Why Bitcoiners Aren't Worried About Tether

The Tether FUD has spread to gold bugs now. They trash on it with without providing any evidence. We talk Ponzi schemes, history, and markets in this one.

I started my adult life as a gold bug, 20+ years ago. I was fortunate to be raised with an appreciation of free markets and sound money. I remained a staunch gold bug until grasping bitcoin's value proposition years ago.

Every now and then, a gold bug post will get sent to me or I will run across them on the free market websites I frequent. Recently, a close relation sent me this post from EnergyandGold.com that bashes Tether and "cryptocurrencies". You can find my highlighted version of the post here (you must have the hypothesis browser extension).

I thought it might be useful to share my response, because much of what they discuss - not all wrong by the way - is commonly believed by people with little exposure to bitcoin topics. This might be helpful if you run across similar talking points in your daily life.

Disclaimer: I have never owned Tether and still own gold and silver.

Tether is a Ponzi scheme hiding in plain sight

The Tether topic starts halfway down the article (emphasis added):

Bob Moriarty: I absolutely want everybody to understand, who’s reading this, that the financial system is in more of a precarious position than I have ever seen or read about. And some things like Tether, Tether’s a $62 billion fraud.

Goldfinger: Yeah. Let’s talk a little bit about Tether and this ponzi scheme that’s hiding in plain sight.

Bob Moriarty: And it’s going to blow up.

Goldfinger: Let’s talk a little bit about Tether and cryptocurrency. So, can you think of another situation where a financial company or some sort of financial product supposedly had $62 billion in assets and it didn’t have to regularly submit to third party accounting and audits?

Bob Moriarty: Sure. Of course.

Goldfinger: Which one is that?

Bob Moriarty: Bernie Madoff.

Tether doesn't offer returns, it's pegged to $1, so it literally cannot be a Ponzi because it doesn't meet the definition:

"Ponzi scheme: A form of fraud in which belief in the success of a nonexistent enterprise is fostered by the payment of quick returns to the early investors from money invested by later investors. Nearly all altcoins and tokens in the Bitcoin space have aspects of a Ponzi scheme. Extreme network effects can appear Ponzi-like." (According to my Bitcoin Dictionary ;)

Moriarty seems to throw that word around nonchalantly, comparing Tether to Madoff. It's completely disingenuous. Tether is obviously not a Ponzi.

Legitimate critiques of Tether include: a) it's not full-cash reserves. A significant percentage of reserves are cash equivalents and commercial paper, but assets are greater than liabilities. b) The government can shut it down. But that doesn't mean Tether holders get nothing. They will be made whole by selling Tether's assets.

How do we know they have the assets they claim? More on that below.

Checkered Past

Goldfinger: Okay, so about Tether, if you look at the background of some of the main people involved, including the CFO, they have a pretty checkered past. Now, normally, in the financial industry, when people have a checkered past, especially in the realm of financial fraud, they’re not given many opportunities to pull it off again, especially not at a large scale. There’s always fools born everyday, but to pull off something in the billions, especially $62 billion, is pretty unheard of. This is incredible, that this is basically the biggest Ponzi scheme ever hiding in plain sight. It’s a Ponzi hiding in plain sight. Have you ever seen anything like this?

Bob Moriarty: Yeah, Bernie Madoff

Saying Tether's CFO Devasini has a checkered past is a stretch. It's not criminal in nature, and these gold guys offer zero evidence.

Admittedly, I only knew about rumors involving Devasini, and had to look up the specifics.

Devasini is a serial entrepreneur, hustler type. Some of his previous businesses have failed and some have likely been sold for pennies on the dollar. Along the way, he has had a couple customer run-ins, like all businesses do. What customer facing business has zero customer complaints?

It's also true that he's been caught in a couple (in my opinion) small lies. That's not good, but these lies are immaterial in regards to the facts of Tether's solvency. They pertain to non-Tether subjects at a time prior to Tether's creation. They might speak to a possible dishonesty streak, sure, but it must also be put in context. He has a fiduciary duty to Tether stakeholders and customers. If he does not evade questions about some minor issues in his past (that should be private) could it harm his current company? Maybe. It is understandable to be misleading then in my opinion, as long as it's not about serious felonies.

He's never been arrested or been imposed a court ordered punishment of any type as far as I know (unless you include the settlement to Tether's fiat-finance attackers). He couldn't very well lie about something if he was found guilty in court somewhere. This criticism remains hearsay.

Tether has been "audited"

Tether has perhaps the best audit you can get, the NY Attorney General's 2-year investigation found they are currently 100% asset-backed, e.g. cash, treasuries, commercial paper, etc. The issue the NYAG was trying to prove was a temporary situation in the past when Tether was not fully-backed, when a third-party defrauded Tether and disappeared with $600M. The illegality was that during that period, Tether still stated on their website that they were fully-backed.

Eventually, the proceedings ended with a settlement, an $18M fine for having a misleading sentence on their website. Yes, the single sentence claiming to be fully-backed was inaccurately displayed for ~24 hours before being updated. (Since that event, Tether has replaced losses with new capital and since been fully-backed)

Tether has also had many attestations of their reserves. Multiple times a year, in fact, they get their assets attested. They haven't been able to get a true audit for a couple reasons.

There is no financial report framework w/r/t to audit conformity w/ a stabelcoin. So you can't perform an "audit." You must instead rely on a 3rd party to attest to whether an assertion (that there is a 1:1 peg) is accurate.

— Cameron Winklevoss (@cameron) October 17, 2018

1) Audit is not the right word anyway. You are verifying that a claim of being fully-backed is true. This requires an attestation not necessarily an audit. Above, Cameron Winklevoss, famous billionaire and competitor to Tether said as much.

2) They couldn't find a Big-4 auditing firm willing to do it privately. There is bias and collusion between banks and auditing firms against ALL bitcoin related companies, not just Tether. These companies refused to deal with Tether on their terms, privately.

3) Tether's business is by definition multi-jurisdictional with finance officials from around the globe trying to attack them. If Tether openly said, 'we bank with Bank XYZ', their accounts would be frozen within a day. Imagine a People's Bank of China official, a Fed official, FBI or CIA agent, making a phone call and freezing the funds without trial. Privacy is extremely important for protection against financial abuse.

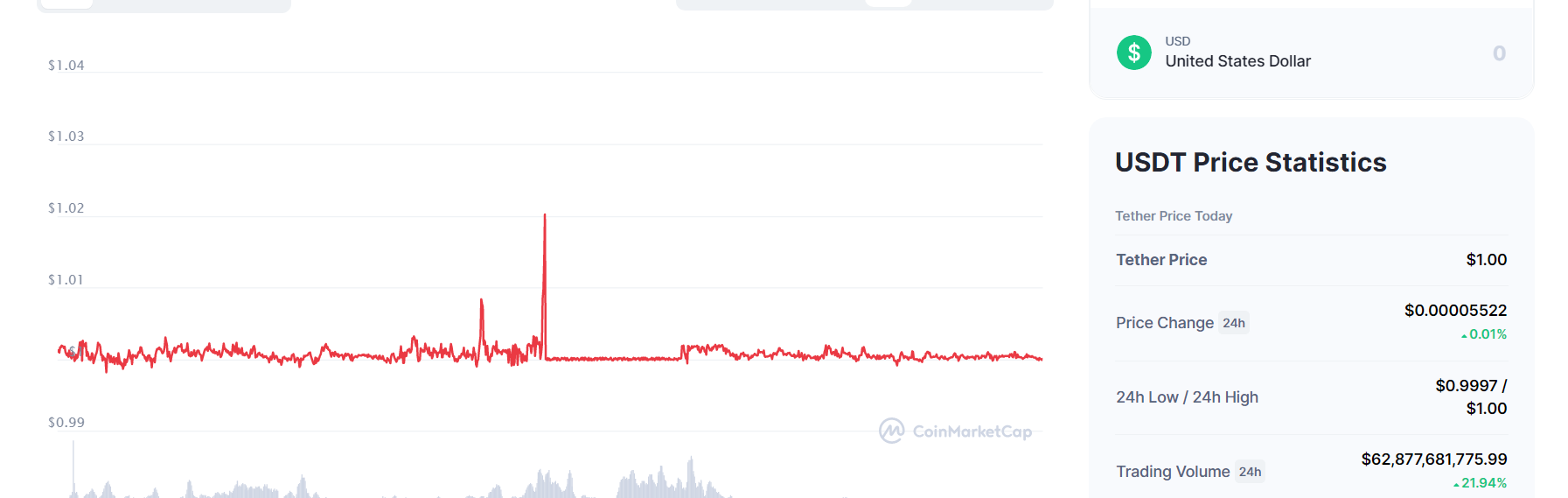

4) Their dollar peg says a lot. The way Tether works is, large direct Tether customers can always redeem 1:1 for dollars from the company Tether itself. But tether also trades on the open market against USD and other tokens, including of course bitcoin. If you are unsure about Tether's solvency, you can dump their token. However, the price on exchanges rarely varies from exactly $1.00.

The market could easily value tether at $0.5 instead of $1. The large direct customers of Tether would then buy it up at $0.5 and redeem it with Tether for $1. Not a bad arbitrage trade.

Tether is not "hiding in plain sight" either. It is one of the the most persistent criticism in the Bitcoin space over the last 4 years. This is very very far from being a fringe topic, only reported by one person to the SEC like Madoff. I can't emphasize this point enough, it is not hiding! Many people have been on a crusade against tether for years, it's one of the most widely addressed issue in the space. Yet, the open market price is stuck to the $1 peg like glue.

Tether will implode one day

Goldfinger: So how does this end? This is a $62 billion financial fraud that is a really integral part of the cryptocurrency system. What happens here?

Bob Moriarty: Somebody pulls the plug, and the water comes out of the toilet. You know exactly what I feel about cryptocurrencies, I have never made any bones about it. There is no there there. Why anyone would speculate, and I acknowledge a lot of people have made a lot of money, but it’s a fraud, and, if it’s a fraud, why would you consider it an investment? It’s going to blow up. One day we’re going to pick up the Wall Street Journal, take a look at it, and see that Tether has imploded.

I have shown how Tether is not a Ponzi and no allegations of financial fraud have stuck, despite years of heavy government and internet investigation.

We now see the introduction to the conversation of the term "cryptocurrency", which is a sign that they are about to lump everything under the sun together in a false equivalency or faulty generalization between obvious altcoin scams and bitcoin. When you notice a person doing that, you must pull them back into discussing specifics about bitcoin.

Bitcoin is not backed by anything, but nothing is. It's subjective value all the way down.

As for imploding, Tether cannot implode. It is backed by assets as described above. In the case, holders can always buy tether at market prices and redeem them for $1/each from Tether. If a government forces Tether to shutdown, it would face billions of dollars worth of lawsuits.

Cryptocurrency is a perfect example of greater fool theory

Bob Moriarty: The idea of cryptocurrency, it’s a perfect example of the greater fool theory. You’re thinking about, and focused on, the value of an investment, and the fact of the matter is, no investment has any value. It’s what somebody perceives, and that changes constantly, so what you’ve got to watch for is human behavior. Now, since Christ was a corporal, people have wanted to speculate. They love the idea of instant riches. They never get it, of course, but it’s really fun, and people get into it big time. They did it with Beanie Babies, they did it with baseball cards, they did it with postage stamps. Now they are doing it with imaginary numbers generated by tens of thousands of computers all churning away doing nothing practical.

I agree with this broad statement, "The idea of cryptocurrency, it’s a perfect example of the greater fool theory." As in the definition of Ponzi scheme at the beginning, I point out altcoins are nearly always Ponzis.

But that's not true for Bitcoin! Bitcoin should not be considered a cryptocurrency, because even among this false grouping, it is unique. We can now see the result of the logical fallacy of faulty generalization. Without having to make any specific arguments, they can condemn bitcoin and Tether alongside obvious scams and bubbles.

Bob Moriarty: Human behavior calls for people to act like a herd, and when the herd changes direction, all of a sudden they’re gone. Now, the beauty of the cryptocurrencies is, because Tether is so obviously a fraud, they’re just going to yank that plug and cryptocurrencies are going to disappear overnight.

Goldfinger: Yeah, it could honestly be the sort of thing where somebody yanks the plug, as you say, and suddenly there are no bids in the market. You could go to sleep one night and your crypto could be priced at $2 a coin, and wake up the next day and it’s priced at five cents, or maybe even less. It could literally be the sort of thing where the market goes “no bid”.

The modern internet parlance is "rug pull". It happens all the time in the altcoin market. It does not, however, occur for the entire market. See how far one's understanding of the situation can get completely off-base by a faulty generalization?

To boot, this is also a basic misunderstanding of markets. Going "no bid" is not a permanent situation. You need a buyer and a seller to set a price. Bitcoin spot, futures and options are traded globally on 10's of billion dollar exchanges. The crash would have to be complete and global.

Many powerful and systemically important investors and institutions are involved, too. If bitcoin crashed to zero, going "no bid" and staying there (impossible) the Chicago Mercantile Exchange (CME) along with many other banks, insurance companies, hedge funds, etc would go bust.

No one will argue that there's been no crashes in bitcoin. But so what? The crashes are within tolerance of the bitcoin investment thesis. And don't forget, it always rallies to massive new highs after the crashes, which is also part of the investment thesis.

All Cryptocurrency Market Cap is Liability

Bob Moriarty: In the cryptocurrency market, you’ve got $1.2 trillion worth of assets, but you’ve got $1.2 trillion worth of liabilities, and nobody can pay off the liabilities. Therefore, if you’re short at $2 and it goes to zero, you’re holding a used lottery ticket with zero value.

Physical gold is no one's liability, the same is true for bitcoin held in private wallets. 1 bitcoin = 1 bitcoin. There is currently estimated, through block chain analytics, to be ~2.4M bitcoins on exchanges, out of a total of 18.7M in circulation or 12.8%. It could be said that those 2.4M are someone's liability, similar to gold in a vault is someone's liability.

But not all bitcoin is a liability and a market price is definitely not a liability. A market price is the current market clearing rate. Calling a market price a liability is a complete misunderstanding of markets.

Of course, the concept of "market cap", the $1.2 trillion Moriarty is referring to, is also a myth, and that goes for all durable assets. If all gold were dumped on the market at the same time, it would also go "no bid". Same for steel, real estate, stocks, dollars, anything. This does not make a price a measure of a liability, that is obtuse.

Conclusion

How have the theories of Moriarty and other stubborn skeptics held up over time? Well, they have been consistently proven wrong, and completely missed the biggest investment in a generation! Calling it a fraud and Ponzi the entire way up, for a decade, and turning their backs on the very monetary arguments that brought them into sound money in the first place!

Even if the excuse is he will eventually be right, it must be viewed in the light of being exactly wrong so far. It becomes increasingly unlikely for him to be right the longer he is wrong. To believe in Moriarty's claims, it would require some extraordinary evidence, the opposite of what is happening here. Unsupported assertions and name-calling won't cut it. What else to you got?