Why Will Bitcoin Be Monetized, If Gold Was Demonetized?

Analysis challenging inflation-based narratives and examining the market's role in selecting money, offering a fresh perspective through Evolutionary Monetary Theory.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

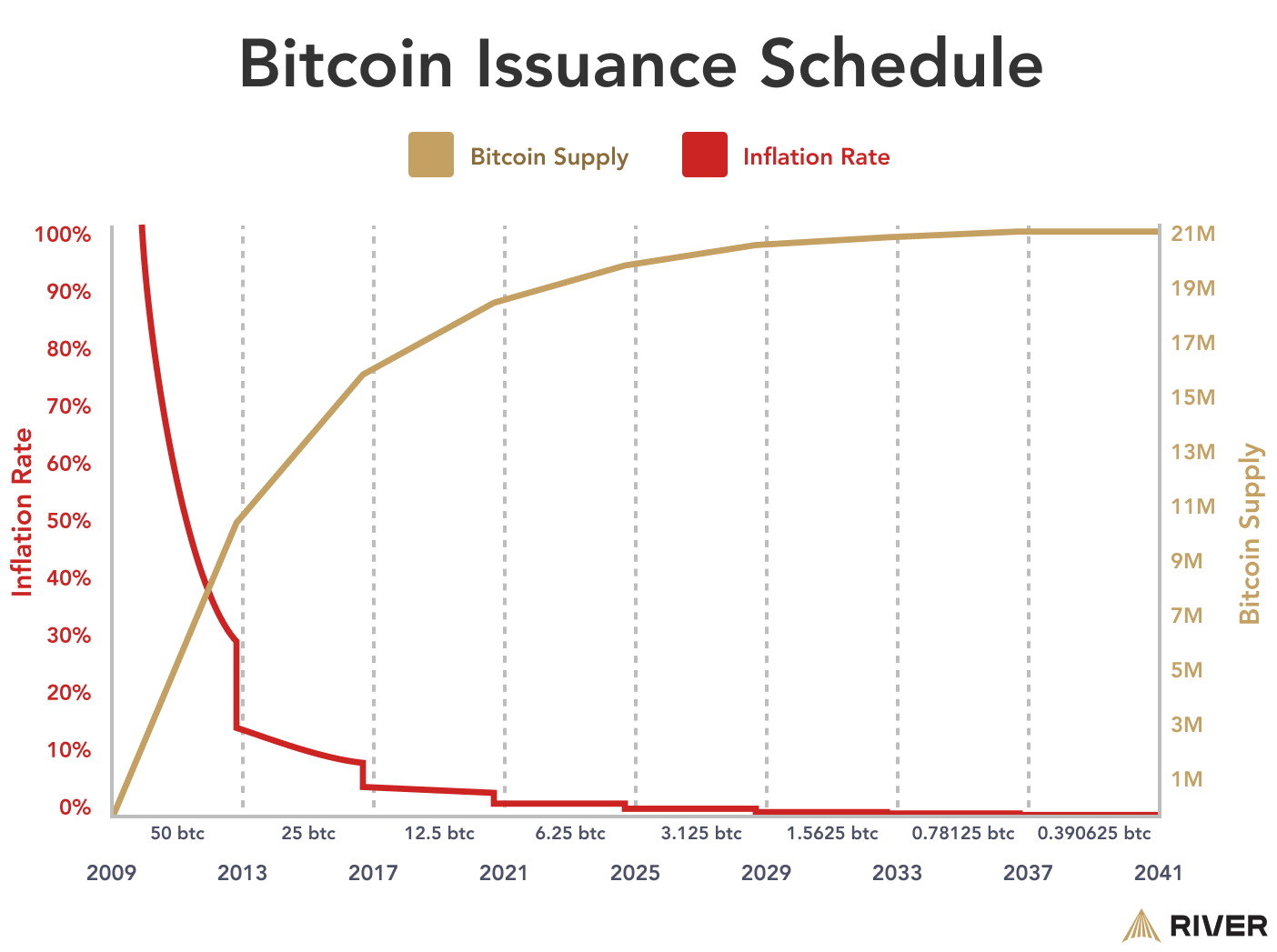

I’ve been deep in the Bitcoin rabbit hole for many years. Back when I started, I believed bitcoin would achieve mass adoption because the US dollar was being printed to oblivion. By logical deduction, a fixed-supply asset like bitcoin seemed destined to be universally adopted as an inflation hedge. Inflationary money also has harmful effects on society, and people would naturally want to fix those by returning to a sound monetary system.

Today, this inflation-driven narrative is the prevailing wisdom among bitcoin adopters, but over the past six years, I’ve moved away from this theory. Specifically, the theory that inflation will inevitably lead people to adopt bitcoin falls apart for two key reasons.

- It’s not clear that we are in a highly inflationary environment. For instance, there have been two periods of higher CPI since 1971, and other periods of higher average inflation over a several year period. The recent period of rising prices coincided with a vast supply chain disruption and global pandemic, yet still topped out at only a 9% YoY CPI. I believe we’re experiencing the slow erosion of a massive credit bubble that is dominated by a deflationary pressure.

- The market has previously chosen less sound money. Gold, which shares many advantages with bitcoin, was abandoned by the market as money decades ago and has not been remonetized since.

The Simple Question

The first reason above is something I address at length in other content, so the rest of this post will focus on the second. This leads us to a straightforward yet crucial question for anyone advocating the inflation-based narrative: Why will bitcoin be adopted as an inflation hedge if gold wasn’t?

I worded this question intentionally. I am specifically questioning the inflationary rationale for bitcoin adoption, because it will affect the validity of predicted economic outcomes of bitcoin adoption. Any theory of monetary evolution that predicts bitcoin adoption must be able to explain both transitions with consistent logic, or else their general theories are wrong.

Logically Inconsistent

This question highlights two monetary revolutions. First, the transition from the gold-backed dollar to the credit-based dollar in the post-WWII era through 1971. Second, the shift from a credit-based dollar to a bitcoin-based system.

The common theory, popularized by Saifedean Ammous, author of The Bitcoin Standard, is that "the hardest money always wins." This idea is not new, it goes back decades among sound money advocates. In other words, in a free market, people will naturally gravitate toward the commodity that is hardest to inflate as money.

While this theory works under specific circumstances, it fails to explain key historical events, and is not universally applicable. For example, during the Great Inflation, people had a clear opportunity to return to gold and silver, yet they did not. From 1974 (when private gold ownership was fully re-legalized) up to 2008 and the launch of bitcoin, the market had ample opportunity to remonetize gold, but it didn’t.

Adherents of the inflation narrative might reply, "Legal tender laws stopped gold from remonetizing." True, but then the hardest money doesn't always win, and those hurdles are even greater for bitcoin. Blaming legal barriers also disregards international dynamics and examples where a government could not stop a transition to a harder money. A great example of this is Germany in 1873. They resisted a gold standard, fought and won a war, but eventually had to accept it, replacing their silver standard.

Therefore, we must accept the idea that the market chose less sound, credit-based money over the gold standard. This debunks the claim that the hardest money always wins and creates a problem for those claiming the inflation narrative.

Bitcoiner Confusion Over Why Gold Lost

When I ask bitcoiners why gold lost, interestingly their responses avoid inflation arguments. They don't say legal tender laws either, because they understand bitcoin is not legal tender. The usual responses involve gold’s limited transportability, its centralization, or lack of programmability. But these issues could, and have, been mitigated through the use of banks and digital money. Bitcoiners will push back on that by saying centralization is also a negative, not realizing gold lost to a more centralized, higher-inflation alternative.

The contradiction is glaring. They are claiming the market chose a system with high inflation, capital controls, and trusted third parties because of some solvable problems, while insisting the market will choose bitcoin for contrary reasons.

Evolutionary Monetary Theory's Synthesis

The reason this simple question is difficult for adherents of the inflation narrative is because they view homo economicus as an independent variable, completely divorced from the underlying societal and economic forces. In their framework, any deviation from their model is attributed to the disruptive application of force or fraud. They would argue it’s impossible for the market to choose a more centralized, higher-inflation alternative without government intervention and financial repression.

Here again, historical data contradicts this view. Since 1971, every major metric of human economic flourishing has skyrocketed. Lifespan has increased, poverty rates have plummeted, and global population has surged. When confronted with this reality, their response is typically a counterfactual. They argue that these extraordinary achievements were accomplished despite the financial repression of the credit-based system and insist things would have been even better under sound money.

This isn’t just a minor counterfactual—it’s an extreme example. They don’t merely suggest that despite a credit-based system a mediocre global economy was still able to emerge. Instead, they ask us to believe that the greatest economic expansion in human history, by a massive margin, is nothing more than luck.

I propose an elegant solution to this problem that incorporates broad, long-term market conditions. It also acknowledges the agency and decision-making of market participants, who shape monetary outcomes and should not be reduced to mere victims of government intervention.

- When credit is highly productive, the market gravitates toward elastic and inflationary money because the benefits of credit expansion far outweigh the costs.

- When credit becomes unproductive and debt burdens grow unsustainable, the market shifts toward counterparty-free reserve assets and commodity money. Bitcoin, as a decentralized, fixed-supply asset, fits this latter scenario.

Evolutionary Monetary Theory (EMT) provides a consistent lens through which to view gold's failure and bitcoin’s success. The market chooses money based on the specific circumstances of the time. In a peaceful, high-trust, low-debt environment, people gravitated toward credit-based money. However, as those conditions inevitably change, people will naturally gravitate toward a money that optimizes their situation under new circumstances. This is supported by the historical fact that monetary systems, and even the assets used as money, have changed every few generations throughout human history.

Rather than relying on simplistic narratives that blame government intervention or assume the inevitability of the 'hardest money', EMT acknowledges the complex interplay of market conditions and participants' incentives. The success of any monetary system depends on its ability to meet specific needs at a specific time. Just as a species evolves within an habitat which is itself evolving, a monetary asset and system adapts to the global economic environment. As the world transitions from the high-trust structures of the last 75 years to a low-trust environment, this new habitat is perfectly suited for bitcoin adoption.

Hope this helps someone.

Your support is crucial in helping us grow and spread my unique message. Please consider donating via Strike or Cash App or becoming a member today and get more critical insights!

Follow me on X @AnselLindner.

I cannot provide this important Bitcoin and Macro analysis without you.

Bitcoin & Markets is enabled by readers like you!

Hold strong and have a great day,

Ansel

- Were you forwarded this post? You can subscribe here.

- Please SHARE with others who might like it!

- Join our Telegram community

- Also available on Substack.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.