Bitcoin Fundamentals Report #271

Bitcoin ETF updates, approval imminent?, thinking on inscriptions, hypocrisy of anti-bitcoin bills, macro and mining sector updates.

January 1, 2024 | Block 823,911

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Consolidation |

| Media sentiment | Very Positive |

| Network traffic | Very High |

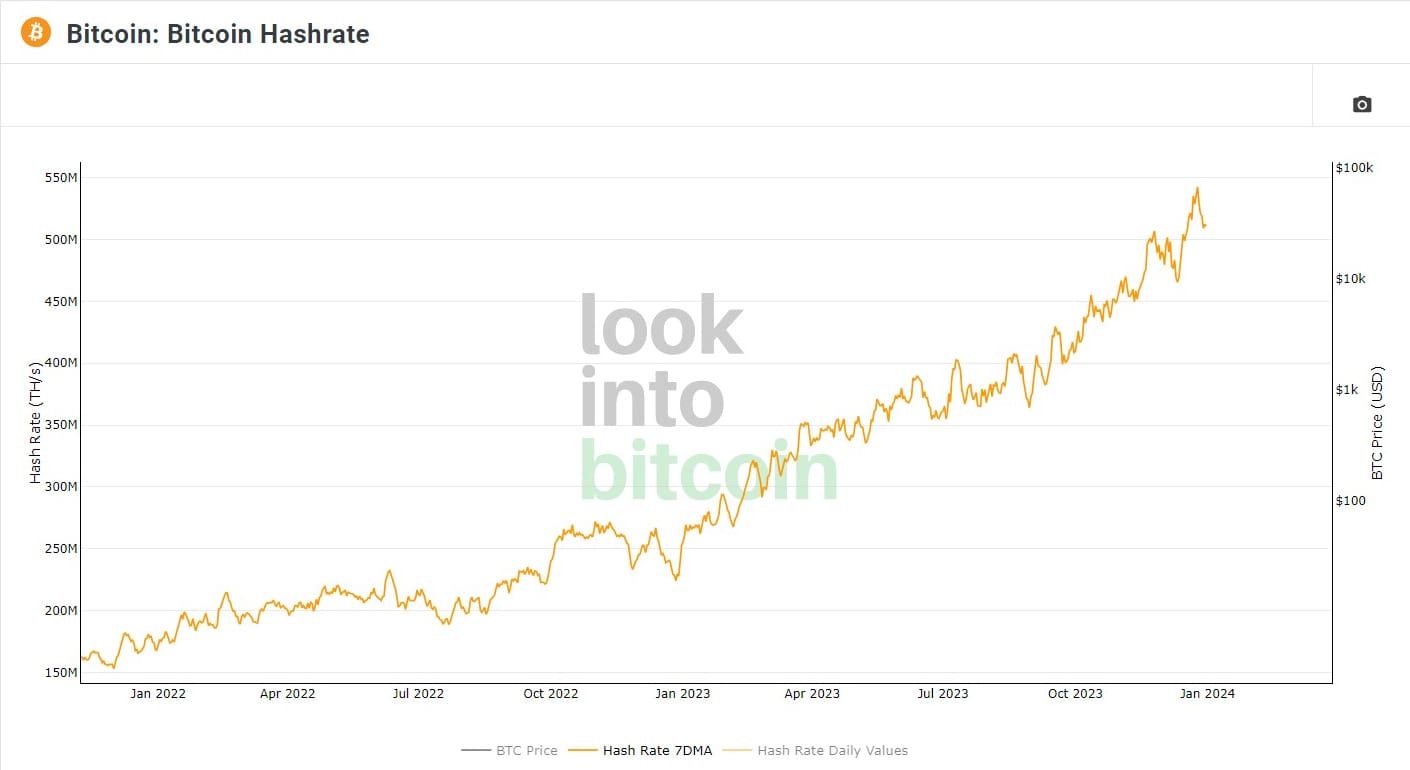

| Mining industry | Growing rapidly |

| Days until Halving | 106 |

| Price Section | |

| Weekly price* | $43,500 (+$1819, +4.4%) |

| Market cap | $0.852 trillion |

| Satoshis/$1 USD | 2,303 |

| 1 finney (1/10,000 btc) | $4.35 |

| Mining Sector | |

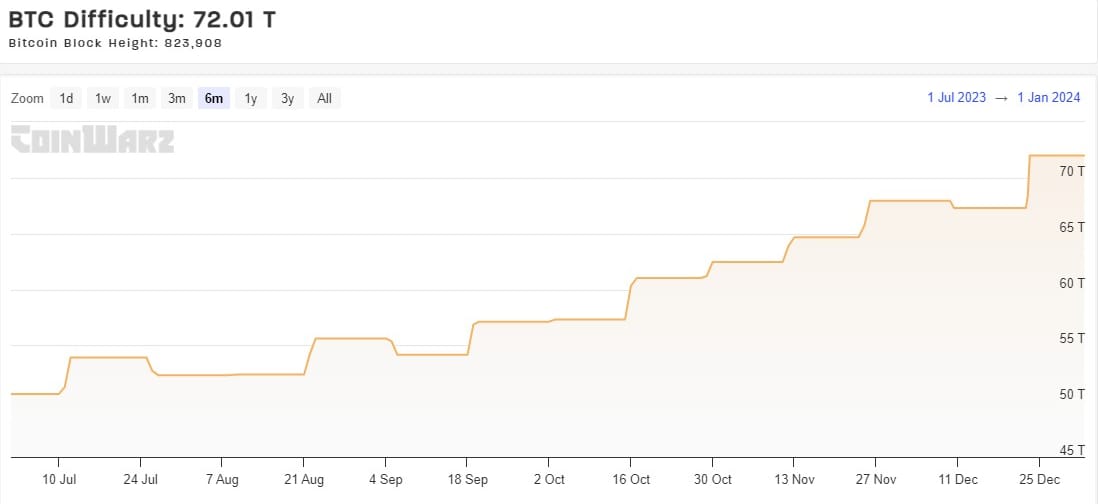

| Previous difficulty adjustment | +6.9834% |

| Next estimated adjustment | +0.2% in ~4 days |

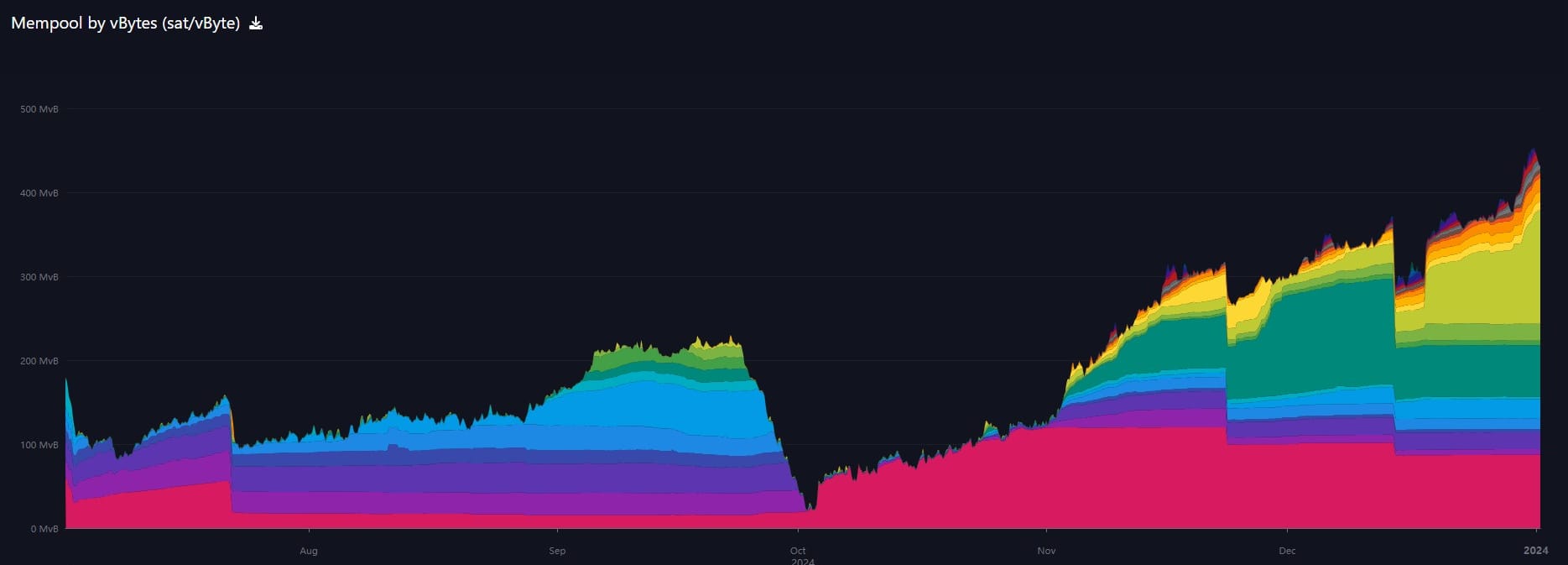

| Mempool | 433 MB |

| Fees for next block (sats/byte) | $7.42 (122 s/vb) |

| Low Priority fee | $5.96 |

| Lightning Network** | |

| Capacity | 5035.03 btc (-0.6%, -30) |

| Channels | 59,272 (-0.4%, -261) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

- Communism Works Better than Markets With Today's Compute?

- Shale: An Earthquake in the Geopolitical Order

Bitcoin Magazine Pro

Headlines

Dear Readers,

Hope you all had a Merry Christmas and a have a prosperous new year! This year was different because both Christmas and New Years are falling on a Monday, right when I release by newsletter. I took as week off, and this week will be a little shorter than normal.

To all my Professional tier members, I skipped last week as well. There was lots of new, which we'll cover below, but not much action on the price front. Nothing to that required a significant change to my forecasts. We will get right back on track in the New Year!

Ansel

December 29th was the deadline set by the SEC to get all changes to the ETF filings in. There was a flood of activity last Friday, and then this article dropped on Reuters. Everything is ready to be approved this week?

People familiar with the filing process said issuers that met their end of the year filing revision deadlines may be able to launch by January 10 - the date by which the SEC is required to either approve or reject the Ark/21Shares ETF.

The SEC may notify issuers as soon as Tuesday or Wednesday that they have been cleared to launch the following week, said those sources, who spoke on background given the confidential nature of the discussions.

- The Inscription debate is making some headway

Over the past few months, the main discussion has been pigeon-holed into pro- vs anti-inscriptions. There has been little room for the moderate approach, with some going as far as to accuse people unconcerned as being part of an attack.

Straw man, you are figuring it out, responding to incentives as part of the market.

— Ansel Lindner 🇦🇷 (@AnselLindner) December 28, 2023

The market will figure it out, and Brian is part of that market. We cannot act outside the market. All comments, debates, discussions, blog posts, buys and sells, options, threats, labels, memes, etc are all part of the market that will figure it out. Even if there is a very powerful market participant (government) they eventually will have to succumb to market forces if they are wrong. If the government is very wrong, you can hedge or partake in jurisdictional arbitrage.

I agree with Adam Back, "you can't stop jpegs on bitcoin." I look at it from a game theoretical and economics perspective. Inscriptions boost miner revenue and reduce liquid supply of bitcoin by freezing low value UTXOs. There is an ebb and flow, and bitcoin and market participants can learn and adjust, likely building new L2 infrastructure.

There has always been a future trade-off ahead of us, when the vast majority of transactions would be priced out of the main chain. I don't think this particular period is the final straw and from now on all bitcoin transacitons will take part on L2's like Elements sidechains, but it is step along the way. These NFT pump and dumpers will run out of money sooner or later, like all other cycles in bitcoin history.

Interesting thread here by @AsherHopp claiming bitcoin has always censored transactions if they were too small and considered dust. It is not the case that anything goes in bitcoin even if it is technically a valid transaction. Food for thought.

Casey Rodarmor, the creator of the current implementation of Ordinals, also wrote a blog post, basically saying we need to move on.

- Black pill bitcoiners not happy with the ETFs

This space has quite a few black pillers, people who found bitcoin initially because they felt hopeless against the current system. They've carried that hopelessness into bitcoin. The ETFs are an extremely major event, perhaps larger than all halvings in bitcoin's history combined. But they will still find a way to explain how it's all a plan to capture and destroy bitcoin. It's far too late for that.

I can see why some people see the ETF as a way to make "paper bitcoin", this is the exact same theory that has been rife in the gold bug community for 20 years. Instead of asking deeper questions, and looking for better understanding of the market and money, they take the short cut and blame manipulation and the all-powerful government manipulator.

Fact is, ETFs are legally required to hold the underlying asset. Gold has underperformed expectations because we've been mired in a deflationary (not inflationary) environment since the GFC. QE and government spending aren't money printing/inflation.

The ETFs can only hold real bitcoin, not derivative products. Any funny business will quickly lead to bankruptcy of that Fund.

- Battle between Globalists and Wall Street

If you view battle as simply government goons and bankers on one team against the people, many of the current events around bitcoin won't make sense. One such case is the Senator Warren bitcoin ban bill. Why would the government be about to approve bitcoin spot ETFs, backed by Wall Street giants like Blackrock, but then Senator Warren is trying to ban bitcoin?

It becomes clear if you view the sides of this battle as the Globalists (including the administration) vs Wall Street (and they happen to be aligned with the people's interest at this moment). The Globalists are losing badly. So much so, they have to brazenly lie about bitcoin to their co-sponsors of the bitcoin ban bill.

This week, we learned that the bill was written by globalists special interests and lied about the bill to co-sponsors. Warren and other claimed it was a soft touch when it is an effective ban. That is what Perianne found out when she went to talk with them.

It seems like this legislation is not going anywhere. It was intended to progress the dialectic in the direction of a ban, however, Perianne and others are doing a great job of re-framing the dialectic toward corruption vs bitcoin neutrality.

Macro

- Red Sea continues to escalate

While the Red Sea chaos continues, it does seem to be affecting the price of oil so far. The fallout of much of the last few weeks will be felt first in Europe and Asia pretty soon. So far, 10's of ships have been targeted, most with no affiliation to Israel. Even a Hong Kong flagged ship was attacked.

The US Navy has been able to protest most all of the shipping, with French and even Iranian naval vessels now coming to assist.

Despite the escalation, I still don't think this will spill over into a WWIII scenario, because everyone has a significant amount to lose. The main takeaway from these events is the ease at which international trade can and will be disrupted in the new era of deglobalization. The cost to protect the sea lanes will be distributed and borne by countries less able to do so, both militarily and budget-wise.

One thing that is completely lost on most anti-US criticism is that the US doesn't need this costly burden, other countries need it for their economy to function. In other words, a breakdown in trade is an asymmetric win for the US.

I haven't been writing much about the China collapse lately, because it has been a slow motion train wreck and not many more big revelations. The communists are trying to figure out how to shift money to households with two other things, 1) not give households more freedom where to use that money (much of it will be put toward capital flight or unapproved uses), and 2) how to not get the households to simply save it.

This was a point made by Micheal Pettis and others, in a middle income trap, you have to find a way to give more GDP to households and have them become consumers. The only way the communists get out of this downward spiral that will eventually end in the end of their economic system is to open up again like under Deng Xiaoping, but they are going the other way. That is on top of a horrible demographic crisis.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

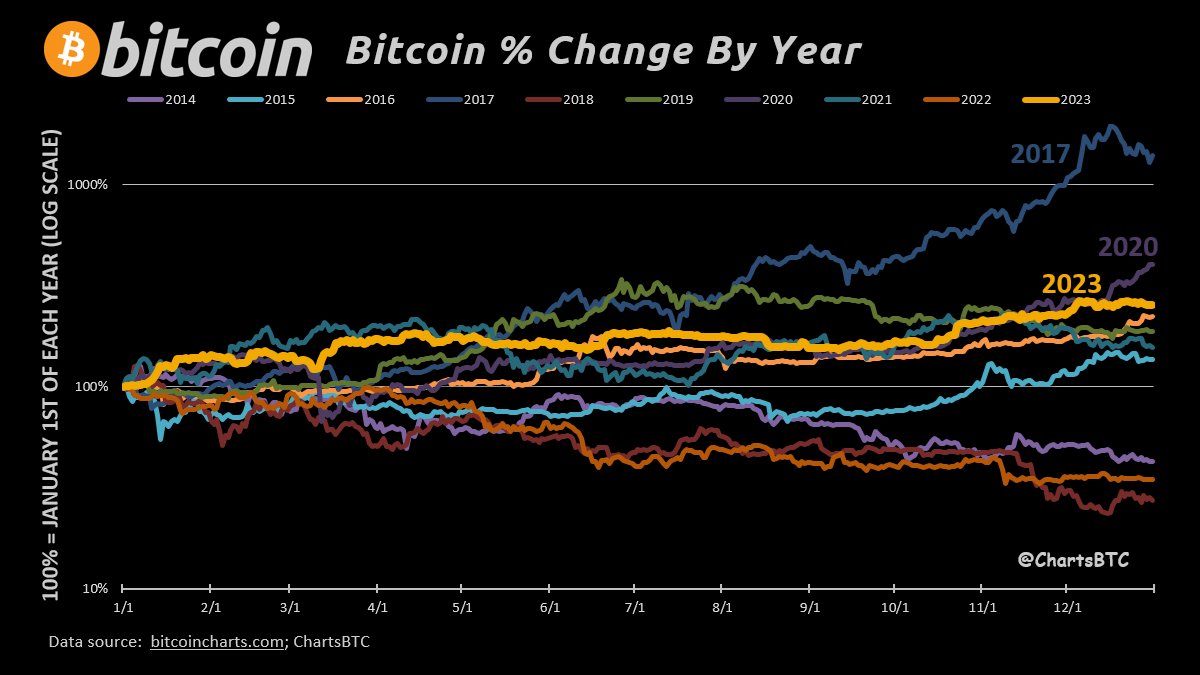

Great chart here by ChartsBTC. It shows that the only two years in the last 10 that have been better than 2023 were the boom years of 2017 and 2020.

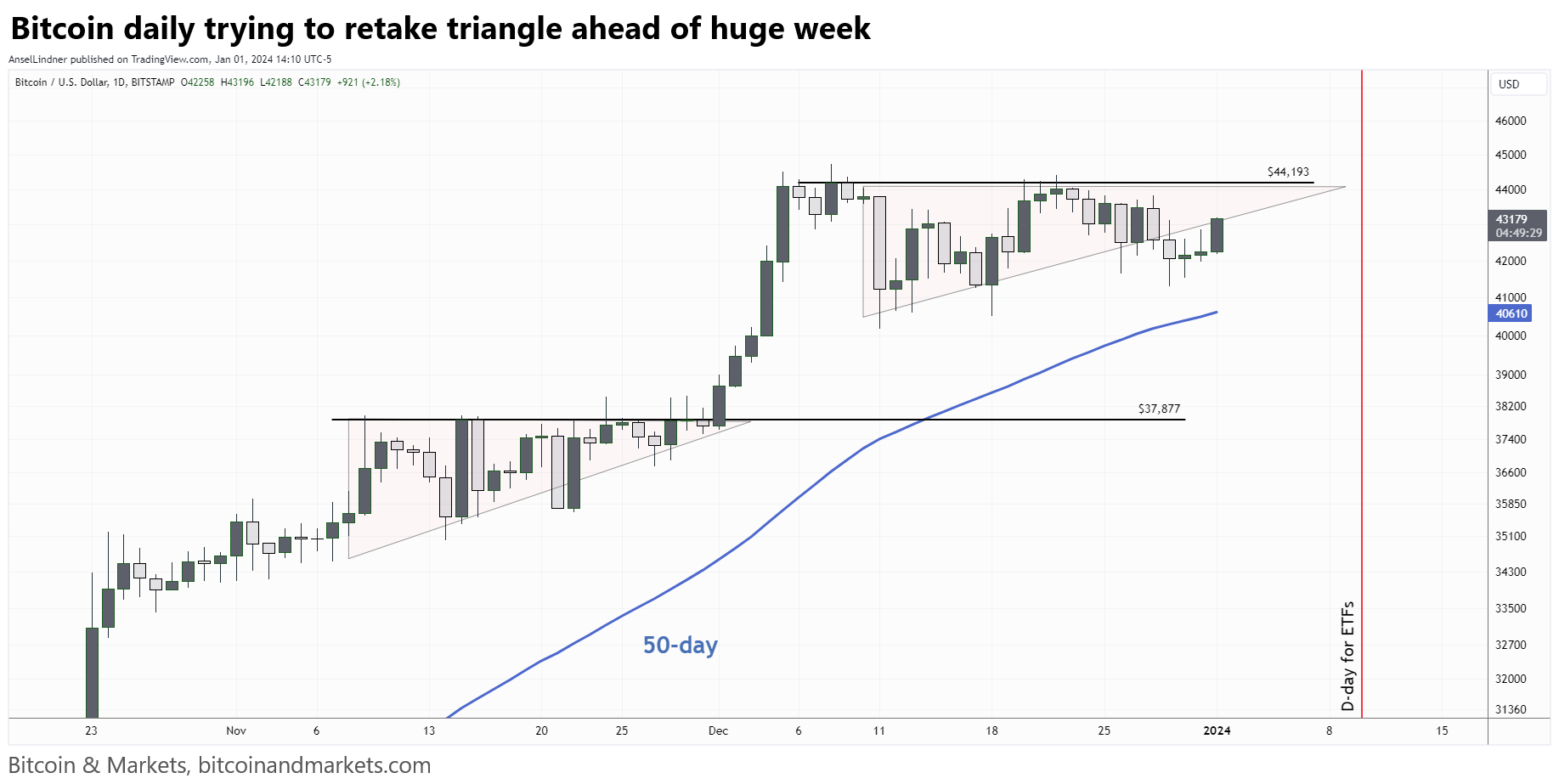

Last issue, I was still talking about the mid-month weakness. It has extended to being the several weeks of sideways. It has held up extremely well with many layers of support below the price. I don't think it breaks the $37,877 support, unless we have a massive flush, like an ETF denial.

Be prepared to buy any dips down the the $37k support with stop-losses below. And don't be surprised with a big candle to open the year.

Still good advice.

My triangle didn't hold the price, but we have been watching the high lows form. I could readjust the triangle to fit, but the I think the flat top is going to be incredibly important this week.

Everything is pointing to ETF approvals very very soon. If they are denied, I think there could be a correction, but probably less significant than most think. While a denial is unlikely, I can almost guarantee the entire market is feeling the stress. The 10% chance feels like 50%. When approval does come, there should be a brief relief spike, followed by a cool off period of a couple days. If that launch is January 10, price will take off before then.

The bitcoin weekly chart is interesting because it has the first ever golden cross for bitcoin on the weekly chart, happening right at $30k, which also corresponds to the Kijun on the weekly cloud. More than a month ago, I said price would never go below $30k again, and it looks very very likely that is the case. I'm getting closer to saying that $40k won't be crossed again, but I'll wait until we pass $50k.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Celsius has a mixed past. I'm not a fan of the company but this is a notable development.

A U.S. bankruptcy judge has approved cryptocurrency lender Celsius Network's pivot to bitcoin mining, ruling that the company could deviate from a previously approved bankruptcy plan because creditors and customers were no worse off under the new restructuring.

Celsius filed for Chapter 11 protection in July 2022, one of several crypto lenders to go bankrupt following the rapid growth of the industry during the COVID-19 pandemic.

US Bitcoin Corp, founded by Hut 8's Asher Genoot, was originally going to manage Celsius alongside other companies in a consortium of bidders which included Arrington Capital and was collectively called "Fahrenheit."

Celsius expects to emerge from bankrutpcy in early 2024.

- Bitcoin Miner ETF was up 385% until the last day of the year, ending the year up 290%

Difficulty

Bitcoin's difficulty rocketed higher on December 23 by 6.9%! It is on track to rise slightly again in 4 days, by <1%.

Hash Rate

Bitcoin hash rate reached new ATHs since our last issue, almost getting 550 EH/s.

Mempool

The mempool continues to fill up. Fees are also adjusting higher. Remember, higher fees effectively shrink the bitcoin supply by making some UXTOs too small to spend. Those two slashes in the mempool occurred about 3 weeks apart, so it is possible it gets slashed again in the coming week.

Inscriptions

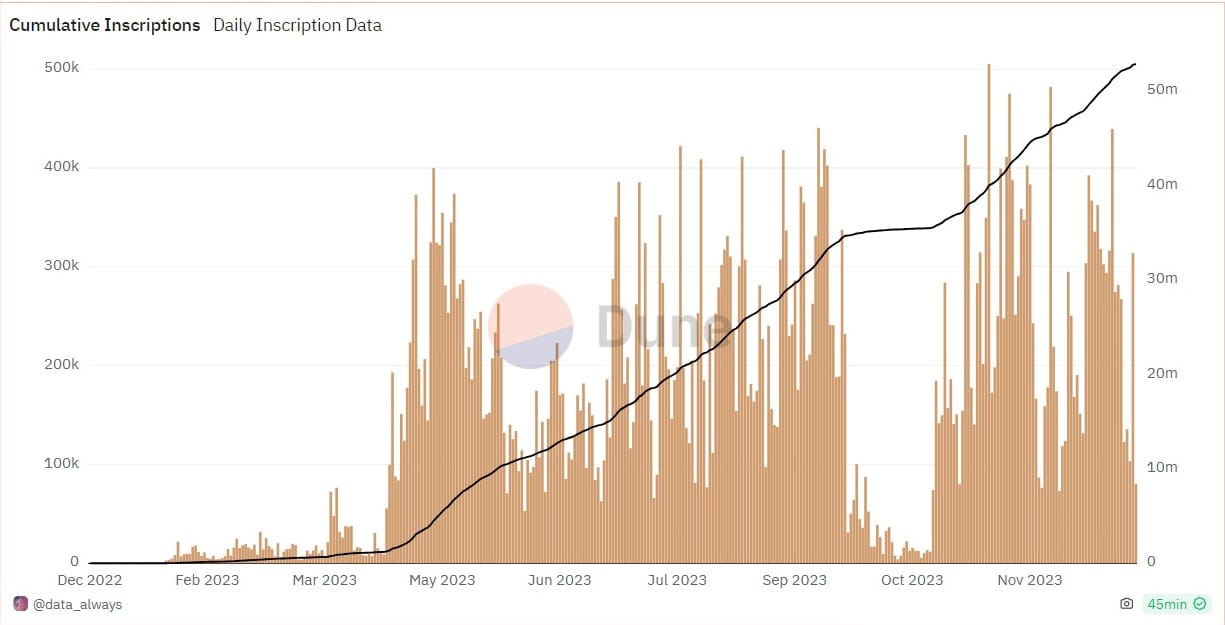

The number of inscriptions has been in a downward trend going into the end of the year. The could create a situation were, as the network works through the existing mempool, the amount of inscriptions could slow again like Sept-Oct.

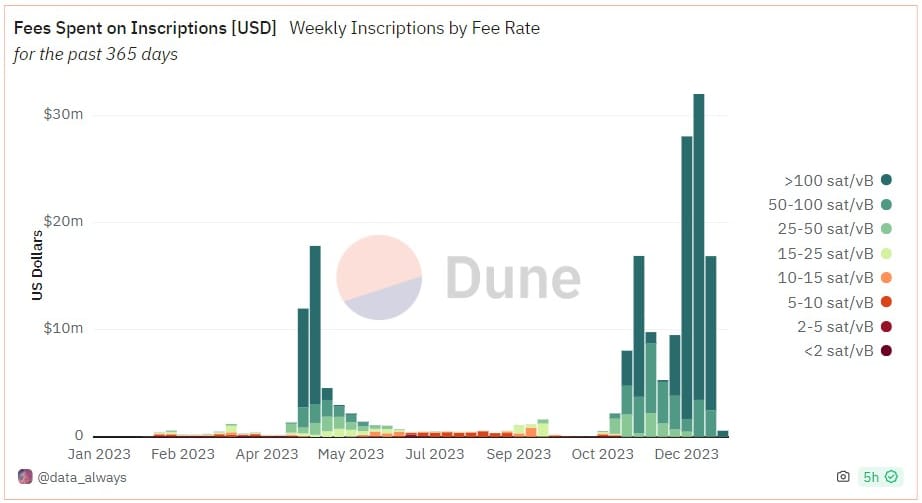

Fees paid by inscribers peaked two weeks ago and came down to $16 million last week.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space