Fundamentals Report #87

May 1, 2020 | Issue #87 | Block 628,465

May 1, 2020 | Issue #87 | Block 628,465 | Disclaimer

Vital Stats

Day until halving: 10

Mayer Multiple: 1.09

Est. Difficulty Adjustment: -2.5% in 4d

Prev Adj: +8.45%

Weekly price H/L: $9485 / $7432

Sats/$1 USD: 11,416

1 finney (1/10,000 btc): $0.87

Market Commentary

The anticipation for the halving is palpable. All eyes are on the price as it's surging.

It's easy to get caught up in the halving celebrations. It's, hands down, the single most noticeable difference between bitcoin and the legacy system. It's part of why we bitcoiners are bitcoiners in the first place. But if you're a trader, beware of price swings. A near unanimous bullishness has taken over the market, and you know what that means. Be careful trading this pre-halving volatility.

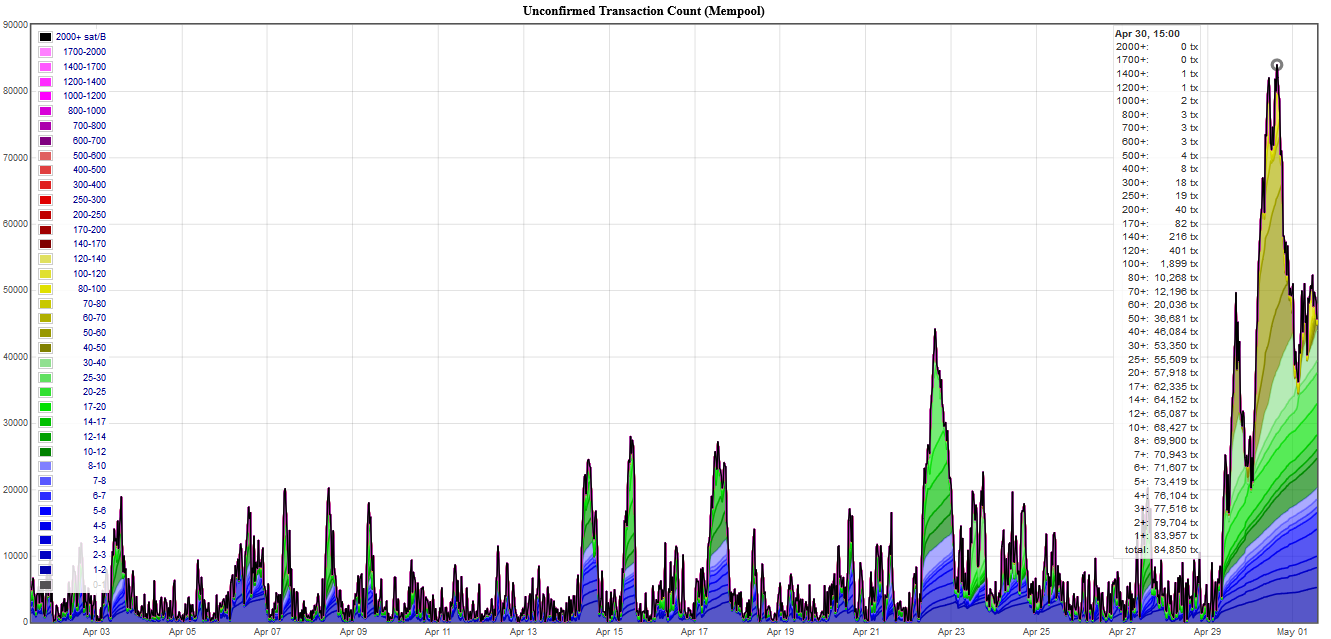

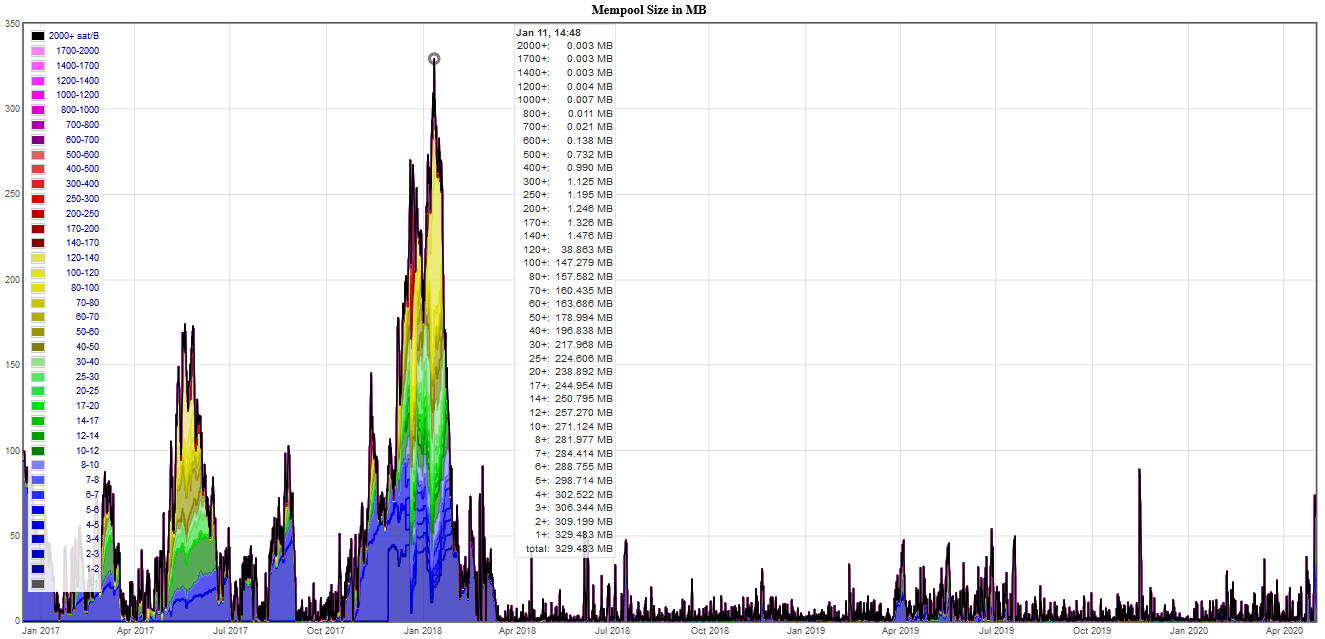

We have a few metrics below to give you a well rounded view of the current stance of this market, including a stock to flow and price break down, the recent spike in the mempool, and Hodl wave.

Other Top Stories

A Quick Rundown of Current CBDC Types

Andreessen Horowitz doubles down on ‘crypto’ with new $515 million fund

ETH 2.0 Issuance Will Be 2 Million a Year at Most Says Vitalik

Ethereum is on the marketing train during the Bitcoin halving hype to say, "Hey, look at us, we're very scarce, too." Vitalik is out on the circuit trying to make people believe that their subjective inflation tweaking is somehow robust against future changes.

Price

Weekly BMI | 0 : Neutral

As we predicted multiple times, April turned out to be a very good month for bitcoin (+$2206 34.3%) ! From the bottom in March, bitcoin is up an astonishing 225%.

There's lots of talk about the exactness of Plan B's S2F model. This week, the price returned right to the historic S2F prediction line. The chart below shows that line in blue and one standard deviation bands in red and green. Truly amazing how well this indicator has performed throughout bitcoin's history.

If you look around the last halving, there was a similar rally at the same time just before it, followed by a return to trend. There were also quite a few shake outs prior to the exponential rise. Expect similar here.

Become a paid member to access our full technical analysis and member newsletter.

Mining / Trends

Despite the historic 16% drop on March 25th, difficulty is right back to near ATH's, where it was prior to that dip. Currently, hash rate is slightly below even, with the next difficulty adjustment estimated to be -2.3% in 4 days. We expect this recent pop in price will allow many marginal miners to get back in the game, so difficulty will likely adjust down less than current estimates, and maybe even flip positive.

Macro

The Bitcoin & Markets series of podcasts on the Case for Deflation has three parts so far. We will be releasing another part soon on Liquidity and REPO markets. We will be touching on this quite a bit over the next few months, because it's an important topic for bitcoin and how the monetary system will evolve over the next few years.

The deflationary argument can be made from several vantage points. We've talked about the debt-based money side of things and touched on demand for dollars in the global dollar market, but some are making it from the US demand destruction angle as well. Lots of ways to skin this cat, adding to the list of things inflation proponents need to be able to explain.

Miscellaneous

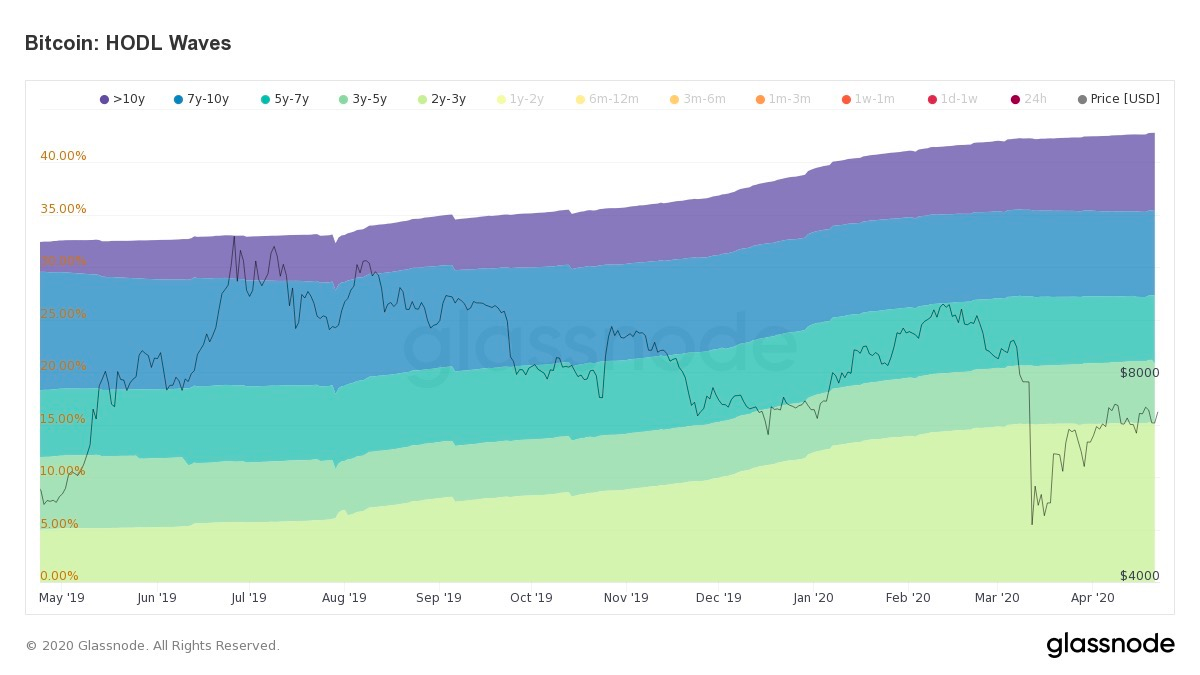

This tweet from @cryptounfolded shows updated hodlwave data from glassnode and reveals coins that have not moved for 2 years account for approximately 42% of the total supply, up 10% since last year. Lets hope this trend continues!

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See