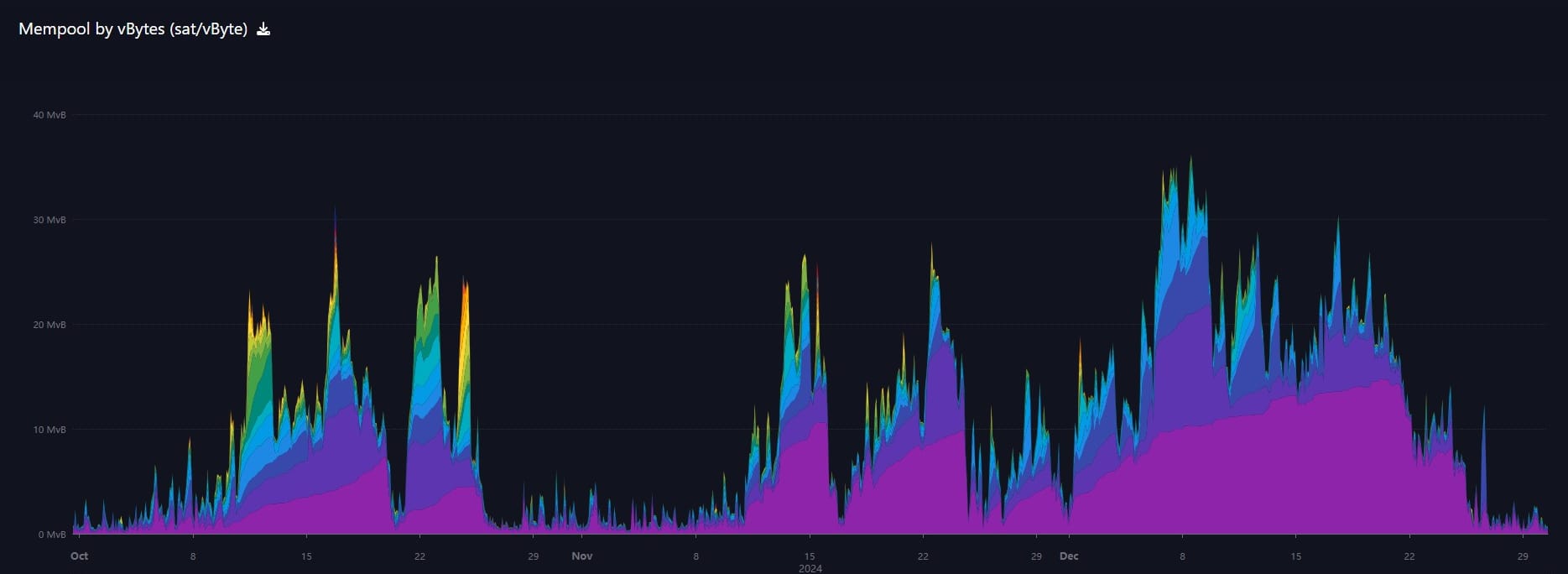

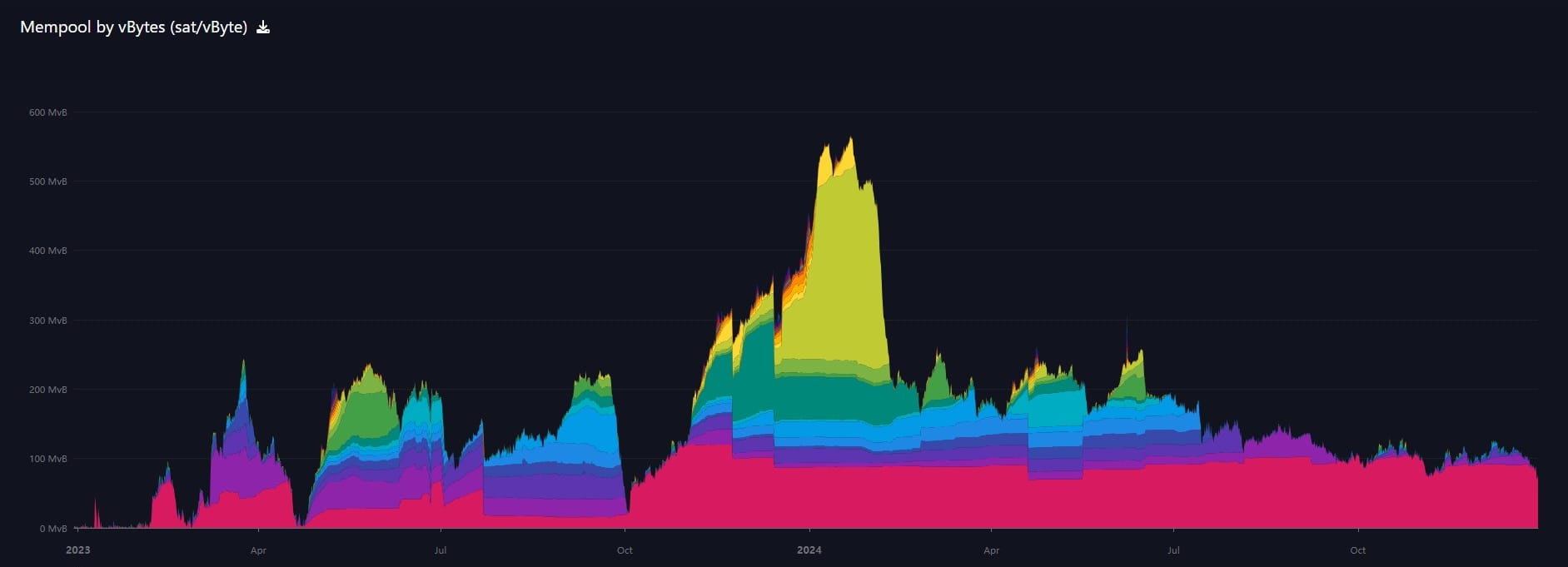

Mempool

The mempool is down big this week, from 100MB to 72MB. There is very little risk of a major sell off in the near term, because if there was increased risk people would be moving coins.

This is the lowest the mempool has been since October 2023!

NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Why Will Bitcoin Be Monetized, If Gold Was Demonetized?

- Endogenous Money and Bitcoin: A Shift in the Monetary Order

- Answering The Critics Of The Bitcoin Reserve Bill

- 10Y Yield and CPI Connection - Premium

- Google’s Quantum Computing Leap: What It Means For Bitcoin’s Security - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com