Fundamentals Report #82 - 3/27/2020

Block 623,219 - Days until halving: 47

Vital Stats

Block 623,219

Days until halving: 47

Mayer Multiple: .805

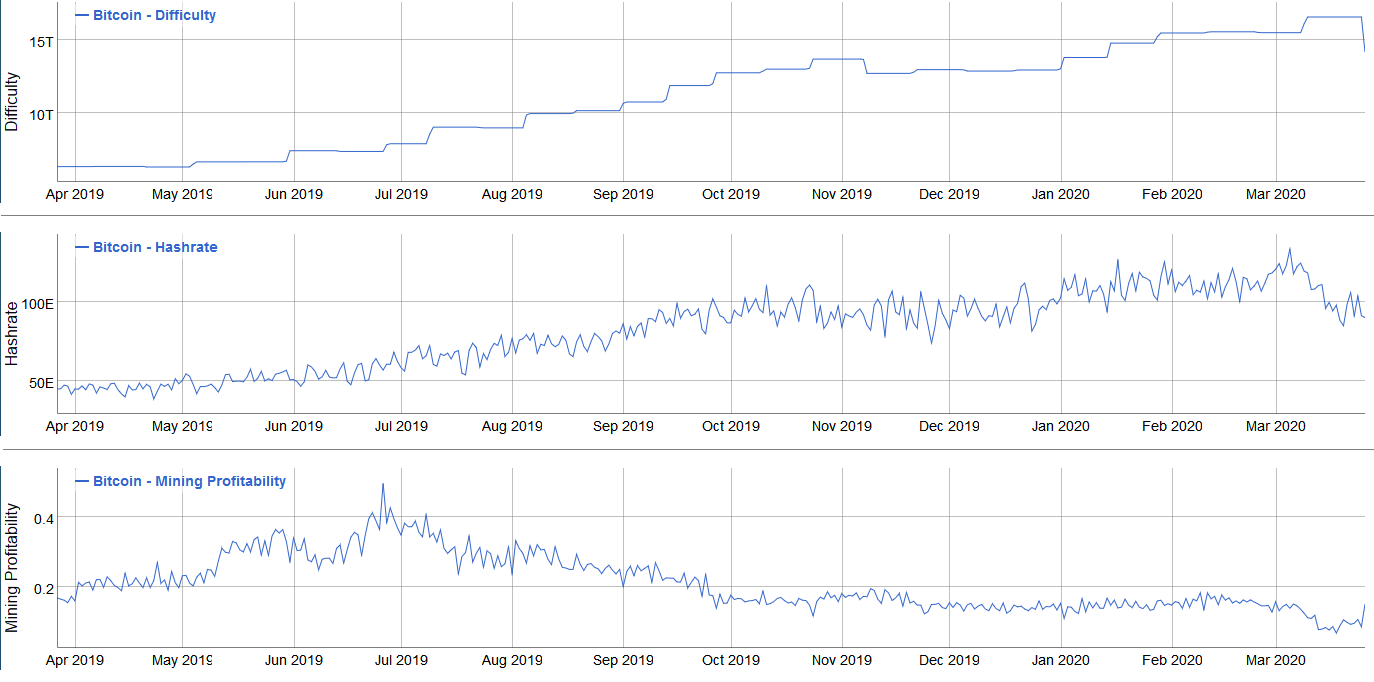

Est. Difficulty Adjustment: +2% to +10% in 12 Days

Prev Adj: -15.95%

Weekly price H/L: $6989 / $5686

Sats/$1 USD: 14,984

Disclaimer

MARKET COMMENTARY

I was on Bitcoin Magazine’s quarantine hang out last night. We talked about a lot of different topics like how bullish are we (LOL) due to helicopter money, the dollar, and altcoins. It was a very casual conversation, but I found myself in the minority of one. I’m the skeptic of the bunch. Everyone is expecting inflation to ramp up, I jump in at 45:55 and say in effect, “What are we considering money supply? Are treasuries money supply? I don’t know if the Fed can create inflation.” Let me try to break that down a little more.

Dollar and Inflation

In the REPO market, the difference between US Treasuries (UST’s) and USD’s becomes blurred. Firms take “collateral” (UST’s) and post it for an overnight loan in USD. What is considered money supply in that market when it’s functioning well? I claim it’s effectively both USD and UST’s. UST’s can become USD immediately in a highly liquid manner. However, when that market stops functioning well, and collateral cannot be swapped for USD’s seamlessly, the effective money supply gets drastically cut. A freezing of the REPO market is a hyper-deflationary event.

Add into this scenario the Fed buying collateral (QE), the Fed turns UST’s into USD (or reserves, but that gets even more complicated).

Before QE: Money supply = USD + UST collateral.

After QE: Money supply = (USD + x) + (UST – x)

Did inflation occur? No. It depends on what is acting as the money supply. Most of the economy is financialization, the money supply isn’t just chasing physical CPI type goods, it’s chasing financial products like CDO’s, MBS’s, UST’s, and a $200 trillion mountain of derivatives. Another problem on top of this, is that the market tries to set the ratio between USD and UST’s, but QE distorts that ratio causing dislocations elsewhere in the financial plumbing.

Bottom line for this inflation vs deflation debate, we need to answer three questions: 1) What is considered “money supply”? 2) How can the Fed increase that money supply? 3) What is the money supply relative to all the products it’s chasing?

Bailouts

Quickly, on fiscal bailouts (government spending). Do they increase the money supply? Well, it depends on what that money is being used for. If it’s being used to pay off debt – debt anywhere in the chain, individuals or the businesses where they spend it – it’s deflationary. Don’t forget, loans are assets for banks. If people and firms start paying off debt with bailouts on net, it could cause the banks to have problems. It’s very complicated for sure, it’s not as easy as saying QE equals inflation, that’s been debunked by observations since 2008.

Bitcoin

There’s much more to say about the dollar, but I want to get to bitcoin. The members of the Bitcoin Magazine hang out held the belief that the dollar was going to inflate and that would correlate to bitcoin going up in USD terms. I was surprised. Bitcoin is uncorrelated, why would it all of sudden become correlated. I don’t think it’s impossible, but what’s the mechanism? It’s more likely that bitcoin remains uncorrelated, 2x’ing in value every year on average (maybe a little more).

TOP STORIES

New nominee to the CME’s Board of Directors says CME should begin mining Bitcoin to create additional value for its stakeholders

The suggestion is that CME should become more energy independent with solar, wind, and hydro to power their operations. The excess could be used to mine bitcoin. The decentralization of power production is spreading.

Top South Korean Bank Plans to Offer Bitcoin Custody

KB Kookmin, one of the top South Korean lenders, filed a trademark for a new bitcoin custody service on Jan 31st, implying a roll out of a new custody service in the coming months.

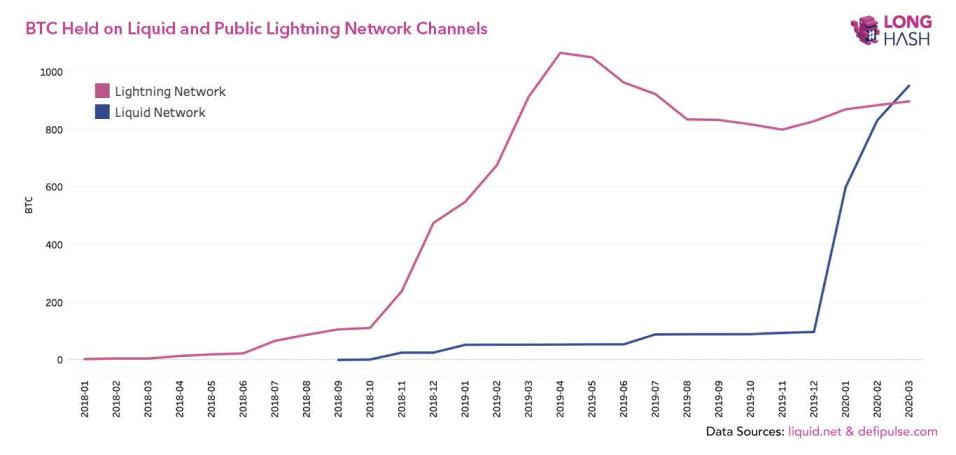

Bitcoin’s Liquid Sidechain Now Holds More Bitcoin Than Public Lightning Network Channels

In a new post by Longhash (chart below), they show the Liquid Network is growing by leaps and bounds. Also, important to the remember that Liquid is just one instance of an Elements sidechain. Perhaps governments will adopt bitcoin as reserves and start their own sidechains, connected by lightning. It’s an exciting time.

PRICE

Weekly BMI | -1 : Slightly bearish

Bitcoin has survived the initial drop and will hold up much better during the next leg down in the traditional markets. April is setting up to be a good month for bitcoin, but we have to get there first.

Several technical indicators are leaning bearish which I wrote about in depth on yesterday’s Bitcoin Pulse. On a daily time frame, the overriding pattern is a rising wedge, similar to what we saw in January through mid-February. This is paired with declining volume and a growing bear div on the 4 hr. My current target is $5700-$5900, before we move higher throughout April. Halving talk will really pick up in April and into May as Bitcoin outperforms traditional markets.

Prices move in a psychological rhythm, almost like a dance, not a random walk as the discredited EMH adherents will tell you. Technical patterns give us a glimpse into the psychology of the market.

MINING / LIGHTNING

Monster bitcoin difficulty adjustment. At -15% it was the second largest difficulty drop in Bitcoin’s history. Despite the size, the drop was expected due to swings in miner profitability. The bitcoin protocol is designed to adapt to market cycles in this way.

Since the adjustment, block times have reset to 10 mins, even slightly faster at the moment, signaling some hashrate has become profitable again in a dynamic process. The mempool is closely related to block times, usually growing when blocks slow down, however, it remained manageable throughout this period. Fees only rose slightly and are back to dirt cheap.

Liquid Network capacity has surpassed Lightning Network public capacity.

ALTCOINS

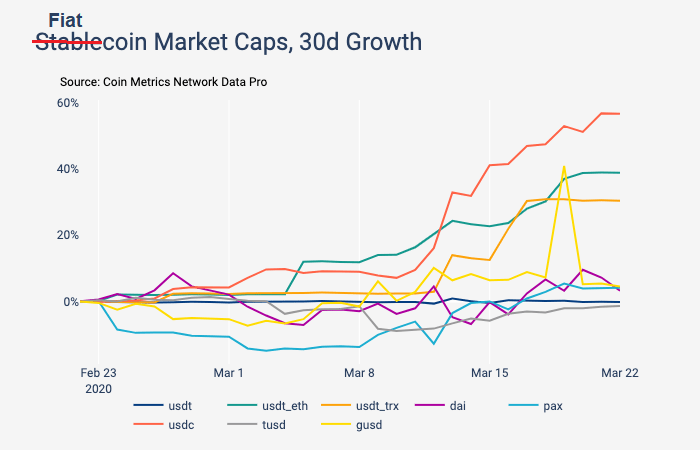

Fiat coins’ growth rate presented with little comment other than to say Tether is still King and even though heavily regulated USDC was added to MKR and saw significant gain because of the market sell off, it will have to prove its staying power.

MACRO

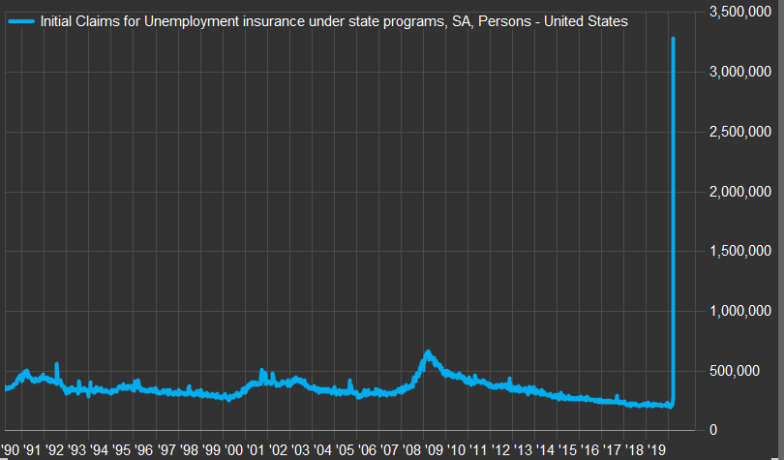

In an almost unbelievable print, 3.3 million Americans filed for unemployment this month. If that’s not an end of an era type chart, I don’t know what is. It’ll only go up from here. Unemployment could hit 10-20% in the next few months.

MISCELLANEOUS

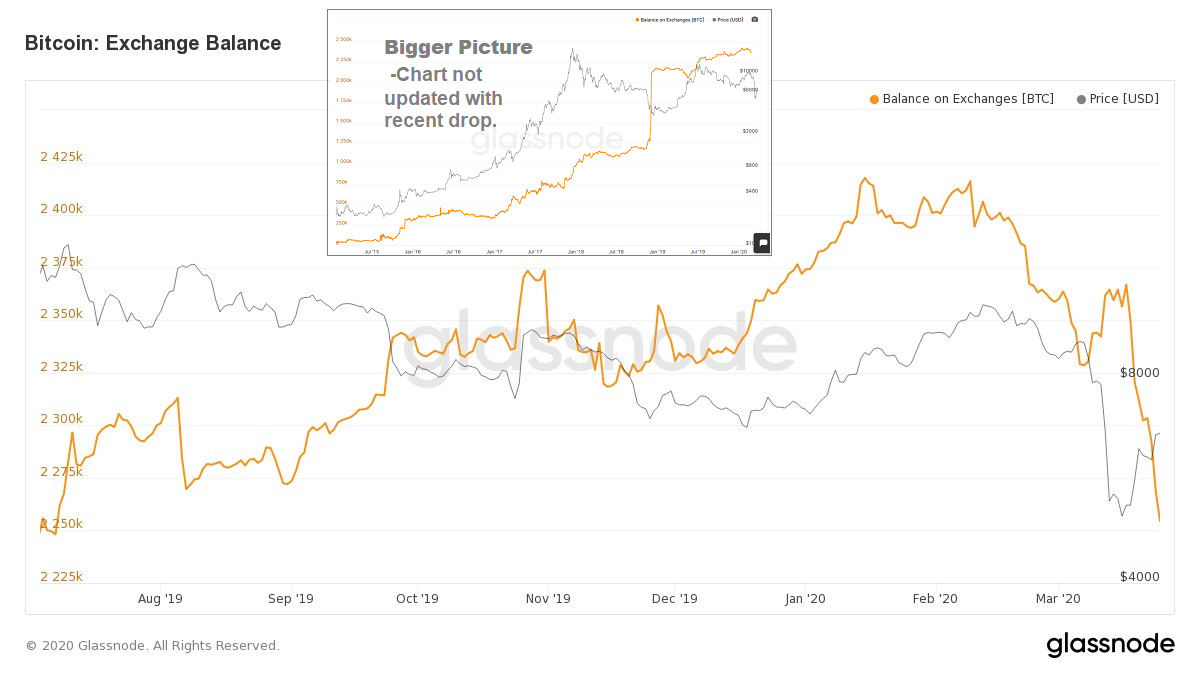

The number of bitcoins held in exchange’s wallets decreased by approximately 160k since Feb, hitting an 8 month low. However, if you zoom out, you can see there’s still over 2,200,000 btc held on the exchanges measured per glassnode. We can infer some things from this number like the number of bitcoins available for sale and overall liquidity is decreasing. This plays into a big moves ahead in April.

Thanks for reading,

A