Fundamentals Report #94

June 19, 2020 | Issue #94 | Block 635,436

June 19, 2020 | Issue #94 | Block 635,436 | Disclaimer

The Bitcoin Dictionary paperback is LIVE on Amazon!

Vital Stats

Weekly price: $9321 (-$32, -0.34%)

Mayer Multiple: 1.13

Est. Difficulty Adjustment: -6% in 11d

Prev Adj: +14.95%

Sats/$1 USD: 10,728

1 finney: $0.93

Market Commentary

It's been a slow news week in bitcoin. A few headlines caught our eye but nothing significant. We touch on those few below. During these slow weeks, we like to zoom out. Today, we're going to zoom way out to focus on one major change from the 2016-2017 cycle to the current market.

In the last few months it has become apparent bitcoin's internal news cycle is losing importance to the external news. The developments in "blockchain" or XYZ platform no longer matter, they've been replaced by headlines concerning stock markets, Central Banks, and the economy as a whole. Bitcoin has shifted its sights from decentralized altcoins to nation-state altcoins (fiat).

It's not surprising. The global economy has been rocked to its core. The social fabric of countries is being stretched. And now, we've taken for granted bitcoin being seen as a natural remedy. Large players like Paul Tudor Jones, the Winklevoss twins, and Fidelity are treating bitcoin extremely seriously.

Just four years ago, when bitcoin's market cap was less than $12 billion and an industry-wide attack on its consensus was imminent, it would not have been impossible to take it seriously as an alternative monetary system. Now, the game is different. Bitcoin is different. It's a real player. And that real-player status will translate into an epic bull run.

Other Top Stories

Bitcoin is becoming more trustworthy than big banks, says survey

"Over 45% of respondents preferred Bitcoin over stocks, real estate and gold."

"47% of respondents trust Bitcoin over big banks."

XRP Isn’t A Security, Declares Former CFTC Chairman

This story is a sad one. Giancarlo, a former head of the CFTC (not in charge of declaring something a security btw) was dubbed Crypto Dad a few years back, because of his friendly testimony in front of Congress. However, after leaving his post, he's formed the Digital Dollar Institute and is a major shareholder in Ripple. Now, he says Ripple is not a security. It's laughable.

‘Snake Oil and Overpriced Junk’: Why Blockchain Doesn’t Fix Online Voting

Another silly "blockchain" use bites the dust. Block chain is only useful for distributed money. None of these extraneous use cases are going to bare fruit other than to fleece dumb investors.

Price

Weekly BMI | 0 : Neutral

Once again this week, price has happily stayed within the consolidation zone we identified weeks ago, frustrating many day traders and benefiting dollar cost averaging. Price is close to a fundamental floor, but that doesn't mean it can't go lower. We expect a daily oversold condition to develop prior to a big breakout. Even prior to the halving, on our member newsletter we wrote about what's happening now.

On May 7th, Bitcoin Pulse #55 excerpt:

"The price keeps climbing steadily on the halving hype! But nothing goes up in a straight line - even bitcoin.

"The halving drives its own hype cycle, that's one reason why it can't be priced in before hand. What we see leading up to the halving is new people being introduced to bitcoin and either buying GBTC in their portfolios or buying through CashApp. This is not the effect of the halving, it's an effect of exposure to the idea of the halving. It is like a mini bubble. "Buy the rumor, sell the news" is the trademark slogan for this phenomenon.

"The consequences of the restricted supply from the halving will be priced in slowly. [...] "Immediate price expectations for after the halving are that hype will subside. People get excited watching the halving live for their first time. It feels like a big deal, but in reality, it's just another day. The halving will come and go, the hype will die down, and price will return to mean."

On May 13th, Bitcoin Pulse #56 excerpt:

There are several new factors at play. The most important is the slow-motion collapse of the eurodollar system, creating a stagnant economy denominated in dollars. The bitcoin denominated economy will be very attractive! The other fat tails at this time are the collapse of the CCP and the dissolution of the EU. Both are looking more likely each day.

Technically, bitcoin is looking bullish, but there is still some overhang from the giant April run we predicted would happen. The expectation for May remains sideways to slightly up, buying on the dips. The same for June.

Mining

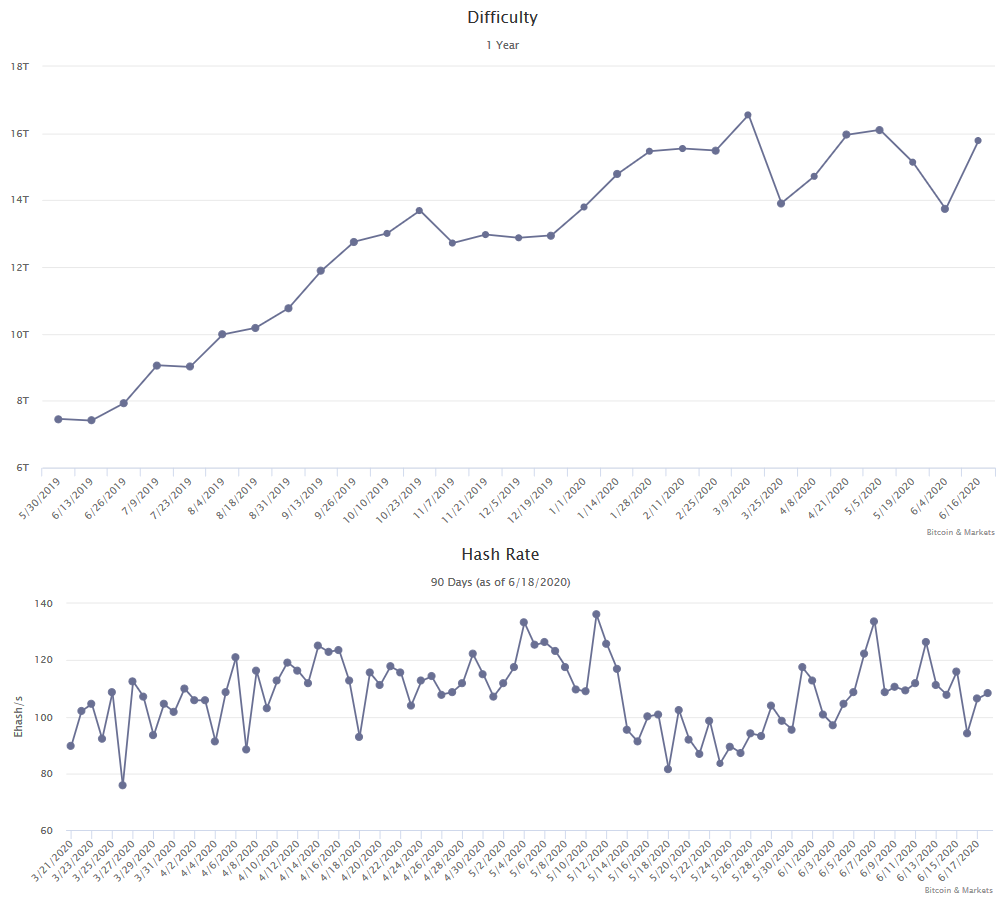

Mining difficulty and hash rate have been crazy. The last three adjustments are -6%, -9.3%, +14.9%, for an average of 0.11%, almost zero.

Mining is maturing and large competitive games are being played to shake the marginal hashers out.

The mempool has been incredibly steady and fees manageable despite the wild swings in hash rate.

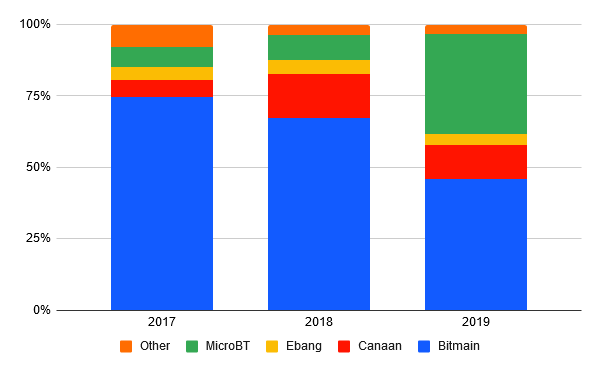

Incredible new report out from Bitmex Research. The chart below shows the ebbs and flows of the highly competitive ASIC manufacturing space over the last three years. Bitmain made the mistake of getting overly political and backing Bcash in 2017, leaving the door open for others to step up.

Stablecoins / CBDC / Altcoins

Tether Dominance : 10.4% (+0.1%)

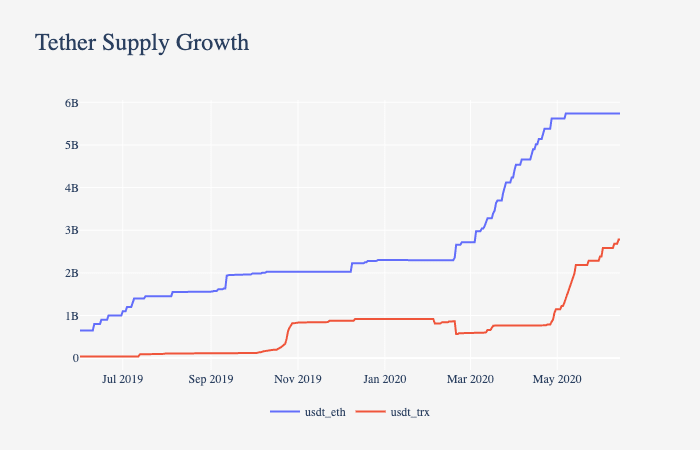

The image below from Coinmeteric's SOTN article shows the saturation of the ethereum network and the corresponding rise in of Tether on Tron. We expect the same thing to repeat as Tether squeezes out all other transactions on the networks it infects. This parasitic infection will make maintaining decentralization in these networks more and more expensive.

Miscellaneous

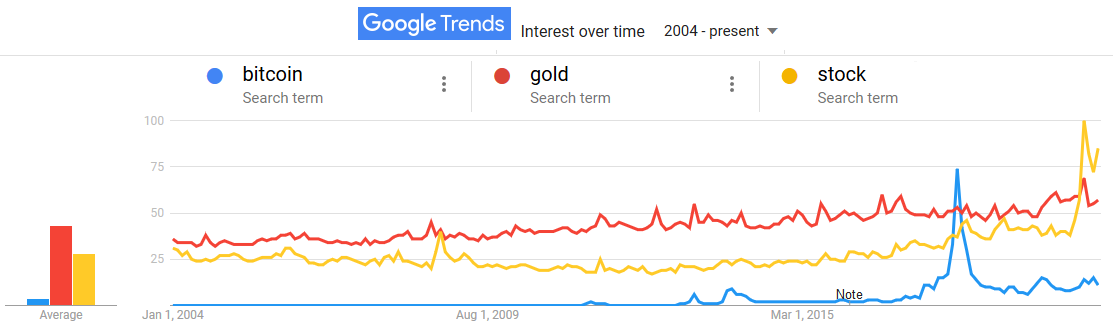

Here is an interesting Google Trends chart we haven't seen elsewhere showing the interest over time for Bitcoin, Gold, and Stock. Bitcoin grabbed the ATH position of interest at the end of 2017, which was just crushed by interest in the stock market following the market crash earlier this year starting on February 20th.

GET THE BITCOIN DICTIONARY!

Demystify Bitcoin Jargon.

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See