Bitcoin Fundamentals Report #276

Bukele and Milei make headlines, US gov investigates the benefits of bitcoin mining, bitcoin price analysis, mining industry headlines.

February 5, 2024 | Block 829,092

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Range bound |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Surging |

| Days until Halving | 72 |

| Price Section | |

| Weekly price* | $42,762 (-$278, -0.6%) |

| Market cap | $0.838 trillion |

| Satoshis/$1 USD | 2,340 |

| 1 finney (1/10,000 btc) | $4.27 |

| Mining Sector | |

| Previous difficulty adjustment | +7.3335% |

| Next estimated adjustment | +7% in ~10 days |

| Mempool | 387 MB |

| Fees for next block (sats/byte) | $1.50 (25 s/vb) |

| Low Priority fee | $1.50 |

| Lightning Network** | |

| Capacity | 4929.79 btc (-1.4%, -68) |

| Channels | 58,675 (-0.7%, -430) |

In Case You Missed It...

Member

Community streams and Podcast

Blog

Bitcoin Magazine Pro

Headlines

- Nayib Bukele Wins Re-election

In the largest margin in a democratically contested election ever, Bukele wins reelection. This is new for bitcoin, obviously, because he has adopted bitcoin as legal tender there, to be used alongside the US dollar. He has very big plans for the country and their bitcoin industry.

This is an interesting story. It is not a crack down on bitcoin but an information gathering exercise. Similar to how the EIA (Energy Information Agency) collects data on oil rigs, production, and exports, they will likely try to impose similar reporting on bitcoin. The only thing that can be learned by the government with this is they find out how beneficial bitcoin mining is. This will orange pill more people.

🚨BREAKING: BIDEN ADMINISTRATION HAS DECLARED BITCOIN A FEDERAL “EMERGENCY” pic.twitter.com/vFhRWUiTc2

— Simply Bitcoin (@SimplyBitcoinTV) February 1, 2024

Should the proposed legislation pass, holding cryptocurrencies in Argentina will not incur taxes, as detailed by accountant Marcos Zocaro. Tax obligations will arise only from capital gains generated through sales, and that too below a specific threshold.

Moreover, international transfers of cryptocurrencies will be subject to a tax rate ranging from 5 to 15%, a strategy designed to attract foreign cryptocurrency investments, as per industry specialists.

This is a good move by Milei, and hopefully a first step. The way I'm reading reports of this bill is that most bitcoin transactions will be untaxed, e.g. no sales tax to purchase bitcoin. However, if you have a capital gain on bitcoin when you sell it over a certain amount you will pay a 15% tax on the capital gain.

The biggest part of this move is showing that world that you must have a policy on bitcoin, it cannot be ignored. You also are best served to be inviting to bitcoin and bitcoin businesses.

Macro

- 27% of Chinese stocks were limit down today

SHANGHAI $SHCOMP -3%, SHENZHEN -4%.

OVER 1,400 (27%) STOCKS ARE AT DOWN LIMITS.

BEIJING STOCK EXCHANGE 50 -7.5%.

STAR 50 INDEX -5%.

CSI 1000 FUTURES -8%.

⚡SHANGHAI $SHCOMP -3%, SHENZHEN -4%.

— CN Wire (@Sino_Market) February 5, 2024

OVER 1,400 (27%) STOCKS ARE AT DOWN LIMITS.

BEIJING STOCK EXCHANGE 50 -7.5%.

STAR 50 INDEX -5%.

CSI 1000 FUTURES -8%.#CHINA #STOCKMARKET #STOCKMARKETCRASH https://t.co/13tn4H2khG pic.twitter.com/CIZGjESdyo

Nothing seems to be able to stop the crash happening in China. US markets are shrugging it off, where in the past they would have been more tightly coupled. This is a sign of deglobalization of the global economy.

There is an aspect of this that should be considered IMO. Average Chinese do not own stocks. Most of the stocks are owned by the rich members of the CCP. If that is the case, why hasn't there been a massive bailout by Beijing yet? Perhaps, Xi sees this as an opportunity to strike at his political rivals.

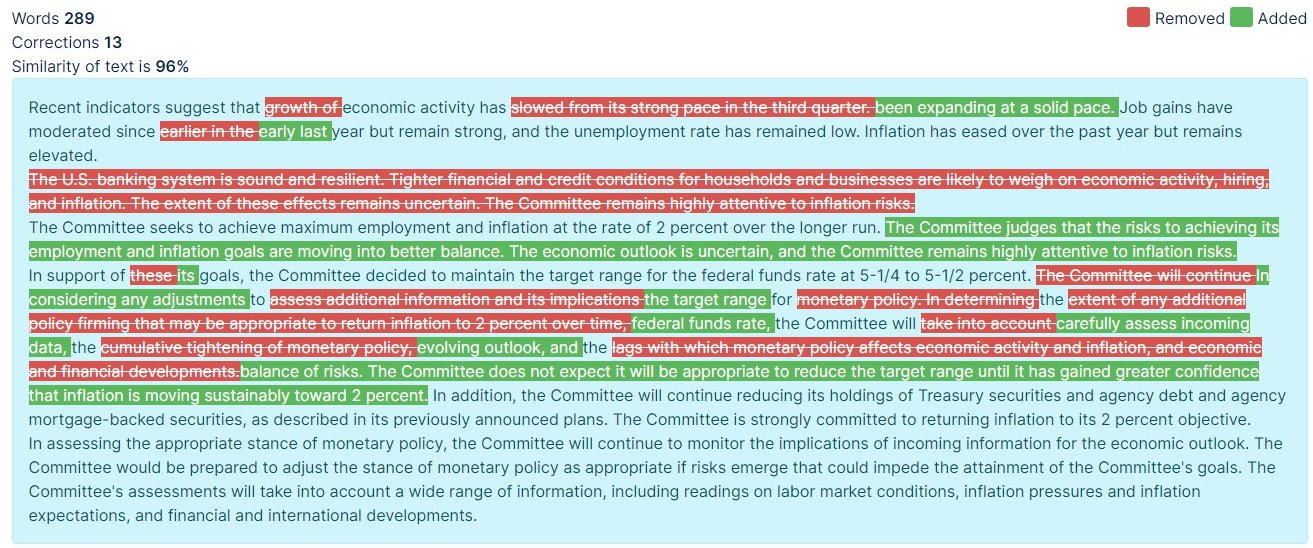

- Federal Reserve gets dovish at FOMC

The Fed held their monetary policy the exact same last week. However, their written statement had a huge dovish shift as you can see below. They removed hawkish words and replaced them with dovish ones. Gone were: cumulative, firming, tightening, and lags. Added were: balance x2, evolving, reduce, and confidence.

Last night, Jerome Powell went onto 60 Minutes talking about their monetary policy, the economy, and government debt. This was his second appearance on 60 Minutes, which is becoming a big part of their monetary policy. He is trying to expose the normies who watch evening programming to their influence operation. Remember, the Fed does not mechanically do anything, their only tool is psychological operations.

I think they see the recession coming and they want to try to influence people that everything is okay. They think that if people believe the economy is okay, they will act as if the economy is okay, and a recession can be avoided. Total bullocks of course.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

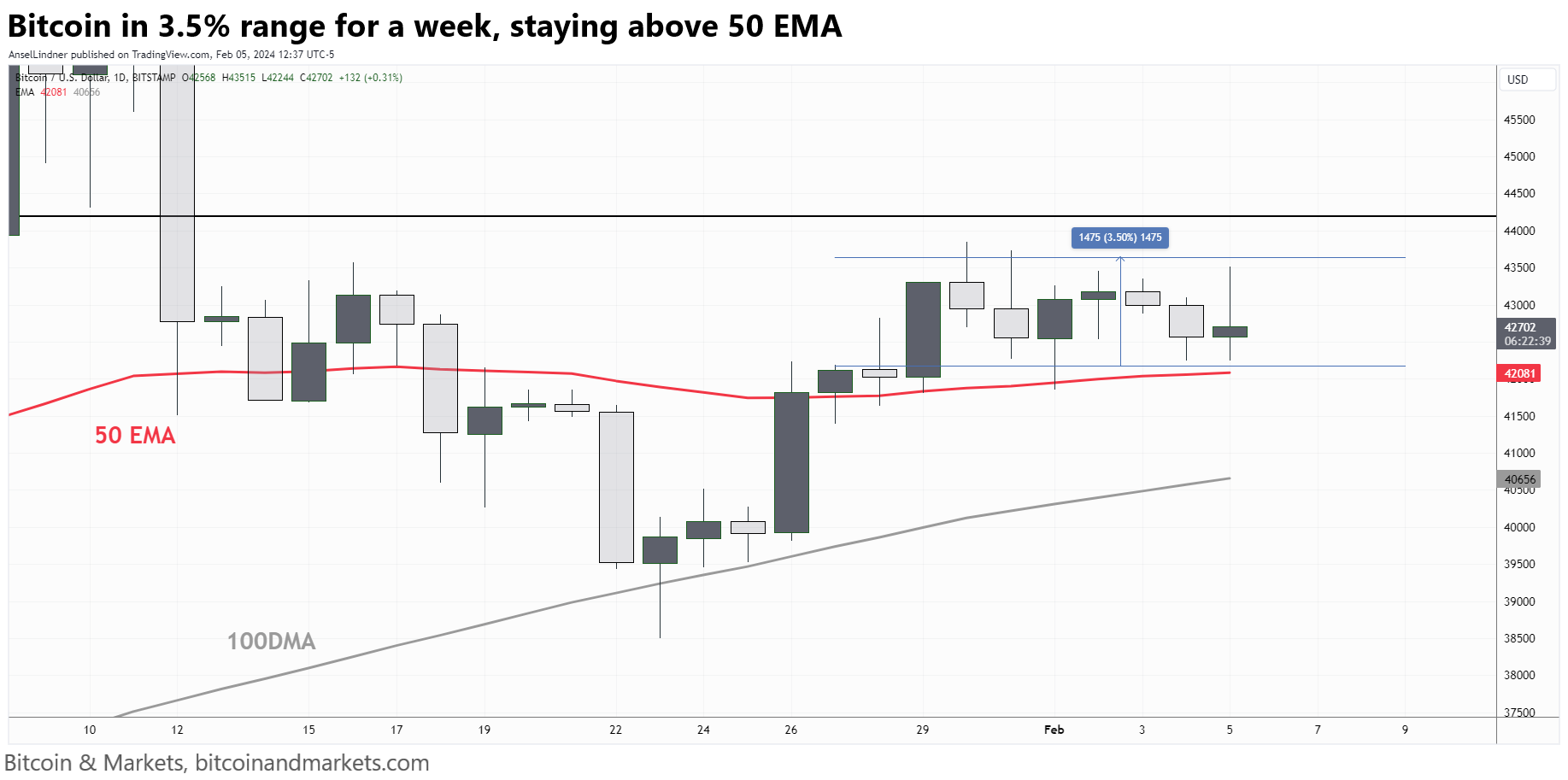

Price has been quite boring this week. We have been trapped in a 3.5% range. On the chart below, the red MA is the exponential where I usually use the simple moving averages, because it has been respected by the price more. EMAs give move weighting to more recent price action, and hence are faster to react to new trends. The reason the 50 EMA might give us a better signal here, is because everyone was watching for short term price movements in regards to the new ETF flows. It could also be a sign that a new group of powerful traders who use the 50 EMA are in the game now. I'll be watching this closely.

The bottom line remains whether using the SMA or EMA, price has not been rejected downward, or failed to hold these levels.

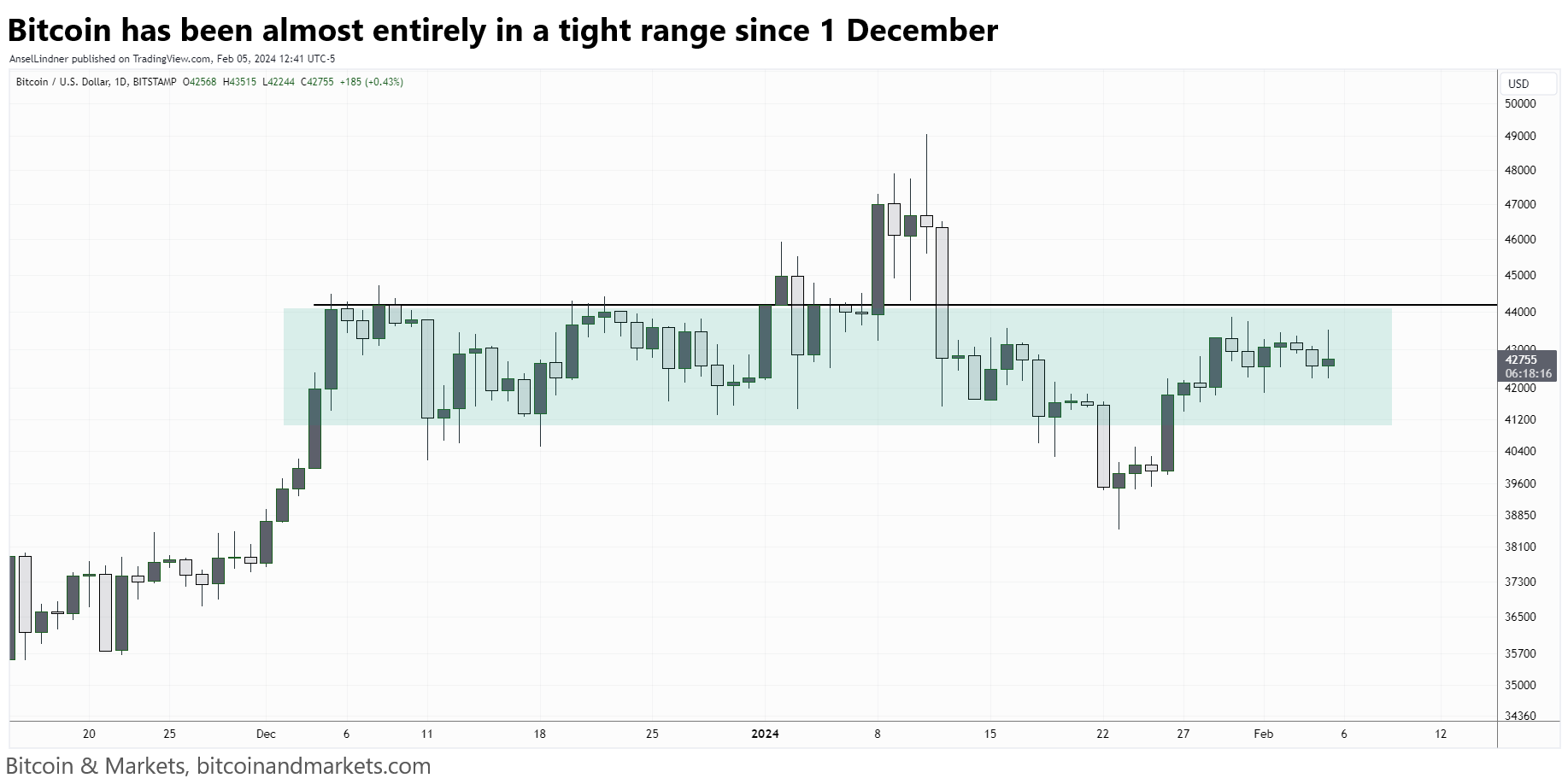

Zooming out a little on the daily chart, we can see this very strong range-bound price action in the lead up to and the aftermath of the ETF launch. It's really an interesting phenomenon. Once we break out of it, this will provide very strong support on any future dips.

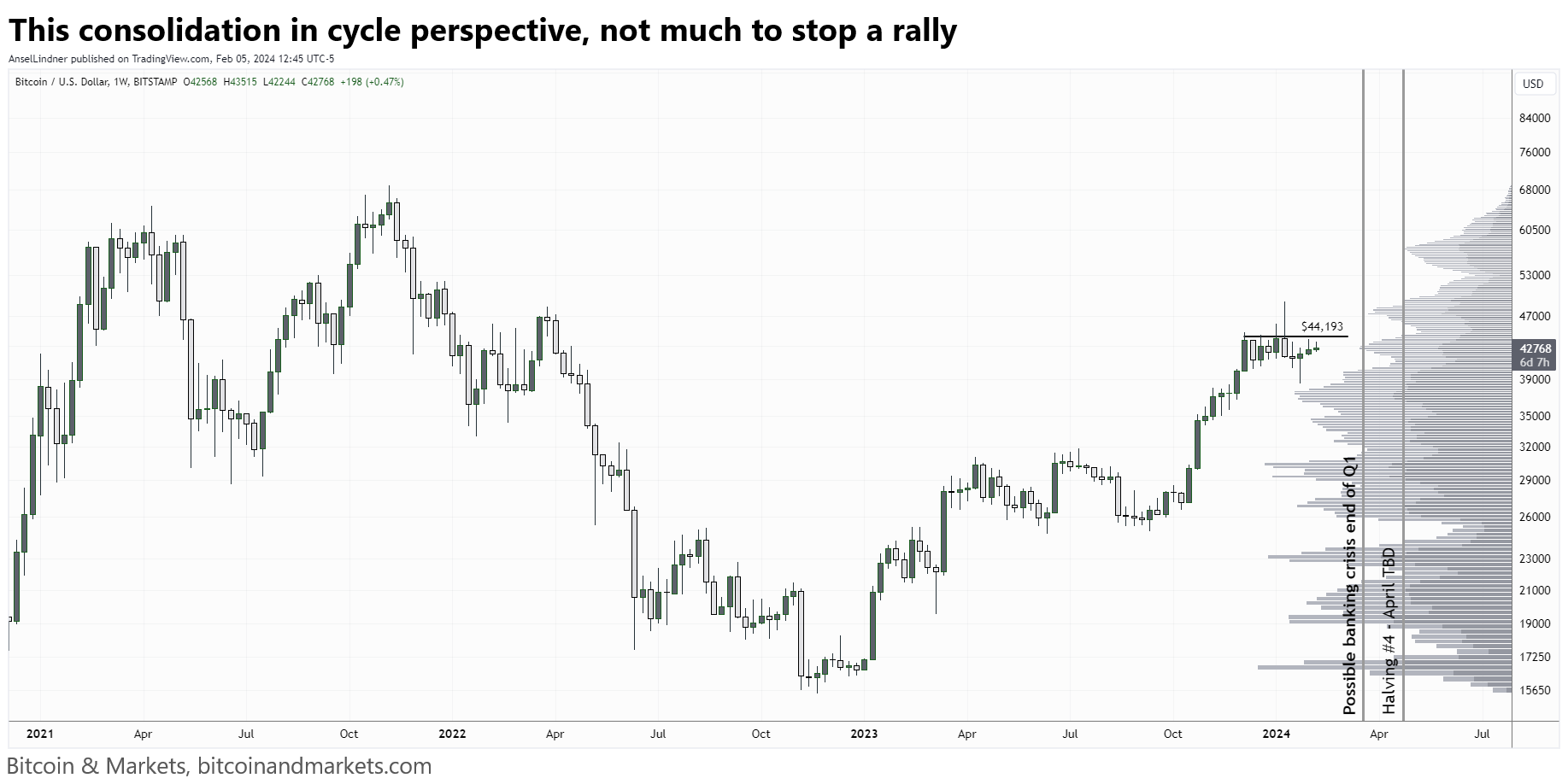

Zooming out again, we have the weekly chart with volume-by-price. You can clearly see that once we break upward, there is little to stop a rally all the way to at least $57,000 and then the ATH.

Sources of demand continue to be strong and will only get stronger as price rises. Demand goes down or up with price in bitcoin. As bitcoin rises, we should expect inflows into the ETFs increase. When we break $49,000 it could be significantly more inflows.

Overall, since FTX price appreciation has come via brief steep appreciation followed by periods of calm. We should NOT be surprised if that continues.

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

Marathon Digital has agreed to pay Hut 8 a termination fee of $13.5 million to take full operational control of its recently acquired bitcoin mining sites in Granbury, Texas and Kearney, Nebraska.

Marathon intends to replace the mining firm as the operator of the sites by April 30, with Hut 8 continuing to provide managed services and conduct self-mining activities in the meantime.

Marathon closed a deal to secure ownership of the sites from Generate Capital for $178.6 million on Jan. 16. However, Hut 8 continued to manage operations at the sites under its agreement with the former owner.

Time Magazine hit piece on bitcoin mining. I know Kearney, Nebraska very well. My two sisters and my wife went to college there. The majority of residents are probably thrilled to have industry come to their town. The few residents complaining about the bitcoin mine are probably the same busy bodies you find everywhere.

In December, Marathon paid $178 million to purchase bitcoin mines in Kearney, Nebraska and Granbury from Generate Capital. But with the Granbury purchase, Marathon also inherited a swath of angry nearby residents across Hood County whose lives have been upended by the mining facility.

Shirley says that he is monitoring the decibel levels of the facility. Texas state law stipulates that a noise is considered unreasonable if it exceeds 85 decibels. For comparison, vacuum cleaners often run at around 75 decibels—and a cardiologist told TIME in 2018 that chronic exposure to anything over 60 decibels had the potential to do harm to the cardiovascular system. Shadden took her own readings at her house near the Bitcoin mining facility that reached 103 decibels.

0.6% to 2.3% of U.S. electricity consumption.

Bitcoin will eventually use half off all energy, and that is a huge positive. If it wasn't people wouldn't do it. No one is twisting their arm to mine bitcoin.

The main thrust of the report is discussing now to estimate bitcoin's energy use. They go over a top-down approach, like that of Cambridge bitcoin mining estimates which consider total hash rate and an average efficiency of the mining equipment, and a bottom-up that includes counting every facility and every machine.

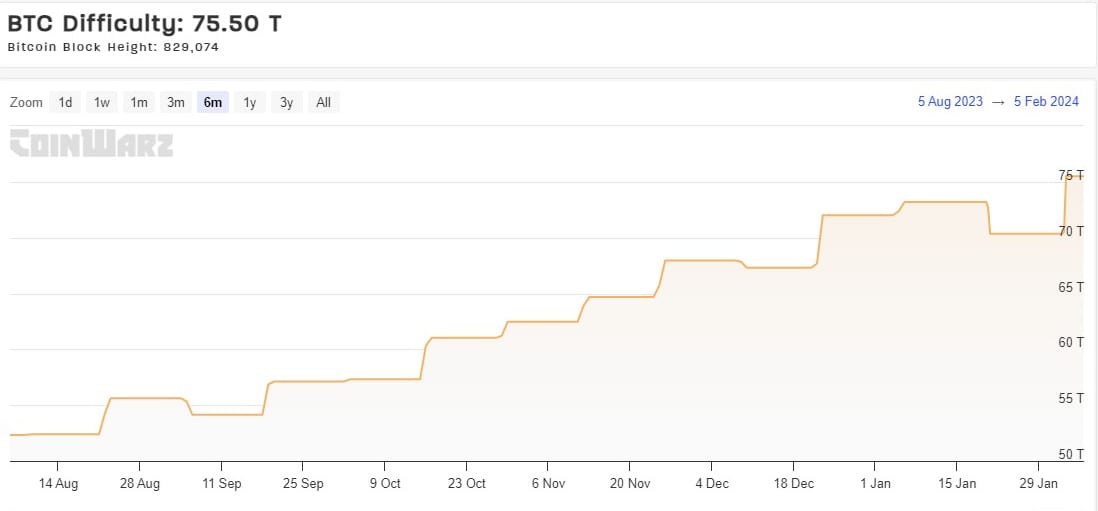

Difficulty

Last Friday saw a huge difficulty jump, +7.33% to a new ATH. Miners are already on a tear toward the next adjustment, which is estimated right now to be about the same size.

For rookies, difficulty is automatically adjusted every 2,016 blocks depending on how fast miners are finding blocks. The formula targets a 10 minute average time. During that time, miners are spending money producing work that cannot be faked. An "attacker" would need to burn the energy and have the equipment to overpower the rest of the network. As difficulty goes higher, the more money must be spent to "double spend" or produce empty blocks (These are the only two attacks possible in this regard. Miners don't control the rules of the network. They can take back their own transactions or refuse to confirm others.)

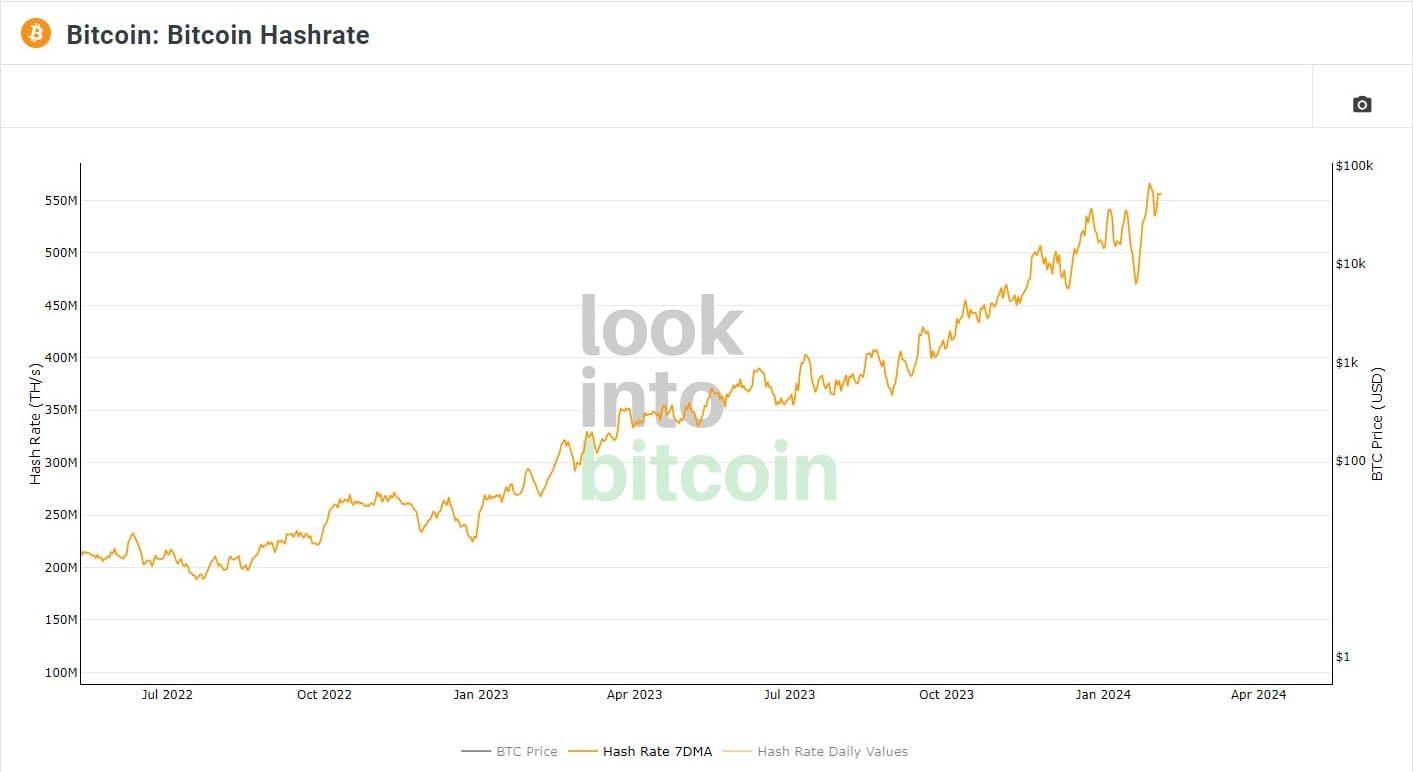

Hash Rate

Hash rate has completely recovered from the cold wave in the US, that triggered a demand response called curtailment. That is when miner shutdown voluntarily to protect the grid in emergencies. This provides a rapid load balance capability to grids, allowing more efficient and safer operations.

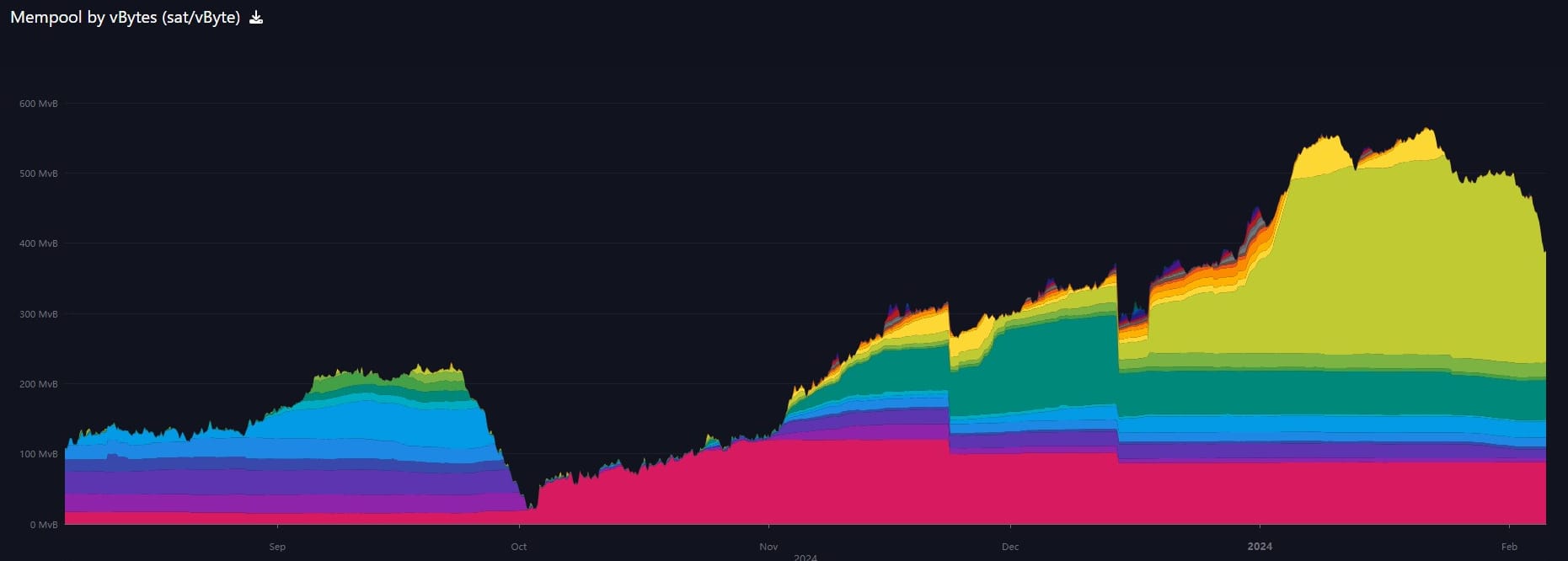

Mempool

The mempool, transactions waiting to be confirmed, has dropped dramatically this week. The excitement of the ETF launch has waned, and there was no large weekend spike for inscriptions.

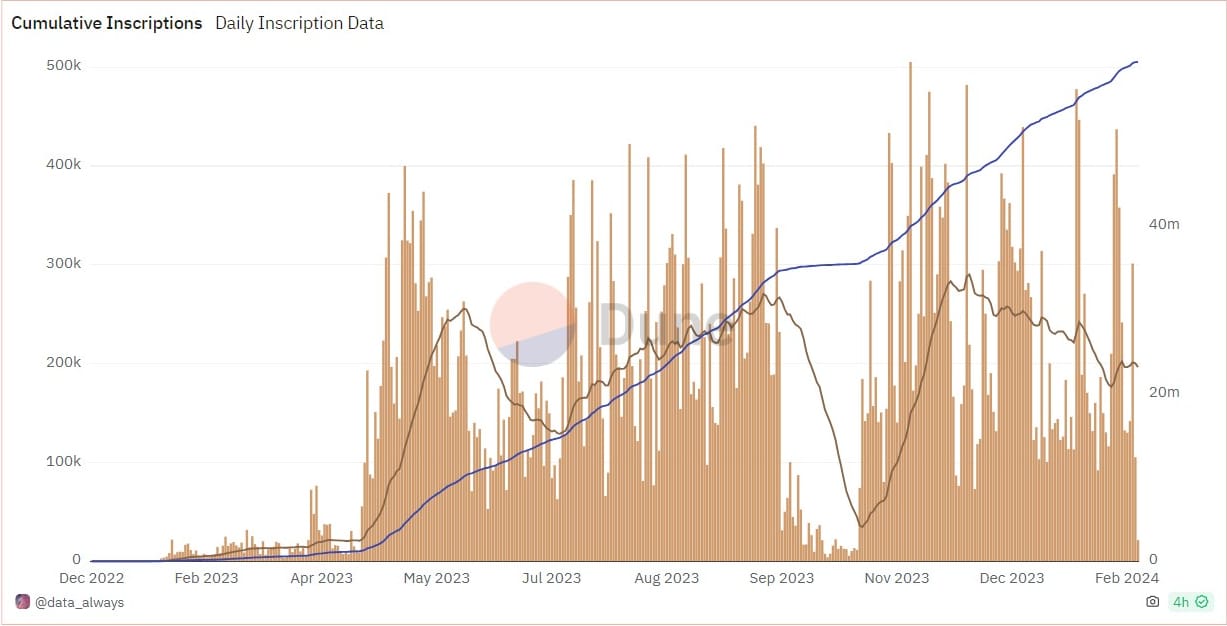

Inscriptions

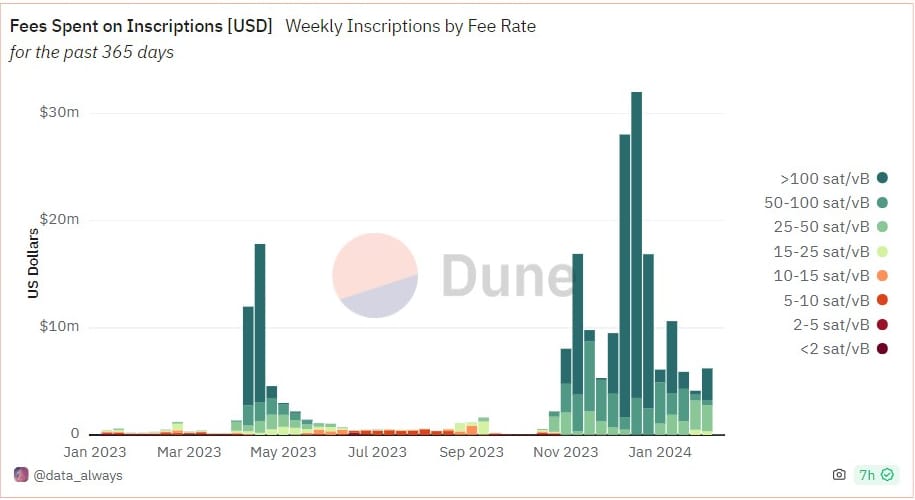

The moving average on this chart in brown resumed its downward trajectory. It does seem if the market for, and excitement around, inscriptions is waning.

Any long-term sustainability of inscriptions must support itself financially. With about $5 million per week in fees, the niche market must provide value at a significant margin above that. For instance, $5M/wk to support a $10M market doesn't make much sense. Even if it were a $100M market, that is a high amount of fees. Remember, NFTs were on altcoins with very low fees for a reason, their Ponzi-like nature can't support the bleed-out of fees.

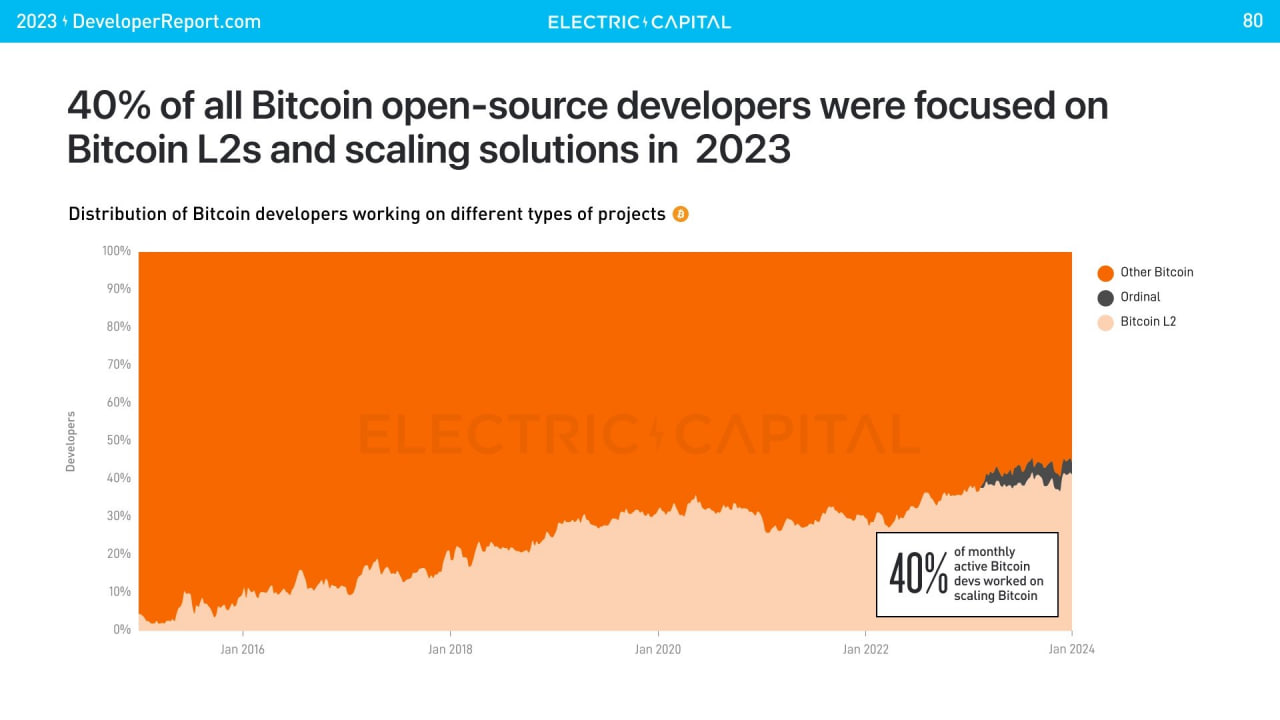

Layer 2

It has been reported this week that 40% of bitcoin developers are working on L2 or Ordinals. This number is not surprising to me at all. In the future, this number should be much higher. What is surprising to me about this, however, is that there is not more progress or adoption of L2. Perhaps, it will pick up during this bull market.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space