Fundamentals Report #90

June 22, 2020 | Issue #90 | Block 631,334

June 22, 2020 | Issue #90 | Block 631,334 | Disclaimer

The Bitcoin Dictionary paperback is LIVE on Amazon!

Vital Stats

Price: $9210

Market Cap: $169 billion

Mayer Multiple: 1.14

Est. Difficulty Adjustment: -9% in 13 Days

Prev Adj: -6.0%

Weekly price H/L: $9966 / $8800

Sats/$1 USD: 10,857

1 finney: $0.92

Market Commentary

Joe Rogan is moving to Spotify, and he's pushing the conversation of censorship forward. Love him or hate him, he's a strong advocate for free speech and has huge influence on the popular consciousness.

As you may know, Bitcoin and crypto YouTube channels are getting taken down out of the blue. For example, Tone Vays, Bitcoin Meister, The Moon, Ivan on Tech and others, have been banned with no warning, only to be reinstated after a manual review process. While many of these incidents were mistakes, the narrowing of topics and thoughts you can express on YouTube is become alarming, and blatantly harmful, like the censorship of the term "coronavirus" in the beginning stages of the pandemic. Even globally recognized doctors and epidemiologist trying to warn the world were getting strikes and bans in January and February.

Of course, "deplatforming" is nothing new. It hit the mainstream with the Sargon of Akkad and Info Wars incidents in 2018, and only accelerated.

YouTube CEO Susan Wojcicki recently stated:

"So people saying, ‘Take vitamin C, take turmeric, we’ll cure you,’ those are the examples of things that would be a violation of our policy,” she told CNN.

“Anything that would go against World Health Organization recommendations would be a violation of our policy.”

"Mrs Wojcicki added YouTube had seen a 75% increase in demand for news from "authoritative" sources."

The reason for the growth in what she deems "authoritative" sources, is because YT only recommends that content, and they aggressively bury independent alternatives.

Back to Joe, his leaving YouTube at this time, relative to growing censorship, is a very teachable moment. It put $100 million well-deserved dollars into his pocket, and he sets an example for all of us.

The quality of mainstream media has dramatically declined in the last 20 years, and has become harmful to freedom and our very health. It is imperative we support each other as independent thinkers and content producers.

In the old days, people in the US would buy a newspaper for $0.25/day and $1 on Sundays. You paid for your content and the content was high quality. Today, free "news" has taken over, paid for by your eyeballs, driven by micro-doses of serotonin. If you want independent high quality media you have to support it.

In June, we're starting a small fundraising drive of sorts for quality content everywhere. It's called the Support Quality, Get Quality. It doesn't have to be Bitcoin & Markets, it can be any quality media you consume, it doesn't matter. The point is to bring awareness to the idea that without direct support, the quality of the content erodes over time. We challenge you to support others with $5/mo - 5 people for $1 or 1 for $5, it's up to you. Think of it like paying for a newspaper.

Other Top Stories

An early wallet caused some commotion when it moved some coins this week

No, it's highly improbable it's Satoshi, but it wouldn't matter if it were. The important part of this story is how most people latched onto it to explain the recent predictable price drop, which had nothing to do with the content of the news, only its timing. It's also funny, because this address was claimed by CSW as his in court.

Progress of the central bank digital currency experimentation process launched by the Banque de France

The Bank of France has "successfully" issued € 40 million in centralized tokenized bonds and settled them in Euros. This is the first time we've seen reference to "wholesale" digital currency, which is a very good description of what they are testing. It's also interesting that this is being conducted by a subordinate central bank and not the ECB.

The Bank of Korea is speeding up the technology review for the pilot test of the Central Bank Digital Currency (CBDC) (initial test)

From Google translate: "We analyzed 12 cases of 14 central banks such as Norway, Sweden, Switzerland, the United Kingdom, Japan and China to refer to the technical review for CBDC pilot test."

Central Bank of Korea official Han said, "Most countries are investigating whether new future-oriented technologies can be applied beyond the centralized ledger management and account-based transactions that are currently applied to payment and settlement systems." He added, "There is no clear market dominant technology yet."

Price

Weekly BMI | -1 : Slightly bearish

From last week's Report: "Don't buy at resistance, buy breakouts."

We've been expecting a post-halving consolidation, and that's exactly what we're seeing. $9000 has held so far but will likely break this week. While we are mid-term bullish after a boring consolidation period above $8000, some analysts are expecting a significant drop down to $6k, or even $4k. A renewed bear market to those levels is very unlikely due to supply fundamentals and growing demand from the institutional class. Instead, expect 1-2 months of boring price movement acting as accumulation for the next rally.

For more technical analysis and price commentary, subscribe to the Bitcoin Pulse.

From our May 19th issue,

"The exuberance from the halving has not subsided fully. The price is stable and pressing on the top-side resistance around the psychological resistance of $10,000. Volume is slightly elevated but trending down. Pressure is building on bulls to sustain this price. Altcoins look weak and, believe it or not, the stock market looks strong... the more likely scenario is for price to find support in a post-halving hangover of sorts."

Mining

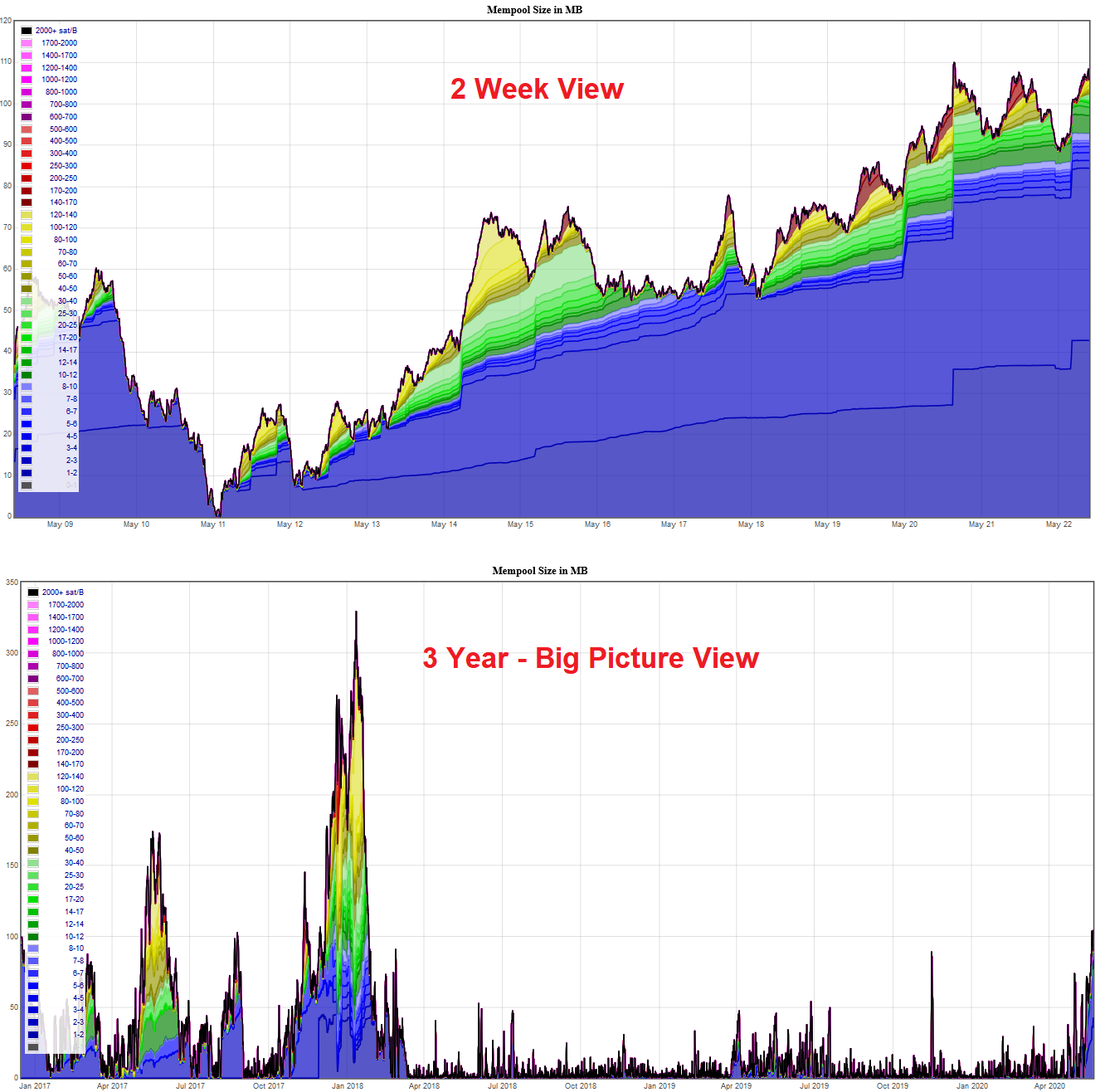

The mempool hasn't cleared since the last report we sent out and it continues to build. It will take one more difficulty adjustment period before the block times "normalize" as the halving occurred in the middle of a difficulty adjustment. Higher fees are required if you need your transaction in the next block or two.

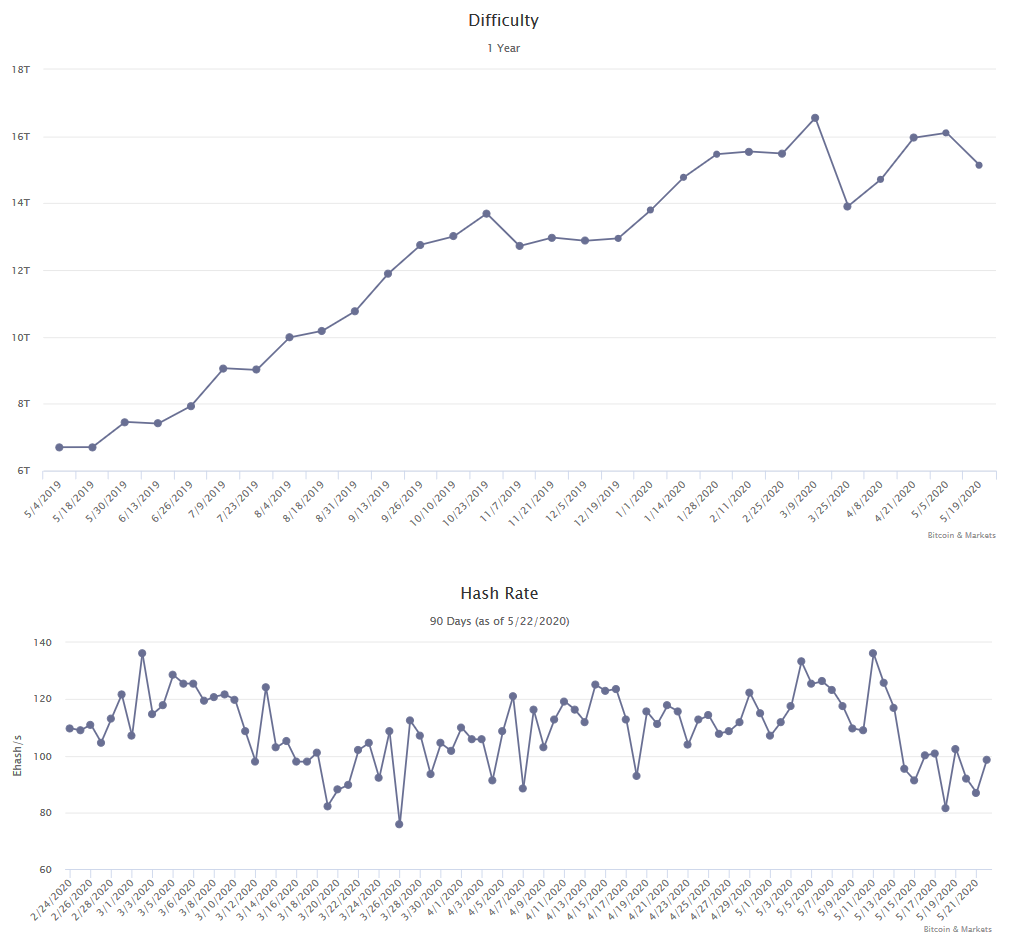

Difficulty adjusted down -6% on the 19th. You can see that on these graphs from our website bitcoinandmarkets.com/difficulty. The estimators are expecting a large -9% adjustment in 13 days, but we expect it to be smaller than that, roughly -5%. The hash rate graph below shows the effect of the halving on the hash rate, dropping approximately 10%.

Stablecoins / Altcoins

There is some altcoin confidence building and we expect to be flooded with ETH marketing over the next month as their Phase 0 approaches. Bags will be pumped.

On the stablecoin/CBDC front, as posted in the OTHER TOP STORIES section above, there's been quite a lot of movement. France, China and now Korea seem to be pushing the pace. We are awaiting the inevitable realization that they don't need a block chain. That'll probably come in the next 12 months as their vocabulary switches to "DLT" and "permissioned blockchains".

Macro

Below is a monthly chart of EURUSD. The red line is a two decade trend line that is in danger of breaking. When this happens around 1.05, there is little to support the Euro until psychological par with the dollar, and even that is not strong support. The Euro could get ugly.

This chart compliments the topic of the first WTF Fed? podcast I co-hosted with Christian which is coming out today. We talked about the ECB and outlook for the Eurozone.

Miscellaneous

Happy Pizza Day everyone!

GET THE BITCOIN DICTIONARY!

Demystify Bitcoin Jargon.

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See