Fundamentals Report #92

June 06, 2020 | Issue #92 | Block 633,250

June 06, 2020 | Issue #92 | Block 633,250 | Disclaimer

The Bitcoin Dictionary paperback is LIVE on Amazon!

Vital Stats

Weekly price: $9690 (+$279, 2.97%)

Mayer Multiple: 1.20

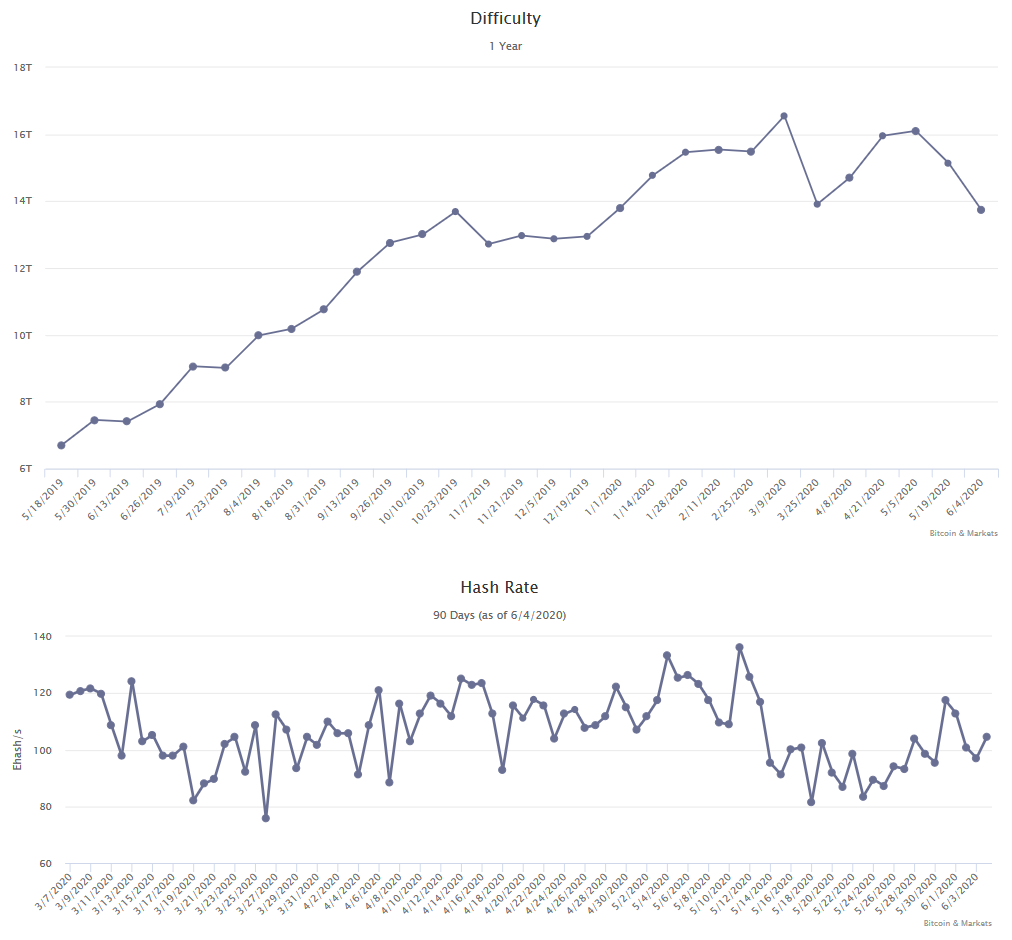

Est. Difficulty Adjustment: +5% to 10% in 11 Days

Prev Adj: -9.3%

Sats/$1 USD: 10320

1 finney: $0.97

Market Commentary

What a week! I hope all of our readers are holding up just fine. Be productive and stack sats.

Don't forget June is Support Quality Content Month for Bitcoin & Markets. Where ever you consume quality content, we challenge you to make a donation or sign up for regular support.

Insane Times

Things have gotten insanely complicated. Riots are continuing to spread across the world, US and European stocks soar as the social fabric is stretched, Powell pumps Eth, and bitcoin Barts. On top of that, the actual economy itself is in free fall. Official estimates for Q2 GDP are > -50%.

The start to this economic depression was intense, and the bear rally is deceptively strong. The MSM will concentrate on the riots and dividing the people, to keep them from focusing attention are the real perpetrators, the State. "Stocks are up! Look here! Racism caused these riots!" Divide and perpetuate is the new divide and conquer.

Don't be fooled by positive reports like the BLS scandal (below), growth will not return in any meaningful manner as far as the eye can see. Most major governments will respond to this crisis by increasing burdens on business through regulation and taxes. Even if they were to de-regulate, the current financial system will not allow for a cleaning of the bad debt. So, we are stuck in a low growth environment. Only when a new financial system is created will growth and inflation come back.

Government and Crony Lies are More Blatant

This week saw the horrible Lancet scandal and the BLS fake number scandal erupt.

The Lancet, one of the most respected medical journals in the world, was caught publishing a fake study on Hydroxychloroquine. (Video summary part 1, part 2)

Researchers and medical professionals were calling them out for two weeks, yet the Lancet refused to withdrawal the paper showing HCQ was dangerous, until the authors themselves withdrew the paper. The scandal rocked the medical profession.

The BLS scandal is late BREAKING. Their May employment number over-performed by the most on record. The estimates had been for another loss of 7 million jobs in May, with the unemployment rate topping 19%. However, the BLS today somehow reported a GAIN of 2.5 million jobs. That's a +9 million swing! They even used a survey week May 10-16, while most things were shutdown. It makes zero sense. It's all tweaking of the variables and models.

People are losing confidence in their government institutions!

Other Top Stories

Instead of rising institutional demand this week, we saw an increase in mining demand!

Nasdaq listed Marathon Patent Group (MARA) Announces Installation of 700 M30S+ ASIC Miners and Company is Debt Free

Mining in the US is picking up quickly. Mining is starting to be see in a nation's strategic interest.Kyrgyzstan is about to legalize cryptocurrency mining

Currently illegal in Kyrgyzstan to use or mine bitcoin, a new proposed law has some support to open that up.Chinese chip maker SMIC preps move into crypto mining hardware

Privacy

Europol did a study of Wasabi and found, "Suspects who avoid major slip-ups, have a very high probability of staying undetected."

Price

Weekly BMI | -2 : Bearish

The fake out and Bart pattern from this week was not a test pump, it was most likely a short squeeze before we continue lower. Bitcoin's long/short ratio is steady, except a MASSIVE call/put imbalance favoring calls on CME options. After the short squeeze, we expect a long squeeze before being able to decisively break $10k. So, continued consolidation. The fireworks will happen in the altcoins.

Grayscale ETH Trust (ETHE)

(As we began writing this ETHE started crashing)

A big area of concern for the whole space right now should be the ETHE premium being 750% and the huge ETH longs/short ratio on Bitfinex being over 11x more longs than shorts. It' has bubble written all over it.

Recent reports of large buys of ETHE and spot ETH on bitfinex have claimed this is huge "institutional demand" for ethereum. But let that sink in, Eth is uncapped in supply, has major scaling issues, and a confusing and impossible roadmap to ETH2.0. They'd also have to be buying ETHE to hodl for 1-year (more below). That doesn't pass the sanity check. These "institutional investors" are likely crypto hedge funds still around since 2017 that are playing the 1-year arbitrage. That's what we see. Bagholders trying to arb.

Through a quirk in the listing requirements of open-ended trusts, there's little supply to short ETHE and no redemptions. (Same with GBTC but it has a more developed secondary market and a steady premium at ~20%.) Retail can buy a share of ETHE on the secondary market like any other ETF or share, or accredited investors can buy through Grayscale at NAV, the underlying spot price. Seems like an easy 750% profit, buy at NAV then sell on the secondary market, but there's a catch. There is a 1-year lockup period when you buy new shares at NAV.

This means, accredited investors are buying and willing to hold for 1-year, and retail is buying at 10x the underlying on the secondary market at a 750% premium. Even if we factor in short hedges, there's still an overwhelming, no, SHOCKING long bias in the Eth market.

We don't know how this works out, but Eth is looking like it might implode soon. There is a massive bubble in ETHE, a crazy amount of margin longs on Bitfinex, and tether is clogging the network. All altcoin bagholder strength left is placing bets on ETH2.0.

An Eth crash will take the altcoin complex with it, even affecting Bitcoin but to a lesser degree. Bitcoin has multiple independent sources of demand, and the halving has recently restricted supply. We don't expect it to fall out of the consolidation zone, but do expect the BTC dominance surge.

Let's see how this plays out.

Development

From Aaron Van Wirdum's Bitcoin Magazine writeup on Core 0.20.0 release:

"Overseen by Bitcoin Core lead maintainer Wladimir van der Laan, this latest major release was developed by over 100 contributors in a span of about six months. The result of more than 500 merged pull requests, Bitcoin Core 0.20.0 mostly cleans up and hardens the Bitcoin Core codebase, advances hardware wallet integration, improves network reliability and includes several other improvements."

Mining

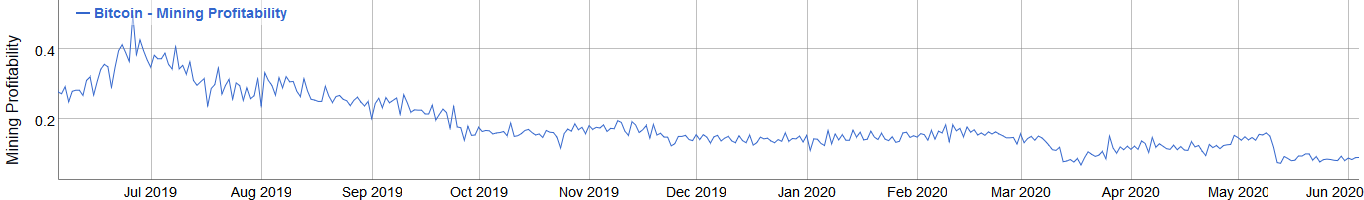

The first full difficulty adjustment since the halving occurred yesterday and was adjusted 9.3% downward. Hashrate has trended up since it's local low on May 18th and overall profitability is around $0.08 to $0.09 USD/Day for 1 TH/s, just slightly above the all time low set pre-halving in March of this year. The mempool is essentially clear so you can move Satoshis around for rock bottom fees.

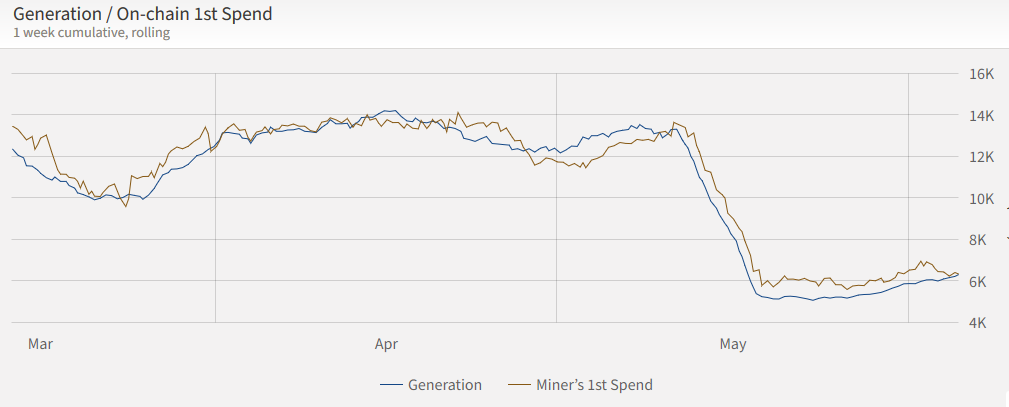

The last chart in this section is an update from ByteTree and their tracking of miner's first spends. This is a 7 day average, but you can still see miners are selling slightly more than they are currently producing.

Stablecoins / CBDC / Altcoins

In a story that is perfect for this section of the report, including both stablecoins and altcoins, the Tether problem is starting to squeeze ethereum. Their gas levels are soaring as Tether crowds out all the "world-changing" (d)Apps and other smart contract tokens.

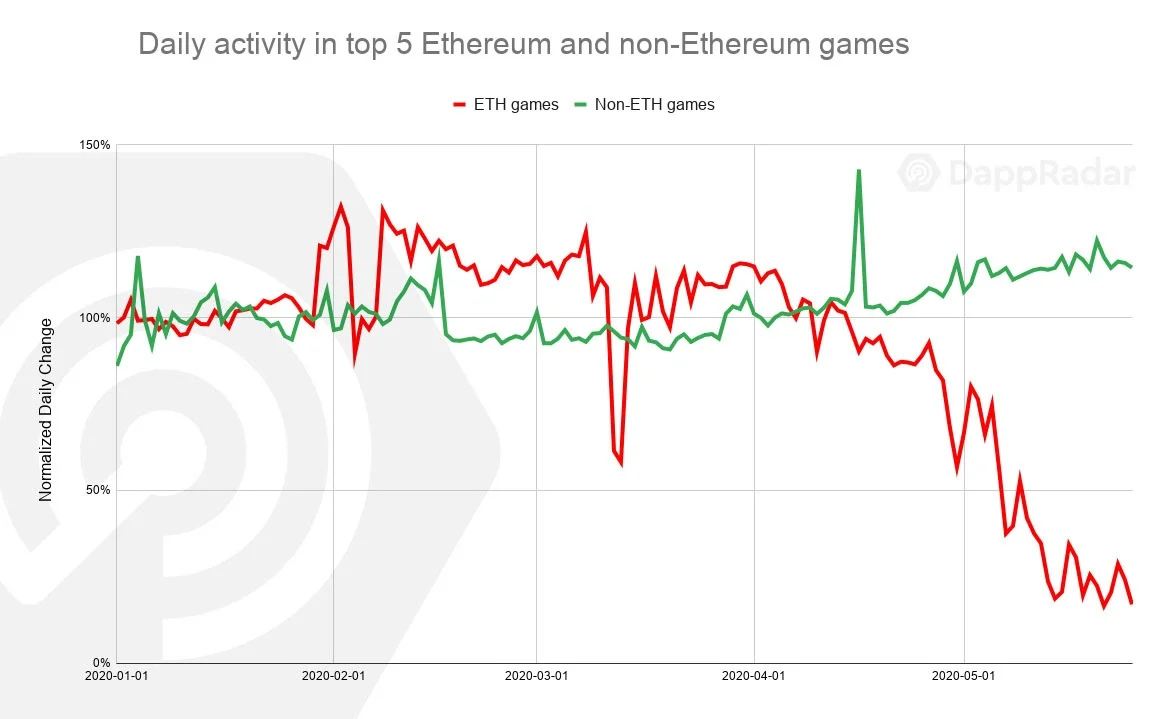

Ethereum is discussing rescuing their flawed network once again by increasing the gas limit, effectively their block size equivalent. Some developers want to increase the 10 mil limit to 25 mil, while Eth King Vitalik says 12-15 million. App usage is dropping hard on Eth as Tether use soars.

In a Block article Bitfinex CTO Paolo Ardoino admitted Tether is crushing Eth's ecosystem, saying, "By migrating USDT value transfers to the OMG Network we save costs, drive performance improvements and relieve pressure on the root chain network. This is good for Bitfinex and our customers, and the whole Ethereum ecosystem."

This will continue to happen. Parkinson's Law of Data says, "Data expands to fill the space available for storage”; buying more memory encourages the use of more memory-intensive techniques. (The original 1958 Parkinson's Law described the structural tendency of bureaucracies to make work for themselves.)"

Applied to Tether and digital currency in general, transactions will expand to fill all available space. And available space is less than advertised. If/when Tether moves to OMG network, their 1000 tps advertised, will be more like <100. That's because, 1000 is the theoretical limit, but as load is applied, and node costs go up, it becomes too burdensome.

For less robust networks, this will cripple them. Tether will be forced to hop from network to network, leaving a path of destruction in its wake. Eventually, networks will try to block Tether, and it will be forced onto a federated or centralized network, like Liquid.

GET THE BITCOIN DICTIONARY!

Demystify Bitcoin Jargon.

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See