Roman and Byzantine Interest Rates - The Roman Republic 500 B.C. to 27 B.C.

Author: Kent Polkinghorne

Source material: A History of Interest Rates, Fourth Edition by Sidney Homer and Richard Sylla (1963, 2005). This book covers interest rate history dating back to ancient times and contains very interesting charts, tables, and analysis which I will attempt to modernize and summarize with contemporary tools. This data can expand our understanding of different eras of monetary and financial information to make us better investors.

***

The history of Roman and Byzantine interest rates will be separated into three parts in order to align with major events in Rome’s history. The first part will cover the Roman Republic, the second will cover the Roman Empire, and the third will cover the Byzantine Empire. Breaking the history into three parts is necessary because of the amount of data provided by the text.

Money and Banking in the Roman Republic

In prehistoric Rome, money mainly consisted of cattle and other domestic animals. Fines were denominated in terms of cattle until at least 452 B.C. but fines levied in terms of metal were not unheard of. By the time of the 12 tables in 443 B.C., cattle are no longer mentioned as money. Copper and bronze were now the main mediums of exchange, with bronze being maintained in this role through the end of the republic. Gold and silver, neither in coin form as of yet, were also traded at this time. In the 2nd century B.C., silver was finally coined into monetary units called denarii.

During the time of the Roman Republic, the Greek trapezita, first mentioned in last weeks' post, were likely performing the actual banking functions. Banking functions included: lending at interest, paying interest on deposits, money changing, buying and selling on behalf of others, etc.

In the late 2nd century B.C., large inflows of silver and gold occurred as Rome continued to expand through conquest; however, much of these inflows were diverted toward expansion and investment in Gaul and Asia. Therefore, these large inflows turned into outflows, thus creating a trade imbalance against Rome. By the 1st century B.C., precious metals had become scarce and in 63 B.C. export of gold and silver were banned altogether. Metal scarcity became even more acute in the years that followed due to the Roman Civil War (49 B.C. to 31 B.C.). Faith in property rights collapsed during this period causing a scarcity of money due to hoarding. It was also during this time that Caesar introduced a gold coin in order to try and stabilize the finances of Rome.

Background on Credit in the Roman Republic

The Roman Republic treated debtors in a similar manner as they were treated in ancient Greece. Once a loan went into arrears, or became seriously delinquent, the debtor was liable to be seized, enslaved, and even sold abroad. Judgements of debt allowed for 30 days to pay and, in the event of default, the debtor would be brought before a magistrate. The creditor could legally seize and fetter (chain) the debtor but was required to feed him. If the outstanding debt involved more than one creditor, the property of the debtor would be seized and divided among his creditors. The creditor, however, was not without legal constraints on his end. A creditor charging more than the legal maxima of 8 1/3% was liable to fourfold damages.

During the 4th century B.C., the prevailing legal maxima shifted multiple times. Maximum interest was fixed at 8 1/3% in 357 B.C., reduced to 4 1/6% in 347 B.C., outlawed entirely in 342 B.C, and soon thereafter returned to the initial 8 1/3%. Debt slavery of Roman citizens was eventually abolished in 326 B.C.

In 192 B.C., usury laws were extended to cover credit issued by foreigners, however, no interest rate restrictions were applied to maritime loans. This was likely due to the great risk that came with sea voyages. The interest rates on ancient Greek bottomry loans, as outlined in our previous post, were very high so one might expect the rates of interest for similar loans within the Roman Republic to be high as well.

As for financing of the State, the Roman Republic did not finance itself through borrowing, similar to the ancient Greeks. Conquest and looting tended to make up a large part of the government coffers. By the 1st century B.C., borrowing by individuals to speculate on Asiatic loans in the recently conquered provinces became common.

In 88 B.C, the Roman General Sulla set interest rates at 12% and imposed harsh financial penalties on conquered territories. Conquered provinces were forced to borrow from Rome at interest rates of 48%, and quite possibly higher, during various periods in the 1st century B.C. From 49 B.C. to 31 B.C., during the time of the Roman Civil War, Rome was bankrupted and interest rates spiked upward. It was during this period that the rise of Caesar was financed by a significant amount of borrowing.

Money and Credit in the Roman Provinces

Egypt (prior to Roman annexation)

Egypt was not yet a province of Rome during the time of the Republic; however, it is important to include what we know concerning Egypt’s money and credit history prior to its annexation by Rome. Records have come down to us which date back to the 9th century B.C. They give us an idea of how money and credit operated in ancient Egypt.

First, examples of loans were mainly inscribed on papyri. The following is a list in approximate chronological order. A 9th century B.C. papyrus records a man being loaned 5 deben of silver with a promise to pay back double within a years’ time, which calculates to an annual interest rate of 100%. A tablet, located at the Metropolitan Museum of Art in New York, from before 664 B.C., records a grain loan with a duration of 8 months at 50% interest, on an annualized basis this would equate to 75% interest. Another document from 568-567 B.C. mentions a 40% rate of interest being charged on a loan but no more details were provided. The British museum possesses a papyrus from around 568 B.C. with a loan inscribed that does not specify the terms of interest but does specify a 40% penalty for non-payment. A grain loan, written on papyrus, from 499 B.C. records a loan with a duration of one year with a 50% interest rate; if delinquent, a penalty of 10% per month would be assessed. Finally, a silver loan from 488 B.C. indicates an interest rate of 85% on an annual basis. This particular loan also assessed a 10% penalty per month for delinquency.

Loans were made mainly in wheat (in the form of grain), but also in silver, during the period of Ptolemaic rule from 300 to 30 B.C. State banks received and distributed funds on behalf of the Ptolemaic rulers. These state banks were situated in the larger cities of Egypt. Private banks did exist but lending itself was performed by temples and lending clubs.

No legal limits on loans are mentioned during this time but a 12% rate of interest is frequently mentioned from century to century. Egyptian peasants were perpetually in debt and private personal loans were the most common type of investment during this period. Ptolemaic rule ended when Egypt fell to Octavian’s forces in 30 B.C. and became a part of, what would become a few years later, the Roman Empire.

Asia Minor

Asia minor encompassed what is modern day Turkey and was historically known as Anatolia. The territory was willed to the Romans by its ruler, Attalus III, upon his death in 133 B.C. Later, a series of wars lasting two decades, known as the Mithridatic Wars, ended with Roman victory in 63 B.C. Pompey confiscated the majority of cash resources in the territory which sent local interest rates very high. A law in 67 B.C., toward the end of this war, prohibited provincials from borrowing in Rome and capped interest in Asia Minor at 12%.

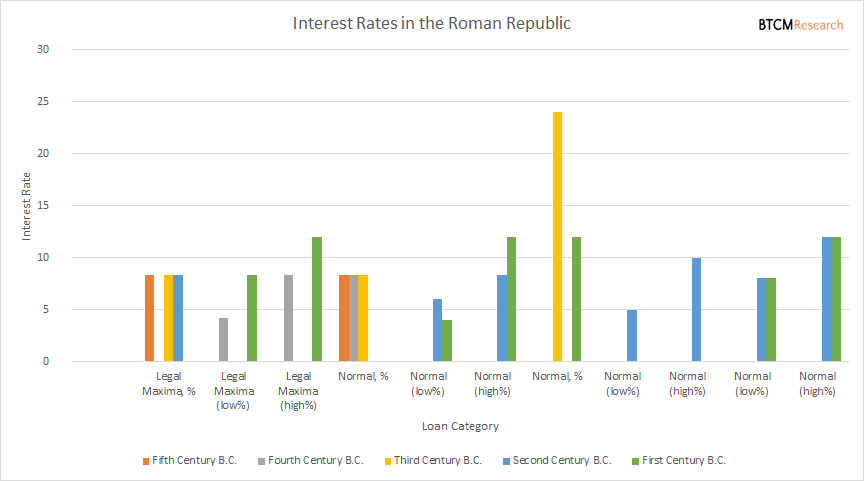

Explanation of Loan Categories

Legal Maxima: This was the maximum legal value of interest that could be charged; however, rates often exceeded this figure in practice.

Enforcing the legal maxima would certainly not have been possible in this era as evidenced by the interest rates on some of the loans depicted below in our chart. The maximum legal rate of interest tended to fluctuate based on circumstances. When there was a political crisis or war, interest rates would increase.

What is interesting is that interest rates often exceeded the legal maxima on the black (free) market and these black market rates would eventually be reflected later when the legal maxima was raised.

When a range of interest rates is present, the low and high end of the ranges will be used as independent data points in the chart we constructed.

Normal Loans: This category covers a broad range of loan types which would resemble those found in ancient Greece. During times of crisis, the interest rates on these loans could exceed the legal maxima. Loans were likely secured by land or real estate and of a short duration. Similar to the legal maxima category, the low and high end of the interest rate ranges, when present, will be used as independent data points in the chart we constructed.

Interest Rates in the Roman Republic

Based on the scant amount of data we have on ancient Roman loans, the interest rates illustrated in the chart are based on a range of values. For example, our source material might mention that rates were between 6 and 12% interest during a specific time period. In order to fit this into a chart, the 6% end of the range would be labeled as “normal (low%)” and the 12% would be represented as “normal (high%) but in reality, these values simply represent the boundaries on a range of interest rates for a given time period.

Rome suffered greatly under the weight of the civil wars in the latter stages of the 1st century B.C. but the entire century itself was marked by conflict and despair. It was during this period that the Roman Republic gave way to the Roman Empire. In our next installment, we will shift our focus to the Roman Empire.