Bitcoin Fundamentals Report #270

Inscription/ordinal debate, spot ETF marketing begins, Red Sea war risk insurance, bitcoin price analysis, mining sector growth, in depth inscription charts.

December 18, 2023 | Block 821,822

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidation |

| Media sentiment | Neutral |

| Network traffic | Very High |

| Mining industry | Growing rapidly |

| Days until Halving | 121 |

| Price Section | |

| Weekly price* | $41,681 (+$486, +1.2%) |

| Market cap | $0.816 trillion |

| Satoshis/$1 USD | 2,400 |

| 1 finney (1/10,000 btc) | $4.17 |

| Mining Sector | |

| Previous difficulty adjustment | -0.9592% |

| Next estimated adjustment | +4% in ~4 days |

| Mempool | 346 MB |

| Fees for next block (sats/byte) | $9.09 (154 s/vb) |

| Low Priority fee | $7.69 |

| Lightning Network** | |

| Capacity | 5064.61 btc (-0.3%, -15) |

| Channels | 59,533 (-0.3%, -187) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

- Market Dashboard Summary 12/12/2023

- The Fed Looks Silly And Bitcoin Takes A Breather

- Mining Dashboard Summary 12/14/23

Headlines

- Mempool and battle over inscriptions

This week, the news cycle in bitcoin has been a bit slow. No major ETF news, another ticker was assigned I think, some more meetings with the SEC took place, and Gary Gensler in an interview said they were forced to take a fresh look at the ETFs after the court ruling against them. Every time we hit a slow news week, internal squabbles seem to fill up the space. Anything to keep the adrenaline up I guess. I'm not invested heavily in this one though.

The current debate is about inscriptions/ordinal (those are interchangeable terms for the most part), between pro- and anti-inscriptions. The third position, which I and Adam Back are in is one of general indifference.

Inscriptions are metadata attached to bitcoin, stored in the bitcoin block chain. In nature, every niche is filled with life. In bitcoin, if there is an empty economic niche something will fill it. Here, it is block space.

Some people don't want idiotic NFTs and ordinals to "clog" up the network, like we've seen recently with fees. But the remedy cannot be worse than the disease. In this case, inscriptions are not catching on. The issuers are either bitcoin attackers or scammers from the altcoin space, coming to bitcoin because they see the writing on the wall for altcoins (I'll grant a tiny fraction of good intentioned bitcoiners, but they wouldn't think this was a thing without those other players IMO).

Inscriptions have a big Achilles' heel, they are very expensive on bitcoin due to fees. IDK what the daily average for an inscription is, but I've seen numbers as high as $2000 per inscription to just mint. That is not economically viable long term, since there is really no value or market for these things.

That is where the indifference comes from. In Adam Back's words: "you can't stop JPEGs on bitcoin. complaining will only make them do it more. trying to stop them and they'll do it in worse ways. the high fees drive adoption of layer2 and force innovation. so relax and build things."

you can't stop JPEGs on bitcoin. complaining will only make them do it more. trying to stop them and they'll do it in worse ways. the high fees drive adoption of layer2 and force innovation. so relax and build things.

— Adam Back (@adam3us) December 16, 2023

I'll add one more thing to that. Inscriptions are likely not going away anytime soon, but since they are sensitive to fees, expect them to go in cycles. When fees are generally lower, inscriptions will ramp up, pushing fees higher. In other words, they may help to provide a floor on fees the miners can count on and plan for. At least as long as they last.

The first commercial from a bitcoin spot ETF issuers I've seen dropped this morning from Bitwise.

- Bitcoin vs Long bonds

Bitcoin is a deflation hedge, very similar to long government bonds. Government bonds are probably the most well-known safe havens for an upcoming recession. One of my central theories in bitcoin over the last several years is that bitcoin will be globally adopted by large pools of capital as a safe haven, instead of the average person as an inflation hedge.

Notable in this chart is that bitcoin held support at the previous BTC/TLT level and is now threatening to make a new ATH.

Macro

I was the first macro analyst in bitcoin to bring up the Red Sea potential fall out on insurance cost and global supply chains.

Fear-mongering around the October 6 attacks were deafening. I calmly debunked this WWIII concern on the live streams, and rightly showed that markets told us the Israel conflict was likely NOT going to spill over. However, as soon as the Houthi started their actions in the Red Sea, I immediately saw the possibility of that expanding and becoming an issue of greater importance, in line with my call for a rise of state-sanctioned piracy/privateering and the rising appreciation to the true cost of sea-lane security.

I do not consider the Red Sea chaos as an extension of the Hamas/Israel conflict, even though the Houthi spokesman said that this was directed at Israel shipping. They have targeted Israeli bound ships in practice.

The news this week is that bulk carriers are starting to route around the Red Sea and Suez around Africa. That adds more than 40% to the route length and weeks in time. That might not seem like much, but considering they make money from multiple round trips a year, that can add up to a significant drop in total shipping capacity.

Where this really matters is energy shipments. 40% longer transits will put a strain on supply relative to demand. Europe can't catch a break.

So far, over 55 ships have diverted, with a daily traffic of 50-90 ships this will quickly show up in prices in Europe. The list of companies avoiding the Red Sea includes BP, Maersk, Hapag-Lloyd, CMA CGM, and Mediterranean Shipping Company.

- Powell Non-Pivot

Immediately after Powell's Wednesday press conference last week, people were calling it a Fed pivot. No, it wasn't... yet. Pro members can read last week's Proton, where I detailed exact timestamps of the press conference and what Powell meant.

First, I want to say that I don't think Fed policy matters all that much. They cannot make drastic changes to the path of the economy, they can only influence at the margin. That being said, people claim recent stock market performance has been due to October CPI surprise to the downside and Powell's pivot. In fact, all the 2023 has been quite bullish for the stock market, as I called for very clearly. Stocks are rising because people aren't putting money into hiring or expanding their own businesses, they are getting defensive ahead of a recession, subconsciously.

Powell's scenario is that they don't want to overshoot with tight policy, so they expect to slightly ease policy. However, this is based on the fact that over doing it will hurt the economy. Therefore, in Powell and my scenarios, rate cuts are coming because the economy is weakening, not strengthening.

People claiming lower rates are simulative are lost. The market is not dumb, most macro analysts are. Low rates obviously are negative for economic potential. More money goes into safer things other than risky entrepreneurship and real wealth creation. People don't invest in stocks because they think their earnings will go up, they invest in stocks because of the alternative.

Bitcoin might have something to say about that, too. Bitcoin getting spot ETFs right in this period is extremely bullish. Bitcoin could take a significant chunk of flight to safety.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

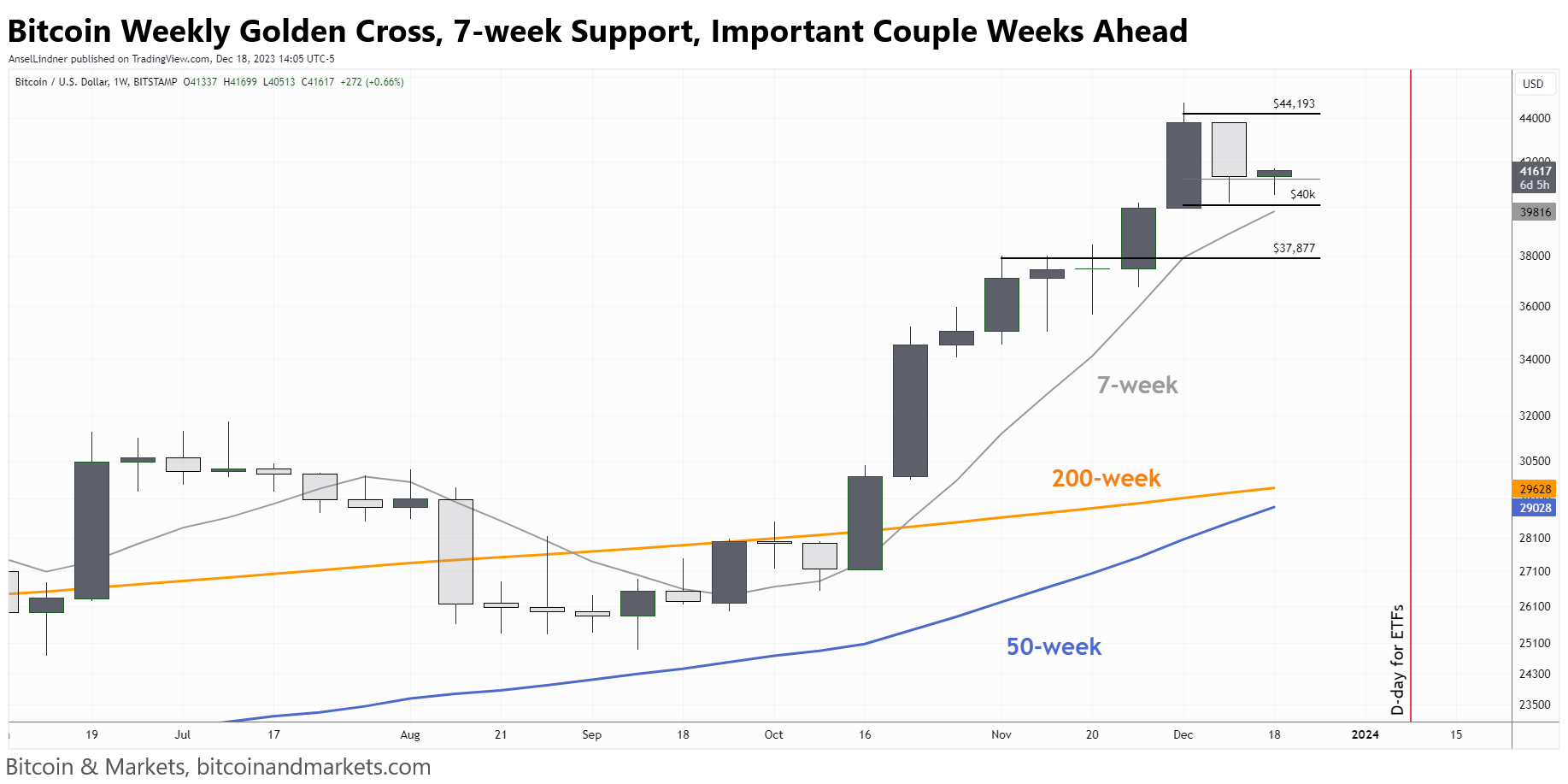

Despite the predicted mid-month weakness, price is holding up very well. There would need to be a massive sell-off PRIOR to the ETF for it to get through every level including the $37,877. That is unlikely.

The ETF issuers' marketing campaigns are ramping up right into the holiday season when many conversations will be had with more interest around the dining table. The ETF is NOT priced in.

This mid-month cool off is also represented in the CME futures to spot spread, down to only $150 with Open Interest coming down. This is an important couple of weeks ahead. We could see some volatility and long legged candles. This will be the first-ever gold cross on the bitcoin weekly chart, expect it to get some attention, meaning price will likely gravitate toward that Schelling point. However, there is tons of support at $37k and above.

Be prepared to buy any dips down the the $37k support with stop-losses below. And don't be surprised with a big candle to open the year.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Deals are flying all around the bitcoin mining sector. This is just the latest:

According to an official press release on Monday, Hut 8 has been selected to build the new facility for Celsius creditors. The company’s president, Asher Genoot, said that the company was chosen for the task due to its track record of successful operations.

"We believe that the strength of Hut 8’s managed services business with 680 MW currently under management, coupled with our track record of swiftly standing up mining infrastructure and efficiently running and optimizing operations, were key factors in being chosen as the partners for this project,” he said.

Work on construction is expected to commence in the coming weeks. Once completed, the new facility will accommodate approximately 66,000 miners. The site will also be powered by a robust energy supply exceeding 215 megawatts (MW) at full operational capacity.

Cipher (CIFR) is a publicly traded miner with 7.2 EH/s already deployed. The 7.1 EH/s purchase would bring to the second most overall hash rate for public miners behind Marathon (MARA). Of course, other public miners are not standing still. All miners are purchasing more hash rate as fast as possible.

- Bitcoin mining ETF has outperformed Bitcoin in 2023 by a lot

Difficulty

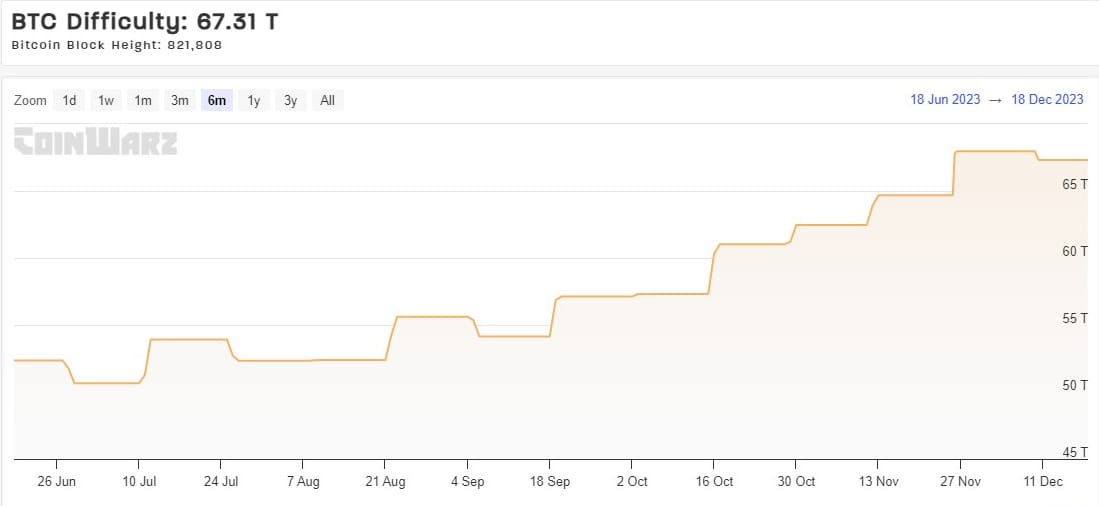

No change in difficulty over the last week. The next adjustment has rapidly changed from an estimated -1% to a +4% in 4 days.

Hash Rate

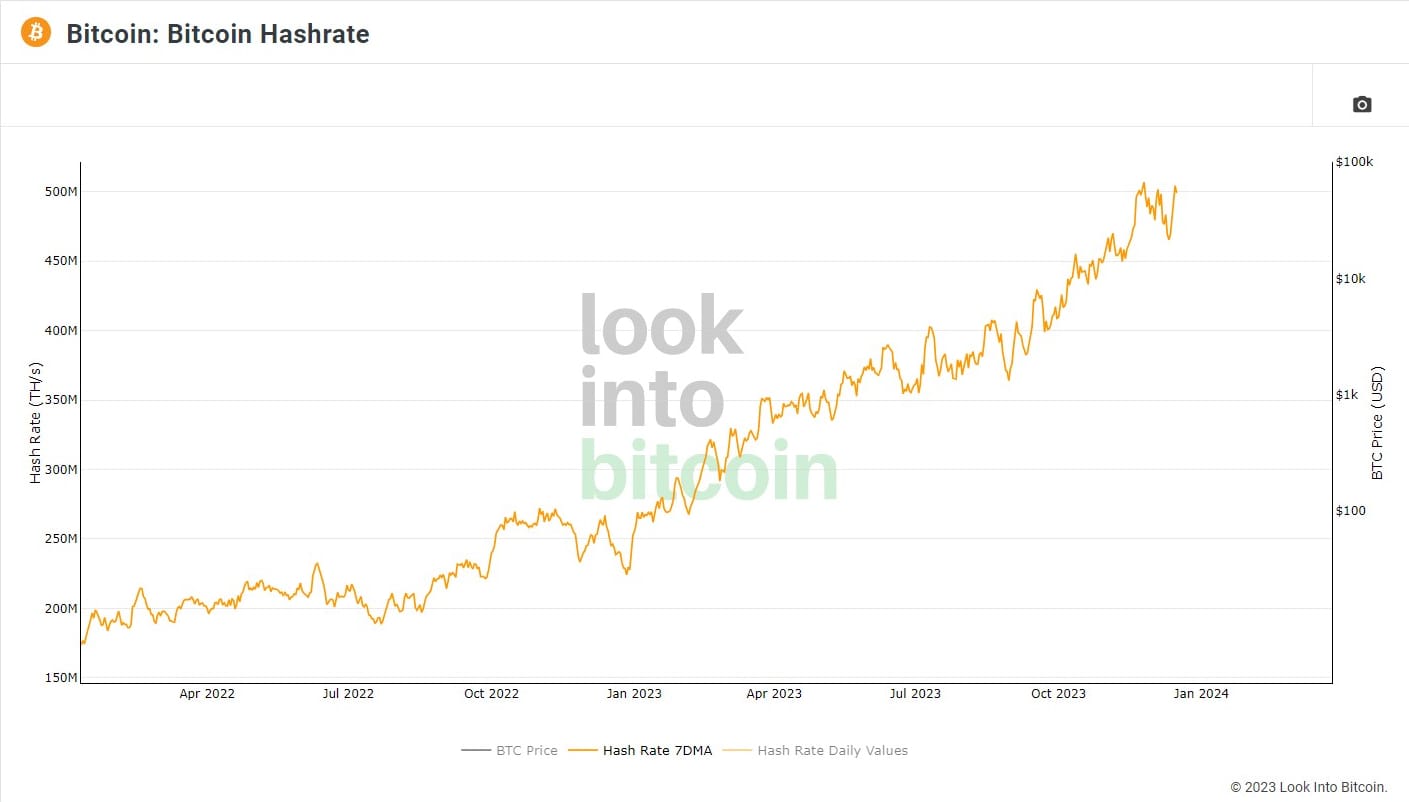

Bitcoin hash rate is making another run for it, very near ATHs again.

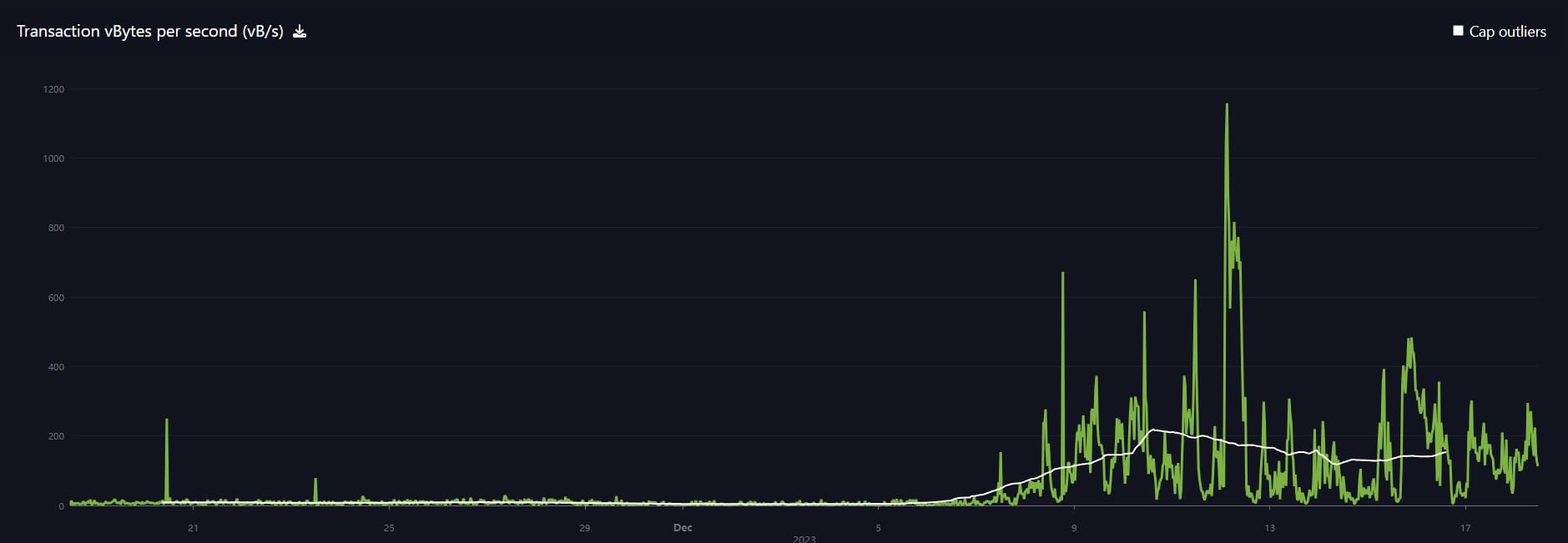

Mempool

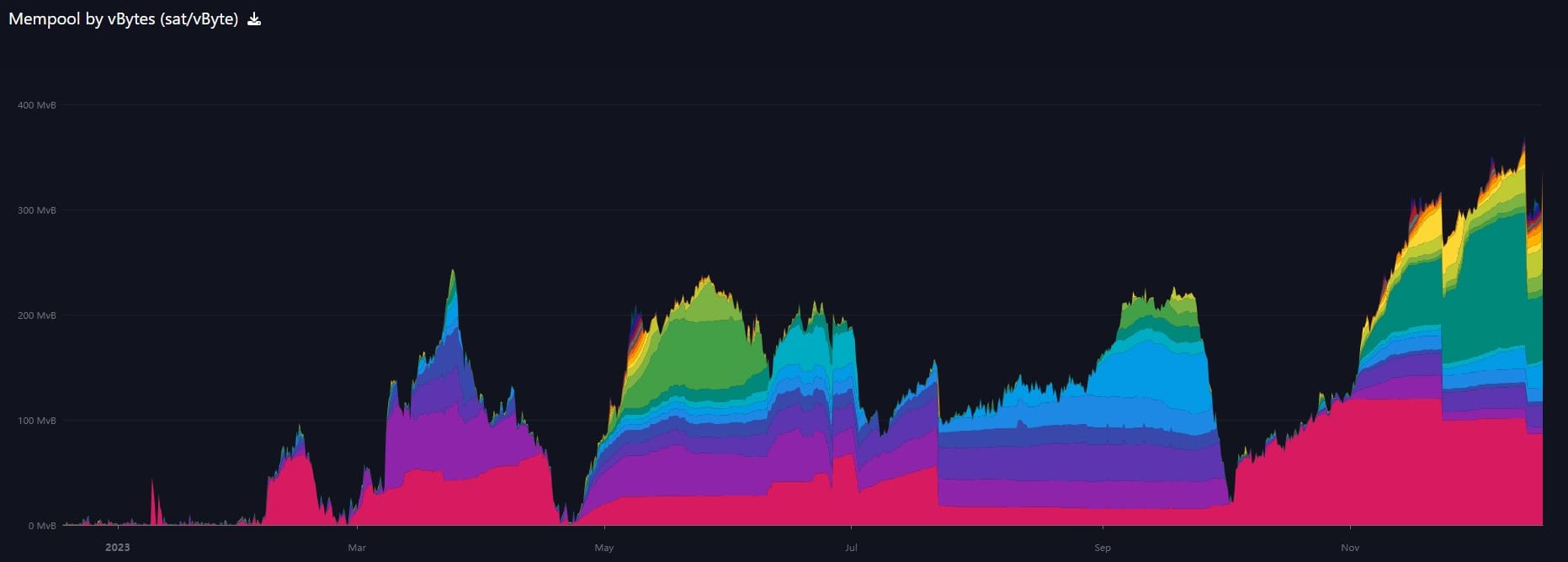

The mempool went through a significant drop this last week, from yearly highs. In the last 24 hours it has spiked once again. Remember the typical pulse of the mempool is that it is busier with p2p transactions during the week. Inscriptions are seemingly doing most of their minting on the weekends.

Inscriptions

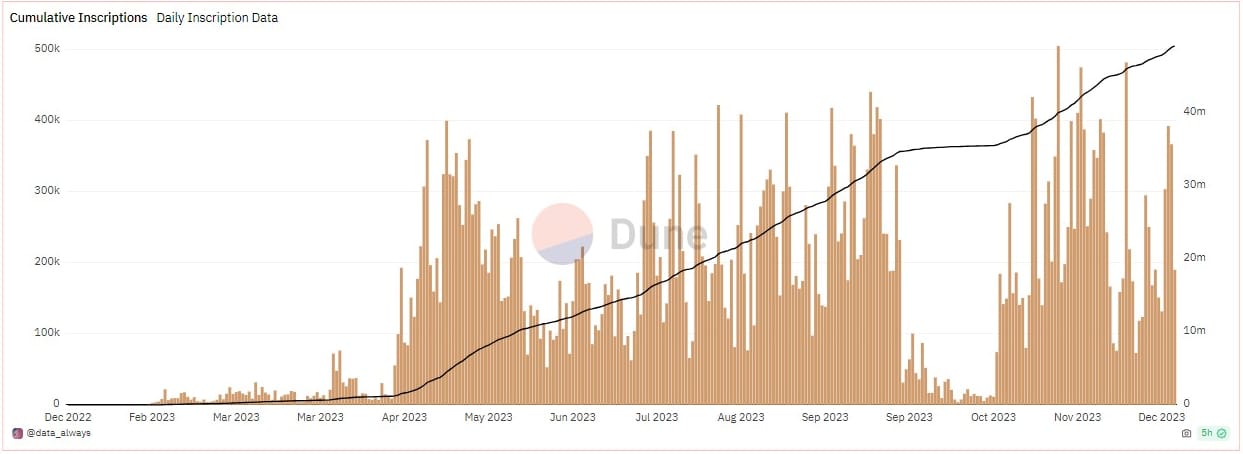

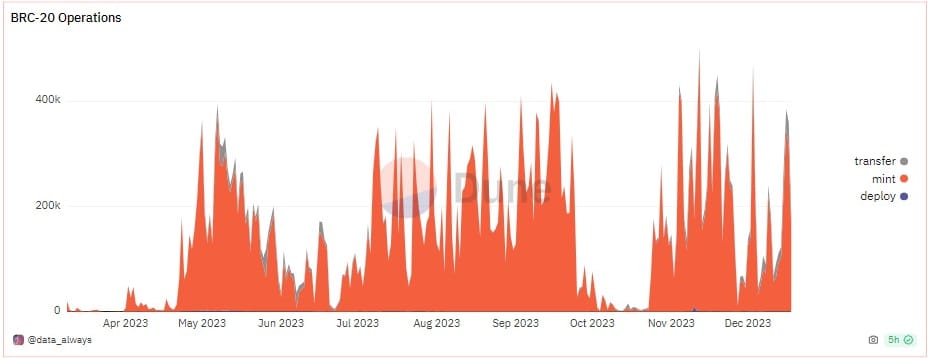

Inscriptions/ordinals are THE internal topic of debate for bitcoin right now. Let's examine what is going on. First up, you can see that the total number of new inscriptions has maintained relatively constant since April, except for September when the numbering system breaking temporarily stopped the auto-minting IMO. Also, November and December do show a very slight decrease.

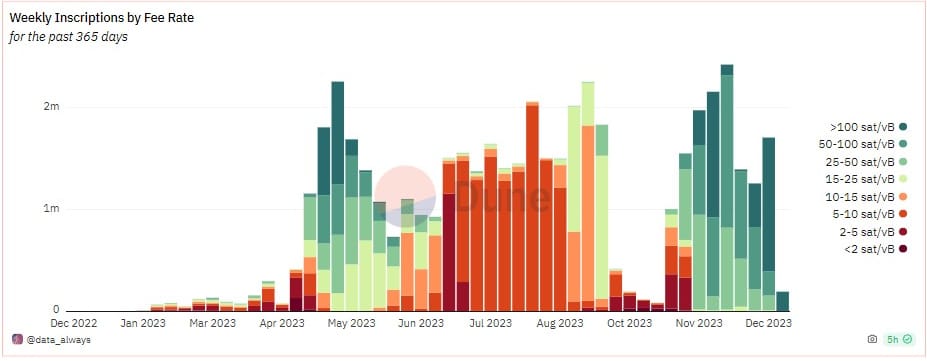

They are feeling the pain of the fees. High fees are the cure for spam. As you can see the green color denotes very high fees.

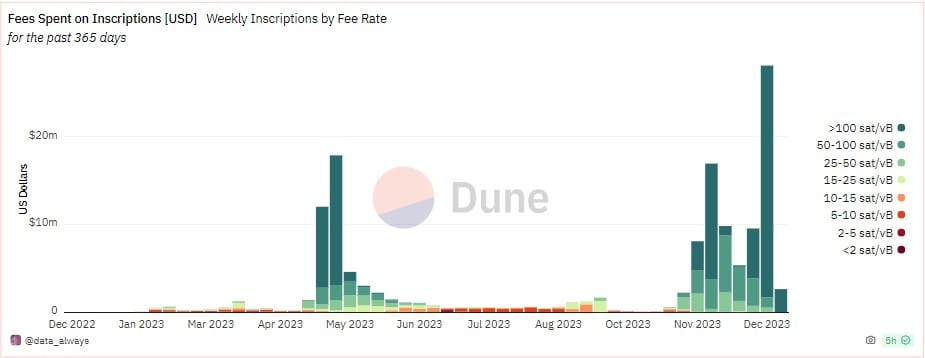

Last week, people spent $28 million to mint these things. This is almost totally wastefully spent, because they could have simply bought more bitcoin.

Below, the orange is simply mint transactions. You can see there is almost zero transfer volume for these things. They are not getting traded. No one wants them. In fact, with that being the case, it provides evidence toward the theory that this is malicious attack on the bitcoin network.

Overall, inscriptions are wasteful and an ultimate loser, just like NFTs before them and altcoins themselves before that. There is an attack vector that a nation-state could clog up the network like this, however, that is a direct stimulus to the bitcoin ecosystem, because they have to first buy the bitcoin to use in the inscriptions and to pay the fees. Then they send millions of dollars a week worth of fees to the miners.

Layer Two

- Is this the Liquid cycle?

There is a learning curve in bitcoin. We are all on this journey together, and a lot of things that are very promising in theory are much less workable in practice. The only way we will discover emerging trade-offs in this new sector is by living through it and letting people experiment and try to build stuff.

In the 2016 halving cycle, we were collectively learning about the decentralization and game theory of the base consensus layer. The outcome of that era taught us that scaling of bitcoin transactions was going to happen on L2. The 2020 halving cycle, lightning was the first L2 to get mass hype, because it was also decentralized like the base layer. However, it seems to add additional trade-offs on top of the that base layer.

This cycle, it could be that people rediscover sidechains. Liquid being the most well known.

2016 cycle, L1 decentralization.

— Ansel Lindner 🇦🇷 (@AnselLindner) December 18, 2023

2020 cycle, L2 Lightning.

2024 cycle, L2 Liquid.

In the last month, more people have been experimenting with Liquid as a solution to traffic from inscriptions (however, there is still very little to no transfer volume for inscriptions and I assume they have to be minted on the main chain).

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space