The Evolution of Global Reserve Money - Infographic

Exploring the history of reserve currencies, the rise of credit-based money, and why Bitcoin is the next step in sound monetary systems.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

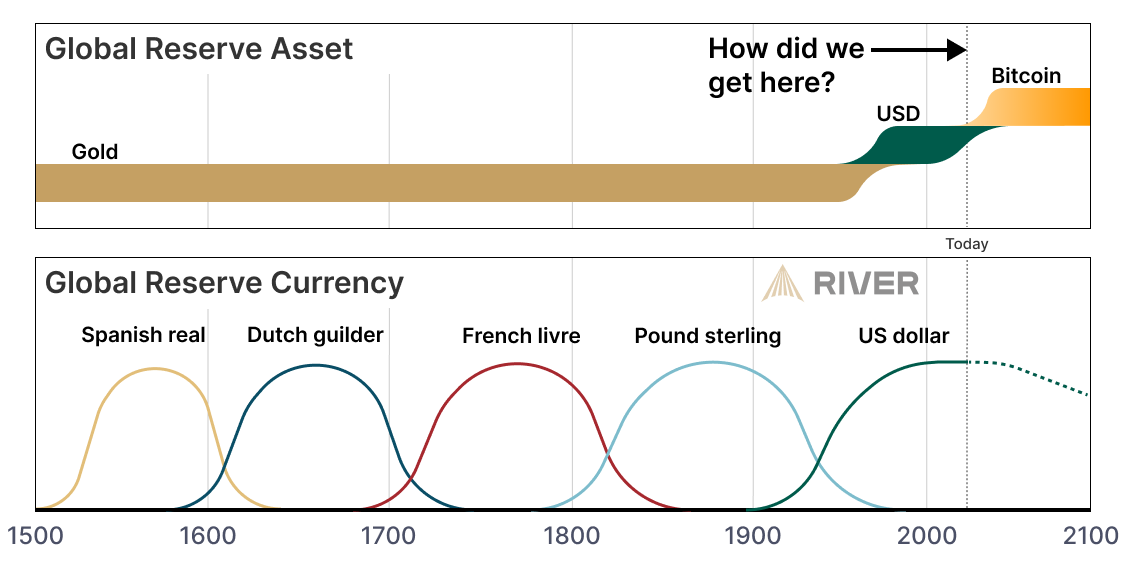

An amazing infographic was recently published by Sam Baker (@macromule) of River Financial. It is a graph of the history of global reserve currency with a twist.

What This Graph Does Well

The reason I love this graph is the fact that he separates the global reserve currency from the global reserve asset. For years, I have been saying that money and currency are different things. The money was gold or silver for thousands of years, and the denomination (currency) on top is what changed. The money on which the currency was derived changed much less often.

The reason the currency changed is that the market constantly acts to choose the best currency. An empire's or nation's currency would usually start trustworthy and of high quality as it is growing and maturing. However, if the issuer begins to decline, they tend to debase their currency. At that time, there is typically a rival or alternative sovereign on the rise with a better currency to hold, so the market would migrate to another global reserve currency.

The graph does a good job of pointing out that the current credit-based US dollar is a break from that tradition. It is an experiment. Purely credit-based money is an aberration, enabled by the particular economic conditions after WWII and especially after 1991 with the fall of the Soviet Union. However, that time is over, and we will return to sound global reserve money backing the currency with bitcoin.

What The Graph Gets Wrong

There are a few things I would update on this graph, and perhaps I'll do that in the future. For starters, the first part of the chart should not be gold. Silver was the global reserve money from around 1515, with the ascension of Charles V, to around 1815 and Waterloo. Only then did the world return to a gold standard, which was fully adopted by 1871.

A quick history lesson on money: Until roughly the year 800, silver was the predominant money, with different forms originally derived from the Greek drachma from Alexander's time. During that period, Europe under the Carolingians continued with a silver denier, but the Mediterranean, Muslim world, and Silk Road—and hence the largest trade network of the time—had shifted to a gold solidus standardized by Byzantium (312 AD). (China was still using copper coins.)

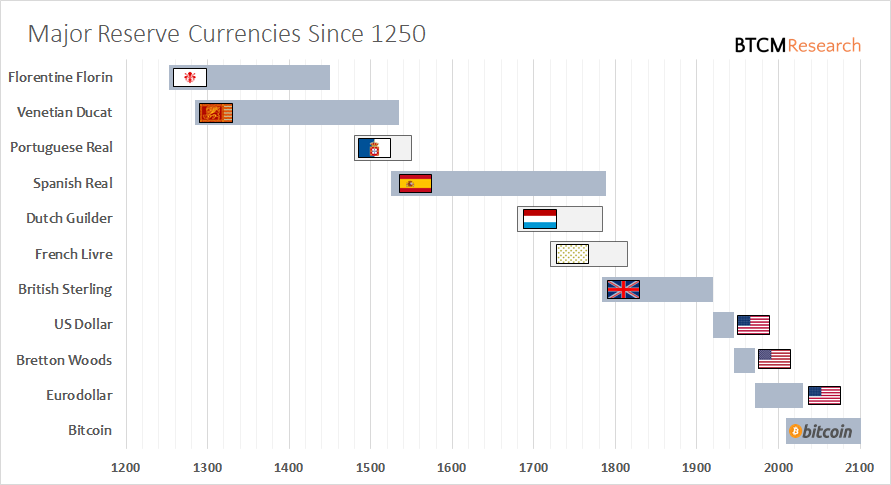

In 1250, as Byzantium was sacked and its coinage fell into disarray, the Italian city-states began minting the gold florin, which spread throughout trade routes as the florin or ducat. This gold standard continued until roughly 1515, with the rise of the Spanish silver real (dollar). The silver standard persisted through the Dutch era, as the Dutch mostly used reals in their trade empire. The silver standard continued until the British returned to gold. Finally, after WWII, the world began transitioning away from gold to a credit-based dollar. This brings us to Bitcoin—a return to backing money with something sound after the brief excursion into credit-based money.

I detailed this history from the year 1250 in a series of posts several years ago (which I need to revisit and update since some of the images are no longer appearing correctly—the archived versions linked in the posts are fine, though).

A Bitcoin Dollar

As you can see on my graph above, the dollar has gone through several versions just since becoming a rival for global reserve currency 100 years ago. The term "Eurodollar" is synonymous with what I call credit-based money today. It is a failing experiment, and it should be any honest observer's base case that the dollar will change once again—this time back to sound money.

History of the dollar:

- 1792 - Coinage Act sets par with Spanish silver dollar, 371.238 grains per dollar

- 1834 - Coinage Act sets $1 to 371.25 grains of silver and/or 23.3 grains gold ($20.67/oz)

- 1873 - Coinage Act demonetized silver

- 1900 - Gold Standard Act codified the de facto gold standard, 25.8 grains of 90% gold ($20.67/oz)

- 1933 - Roosevelt's Gold Program, Executive Order 6102 and change to $35/oz

- 1944 - Bretton Woods, $35/oz and pegs other currencies to dollar

- 1950s-1970s - Rise of the Eurodollar system

- 1971 - Nixon shock ends gold redeemability

- 2025 - ... bitcoin standard

The dollar is not a monolithic, unchanging thing. In fact, today we are living through the longest period in US history without a revision to what the dollar is. It is a safe assumption that the dollar will evolve again. Right now, it is moving in the direction of Bitcoin.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.