Bitcoin Fundamentals Report #247

Blackrock remains the top story this week. The incumbents had a lot to say this week about CBDCs and bitcoin. China is crashing. Plus, price, mining, and lightning news.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Try to extend new highs |

| Media sentiment | Slightly positive |

| Network traffic | High |

| Mining industry | Strong |

| Price Section | |

| Weekly price* | $30,039 (+$3266, +12.2%) |

| Market cap | $0.583 trillion |

| Satoshis/$1 USD | 3,327 |

| 1 finney (1/10,000 btc) | $3.00 |

| Mining Sector | |

| Previous difficulty adjustment | +2.1784% |

| Next estimated adjustment | -1.5% in ~1 day |

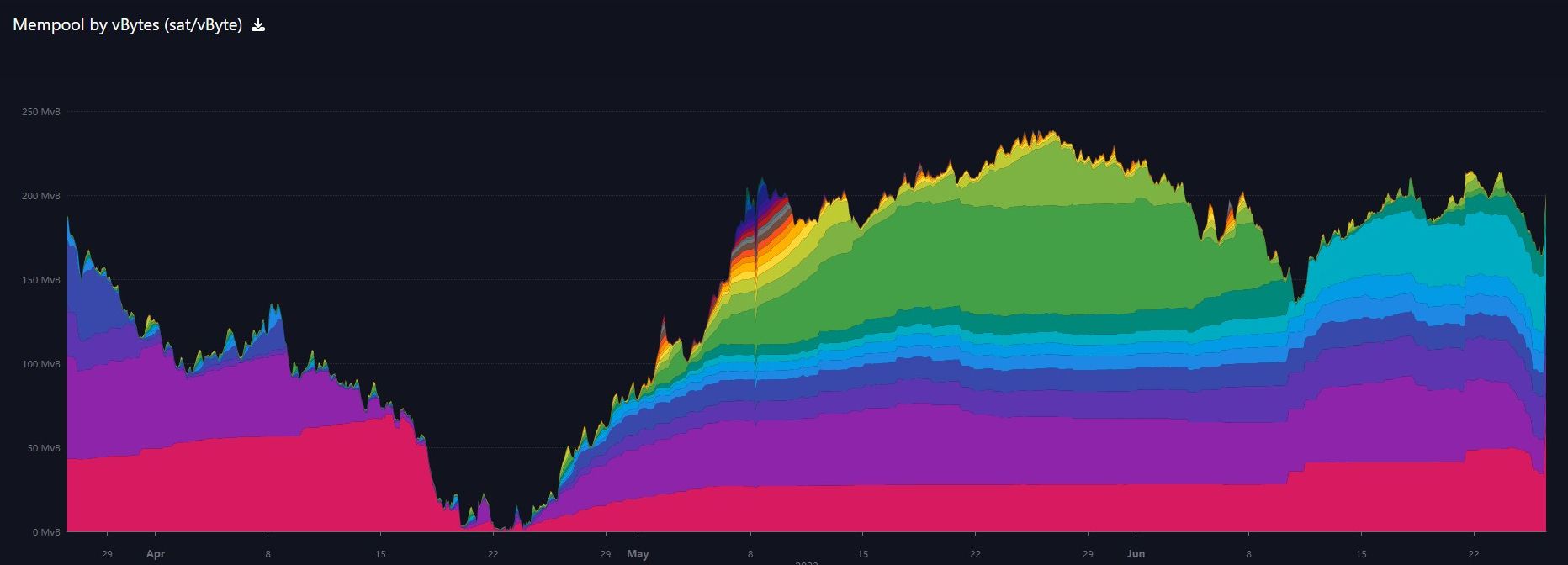

| Mempool | 201 MB |

| Fees for next block (sats/byte) | $0.63 (15 s/vb) |

| Median fee | $0.59 |

| Lightning Network** | |

| Capacity | 5,485.45 btc (+0.3%, +14) |

| Channels | 69,369 (+0.2%, +144) |

In Case You Missed It...

Member

Community streams

- Weekly Bitcoin Update, Everything is About to Change Forever - E353

- Plus live streams that haven't made it to podcast yet!

Fed Watch

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

Binance and Coinbase have completely left the Bitcoin news cycles. Not the SEC though. Speculation about the Blackrock ETF approval rages on.

Will Blackrock's ETF Get Approved?

The most likely rationale for Blackrock's filing is their legal team thought Grayscale is likely to win against the SEC in court, freeing Grayscale up to turn GBTC into a spot ETF. They wanted to beat them to it.

I've seen experts say Blackrock has about a 50/50 chance of getting approval by August!

The plot thickened even more last on Friday, as the SEC approved a 2x leveraged bitcoin futures ETF. So, the SEC has bypassed a spot (physical) ETF but approves an ETF that's based on a derivative of a derivative.

The leveraged ETF development is logically out of order, and makes very little sense, unless it is a formality to approve leveraged versions of ETFs. I'm not an ETF expert, but read ETF experts and they were surpirsed as well.

I think you have to put the Blackrock filing in the context of bitcoin not going away. Even after 2022, Bitcoin was rallying, its perceived competition/substitutes are being wiped out, multiple other jurisdictions have ETF products, miners are traded publicly, it's not going away and the US ETF issue must be dealt with. And of course, it is Blackrock, not some small outfit.

I'll add one more thing to the analysis, yes, price jumped 15% last week, but that was not outside the normal bitcoin volatility. I am not convinced that insiders know if this will be approved. If they did, 15% would small potatoes.

I really hate trying to guess what the SEC will do the ETFs, because I've been let down so many times in the past, but with all this together, I'm sticking with my original 90% likelihood from last week.

Lots of Headlines About CBDCs and Globalist Coping

- IMF Capitulates on Bitcoin Bans, Says They're Not Effective

- ECB official labels crypto as ‘deleterious’ with ‘no societal benefits’ in scathing speech

- BIS Annual Economic Report Chapter III on CBDCs and "Unified Ledger"

- Deutsche Bank Applies for Digital Asset Custody License in Germany: Report

The messaging here is odd, it is not cohesive. The-powers-that-be don't seem to have a clear strategy on Bitcoin anymore. In a story from April, IMF managing director Kristalina, said "retail" CBDCs would radically change the global financial system in ways they don't understand. A pretty big admission. The IMF is sounding even more friendly saying that, "bans are not effective."

Powell said the same thing this week, that retail CBDCs are out of the question. Nigeria's CBDC experiment has utterly failed at this point. Everything is pointing away from CBDCs as a failed globalist fantasy. But somehow the BIS didn't get the memo.

HSBC, the largest bank in Hong Kong, today allows its customers to buy and sell Bitcoin and Ethereum ETFs listed on the Hong Kong exchange, and is also the first bank in Hong Kong to allow it. The move will expand local users’ exposure to cryptocurrencies in Hong Kong.

These are futures-based ETFs so don't affect spot demand directly. However, this is an interesting sign that there is competition brewing for bitcoin related products.

So what did the documents reveal? Simply put, Tether was accurate about their holdings. The files showed that Tether held billions of dollars in commercial paper issued by various international financial institutions and maintained funds in numerous banks worldwide. It also detailed the company's know-your-customer (KYC) protocols and other regulatory compliance procedures.

Many expected dramatic revelations, financial impropriety, or at least some undisclosed issues. Instead, the documents validated Tether's long-standing claims of being fully backed by reserves.

Tether haters rekt. We're right about another one.

Macro

Europe is already in recession in Q4 2022 and Q1 2023, and things keep getting worse. It is not likely that they will be able to get out of this economic decline with the current anti-human policies they have strangling their economies.

It'll get worse before it gets better.

The CCP are already going to major lengths to prop-up their failing economy. We don't know the true state of the Chinese economy, but these types of things are tried once you are DEEP in recession.

“It’s basically advising banks to help firms repair their credit, ignore firms’ missed payments, and so on,” said Balding. “The fact that they’re putting out that type of advice to financial institutions, as a regulator, speaks to the depth of the problem related to debt.”

“I think there’s a lot of possibilities or a lot of hope for China, but it would absolutely require dismantling policies in China that are not going to be dismantled,”

“All the sensible infrastructure has already been built in China; we’re at a point where all the major ports, the cities, everything is connected. So when they build more infrastructure now, it’s really just making work,”

“You’re just creating jobs, paying for it out of the public revenues, and it’s not necessarily yielding any sort of significant GDP advantage.”

Another one in the Told-you-so column. The CCP is ignoring debt problems outright, while building negative-economic value projects.

I said years ago that the Chinese Miracle is just like the Japanese Miracle, built off massive amounts of debt to become major exporters. The big difference between them is that Japan became wealthy before the crash. China is still a poor and communist country.

The double whammy of depressed consumption and investment is raising fears of long-term stagnation similar to Japan's "lost decade" in the 1990s following a real estate crash, when annual economic growth averaged just 1%. Beijing has tighter administrative controls and it can probably avoid a sudden property price correction or messy bursting of debt bubbles. Yet without action China risks slowly slipping into the same outcome.

Price Analysis

Join the Professional tier for in-depth price reports and actionable forecasts!

Daily Chart

On today's chart, I'm drawing your attention to the 50 and 128-day moving averages. At this point, it looks as though they will not cross, neither will the 50 cross below the 200-day.

Successfully defending against this cross is significant because it happens at the beginning of every bull market. In October 2020 (leading to a 470% rally) and March 2016 (leading to a 3500% rally).

The set up is there for a major rally, regardless of Blackrock.

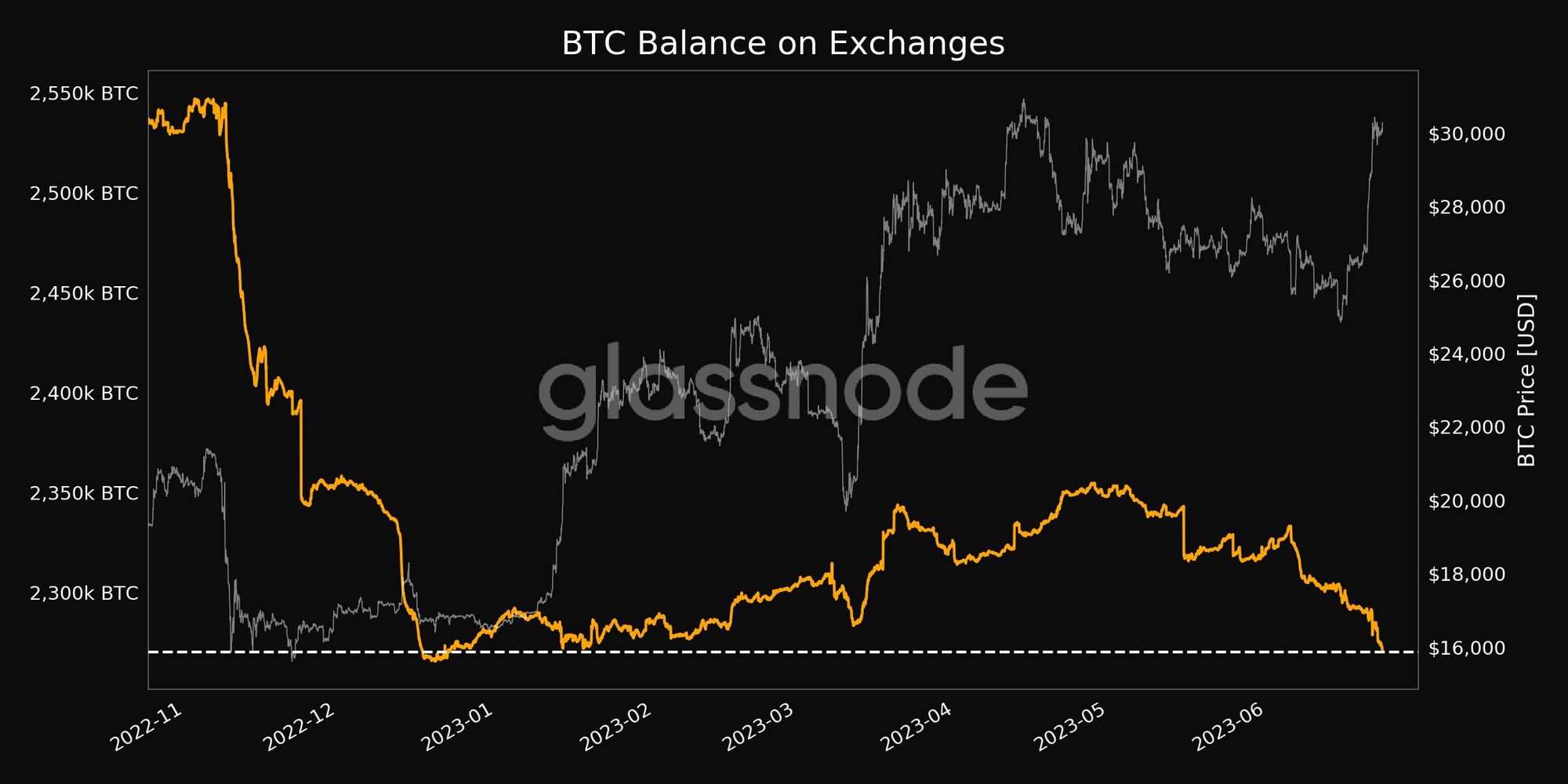

Bitcoin liquidity continues to crash, meaning price movements will be violent with a huge bias to the upside. Any dips will be aggressively bought by stackers. We don't have OTC supply numbers, but if bitcoin on exchanges is so low, we can expect OTC supply to be low as well. Money is made in the volatility, and it's going to be harder to push the price down than up. Therefore, the likelihood of continuation is very high this week.

Get my short, medium and long term forecasts on Market Pro!

Mining

Headlines

Step one: mine Bitcoin. Mining uses electricity for computing power and generates heat as a byproduct.

Step two: send the heat generated by the miners to heat exchangers and heat our pools.

Step three: enjoy hot pool while supporting the Bitcoin network. The pools absorb the heat and circulate cool liquid back to the miners.

This story probably was only big in our little corner of the internet. There were a few NPC responses like, "This makes me like Bathhouse less." LMAO

The response by co-founder Jason Goodman is a great one.

"Instead of using electricity for an electric pool heater, we use electricity to run the miners. The net result is that we are essentially energy-neutral because we are powering the miners with energy we already needed to purchase to heat our pools,” Goodman continued. “Therefore, we are able to use this electricity ‘twice’ in a certain sense … We are able to recover a lot of our energy costs while supporting the Bitcoin network and nerding out on a fun engineering project.”

Bitcoin miners in Texas curbed operations, crimping power usage, as a heat wave drove electricity prices sky-high Tuesday and threatened to cripple the grid in the second-largest US state.

“Prices were elevated and the nature of the incentive programs available to all Ercot citizens, not just Bitcoin miners, resulted in most or all large flexible loads being off,” a spokesperson for the Texas Blockchain Council wrote in an email.

Texas was perilously close to a power crisis Tuesday evening as demand spiked and available supplies dipped as solar output fell with the setting sun. At one point, spare electricity supplies shrank to just 2% of overall capacity.

“It appears most crypto sites appeared to have dropped virtually all their load,” Ercot spokesperson Christy Penders wrote in an email.

I found this story interesting because they bought two existing mining facilities in Georgia, for a medium sum. Each facility appears to host about 3,000 machines. As many more of these medium sized facilities get set up all over the world, mining companies could trade them to get more jurisdictional arbitrage, power source diversification, etc.

Difficulty and Hash Rate

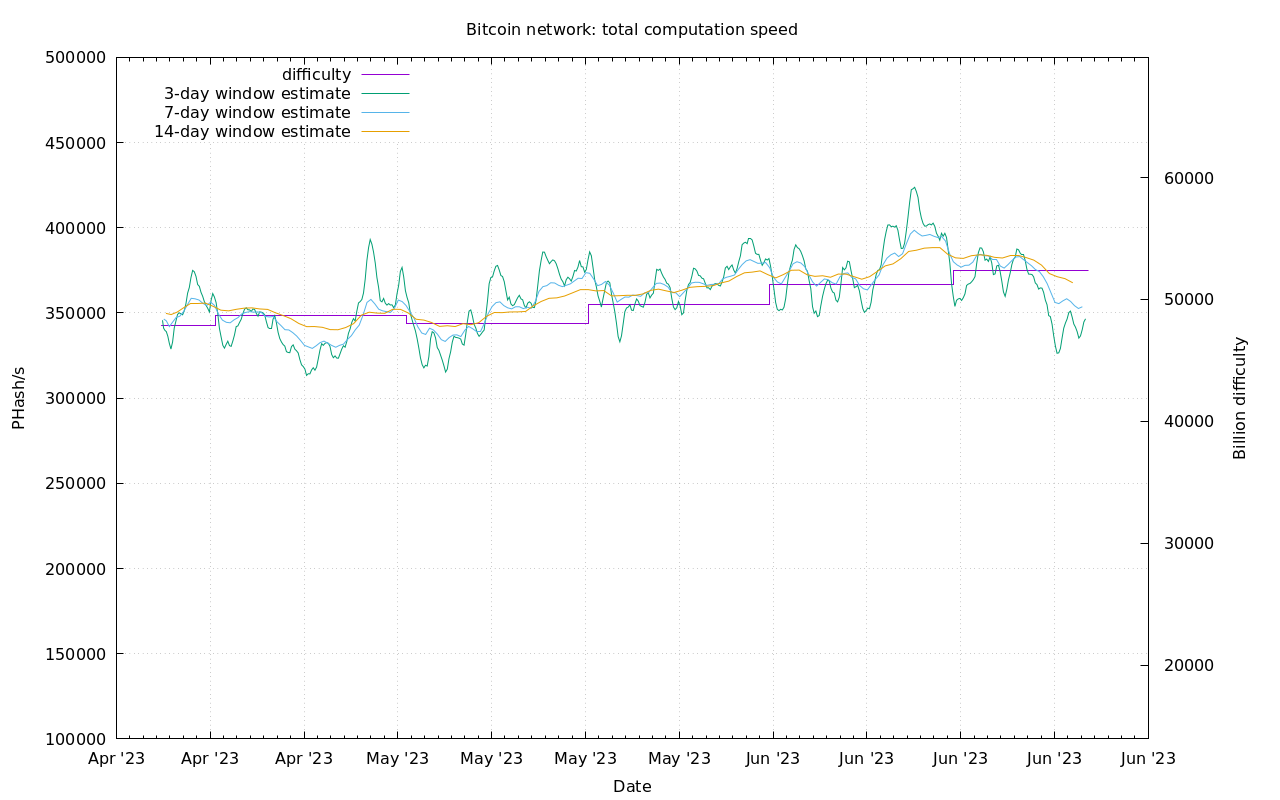

Hash rate has dipped this week with the Texas miners coming offline. Price up and hash rate down cannot last long. However, we have to be watching this as a proxy for hard to see market fundamentals. If hash rate continues to drop as price rises, there will likely be a sizable correction to price coming.

Mempool

The mempool had been trend back down until the last few hours when it spiked again back above 200 MB. Fees remain low.

Lightning Network

- Not a lot of news in the Layer 2 space this week, but I did find this post by Bitfinex giving a good intro to RGB. RGB is a color coin system that works on Bitcoin main net and Lightning Network.

- How Can RGB Improve Bitcoin?

I'm personally not a fan of color coins or RGB, but it is definitely an altcoin narrative killer.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

June 26, 2023 | Issue #247 | Block 796,044 | Disclaimer

* Price change since last week's report

** According to mempool.space