Shale: An Earthquake in the Geopolitical Order

Discussion on the scale of the Shale revolution

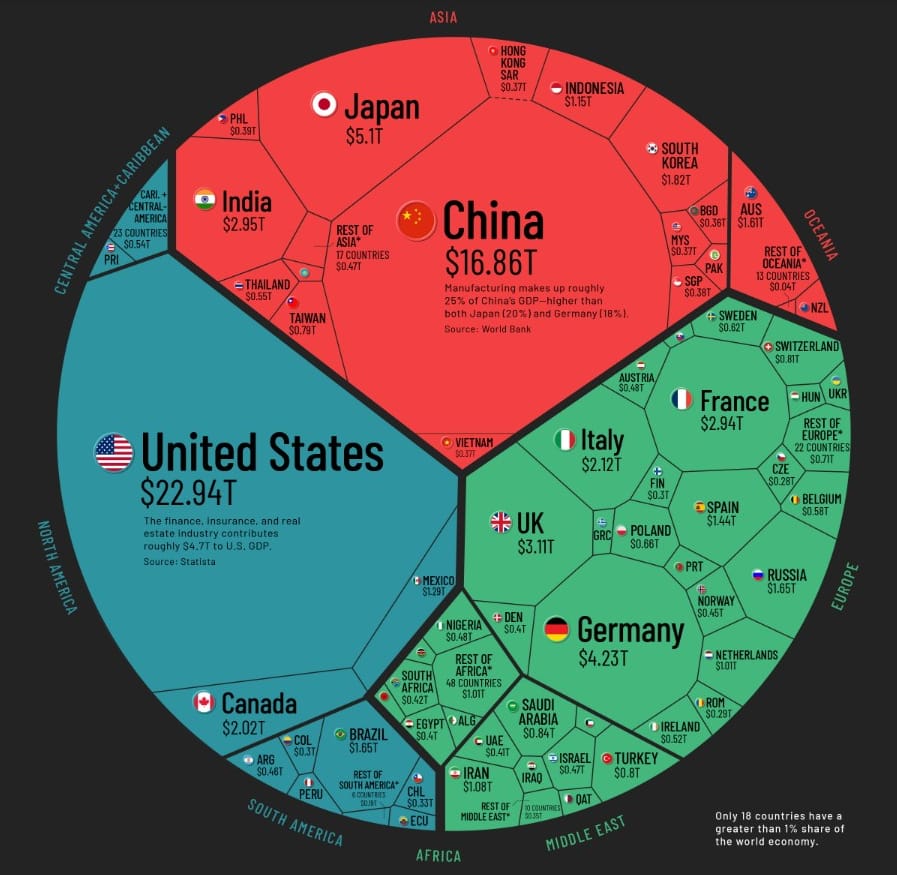

There are important geopolitical developments and then there's the US shale revolution. Important geopolitical events are usually small, like a regional war, major shifts in trade agreements, etc. However, the shale revolution ranks up there with events that completely change the world order, like the World Wars or the break-up of the Soviet Union. It's that big.

US oil production is a pivotal part of my macro thesis. As the US becomes less reliant on the world for necessities like oil, the natural force of geographic distance begins leaning it toward isolationism. The US wanted to defeat communism and did that by globalizing the rest of the world through enforcement of international agreements, peace between great powers and free trade, all things that are great for business. Post-1991 and the break up of the Soviet Union, no unifying narrative or grand vision has successfully taking over.

Two attempts were made by competing factions within the "West" to create this new uniting story for the world. One faction is what we colloquially call the neocons. They focused on the enforcement of order and tried to create global unity around fighting terrorism. The Global War on Terror importantly had a global aspect with its coalitions to go fight a never-ending police action in the Middle East. This faction was vulnerable to crony-capitalism and government deficits. There was a ticking clock to how long the neocons could last represented by government debt-to-GDP.

The second competing faction was the bureaucrat class. They focused on supra-national cooperation through unions like the EU and global climate initiatives. The European project was their stronghold dating back to the 1970's, and they grew from there. I call them globalists, Davos, or Marxists. Their coercive bureaucratic tactics were extremely vulnerable to Maoist-style cultural Marxism due to its concentration of power outside the confines of Western law. Thirty years later, it has completely devolved into a hodgepodge of radical cultural Marxists.

Both these factions have failed and are at the end of the useful lives. Government debt is too high to continue the neocon strategy and the globalists are too radical for the average sane people around the world.

Some might add the Thucydides Trap (TT) as some sort of uniting Western force, but conceit is not a globalizing motive, and it's actually backward. The US wins the TT by refusing to play and embracing isolationism. If they do that, globalization breaks down because there's no customers and security costs skyrocket, the Chinese economy and the CCP would collapse, or rivalries and blood feuds would reemerge everywhere. If the US withdraws support for the system, it's the rest of the world that will need to adjust negatively.

Energy Independence

Since 1991, it was the US's reliance on foreign energy that created the need for the international system's continued existence. The international system in turn needed a grand vision to give it meaning. This is what gave air to the above competing factions.

That underlying impetus is now gone. The last few years has been dominated by these groups trying to create a new reason for them to exist. Climate disaster, global pandemics, war on terror, Russia Russia Russia, etc. They've even joined forces to keep down popular movements around the world, from the US to France to Pakistan. For example, neocons in some nations have joined with the radial globalists in trying to marginalize emerging popular leaders. And when those leaders still overcome the odds and win power, like Trump, Meloni and Orban, these two sides work to undermine them. The global narrative emerging is a return of populist nationalism.

This would not happen if the motivation of the US to maintain the system for energy needs were still acute. We are on the verge a disintegration.

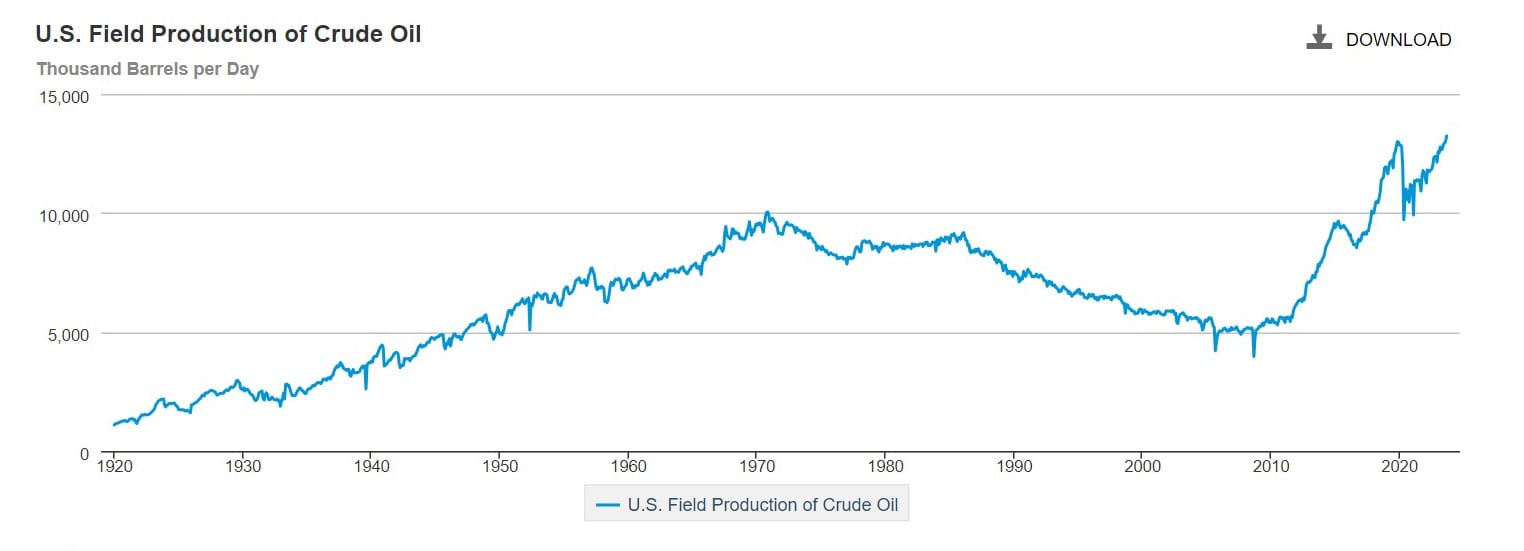

US oil production

Currently, the US is the largest oil and natural gas producer in the world. It still relies on foreign refining capacity, but that could be taken care in less than a decade. On the flip side of refineries, is those countries rely on that income.

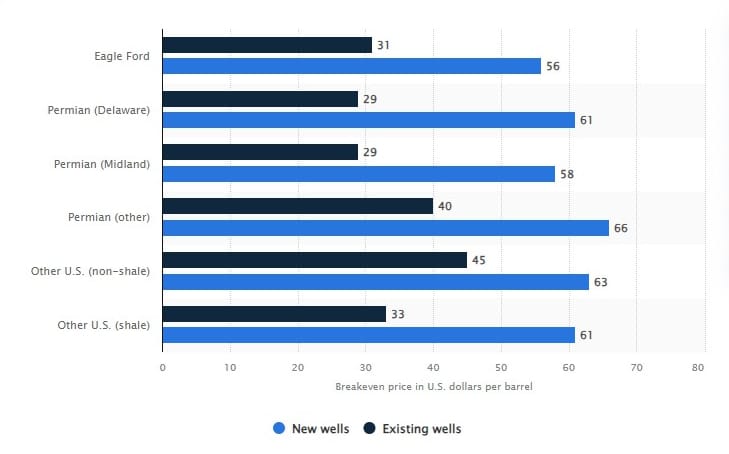

This rise is far from over. The US has by far the most shale oil reserves and the technology keeps improving. Recent advancements promise to double the productivity of shale wells. Refracs are also gaining in popularity. That is the practice by which an old well is re-stimulated to start producing oil again. One company in south Texas has said that refracs with new liner technology can even outproduce new wells. All this pushing down costs and break evens.

The climate globalists can't stop this. The more restrictive policies the current administration puts on the industry, the more it stimulates technological advancement. The intended consequence of strict regulation is to keep the US more involved in world affairs, the unintended consequence is to make the shift to isolationism that much stronger and inevitable. Trump is likely to win the next presidential election in the US and has already said his first policy will be "Drill baby, drill."

This opens up many geopolitical strategies. If the US wanted to, they could use oil as a weapon. Opening the taps, it would drive the price of oil down, and put strain on OPEC+ economies. They have already cut production and countries have started leaving the alliance. Saudi Arabia has a budget deficit and a is surrounded by enemies. It also makes the US's strategic rivals much more reliant on global chokepoints than the US is which is a big problem as we've seen with the Houthis recently. Imagine if the US was behind an effort to close Hormuz or Malacca. The more the US pumps, the more geopolitical weight it has, and the less it will care about the rest of the world.

New counting of oil production

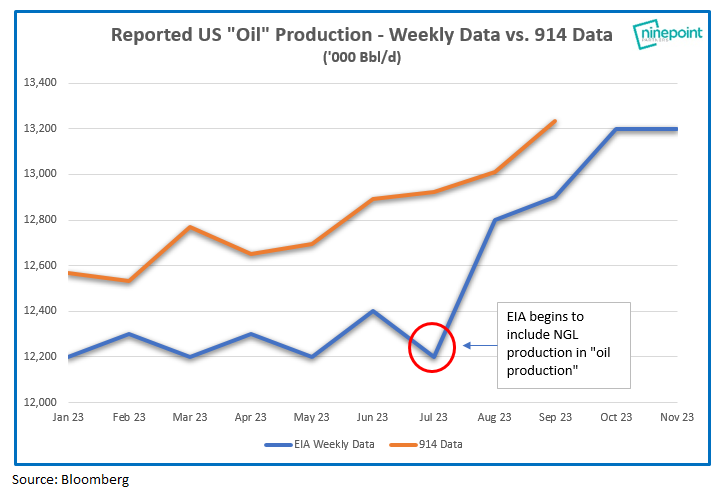

This brings me to the thing that sent me down this rabbit hole the other day. On twitter, I saw this post from Eric Nuttall.

US shale production is not suddenly "surging." This bearish narrative we believe is wrong, has been extremely damaging to sentiment, and is rooted in the EIAs recent inclusion of NGL production in their weekly reported calculation of "oil" production (see chart 1). The more… pic.twitter.com/aLsGJictuG

— Eric Nuttall (@ericnuttall) December 8, 2023

He is attempting to pour cold water on oil bears (thinking oil will drop in price) pointing to the recent rise in US production to a record level as being tainted by a counting change.

"This bearish narrative we believe is wrong, has been extremely damaging to sentiment, and is rooted in the EIAs recent inclusion of NGL production in their weekly reported calculation of "oil" production."

I spent some time researching it, and this is what I found.

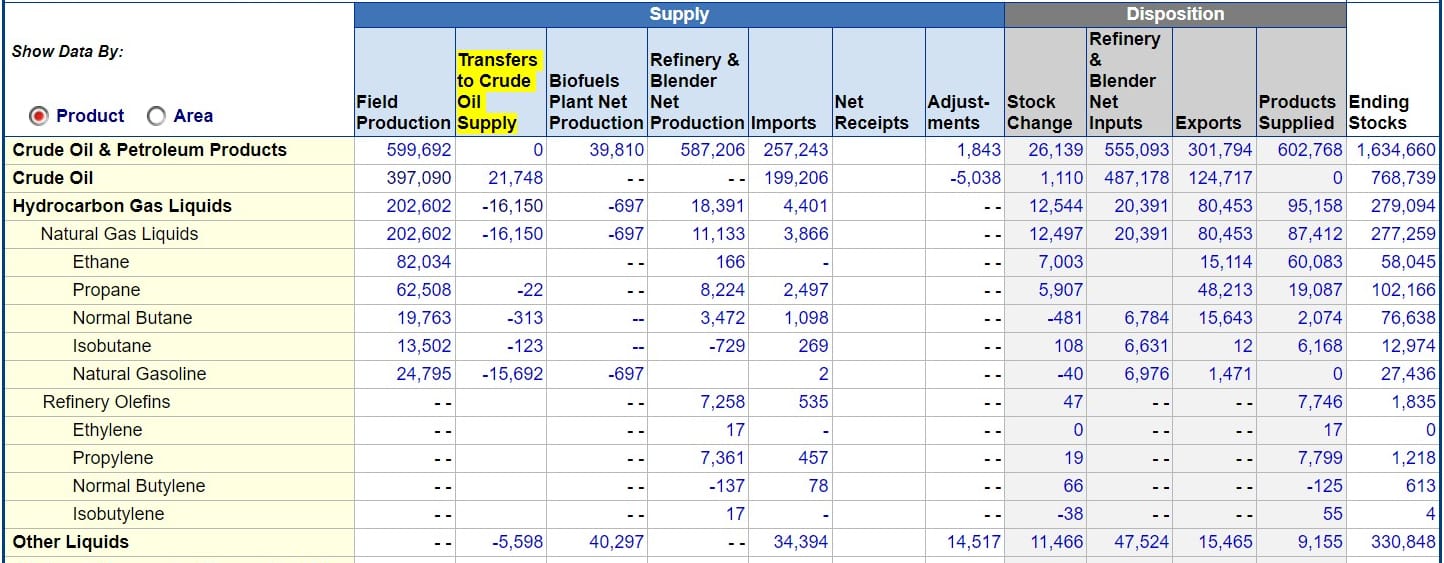

The EIA had a problem with their numbers. Things weren't adding up. The supply and demand numbers were being adjusted by as much as 2.3 mmbd to make them balance. Oil traders started calling this "the missing row" on the supply and demand data and it kept growing. It got so embarrassing for the EIA that they undertook a 90-day study to find the missing oil. They found out that the way they were counting oil production was wrong, due to blending of oil and natural gas liquids (liquids that fall out of natural gas).

In 2023, they went back and updated the 2022 data (914 that Eric Nuttall mentions). 2022 and onward now has a column called "Transfers to Crude Oil Supply". Starting in July, they started doing this for new weekly production data.

As you can see above, in September, the most recent full month of data, under Transfers to Crude Oil Supply there was a total of 21 million barrels added to oil production from these other liquids. 21 million/30 days = 700,000 bpd out of the 13.24 mmbpd total (5%). 700,000 does not cover the whole discrepancy problem, but it goes a long way to start fixing it. I think they will likely make more improvements in the future.

To Nuttall's point though, this update does not decrease the bearish trend to high production. It does help traders understand the make up of the market better and that might create a change in price, but the trend remains the same. Oil supply is increasing, promises to increase a lot more in the future, demand is falling going into recession, global trade is slowing and demographics have locked in this trend for the foreseeable future.