Bitcoin Insider #322

Slower week for the bitcoin news cycle, wildfires in California and macro take center stage. All awaiting Trump's inauguration.

January 13, 2025 | Block 879,114

Quick Navigation: Headlines | Macro | Price Analysis | Mining | Layer 2 | Previous Posts

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Snapshot of Bitcoin

| General Bitcoin | |

| Weekly trend | Holding support |

| Media sentiment | Positive |

| Network traffic | Very low |

| Mining industry | Steady |

| Price Section | |

| Weekly price* | $92,913 (-$9,130, -8.9%) |

| Market cap | $1.846 trillion |

| Satoshis/$1 USD | 1077 |

| 1 finney (1/10,000 btc) | $9.28 |

| Mining Sector | |

| Previous difficulty adjustment | +0.6101% |

| Next estimated adjustment | -2% in ~13 days |

| Mempool | 51MB |

| Fees for next block (sats/byte) | $0.39 (3 s/vb) |

| Low Priority fee | $0.39 |

| Lightning Network** | |

| Capacity | 5069.06 btc (+1.1%, +55) |

| Channels | 45,211 (-0.3%, -131) |

Rumors of US Sale of 69,000 BTC

These remain unsubstantiated. While it is true that a court gave the go ahead to sell these coins, and that some bitcoin was sent to Coinbase, there is no evidence that they are selling or intend to sell anytime soon. So far the threat, and the always present doomerism, is enough to cause this micro sell off.

The typical behavior of the US government when selling bitcoin is to hold an auction. They are unlikely to market sell 69,000 coins which would dramatically harm bitcoiners and set the government up for law suits. They would telegraph this far ahead of time. And with Trump coming in, it is unlikely to happen at this point.

Careful of People Asking for Bitcoin Donations

I don't want to bring up specific names here today (I did that on a stream last week), but I want to caution you about people scamming for bitcoin donations. Natural disasters are a perfect opportunity for people to pull on your heart strings and ask for donations. Beware of rapidly rising influencers who turn around and ask for bitcoin donations because of a disaster in their lives.

1) There are well-established organizations you can donate to.

2) Bitcoin can be traced. If you donate from a larger wallet, say you want to donate $100 from a wallet with $5000 in bitcoin, you've now doxxed that larger stash.

3) Donating government currency comes with several benefits, like not giving up your fixed supply asset and certain fraud protections that can allow you to reverse the transaction if it turns out to be a scam.

Bessent Owns Up To $500,000 Of IBIT

"A document released on Saturday by the U.S. Office of Government Ethics (OGE) revealed Bessent’s ownership of the stake in a BTC ETF. It showed that the prospective government official held between $250,000 and $500,000 worth of BlackRock’s iShares Bitcoin Trust ETF (IBIT) shares."

Tether Relocates To El Salvador

This is a symbolic move for one of the largest companies in the bitcoin space. They are moving where they are treated best. This could go a long way to insulating them from outside attacks. We'll have to wait and see the outcome.

Macro

California Wildfires

There are some suspicious coincidences going on with these fires. They all started at the same time. There's video of one of the initial fires starting with a person present. There were no firetrucks simply protecting homes. And on and on.

This could also go a long way to turning California toward MAGA. People usually don't know that most of the state is republican, and was a republican stronghold not many decades ago. It is the coastal cities that keep CA blue for now. But the fallout from these fires could go along way in convincing marginal voters to vote MAGA next time.

Former EU Commissioner Thierry Breton fantasizes about a possible annulment of the upcoming elections in Germany

"We did it in Romania, and we will obviously have to do it, if necessary, in Germany." While these people are gaslighting you about the dangers of free speech, they openly cancel elections they lose.

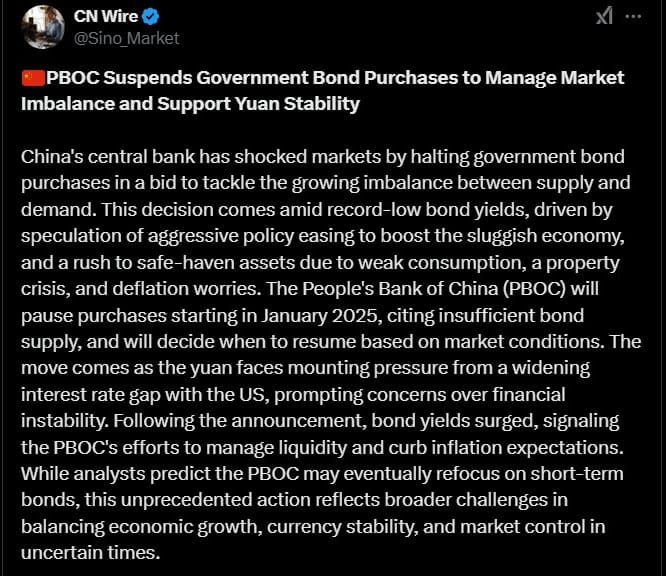

China Suspends Gov Bond Purchase to Manage Panic

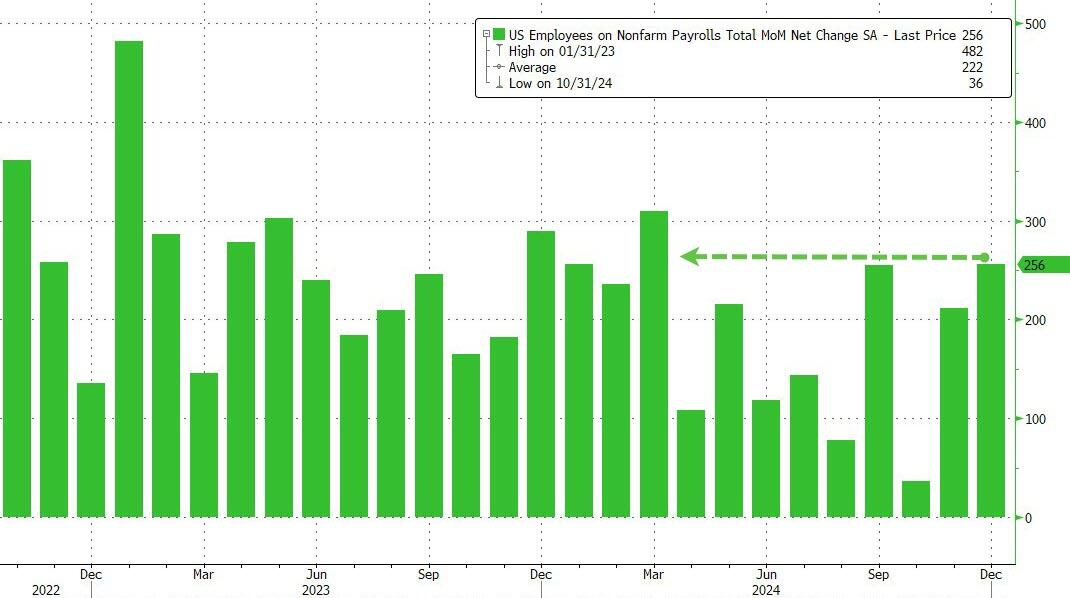

Scorching Hot December Jobs

In the US, December jobs data shows a massive 256k increase, however, a net loss of 350k full time jobs. This means there was a large rotation from full time jobs to temporary jobs around the holiday season. This is typical behavior but more exaggerated than usual.

Overall, my reading of this jobs report is a strong headline number masking the more fundamental weakness. However, we can also say that this report does not symbolize imminent recession. It would be consistent with the recession still being several months away.

Join the Professional tier to receive my MARKET PRO, price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Last week:

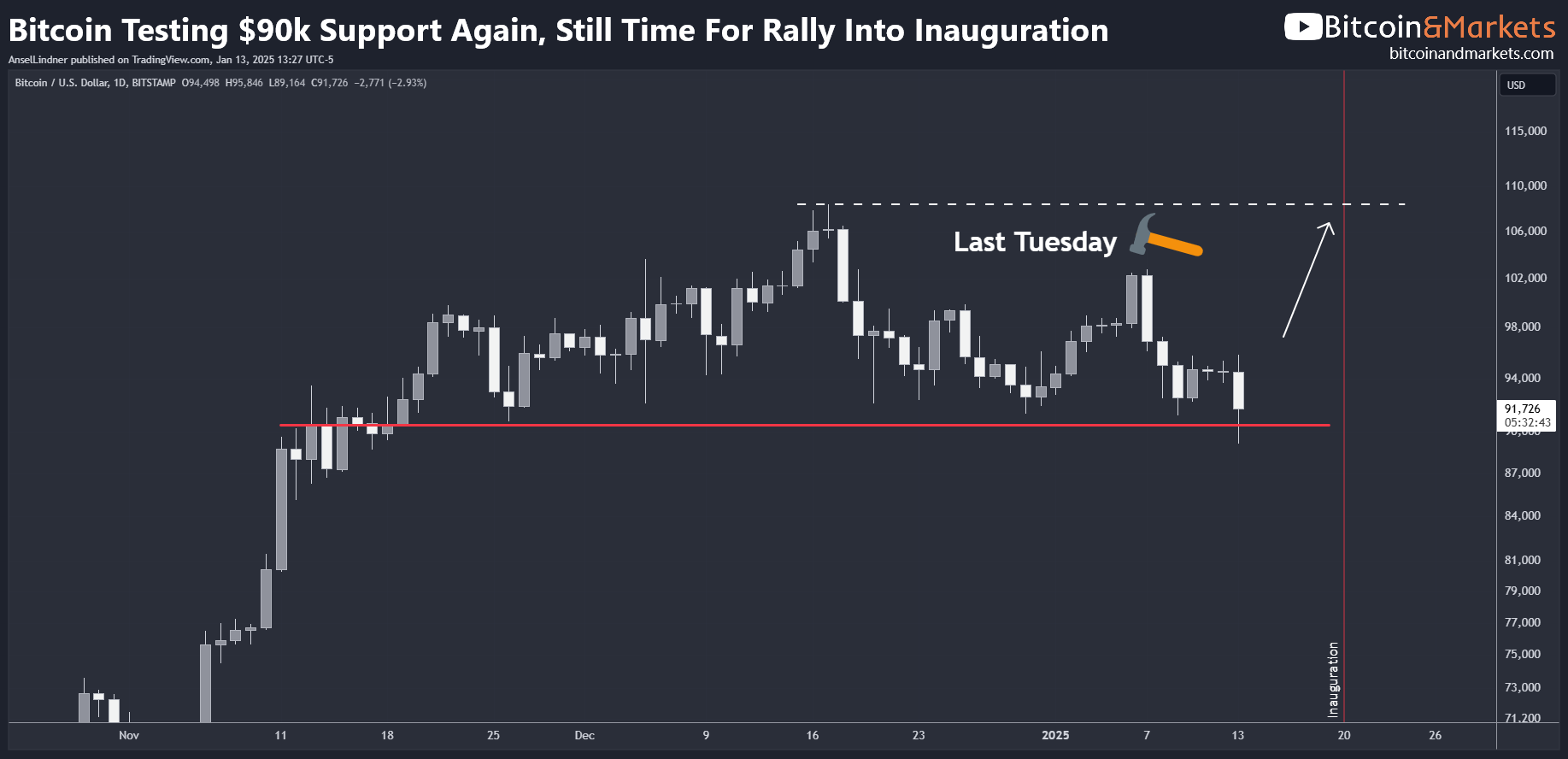

"My base case for this week is to inch toward the ATH, with a rising chance of a breakout to a new ATH."

That was perhaps my worst weekly forecast in the last 6-12 months. So far, we've only had a wick below $90k, which I did warn was a possibility. There is still time before the inauguration to rally back to the ATH.

The sentiment in the market is low. We finished the most bullish year in bitcoin history, made it through the EOY selling, and the odds of at least a Strategic Bitcoin Reserve conversion of current bitcoin held by the USG are very high. Yet, price is simply consolidating and threatening to break down.

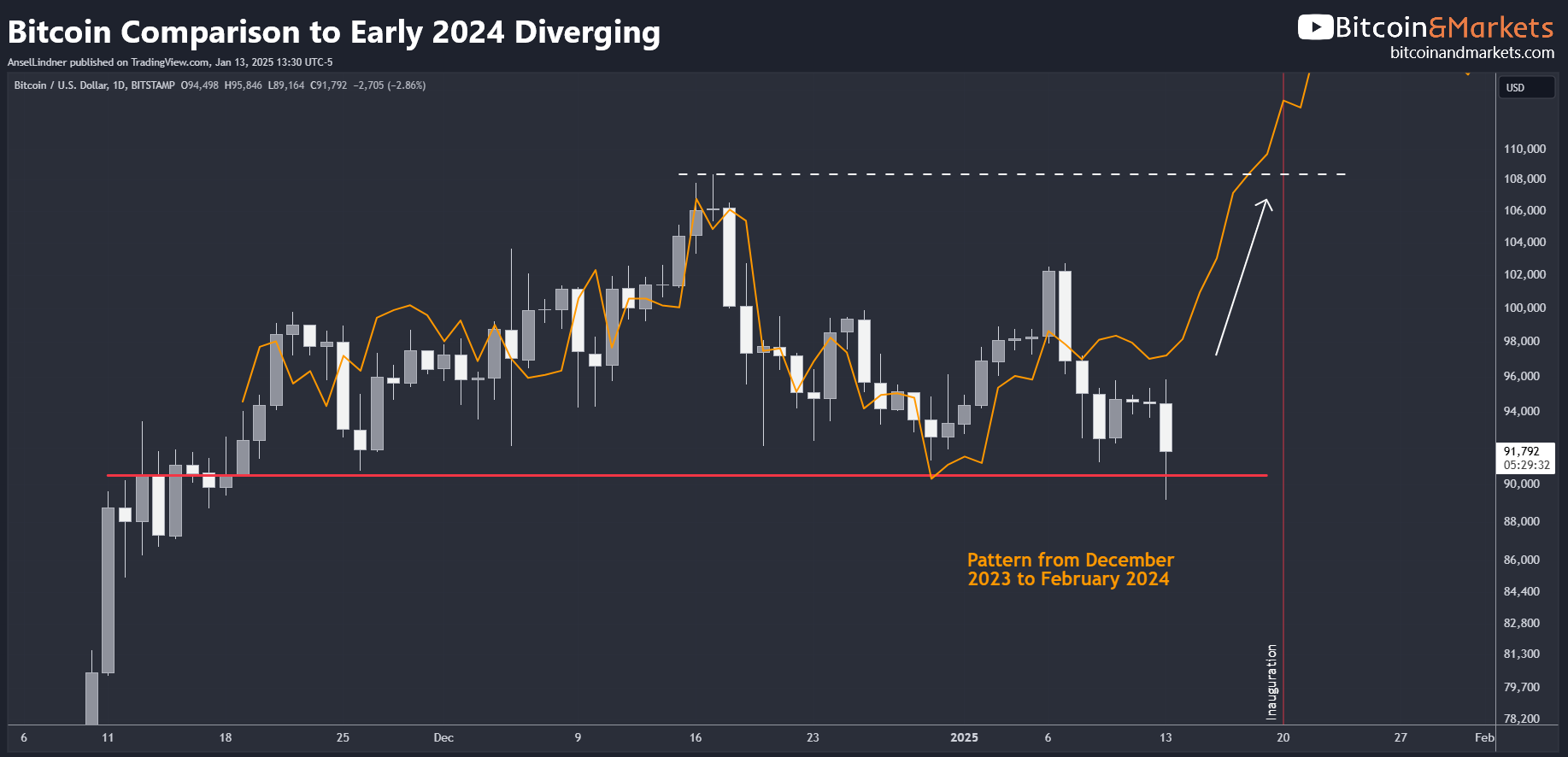

Below is the December 2023 to February 2024 pattern I introduced two weeks ago. We did break with the trend last Monday with our rally above $100k. That turned around and now we've broken it to the downside. There is still some hope of regaining the pattern prior to the inauguration.

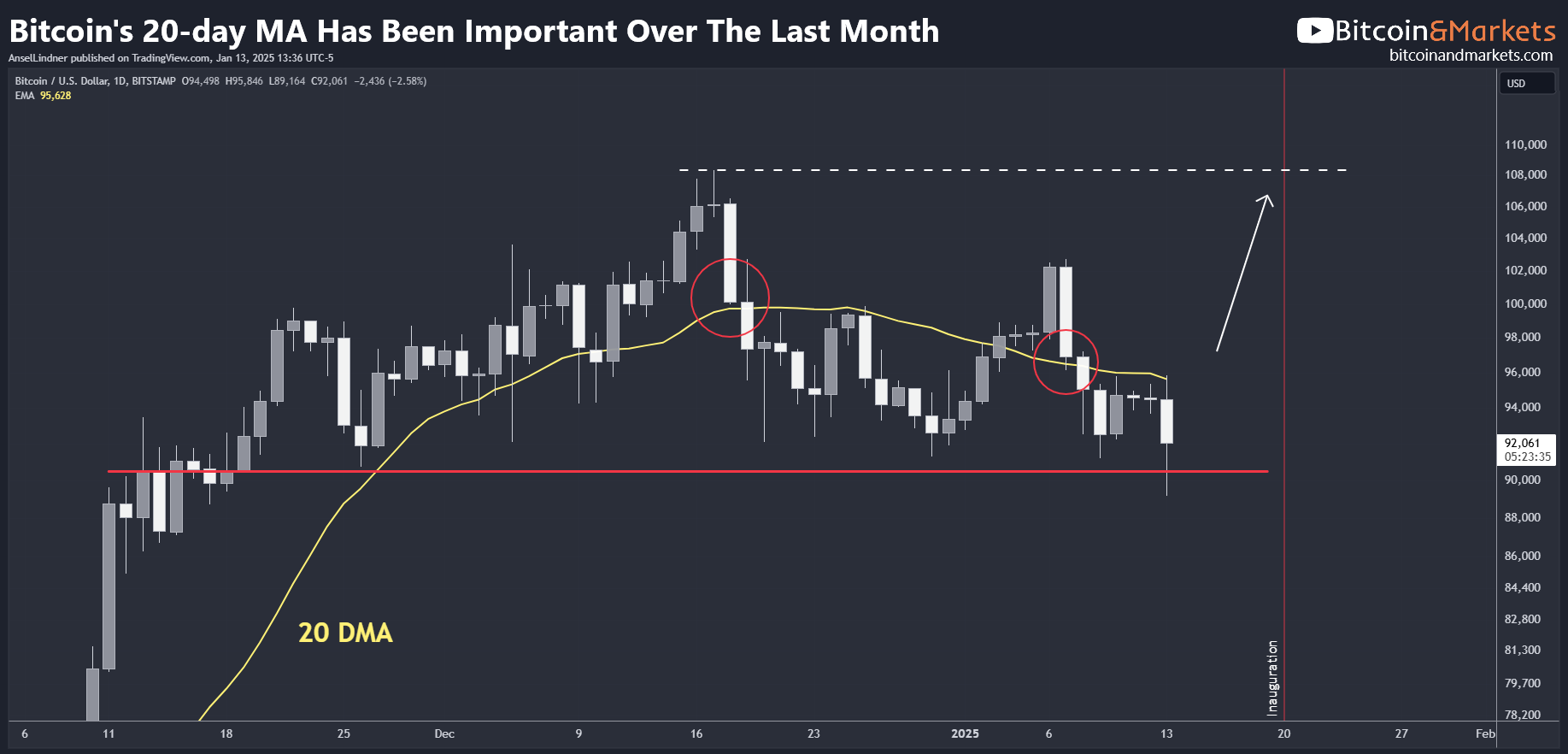

Below is the daily chart with the 20-day MA. What strick me was the seeming importance of this metric recently. It could be that a large market maker is using the 20-day in their trading. Dec 16th looks an awful lot like last Tuesday (red circles).

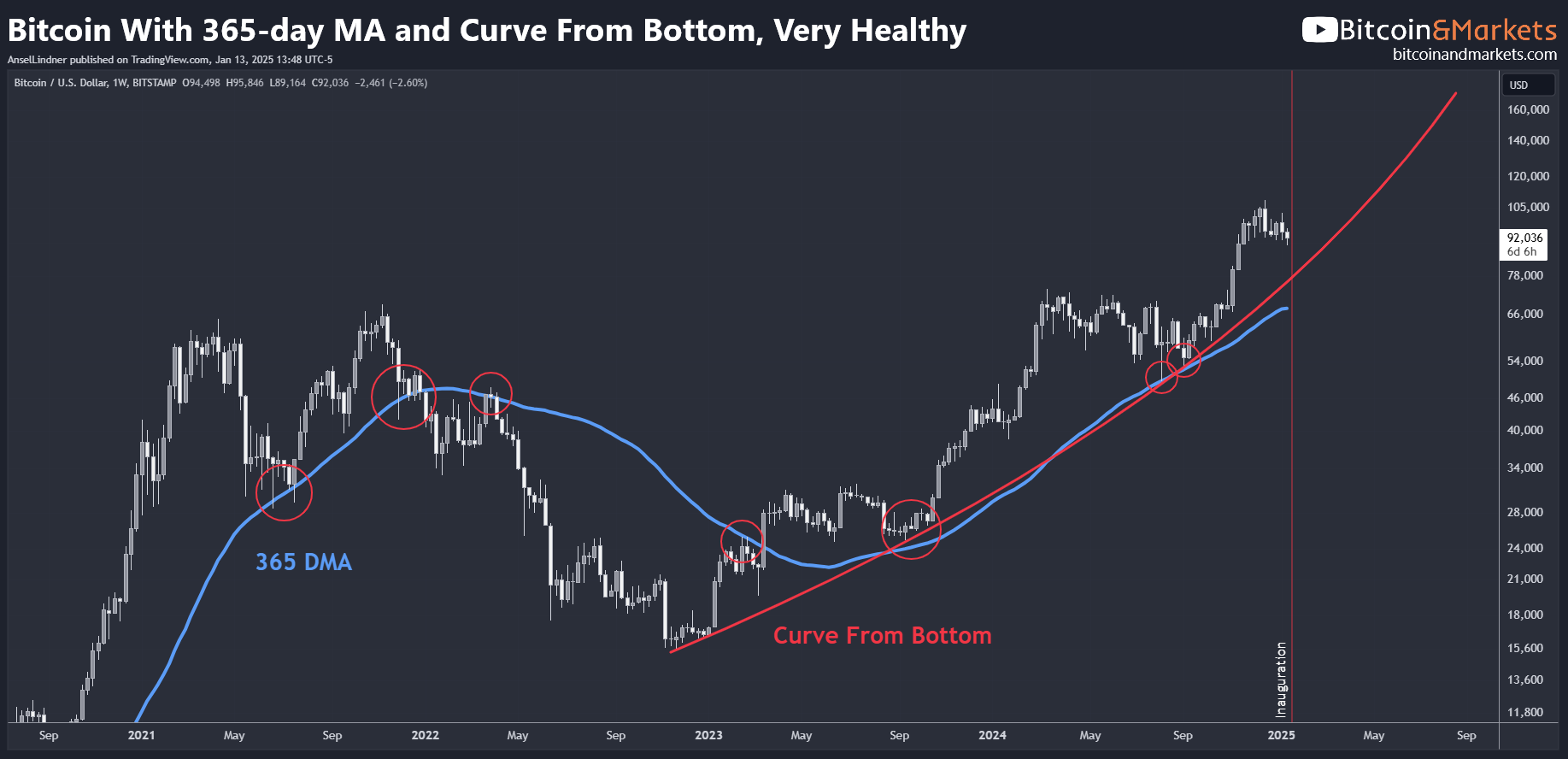

Here is a weekly chart with the 365-day MA. As you can see the 365-day has been quite important over the last cycle, acting as support 5 times (always positively sloped) and resistance twice (always negatively sloped). The red curve is simply a best fit from the bottom. I add this chart to show the bull market is still healthy and intact.

My base case for this week is recovery toward the ATH. I'm always going to be big-picture bullish in a bull market. However, IF bitcoin breaks and closes below $90k in a significant way, we will be looking at least a month more of consolidation. The threat of a significant sell off is still low.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Headlines

Russia’s Bitcoin mining demand triples amid regulatory shifts and price rally

Russia has seen a sharp rise in Bitcoin mining activity as citizens and businesses turn to crypto mining for additional income streams, local media outlet Prime reported.

According to the report, the demand for industrial Bitcoin mining equipment in Russia has tripled compared to the same quarter in 2023.

Last year, the Russian government legalized crypto mining under specific guidelines.

Moreover, the tax reforms have further shaped the industry. Russia’s updated tax code exempts crypto transactions from value-added tax but imposes a 15% tax on mined assets.

Canaan Launches Dual-Purpose Bitcoin Mining Device That Heats Homes

According to the official press release, the Avalon Mini 3 combines high-performance Bitcoin mining with home heating, boasting a hash rate of 37.5Th/s and a user-friendly app-controlled interface.

Transforming cryptocurrency mining rigs into household devices is not a new concept. Back in 2017, Avi Aisenberg, who operated South Florida Distillers in Fort Lauderdale, Florida, created a heating system that used ASIC miners to mine crypto while accelerating the rum-distillation process. In 2018, the French start-up Qarnot introduced the QC-1, a heater designed specifically for cryptocurrency mining.

More recently, companies like Heatbit and D-Central have entered the market with products that combine heating capabilities with crypto mining.

I included this story as an educational opportunity. Bitcoin mining can only be used for secondary applications for limited timeframes due to the nature of competitive markets. Marginal cost will approach marginal revenue with time.

MR = value of bitcoin mined + savings from secondary use

MC = mining equipment + electricity

Since bitcoin mining is competitive, difficulty consistently goes up. If there was significant value added from heat capture, more miners would adopt the practice. The money saved from the secondary use will be dumped back into competitively raising the hash rate. Therefore, your MC will rise in proportion to MR of savings on secondary use.

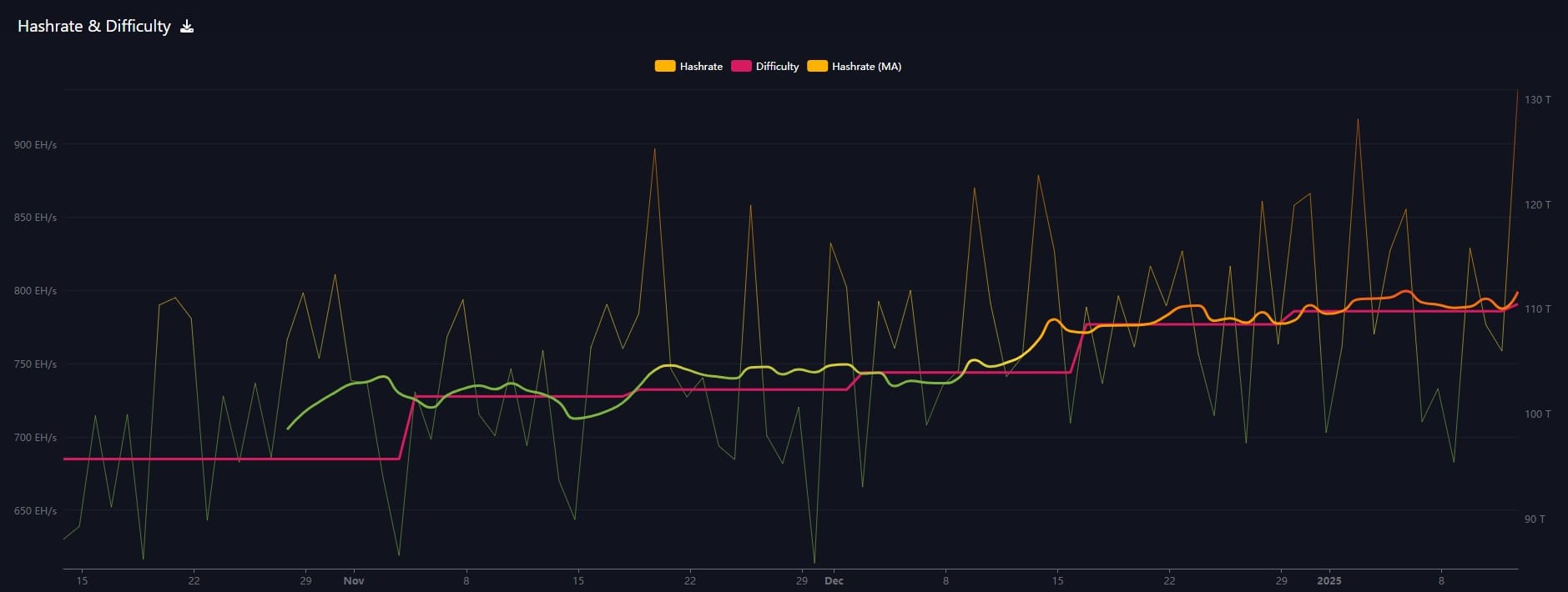

Hash rate and Difficulty

The bitcoin difficulty adjusted yesterday by +0.6%. A small but positive adjustment. This makes 8 positive adjustments in a row since October 2024. Hash rate has just jumped to a new ATH.

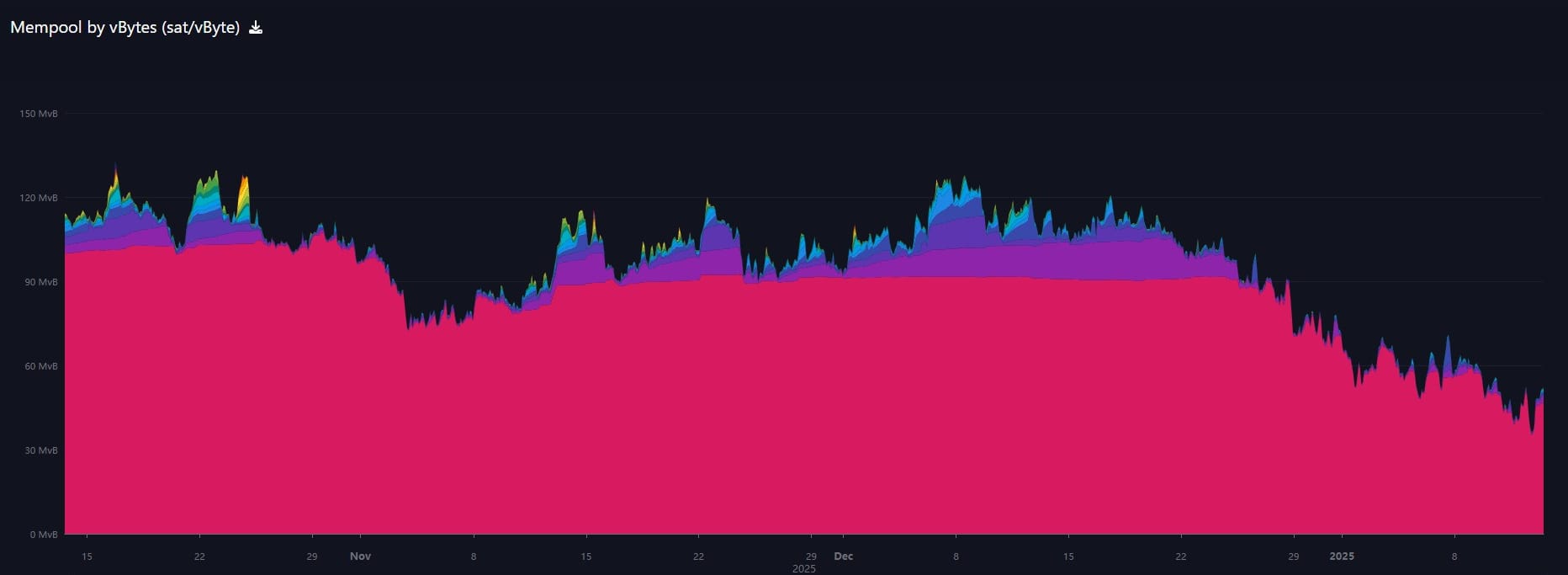

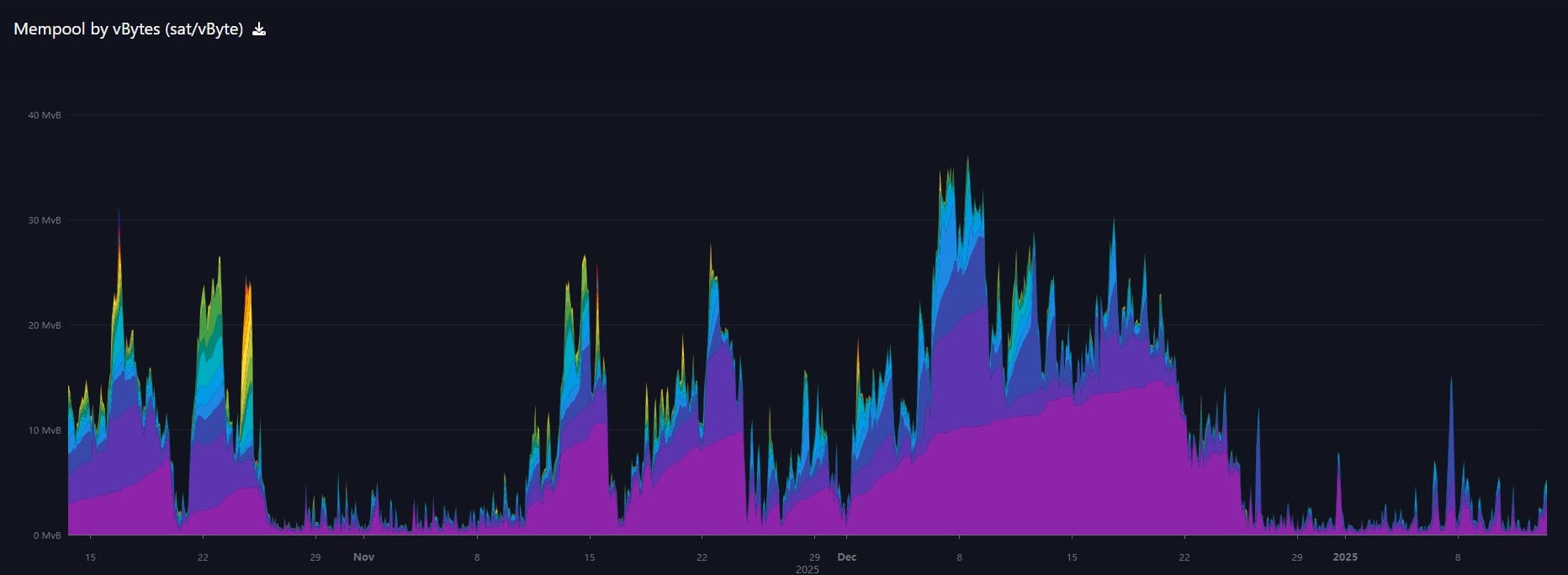

Mempool

The mempool continues to drop, down to 51MB this week. This signifies a drop in transactional demand relative to holding. The recent flat price action has flushed out many weak new hands and we are left with the strong holders.

An example of these weak hands is The Ranch Lawyer, who recently was convinced by tweet replies to DCA. He claimed to be buying $100 of BTC every day for a year. That lasted less than two weeks with him selling at a loss.

Stripping out the cheapest transactions we can see more clearly the total inactivity in the mempool.

In Case You Missed It...

My latest posts

- I have been releasing standalone videos for blog posts now. Please check them out and drop a comment!

- Bitcoin Is The Antithesis Of Fiat

- Bitcoin Indicators and Forecast - Premium

- Google’s Quantum Computing Leap: What It Means For Bitcoin’s Security - FORBES

Hold Strong!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com