Fundamentals Report #79 - 3/6/2020

Block: 620,530 - Est. Days Until Halving: 65

VITAL STATS

Block: 620,530

Est. Days Until Halving: 65

Mayer Multiple: 1.049

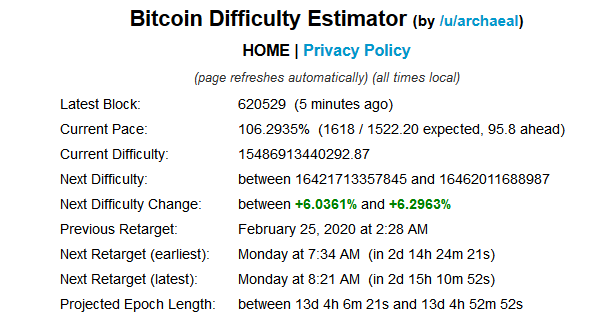

Est. Difficulty Adjustment: +6.0% in 3 days

Prev Adj: -0.4%

Weekly price H/L: $9,171/$8,490

Sats/$1 USD: 10,997

Disclaimer

MARKET COMMENTARY

Traditional markets are coming apart at the seams. Bitcoin is chilling.

The place to watch is the credit markets. Yields are plunging, meaning money is flooding into treasury bonds. The “risk off” scenario is approaching “ultra risk off”.

As a panic progresses, instead of professional investors diversifying into less risky assets, you get professional investors actively selling risky investments to cover margin calls or to flee to safety with what they can.

Confidence in the Fed is wavering. Their complete lack of control was demonstrated this week by the “emergency” rate cut of 50 bps and their failure to calm REPO markets. The carefully crafted illusion since the financial crisis of 2008 depends on the market’s belief in the Fed’s omniscience. More emergency rate cuts are coming. Zero rates are a certainty; how far negative will they try to push rates is the only question. Who wouldn’t buy bonds here, when rates are guaranteed to go lower and the stock market is crashing?

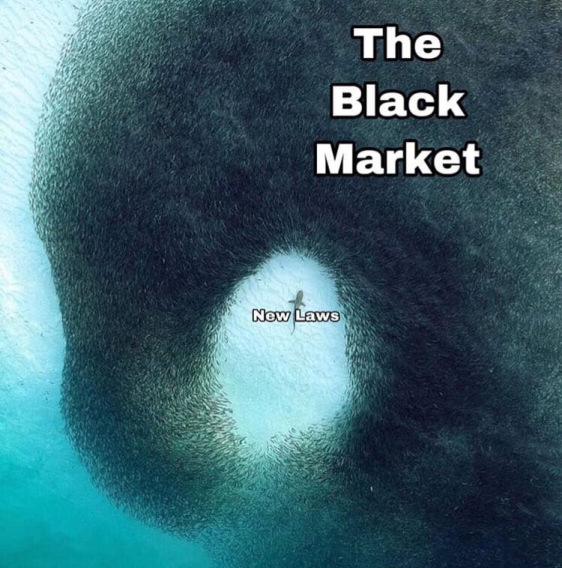

During all of this market mayhem bitcoin is sitting there calmly. It had a good sell off over the last couple of weeks, but is now stable. The aggressive rhetoric from government officials has stopped, too. Maybe it’s because they are too busy with other things, but we’ve also seen a very surprising about-face from several jurisdictions, like Australia, Germany and France. They have “legalized” bitcoin.

TOP STORIES

Australia: A NSW court has allowed a cryptocurrency exchange account to be used as security for legal costs

France: A French court considers bitcoin a fungible intangible asset. This ruling is significant for the use of bitcoin in lending and will lead to more liquidity.

Germany: Crypto Now Officially Seen as Financial Instruments in Germany. Germans now have clarification that bitcoin can legally be transmitted, stored and traded. It also show the assimilation of the idea of independent digital goods. Instead of only applying to centrally issued tokens or securities, it now applies to bitcoin, too.

India: Supreme Court Overrules Its Central Bank (RBI) Lifts Ban on Banks Servicing Crypto Firms. The RBI is fighting back though, seeking a review of the Supreme Court ruling.

PRICE

Weekly BMI | -1 : Slightly bearish

No surprises for the bitcoin price this week. It tracked the arrow on last week’s chart almost exactly so far. The next move is toward more consolidation in bitcoin as the altcoins disproportionately suffer during more traditional market weakness.

Price bounced almost perfectly on the 20 week moving average, which has been a very important bull/bear signal in bitcoin’s history and completed the rising wedge pattern with a full retrace. The small rally here has been low volume, currently trying to break above the 50 day EMA.

Price will struggle to get above current levels until some more consolidation. We expect a return to the 20 week MA over the next few days. Bitcoin will be surprisingly stable as traditional markets become very volatile.

Get more charts and detailed analysis on the member newsletter the Bitcoin Pulse.

MINING

Another surprise this week is the surging hash rate. The next difficulty adjustment is being estimated to be +6%. We can only speculate as to the reason. Perhaps distribution of new mining rigs out of China has resumed? Maybe marginal hashers are getting bullish? Increased hash rate as we approach the halving is logical, and they might even be mining uneconomically for the time being.

ALTCOINS

Ethereum’s ProgPow hard fork is being marketed like a corollary to Bitcoin’s scaling conflict that ended in 2017. How are Eth decisions made? Will developers be able to overrule “the community?” In reality, it’s very simple, “What Will Vitalik Do?” (WWVD) Whichever, way Vitalik goes will be Ethereum, it will also be the way Joe Lubin and Infura goes. If those two split up on different networks, the price of Eth will crater, and their once grand promises will openly fall apart. Don’t fall for the faux Eth debate.

The ETH price has been able to stay above the all important 0.025btc support for 22 days. It barely held on to that level yesterday, recovering a little versus bitcoin today. If there’s a daily close below 0.025, back to the lows ETH goes.

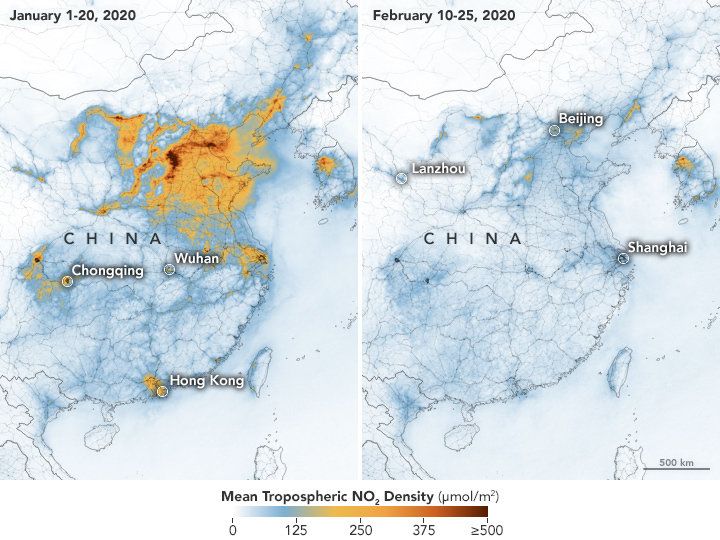

MACRO

The dramatic bullish move in the EUR/USD is a surprise. The dollar index erased all gains this year and looks to be headed lower. The dollar is being hit from the supply side and the demand side. On the supply side, investors would rather hold US treasuries than dollars, so they sell dollars and buy USTs. On the demand side, the Fed has opened up the liquidity flood gates in the REPO market and likely turned on currency swap lines (handing out dollars to foreign banks).

The other big reason for a Euro spike is Euro denominated bonds are all negative. German bunds are negative all the way out to the 30 year. Europeans would rather hold Euros.

This won’t last, prepare for volatility in the dollar. US rates will race toward zero, and dollar demand will spike. It’s very important to realize printing money pushes demand into the future, because it creates more debt. Demand might be neutralized for today, but a demand explosion is lurking. If new dollars were used to pay off debt, it contracts the monetary base, or deflation. All roads still lead to a melt up in the dollar.

MISCELLANEOUS

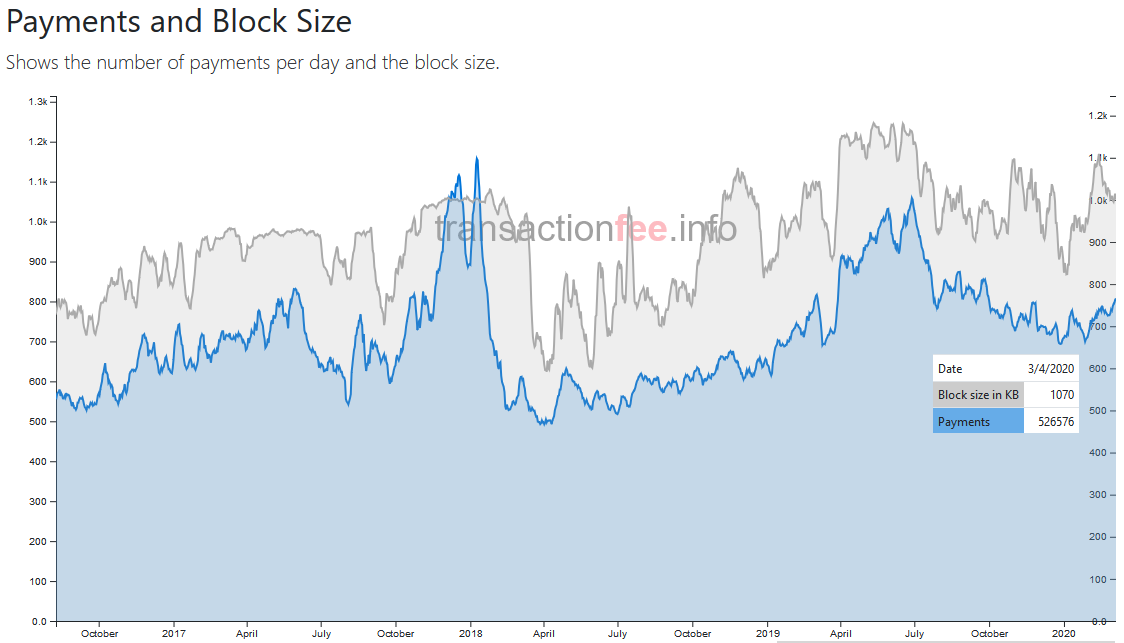

Here is an updated chart of bitcoin’s payments and block size, going back to the end of 2017’s bull run for comparison purposes. Considering the mempool is relatively empty with low fees, this looks healthy.

Subscribe to get the newsletter in your inbox every Friday,

A