Bitcoin Fundamentals Report #321

Inside Bitcoin: Tax Rule Changes, $100K Trends, and Global Economic Upheaval

January 6, 2025 | Block 878,126

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Back above $100k |

| Media sentiment | Very Positive |

| Network traffic | Very low |

| Mining industry | Steady |

| Price Section | |

| Weekly price* | $102,043 (+$7,692, +8.2%) |

| Market cap | $2.024 trillion |

| Satoshis/$1 USD | 979 |

| 1 finney (1/10,000 btc) | $10.20 |

| Mining Sector | |

| Previous difficulty adjustment | +1.1605% |

| Next estimated adjustment | +1.5% in ~5 days |

| Mempool | 62MB |

| Fees for next block (sats/byte) | $1.43 (10 s/vb) |

| Low Priority fee | $1.00 |

| Lightning Network** | |

| Capacity | 5014.00 btc (-0.8%, -38) |

| Channels | 45,342 (-0.2%, -78) |

Happy New Year!

IRS Delays New Bitcoin Tax Reporting Until 2026

This rule would have clarified the cost-basis accounting for bitcoin capital gains, requiring First In, First Out (FIFO) by account, which it already is under general good faith practices.

IRS Delays Crypto Tax Reporting Requirements Until 2026https://t.co/89MPpyKJPu

— Watcher.Guru (@WatcherGuru) January 2, 2025

Many people utilize the "universal account" method, which treats all their bitcoin as if it were held in a single account. They sell some low-basis bitcoin from one account, but a high-basis from another account. They are playing with which basis they apply, this rule would put an end to that.

This rule would also clarify how to apply basis to self-custody bitcoin that is comingled from multiple sources.

This is not tax advise, but be very diligent in tracking coins and their basis to minimize tax headaches in the future. Consider multiple cold storage wallets, one per account. Lastly, don't sell bitcoin. If you hold for another 5-10 years you might not have to sell your bitcoin, you could leverage your bitcoin for income, and/or the tax rules might be better if it becomes vital to the US dollar.

Saylor's $100k Party

I didn't watch any of the coverage from this party. It didn't interest me in the least.

Trace Mayer made an appearance! He's one of the wealthiest bitcoiners who disappeared after an uncharacteristic fling with MimbleWimble shitcoin. Many, including myself, think he staged his disappearance from public bitcoin life.

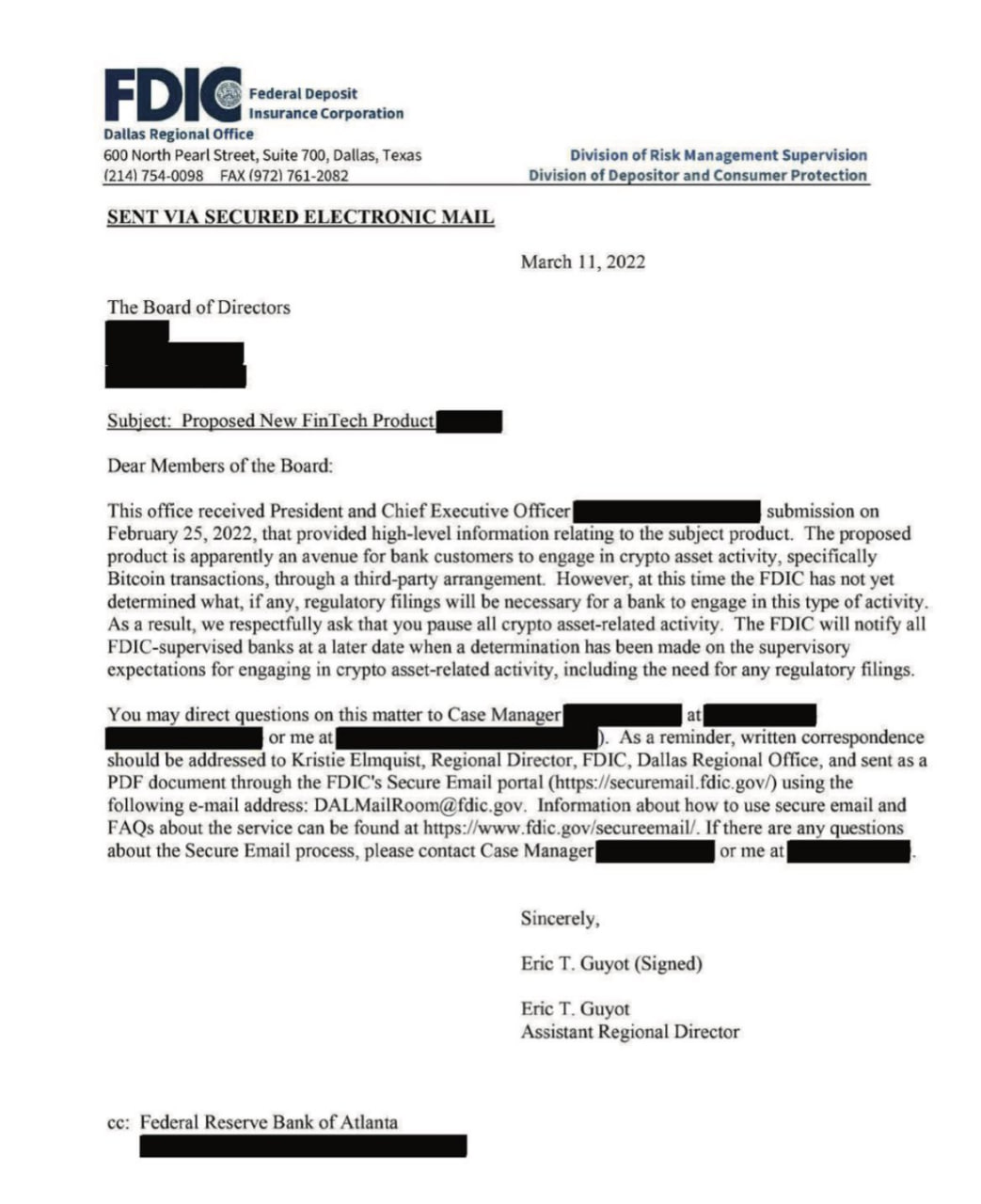

Internal FDIC Letter Leaked Showing OCP 2.0

Once again the Operation Chokepoint 2.0 is back in the news. This week, an internal letter from the FDIC was leaked that apparently shows that the FDIC announcing an unofficial policy to "pause all crypto asset-related activity."

This is the best evidence yet of a coordinated effort to ban bitcoin specifically. I don't really care much about the shitcoin crackdown all that much, because we'd have to support fraud or force, so I don't take a side. However, for bitcoin specifically, that is a different question.

I also question shitcoiners claims of discrimination because I know they are scammers and they lie.

Whatever the case is here, we can clearly see this is a request not a command.

Another development along these lines is the resignation of Michael Barr from his role at the Federal Reserve as Vice Chair of Supervision. He was on Nic Carter's most wanted list for Operation Chokepoint. This is seen as a major win for the Caitlin Long and other bitcoin banks.

🚨NEW: The @federalreserve Board has announced the resignation of Michael Barr as the vice chair for supervision. Barr will remain on the board of governors.

— Eleanor Terrett (@EleanorTerrett) January 6, 2025

A Warren acolyte, Barr was widely considered to be a big part of the reason why banks have been unable to engage with…

Macro

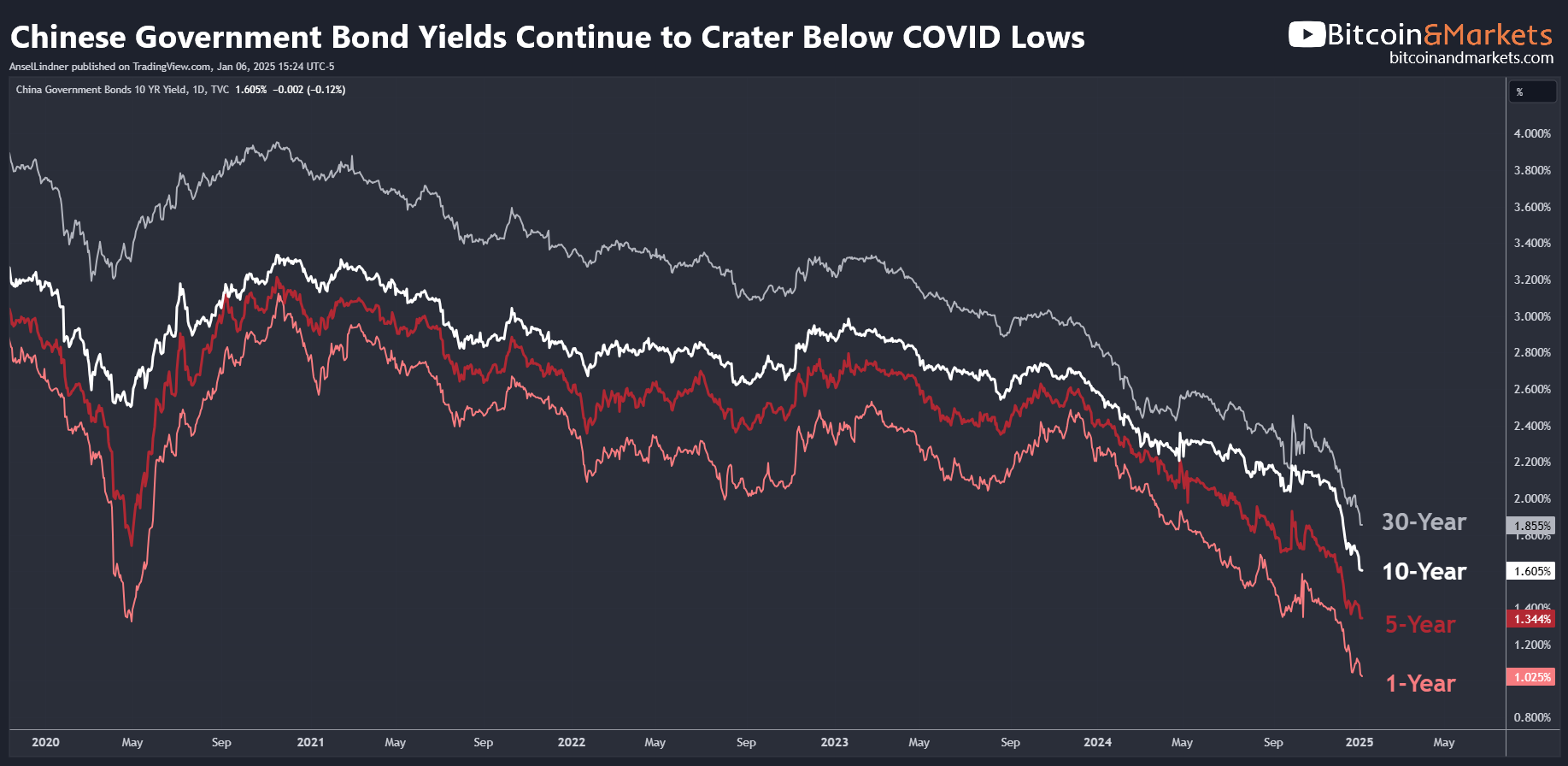

Chinese Government Bond Yields Continue to Decline

China's economic situation continues to worsen. This is a flight to safety, with all yields below the COVID crash lows. There are rumors of another virus spreading in China, but with much less attention than COVID. It could be a plan by the CCP to blame a virus again.

There is some acute stress taking place right now, as if a bank run is on. We aren't getting much from behind the curtain in China, but I think we will start getting some leaks over the next few weeks. It should have sunk in for people that the Chinese miracle is over. They won't be pulling us out of the next global slowdown.

Major Upheaval in Western Governments

This morning, Justin Trudeau resigned as Prime Minister. He opens the way for his party to select a new Prime Minister and has suspended Parliament until March 24. This comes ahead of the national vote in October.

Germany is still attempting to freeze out the rapidly rising AfD party from ever forming a government. Even amending the Constitution to freeze them out of influencing the Judiciary branch if elected. They also are losing their minds about Musk tweeting support for the AfD.

In France, Macron is also losing his cool at Elon, while they attempt to keep Le Pen from ever running for office again with lawfare.

Overall, the wave of populist conservatism is picking up speed, pushing back against the institutionalized Marxism the people want out.

Ukraine Stops Russian Gas to Europe

On the morning of the first day of 2025, the Russian Federation stopped supplying gas to European buyers via Ukraine. Even amidst the conflict, the Russian Gazprom and Ukrainian Naftogaz had kept in operation an energy transit agreement signed in 2020, which expired on the last day of 2024. Previously, Kiev had already announced it was unwilling to renew the contract with Gazprom, although some European countries repeatedly asked Ukraine to do so.

Obviously, there are currently energy reserves that may be enough to cope with the challenges of the current season, but the situation will progressively become more critical over time. European nations will have to find new sources of gas or expand the use of the only two remaining routes for Russian gas (via Turkey and the Black Sea).

They can also buy more from the United States. Pretty convenient.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

"My base case for this week is to hold $90k. There could be a resurgence of buying in the new year. If any rally comes it will likely start then."

Two weeks ago I wrote:

"We could range until after the inauguration. However, if we hold above $90k, there could be a significant rally on the rumor prior."

Well, we held $90k and have are working on our 7th positive day in a row.

Below is the December 2023 to February 2024 pattern I introduced last week. So far, we are following this pretty well, even breaking higher sooner. It remains to be seen if we can hold $100k for good or do we still have another week of consolidation.

I am expecting a new ATH by the inauguration, in a front run of Trump's first day actions. If those first day actions disappoint, we will likely head back to $100k soon after the inauguration. However, if he frees Ross Ulbricht and announces the conversion of the seized bitcoin into a Bitcoin Reserve, price could continue directly higher after day one.

If things go well, we might see a slew of countries announce their bitcoin reserves at the same time as Trump. More on those price targets in the Premium posts.

We are back above back above the 50-day MA showing some major strength holding it through the weekend and then jumping off of it today.

My base case for this week is to inch toward the ATH, with a rising chance of a breakout to a new ATH. If a breakout does occur this week, it will follow the now standard behavior. This is where the breakout happens quickly and doesn't allow for people to get in late.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Experts are turning to an unexpected industry to ease geopolitical tensions and offset rising energy costs: 'It's about solving real-world problems'

The European Bitcoin Energy Association believes the sector will play a crucial role in solving the continent's energy crisis by stabilizing grids while utilizing surplus power and renewable energy.

"Bitcoin miners can switch off when electricity prices surge and switch on when prices drop, making it an ideal partner for stabilizing grids," EBEA chair Rachel Geyer told Forbes. "EBEA is collecting proof-of-concept projects to demonstrate how bitcoin mining can help with the build out of renewables and aid grid stability."

For example, the organization is running a pilot program that combines clean energy and bitcoin mining to stabilize the grid in Austria, which had the ninth-highest per capita electricity generated by hydroelectric power in 2023.

Mining company MARA lent out 7,377 BTC to third parties in 2024

According to Samuels, MARA’s Bitcoin lending program “Focuses on short-term arrangements with well-established third parties, generates a modest single-digit yield, and has been active throughout 2024.”

The MARA executive added that the purpose of the lending program is to generate income to offset operating expenses incurred by mining.

Mining is an energy-intensive business with tough fundamentals due to reduced block subsidies every four years during the Bitcoin halving — which last occurred in April 2024 — reducing the block reward to 3.125 BTC per block mined.

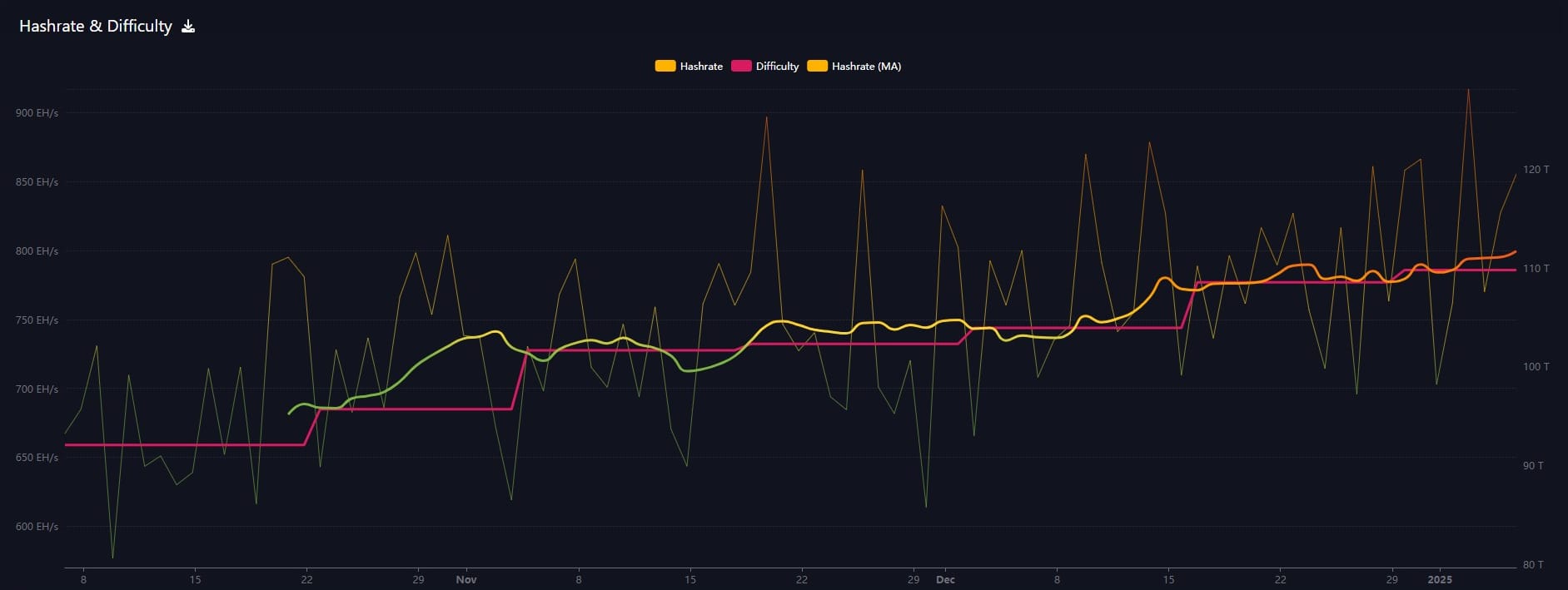

Hash rate and Difficulty

Difficulty has adjusted upward by 1% this weekend to a new ATH, but has yet to truly spike following the rally up to $100k. This is solid performance, and I believe hash rate will really start accelerating soon.

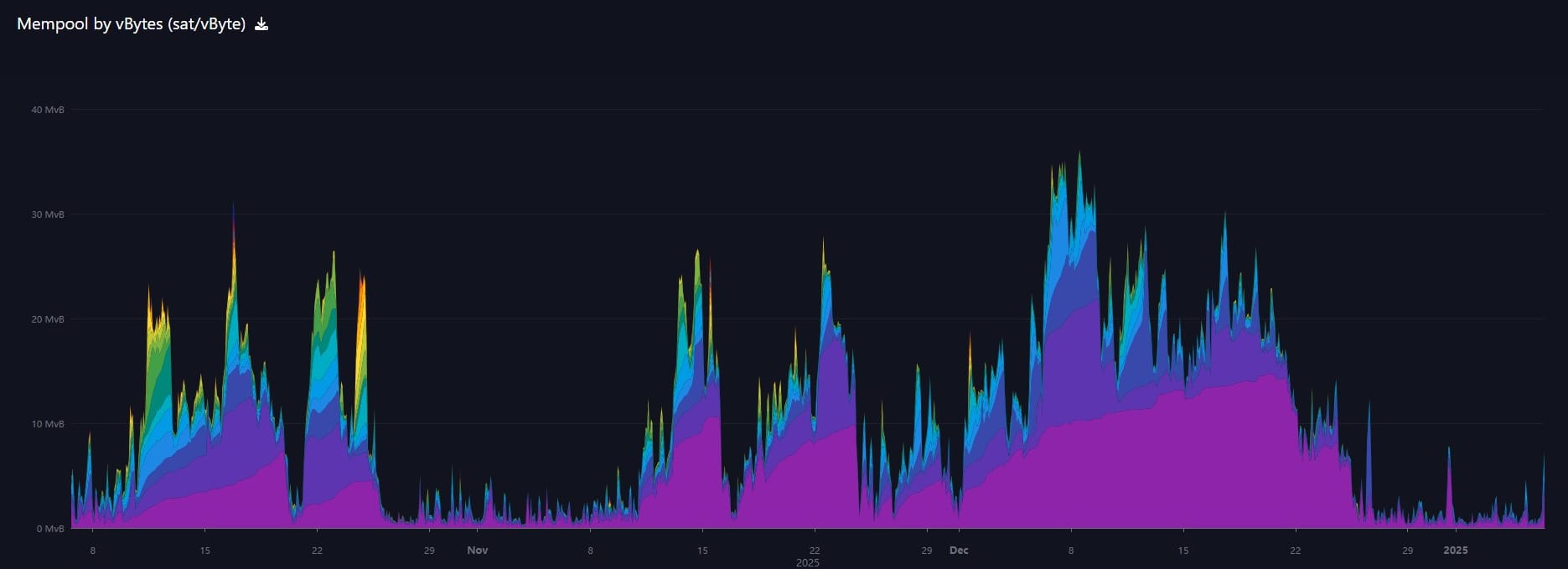

Mempool

The mempool is down big this week, from 100MB to 72MB. There is very little risk of a major sell off in the near term, because if there was increased risk people would be moving coins.

Taking the pink 1-2 sats per byte fees.

NSTR

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Bitcoin Is The Antithesis Of Fiat

- Bitcoin Indicators and Forecast - Premium

- Google’s Quantum Computing Leap: What It Means For Bitcoin’s Security - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com