Latest

Bitcoin Holds Strong Amidst Market Panic and Volatility

Tariff Drama Shocks To The Market, But Is It Sustainable?

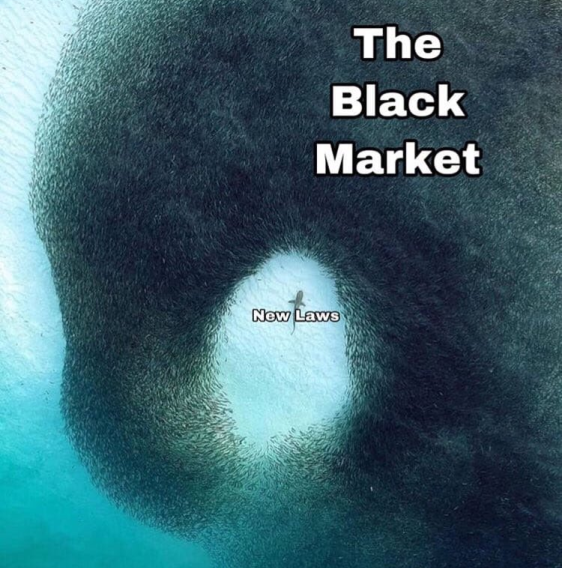

Augustus’ Fertility Laws and the Battle to Save Rome

How Rome's first emperor tried to reverse a demographic decline with legal and moral reform

April Price Forecast Competition

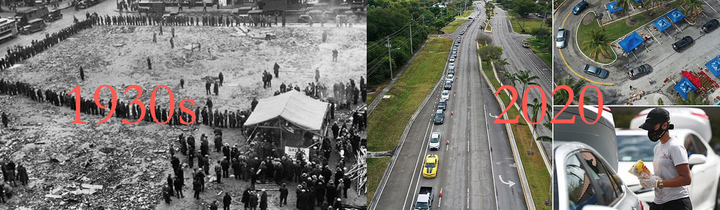

The Modern Effect Of Tariffs

Two Mental Traps That Derail Macro Thinking

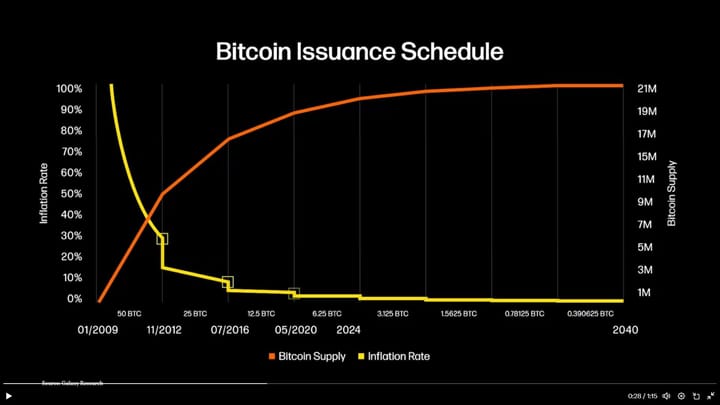

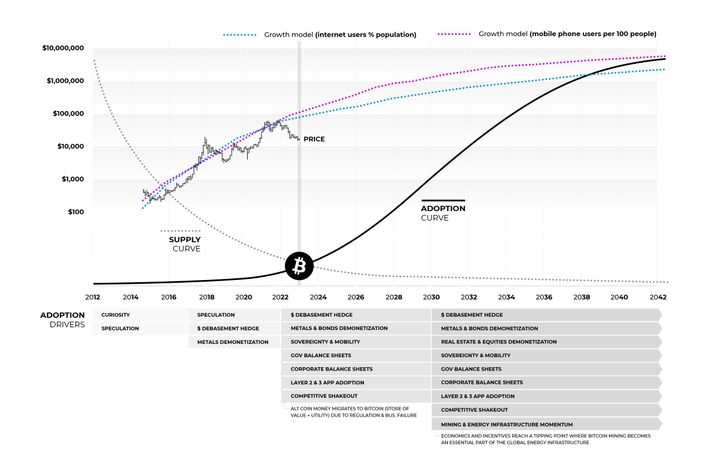

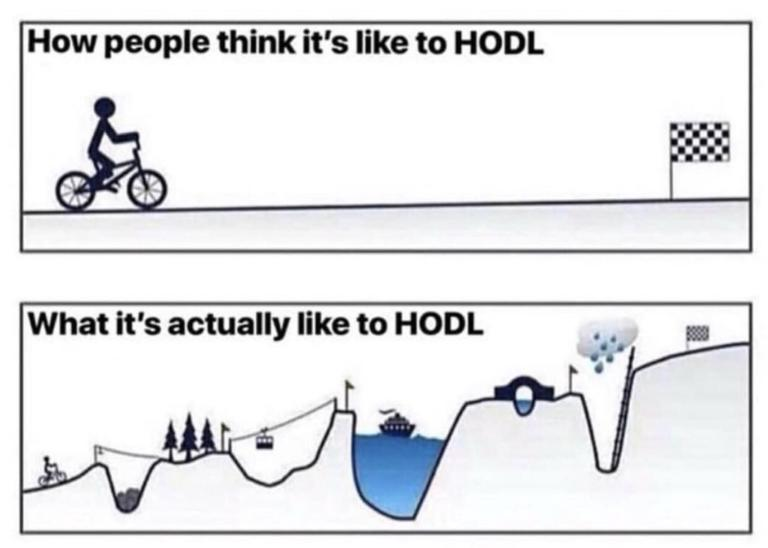

Here's How Bitcoin Stair Steps To $1 Million

Bitcoin Signs of Life, Fighting Macro Headwinds

Crisis Signals and Bitcoin Calm: Reading Between the Fed Lines

Divergences, Dominance, and a Developing Breakout

The Euro's Last Recession?

Bitcoin Strategic Reserve: A Game-Changer for Global Adoption

10Y Breakdown and Recession Signals - Macro Update

March Price Forecast Competition

Bitcoin’s Wild Week, BlackRock’s Signal, and GDP Shock

Markets at a Crossroads as Q1 Volatility Kicks In

Bullish Fundamentals and Bybit Hack - How Bad Will The Bitcoin Dip Get?

Big Macro Update: Fear Runs High, but Markets Follow the Script

From Boredom to Breakout: Bitcoin’s Next Rally is Brewing

The Future of Reserve Assets - Gold vs Bitcoin

Dip Before Rip? Bitcoin Chart Updates - Pro

Can Gold Continue Its Rally? - Macro Update

February Price Forecast Competition

Bitcoin Chart Updates - Pro #52

FOMC, Dollar, Stocks - Macro Update - Premium

Announcement and Bitcoin Forecast - Premium

Bitcoin Insider #323

Trump takes office and we await his Bitcoin Executive Orders and hoping for Ross Ulbricht's freedom. A lot is coming for Bitcoin over the next few days!

Is Quantum Computing the Biggest Threat to Bitcoin? And Your Comments - E430

Debunking the quantum computing FUD about bitcoin

Will Trump's Tariffs Work? Reaction to Patrick Boyle - E429

I react to Patrick Boyle's tariff episode. It was a balanced take from Patrick, and I add my own color to it.

Bitcoin Insider #322

Slower week for the bitcoin news cycle, wildfires in California and macro take center stage. All awaiting Trump's inauguration.

Bitcoin Round Up - MSTR, IMF and El Salvador, China Stimulus, Price and more - E428

The main topics today are MSTR once again, the IMF hassling El Salvador and China stimulus.

They Finally See Bitcoin Coming, Some Are Trying To Stop It - E427

Listening and reacting to great Charles Schwab and Tom Lee takes on bitcoin and a terrible one from Bill Dudley.

Bitcoin Gets the Support of Powerful Elites, Major Statements from Powell and Putin - E426

I react to Putin and Powell public comments about bitcoin. I also read through one of my recent blog posts about Endogenous Money.

Bitcoin OTC Desks Drained, Geopolitical Chaos Erupts - Bitcoin Roundup - E425

LIVE stream from Dec 2, 2024 as podcast. MicroStrategy, Marc Andreessen on Rogan, and the start of the China collapse.

Bitcoin Fundamentals Report #321

Inside Bitcoin: Tax Rule Changes, $100K Trends, and Global Economic Upheaval

Bitcoin Is The Antithesis Of Fiat

Debunking the claim that Bitcoin is fiat currency. We explore Bitcoin’s non-arbitrary design, market-driven value, and role as a distributed consensus system, while clarifying the true nature of fiat currency.

January Price Forecast Competition

Bitcoin Fundamentals Report #320

A weekly roundup including Tether FUD, Russia using bitcoin for trade, Chinese yields collapse, price holding $90k and mining industry news.

Bitcoin Indicators and Forecast - Premium

Bottom Up Adoption: A Theory Based In The Inflation Argument

In a follow up to last week's post on gold versus bitcoin monetization and monetary evolution, this post tackles the technical consequences of an inflation-hedge mindset and how it led to the scaling conflict.

Bitcoin Fundamentals Report #319

The bitcoin price cools as corporate buying slows, macro and geopolitical calm before the storm, bitcoin price analysis, and miners buying bitcoin instead of ASICs.

Why Will Bitcoin Be Monetized, If Gold Was Demonetized?

Analysis challenging inflation-based narratives and examining the market's role in selecting money, offering a fresh perspective through Evolutionary Monetary Theory.

Gold vs Bitcoin Debate Reaction, with Peter Schiff and Robert Breedlove - E424

Reaction to Schiff vs Breedlove gold vs bitcoin debate

Bitcoin Takes a Breather, MSTR dominates news cycle, ETF options and more - E423

MicroStrategy dominates the news cycle, ETF options make a splash, and price cools after first $100k run.

Bitcoin Nears $100,000! LIVE Hangout! - E422

Recording of the live stream on Nov 22, 2024 as bitcoin is approaching $100k for the first time. We also learn about bitcoin collateral securing real estate loans.

Full Bitcoin Bull, MSTR Feedback Loop - Weekly Roundup - E421

Review of the weekly bitcoin news from Nov 18, 2024. "No dips allowed" during the consolidation.

Bitcoin Fundamentals Report #318

MSTR joins Nasdaq, FASB accounting rule changes, global Bitcoin reserve news, and expert price analysis in our comprehensive newsletter

10Y Yield and CPI Connection - Premium

Answering The Critics Of The Bitcoin Reserve Bill

A comprehensive refutation of Chris Hayes and Cenk Uygur's misleading criticisms of the Bitcoin Reserve Bill, highlighting its strategic importance and debunking bailout myths.

Bitcoin Fundamentals Report #317

MicroStrategy's new purchase, Czech Republic's Bitcoin protections, Powell's gold comparison, and El Salvador's IMF deal. Plus, deep dives into CPI trends, China's economic struggles, and key Bitcoin market insights.

Endogenous Money and Bitcoin: A Shift in the Monetary Order

Exploring how the decline of the high-trust system that enabled endogenous money creation could lead to a transition toward bitcoin and trust-minimized forms of money.

Bitcoin Fundamentals Report #316

MicroStrategy's massive BTC accumulation, Hong Kong's tax incentives, demographic challenges, and shifting global power dynamics. Plus, bitcoin price analysis and mining headlines.

Macro Rundown Amid Bearish Shift, As Bitcoin Approaches $100k - Premium

December Price Forecast Competition

LIVE debate reaction to Saifedean and Brent Johnson, Bitcoin as money - E420

Saifedean and Brent Johnson's recent debate about Bitcoin as money

October CPI release and live reaction - E419

Reacting to the October 2024 CPI release

Bitcoin Surprises the World with New ATH, Bitcoiners Were Right! - E418

Speaking about the bitcoin price and Trump's potential to be the reverse-FDR populist as the first-ever populist conservative President.

Huge week for Bitcoin! Election, FOMC, end of year price targets! - E417

Friday hang out discussing bitcoin and macro prices, and reacting to some CNBC interviews.

Bitcoin Fundamentals Report #315

MicroStrategy dominates the news cycle, ETF options make a splash, price cools after first $100k run, and mining sector news.

Retail Traders Are Coming: New Google Trends Data For Bitcoin

Retail traders are returning to the bitcoin market, fueling momentum alongside institutional accumulation and spot ETFs. Could this convergence finally push bitcoin past the $100k milestone?

Trump Wins, Bitcoin Wins! What is Next?? - E416

Discussing the results of the US election and the impacts on bitcoin's near and long term future

Bitcoin's Weekly Wrap Up - MicroStrategy, ETFs, Macro, Bitcoin Price and Election Impact - E415

Discussing the potential results of the US election and the impacts on bitcoin's near and long term future

Out of Nowhere Bitcoin Dip, Is This The End? - E414

Bitcoin and macro update, is the bull market over? Along with the Free Ross campaign and more

Bitcoin Fundamentals Report #314

Comprehensive industry newsletter, Bitcoin consolidates after a panic-driven rally, fueled by MicroStrategy's aggressive buying and spot ETF options approval, setting the stage for a potential breakout.

The Evolution of Global Reserve Money - Infographic

Exploring the history of reserve currencies, the rise of credit-based money, and why Bitcoin is the next step in sound monetary systems.

Key Indicators for Bitcoin's Path to $100K and Beyond - Premium

Bitcoin In The News As It Approaches ATH, When $100k? - E413

Howard Lutnick on Bitcoin and more

Bitcoin Momentum is Surging - Weekly Roundup! - E412

In-fighting, Tether FUD and growing momentum in bitcoin for the week of 28 Oct 2024.

Bitcoin Fundamentals Report #313

Rumors of major buyers entering the market, bitcoin price spike and analysis for the near term, institutional FOMO, Trump ripple effects, and more.

Housing Costs: Inflation vs. Lifestyle

Exploring how expectations, not just inflation, shape housing affordability—and what that means for today’s buyers.

ETF Options Approval and Central Bankers Attack Bitcoin With Nonsense - E410

FUD from central bankers on bitcoin, and bitcoin options trading approval

Microsoft Votes On Bitcoin, BRICS Launch Dollar Killer - E411

Microsoft on adding bitcoin to their balance sheet, plus BRICS new currency revealed at their recent meeting.

Fertility Rates and the Future of Political Power

Demographic forces reshaping Western politics: How fertility rates, heritability of political leanings, and aging trends mean a shift away from degrowth leftism toward a conservative majority.

Bitcoin Fundamentals Report #312

MicroStrategy’s plan to buy $42B in bitcoin, ETF historic performance, and Florida’s adoption highlight a shifting landscape. Pre-election market analysis, mining innovations, and macro updates.

Bitcoin Price Spikes! Shorts Panic - E409

The new Bitcoin Options approval, bitcoin price and macro events.

Macro Minute: Reliable Recession Signals to Anchor Your Forecasts

Yield curve inversions, steepening, and employment data provide highly reliable signals to guide recession forecasts and avoid flip-flopping.

Bitcoin Nearing Major Breakout! Dollar Up, Oil Down, What is Happening!? - E408

The bitcoin price and path for the next several months. Then I go into some of the recent writings about bitcoin and macro, including the Buffett Indicator.

Massive Bitcoin Endorsements! - Monday Weekly Roundup - E407

MtGox repayment delayed; MSTR surges 250%; Kamala on equity in Bitcoin; China stimulus fades; Bitcoin price nears breakout; mining stocks rise; Uniswap's Layer 2 threatens Ethereum.

November Price Forecast Competition

Bitcoin Breakout and 10-Year Treasury Misinterpretation - Premium

Bitcoin and Microstrategy Spike Higher, Macro Setups, and XRP Co-founder Donations - E406

Microstrategy MSTR spike and the reasons behind it, the bitcoin price, and XRP scammers funding democrats.

Bitcoin Fundamentals Report #311

The most comprehensive newsletter in Bitcoin! Growing momentum of the Bitcoin ecosystem, in-fighting, Tether FUD, price breakout, and shifting macroeconomic dynamics.

Blackrock Evangelizes Bitcoin, IMF Obsessed, Marco News and Bitcoin Price - E405

Blackrock, the IMF's obsession with El Salvador, and more.

Can Bitcoin Recover? What Headwinds or Tailwinds Are Dominating The Market? - E404

Bitcoin price and commentary by Tom Lee on CNBC.

China Stimulus, Bitcoin and Politics - E403

A weekly update on bitcoin and macro, with focus on the Chinese stimulus.

Macro Minute: From Eurodollar to Bitcoin - A New Parallel Path

Gold's price is rising because of uncertainty around global monetary transitions. Bitcoin offers a unique solution to the monetary evolution puzzle.

Soft War by Jason P. Lowery

Soft War has become an imfamous book. Recently, the Department of Defense has limited the distribution of the book. I'm hosting the PDF version here as a service for the community.

Softwar_ A Novel Theory on Powe - Jason P. LowerySoftwar_ A Novel Theory on Powe - Jason

Bitcoin Fundamentals Report #310

Bitcoin sees ETF options approval while facing criticism from central banks. Market volatility, miner strategies, and bullish momentum shape the industry's outlook.

Short Squeeze, Time To Pay Attention - Premium

Record September for Bitcoin, Massive China Stimulus, Bring on Q4! - E402

The Chinese stimulus is not bullish. Here is what you need to know.

Bitcoin Ready to Spike, plus Crypto Games In Congress - E401

Discussion of the bitcoin price and how to view the grilling of Gary Gensler in Congress.

Macro Minute: Has The Buffett Indicator Outlived Its Usefulness?

Explore the limitations of the Buffett Indicator in today's economy, including shifts in market behavior, the evolving role of major stocks, and long-term GDP distortions.

Bitcoin Minute: Institutional Giants Clash Over Bitcoin

BlackRock’s CEO embraces Bitcoin’s rise, while Fed critics call it useless. Who's right? The market will decide.

Bitcoin Fundamentals Report #309

MtGox repayment delayed; MSTR surges 250%; Kamala on equity in Bitcoin; China stimulus fades; Bitcoin price nears breakout; mining stocks rise; Uniswap's Layer 2 threatens Ethereum.

Macro Minute: Federal Reserve Is Playing A Different Game

The Federal Reserve isn't trapped; it plays a different game, managing existential threats through narrative and psychological influence rather than just reacting to economic data.

Macro Minute: Demographics Impact on Global Oil Demand

How Aging Populations and Shrinking Growth Rates Are Reshaping the Future of Oil Consumption Worldwide

Macro Influences: How Commodities and Yields Are Shaping Bitcoin's Investment Environment - Premium

Bitcoin Fundamentals Report #308

The Most Comprehensive Newsletter in Bitcoin Explores Blackrock’s Sound Money Push, IMF’s Bitcoin Obsession, Support for Bitcoin Reserve, Price Analysis, and Mining Sector News

Macro Minute: The Fertility Crisis: Why Economic Decline, Not Technology, Will Boost Birth Rates

Exploring the link between wealth, fertility, and technological progress—and why a global economic regression may be the only path to reversing declining birth rates.

Bitcoin Minute: Clarity on Why Bitcoin Is A Geopolitical Hedge

The perennial bitcoin FUD debunked. Tactical versus Strategic Hedges, what's the difference. Why critics are wrong about bitcoin and WWIII.

October Price Forecast Competition

Game-changing Week, Huge Fundamental Flood Gates - E400

Discussing topics from the most comprehensive bitcoin industry newsletter!

Bitcoin Spikes As TradFi Rushes In, Major Implications - E399

Myths about Bitcoin debunked, Blackrock report review, and bitcoin price analysis.

Bitcoin Fundamentals Report #307

Weekly Bitcoin Recap: SEC Battles, China Stimulus Impact, FTX, Price Analysis, ETF Inflows, and Mining Sector Update

Best September In Bitcoin History - Premium

Bitcoin Minute: Crypto Gaslighting In Congress

Examining SEC Chairman Gary Gensler's recent testimony in Congress and the dangers of promoting fraudulent crypto projects. A call for clarity and the importance of adhering to the Howey Test for securities.

Macro Minute: More Signs of Recession, 5y5y Forward and Breakevens

How the 5Y5Y Forward and breakevens reveal transitory inflation and signal a looming recession through market inversions.

The Fed Makes A Huge Mistake, Cuts Rates - Reaction - E398

Replay of live stream reacting to the Federal Reserves latest rate cut and Chairman Powell's press conference. Seeing through the noise and realizing what the Fed is really saying.

Bitcoin Fundamentals Report #306

Get the latest updates on the Bitcoin industry, including the SEC’s approval of options for BlackRock’s Bitcoin ETF, MicroStrategy’s ongoing Bitcoin purchases, macroeconomic factors impacting Bitcoin, and a closer look at mining and market trends.

Shorts Getting Nervous, Bitcoin Threatens to Break Out - Premium

Macro Minute: Overproduction Does Not Bring Demand, China's Economic Illiteracy

Exposing the Economic Nonsense of Central Planning: How China's Overproduction and Misguided Policies Undermine Their Own Economy

Major implications from the Federal Reserve rate cut this week for Bitcoin - E397

Top headlines for bitcoin and macro, as well as price analysis, bitcoin mining news and network status, and finally an exploration of Layer 2 and old schemes are new again.

Bitcoin Minute: False Assumptions About Gold vs Bitcoin

Exploring the misconceptions about gold's failure as money, the role of elasticity in economic systems, and why bitcoin may offer a solution to the pitfalls of centralized, credit-based monetary systems.

Bitcoin Surges, Holds Critical Levels, What is Next?? - E396

An exploration of Bitcoin cycles and current price analysis. The Top 3 Concepts to Know about Bitcoin's 4-year Cycles.

Bitcoin Fundamentals Report #305

Federal Reserve Rate Cuts, Altcoin Declines, and the Growing Dominance of BTC in an Uncertain Economic Landscape

September Turns Positive, Q4 Move Starting Early - Premium

Can Bitcoin turn it around right here, right now in Uptember? Bitcoin Dawn, Weekly Round up - E395

A discussion of the Bitcoin Fundamentals Report #304. All the news you need for the entire bitcoin space, every week, for Free on bitcoinandmarkets.com

Bitcoin Minute: Rethinking the Bitcoin vs Gold Debate

Debunking Peter Schiff's anti-Bitcoin stance and exploring Jack Mallers’ defense, while addressing the overlooked economic context behind, "why now?"

Bitcoin Dives, What's Next, Can Bitcoin Recover? - E394

The silent protest happening in China, the Bai Lan movement affects marriage and demographics and youth unemployment. Also, the bitcoin price dip and what to expect going forward.

Bitcoin Fundamentals Report #304

Bullish signals are emerging, with Trump leading in polls and FTX set to distribute $16B to creditors. We explore market dynamics, Federal Reserve rate expectations, CPI trends, and Bitcoin mining developments, while diving into key chart patterns and macroeconomic implications.

Bitcoin’s Breaking Point: September's Bearish Cycle and What Comes Next - Premium

Macro Minute: Bai Lan (Let It Rot) in China

Disillusionment and Decline: How the Bai Lan Movement is Helping Shape China's Demographic and Economic Future

Macro Minute: Recession Risks Rise as Yield Curves Un-Invert

Understanding the significance of the 10Y-2Y yield curve un-inverting while the 10Y-3M remains deeply inverted, and what this divergence means for predicting future economic downturns and investment strategies.

Bitcoin Chop is Ending, Here's What to Watch - E393

The most comprehensive Bitcoin weekly newsletter and live stream every Monday!

Macro Minute: Oil Prices Plunge as Supply Outpaces Demand

Exploring the evolving oil market dynamics: technological advancements, shifting demand, and the impact of U.S. shale production on global oil prices amidst an outdated economic framework.

Bitcoin Fundamentals Report #303

Bitcoin Market Holds Steady: Price Trends, Altcoin Decline, Miner Activity, and Macro Factors Ahead of September

September Price Forecast Competition

Bitcoin Minute - Bitcoin's Historical Performance in Q3 and What to Expect This Year

How End-of-Quarter Trends and Fiscal Calendars Shape Market Crises and Economic Activity

Bitcoin Minute: Bitcoin Cycles and US Presidential Elections

Examining the Impact of Halvings and U.S. Elections on Bitcoin Price Movements

The FED Just Changed Everything - E392

Reaction to Jackson Hole speech by Fed Chair Jerome Powell

All Eyes On September, A Critical Month For Bitcoin and Macro - Premium

Macro Minute: As Economic Data Weakens, Bitcoin Takes Cues from Gold

With economic indicators pointing to a downturn, exploring how gold's historical role as a safe haven asset can guide Bitcoin's future performance.

Dollar CRASH, Bitcoin Ready to SPIKE? - E391

What does the 818,000 revision to US payrolls mean for recession and bitcoin, plus tons of other topics in this banger.

Bitcoin Fundamentals Report #302

Bitcoin weekly developments from spiking fees to CBDCs, ETF flows and Telegram bros, Macro headlines, price update, and mining sector news.

Macro Minute: The Fed's Illusion of Control

Illuminating the Myth of the Federal Reserve's Omnipotence

Bitcoin Minute: A Tale of Babylon, PoS and Fees

Analyzing the Sudden Spike in Bitcoin Transaction Fees Due to Babylon's Staking Launch

Bitcoin Path to New ATH, Weekly Round Up - E390

Bitcoin Ticks Along; 13F Updates, Bitcoin Elasticity Debate, Fed Watching, Price Path to New ATH, Miner Revenue and Reserves, and Layer 2 News

Macro Minute: Myths and Realities of Global Dollar Dominance

Why the Dollar's Reign Isn't Ending Anytime Soon and How Bitcoin Will Play a Role in Its Future

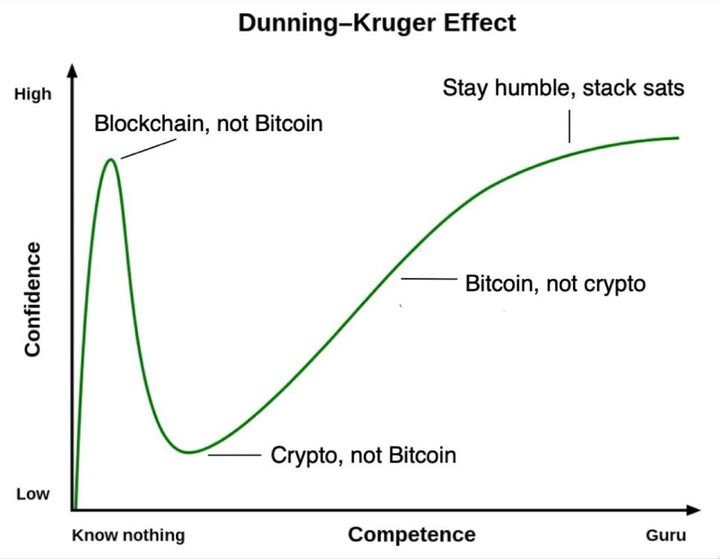

Bitcoin Minute: Levels of Bitcoin Awareness

Exploring the stages of understanding Bitcoin and aligning your actions with long-term incentives.

Bitcoin Fundamentals Report #301

Bitcoin Ticks Along; 13F Updates, Bitcoin Elasticity Debate, Fed Watching, Price Path to New ATH, Miner Revenue and Reserves, and Layer 2 News

Charting Bitcoin: Critical Juncture for Entire Cycle - Premium

Weekly Round Up of the Bitcoin Market, Uncertainty Amid Bullishness - E389

Can't see player? - Listen here

Today's episode is a discussion on the current state of the Bitcoin industry following the Bitcoin Fundamentals Report. Stability is returning but with major macro uncertainty headwinds.

Enjoy.

Links

* Youtube link

Got value from the show? Support directly!

Fountain app:

Macro Minute: Predicted Stabilization in Markets, Decision Time

Understanding last week's panic, Bitcoin's rebound, and the time scales guiding long-term market trends.

Bitcoin Minute: 13F Deadline, Big Players Quietly Expand Bitcoin Holdings

Goldman Sachs leads with $419M in Bitcoin ETFs, while international institutions increase stakes in MicroStrategy. Despite a slower Q2, early signs indicate a strong Q3 for Bitcoin investment.

A closer look at commodities and recession, plus Bitcoin ETF flows update - E388

Today's podcast is on price predictions for bitcoin and a commodity update.

Deflationary Drift: Insights from PPI, CPI, Stocks, Curves, and Shipping - Premium

Bitcoin Fundamentals Report #300

Marathon borrows to buy Bitcoin, Trump Jr Bitcoin platform, China struggles, Iran uncertainty, price analysis - it wants to go up, mining and layer 2 news.

Macro Minute: Commodities Under Pressure, Support Recessionary Signals

Exploring the weakening trends in oil, copper, and the commodity index, and what they signal for the global economy and Bitcoin.

Rally or Retest? Navigating the Bitcoin Rollercoaster - Premium

The Bottom Falls Out, What Is Next For Markets? - E387

Global Markets in Freefall: A Bitcoin Buy Opportunity Amid Broad Panic

Bitcoin Minute: Bitcoin ETFs Hold Strong Amid Market Panic

A review of recent Bitcoin and Ethereum ETF flows, highlighting the resilience of Bitcoin amid market turbulence and the disastrous performance of Ethereum ETFs

Podcast Replay: Markets Panic, Bitcoin Holds, Q3 Seasonality Strikes - E386

Friday 2 Aug reaction during live stream. Panic not fundamentals was the diagnosis

Macro Minute: Markets Stabilize Amid Overblown Fears

Analyzing the Panic-Driven Market Moves, Japan's Economic Struggles, US Treasury Yields and Bitcoin's Path to Recovery

Bitcoin Fundamentals Report #299

Global Markets in Freefall: A Bitcoin Buy Opportunity Amid Broad Panic

Bitcoin’s Precarious Position, When Bull Reversal? - Premium

August Price Forecast Competition

Bitcoin Minute: RFK vs Trump vs Kamala on Bitcoin

A comparison of Bitcoin policy positions, careful not to overstate RFK's support and differentiating Trump's openness and Kamala's radical hardline stance.

Podcast Replay - Federal Reserve Prepares for September Rate Cut - E385

Understanding how to view the Fed's recent statements, why they are less important from a policy perspective and more important on a ideological front, and what to expect going forward.

Macro Minute: 1970s CPI versus Today

A Comparative Analysis of Historical and Modern CPI, and Why This is Not Like the 1970s

Bitcoin Minute: Weird Cycle Patterns and FOMC Watch

Analyzing Bitcoin's Cyclical Patterns, Fed Rate Cuts, and Why All Roads Lead to Bitcoin

Podcast Replay - Bitcoin and Trump, US Gov sells bitcoin? Macro deglobalization and price analysis - E384

Weekly news roundup for the entire Bitcoin industry. Trump, Strategic Reserve, Macro and China, Price Analysis, Mining Sector and More

Macro Minute: Xi Jinping Thought

CCP Apologetics and Reasserting Communism in Modern China - A Response

Bitcoin Fundamentals Report #298

Trump's Bitcoin Endorsement, USG Moves Bitcoin, Strategic Reserves, Global Adoption, Deglobalization in Macro, Mining Sector Turnaround, and Price Analysis

Macro Minute: Fed Rate Cut Odds Soar, Bitcoin is Ready

Interpreting the 2-Year Treasury Yield's Decline and Its Bullish Implications for Bitcoin Amid Rising Expectations of a Fed Rate Cut

Bitcoin Minute: Historical Price Performance During Bitcoin Conferences

Analyzing the Bitcoin Price During Each Year's Bitcoin Magazine Conference and What to Expect This Year

Short-Term Bitcoin Forecast and ETH ETF Impacts

Bitcoin Minute: Trump vs Bukele

It is improper to compare the US and El Salvador because the scales are completely different

Bitcoin Minute: Here is what to expect from the Ethereum ETFs Launch This Week

Ethereum faces a rocky road with its spot ETFs launch. Explore the contrasting pre-launch movements, fundamental differences, and what lies ahead.

Bullish Breakout: Short, Medium and Long-Term Bitcoin Forecasts - Premium

Macro Minute: Dr. Copper Crashing is Bad Signal for the Global Economy

The Implications of China's Slowing Economy, Copper Stockpiles and Global Market Trends

Bitcoin Minute: Pitchfork Analysis

Exploring the technical insights of Andrews' Pitchfork, past cycle patterns, and potential future trends influenced by Bitcoin news.

The Next Chapter: Successful Macro Insights and Bitcoin Adaptations

Macro Minute: Gold's Breakout Hints at Bitcoin's Next Move

Gold's multi-year Wyckoff accumulation applied to Bitcoin's multi-month accumulation

Bitcoin Fundamentals Report #297

Bottom is in, Trump Tragedy and its affect on Bitcoin, China woes, Price Update and Mining sector news

Soft CPI Sparks Rate Cut Speculation, And Its Effect on Bitcoin

Bitcoin's Path to Recovery Amidst Market Volatility

Bitcoin Fundamentals Report #296

Germany dumps bitcoin, ETF flows turn positive, China in economic trouble, Price analysis and mining sector updates.

Analyzing Bitcoin’s Current Correction and Future Forecasts

Bitcoin Fundamentals Report #295

Bitcoin may have bottomed, Sony to launch bitcoin exchange, political upheaval, price analysis, and mining news.

Bitcoin at a Crossroads: Price Metrics vs. Derivatives Insights

July Price Forecast Competition

Overblown Market Fears: Bitcoin Well Within Range and Now Oversold

Miners More Stable Than They Appear During Price Dip

Short, Medium and Long Term Forecast Update - Premium

By the Numbers: Bitcoin Gets Bumpy

Bitcoin Fundamentals Report #294

Billionaires falling in love with bitcoin, Bitcoin in politics, EU-China trade war, bitcoin price and mining news.

Complex Times, Bitcoin & Macro - E383

Today's episode I go over my macro thesis. Join us on Telegram to comment directly or on YT.

Four Bitcoin Indicators, One Comprehensive Conclusion

By the Numbers: Signals of Stability in Bitcoin Mining Sector

Bitcoin Fundamentals Report #293

Bitcoin too big to be ignored by politicians, adoption everywhere, macro headwinds, bitcoin price, mining industry update, and more

By The Numbers: Macro Headwinds Testing Bitcoin’s Fundamentals

By the Numbers: Bitcoin Miners and Network Trends

Federal Reserve’s Terrible Projections, Macro Implications for Bitcoin

Bitcoin Fundamentals Report #292

Massive short position in bitcoin futures explained, mergers and acquisition season, ETF inflow streak, FOMC and CPI this week, plus mining industry news

The Central Bank Tipping Point and the Rise of Bitcoin

Demographic Collapse: Effects of Urbanization

The roots of the demographic decline, specifically urbanization, which has long been linked to reduced fertility rates. History, failed policies and schools of thought, and summary.

June 2024 Price Forecast Competition

Bitcoin Fundamentals Report #291

Roughly 17% of Americans own bitcoin, bitcoin floods out of exchanges, Andreas reappears, OPEC keeps cuts, Trump, price analysis, and mining news.

Bitcoin Fundamentals Report #290

The pro-Bitcoin realignment continues. Trump endorses bitcoin and disavows CBDCs. Something strange is happening in China. Price analysis, mining sector news, and more.

Bitcoin Fundamentals Report #289

Price up, 13Fs stimulate more demand, CME to get spot trading, Tether in China, CPI heading down, heads of State under attack, price analysis and mining news.

Discussing Reserves: Sources, Utility and Why QE Doesn't Work

Understanding the Economic Utility and Market Perception of Bank Reserves and Why QE Reserves Are Inferior and Dangerous

Full Bitcoin Update, Charts and Emerging Fundamentals - Premium

Bitcoin Fundamentals Report #288

Slow price news but lots happening behind the scenes in Congress and with 13F filings. 2024 is the Bitcoin election? SLOOS debrief and CPI coming up this week. Mining and L2 news.

Bitcoin Fundamentals Report #287

Arresting devs, definition of money service business, keeping perspective, JPY spikes, GDP disappoints, Biden wants to eat the rich, and more

May 2024 Price Forecast Competition

Discussing Possible Post-Halving Paths for Price

Bitcoin Fundamentals Report #286

Bitcoin halving debrief, HK ETFs, looming dollar crisis, bitcoin price analysis for after the halving, miners raked it in, Runes update.

Bitcoin Fundamentals Report #285

HK Bitcoin ETFs, Iran FUD, China crash, bitcoin price analysis, miners bracing for halving and MORE!

Bitcoin Fundamentals Report #284

Tectonic plate movements in bitcoin, major macro pivots, bitcoin price analysis and mining industry news.

Gold and Yields Tell Us Everything About the Upcoming Recession

Bitcoin Fundamentals Report #283

Argentina regulates bitcoin, Tether buys 8,888 btc again, SWIFT CBDC, Gold spikes, bitcoin price analysis, mining industry gets ready for halving!

April 2024 Price Forecast Competition

A Deep Dive into Bitcoin Spot ETF Mechanics

What to expect heading into the halving?

Bitcoin Fundamentals Report #282

Stay up on the last week in bitcoin. Inscriptions or no, altcoins scams picking up, macro news FOMC, price analysis, and very positive mining news.

Federal Reserve Losing Credibility, Insights of FOMC Press Conference 3/20/24- E382

A pre-show chat about Ethereum and general market things, then the FOMC press conference reaction. Jerome Powell's answers to the financial press's questions.

Bitcoin Fundamentals Report #281

Craig Wrong the only person who is not Satoshi, more bitcoin news headlines, macro events, Bitcoin price analysis, and mining industry update.

Response to AIER's Salter on Inflation and Interest Rates

Inflation expectations is a horrible economic variable and should be ignored.

More on Bitcoin Equity Alts and Tracker, Plus Forecasts

Bitcoin Fundamentals Report #280

Vanguard CEO resignation appearances, Bitcoin ATHs in many currencies, March banking crisis update, price might temporarily top here, and mining sector update.

March '24 Price Forecast Competition

Bitcoin Breaks ATH in Four Major Currencies, USD Next

Bitcoin Fundamentals Report #279

Bitcoin eats gold, ECB FUD, Peak Cheap Oil collapses, Bitcoin price analysis, miner sue US Gov.

Asian Currency Crisis 2.0 and Bitcoin Halving Forecast

Bitcoin Fundamentals Report #278

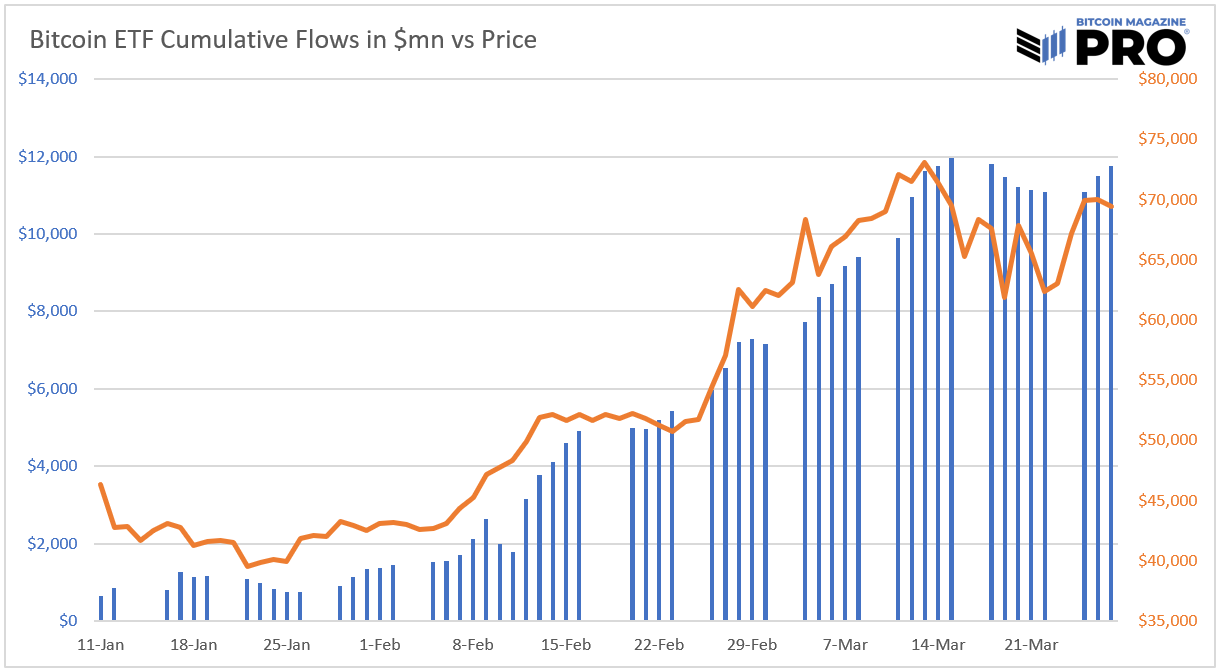

Bitcoin spot ETF inflows surge, bitcoin adoption route, China and other macro, bitcoin price analysis for the week, mining sector update.

A Response from Team Transitory

Was inflation transitory or not? It seems so, but what were the reasons and excuses now offered by the other side. A response to a AIER post.

Bitcoin Fundamentals Report #277

Bitcoin's price is taking all the headlines, but I talk ETF flows, Macro update, price analysis with warning, mining industry news and stats.

Is the Crescendo Peaking for Now?

Bitcoin and Macro Reality, Plus SLOOS Data is Window Into Shadow Banking - E381

Quick discussion on macro situation around bitcoin, stocks, bonds, oil and the dollar. Then a deep dive into the SLOOS data from the Federal Reserve.

Bitcoin Fundamentals Report #276

Bukele and Milei make headlines, US gov investigates the benefits of bitcoin mining, bitcoin price analysis, mining industry headlines.

February Price Forecast Competition

Hello Members,

The monthly forecast competition has been a part of our community since 2019. It is a fun way to put our understanding of bitcoin and macro to the test and have some friendly competition.

January Winner

Congrats to AJ Garnerin for having the best forecast for January!! You

Bitcoin Fundamentals Report #275

Bitcoin ETF update, China bitcoin demand, transparency in spot ETFs, Texas border issue, Evergrande, peak cheap oil takedown, price analysis, and mining industry news

Chinese Stock Market Bailout is Good for Bitcoin

Bitcoin Fundamentals Report #274

Free newsletter - ETF flows are hot topic. FTX sold $1 billion of GBTC. Net buying still positive, China crash update, bitcoin price, miners battle cold weather.

Business Cycle: Is Limiting Credit the Best Route to Sanity?

Bitcoin Fundamentals Report #273

Bitcoin ETF launch exposes incompetent Tradfi, debrief, Macro new including CPI and Taiwan election, price analysis, mining news and more.

Bitcoin ETFs' Effect on Forecasts and Global News

Why a Bitcoin 6102 Won't Happen

There are several misconceptions about the details of the program that make people unreasonably worried today in regards to bitcoin

Bitcoin Fundamentals Report #272

January 8, 2024 | Block 824,909

Snapshot of Bitcoin

General Bitcoin Headlines

Weekly trend

Ready for approval

Media sentiment

Very Positive

Network traffic

Very High

Mining industry

Growing rapidly

Days until Halving

99

Price Section

Weekly price*

$46,952 (+$3452, +7.9%)

Market cap

$0.919 trillion

Satoshis/$1 USD

Bitcoin Singularity and What's Coming up for Oil Prices

January Price Forecast Competition

Bitcoin Fundamentals Report #271

Bitcoin ETF updates, approval imminent?, thinking on inscriptions, hypocrisy of anti-bitcoin bills, macro and mining sector updates.

Why AI Needs Bitcoin - E380

Wide ranging discussion. See link for video for charts. We talk bitcoin price, macro charts, mempool and inscription controversy, problems with AI and the shale oil revolution.

Merry Christmas and Quick Bitcoin Forecast Update

Shale: An Earthquake in the Geopolitical Order

Discussion on the scale of the Shale revolution

There are important geopolitical developments and then there's the US shale revolution. Important geopolitical events are usually small, like a regional war, major shifts in trade agreements, etc. However, the shale revolution ranks up there with events that completely change

Bitcoin Fundamentals Report #270

Inscription/ordinal debate, spot ETF marketing begins, Red Sea war risk insurance, bitcoin price analysis, mining sector growth, in depth inscription charts.

It's All Noise Around the Recession Signal

Bitcoin ETF: Wall Street vs Globalists E379

Jamie Dimon bashes bitcoin, What is the real battle going on over the Bitcoin ETF?

Bitcoin Fundamentals Report #269

Recap of the last week, ETF news, macro, price action, why the dip, mining news, ethereum being censored, liquid sidechain action.

CPI Prediction and How I Did in Calls for 2023

Bitcoin Fundamentals Report #268

Bitcoin's price steals the show, spot ETF news, Gold jumps, Red Sea warfare, What's next for price, and new decentralized mining pool.

Bitcoin Related Stocks and Pricing in the ETFs

December Price Forecast Competition

The Dangers of Mislabeling Inflation: A Response

If you call everything inflation, you lose any explanatory, and hopefully predictive, power of your model of the economy.

The Bitcoin Cantillon Effect - E378

How the current global financial system works, and the coming massive inflationary stimulus of Bitcoin's appreciation. The benefits will go to the bitcoin economy.

Bitcoin Fundamentals Report #267

Binance fined, bitcoin ETF in-kind vs cash creates drama, the increase in piracy, bitcoin price analysis, mining sector news, and Lightning wallet delisted from Apple and Google stores.

Communism Works Better than Markets With Today's Compute?

Response to a communist tweet about compute power vs markets.

Two Scenarios to Watch Develop into 2024

Bitcoin Fundamentals Report #266

Javier Milei's wins Argentina's Presidential election, Bitcoin ETF news, Coindesk acquired, Tether freezes coins, plus price analysis, mining and layer two news.

US Consumer is Tapped Out, Deflationary Pressure Everywhere

Bitcoin Spikes plus Tidal Macro Forces - E377

Bitcoin price charts, macro related moves and Bitcoin as a new asset class.

Bitcoin Fundamentals Report #265

Bitcoin news of the week, ETF approval rumors, CPI preview, freight recession, bitcoin price analysis, mining news, ordinals update.

Massive Breakout or Fake Out?

Bitcoin Fundamentals Report #264

A few influential push backs on bitcoin, DCG problems, HK mulls spot ETF, SLOOS data, market shift, price analysis, mining and layer 2 news.

US Treasury Yields Break Down, Oil Demand and Price Update

November Price Forecast Competition

Bitcoin Fundamentals Report #263

Everything you need to know about bitcoin in the latest week. WSJ FUD debrief, DTCC ETF listing, pre-FOMC look, US GDP hits 4.9%, mining and lightning news.

Stock Market Update, Yield Curve and Rollover, Bitcoin Price

Bitcoin as Hedge Against Geopolitical Risk - E376

Bitcoin is a hedge against geopolitical risk and inflation

Bitcoin Fundamentals Report #262

Bitcoin price pump, ETF update, Bitcoin in politics this week, China crisis, price analysis, mining sector news and lightning network update.

BREAKING: Bitcoin Rallies to Pivotal Point

Bank Credit Shows Deflation is Here

Bitcoin is a Hedge Against Geopolitical Risk (continued...)

This is a written response to accompany my recent podcast.

Bob Elliot and Michael Green appeared on Blockworks podcast. Starting at minute 49:00 they talk about bitcoin. Their basic premise is that bitcoin has not performed as a hedge against geopolitical risk in the few days since the Israel-Gaza

Peak Cheap Oil vs Peak Oil Demand - E375

Peak cheap oil is not happening. Peak oil demand better describes what's happening.

Bitcoin Fundamentals Report #261

Debriefing this morning's Cointelegraph and spot ETF approval drama. Plus, price analysis, mining industry news.

Breaking Down CPI Components and Money Printing

Bitcoin Fundamentals Report #260

Slow week in bitcoin, big week in macro. I cover bitcoin and macro headlines, bitcoin price, mining, and Layer 2.

Crashing Oil Demand, Gold Rebound, Bitcoin Bull Starting

Bitcoin Fundamentals Report #259

Bitcoin spot ETF reshuffle, Macro climax update, bitcoin price, mining and layer 2 news.

October 2023 Price Forecast Competition

Shadow Banking Secrets: Collateral Multiplier - E374

Discussing why rates will peak soon due to break down in collateral re-use. Shadow banking secrets.

Futures Trading Controls Bitcoin Price?? - E373

Comment on Willy Woo tweet, Fed RRP, Treasury buyback program, bitcoin mining, and price.

Climax in markets leads to bullish period ahead - Proton 4

A look at seasonality, and historical trends preceding recessions.

Paradox in Economic Headwinds: Recession or Inflation

Yields and oil continue to rise signaling higher inflation, yet these things fall in recessions

Bitcoin Fundamentals Report #258

Bitcoin is dominated by futures market manipulation? Strong dollar, yields, and oil, versus weak bitcoin and stocks. Plus price analysis and mining sector news.

Dr. Copper Has Something to Say, Ethereum and Bitcoin Forecasts - Proton 3

Does the Fed Really Print Money?? - E372

Answering the question of whether or not the Fed can print money.

Predictions for 2024 and Cycles - Proton 2

Bitcoin Fundamentals Report #257

Topics: NSA invented Bitcoin?, Coinbase adds lightning, Templeton joins ETFs, CPI debrief, Turkey and China news, Price analysis and mining news.

Peak Oil Demand and Bitcoin Adoption - Bitcoin Proton #1

Demographic Collapse: Several Case Studies

In this post, I examine fertility rates and policies from Hungary, Denmark, South Korea, Japan and Israel.

Bitcoin Fundamentals Report #256

Update on Fortress Trust and Ripple, bitcoin's security budget as a cult movement, G20 vs BRICS, upcoming week, price analysis and more

The Truth about Bitcoin's Security Budget - E371

Talking bitcoin's security budget. What is it and should we be worried?

Market Pro 27 - Rumblings of a Bullish Shift

The Dollar Wrecking Ball is Back - FED159

The dollar wrecking ball is back, we talk DXY, CNY, Oil and bitcoin accounting rules.

BIP300 Debate and Other News, Weekly Bitcoin Update - E369

Main topics are flat price action, BIP300 debate, Bitcoin price analysis, mining news and Liquid open sourcing their code.

Bitcoin Fundamentals Report #255

BIP300 debate, mining's energy consumption revised down, China starting to bully bad sign for BRICS, Liquid open sourcing code, price analysis and mining news.

Demographic Collapse: Why Should We Care?

There's a demographic decline coming, but why should we care?

September 2023 Price Forecast Competition

Market Pro 26 - ETFs, Manipulation and Mismatches

ETF Approval Tomorrow Changes Everything - FED 158

Topics covered, Grayscale win vs SEC, Jackson Hole and Powell, German industry flees, and coup in Gabon.

Reaction to Grayscale WIN - E368

Reaction to the news that Grayscale won their suit against the SEC (Live stream replay)

Quiet Before the Storm - Weekly Update - E367

Lack of bitcoin volatility, BIP300, ETF updates, macro Q3, BRICS expansion, price analysis, Blackrock gets into mining, and Lightning Funds

BRICS Opens Door to Bitcoin - FED 157

Topics include bitcoin price, BNB coin discussion, Tornado Cash, ETF chance, BRICS and China local government bankruptcy.

Tornado Cash Suit is not about Privacy - E366

People have lost the plot. Cypherpunks weren't about starting a business and whining about the government cracking down. They were about selfless building.

Bitcoin Fundamentals Report #254

Quiet week for bitcoin, topics include upcoming ETF date, BIP300, macro headlines, price analysis, mining industry news, and lightning network news.

What's Happening Now? Bitcoin Dip, China Crash - E365

Talking the Bitcoin dip, headlines from the last week, macro out of China, Bitcoin price, bitcoin mining, and Tether on RGB via Lightning Network.

Bitcoin Fundamentals Report #253

Bitcoin price dip, what this means for the cycle, China crisis, bitcoin price analysis, mining sector news and RGB+Lightning news.

An Economic Boom? Where’s the Recession? - FED 156

Japan and US GDP numbers are showing a booming economy. Is that legit? We breakdown the numbers and check that story against commodity prices. Plus more China crisis news.

The Coming Multipolar World - E364

A refreshingly new theory on the coming multipolar world order.

Market Pro 25 - The Dip

Bitcoin President in Argentina! China Collapse, ETF Update - E363

Javier Milei wins Argentina's Presidential primary, China is crashing, Bitcoin ETF update, price analysis and network statistics.

Bitcoin Fundamentals Report #252

This week's topics include Bitcoiner candidate wins Argentine Presidential primary, ETFs could be only 18 days away, China's collapse, price analysis, and mining gets more love.

Market Pro 24 - Inflation is Dead and Recession Odds

Global Prices Crash! Deflation then Inflation? - FED 155

Today's episode is all about US and China CPI. We also cover the bitcoin chart and related news.

Bitcoin ETF Imminent, Industry Update, Big Move Coming! - E362

Bitcoin and macro headlines, spot ETFs, Ripple, Uniswap, bitcoin mining news and statistics, and Lightning network news.

Bitcoin Fundamentals Report #251

Volatility will come back, ETF timeline, Ripple update, Bitcoin gets love from everywhere but the chart, time to pay attention.

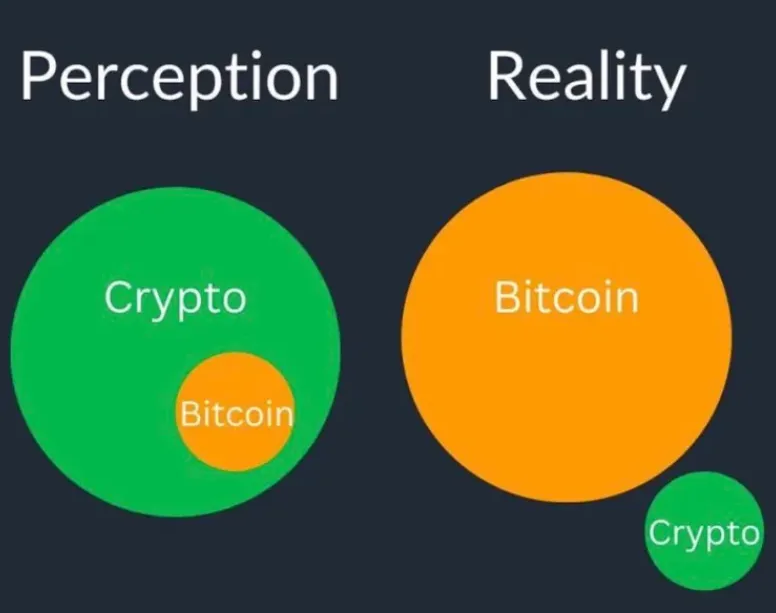

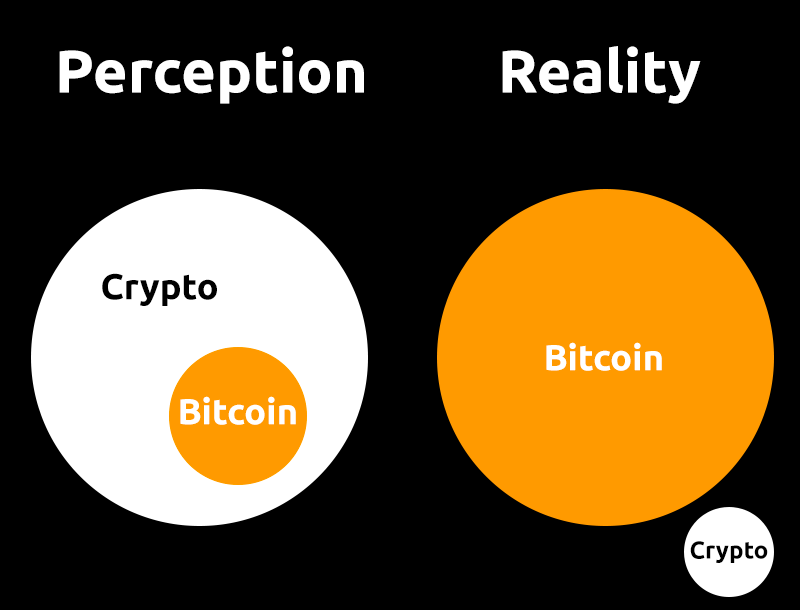

"Crypto" is an Affinity Fraud Trying to be "Like Bitcoin" - E361

"Crypto" is not Bitcoin, it only survives by pretending to be "like Bitcoin" using a category error for plausible deniability. Crypto is a scam, Bitcoin is legit.

Market Pro 23 - Commodities Do Not Indicate Return to High Inflation

Bitcoin is the Real ESG - FED154

Topics this week include KPMG report on the benefits of bitcoin and bitcoin mining, and the Federal Reserve's SLOOS report of bank lending.

Bitcoin Industry Update - Major Developments Underway! E360

Topics include Ripple, RFK Jr, SEC tells Coinbase everything other than bitcoin is a security, Bitcoin price, Bitcoin mining, and Lightning updates.

August 2023 Price Forecast Competition

Bitcoin Fundamentals Report #250

Catching up on the last 3 weeks of news in Bitcoin and Macro. Bitcoin headlines, price, mining and Layer 2s.

The Coming Multipolar World

There are competing theories of what the coming multipolar world will look like. This is my synthesis of views.

Market Pro 22 - Change to End of Quarter Forecast

Recession Avoided or Imminent? - FED 153

This week we discussion bitcoin developments like RFK backing the dollar with bitcoin. FOMC monetary policy decision. US GDP. And finally China facing hard truths.

"Crypto" is an Affinity Fraud on Bitcoin

The all-encompassing fraud in crypto is an affinity fraud on bitcoin. It is a category error to lump scams in with Bitcoin.

June CPI Did Not Surprise Us, Here's Why - E359

LIVE reaction to the June CPI data release. Not surprising, we nailed it!

Market Pro 21 - Bearish Probabilities Remain, Timeline Adjustments

CPI and Major Macro Shifts Everywhere - FED 152

US CPI, Lummis "crypto" bill, bitcoin price and ETF discussion, plus breaking news on Ripple vs SEC.

MSM Flips Bullish on Bitcoin Mining!? - E358

Readthrough of this week's newsletter which is total bitcoin market update. We cover MSM flipping positive on bitcoin, bitcoin mining, news, adoption, and more

Bitcoin Fundamentals Report #249

Major narrative shift from MSM to bitcoin friendly. Fundamentals are looking up, in adoption, mining and building.

BRICS Currency Disaster - E357

The expected BRICS currency will be a disaster if it is even possible in the first place. Here is what I think.

Market Pro 20 - Bearish Probabilities Rise

The Perfect Asset - Fed151

Bitcoin's market reaction to Larry Fink, CEO of Blackrock's surprise admission about bitcoin. ETF status update, CBDC dystopia, PBOC leadership reshuffle and panic

Bitcoin ETF Drama, Europe in Crisis, Price and More - E356

Bitcoin and Macro headlines, SEC and Bitcoin ETFs, Europe in crisis, Bitcoin price, miners selling bitcoin, Damus app vs Apple.

Bitcoin Fundamentals Report #248

Rumors from AI, Bitcoin ETFs, France and Europe are collapsing, Bitcoin price ready to pump, mining is stable, lightning vs Apple

July 2023 Price Forecast Competition

Market Pro 19 - Misinterpreting Breaking News

Front Running Wall Street - FED 150

We discuss Blackrock's Bitcoin ETF chances, adding bitcoin to balance sheets everywhere, and CBDCs

This Week in Bitcoin | E355

A readthrough of all the important news in the last week for Bitcoin and related macro.

Clarity from the SEC !! | E354

Listen to an interview on CNBC with Gary Gensler on Bitcoin and Crypto and comment throughout.

Bitcoin Fundamentals Report #247

Blackrock remains the top story this week. The incumbents had a lot to say this week about CBDCs and bitcoin. China is crashing. Plus, price, mining, and lightning news.

Market Pro 18 - Front Running Blackrock or Typical Short Squeeze?

Bitcoin Pump vs CBDC Obsession - FED 149

Discussion topics are Bitcoin ETFs, timeline, likelihood, GBTC vs Blackrock, Fed gives up on CBDC while other double down, plus Chinese yuan crash

Weekly Bitcoin Update, Everything is About to Change Forever - E353

The big news items of the week in Bitcoin and Macro. The SEC actions against Coinbase and Binance are old news already, now it is Blackrock's ETF filing

Bitcoin Fundamentals Report #246

Coinbase and Binance fear has given way to Blackrock ETF bullishness. Plus Macro updates, mining sector, lightning network news.

Live Reaction to JPow Fed Pause, Mixed Messages + Bitcoin | E352

Reacting to the Federal Reserve rate pause. Tying everything back to bitcoin.

Market Pro 17: Can we get a bounce!?

Fed Messaging Blunder, "Hawkish Pause" - Fed 148

FOMC policy decision and messaging of a hawkish pause is such a big mistake, SEC opinions from two angles, and ECB makes even bigger mistake.

June 2023 So Far, Bitcoin Wrap-up Part 2 - Live E351

SEC sues Coinbase and Binance. HUGE week, this week for the markets! Bitcoin price is holding up, will that continue? Mining and lightning news!

June 2023 So Far, Bitcoin Wrap-up Part 1 - Live E350

Complete summary of bitcoin this week. Halving is coming, CBDC being rejected already, scam financing collapses, mining, and lightning news.

Bitcoin Fundamentals Report #245

SEC sues Coinbase and Binance. HUGE week, this week for the markets! Bitcoin price is holding up, will that continue? Mining and lightning news!

Binance and Coinbase, “Crypto not Bitcoin” Crash, Plus Recessionary Hurricane - FED 147

Talking Binance and Coinbase getting sued by the SEC. Plus China import and export numbers disappoint, and Europe slides into official recession.

Market Pro 16 - Bitcoin BTD and Stock Market Historic Comparisons

What's Going On In Macro !!??? Charts and More - Live 5/31/23 | E349

Discussion recent developments in bitcoin, dollar, stocks, oil, bonds, and more. Reacting to bitcoin replacing real estate as store of value.

Bitcoin Fundamentals Report #244

Complete summary of bitcoin this week. Halving is coming, CBDC being rejected already, scam financing collapses, mining, and lightning news.

Gold vs Bitcoin: Responses to Common Criticisms - Pyramid or Ponzi

Pyramid scheme

According to Investor.gov:

In the classic "pyramid" scheme, participants attempt to make money solely by recruiting new participants, usually where:

- The promoter promises a high return in a short period of time;

- No genuine product or service is actually sold; and

- The

Debt Ceiling Deal Threat to Risk Assets? - FED 146

US debt ceiling avoids default, but will it dry up liquidity as the Treasury refills the TGA? China PMI disaster, German recession and more

Bitcoin Weekly Update, Fundamentals Report - Daily Live 29 May 23 | E348

Covering the headlines of the week for bitcoin and macro. Plus, price analysis, mining news and lightning developments.

Market Pro 15 - Bitcoin Update, Dollar and Select Commodities

Gold vs Bitcoin: Responses to Common Criticisms - 5000 Year History

In this post I take down the claim that gold has a 5000-year history that bitcoin must compete with. In reality, it is 120 years.

Gold vs Bitcoin Debate Reaction, Weiner vs Rochard - Daily Live 28 May 23 | E347

A reaction to a Gold vs Bitcoin debate. I respond to the pro-gold/anti-bitcoin commentary in real time.

Bitcoin Fundamentals Report #243

Bitcoin news about Hong Kong and China's return, macro updates on China and OPEC, price analysis, DAME tax is dead, and Ark L2.

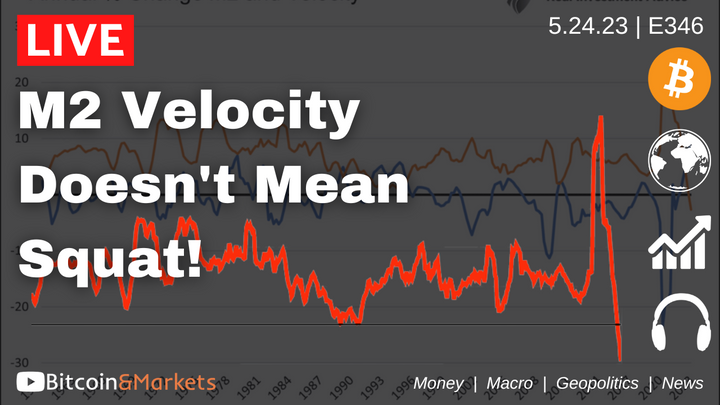

M2 Velocity Doesn't Mean Squat - Daily Live 24 May 23 | E346

Bitcoin price and article about M2 and M2 velocity

Public Thoughts on Bitcoin 2023, plus Macro Update - FED 145

Hosts: Ansel Lindner and Christian Keroles

Fed Watch is a macro podcast with a clear contrarian thesis of a deflationary breakdown of the financial system leading to bitcoin adoption. We question narratives and schools of thought, and try to form new understanding. Each episode we use current events to question

June 2023 Price Forecast Competition

Dedollarization and Inflation

What we are told about dedollarization and inflation is backwards.

Bitcoin Miami Reaction, Weekly Market Update - Daily Live 5/22/23 | E345

Quick debrief on the Bitcoin 2023 conference in Miami, other news, macro, bitcoin price analysis, mining sector news and lighting news

Bitcoin Fundamentals Report #242

This week, a quick debrief on the Bitcoin 2023 conference in Miami, other news, macro, bitcoin price analysis, mining sector news and lighting news.

Bitcoin Fundamentals Report #241

Bitcoin and Macro headlines of the week, including bitcoin mining, price and Lightning network.

CPI Forces Fed to Crush Banks, China reopening flops, Bitcoin Warming Up - FED 144

US CPI and PPI data, bank runs and PacWest, Chinese import/export numbers are not good.

Market Pro 14 - Bitcoin update, SLOOS forecasts

Crypto Scammers Gaslight about SEC Clarity - Daily Live from 4/19/23 | E344

I react to Gary Gensler in front of Congress, discuss Chinese debt to GDP vs other economies, and the possibility of a rotation back into equities for the remainder of the year

Bitcoin Fundamentals Report #240

Bitcoin under attack. Is there anything to worry about from high fees and inscriptions? Find out this week.

I'm Losing Faith in Bitcoin - Daily Live from 4/17/23 | E343

Can't see player? - Listen here

This episode was recorded on April 17, 2023. The original full live stream can be seen here: https://youtu.be/z5GQUXSqZKE. In this one I read through and address concerns in a post by BTC_remnant in which he voices his concerns

Has the Fed Doomed the Economy? - FED 143

FOMC reaction, IMF on CBDCs, DAME tax for bitcoin mining, and more!

Correcting Gold Bugs, plus Important Bitcoin Updates - Daily Live from 4/10/23 | E342

Why a gold-backed digital currency hasn't and won't work, bitcoin mining news, and dedollarization derangement syndrome.

Bitcoin Fundamentals Report #239

Jump to section: Bitcoin headlines / Macro / Price / Mining / Lightning

💡Share the Bitcoin Fundamentals Report!

Snapshot of Bitcoin

General Bitcoin Headlines

Weekly trend

Holding support

Media sentiment

Negative

Network traffic

High

Mining industry

Very stable

Price Section

Weekly price*

$28,248 (+$994, +3.6%)

Market cap

$0.546 trillion

Satoshis/$1

Dollar Demise or Shortage? - FED 142

US GDP, M2 money supply and dedollarization have to be taken together to make sense.

Market Pro 13: Repeat of Early March?

Where We Are and Where We Are Going in Bitcoin & Markets - E341

In this interview, we talk about almost every major topic in bitcoin and macro today. It is a relatively clear summary of my market thesis.

Bitcoin Fundamentals Report #238

The Bitcoin halving is coming, elites slowly pivoting, mixed signals from different markets, price analysis, mining news, and lighting network news.

Market Pro-12: Treasury Bill Chaos

SEC has FAILED, CBDC news heats up! - FED 141

Bitcoin price charts, oil, dollar, US treasury rates. Gensler testimony in front of Congress. Lagarde speech for unity in a fragmenting world.

Global Loan Issuance Crashes, Loose vs Tight Money - Daily Live 4/5/23 | E340

Discussing what rates and loan surveys can tell us about the current monetary environment, and coming deflation.

On Manipulation and De-dollarization - Daily Live 4/4/23 | E339

Discussing unemployment and the supposed manipulation of data, plus the CNY replacing the USD in commodities trading.

Bitcoin Fundamentals Report #237

Bitcoin mining as zero-emission, the coming recession, and de-dollarization dominated the news cycle this week.

Evolution of the Financial System plus Bitcoin Market Update - Daily Live 4/3/23 | E338

Can't see player? - Listen here

Today's episode was recorded on April 3, 2023. You can find the live streams on YouTube and Twitter. In this one, I cover my weekly newsletter including headlines and narratives in the bitcoin space, with my classic commentary and tangents.

CPI and PPI Reveal Startling Facts! - FED 140

We discuss March CPI and PPI, as well as economic indicator pointing to a global economic slowdown.

BRICS Destroy Dollar, plus Bitcoin and National Security - Daily Live 3.31.23 | E337

Jason Lowery's best selling book on bitcoin, reported on in MSM. Plus BRICS to form new currency.

Market Pro 11 - Break Out Baby!

Bitcoin Fundamentals Report #236

The general themes this week were zero price action, de-dollarization, more hit pieces on bitcoin, mining and lightning news.

Refining Bitcoin's Elevator Pitch - Daily Live 3/29/23 | E336

Easy bitcoin sound bites, new banks coming in to serve bitcoin businesses, and Florida banning CBDCs.

Is this the turning point? Making Sense of Economic Data - FED 139

OPEC production cut, ISM and PMI data, US jobs data

Market Pro 10: Oil Glut and Bitcoin Price

Governments Attacking Crypto NOT Bitcoin - Daily Live 2/27/23 | E335

Can't see player? - Listen here

In today's episode, I walk through my weekly newsletter starting with important bitcoin and macro headlines, then moving on to price analysis, mining sector news and finally, the lightning network.

The main theme of the day is a growing "

Greenpeace Self-Own with Skull of Satoshi - Daily Live 3/24/23 | E334

Discussing the phenomenon that was the Skull of Satoshi, and how bitcoiners quickly flipped the anti bitcoin mining concept on its head.

Bitcoin Fundamentals Report #235

Attacks on bitcoin slow, FedNow update, dollar competition from BRICS and bitcoin, price analysis, mining and lightning news.

Why Aren't Markets Crashing? - Fed 138

Markets are defying expectations. Stocks and bitcoin continue to rise despite the most anticipated recession in history being on the doorstep.

Market Pro 9 - Is the Bitcoin Consolidation Over?

Bitcoin 2.0 is Impossible - Daily Live 3/21/23 | E333

Reaction to Jack Mallers interview and Yellen testimony. Deep bitcoin knowledge in this one.

Bitcoin Fundamentals Report #234

This week, coordinated attacks on bitcoin or "crypto"? Bitcoin-only on ramps unaffected. Slow burn bank runs. Mining sector and lightning news.

$1 Million Bitcoin Bet, the Dollar Dies in 90 Days - Daily Live 3.20.23 | E332

Balaji's $1 million bitcoin bet, and reaction to is criticism of Bitcoin Maximalism. Plus swap lines from Federal Reserve to foreign banks.

Market Pro 8 - Complete Macro Rundown, Where Are We?

Operation Chokepoint 2.0! Central Banks continue to Hike Rates! - FED 137

FOMC decision and reaction, banking crisis and bank runs, US attacks on bitcoin.

Calling the Recent Bottom and Bitcoin Mining Taxes - Daily Live 3/10/23 | E331

Daily live stream in my unique style, calling price predictions back at the bottom on March 10, plus discussing new bitcoin mining taxes

JPow's Comments Days Before the Bank Failures - Daily Live 3/8/23 | E330

Commenting on Jerome Powell's testimony in front of Congress and GBTC as an ETF.

Market Pro 7 - Look Back, and Where Does Bitcoin Go Next

Bitcoin Fundamentals Report #233

Bitcoin and macro headlines, price analysis, mining news and lightning developments.

Is This the Big One? Credit Suisse Today, Who is Next?? - FED 136

HUGE week for bank failures, bailouts and the Bitcoin price! Talking Credit Suisse, SVB and Signature, US CPI and PPI for Feb, and bitcoin.

Bank Failures Coming and Federal Reserve Under Fire - FED 135

Bitcoin and macro chart discussion, followed by talk about bank failures, and finally, Powell testimony in front of Congress.

Silvergate are Idiots, and More Bitcoin News - Daily Live 3.6.23 | E329

Bitcoin banking, bitcoin mining, and more news

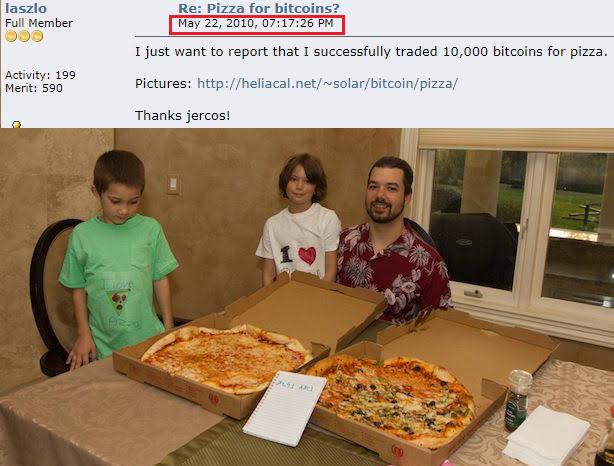

Bitcoin in a Hybrid WW3 ft Arthur Hayes - Daily Live 3.3.23 | E328

Talking geopolitics of WW3 using the oil market as proxy. Discussion the monetary policy reaction and bitcoin.

Market Pro #6: Drip to Bounce

The Burden, Not Privilege, of the Reserve Credit Currency - Daily Live 3.1.23 | E327

Podcast covering bitcoin, dollar, Federal Reserve, the exorbitant burden of global reserve currency, and dying for a failing order.

Bitcoiners Told You, You Didn't Listen - Daily Live 2.28.23 | E326

The fraud caught up with them finally. The exact crackdown we warned about happened, the SEC is calling everything but bitcoin a security.

Bitcoin Fundamental Report #232

Bitcoin news cycle was slow, but there are several developments that flew under the radar this week. Price, mining and lightning network.

What's Happening This Week in Bitcoin - Daily Live 2.27.23 | E325

The Bitcoin Fundamentals Report #231

Battle over the Digital Dollar - FED 134

Hosts: Ansel Lindner and Christian Keroles

Special co-host: Nolan Bauerle, @countbtc

Fed Watch is a macro podcast with a clear contrarian thesis of a deflationary breakdown of the financial system leading to bitcoin adoption. We question narratives and schools of thought, and try to form new understanding. Each episode we

More of the Same Won't Work, plus Policy or Panic - Daily Live 2.24.34 | E324

US PCE numbers and their significance, strong dollar and US 10Y Treasury rate, and India speech at UN.

Market Pro #5: Time to Pay Attention

A Better Bitcoin? plus, Human Rights in the Future - Daily Live 2.22.23 | E323

Talk about a better bitcoin, scammers mad at bitcoiners, and bitcoin's effect on free speech and property rights.

China Coming to Their Senses on Bitcoin?? - Daily Live 2.21.23 | E322

Today, I'm talking about China getting involved in the military conflict between the West and Russia. Then talking about Hong Kong opening back up to bitcoin.

China Coming to Their Senses on Bitcoin?? - Daily Live 2.21.23 | E322

Today, I'm talking about China getting involved in the military conflict between the West and Russia. Then talking about Hong Kong opening back up to bitcoin.

Bitcoin Fundamentals Report #231

Bitcoin winning the war vs BIS apparently, ordinal / inscriptions update, macro events, price, mining and lightning news.

Bad Inflation Models Lead to Confusion - Daily Live 2.20.23 | E321

How do we know when price increases are due to inflation (money printing) or other factors?

Why the China Reopening is All Hype - FED 133

FOMC, bitcoin and macro, plus why China's reopening is hype.

Market Pro #4 - Bitcoin Mid-week Dip Analysis

Disaster in Nigeria, plus ESG Promoters Get Desperate - Daily Live 2.17.23 | E320

Talking about the banking collapse in Nigeria and some unique problems for the country. Also, ESG climate globalists get desperate, try to force compliance.

Will a Freer Market with Bitcoin Lead to More Technology Advancement? - Daily Live 2.15.23 | E319

Talking a little about futurology and progressive fallacy. Also about altcoiners seeing the light on bitcoin and false conclusions about the Fed.

Bitcoin Fundamentals Report #230

All the important news for the week in bitcoin. Hong Kong welcomes bitcoin back, Ordinal statistics update, China, Nigeria, EU news, mining sector, and LN.

LIVE CPI REACTION, Reacceleration or Transitory - Daily Live 2.14.23 | E318

Simple live reaction to January 2023 CPI release

US CPI and EU Banks told to Cap Bitcoin Purchases - FED 132

This week CK and I talk about US CPI for January 2023, look at commodities and the dollar to help interpret it, then read about the EU threat to banks over bitcoin reserves

Market Pro #3 - Fibonaccis and Cloud

What Happens to Prices in Deglobalization? - Daily Live 2.13.23 | E317

Talking CPI and how to look at the January inflation print, plus further crackdown in the bitcoin space with Binance USD

Market Pro #2 - January CPI and Bitcoin

SEC Explains Kraken Suit, Plus China Credit Explodes - Daily Live 2.10.23 | E316

Taking about the Kraken settlement with the SEC over staking and industry fallout. Then discuss the China credit pumping operation.

Bitcoin Fundamentals Report #229

Bitcoin update with news on SEC enforcement, Binance stablecoin, CPI and inflation forecast, Nord Stream, price analysis, mining sector and Lightning news

This Will Crash the Economy, Credit Creation Plunges - FED131

US credit data in SLOOS report plus UK's crazy attempts to build a CBDC.

Wow in the Oil Market, & Panopticon Coin - Daily Live 2.8.23 | E315

Talking macro state of the oil market, US crude oil inventory builds, and the UK's attempt at a CBDC so far.

Make Sense of Jobs Data, plus Deflation is Back - Daily Live 2.7.23 | E314

Talking about the Jobs Report's effect on Chairman Powell's recent interview. Then we get into the SLOOS data showing credit contraction.

Market Pro #1 - Bitcoin

The Bitcoin Scaling Debate is Back - Daily Live 2.6.23 | E313

Discussion about the Ordinal debate in Bitcoin, as NFTs and scaling. We also touch on the China Spy Balloon story.

No, A Dollar CBDC is NOT Coming - Daily Live 2.3.23 | E312

Brief comments on the China spy balloon, Ripple's SEC lawsuit, and then mainly about why a US CBDC is not coming any time soon.

Bitcoin Fundamentals Report #228

Ordinals booming, Charlie Munger is old, macro developments, price considerations, mining sector and lightning news.

The Fed Just Made This HUGE Mistake - FED 130

Federal Reserve policy decision coverage, as well as the ECB policy decision. Of course, bitcoin and macro charts!

Important Takeaways From Fed's Rate Hike - Daily Live 2.1.23 | E311

Live reaction to the Federal Reserve's FOMC policy decision, while watching markets like stocks and bitcoin.

Peak Oil Demand and a Defense of CPI - Daily Live 1.31.23 | E310

After a much deserved laugh, we get into Peak Oil Demand, followed by a discussion of CPI as open source or not.

Disbelief Stage, No Recession, Culture vs Technology - Daily Live 1.30.23 | E309

Bull market in 2023, recession worry is overblown, macro theory, Ray Dalio and bitcoin as gold alternative, culture versus technology

Bitcoin Fundamentals Report #227

New debate in bitcoin about Ordinals, more people coming around to bitcoin as money, price analysis, recession analysis, mining and lightning news

Global South, Zoltan, and Betting on Communists - Daily Live 1.27.23 | E308

Review of the bitcoin market and cycle, then destroy Zoltan Poszar's ideas of a China led international order.

US GDP Numbers and Japan's New Money Bazooka - Fed129

We talk about US Q4 and 2022 real GDP numbers in relation to inflation and recession. Then Japan's new bond buying program.

The Globalists Gaslighting About Unity - Daily Live 1.25.23 | E307

Covering Macro and Bitcoin charts, then listening to rhetoric from Biden and Baerbock on unity in the West.

What Comes Next? plus Peter Schiff Silliness - Daily Live 1.24.23 | E306

There is a feeling of confusion and concern in the markets, waiting for the impending recession everyone says is coming. Plus some Peter Schiff craziness.

The World is Going Against Globalization and Globalists - Daily Live 1.23.23 | E305

The total failure of the Davos 2023 agenda and Brazil talks with Argentina about a common currency.

Bitcoin's Price PUMP and Fed Whisperers - Daily Live 1.20.23 | E304

In this episode of the Bitcoin & Markets podcast, I take a look at bitcoin's latest price pump, other macro charts, the China reopening narrative, and Federal Reserve policy

Bitcoin Fundamentals Report #226

Headlines on contraindicators, dead cat and bull trap callers, Genesis and Bitzlato, price analysis and forecast, and mining sector news.

International "Crypto" Enforcement, Should We Be Worried? - Daily Live 1.18.23 | E303

Discussing the bitcoin price and reaction to the DOJ's international enforcement action.

What the Elites at Davos Really Think of Bitcoin - FED 128

This episode of Fed Watch was about the US debt ceiling, PPI, bitcoin at Davos 2023, and the BIS report on how to stop bitcoin.

Ransomware and Bitcoin Demand - Daily Live 1.17.23 | E302

We examine the claim of the FAA ransomware attack that took down the NOTAMS system nation-wide, and it coinciding with the bitcoin pump.

Davos WEF History and Future Plans - Daily Live 1.16.23 | E301

Learn where the World Economic Forum WEF in Davos originated, their Marxist nature and their current narrative tactics and plans.

Bitcoin Fundamentals Report #225

Covering all the weekly news, from Winklevoss vs the SEC, to Zeihan on Bitcoin, Russian war updates, epic price section, and the bitcoin mining boom!

Bitcoin Back Above $20K, plus SEC Timing - Daily Live 1.13.23 | E300

Bitcoin price pumps above $20,000 signaling we could be entering the next bull market, plus SEC sues Gemini reaction.

My LIVE Reaction to Negative CPI in December - Daily Live 1.12.23 | E299

US December CPI was a sea change coming is negative month-over-month. This is my fun live reaction.

The Wealth Effect is Backwards - Daily Live 1.11.23 | E298

In this episode, I update the bitcoin price and then read through 3 articles. One on the reverse wealth effect, one on oil and the last on the Fed and climate policy.

JPow SLAMS Central Bank ESG Lunacy! - Daily Live 1.10.23 | E297

Live reaction to Jerome Powell's comments at central bank meeting in Sweden where he closed the door on central bank policy being use for ESG madness.

Debunking Peter Zeihan About Bitcoin - Daily Live 1.9.23 | E296

Reacting to Peter Zeihan's horrible take on bitcoin in the Joe Rogan interview.

Bitcoin Fundamentals Report #224

Bitcoin news on DCG and Grayscale, Mexican CBDC, Russian bitcoin adoption news, price analysis, mining sector news.

Malthus vs Free Market vs Credit Money - Daily Live 1/6/23 | E295

Macro update and reaction to Saifedean's podcast on Malthus and Superabundance.

Global Economic Slowdown Everywhere - Daily Live 1.4.23 | E294

Topics for today are macro charts of bitcoin, the dollar index DXY, oil WTI; also, US ISM data and German CPI for December.

Bitcoin Core Developer Hacked, Loses BTC - Daily Live 1.2.23 | E293

Luke Dashjr hack, hardware wallets vs hot wallets, bitcoin price, and more.

Bitcoin Fundamentals Report #223

Luke Dash Jr's bitcoins, Brazil bitcoin adoption, Chinese 2022 growth failure, Price analysis and 2023 prediction, and resurgence in mining

Bitcoin Cycles Dead?? - Daily Live 12.30.22 | E292

Reacting to two twitter threads. One about bitcoin cycles and 2023 predictions. The second is about the record asset purchases by the Bank of Japan.

Zoltan's Dispatch is Nonsense, Here's Why - Daily Live 12.29.22 | E291

Today, I talk about inflation vs deflation in regards to Mish's recent post. Then, I dissect Zoltan Poznar's recent dispatch from Credit Suisse about China, Saudi Arabia, CBDCs and other fantasies.

Michael Saylor VS Bitcoin Immune System - Daily Live 12.28.22 | E290

Michael Saylor gets swarmed by toxic maximalists, CPI vs inflation vs Shadow Stats vs Chapwood, unimportant of M2, and Fab 4 semiconductor pact, plus US home sales.

Macro Environment Analysis and Bitcoin - Daily Live 12.27.22 | E289

Discussion about macro charts including natural gas futures, shipping rates, and commodities. Then we talk about how the market selects a money.

Bitcoin Fundamentals Report #222

Bitcoin miners perform a miracle on Christmas, Bitcoin and international trade, economic stats, China, EU breakup, Bitcoin price analysis and mining update.

Russia Makes Move Into Bitcoin !! - Daily Live 12.23.22 | E288

Today we discuss the shifting oil market globally with the US as increasing exporter, inflation and finally Russia adopting bitcoin.

End of Year Crisis Dead Ahead!?? - Daily Live 12.22.22 | E287

Deep dive on repo rates and what they mean, recession timing, and bitcoin vs crypto in listener comments.

Severe or Slight Recession? - Daily Live 12.21.22 | E286

Discussing the oil market and using it to predict recession. Also, some deep thoughts on the general state of humanity.

Economic Bloodletting, Yield Curve Control - Daily Live 12.20.22 | E285

The Bank of Japan relaxes their yield curve control program, reaction and analysis.

You Won't Believe the Truth About Inflation - Daily Live 12.19.22 | E284

Discussion clarifying confusion and fallacies about inflation, and news about the Federal Reserve hacks and jobs research.

Weekly Headlines, Price Analysis, and LIVE Q&A - Daily Live 12.16.22 | E283

Bitcoin weekly headlines, price analysis, Elon Musk free speech and Twitter, and LIVE Q&A

Bitcoin Fundamentals Report #221

Jump to: Market Roundup / Price analysis + Price Conclusion / Mining sector / Lightning Network

In Case You Missed It...

Daily Live streams

* Weekly Report Summary and Chat on Credit - Daily Live 12.5.22 | E275

* The Great Retirement Boom and Deglobalization - Daily Live 12.6.22 | E276

* Global Macro, a

Anti-Bitcoin Bill is a Joke and DOA - Daily Live 12.15.22 | E282

Elizabeth Warren's anti-bitcoin bill is unconstitutional in multiple ways and DOA. Plus, Japan's economic research says China will never overtake the US.

Live CPI Reaction, Key Insights - Daily Live 12.13.22 | E281

Can't see player? - Listen here

In today's episode, I include two live streams from Tuesday together. I heavily edited them for time and clarity. The first one is a live reaction to the CPI. The second is a wide ranging talk on why the market

Mortgage Your House for Bitcoin? - Daily Live 12.12.22 | E280

Can't see player? - Listen here

Today's episode is about the busy week ahead for macro and bitcoin. The US CPI comes out tomorrow, and the FOMC rate decision on Wednesday. I give some background and my latest prediction.

The main part of the show is

Free Form Friday, Everything Bitcoin, Ethereum, and Macro - Daily Live 12.9.22 | E279

Can't see player? - Listen here

Today's episode is a free flowing discussion about the news of the day. I take several posts I made in Telegram, and expand on them, including a crazy tweet about ethereum being ultra sound money. At the end of the

"Crypto" is Low (T)oxicity, Bitcoin is High T - Daily Live 12.8.22 | E278

Can't see player? - Listen here

In this episode, I comment on the bitcoin price and then get into a tweet from disingenuous Udi. That takes me on a twisting rant about "crypto" and the entire space. Enjoy.

Links

* USDC gets access to Fed's

Global Macro, a Holistic View - Daily Live 12.7.22 | E277

Can't see player? - Listen here

In this episode, while talking about current macro charts I end up summarizing my macro and geopolitical framework. Oil, stocks, bitcoin, and Treasury yields are the main topics.

Links

* Judge Dismisses Lawsuit Against Saudi Prince Over Khashoggi Killing Citing Biden Immunity

* Most

The Great Retirement Boom and Deglobalization - Daily Live 12.6.22 | E276

Can't see player? - Listen here

In this episode, I go through several comments by my community on Telegram. Then we talk the bitcoin chart a little bit. After that, I read the abstract of the Fed's new paper on retirement and discuss. Finally, I read

Weekly Report Summary and Chat on Credit - Daily Live 12.5.22 | E275

Can't see player? - Listen here

In this episode, I summarize my weekly newsletter and discussion credit in a post-bitcoin world. I spend a lot of time usually talking about how credit works today and how it will change going into a bitcoin world. But once bitcoin has

Bitcoin Fundamentals Report #220

This week was a slow news cycle for #Bitcoin. We cover a few headlines, price analysis including headwinds and tailwinds, mining sector and a lightning network story.

Bitcoin Realism & Conspiracies - Daily Live 12.2.22 | E274

ECB attack on bitcoin and the US jobs report.