Fundamentals Report #80 - 3/13/2020

Block: 621,521 - Day until halving: 58

VITAL STATS

Block: 621,521

Day until halving: 58

Mayer Multiple: 0.631

Est. Difficulty Adjustment: -4% in 10 Days

Prev Adj: +6.9%

Weekly price H/L: $8,185 / $3,800ish

Sats/$1 USD: 18,192

Disclaimer

MARKET COMMENTARY

Time to panic buy! A huge amount of damage to the bitcoin chart this week, but we should have been expecting this. The initial stages of a financial crisis were always going to be bad for bitcoin. We’ve been saying it for months now. We didn’t fully appreciate the illiquid conditions or the amount of selling that would occur.

We’ve just lived through an historic drop in bitcoin. A 62% drop from recent highs. If you’re new and held on for the ride, you’ve been baptized as a true hodler. Bitcoin will begin to separate itself from other asset classes soon. It will be a huge part of any new Plaza Accord or Bretton Woods type talks.

Prepare! – Time is almost over to prepare. Government instituted lock ins are coming to the US. There are rumors from sources we trust (but obviously can’t corroborate) that State governments in the US are preparing a 4 week lock down for major outbreak areas. We have to assume that the virus is everywhere at this point, and hospitals are going to be overwhelmed in a matter of weeks.

Think about your food rotation. You want to have some large items like a big bag of rice and some canned food that you won’t be rotating, but for your basics that you like to eat, start a rotation of a set number of meals. This situation is slightly easier to plan for because power and water should not be affected.

Social distancing is very important. Work from home if at all possible. Try to cut your daily exposure to people down by >95% or so.

TOP STORIES

USA’s IRS hosts crypto panel discussing exchanges, taxes, regulations & publishes ‘non-binding’ FAQs

“from the IRS side, numerous agency employees filled the auditorium and had many questions, such as asking for clarity on how blockchain forensics work on a technical level, how privacy coins differ from cryptocurrencies like Bitcoin, and what specifically they could do to simplify the process for taxpayers.” Fed offers $1.5 trillion in 2 days (More in Macro section) Fed announces another $33 billion in emergency QE – something is very wrong

DeFi Leader MakerDAO Weighs Emergency Shutdown Following ETH Price Drop

The crash in ETH price has created a situation where DAI is under-collateralized and they are debating closing the whole thing down. That would cause waves throughout all of ETH and likely be a quick path to a complete collapse in ETH.

Defi Update (4pm Friday)- MakerDAO completed an emergency “vote” to bailout and rescue their system. It passed within 3 hrs which effectively prints more DAI and MKR tokens to make up for earlier mistakes, as well as a whole host of other tweaks. It was a “vote” with the top 4 voting addresses making up 84% of all “votes”, and the top 3 making up 77%.

PRICE

Weekly BMI | 2 : Bullish

This is the opportunity that many people dream of, a huge Bitcoin sell off at the beginning of a new financial crisis. We are treating this like the best buying opportunity in years and expect a relatively quick climb to test $6500.

Though the chart appears ugly, what we have here is a late cycle double bottom and a setup for extremely aggressive correction into the halving. For weeks, we had been waiting for the daily RSI to touch oversold, and boy did it. It crushed it. The daily RSI was the most oversold since the initial drop from $6k back in 2018. Price also broke through several important levels where we expected support. This is truly uncharted territory.

If technicals are spotty, we need to rely on fundamentals, and Bitcoin’s fundamentals are solid with the exception of hash rate. However, a -4% est adjustment after a 62% decline from recent highs can be interpreted bullishly.

We just lived through a massive downside shock that shook out all the weak hands, one of the largest moves of its type in bitcoin history. The price may take a few days to consolidate before the next move, but so close to the halving and taking all other fundamentals into account, the future looks bright.

Get more technical and fundamental analysis with tons of charts by joining our Bitcoin Pulse member newsletter.

TRENDS

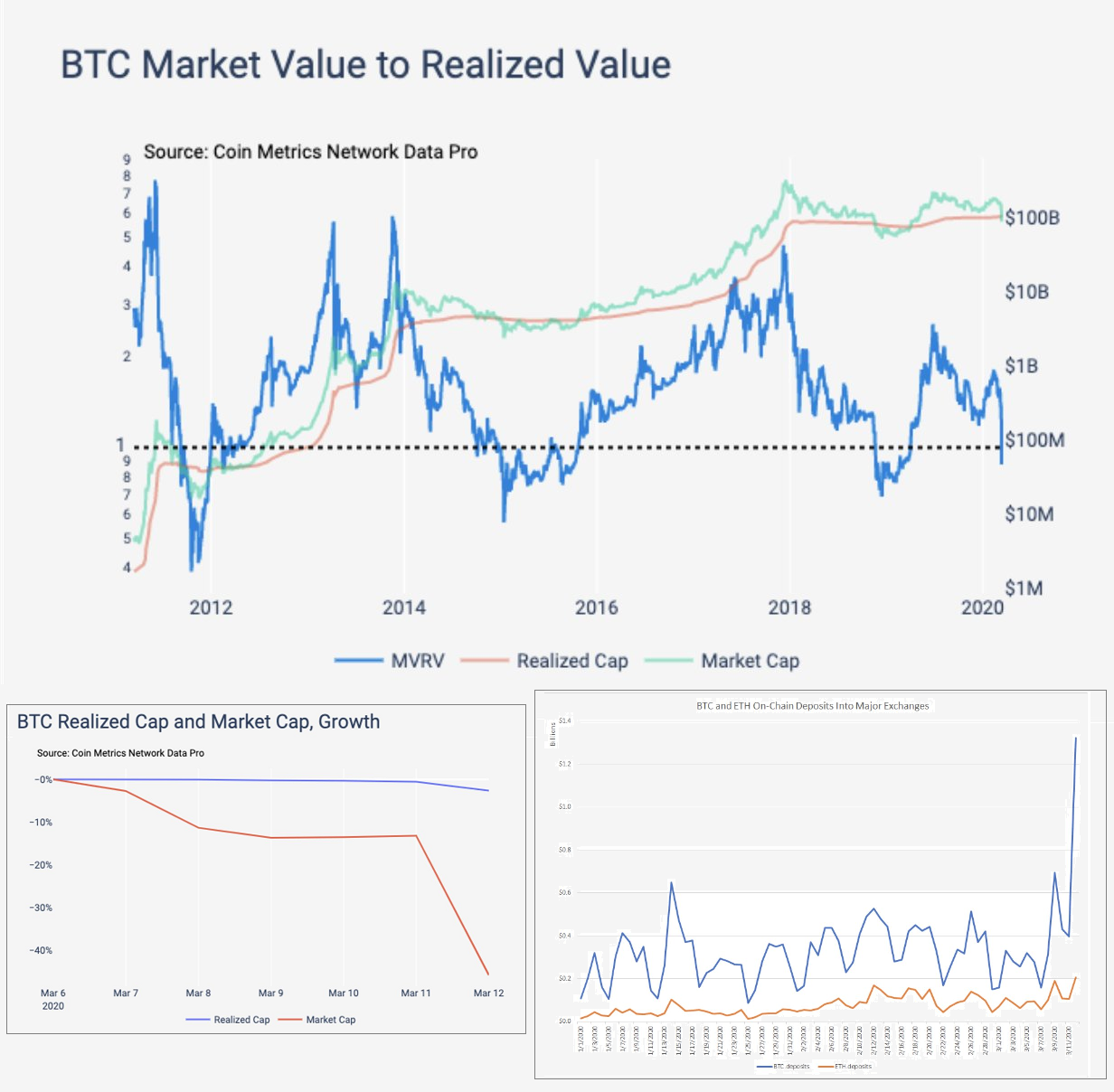

Coinmetrics published this MVRV chart and pointed out this is only the 4th time in history the MVRV dropped below 1, which have previously signaled bottoms. In the smaller image on the left, you can see the realized cap only dropped 3% while the BTC market cap dropped 46%, “signaling longer-term holders are staying strong and the recent price action is likely driven by newer buyers.” If this is true, this is very bullish as these newer buyers will start building a hodl stash as they learn about bitcoin.

ALTCOINS

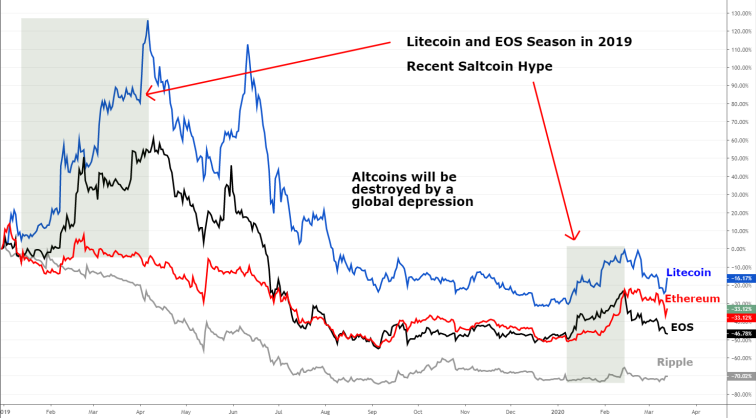

(DeFi headlines above) The next 6 month could be an Altcoin Winter where most bagholders will be rekt. Be advised.

MACRO

We are in full global meltdown. The Fed has come out swinging, but it won’t work.

The Fed offered an insane $1.5 trillion in REPO liquidity in the last 2 days. The result, only $119B was taken, despite liquidity conditions being tight. They are utterly confused and their “Bazooka” misfired. Why won’t this liquidity pump work?

First, dollars are units of debt, debt needs to get paid back. By flooding the system with more dollars, the Fed is increasing demand for dollars tomorrow, exacerbating the crisis. Second, dollar deposits are used to make loans by banks, expanding the pyramid of debt. If new money is used to pay off debt, it’s like knocking a block out at the bottom of the supply pyramid. The supply of dollars contracts dramatically.

There’s nothing the Fed can do with the form of money that the system is built on. Fiat money, that is a unit of debt, is the problem. Print all they want, it will lead to more demand for the dollar until the whole thing freezes up and collapses.

The chart below is the dollar index (DXY). After some shifty moves by the Fed to try to hammer demand, the dollar melt up resumes. This will continue to be volatile, but the trend is clear.

MISCELLANEOUS

Stay safe friends, if you haven’t already, get your ass to the store and stock up on supplies you may need for a few weeks!

Thanks for reading,

A