Fundamentals Report #84

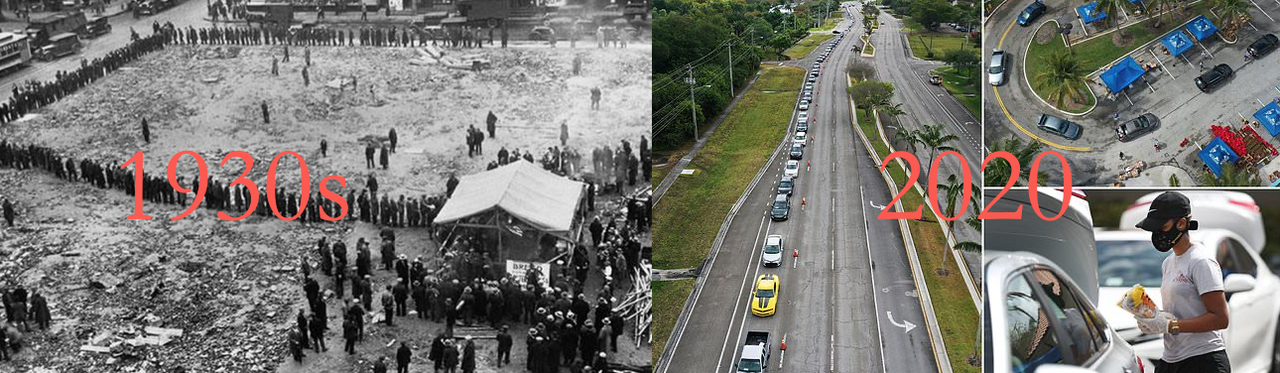

The Greatest Depression has started. We won't sugar coat things, it's going to get much worse before it gets better.

April 10, 2020 | Issue #84 | Block 625,337 | Disclaimer

Bitcoin Vital Stats

Day until halving: 32

Mayer Multiple: 0.854

Est. Difficulty Adjustment: +2% in 11 Days

Prev Adj: +5.8%

Weekly price H/L: $7475/$6766

Sats/$1 USD: 14,457

Bitcoin Market Commentary

The Greatest Depression has started. We won't sugar coat things, it's going to get much worse before it gets better. While the stock market and other asset prices have stabilized for the time being, fundamentals like unemployment and productivity are still collapsing. We are in the eye of the storm.

The virus is close to solved. Not over, but solved. The hydroxychloroquine treatment is showing great success and doctors are starting to figure out the virus is a blood disease and not a respiratory one. Once again, the market would have handled this better months ago. They would have used this safe treatment and studied the disease more if the CDC, FDA and WHO hadn't told lies and stood in their way. This is a failure of government 100%.

It now seems the virus will subside from here on out. There will still be outbreaks and hospitals will still be swamped, but the doomsday scenario is no longer viable. What we are left with is an economy that is malfunctioning. The plumbing is broken, as the Fed taking over nearly the entire economy shows. You can't taper a Ponzi scheme.

Bitcoin, however, is thriving in this environment. Institutional buyers are moving into mining, Fidelity is seeing an uptick in client interest and is expanding with ErisX exchange, and a bitcoin fund was added to the Toronto Stock Exchange.

The halving is also approaching, which is a unique event in the monetary world. Search volume for halving has skyrocketed recently (chart below) as interest in a sane money increases. Overall, 2020 will be a big year for bitcoin.

Other Top Stories in Bitcoin

Private Companies Could Play Role in Digital Currency Issuance, Bank of England Says

Lots of serious research is going into CBDC's. It's beginning to look like this will happen as part of a new Bretton Woods. We envision a large multinational federation creating a CBDC. Develeoping of course...

Twitter CEO Jack Dorsey donates $1 billion equivilent to fighting CV

Once again, Jack steps up to the plate. We're proud he's also a huge advocate of bitcoin.

Onslaught Of Crypto Class Action Lawsuits Launched On April 3 Against BitMEX, Binance, KuCoin, Tron Foundation, EOS, Quantstamp, BiBox, Status, Civic, Bancor, and Kyber Network

Once again, the regulators trying to flex their muscles three years too late. They can't sue bitcoin. Some of these people deserve punishment for their scams, but not by corrupt regulators, who themselves are scammers.

Bitcoin Price

Weekly BMI | 2 : Bullish

The bitcoin price hasn't been very exciting this week. It's showed strength in the face of uncertainty, but on low volume. As panic in the traditional market subsides for now, bitcoin is free to accumulate prior to the halving, only 32 days away.

The dip today is right into an area of high support. It's unlikely to break down further. Our April forecast is still very bullish, retracing much of March's losses and getting back on the bullish side of many indicators.

Very few weak hands remain in bitcoin, but the economic situation is affecting people's normal buying habits. When the helicopter money arrives in the US, expect a surge in buying.

Become a paid member to access our full technical analysis and member newsletter.

Bitcoin Mining

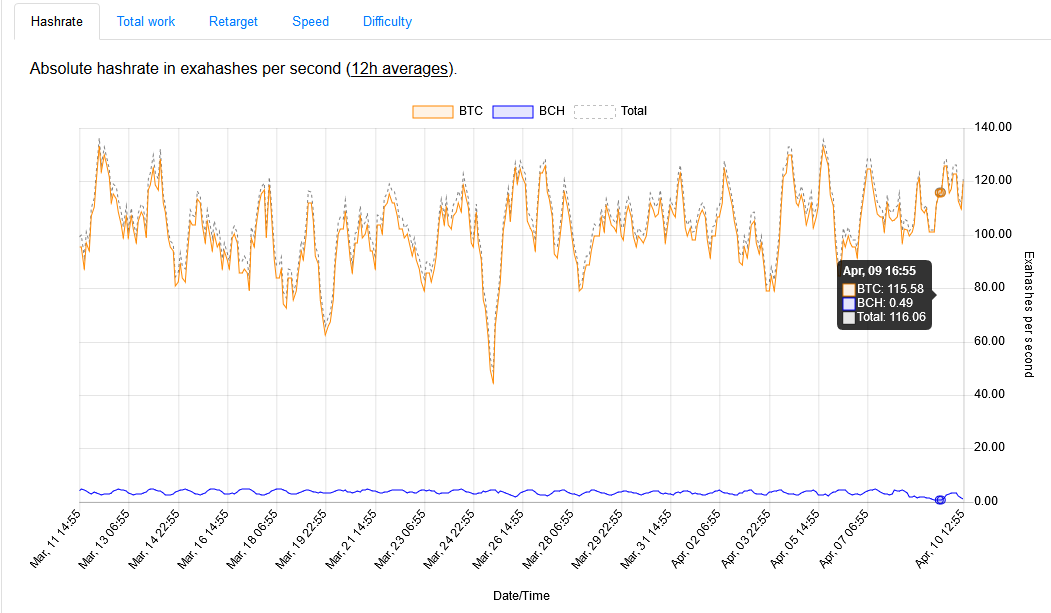

The Bcash halving occurred on Wednesday this week, and boy did they have problems. Per fork.lol, the hash rate went from between 3-4 exahashes per second down to 0.50 per second. The pro-BCH site cash.coin.dance shows the hashrate bottoming out around 1 exahashes per second and other sites like bitcoin[dot]com is too embarrassed to even update their numbers. The network also went several hours without a block right at the halving, relying on some faithful (stupid) miners mining it at a big loss.

Bcash has their own difficulty adjustment they dreamed up to fight the aggressive swings in hash rate and block times early in it's existence in 2017. They calculate it every block, so only the first few blocks after the halving were affected.

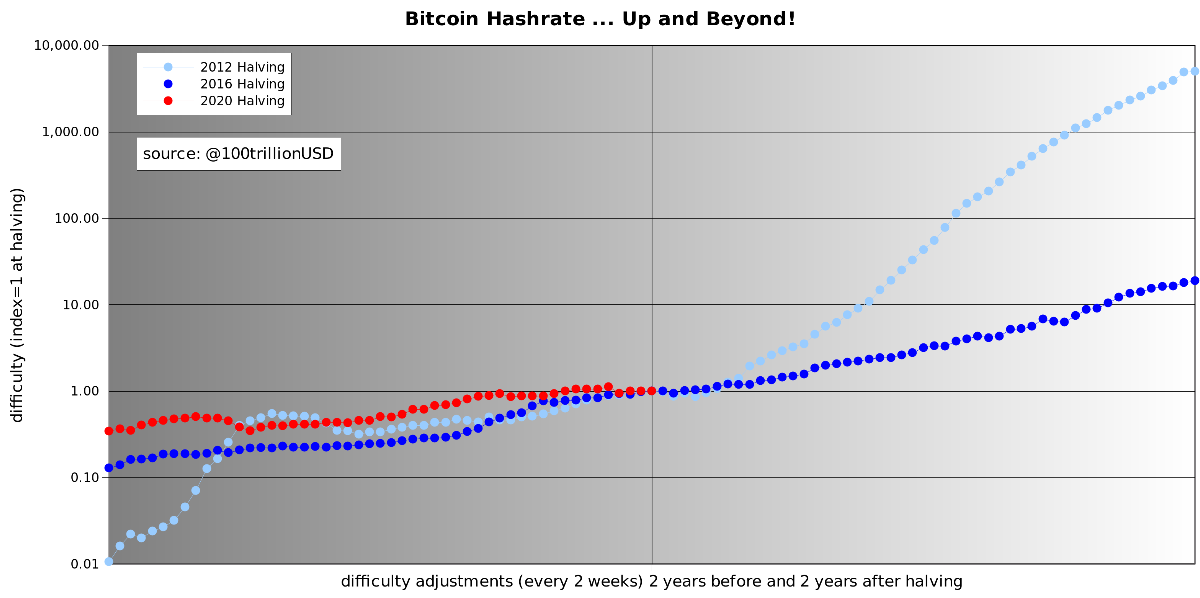

In other news, the Bitcoin halving is being meme'd as "Quantitative Hardening," and estimated to occur on May 13th. Bitcoin won't suffer the same fate as Bcash. Since Bcash has weaker monetary properties it's hash rate was accommodated the halving. In Bitcoin's case, the price will accommodate the halving by going up as a natural reaction to increased scarcity. The second chart below from @100TrillionUSD shows no significant drops in difficulty/hashrate after the last two halvings.

Altcoins

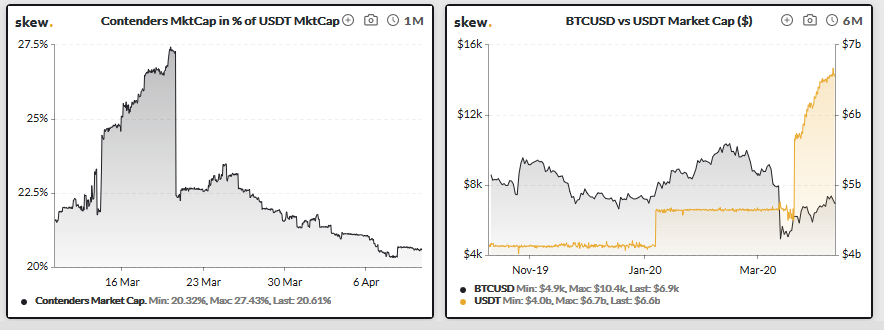

Tether is the top altcoin, so we have two Tether charts for you. Left, is the sum of all other USD coins as a percentage of Tether's market cap. Trending down. Right, is Tether market cap (supply) over bitcoin price. We can see the reaction to sale on bitcoin in March was a jump in Tether supply as people came in to buy the dip. The supply keeps growing, now over $6.5B. Bullish.

Miscellaneous

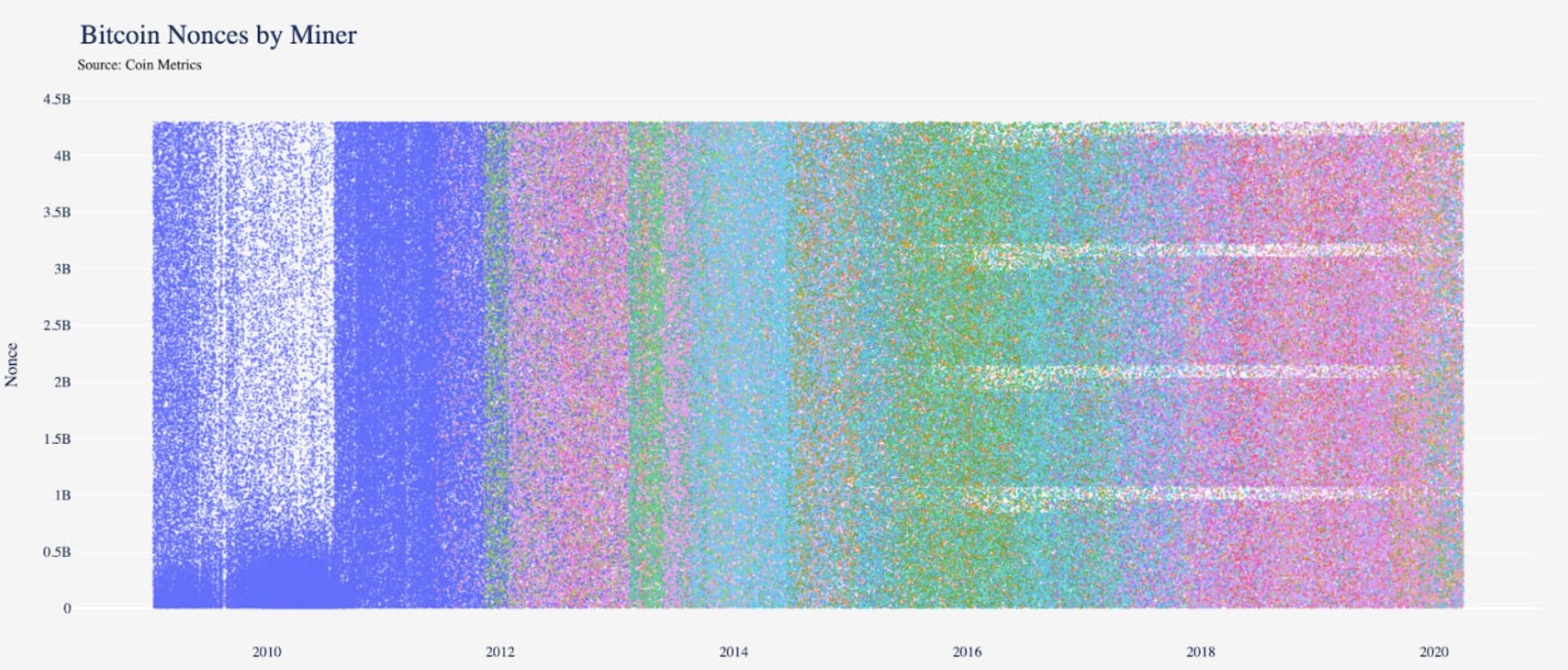

Below is an update to the Nonce graph we have talked about in the past. In this article by Coinmetrics, they speculate the pattern of white streaks starting in 2016 and ending around 2019 are due to Bitmains S7 and S9 miners. In April of 2019, the S17 miner was released and at the same time the white streak fades. There are still S7 & S9's hashing and if you look closely, you can still seen areas where it appears those nonces are not attempted.

These streaks are not a problem. They represent how certain mining hardware guessed the nonces to mine bitcoin. It's a fingerprint of sorts for specific models and versions of mining equipment. We can use this data to infer some miner behavior and sentiment. Maybe more on that in an episode of the podcast.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See