Fundamentals Report #86

April 24, 2020 | Issue #86 | Block 620,481

April 24, 2020 | Issue #86 | Block 620,481 | Disclaimer

Vital Stats

Day until halving: 17 !

Mayer Multiple: 0.940

Est. Difficulty Adjustment: +0.5 in 11 Days

Prev Adj: +8.5%

Weekly price H/L: $7802/$6751

Sats/$1 USD: 13,289

Market Commentary

The halving excitement is starting to build. Can you feel it?

We should discuss quickly the rationale behind why the halving is so bullish. For starters, a successful halving is a unique monetary event. Each halving proves bitcoin is not in anyone's control, and adds credence and confidence to bitcoin's fixed supply. That's number one.

Secondly, it's an increase in demand. The halving doesn't affect current use cases of actual spending, saving, collateral, the flow of bitcoin. The way bitcoin functions in unaffected. Current demand is untouched. However, it does introduce more people to the principles of hard money and bitcoin's scarcity is plastered all over the headlines. Demand for bitcoin marginally rises as a result.

Lastly, supply is restricted. The rate of supply increase is slowed permanently. The permanently portion is the unique part of bitcoin. We don't have to worry about new supply coming online as the price increases. Currently, 1800 bitcoin's are produced a day to service ever-growing demand. After the halving, the supply increase is cut to only 900/day.

All of these things combine to pull the price up.

Celebrate the halving with us on Discord and with Bitcoin Magazine on their 21 hour halvening extravaganza.

Top Stories

The Case for Deflation, a series of new podcasts from Bitcoin & MarketsOil Price Mayhem - Is The Market Broken? - Oilprice.com write up

"In a historic first, WTI closed in negative territory on Monday, or -$37.63 to be exact."

New Toronto based Bitcoin Fund had record volume yesterday showing institutional demand could be buildingVenture Smart Asia is Hong Kong’s first approved cryptocurrency fund

They are targeting $100 million in their fund this year. “We decided to launch this fund to address market demand from professional investors who are increasingly focused on Bitcoin as an alternative store of value."

Coinbase launches a price oracle in a desperate attempt to save Defi

The only reason for Defi's growth is because all other use cases of ethereum have proven to be losers. Now, this is the nail in the coffin of defi's pretense to decentralization. Even if many defi fanboys reject it, some won't and coinbase's centralized control oracle will corrupt the system. LOL

"A highly reliable price feed anchored (controlled and centralized) into Coinbase’s secure (controlled and centralized) infrastructure can help make the DeFi ecosystem safer, reduce systemic risks and unlock the next wave of growth and adoption." emphasis added

Price

Weekly BMI | 2 : Bullish

Big breakout in price over the last couple of days. April is turning out to be a great month as we predicted here. So far, April +$1094 17%. It really has become a breakout month, as bitcoin shows good stability and better performance than Gold +$145 +9%.

We expect further price gains by the end of the month, with a target of $7950, and over performance up to $8300, before some cooling off.

As our member newsletter has said, where you get more technical and fundamental analysis, "a slow scarcity driven climb is in order until levels get exciting." It'd be ideal to see a steady climb in the highlighted channel in the next two weeks until the halving.

Become a paid member to access our full technical analysis and member newsletter.

Mining

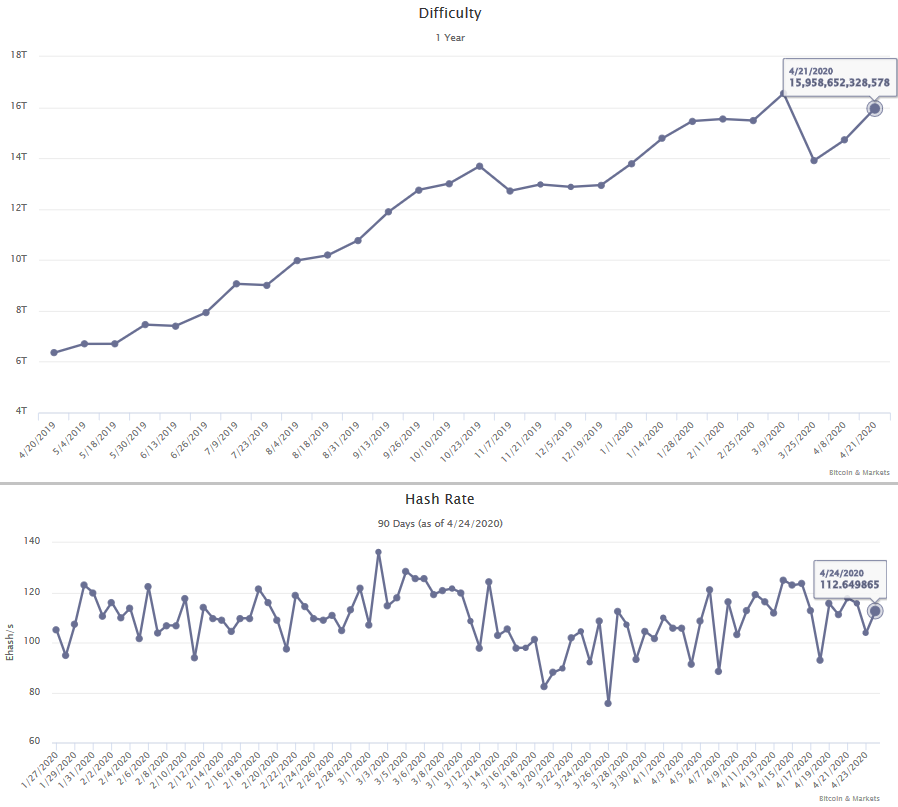

Difficulty increased by 8,45%. This is the one year chart you can find on our website. Difficulty is very near an ATH despite being below 50% from the ATH price. Several new more efficient and powerful mining rigs have come out recently, along with the halving, is pushing hash rate steadily up. Bitcoin mining is extremely healthy.

Altcoins / Stablecoins

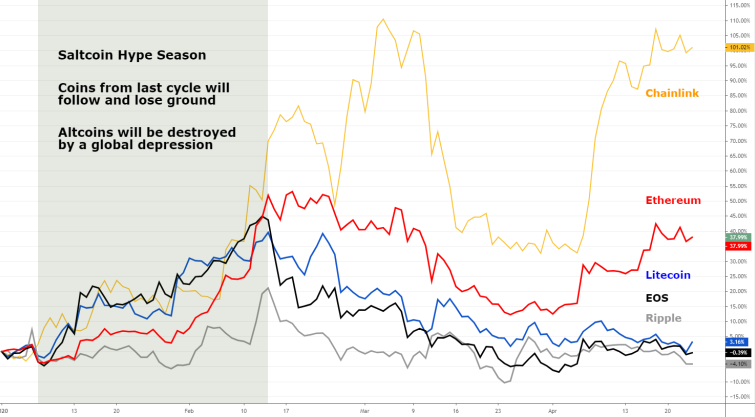

This has become the Stablecoin/Fiatcoin section. Altcoins are dead. Zero exciting things are happening on the altcoin side of the crypto house. People are losing their jobs, they aren't worried about Tron or EOS. Ethereum is the only altcoin of any importance, and even it has lost any hype or momentum (or reason for being).

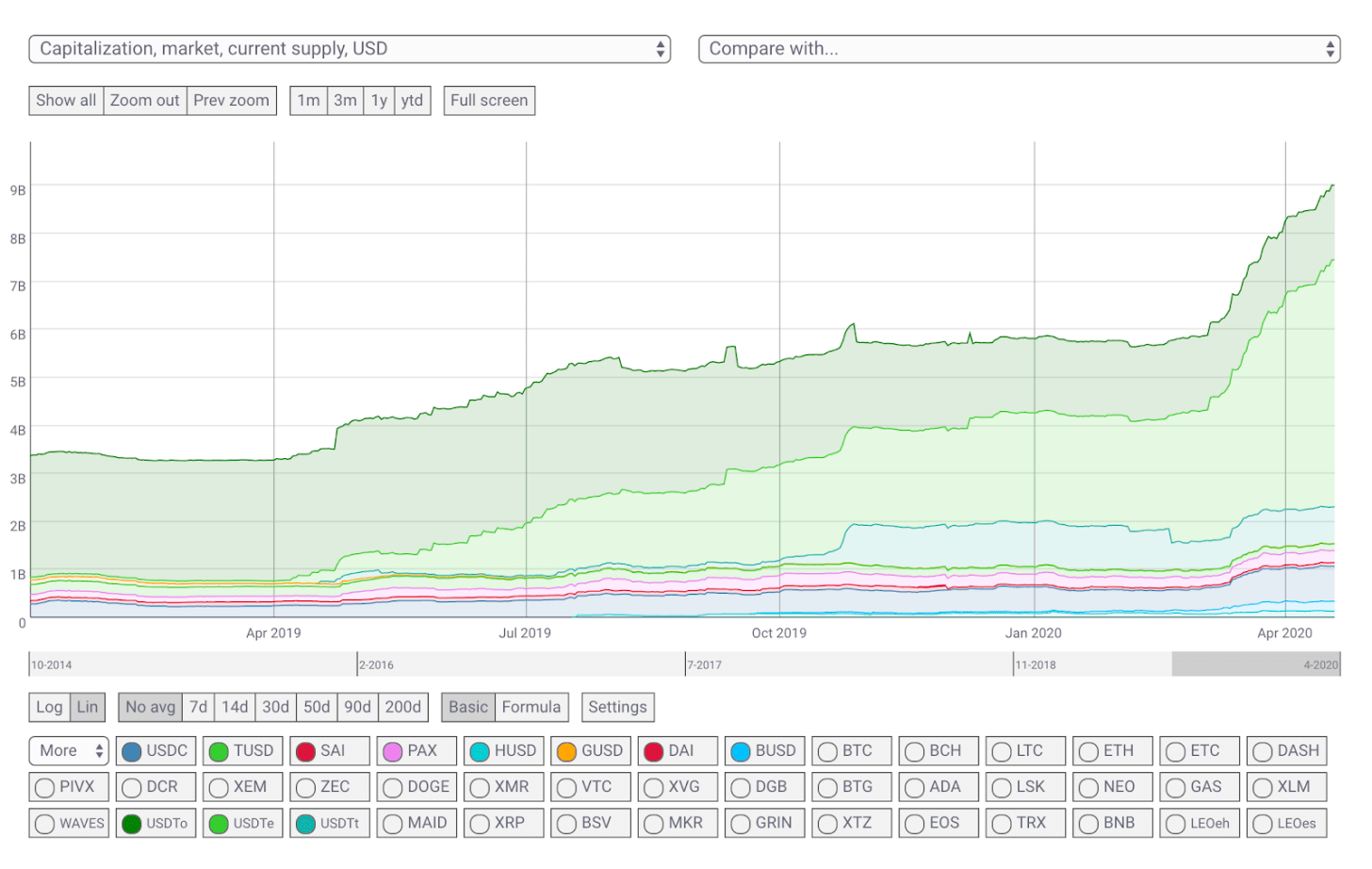

Stablecoins are the future of altcoins. And increasingly the future of ethereum, remember about 3-4x more tether value is transacted on the Eth network than ether itself, and all the hype is around Maker and DAI stablecoin Defi.

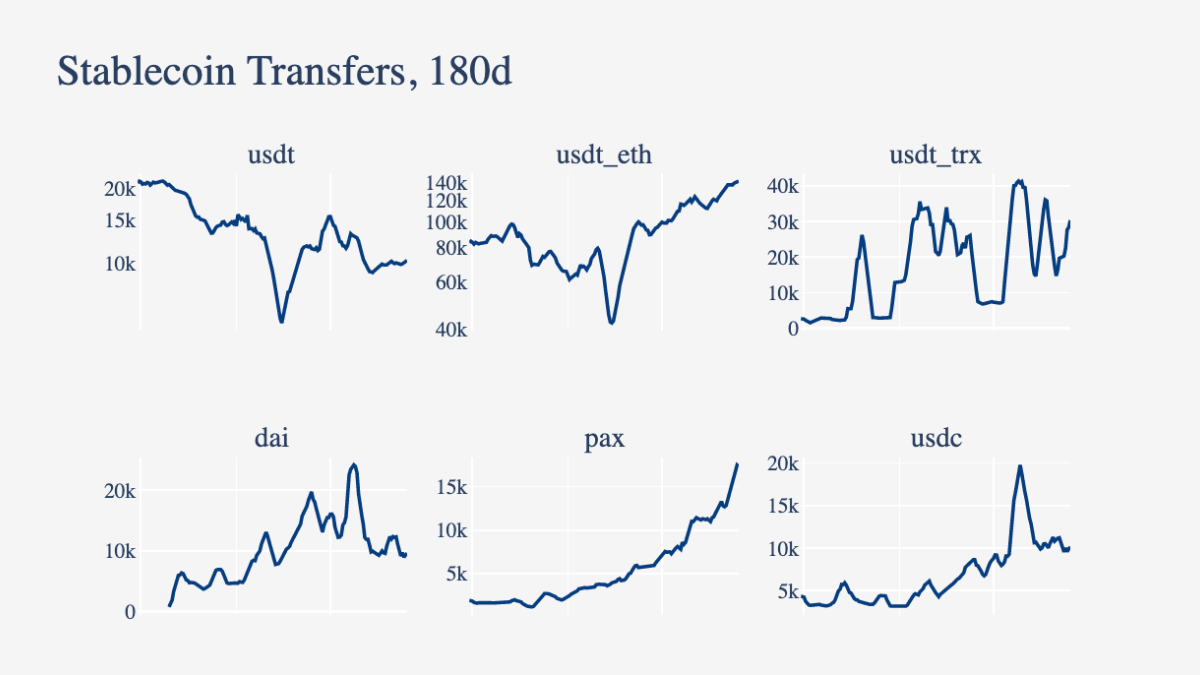

In the charts below via COINMETRICS, we can see the growth of stablecoins led again by Tether. They added nearly $1 billion in market cap in April alone. In the last 6 months, Tether has gone from roughly 100k total transactions per day to 150k, while others struggle to stay "stable".

Lastly, we included the top tier altcoin year-to-date (YTD) chart. What jumps out at you is the older altcoins falling in line with bitcoin, living happily in bitcoin's shadow. When bitcoin rallies hard, they will be left behind (with a possibility to play a little catch up later).

Ethereum is still trying to make a go of it. They have their Phase 0 upgrade (of at least 7 needed for ETH2.0) scheduled for July. Chainlink is a derivative play on Ethereum as a network for smart contract oracles. Apart from being much more illiquid in userbase than bitcoin, ethereum is a hope-and-dreams investment. It's technically and economically inferior to the bitcoin stack, and chainlink acts like a leveraged play on ethereum.

Macro

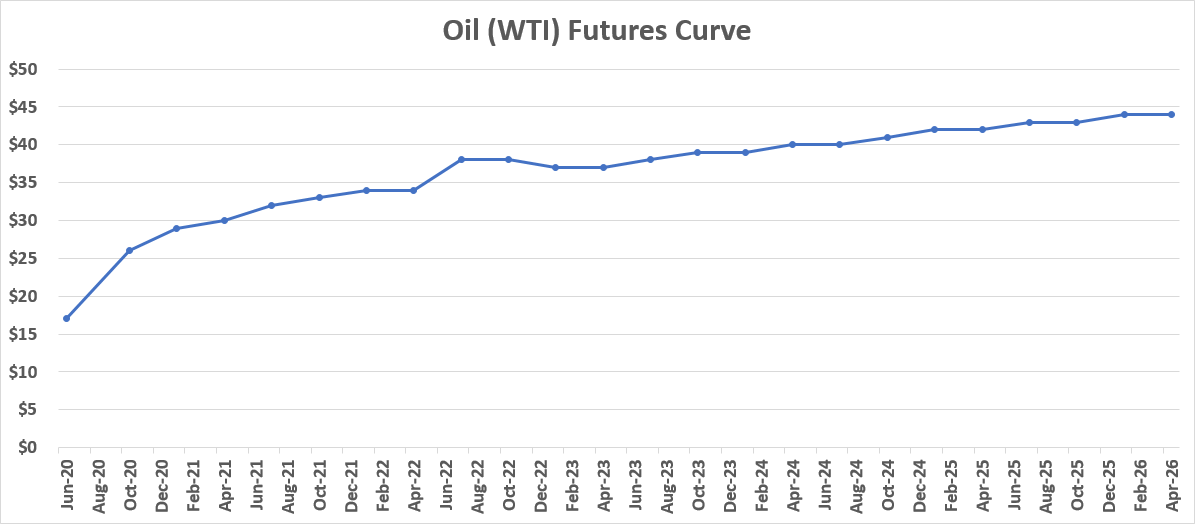

After the historic negative oil prices on Monday, let's take a look at the oil futures curve. It does not get to $45 all the way out to April 2026. Further out, the contract for Aug 2028 (not shown) is still under $50! The market is telling us peak oil demand has come and professionals expect this crisis to last much longer than expected. There's no V-shape recovery.

Miscellaneous

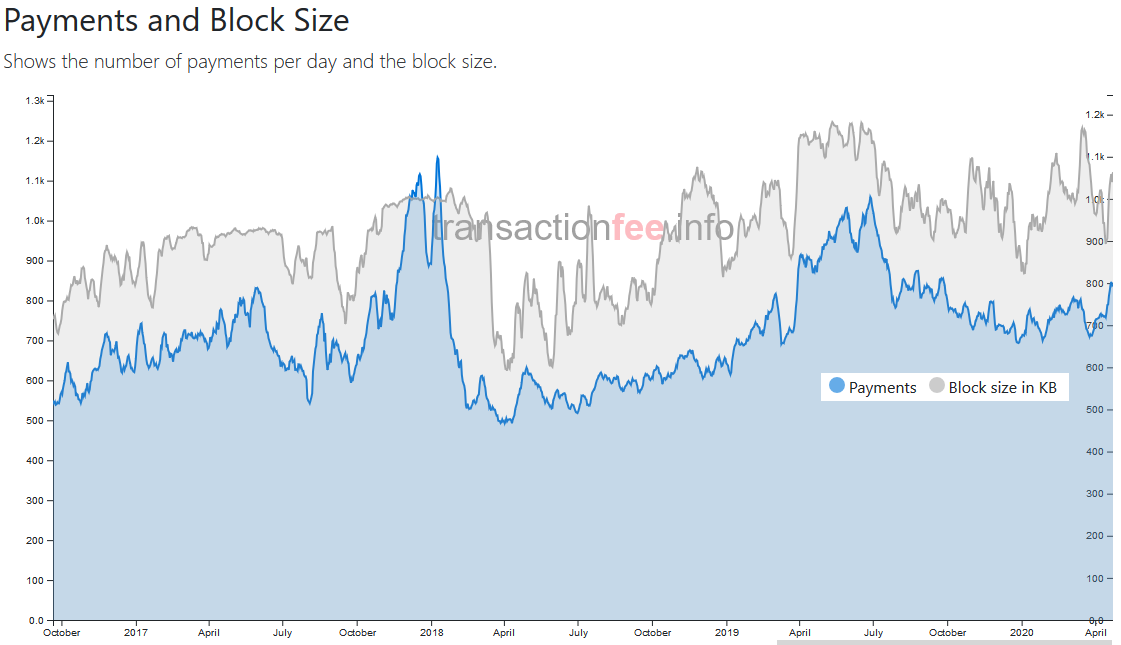

Here are two charts showing Bitcoin's on chain fundamentals.

The first chart shows almost 4 years of block utilization (gray) and number of payments (blue). Block utilization is near peaks and the number of payments is climbing back up. The recent valley in payments is higher than previous and a good sign for layer 2 growth in during this bull market.

The second chart from user @ColeGarnerBTC shows the number of entities (filtered to not double counting known exchanges and businesses) with bitcoin balances over 1000 btc. This is an extremely useful metric at this price level, because a balance of 1000 bitcoins means that address contains over $7 million worth of bitcoin. Other stats like addresses with 1 btc, could be double counting a lot of holders, while the 1000 btc bar won't.

GET THE BITCOIN DICTIONARY

Demystify Bitcoin Jargon

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

LIVE on Amazon!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See