Bitcoin Fundamentals Report #282

Stay up on the last week in bitcoin. Inscriptions or no, altcoins scams picking up, macro news FOMC, price analysis, and very positive mining news.

March 25, 2024 | Block 835,271

Snapshot of Bitcoin

| General Bitcoin Headlines | |

| Weekly trend | Cool off |

| Media sentiment | Neutral |

| Network traffic | Moderate |

| Mining industry | Stable |

| Days until Halving | 24 |

| Price Section | |

| Weekly price* | $70,931 (+$3,747, +5.6%) |

| Market cap | $1.394 trillion |

| Satoshis/$1 USD | 1412 |

| 1 finney (1/10,000 btc) | $7.08 |

| Mining Sector | |

| Previous difficulty adjustment | +5.7928% |

| Next estimated adjustment | -0.4% in ~2 days |

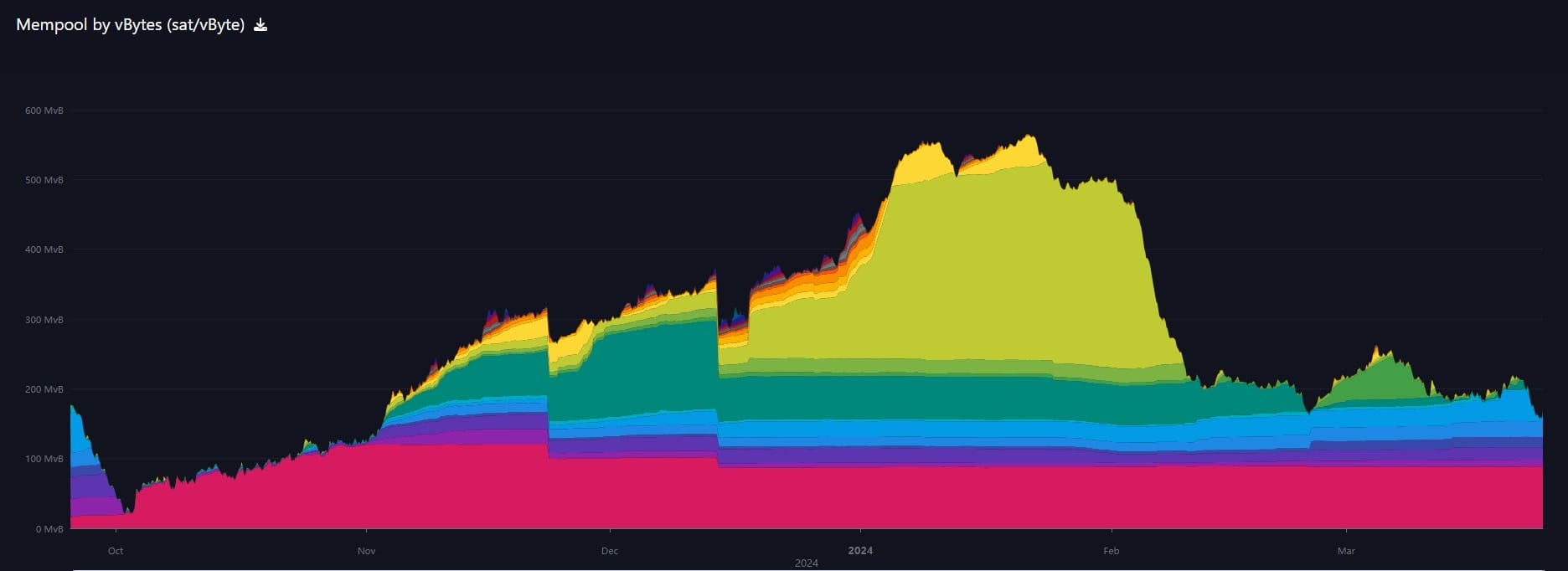

| Mempool | 161 MB |

| Fees for next block (sats/byte) | $2.20 (24 s/vb) |

| Low Priority fee | $1.82 |

| Lightning Network** | |

| Capacity | 4514.5 btc (-2.8%, -129) |

| Channels | 53,397 (-1.3%, -699) |

In Case You Missed It...

Bitcoin Magazine Pro

Member

Community streams and Podcast

Blog

Headlines

There is a big divide in the bitcoin social scene. Those who don't see anything wrong with NFTs on bitcoin and those who literally think it is evil. I still fall somewhere in between. I think they are good and bad. They're a horrible use of block space and a scam, but it will ultimately teach a valuable lesson.

This rift in bitcoin was beautifully illustrated in this exchange between David Bailey of Bitcoin Magazine and the artist MADEX. He turned down $70k on principle.

His response:

thank you for the offer pic.twitter.com/XLmQx5GsHL

— MADEX (@SPACEBULL) March 19, 2024

- Altcoin scams are picking up again

Guys out there buying this hot garbage, you didn't miss bitcoin. Just stay humble and stack sats. This guy straight up scammed people out of a $10k initial investment. You have to be in awe of pulling the rug before even launching.

Macro

Last week, the biggest macro event was probably the FOMC meeting. I wrote extensively on it for BMPRO and did a live stream and published a podcast of my reaction.

What should we take away from the FOMC meeting? First, they are not “giving up” on fighting inflation. In their minds, they will still be sufficiently restrictive if they cut as estimated. Second, they are not concerned about inflation reaccelerating. They are more concerned that the US will follow other major economies into recession, which is deflationary.

Lastly, the Federal Reserve has lost a lot of credibility, not only in their diagnosis of the economy but in their very monetary theories and tools. The market did not buy the optimistic language that “economic activity has been expanding at a solid pace.” Several times in the press conference, I found myself thinking, ‘That was a weak answer. Powell sounds unsure.’

The market, to a degree, relies on the Fed’s psychological policy to remain calm. This meeting did little to calm anyone’s fears. Those who think inflation will pick back up will interpret this as giving up on the inflation fight. Those who are already feeling a recession will think the Fed is going to act too late. Those who believe in the Fed’s omnipotence will come away questioning its credibility.

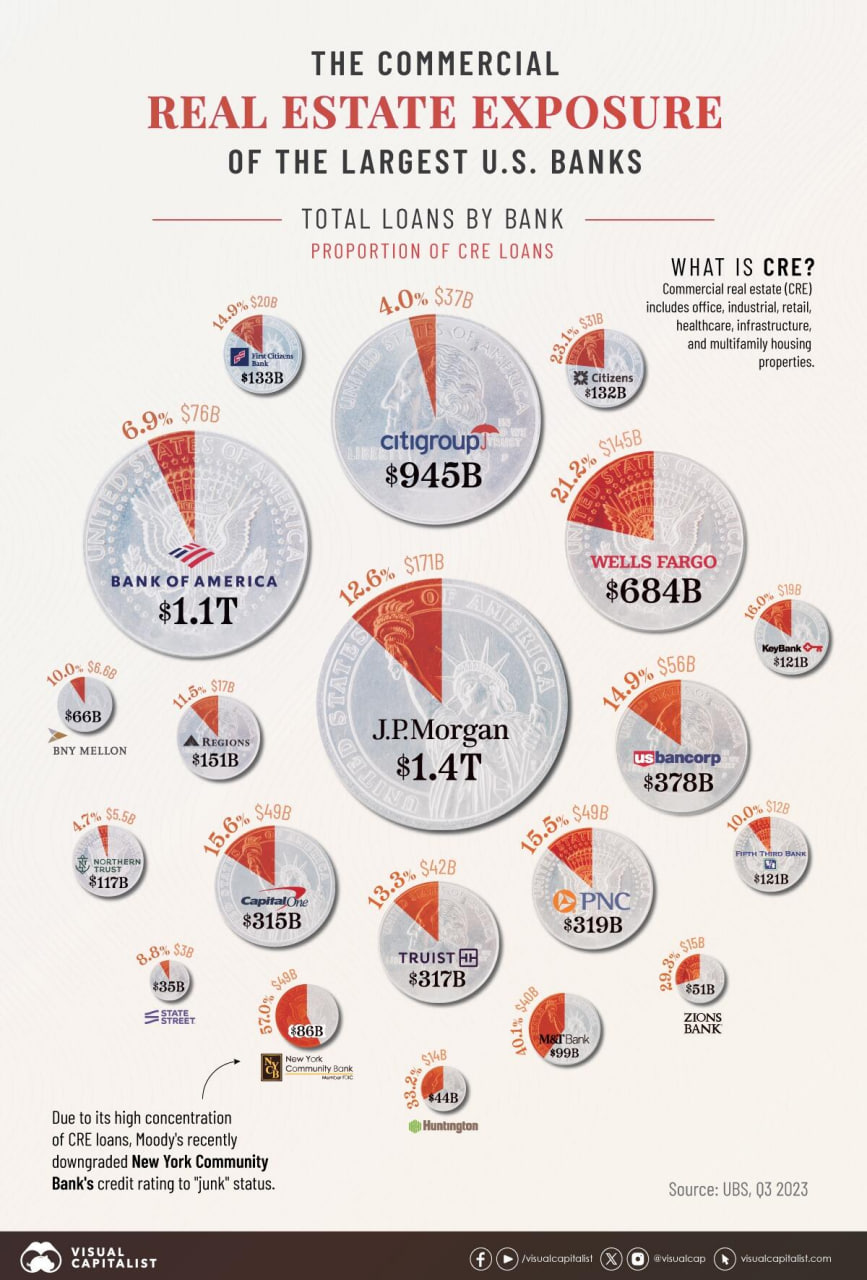

- Real Estate Exposure and EOQ1

For the last 6 months, I've been eyeing the end of Q1 as a potential financial squeeze on the banking system, very similar to last March with Silicon Valley Bank and Signature Bank, but it has yet to come. Several banks have had issues, but nothing has spread like last year.

Last year, one of the main driving forces was the draining of deposits from regional banks into money market funds to get the 5% interest. This year, we have not seen that much movement, probably because if you were going to move into a money market fund, you have already done so.

What could be the catalyst this time? Commercial real estate looks in big trouble here. And several regional banks have significant exposure. Much of the real estate market is simply not marked to market, or is being sold right now. Banks are sitting on massive unrealized loses.

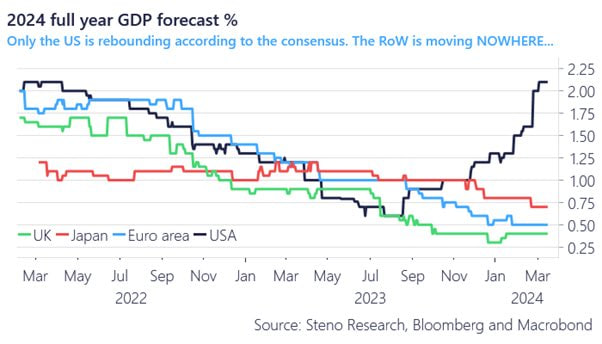

- US Growth will catch down to the ROW

I shared this chart with the Telegram to show that the US is the odd economy out right now. This is a temporary result IMO of a narrowing of the global economy. Capital flight into US assets has a lot to do with it, as well as what projects involving the US and foreign businesses are likely getting most of the funding that's is out there. IOW, a wholly German project taking place in Germany with mainly German companies are not getting the go ahead, nearly as much as an American project built by German company in the US. Something like that.

However, I think this is only temporary as malaise spreads, the US will catch down with the rest of the world.

Price Analysis

Join the Professional tier to receive my MARKET PROTONS, short price analysis and actionable forecast updates on Bitcoin and macroeconomic factors! Sign up today!

Bitcoin Charts

Apologies for no Premium newsletter last week, there was very little price action to update. Especially, when you consider that I specifically called for a pull back and slow down, exactly as we saw. There will be a new issue this week. It is a great way to stay a week ahead of the market and support my content efforts. I love my subscribers that enable me to do this.

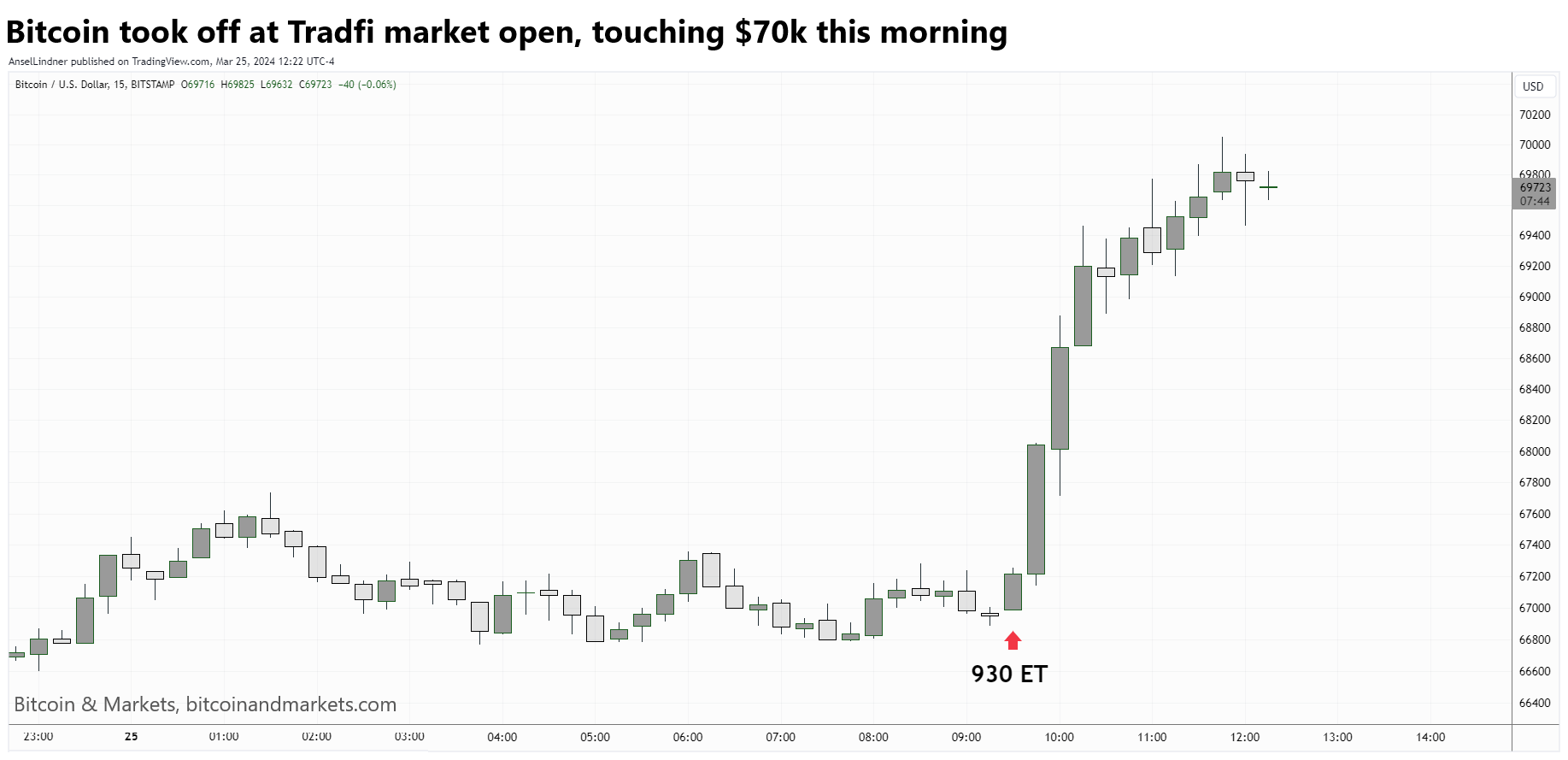

On to the price today. We are seeing some action right now. Just as the tradfi markets opened, price took off.

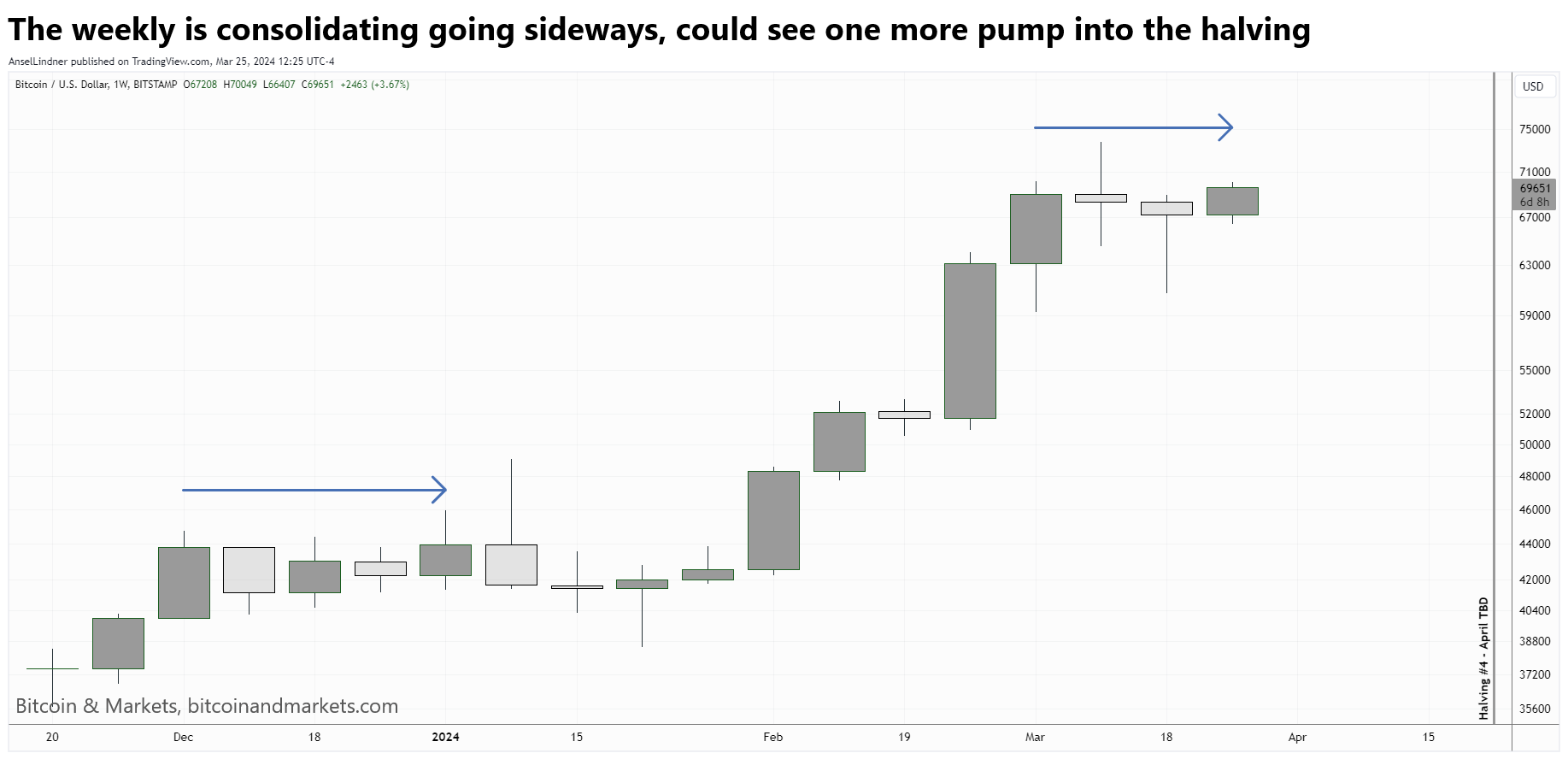

Price has done a great job holding flat for the last week, which we can see when we look at the weekly chart. It is very reminiscent of the consolidation at the end of last year.

Last week:

Could we make one more push pre-halving? Yes, any furtherance of this parabola would be vertical. That would put $100k in play pre-halving. I don't think that is the likely thing to happen though. Several macro indicators like the US10Y are signaling that some outside pressure driving bitcoin's price up is lessening temporarily here. Most likely we continue a consolidation for at least the next week, and it could stretch into the halving.

Commenting on the above chart still, if we put in the same kind of move we did after the last consolidation and ETF launch (67% rise), that puts price at $115k. See, the $100k doesn't seem so outlandish. A 44% move over 3 weeks until the halving is possible, though I still think unlikely.

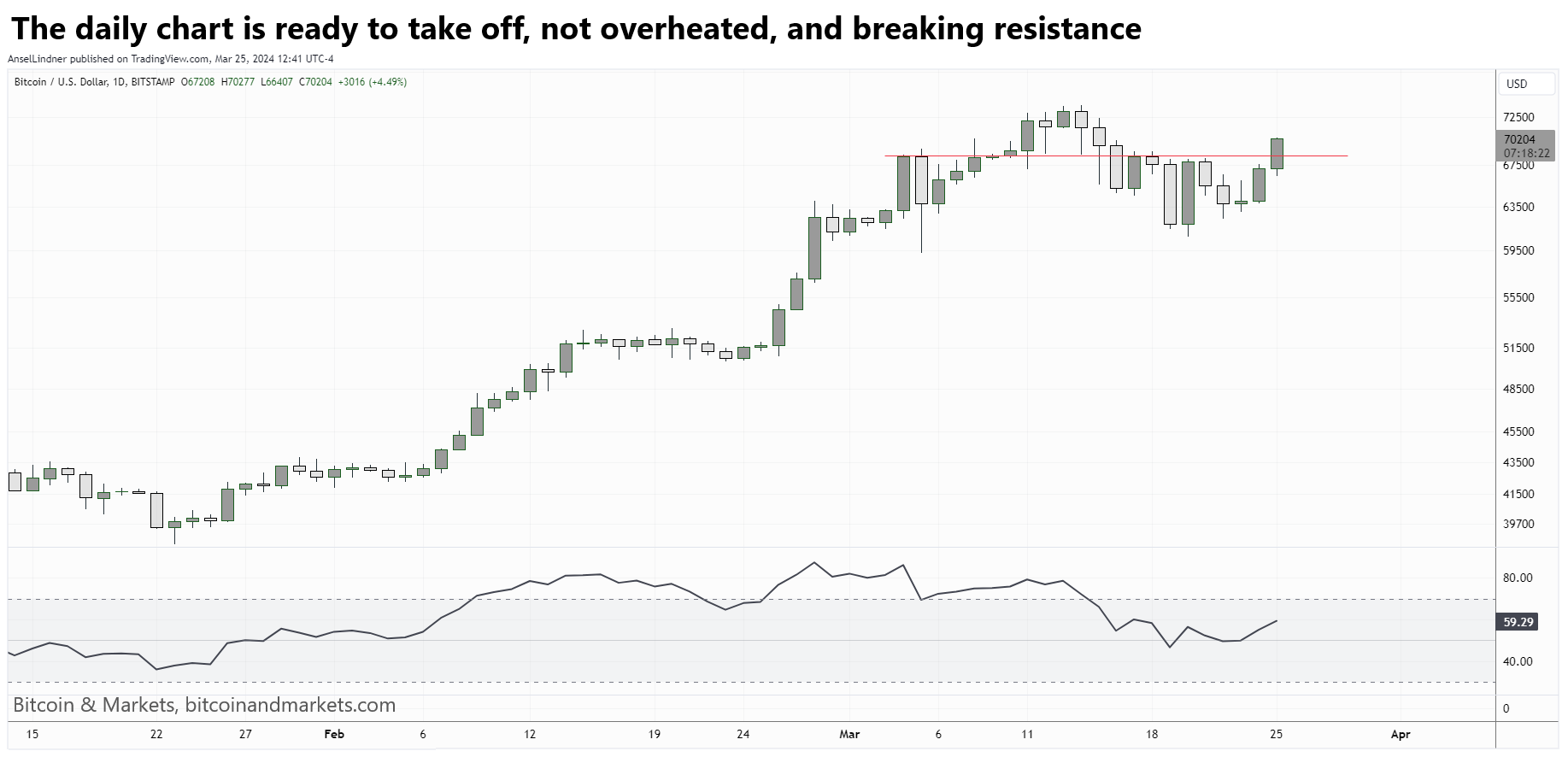

Below, on the daily, you can see the dip that bottomed last Monday. RSI has cooled enough (not on the weekly chart though) and price is now breaking the $69k resistance. It would be healthy to revisit those lows again before continuing higher, but it is so hard to move down against the ETFs.

Things are setting up for a pump pre-halving. How high we get is less clear. I have my forecast on the Premium newsletter for that. I will say that a rally right now, without letting the weekly get a little cooler, might be setting us up for either a significant post-halving pull back.

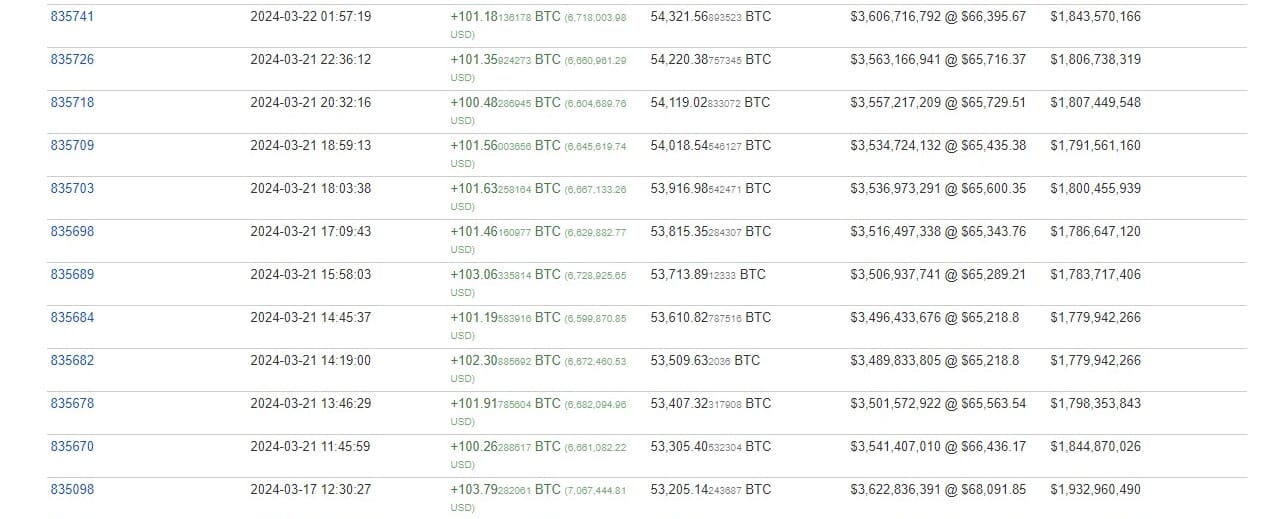

Mr. 100 is back

After slowing down purchases for a while, Mr. 100 is back with a vengeance. They stacked 1,000 BTC on 21 March alone.

As it turns out, this address is operated by Upbit, a Korean exchange. However, speculation is still swirling about who is buying. For example, Microstrategy custodies their bitcoin with Coinbase, who could be using Upbit?

Even though Arkham Intelligence says this is normal behavior for cold storage wallets, why don't we see other Mr 100's from the other exchanges? Something is odd. IMO, it fits better with a large fund acquiring bitcoin and holding it with Upbit. This does narrow down the possibilities of who it could be IMO, since it is likely not an American or European buyer. It is more likely to be a buyer from East Asia or the Middle East.

Who is Mr. 100?

— Arkham (@ArkhamIntel) March 16, 2024

Mr. 100 is a BTC address that receives 100 BTC at a time.

Many have speculated that Mr. 100 is buying BTC - as a large fund, Middle Eastern nation, or even a Bitcoin ETF.

We believe these assertions are incorrect - ‘Mr. 100’ is in fact an Upbit Cold Wallet. pic.twitter.com/92KMljoZ6e

MUCH MORE detailed price analysis, including short, medium and long-term forecasts on Market Protons!

Bitcoin Mining

Headlines

From Forbes:

While Iceland is renowned for its abundance of renewable energy, its heavy reliance on food imports paints a contrasting picture of its self-sufficiency. According to The Observatory of Economic Complexity, Iceland exports approximately $234,000 of tropical fruits but imports a staggering $9.28 million worth, revealing a large gap in its food trade balance. This dependency on imports for basic necessities shows the need for solutions to enhance local sustainability.

Utilizing waste heat from bitcoin mining presents an opportunity for businesses. By tapping into the excess heat generated by mining operations, businesses enhance their environmental sustainability and unlock additional revenue streams. This approach highlights the potential for bitcoin mining to contribute positively to economic viability and caring for the environment, offering a model for sustainability-conscious industries worldwide.

From Bloomberg:

About 6,000 older Bitcoin mining machines in the US will soon be idled and sent to a warehouse in Colorado Springs where they’ll be refreshed and resold to buyers overseas looking to profit from mining in lower-cost environs.

“It’s a natural migration” with buyers of the old machines operating in parts of the world where power is the cheapest, said SunnySide Digital Chief Executive Officer Taras Kulyk, who has resold US computers to miners in countries such as Ethiopia, Tanzania, Paraguay and Uruguay. “This is accelerated by the halving.”

“There are more risks for my machines in Africa but I have to move them there,” he said. “Cheaper electricity outside the US means it will take a much shorter time to recover the overhead costs,” with labor and building materials also much less expensive, Nuo Yu said.

Still have a way to go for them to understand it completely, if they ever do, but these are very positive articles. Miners don't validate transactions, they order them into blocks.

In Bitcoin mining, specialized machines are used to validate transactions on the blockchain and earn operators a fixed token reward.

Hash rate and Difficulty

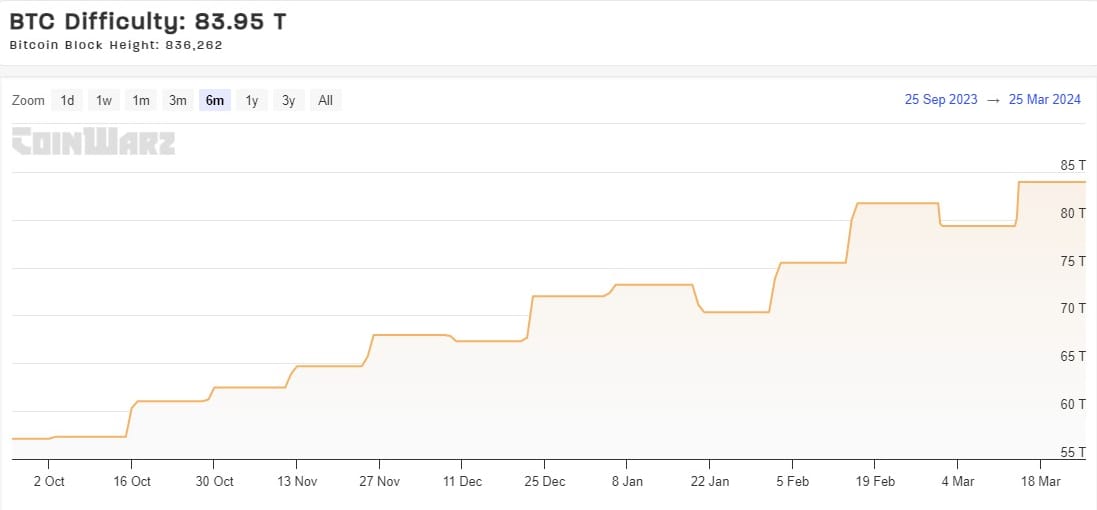

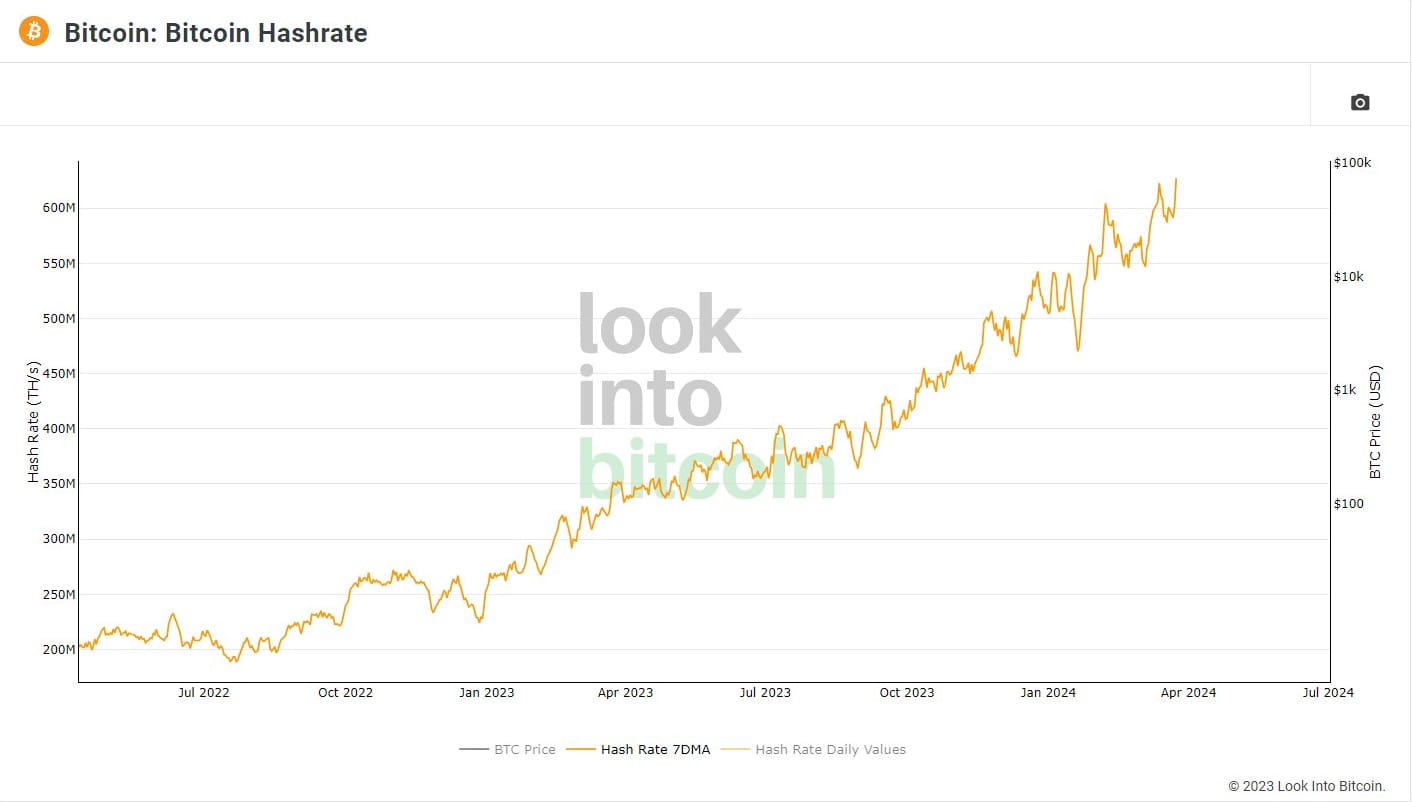

Difficulty did not adjust this week. It is on pace for a small decline by 0.4% in 2 days.

Hash rate is spiking a little bit here, which could potentially pull the difficulty adjustment into positive territory. But we are getting short on time to lower the average block time under 10 minutes.

Mempool

The mempool continues to shrink very slowly. The transaction behavior we are seeing is not indicative of an unsustainable price spike is imminent.

Inscriptions

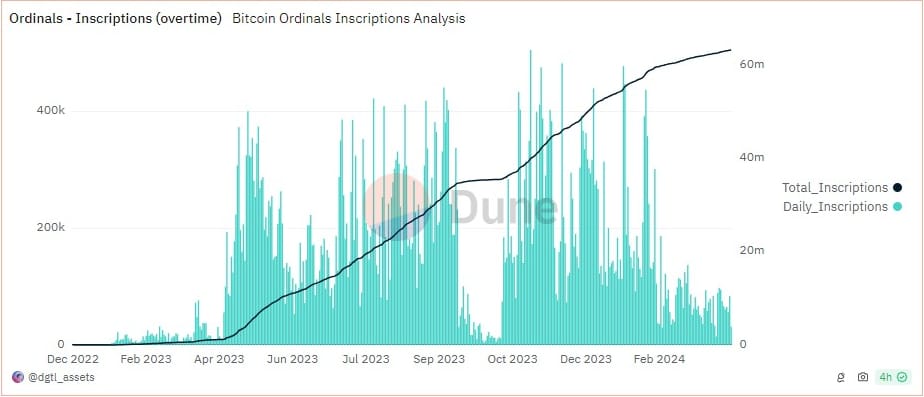

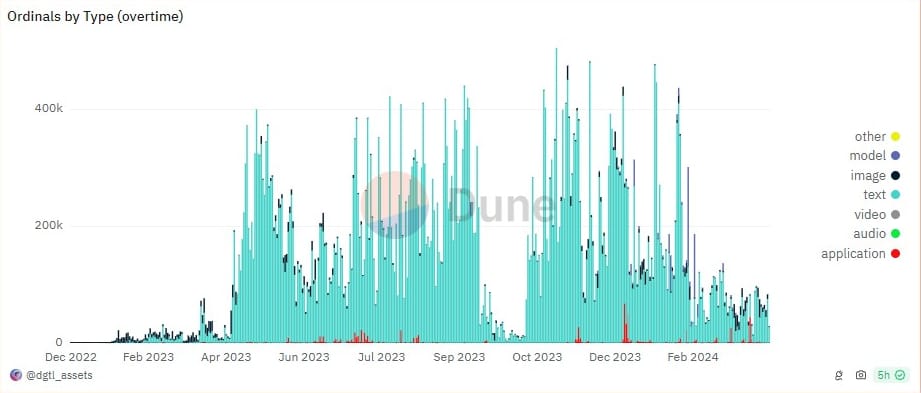

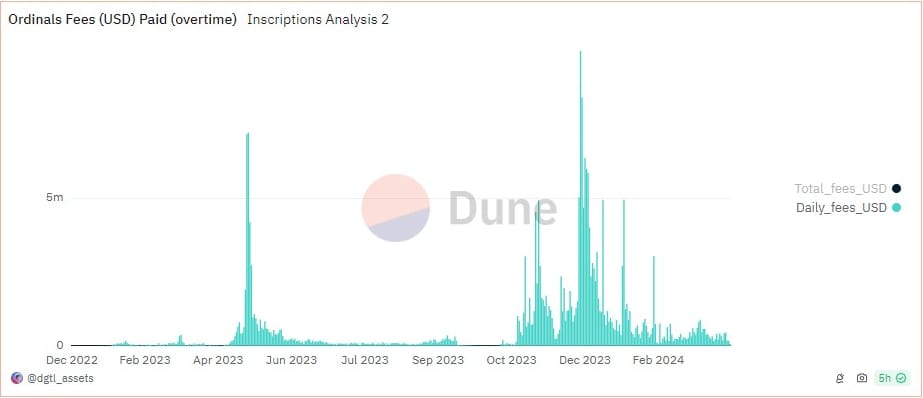

My original source for inscription data is having issues with their updates. So, these charts are from another provider on Dune.com.

I've written recently on BMPRO how to use inscriptions to measure speculative fervor in this bitcoin rally. When we get to the stage of the cycle where YOLO traders are getting in, we should see that spill over into inscriptions like we've seen it in altcoins for years. Until this number spikes, we haven't see the end of the cycle. This number should also move up with altcoin prices.

First chart, is the total number of inscriptions per day. As you can see they have plateaued under 100k, even with fees relatively cheap and the mempool shrinking.

The next one shows inscriptions by type. As you can see they are most text inscriptions with a few images.

The last one is fees paid by inscriptions. It's been staying under $500,000/day for a while. This gives us an idea about how much value people are able to scam in the ecosystem.

That's it for this week. See you again next Monday!!!

A

- Were you forwarded this newsletter? You can subscribe here.

- If you liked this newsletter please SHARE with others who might like it!

- Podcast links and socials on our Info Page.

- More ways to support our content, some don't cost a thing!

DONATE directly on Strike or Cash App to support my work! You make my content possible! Thank you.

Disclaimer: The content of Bitcoin & Markets shall not be construed as tax, legal or financial advice. Do you own research.

* Price change since last report

** According to mempool.space or 1ml.com