Fundamentals Report #83

The Bitcoin specific news cycle is slow. It's chugging along. As we've said in the past, Bitcoin is in its own world, only affected by deep fundamental cracks in the traditional system.

April 3, 2020 | Issue #83 | Block 624,256 | Disclaimer

Bitcoin Vital Stats

Days until halving: 39

Mayer Multiple: .828

Est. Difficulty Adjustment: +4% in 5 Days

Prev Adj: -15.95%

Weekly price H/L: $7236 / $5856

Sats/$1 USD: 14,690

Bitcoin Market Commentary

Several interesting threads have developed this week. People questioning the government story of the coronavirus and the need for the lock downs and shortages in gold and dollar. The Bitcoin specific news cycle is slow. It's chugging along. As we've said in the past, Bitcoin is in its own world, only affected by deep fundamental cracks in the traditional system.

Coronavirus

A story emerging from US lock downs is one of extreme skepticism. People are starting to think this whole virus is a hoax. It's a healthy reaction, but one that needs to be tempered by DYOR. It seems that the social distancing and self-isolation are doing their job and limiting the spread of the virus, but people misinterpreting that as there being no need for the these measures.

We should realize the government is unable to enforce a lock down on its own. That's why above we said "self-isolation". If people didn't decide to self-isolate, the government couldn't do anything about it. We are acting in concert to limit the spread of the virus. The government lock downs take credit for the actions of the market. Surprisingly, this is very similar to how the Fed tries to take credit for market moves, when in reality they follow. It's a carefully maintained illusion in both cases. If lock downs weren't announced there would have been riots and panic and people would have self-isolated anyway.

Not to be cliche, but freedom isn't free. A child yearns for and deserves freedom from their parents, but the parents know the child needs to learn responsibility, respect and liability/consequences of their actions. To act well, we need to consider these things. Applying this to a pathogen is a unique challenge. How do you act responsibly? What kind of consequences follow from our actions? How do we act respectfully of other people's rights and freedoms in regards to a pathogen? There's no right answer, but it's best to err on the side of not spreading the disease, self-isolation.

Gold and Dollar Shortages

This week the gold market exploded as shortages wrecked havoc. There weren't any gold bars to be found. A mad scramble ensued for physical to meet delivery requests. Gold bugs, and obviously bitcoiners, knew this would happen. Where the two camps differ is gold bugs think the inability to get physical gold is a benefit for gold, when in fact, it will incentivize people to buy bitcoin.

Bitcoin is immediately divisible and deliverable. It is superior to gold in a rush to gold. Can't source gold for delivery? How about buying bitcoin? You'd be able to buy any denomination and get it settled in 10 mins anywhere in the world. This is the time for bitcoin to out shine the yellow metal.

The dollar shortage continues. I recommend checking out Jeff Snider's commentary at Alhambra Investments. He writes short posts there every day. The Fed is acting as a domestic banking authority and not an international monetary authority, meaning their current tools do not allow them to control monetary conditions. Even their asset purchases simply increase demand for dollar debt units. Internationally, they're trying to do the same thing, but pushing demand into the future through REPO facilities. This won't work to weaken the dollar. It's getting more entrenched, creating a more epic explosion right around the corner.

The market is still on track for a dollar melt up. It's spilled into gold already and will spill into bitcoin very soon. The dollar system experiment is over. They were right about the deflationary boogeyman all along. We were right about the inadequacy of fiat money. Deflation won because the properties of debt-based money naturally funnels newly created money into asset prices and risky investments, causing a cycle of bubbles that must deflate.

Bitcoin Top Stories

Revolut brings Bitcoin to all of its 7 million users

A payments app from the UK follows the lead of Cash App and the Italian Bank Banca Stella in offering bitcoin as part of it's app's products. This will continue and a new generation globally will be able to stack sats.

Binance is set to acquire CoinMarketCap, the deal could be worth as much as $400 million

CMC is prime real estate in bitcoin. During rallies it is ranked very high on the Alexa internet traffic rankings. It's a great purchase by Binance, but will it bare fruit if altcoin season is permanently cancelled?

China’s Digitization Endeavors Continue: National Blockchain Platform to Go Live in April

The Chinese blockchain comedy continues. Hint: blockchains don't scale. The "Blockchain Service Network (BSN) is a trans-regional public infrastructure network jointly launched by the Chinese National Information Center, a state-run telecom company China Mobile, China UnionPay, Red Date, and other institutions like banks and government groups."

Bank of France Says ETH and Ripple Could Power Central Bank Digital Currencies

This week the Bank of France put out a call for ideas for how they could leverage a CBDC. Are they planning to introduce a digital Franc? That alone would be a huge story. The Eth and Ripple marketers jumped in and this article claims they can use a token on these platforms, maybe even a cross chain token. Of course, this is a complete joke. Wait until they discover Liquid and Elements sidechain, where they can peg to bitcoin.

Price

Weekly BMI | 2 : Bullish

Price has really been strong this week, squeezing shorts in the process. Don't be confused by our "2: Bullish" BMI rating, we could see near term pressure on longs, followed next week by a quick recovery. Our mid-month projection, detailed on the member newsletter the Bitcoin Pulse, is driving our bullish weekly call. April should be a good month for the bitcoin price.

$6500 is an important level. If price can hold above it for a few days, there is a better chance it'll continue going up without returning to test lows. At the time of writing, price is exactly where it was on CME at the close of last week. Price slumped throughout the weekend and then rallied when CME reopened. We wouldn't be surprised to see an almost exact replay of last weekend, however followed by a much stronger bounce.

A rising wedge is a bearish pattern that break to the downside 70% of the time. Like last week a truncated drop over the wedge is expected. Being bullish won't be easy.

Altcoins

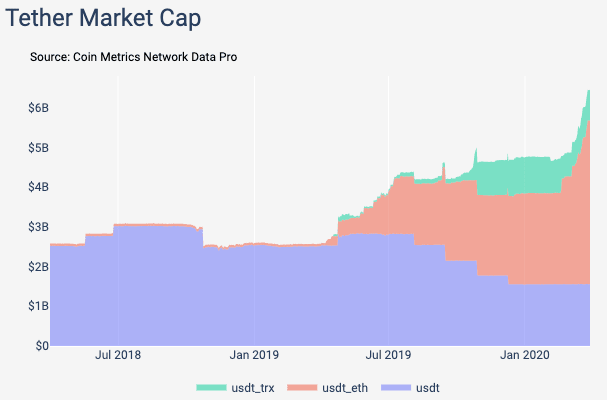

Last week, we published a chart from CoinMetrics showing the increase of fiatcoin printing. It has continued so we pulled a couple more images from Coinmetric's State of the Network article. Printers go brrrrrr. Fiatcoins and CBDC's will slowly replace altcoins, both in terms of market cap and usage.

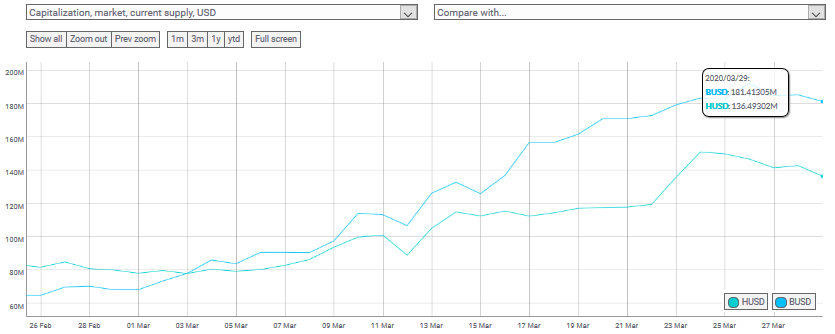

The second chart below is the Binance USD and Huobi USD supplies over the last month. They've tripled and doubled respectively.

Macro

The dollar is surging again despite the unlimited REPO, QEterity, municipal bond buying, corporate bond buying, foreign currency swaps, and, most recently, foreign REPO's! Think about that for a second. The Fed has unloaded an unimaginable amount of liquidity and debt into the system, yet the the dollar goes up?!

We are watching this very closely. If the 2016 high of 103.82 breaks, it will be 18 year highs! and it could run to 108 quickly.

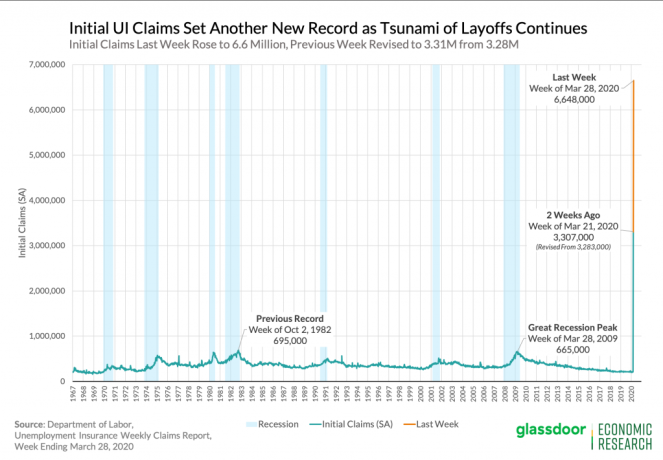

Take a look at the job numbers below. Last week's print was on the report as well, because it was so incredible. This week's number is higher! 3.34 million new unemployment filings. In the great depression it took years to get to 9% unemployment, we've now gotten there in two weeks. It's scary looking at this chart, but think of it this way, all those new unemployed could be red pilled against the Fed and corporatocracy.

Miscellaneous

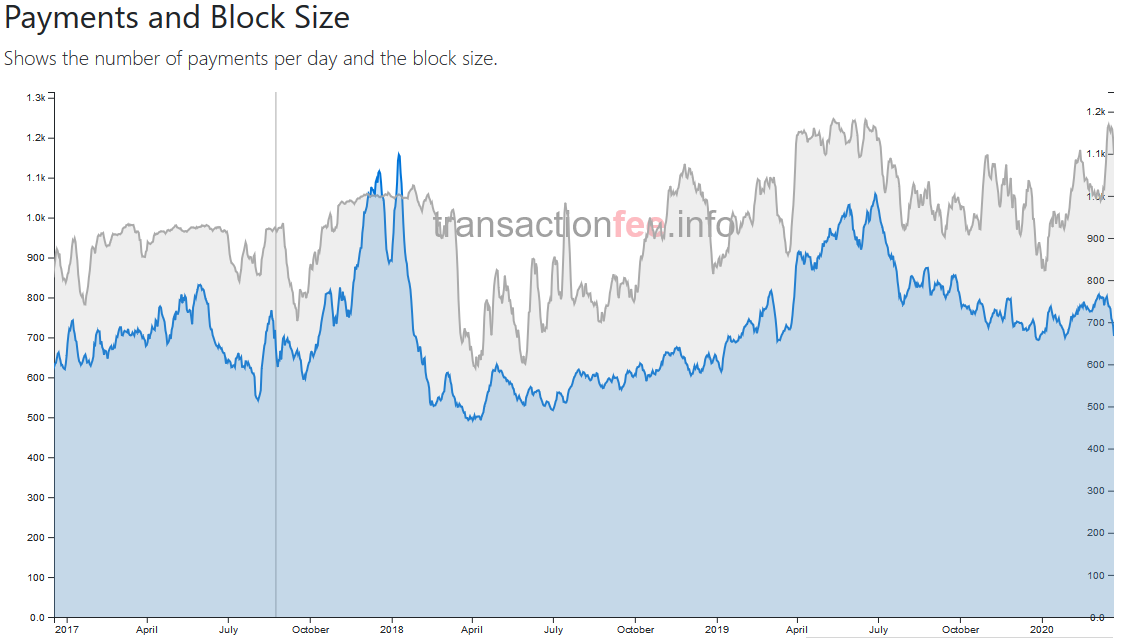

Here's a long term view of Bitcoin's payments and block size showing block size near ATHs despite the mempool being relatively empty. Also note the recent decoupling as number payments per block decreases as the size of blocks increases.

Demystify Bitcoin Jargon with the Bitcoin Dictionary

Years of knowledge about bitcoin, blockchain, and cryptocurrency in 80 easy-to-read pages. Exposure to a diverse set of disciplines needed to understand Bitcoin. Economics, cryptography, mathematics, computer science, political science, and game theory.

Go to our Info Page to join our community, find where to listen, and follow us.

Written by Ansel Lindner and Jeff See