Bitcoin Fundamentals Report #254

Quiet week for bitcoin, topics include upcoming ETF date, BIP300, macro headlines, price analysis, mining industry news, and lightning network news.

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Volatility dead again |

| Media sentiment | Positive |

| Network traffic | Medium |

| Mining industry | Surging |

| Days until Halving | 231 |

| Price Section | |

| Weekly price* | $26,096 (+$45, +0.2%) |

| Market cap | $0.508 trillion |

| Satoshis/$1 USD | 3,829 |

| 1 finney (1/10,000 btc) | $2.61 |

| Mining Sector | |

| Previous difficulty adjustment | +0.1201% |

| Next estimated adjustment | -6% in ~9 days |

| Mempool | 149 MB |

| Fees for next block (sats/byte) | $0.51 (14 s/vb) |

| Median fee | $0.48 |

| Lightning Network** | |

| Capacity | 4796.62 btc (+1.7%, +80) |

| Channels | 66,786 (-1.2%, -845) |

In Case You Missed It...

Member

Community streams

- Demographic Discussion and Effect on Bitcoin - Live

- New Bitcoin Taxes and Why is the Demographic Cliff So Horrible - Live

- What's Happening Now? Bitcoin Dip, China Crash - E365

- Plus live streams that haven't made it to podcast yet!

Fed Watch

Blog

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Headlines

- The Quiet before the storm

A very quiet week last week and the weekend was much different. I've been struggling this morning to compile news stories for Bitcoin, not coming up with much other than the waiting game on ETFs. For that reason, this issue will likely be shorter than normal and I will be able to look at other things tangential to Bitcoin on my live streams.

We thought volatility was back but, wow, were we mistaken. This week, the price is exactly where it was on last week's newsletter. Volatility did not return, it was only a brief flush of liquidations. That fact makes me less confident in a bounce from these levels, and less confident on the approval of the spot ETFs. I'll go into that more in depth in the Price section below.

Last week, I touched on demographics on two live streams and I'm writing a couple posts on why a demographic collapse is so bad and what we can do about it. This topic matches perfectly with other economic topics I discuss. I view the coming era as deflationary, deglobalization, and demographic collapse. I've spent a lot of ink and podcast hours on deflation and deglobalization, but demographics is a major force that is going to lock-in this path. Bitcoin will do great in this era because the existing system won't. More content coming on that perfect storm that's coming.

- Big spot ETF decision this Friday!!

All eyes on Friday's SEC decision! This is the major news of last week and this week. September 1st we will get the first decision from the SEC on the Blackrock ETF, as well as 6 others. Delay or approval are the two options. Of course, they could also outright reject, but that is less than a 1% chance IMO.

Delay or approve? The markets are saying loud and clear that it will be a delay. We shouldn't be surprised at that outcome. A delay doesn't mean they won't get approved in October, it is Blackrock after all, but it does make eventual approval less likely.

After a delay, the odds of approval drop below 50% IMO. We will have to watch the tape. Price is all that matters, and the market knows better than us all. If price rallies throughout September, that would be a sign that approval chances are increasing. I do expect a slight dip on any news of delay though.

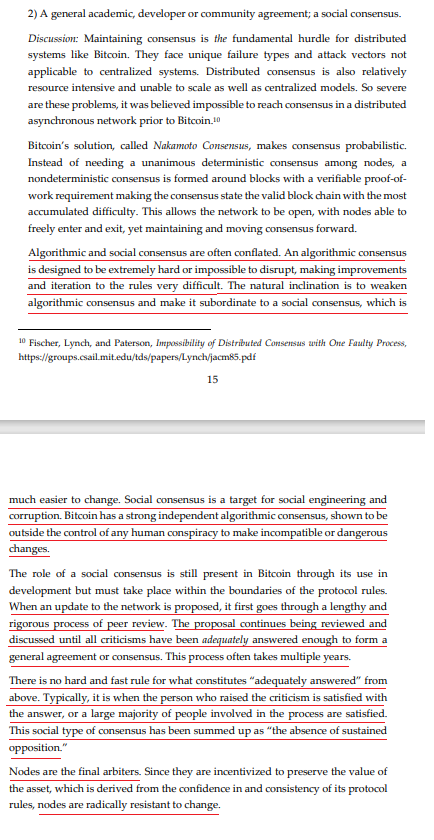

- Bitcoin BIP300 Debate

Bitcoin Improvement Proposals (BIPs) are the unofficial process for upgrading Bitcoin. A developer proposes a change in plain language and then in code via the Bitcoin mailing list and Github. That begins debate on the need for the upgrade, the incentives, the code, the activation mechanism, etc etc.

It is a long process that is not official. Anyone can release a change to Bitcoin node software. The ultimate test is if the nodes decide to run it. There is no central party saying "upgrade now" like in Ethereum and all altcoins. For example, there have been upgrades that get nearly 99% agreement of the need for the change, 99% agreement on the code, but there might be disagreement on the activation mechanism that delays the upgrade for years.

The bar for an upgrade is likewise unofficial and undefined. I covered in the Consensus definition in the Bitcoin Dictionary.

I'm not concerned about the BIP300 attack at this point. Perhaps, it will grow in the future, but the idea is very old, has never been popular, the developer (Jeff Garzik) is an enemy of bitcoin, there's no need for it, and game theory-wise it only adds uncertainty which will be bad for the price. IOW I'm very confident that nodes will reject it.

Macro

- End of Q3 is coming

I've been talking about Q3 of 2023 as being of huge significance for the last year. Seasonally, it is the end of Q3 that sees most economic/financial crises and I saw as the transitory inflation became evident by this point, we would be in danger of economic conditions continuing to deteriorate, perhaps with a major bank failure or something.

What the trigger is is less important than the general state of the economy. If they economy is weak, anything could set off a cascading crisis. If the economy were strong, contagion is much less of a concern.

High CPI tells us that economic activity is sustainable at a higher level. Transitory or falling CPI tells us that the economy is tightening its belt or unable to secure economic activity at that level. Therefore, falling CPI is the fragile condition where crises have much more fertile ground.

As we progressed toward the end of Q3 I become less convinced that a crisis would happen. I'm not seening it in the charts for the US. Yes, times are very tough right now, but no recession on the horizon for now. However, we do see major signs in China and to a lesser degree in Europe/Germany. Therefore, I think it is likely that Q3/Q4 of 2023 could see a crisis in China and that takes 6-12 months to come to the US.

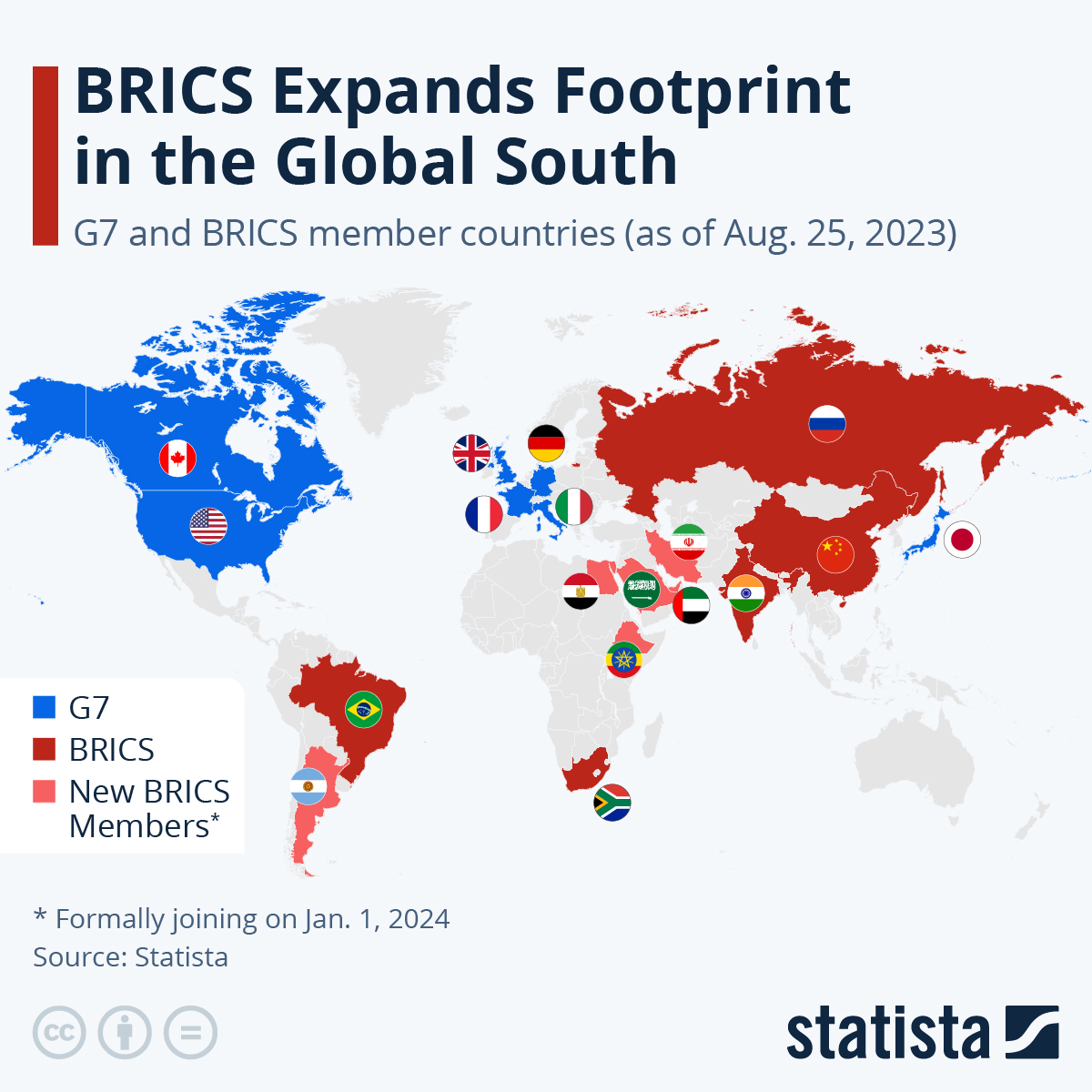

- BRICS expand

This was given a lot of air time this week as BRICS added Argentina, Egypt, Ethiopia, Saudi Arabia, Iran, and the UAE. The US dollar received most of the bad press, but I think this carries very little monetary significance.

The significance it does carry is in a geopolitical order, or the coming multipolar world. I predict that the BRICS (ex-China) will become one of the major poles of this new era. However, it will not be able to compete directly with the US as a hegemonic order because the individual countries are almost all enemies.

For example, the new entrants, Egypt and Ethiopia are on the brink of war over the new Ethiopian dam on the Blue Nile. Saudi and Iran, are poles in the Sunni/Shite struggles, and existing members India and China are perennial enemies. This alliance is defined by its opposition to the US order, and when that is over internal animosities will take over.

- Powell speaks at Jackson Hole

People were expecting some forward guidance from Powell at his Jackson Hole speech. Will the Fed keep raising rates? Do they see the economic troubles brewing? Will they keep rates higher for longer even as the economic situation deteriorates?

All of these questions were left unanswered. LOL This speech was universally seen as a Nothing Burger. I took it as confirming what I've been saying for ages. The Fed doesn't do anything, they don't know what they are doing, and they follow. We just have to wait for a dramatic crisis that will force them to act. So far, the Fed has threaded the needle by rhetorically placing themselves in a place where a "soft landing" is very possible.

Price Analysis

Join the Professional tier for in-depth price reports and actionable forecasts! Sign up today!

Bitcoin Charts

Last week:

Volatility is back baby. Or is it?

That was a very good question, as it appears volatility is not back yet. The selloff on the 17th was a solitary event it seems. People got ahead of themselves. So far, just more tightness.

I did not produce a Market Pro letter last week, because of the lack of price action. I will make up for that this week, with an issue coming mid-week.

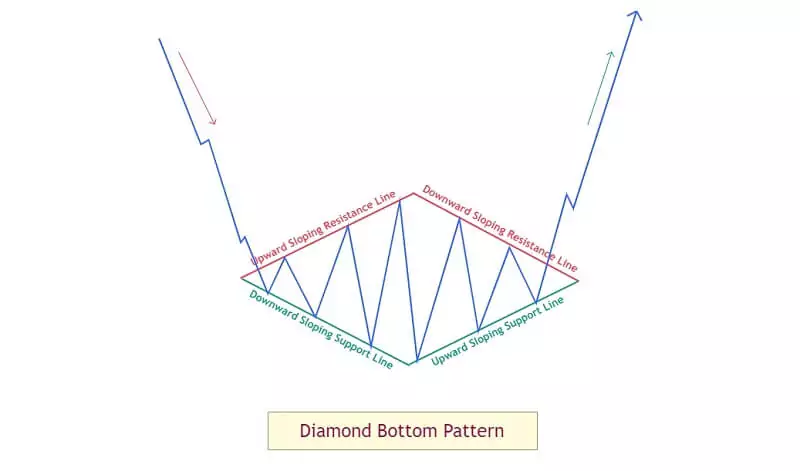

Overall, we've dropped below the important moving averages of the 200-day and 200-week. That alone is enough to convince most people of the bearish break.

However, with the extreme oversold condition that has persisted, and some bullish divergences starting to appear, at least a short term bounce is in order. If that comes prior to the ETFs, we could see a wild week.

We can also start to make out a diamond reversal down here, which adds probability to an upward move.

I'll be looking for any bullish move to rip through those 200-period averages and challenge the 50-day this week. If there is any weakness in that move, expect a big sell0ff on ETF news.

Get my short, medium and long term forecasts on Market Pro!

Mining

Headlines

Indeed, it turns out not only that it has invested in four of the five largest publicly traded Bitcoin mining companies, but also that it is the second largest shareholder in all four.

Wow, Blackrock is all in. Any questions if they were truly serious about Bitcoin or only hedging, this should go a long way to settling.

That being said, this could also be overstated. Blackrock is a major owner of most stocks. At least this says that Blackrock thinks of Bitcoin mining as a legitimate industry, which is a vote of confidence all on its own.

Laos state-owned electricity distribution company Électricité du Laos (EDL) has announced that it will suspend electricity supply to ̶c̶r̶y̶p̶t̶o̶ bitcoin mining operations in the country, citing various reasons such as the struggle to generate enough power amid drought conditions.

This is interesting because it goes to show that some locations might have good sources of power much of the time, but events like these add uncertainty. Therefore, bitcoin hashrate will seek out not only the lowest prices but the cheapest and most predictable energy.

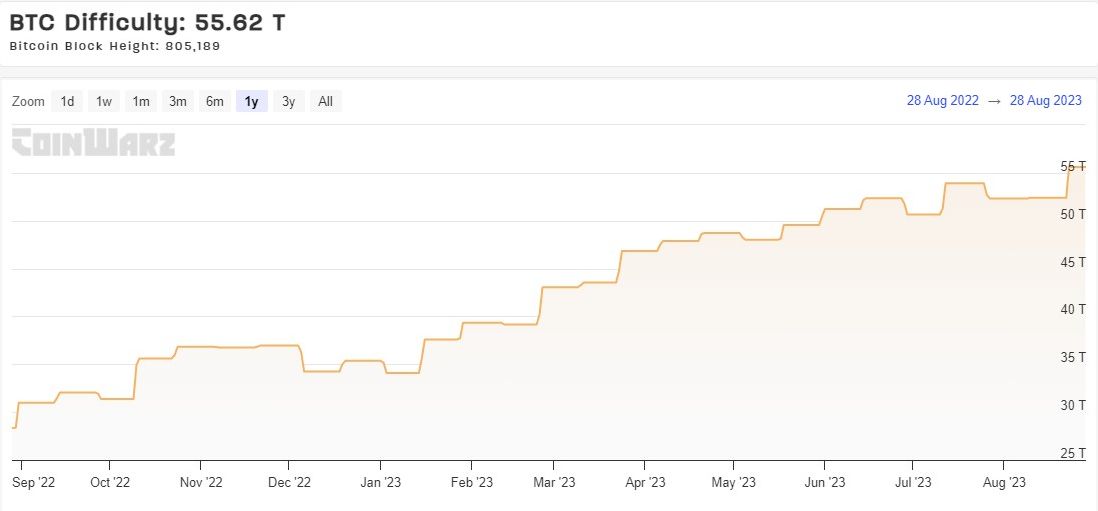

Difficulty and Hash Rate

Bitcoin's difficulty adjusted +6% last week to reach a new ATH, despite the price situation. This is a huge vote of confidence from the people in the ecosystem with the deepest, widest exposure to major economic forces. Since this jump in difficulty, hashrate has slowed. The next adjustment is estimated to be -6% in 9 days.

Mempool

Mempool is extremely stable again this week. The network traffic is at the perfect clearing pace, where the number of new transactions is maintaining the size the mempool, but not making it grow. In fact, in the last few hours, the mempool has ever so slightly declined in the dark blue fee group on the chart below.

Lightning and Layer 2

Splicing is the new cool Lightning Network upgrade and it's starting to get implemented into node software. This is a necessary improvement for mass adoption, but not sufficient.

Splicing is expected to tackle a persistent challenge within the Lightning network—liquidity constraints. These constraints have long been cited as a barrier to widespread adoption, impeding the seamless flow of transactions. With Splicing, Blockstream aims to alleviate these liquidity challenges, ultimately leading to more affordable and reliable transactions for Lightning users.

This is a VERY good idea. It implements the idea by Nik Bhatia of a "risk-free rate" in bitcoin. Large funds could hold their bitcoin in LN infrastructure, not only provide liquidity for adoption, but earning fees for their clients. Brilliant. Hope to see the first application soon.

A Lightning fund would allow investors to gain exposure to not only bitcoin’s price, but also its emergent and growing utility as a medium of exchange.

In practice, a Lightning fund would consist of investors purchasing shares of bitcoin that are held in Lightning-capable infrastructure. Fund managers could strategically deploy the bitcoin held within the fund into various Lightning channels. Node operators are already familiar with the process of deploying bitcoin in Lightning channels: The fees generated from supplying and maintaining the ledger more than pay for the costs of converting on-chain bitcoin to Lightning channels and back.

That's it for this week. See you again next Monday!!!

DONATE directly on Strike or Cash App to support my work! You make this content possible! Thank you.

A

- Were you forwarded this newsletter? You can subscribe here.

- Podcast links and socials on our Info Page.

- If you liked this newsletter please SHARE with others who might like it!

- More ways to support our content some don't cost a thing!

August 28, 2023 | Issue #254 | Block 805,192 | Disclaimer

* Price change since last report

** According to mempool.space