Bitcoin Fundamentals Report #249

Major narrative shift from MSM to bitcoin friendly. Fundamentals are looking up, in adoption, mining and building.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidate to breakout |

| Media sentiment | Positive |

| Network traffic | Low |

| Mining industry | Stable |

| Price Section | |

| Weekly price* | $30,294 (-$733, -2.4%) |

| Market cap | $0.588 trillion |

| Satoshis/$1 USD | 3,301 |

| 1 finney (1/10,000 btc) | $3.03 |

| Mining Sector | |

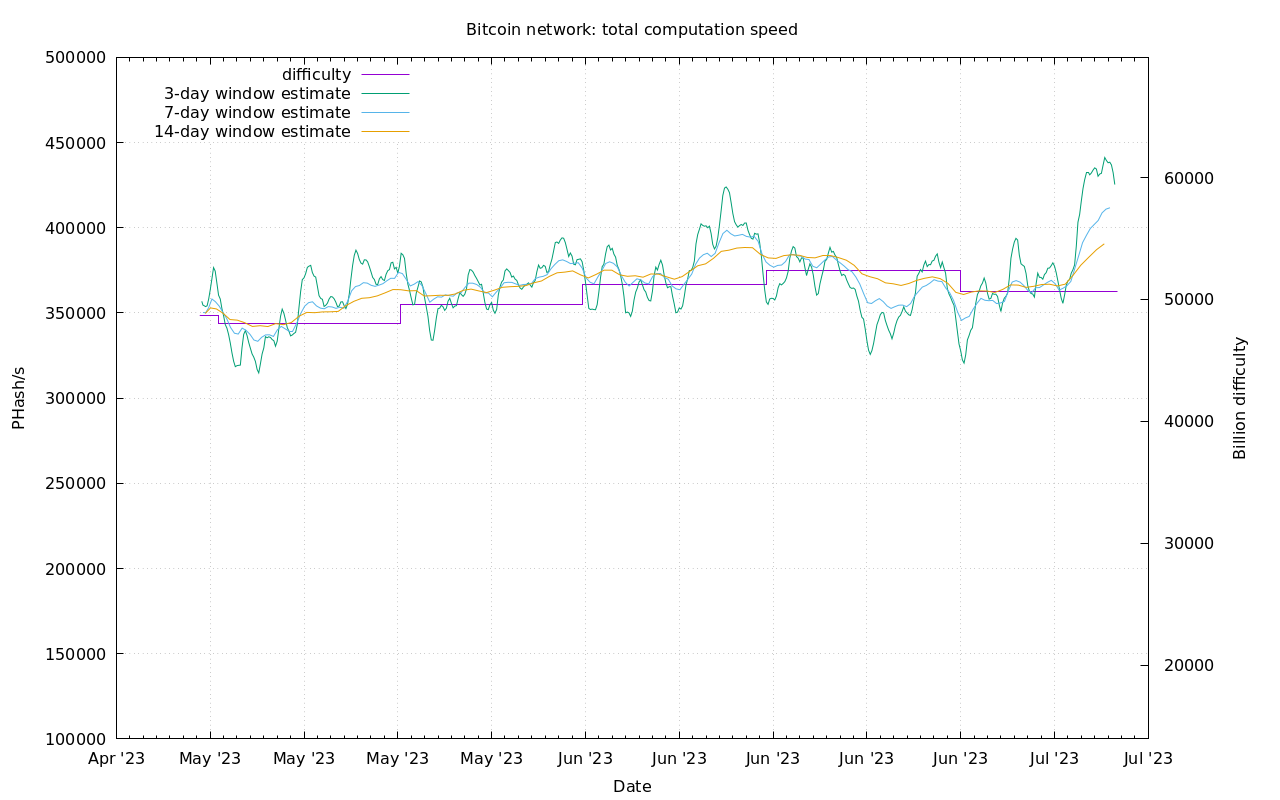

| Previous difficulty adjustment | -3.2554% |

| Next estimated adjustment | +7.1% in ~1 day |

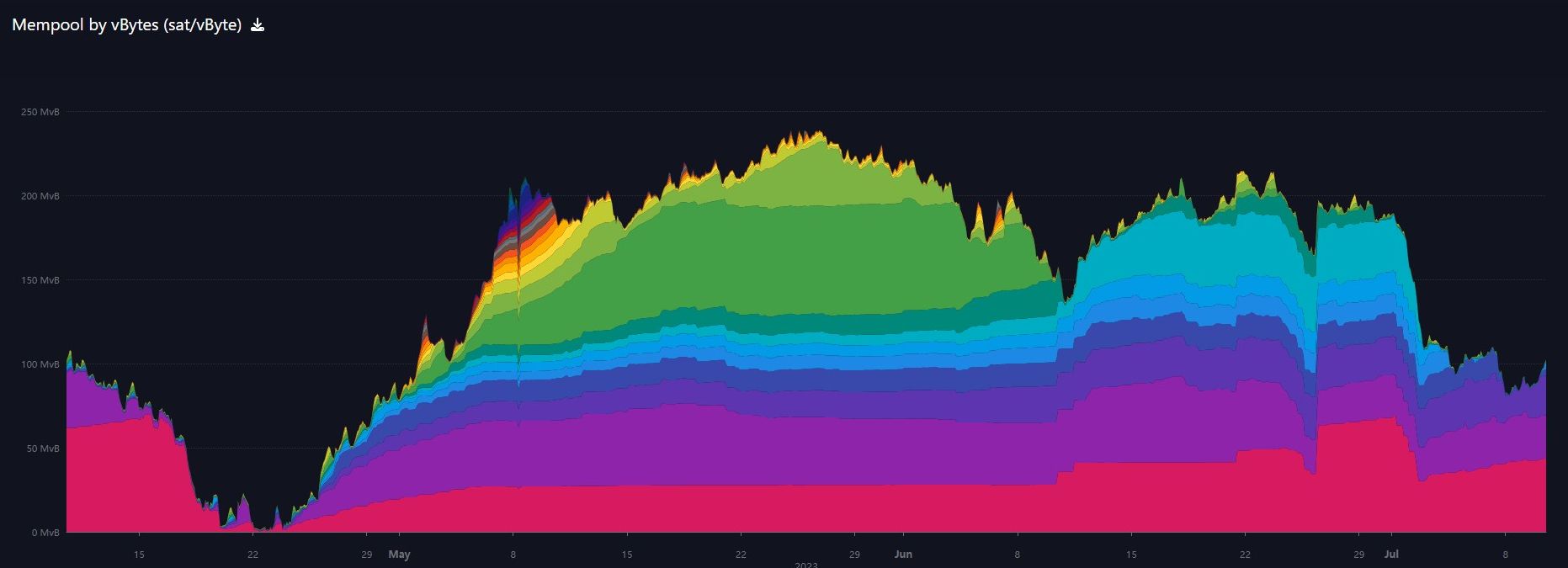

| Mempool | 100 MB |

| Fees for next block (sats/byte) | $0.34 (8 s/vb) |

| Median fee | $0.30 |

| Lightning Network** | |

| Capacity | 5,501.31 btc (+0.4%, +22) |

| Channels | 69,125 (+0.1%, +89) |

In Case You Missed It...

Member

Community streams

- Bitcoin ETF Drama, Europe in Crisis, Price and More - E356

- BRICS Currency Disaster - E357

- Plus live streams that haven't made it to podcast yet!

Fed Watch

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

- All Bitcoin spot ETFs have refiled

The biggest story over the last three weeks has been the Blackrock and subsequent Bitcoin spot ETF filings. Last week, they were returned by the SEC who wanted more clarity on the surveillance sharing agreements (SSA).

All ETFs refiled almost immediately, though public announcements trickled out throughout the week, and all claimed Coinbase as their exchange with the SSA. Only Blackrock, that I'm aware of, has an agreement in place already (as of June 16th). That could be a differentiator.

- Larry Fink pulls complete U-turn on Bitcoin narrative

See the original video clip in tweet here.

In this interview, he says Bitcoin is like "digitizing gold" and an "international asset." He also claims it is a hedge against inflation and represents "hope." I mean, he hit all bitcoin narratives on the head except disintermediating trusted third-parties.

It was only a few years ago that he publicly bashed Bitcoin, now after the ETF filing, he is all for it. Fink wants to make sure his ETF is approved.

- Media coverage of Bitcoin and Bitcoin mining has reverse dramatically!

The shift is palatable. Blackrock has massive influence in media and you can see the marketing has begun. Of course, all they have to do is use the well researched arguments bitcoiners already use.

The rapid shift in narrative out of Blackrock, not just in regards to Bitcoin, but also Fink's refutation of ESG, is something I will be watching very closely.

The value of top cryptocurrency bitcoin could reach $50,000 this year and $120,000 by the end of 2024 Standard Chartered said on Monday, predicting the recent jump in its price could encourage bitcoin "miners" to hoard more of the supply.

Standard Chartered published a $100,000 end-2024 forecast for bitcoin back in April on the view the so-called "crypto winter" was over, but one of the bank's top FX analysts, Geoff Kendrick, said there was now 20% "upside" to that call.

Macro

I went on a whole rant on the podcast about this topic.

People are losing their minds over this gold-backed BRICS currency. It is another form of Dollar Derangement Syndrome. There is no basis in reality for these claims and even the CFO of the BRICS bank says it's not happening.

A new currency requires a massive financial and payments system around it. You cannot simply launch a new "gold-backed" currency and it become widely used and held. Bitcoin's experience demonstrates this. It takes years to slowly get adopted, working its way further into savings and reserves.

As least some commentators are realizing that a gold-backing would cause massive INFLATION in the very countries who want to use it. This is because of the fact that once you have a backing, and government spending and debt is denominated in fiat unit, it is simple to debase the unit.

The dollar has the superior position, they get to move second in this game. The dollar holds all the cards and a game winning move available if the BRICS stupidly go to gold; Wall Street/Federal Reserve can start buying bitcoin.

And right on queue, the Indians pour more cold water on this topic.

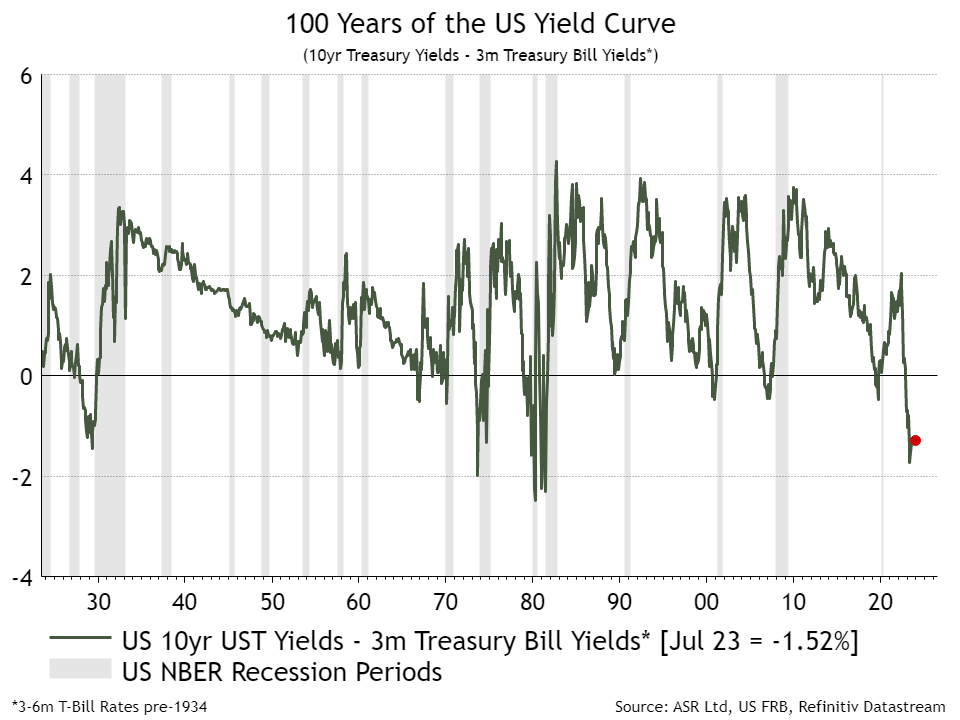

- The Yield Curve is off its extremes

If you notice in the chart below, recession comes after the yield curve inversion ends. This is characterized by a crashing in short term rates relative to longer term rates.

As we edge toward the end of Q3 crunch time, we should expect this inversion to close and the financial press to concentrate more on it. Calls about recession will be deafening. HOWEVER, while a mild recession looks likely, perhaps acknowledged by Q1 2024, it DOES NOT mean a bear market in bitcoin or risk assets is imminent.

- The Real Multipolar World to Come

Last week on Fed Watch, Nolan Bauerle and myself dug into a more realistic version of the coming multipolar world. We hear from geopolitical "realists" like Mearsheimer, that the poles in this new order will be US, Russia and China. I do not think that is likely for several reasons, which I'll breakdown in an upcoming blog post, but suffice it to say here:

- China is in existential trouble. Economically, they cannot survive without the current international trade order. Demographics are horrible and they are still a low income country.

- Russia also has demographic problems and are caught between east and west. They will have more clout on the international stage than China, but still have very little ability to project power outside their neighborhood.

- The US is by far the most dominant, most efficient economy in the world, with the best demographics of any major power by a long way. It is more self-sufficient than any other economy, and has leads in almost every statistic that matters.

The US dominance is so great that it will be the source of two of the three poles. The real multipolar world is going to be Wall Street, Davos, and BRICS.

Price Analysis

Join the Professional tier for in-depth price reports and actionable forecasts!

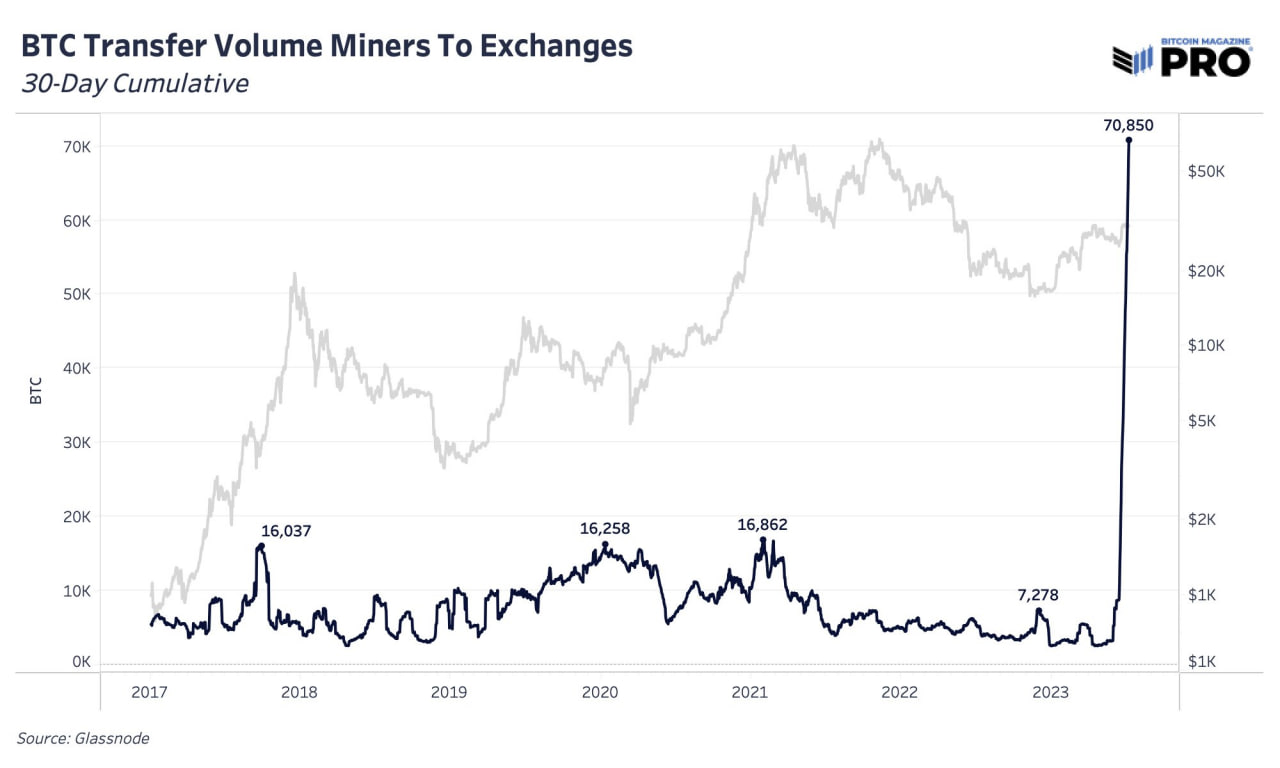

Miners continue to move bitcoin to exchanges.

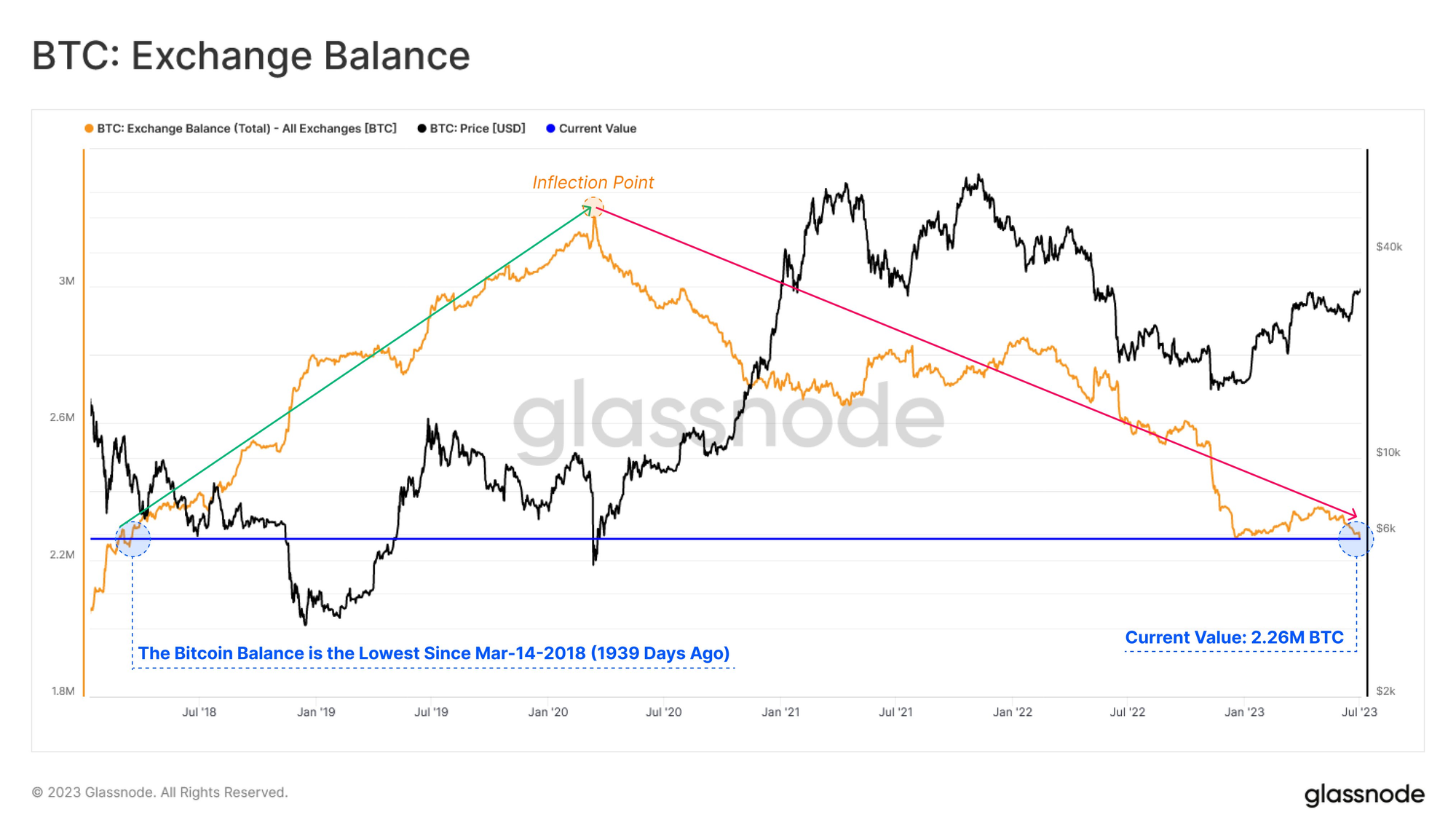

However, Bitcoin continues to be taken off exchanges in total.

Grayscale GBTC discount is disappearing quickly meaning people are buying the discount, either because they simply expect the price to rise or because they expect Grayscale to win their lawsuit with the SEC.

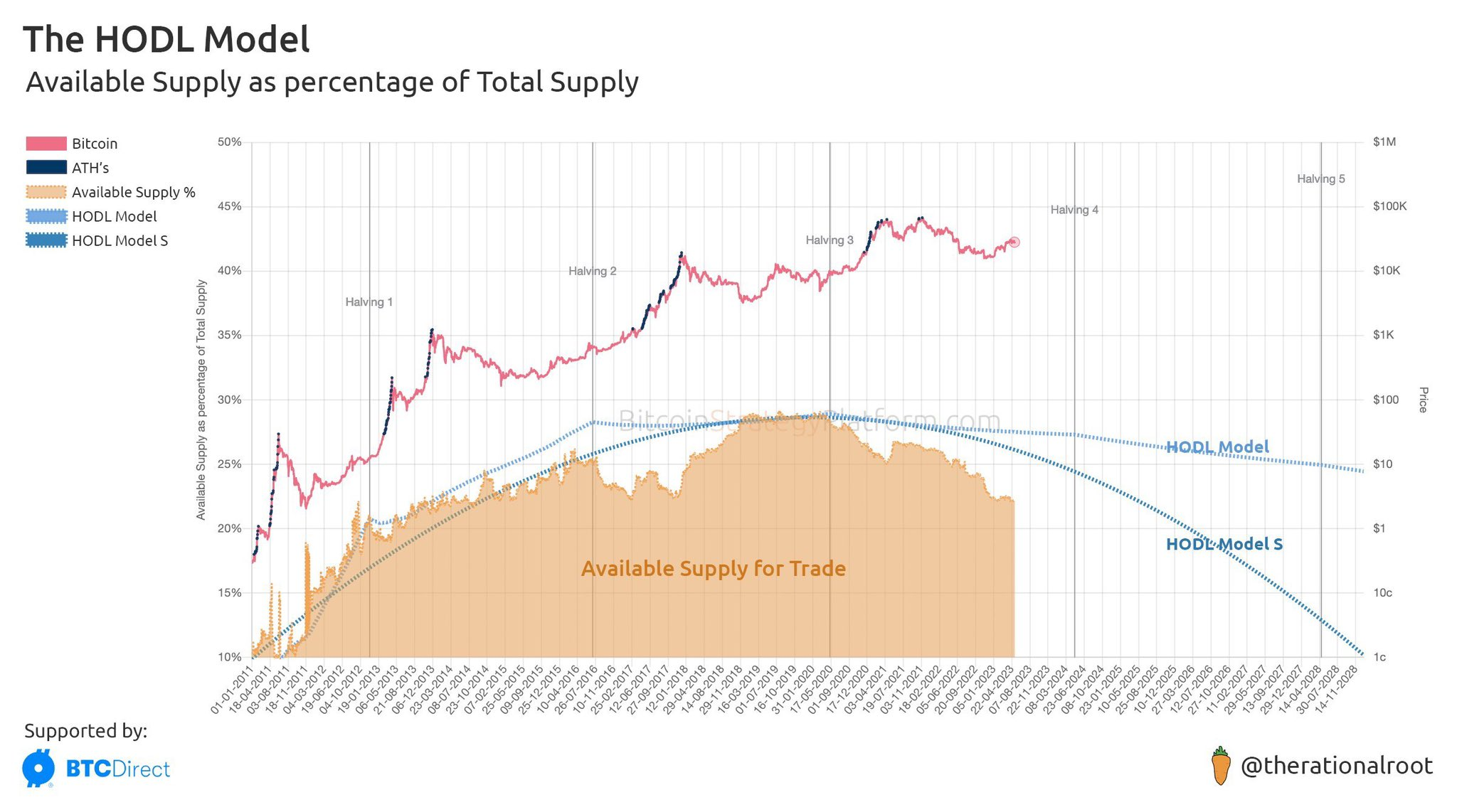

Interesting chart has been circulating from @TheRationalRoot. His Hodl Model strikes me as reminiscent of the Stock-to-Flow model in its predictions. I still agree with the S2F model btw.

Below, you can see that around the last halving something changed and supply started to come off exchanges. It is interesting the leverage grew throughout the 2020 bull market, probably partly to stem this tide of bitcoin leaving the exchanges.

Lower level of bitcoin on exchanges signals a move away from the speculative bootstrapping phase to reserve/savings phase. This could lead to rapid illiquidity and volatility if the price starts to move higher, and it will provide a price floor below the price. Here are the dynamics:

As price drops, the value of the bitcoin on exchanges drops. On dips, the DCA army tends to increase their DCA as I recommend. This results in more dollar value chasing less dollar value of bitcoin.

The reverse also happens on blow-off tops. As the price of bitcoin rises rapidly, the dollar value of bitcoin on exchanges rises rapidly. As long as demand outpaces this rise in dollar value of bitcoin on exchanges, price will continue to rise. The blow-off top happens when price surges, say 100% in a couple weeks, the dollar value on exchanges surpasses the demand, and price drops.

Veblen good dynamics take over, demand will increase as price increases, and decrease as price decreases. That is until you hit the floor of the DCA army, where their hodling and inflow tip the scale forming a bottom.

Daily Chart

The daily chart is struggling with this resistance zone, but is holding the bull flag consolidation nicely. It is pinched between the center of the horizontal channel (red dash line) and $30,000. Down side is limited right now due to fundamentals, giving the upper hand to breakout higher any time now.

Last week I said we were in the calm before the storm. It still feels that way, but everything is set for a quick move in the coming week.

Get my short, medium and long term forecasts on Market Pro!

Mining

Headlines

Mentioned above as part of the narrative shift in favor of bitcoin. Wow, just read the first two paragraphs...

Bitcoin, the world's first decentralized digital currency, has been embroiled in a persistent debate regarding its environmental footprint. However, it is crucial to clarify that energy usage does not inherently lead to environmental harm. According to the Cambridge Centre for Alternative Finance, bitcoin's annual energy consumption amounts to a substantial 129.45 TWh, comparable to that of entire countries. Yet, this comparison often leads to misunderstandings about the true nature of bitcoin's environmental impact.

In fact, the CCAF has determined that the bitcoin industry uses a significant amount of renewable energy, sometimes more than half, depending on the jurisdiction. This is a testament to the industry's commitment to sustainability and its potential role in the green revolution.

Where are all the bitcoiners claiming they are going to fight tooth and nail against bitcoin? I've said that bitcoin's incentives will court the powerful elites just like

Another from Forbes... I mean guys, this is the mainstream financial press that is completely captured by elite globalists. Their narrative has completely flipped. So bullish.

“Like eVs, bitcoin does not have any direct emissions, [but] we want to go one step further and also mitigate all emissions caused by use of electricity,” Batten said about the fund’s intent. According to him, by targeting landfills that vent their methane, they can mitigate emissions ten times faster than other techniques.

Halving is also all over the mainstream headlines as predicted. The halving is a hype event in addition to a mechanical supply event. As the mechanical effects wane in coming cycles, the hype will grow. It will be a celebration of certainty in a very uncertain world.

Interesting paragraph could explain the miners selling bitcoin right now.

The global mining industry has $4.5 billion to $6 billion in debt — down from $8 billion in 2022 — spanning senior debt, loans collateralized by mining rigs, and Bitcoin-backed loans, estimates Ethan Vera, chief operations officer at crypto-mining services firm Luxor Technologies. Outstanding loans for 12 major public mining companies such as Marathon Digital Holdings and Riot Platforms stood at around $2 billion at the end of the first quarter, down from $2.3 billion in the previous quarter, data compiled by Hashrate Index shows.

Here's the important line:

“Nearly half of the miners will suffer given they have less efficient mining operations with higher costs,” predicts Jaran Mellerud, crypto-mining analyst at Hashrate Index.

Of course, that is unless the price doubles before the halving, which I expect it will.

Difficulty and Hash Rate

Hash rate surges this week to a new ATH, even as miners continue to route bitcoin to exchanges.

Mempool

The mempool has not dropped a ton is size this week, but it continues to chew through transactions to lower and lower fees.

Lightning Network

One of the tools included in the release is LangChainBitcoin, which enables Langchain agents to interact directly with Bitcoin and the Lightning Network. It includes features such as LLM Agent Bitcoin Tools, which utilize OpenAI GPT function calls to enable developers to create agents capable of holding a bitcoin balance, sending/receiving bitcoin on Lightning and driving with a LND node.

The L402 protocol, introduced in 2020, is a standard for payment-metered APIs designed to utilize the existing HTTP 402 Payment Required status response code. It combines bitcoin and the Lightning Network to enable global micropayments for paid APIs.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

July 10, 2023 | Issue #249 | Block 798,142 | Disclaimer

* Price change since last week's report

** According to mempool.space